AeroVironment, Inc. (NASDAQ: AVAV), a global leader in

intelligent, multi-domain robotic systems, today reported financial

results for the fiscal second quarter ended October 29, 2022.

Second Quarter Highlights

- Strong bookings of $197.3 million in the second quarter

- Second quarter revenue in line with expectations of $111.6

million

- Raising FY23 revenue guidance to between $505 million and $525

million

- $86 Million FMS order received in November resulting in record

funded backlog of $388.2 million as of November 26, 2022

“Our second quarter results came in line or slightly better than

expectations and, given recent awards and accelerating demand

across our portfolio, we are increasing our revenue guidance for

fiscal year 2023,” said Wahid Nawabi, AeroVironment chairman,

president and chief executive officer. “In November, we were

awarded a Puma Small UAS systems contract with a ceiling value of

$176 million and initial funding of $86 million. This award is the

largest FMS order in the company’s history, and we expect shipments

to start next quarter and continue over the next 6-12 months. This

award, combined with our record backlog, gives us confidence to

raise revenue guidance even as we continue managing ongoing supply

chain constraints and inflationary cost pressures.

“In addition, we are also slightly reducing our profitability

outlook for fiscal year 2023 due to increased R&D investments

targeted at additional growth opportunities and accelerated Medium

UAS asset depreciation related to a shift in US DOD funding

priorities. We expect margins will recover and backlog will

increase throughout the second half of fiscal year 2023 setting the

stage for profitable organic double-digit growth in fiscal year

2024 and beyond.”

FISCAL 2023 SECOND QUARTER RESULTS

Revenue for the second quarter of fiscal 2023 was $111.6

million, a decrease of 9% from the second quarter of fiscal 2022

revenue of $122.0 million. The decrease in revenue reflects a

decline in product sales of $8.7 million and service revenue of

$1.8 million. The overall decrease in revenue was primarily due to

a decrease in revenue in the Small UAS segment of $28.0 million,

partially offset by an increase in revenue from the Tactical

Missile Systems (“TMS”) segment of $12.7 million and an increase in

customer-funded research and development revenue of $4.2

million.

Gross margin for the second quarter of fiscal 2023 was $25.9

million, a decrease of 39% from the second quarter of fiscal 2022

gross margin of $42.5 million. The decrease in gross margin

reflects lower product margin of $9.2 million and lower service

margin of $7.4 million. As a percentage of revenue, gross margin

decreased to 23% from 35%. The decrease in gross margin percentage

was primarily related to unfavorable product mix and accelerated

depreciation charges related to the anticipated completion of

certain MUAS COCO site locations of $4.5 million. Gross margin was

negatively impacted by $4.0 million of intangible amortization

expense and other related non-cash purchase accounting expenses in

the second quarter of fiscal 2023 as compared to $5.5 million in

the second quarter of fiscal 2022.

Loss from operations for the second quarter of fiscal 2023 was

$14.3 million, a decrease of $17.6 million from the second quarter

of fiscal 2022 income from operations of $3.3 million. The decrease

in income from operations was primarily the result of a decrease in

gross margin of $16.6 million and an increase in research and

development (“R&D”) expense of $2.3 million, partially offset

by a decrease in selling, general and administrative (“SG&A”)

expense of $1.2 million. The decrease in SG&A expense reflects

a decrease in intangible amortization expense and other related

non-cash purchase accounting expenses of $1.0 million.

Other loss, net, for the second quarter of fiscal 2023 was $1.5

million, as compared to $11.4 million for the second quarter of

fiscal 2022. The second quarter of fiscal 2022 included legal

expenses of $10.0 million for the settlement of all claims from the

buyers of our former EES business. The increase in interest expense

was primarily due to an increase in interest rates. Other income,

net for the second quarter of fiscal 2023 includes unrealized gains

associated with the increases in the fair market value for equity

security investments.

Benefit from income taxes for the second quarter of fiscal 2023

was $(10.5) million, as compared to a benefit from income taxes of

$(9.5) million for the second quarter of fiscal 2022. The increase

in benefit from income taxes was primarily due to expected federal

R&D tax credits and foreign-derived intangible income

deductions.

Equity method investment loss, net of tax, for the second

quarter of fiscal 2023 was $(1.3) million, as compared to equity

method investment income $1.1 million for the second quarter of

fiscal 2022. Subsequent to the sale of the equity interest in

HAPSMobile during the three months ended April 30, 2022, equity

method investment loss, net of tax no longer includes activity from

HAPSMobile.

Net loss attributable to AeroVironment for the second quarter of

fiscal 2023 was $6.7 million, or $(0.27) per diluted share, as

compared to net income of $2.5 million, or $0.10 per diluted share,

for the second quarter of fiscal 2022.

Non-GAAP adjusted EBITDA for the second quarter of fiscal 2023

was $6.8 million and non-GAAP earnings per diluted share was $0, as

compared to $21.9 million and $0.78 for the second quarter of

fiscal 2022.

BACKLOG

As of October 29, 2022, funded backlog (defined as remaining

performance obligations under firm orders for which funding is

currently appropriated to the Company under a customer contract)

was $293.1 million, as compared to $210.8 million as of April 30,

2022. As of November 26, 2022, funded backlog was $388.2

million.

FISCAL 2023 — OUTLOOK FOR THE FULL YEAR

For the fiscal year 2023, the Company now expects revenue of

between $505 million and $525 million, net income of between $8

million and $17 million, Non-GAAP adjusted EBITDA of between $84

million and $92 million, earnings per diluted share of between

$0.33 and $0.65 and non-GAAP earnings per diluted share, which

excludes amortization of intangible assets and other non-cash

purchase accounting expenses, of between $1.26 and $1.58.

The foregoing estimates are forward-looking and reflect

management’s view of current and future market conditions, subject

to certain risks and uncertainties, and including certain

assumptions with respect to our ability to efficiently and on a

timely basis integrate our acquisitions, obtain and retain

government contracts, changes in the timing and/or amount of

government spending, changes in the demand for our products and

services, activities of competitors, changes in the regulatory

environment, and general economic and business conditions in the

United States and elsewhere in the world. Investors are reminded

that actual results may differ materially from these estimates.

CONFERENCE CALL AND PRESENTATION

In conjunction with this release, AeroVironment, Inc. will host

a conference call today, Tuesday, December 6, 2022, at 4:30 pm

Eastern Time that will be webcast live. Wahid Nawabi, chairman,

president and chief executive officer, Kevin P. McDonnell, chief

financial officer and Jonah Teeter-Balin, senior director corporate

development and investor relations, will host the call.

New this quarter, investors may access the call by registering

via the following participant registration link up to ten minutes

prior to the start time.

Participant registration URL:

https://register.vevent.com/register/BI917865171ebf49738b3207daea259095

Investors may also listen to the live audio webcast via the

Investor Relations page of the AeroVironment, Inc. website,

http://investor.avinc.com. Please allow 15 minutes prior to the

call to download and install any necessary audio software.

A supplementary investor presentation for the second quarter

fiscal year 2023 can be accessed at

https://investor.avinc.com/events-and-presentations.

Audio Replay

An audio replay of the event will be archived on the Investor

Relations section of the Company's website at

http://investor.avinc.com.

ABOUT AEROVIRONMENT, INC.

AeroVironment (NASDAQ: AVAV) provides technology solutions at

the intersection of robotics, sensors, software analytics and

connectivity that deliver more actionable intelligence so you can

Proceed with Certainty. Headquartered in Virginia,

AeroVironment is a global leader in intelligent, multi-domain

robotic systems, and serves defense, government and commercial

customers. For more information, visit www.avinc.com.

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements" as that

term is defined in the Private Securities Litigation Reform Act of

1995. Forward-looking statements include, without limitation, any

statement that may predict, forecast, indicate or imply future

results, performance or achievements, and may contain words such as

“believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,”

“plan,” or words or phrases with similar meaning. Forward-looking

statements are based on current expectations, forecasts and

assumptions that involve risks and uncertainties, including, but

not limited to, economic, competitive, governmental and

technological factors outside of our control, that may cause our

business, strategy or actual results to differ materially from the

forward-looking statements.

Factors that could cause actual results to differ materially

from the forward-looking statements include, but are not limited

to, the impact of our recent acquisitions, including but not

limited to Arcturus UAV, Telerob and ISG and our ability to

successfully integrate them into our operations; the risk that

disruptions will occur from the transactions that will harm our

business; any disruptions or threatened disruptions to our

relationships with our distributors, suppliers, customers and

employees, including shortages in components for our products; the

ability to timely and sufficiently integrate international

operations into our ongoing business and compliance programs;

reliance on sales to the U.S. government and related to our

development of HAPS UAS; availability of U.S. government funding

for defense procurement and R&D programs; changes in the timing

and/or amount of government spending; our ability to perform under

existing contracts and obtain new contracts; risks related to our

international business, including compliance with export control

laws; potential need for changes in our long-term strategy in

response to future developments; the extensive regulatory

requirements governing our contracts with the U.S. government and

international customers; the consequences to our financial

position, business and reputation that could result from failing to

comply with such regulatory requirements; unexpected technical and

marketing difficulties inherent in major research and product

development efforts; the impact of potential security and cyber

threats or the risk of unauthorized access to our, our customers’

and/or our suppliers’ information and systems; changes in the

supply and/or demand and/or prices for our products and services;

increased competition; uncertainty in the customer adoption rate of

commercial use unmanned aircraft systems; failure to remain a

market innovator, to create new market opportunities or to expand

into new markets; unexpected changes in significant operating

expenses, including components and raw materials; failure to

develop new products or integrate new technology into current

products; unfavorable results in legal proceedings; our ability to

respond and adapt to unexpected legal, regulatory and government

budgetary changes, including those resulting from the ongoing

COVID-19 pandemic, such as supply chain disruptions, vaccine

mandates, the threat of future variants and potential

governmentally-mandated shutdowns, quarantine policies, travel

restrictions and social distancing, curtailment of trade, diversion

of government resources to non-defense priorities, and other

business restrictions affecting our ability to manufacture and sell

our products and provide our services; our ability to comply with

the covenants in our loan documents; our ability to attract and

retain skilled employees; the impact of inflation; and general

economic and business conditions in the United States and elsewhere

in the world; and the failure to establish and maintain effective

internal control over financial reporting. For a further list and

description of such risks and uncertainties, see the reports we

file with the Securities and Exchange Commission. We do not intend,

and undertake no obligation, to update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

NON-GAAP MEASURES

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), this earnings

release also contains non-GAAP financial measures. See in the

financial tables below the calculation of these measures, the

reasons why we believe these measures provide useful information to

investors, and a reconciliation of these measures to the most

directly comparable GAAP measures.

AeroVironment, Inc.

Consolidated Statements of

Operations (Unaudited)

(In thousands except share and

per share data)

Three Months Ended

Six Months Ended

October 29,

October 30,

October 29,

October 30,

2022

2021

2022

2021

(Unaudited)

(Unaudited)

Revenue:

Product sales

$

62,343

$

70,998

$

120,317

$

124,114

Contract services

49,241

51,010

99,783

98,903

111,584

122,008

220,100

223,017

Cost of sales:

Product sales

39,445

38,937

72,344

71,527

Contract services

46,249

40,616

88,152

80,312

85,694

79,553

160,496

151,839

Gross margin:

Product sales

22,898

32,061

47,973

52,587

Contract services

2,992

10,394

11,631

18,591

25,890

42,455

59,604

71,178

Selling, general and administrative

23,613

24,819

45,556

51,947

Research and development

16,591

14,297

31,636

28,005

(Loss) income from operations

(14,314

)

3,339

(17,588

)

(8,774

)

Other (loss) income:

Interest expense, net

(2,309

)

(1,379

)

(3,912

)

(2,654

)

Other income (expense), net

810

(10,048

)

404

(10,394

)

Loss before income taxes

(15,813

)

(8,088

)

(21,096

)

(21,822

)

Benefit from income taxes

(10,457

)

(9,511

)

(7,851

)

(10,468

)

Equity method investment (loss) income,

net of tax

(1,273

)

1,133

(1,773

)

(8

)

Net (loss) income

(6,629

)

2,556

(15,018

)

(11,362

)

Net income attributable to noncontrolling

interest

(39

)

(31

)

(45

)

(94

)

Net (loss) income attributable to

AeroVironment, Inc.

$

(6,668

)

$

2,525

$

(15,063

)

$

(11,456

)

Net (loss) income per share attributable

to AeroVironment, Inc.

Basic

$

(0.27

)

$

0.10

$

(0.61

)

$

(0.47

)

Diluted

$

(0.27

)

$

0.10

$

(0.61

)

$

(0.47

)

Weighted-average shares outstanding:

Basic

24,900,873

24,641,614

24,852,219

24,630,838

Diluted

24,900,873

24,885,870

24,852,219

24,630,838

AeroVironment, Inc.

Consolidated Balance

Sheets

(In thousands except share

data)

October 29,

April 30,

2022

2022

(Unaudited)

Assets

Current assets:

Cash and cash equivalents

$

101,417

$

77,231

Short-term investments

—

24,716

Accounts receivable, net of allowance for

doubtful accounts of $74 at October 29, 2022 and $592 at April 30,

2022

31,664

60,170

Unbilled receivables and retentions

92,457

104,194

Inventories, net

109,810

90,629

Income taxes receivable

8,940

442

Prepaid expenses and other current

assets

13,244

11,527

Total current assets

357,532

368,909

Long-term investments

22,462

15,433

Property and equipment, net

52,415

62,296

Operating lease right-of-use assets

25,580

26,769

Deferred income taxes

8,098

7,290

Intangibles, net

88,660

97,224

Goodwill

334,963

334,347

Other assets

1,972

1,932

Total assets

$

891,682

$

914,200

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

26,317

$

19,244

Wages and related accruals

25,049

25,398

Customer advances

7,074

8,968

Current portion of long-term debt

10,000

10,000

Current operating lease liabilities

7,564

6,819

Income taxes payable

26

759

Other current liabilities

27,824

30,203

Total current liabilities

103,854

101,391

Long-term debt, net of current portion

155,622

177,840

Non-current operating lease

liabilities

20,043

21,915

Other non-current liabilities

748

768

Liability for uncertain tax positions

1,450

1,450

Deferred income taxes

2,482

2,626

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value:

Authorized shares—10,000,000; none issued

or outstanding at October 29, 2022 and April 30, 2022

—

—

Common stock, $0.0001 par value:

Authorized shares—100,000,000

Issued and outstanding shares—25,157,618

shares at October 29, 2022 and 24,951,287 shares at April 30,

2022

4

2

Additional paid-in capital

283,789

267,248

Accumulated other comprehensive loss

(8,480

)

(6,514

)

Retained earnings

332,170

347,233

Total AeroVironment, Inc. stockholders’

equity

607,483

607,969

Noncontrolling interest

—

241

Total equity

607,483

608,210

Total liabilities and stockholders’

equity

$

891,682

$

914,200

AeroVironment, Inc.

Consolidated Statements of

Cash Flows (Unaudited)

(In thousands)

Six Months Ended

October 29,

October 30,

2022

2021

Operating activities

Net loss

$

(15,018

)

$

(11,362

)

Adjustments to reconcile net loss from

operations to cash provided by (used in) operating activities:

Depreciation and amortization

32,275

30,019

Loss (income) from equity method

investments

1,773

(520

)

Loss on deconsolidation of previously

controlled subsidiary

189

—

Amortization of debt issuance costs

422

258

Provision for doubtful accounts

19

(35

)

Other non-cash expense, net

565

157

Non-cash lease expense

3,775

3,358

(Gain) loss on foreign currency

transactions

(59

)

30

Unrealized gain on available-for-sale

equity securities, net

(928

)

—

Deferred income taxes

(808

)

(840

)

Stock-based compensation

4,402

2,342

Loss on disposal of property and

equipment

825

3,036

Amortization of debt securities

125

113

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable

28,012

37,134

Unbilled receivables and retentions

11,696

(46,619

)

Inventories

(23,836

)

(10,075

)

Income taxes receivable

(8,539

)

(10,667

)

Prepaid expenses and other assets

(1,117

)

272

Accounts payable

6,823

(3,587

)

Other liabilities

(8,664

)

3,642

Net cash provided by (used in) operating

activities

31,932

(3,344

)

Investing activities

Acquisition of property and equipment

(7,587

)

(13,147

)

Equity method investments

(2,774

)

(6,245

)

Equity security investments

(5,100

)

—

Business acquisitions, net of cash

acquired

(5,105

)

(46,150

)

Proceeds from deconsolidation of

previously controlled subsidiary, net of cash deconsolidated

(635

)

—

Redemptions of available-for-sale

investments

25,945

30,531

Purchases of available-for-sale

investments

(1,326

)

—

Other

—

224

Net cash provided by (used in) investing

activities

3,418

(34,787

)

Financing activities

Principal payments of term loan

(22,500

)

(5,000

)

Holdback and retention payments for

business acquisition

—

(5,991

)

Proceeds from shares issued, net of

issuance costs

11,778

—

Tax withholding payment related to net

settlement of equity awards

(853

)

(1,176

)

Exercise of stock options

682

119

Other

(14

)

(16

)

Net cash used in financing activities

(10,907

)

(12,064

)

Effects of currency translation on cash

and cash equivalents

(257

)

(275

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

24,186

(50,470

)

Cash, cash equivalents and restricted cash

at beginning of period

77,231

157,063

Cash, cash equivalents and restricted cash

at end of period

$

101,417

$

106,593

Supplemental disclosures of cash flow

information

Cash paid, net during the period for:

Income taxes

$

718

$

1,923

Interest

$

3,398

$

2,283

Non-cash activities

Unrealized (gain) loss on

available-for-sale investments, net of deferred tax expense of $0

for the six months ended October 29, 2022 and October 30, 2021,

respectively

$

(26

)

$

3

Change in foreign currency translation

adjustments

$

(1,992

)

$

(2,017

)

Issuances of inventory to property and

equipment, ISR in-service assets

$

4,085

$

12,472

Acquisitions of property and equipment

included in accounts payable

$

810

$

415

AeroVironment, Inc.

Reportable Segment Results

(Unaudited)

(In thousands)

Three Months Ended October 29,

2022

Small UAS

TMS

MUAS

HAPS

All other

Total

Revenue

$

26,681

$

31,101

$

27,281

$

9,066

$

17,455

$

111,584

Gross margin

12,319

12,636

(6,884

)

3,001

4,818

25,890

Income (loss) from operations

(2,079

)

2,004

(15,242

)

1,564

(561

)

(14,314

)

Acquisition-related expenses

-

-

119

-

450

569

Amortization of acquired intangible assets

and other purchase accounting adjustments

669

-

5,897

-

1,276

7,842

Adjusted income (loss) from operations

$

(1,410

)

$

2,004

$

(9,226

)

$

1,564

$

1,165

$

(5,903

)

Three Months Ended October 30,

2021

Small UAS

TMS

MUAS

HAPS

All other

Total

Revenue

$

54,714

$

18,418

$

26,525

$

10,342

$

12,009

$

122,008

Gross margin

27,754

6,222

2,223

3,944

2,312

42,455

Income (loss) from operations

13,377

47

(7,000

)

2,073

(5,158

)

3,339

Acquisition-related expenses

297

163

108

58

222

848

Amortization of acquired intangible assets

and other purchase accounting adjustments

707

-

6,358

-

3,257

10,322

Adjusted income (loss) from operations

$

14,381

$

210

$

(534

)

$

2,131

$

(1,679

)

$

14,509

AeroVironment, Inc.

Reconciliation of non-GAAP

(Loss) Earnings per Diluted Share (Unaudited)

Three Months Ended

Three Months Ended

Six Months Ended

Six Months Ended

October 29, 2022

October 30, 2021

October 29, 2022

October 30, 2021

(Loss) earnings per diluted share

$

(0.27

)

$

0.10

$

(0.61

)

$

(0.47

)

Acquisition-related expenses

0.02

0.03

0.03

0.15

Amortization of acquired intangible assets

and other purchase accounting adjustments

0.25

0.33

0.47

0.62

Legal accrual related to our former EES

business

—

0.32

—

0.32

Earnings (loss) per diluted share as

adjusted (Non-GAAP)

$

—

$

0.78

$

(0.11

)

$

0.62

Reconciliation of non-GAAP

adjusted EBITDA (Unaudited)

Three Months Ended

Three Months Ended

Six Months Ended

Six Months Ended

(in millions)

October 29, 2022

October 30, 2021

October 29, 2022

October 30, 2021

Net (loss) income

$

(7

)

$

3

$

(15

)

$

(11

)

Interest expense, net

2

1

4

3

Benefit from income taxes

(10

)

(10

)

(8

)

(10

)

Depreciation and amortization

19

17

32

30

EBITDA (Non-GAAP)

4

11

13

12

Amortization of purchase accounting

adjustment included in loss on disposal of property and

equipment

—

1

—

1

Stock-based compensation

2

—

4

2

Equity method and equity securities

investments activity, net

—

(1

)

2

—

Acquisition-related expenses

1

1

1

4

Legal accrual related to our former EES

business

—

10

—

10

Adjusted EBITDA (Non-GAAP)

$

7

$

22

$

20

$

29

Reconciliation of Forecast Earnings per

Diluted Share (Unaudited)

Fiscal year ending

April 30, 2023

Forecast earnings per diluted share

$

0.33 - 0.65

Acquisition-related expenses

0.02

Amortization of acquired intangible assets

and other purchase accounting adjustments

0.91

Forecast earnings per diluted share as

adjusted (Non-GAAP)

$

1.26 - 1.58

Reconciliation of 2023 Forecast and Fiscal

Year 2022 Actual Non-GAAP adjusted EBITDA (Unaudited)

Fiscal year ending

Fiscal year ended

(in millions)

April 30, 2023

April 30, 2022

Net income (loss)

$

8 - 17

$

(4

)

Interest expense, net

9

5

Benefit from income taxes

(6) - (7

)

(10

)

Depreciation and amortization

63

61

EBITDA (Non-GAAP)

74 - 82

52

Amortization of purchase accounting

adjustment included in loss on disposal of property and

equipment

—

1

Stock-based compensation

8

5

Sale of ownership in HAPSMobile Inc. joint

venture

—

(6

)

Equity method and equity securities

investments activity, net

1

(5

)

Legal accrual related to our former EES

business

—

10

Acquisition-related expenses

1

5

Adjusted EBITDA (Non-GAAP)

$

84 - 92

$

62

Statement Regarding Non-GAAP Measures

The non-GAAP measures set forth above should be considered in

addition to, and not as a replacement for or superior to, the

comparable GAAP measures, and may not be comparable to similarly

titled measures reported by other companies. Management believes

that these measures provide useful information to investors by

offering additional ways of viewing our results that, when

reconciled to the corresponding GAAP measures, help our investors

to understand the long-term profitability trends of our business

and compare our profitability to prior and future periods and to

our peers. In addition, management uses these non-GAAP measures to

evaluate our operating and financial performance.

Non-GAAP Adjusted Operating Income

Adjusted operating income is defined as operating income before

intangible amortization, amortization of non-cash purchase

accounting adjustments, and acquisition related expenses.

Non-GAAP Earnings per Diluted Share

We exclude the acquisition-related expenses, amortization of

acquisition-related intangible assets and one-time non-operating

items because we believe this facilitates more consistent

comparisons of operating results over time between our newly

acquired and existing businesses, and with our peer companies. We

believe, however, that it is important for investors to understand

that such intangible assets contribute to revenue generation and

that intangible asset amortization will recur in future periods

until such intangible assets have been fully amortized.

Adjusted EBITDA (Non-GAAP)

Adjusted EBITDA is defined as net income before interest income,

interest expense, income tax expense (benefit) and depreciation and

amortization including amortization of purchase accounting

adjustments, adjusted for the impact of certain other items,

including stock-based compensation, acquisition related expenses,

equity method investment gains or losses, equity securities

investments gains or losses, and one-time non-operating gains or

losses. We present Adjusted EBITDA, which is not a recognized

financial measure under U.S. GAAP, because we believe it is

frequently used by analysts, investors and other interested parties

to evaluate companies in our industry. We believe this facilitates

more consistent comparisons of operating results over time between

our newly acquired and existing businesses, and with our peer

companies. We believe, however, that it is important for investors

to understand that such intangible assets contribute to revenue

generation, intangible asset amortization will recur in future

periods until such intangible assets have been fully amortized and

that interest and income tax expenses will recur in future periods.

In addition, Adjusted EBITDA may not be comparable to similarly

titled measures used by other companies in our industry or across

different industries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221206005976/en/

Jonah Teeter-Balin +1 (805) 520-8350 x4278

https://investor.avinc.com/contact-us

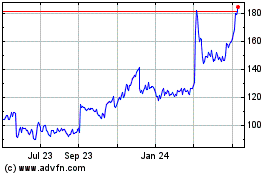

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

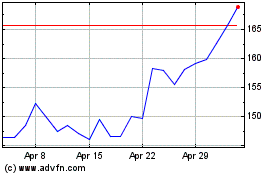

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Apr 2023 to Apr 2024