Washington, D.C. 20549

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held at 1:00 p.m. Pacific Time on March 11, 2022

Dear Stockholders of Avinger, Inc.:

We cordially invite you to attend a special meeting of stockholders, which we refer to as the Special Meeting, of Avinger, Inc., a Delaware corporation (the “Company” or “Avinger”), which will be held on March 11, 2022 at 1:00 p.m. Pacific Time, in person at our offices at 400 Chesapeake Drive, Redwood City, California 94063, for the following purposes, as more fully described in the accompanying proxy statement:

1. To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a reverse stock split at a ratio not less than 1-for-5 and not greater than 1-for-20, with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders;

2. To approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes in favor of the foregoing proposal; and

3. To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof.

Our board of directors has fixed the close of business on January 18, 2022 as the record date for the Special Meeting. Only holders of record of our common stock and Series D preferred stock on January 18, 2022 are entitled to notice of and to vote at the Special Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

We are carefully monitoring the public health impact of the coronavirus (COVID-19) on a daily basis, and may decide to forego the physical, in person Special Meeting in favor of a virtual-only Special Meeting or some other alternative depending on the situation. While we understand this could disrupt the travel plans of those who plan to attend, our first priority is the health and safety of our communities, stockholders, employees and other stakeholders. In the event we decide to hold a virtual-only Special Meeting or some other alternative, stockholders will be notified and provided with additional details in a press release, at our website at www.avinger.com, and pursuant to filings we make with the U.S. Securities and Exchange Commission. At any virtual-only Special Meeting, we will ensure that all stockholders or their proxyholder have the ability to participate, ask questions and vote their shares. As always, we encourage you to vote your shares prior to the Special Meeting.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Special Meeting, we urge you to submit your vote via the Internet, telephone or mail.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to be held on March 11, 2022: The Proxy Statement is available at www.proxyvote.com

We appreciate your continued support of Avinger.

|

|

By order of the Board of Directors,

|

|

|

|

|

|

Jeffrey M. Soinski

|

|

|

Chief Executive Officer

|

|

|

Redwood City, California

|

|

|

January , 2022

|

|

|

Page

|

|

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

|

|

|

What matters am I voting on?

|

1

|

|

How does the board of directors recommend I vote on these proposals?

|

1

|

|

Who is entitled to vote?

|

1

|

|

How many votes are needed for approval of each proposal?

|

2

|

|

What is the quorum?

|

2

|

|

How do I vote?

|

2

|

|

Can I change my vote?

|

3

|

|

What do I need to do to attend the Special Meeting in person?

|

3

|

|

What is the effect of giving a proxy?

|

4

|

|

How are proxies solicited for the Special Meeting?

|

4

|

|

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

|

4

|

|

Where can I find the voting results of the Special Meeting?

|

4

|

|

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

|

4

|

|

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

|

5

|

|

Who can help answer my questions?

|

6

|

|

PROPOSAL NO. 1 APPROVAL OF AMENDMENT OF THE CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

|

7

|

|

Background for the Proposal

|

8

|

|

Reasons for the Reverse Stock Split

|

9

|

|

Possible Effects of the Reverse Stock Split

|

10

|

|

Effectiveness of Reverse Stock Split

|

14

|

|

Exchange Procedures

|

14

|

|

No Appraisal Rights

|

15

|

|

Interests of Directors and Executive Officers

|

15

|

|

Vote Required

|

15

|

|

PROPOSAL NO. 2 ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO CONTINUE TO SOLICIT VOTES IN FAVOR OF THE FOREGOING PROPOSAL

|

16

|

|

Overview

|

16

|

|

Vote Required

|

16

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

17

|

|

OTHER MATTERS

|

18

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

18

|

|

APPENDIX A CERTIFICATE OF AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF AVINGER, INC.

|

19

|

AVINGER, INC.

PROXY STATEMENT

FOR SPECIAL MEETING OF STOCKHOLDERS

To Be Held at 1:00 p.m. Pacific Time on March 11, 2022

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the special meeting of stockholders of Avinger, Inc., a Delaware corporation, and any postponements, adjournments or continuations thereof, which we refer to as the Special Meeting. The Special Meeting will be held on March 11, 2022 at 1:00 p.m. Pacific Time, at our offices at 400 Chesapeake Drive, Redwood City, California 94063. This proxy statement is being first being mailed on or about January , 2022 to all stockholders entitled to vote at the Special Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

What matters am I voting on?

You will be voting on:

|

|

●

|

a proposal to amend the Company’s Certificate of Incorporation to effect a reverse stock split at a ratio not less than 1-for-5 and not greater than 1-for-20, with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders (such action, the “Reverse Stock Split” and such proposal is referred to herein as the “Reverse Stock Split Proposal”); and

|

|

|

●

|

a proposal to approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes in favor of the foregoing proposal (the “Adjournment Proposal”).

|

How does the board of directors recommend I vote on these proposals?

Our board of directors recommends a vote:

|

|

●

|

“FOR” the Reverse Stock Split Proposal.

|

|

|

●

|

“FOR” the Adjournment Proposal.

|

Who is entitled to vote?

Holders of our common stock and our Series D Convertible Preferred Stock (the “Series D Preferred Stock”) as of the close of business on January 18, 2022, the record date for the Special Meeting, may vote at the Special Meeting. Holders of our Series A Convertible preferred stock, par value $0.001 per share, or Series A preferred stock, and Series B Convertible preferred stock, par value $0.001 per share, or Series B preferred stock, are not entitled to notice of or a vote upon any matters to be presented at the Special Meeting. As of the record date, there were 95,565,237 shares of our common stock outstanding, and 7,600 shares of Series D Preferred Stock outstanding. Holders of record of shares of common stock will be entitled to one vote for each share of our common stock held by them on the record date, and have the right to vote on all matters brought before the Special Meeting. Holders of record of shares of our Series D Preferred Stock have the right to vote only on the Reverse Stock Split Proposal, and are entitled to 750,000 votes for each share of Series D Preferred Stock outstanding as of the Record Date, provided, that such votes must be counted by the Company in the same proportion as the aggregate shares of common stock voted on this proposal. As an example, if 50.5% of the shares of common stock voted at the Special Meeting are voted at the Special Meeting in favor of the Reverse Stock Split Proposal, the Company can count 50.5% of the votes cast by the holders of the Series D Preferred Stock as votes in favor of the Reverse Stock Split Proposal. Holders of common stock and Series D Preferred Stock will vote on the Reverse Stock Split Proposal as a single class. Only holders of our common stock are entitled to vote on the Adjournment Proposal.

Registered Stockholders. If shares of our common stock or Series D preferred stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares and notice of the Special Meeting was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or vote in person at the Special Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If shares of our common stock or Series D preferred stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and notice of the Special Meeting was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Special Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock in person at the Special Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

We are carefully monitoring the public health impact of the coronavirus (COVID-19) on a daily basis, and may decide to forego the physical, in person Special Meeting in favor of a virtual-only Special Meeting or some other alternative depending on the situation. While we understand this could disrupt the travel plans of those who plan to attend, our first priority is the health and safety of our communities, stockholders, employees and other stakeholders. In the event we decide to hold a virtual-only Special Meeting or some other alternative, stockholders will be notified and provided with additional details in a press release, at our website at www.avinger.com and pursuant to filings we make with the U.S. Securities and Exchange Commission (“SEC”). At any virtual-only Special Meeting, we will ensure that all stockholders or their proxyholder have the ability to participate, ask questions and vote their shares. As always, we encourage you to vote your shares prior to the Special Meeting.

How many votes are needed for approval of each proposal?

|

|

●

|

Proposal No. 1: The approval of the Reverse Stock Split Proposal requires the affirmative vote of a majority of the voting power outstanding. The holders of common stock have the right to cast one (1) vote per share of common stock on this proposal. The holders of Series D Preferred Stock have the right to cast 750,000 votes per share of Series D Preferred Stock on this proposal, provided, that such votes must be counted by the Company in the same proportion as the aggregate shares of common stock voted on this proposal (the “Supermajority Voting Rights”). As an example, if 50.5% of the shares of common stock voted at the Special Meeting are voted in favor of the Reverse Stock Split Proposal, the Company can count 50.5% of the votes cast by the holders of the Series D Preferred Stock as votes in favor of the Reverse Stock Split Proposal. These Supermajority Voting Rights mean that the Reverse Stock Split Proposal could be approved if a majority of the shares of common stock voting at the Special Meeting vote in favor of the Reverse Stock Split Proposal, even if less than a majority of the outstanding shares of common stock vote in favor of the Reverse Stock Split Proposal.

Because the affirmative vote of holders of a majority of the voting power outstanding is required for this proposal, abstentions, and broker non-votes will have the same effect as votes against this proposal. We believe that the Reverse Stock Split Proposal would be considered a “routine” matter. If you hold shares of our common stock in street name, in the absence of timely directions, your broker will have discretion to vote your shares on routine matters.

|

|

|

●

|

Proposal No. 2: The approval of the Adjournment Proposal requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Special Meeting and entitled to vote thereon to be approved. Only the holders of outstanding shares of common stock are entitled to vote on this proposal. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “against” the proposal. We believe the Adjournment Proposal would be considered a “routine” matter. If you hold shares of our common stock in street name, in the absence of timely directions, your broker will have discretion to vote your shares on routine matters.

|

What is the quorum?

A quorum is the minimum number of shares required to be present at the Special Meeting for the Special Meeting to be properly held under our amended and restated bylaws and Delaware law. The presence, in person or by proxy, of at least one-third of all issued and outstanding shares of our common stock and Series D Preferred Stock entitled to vote at the Special Meeting will constitute a quorum at the Special Meeting, provided that the presence, in person or by proxy, of at least one-third of all issued and outstanding shares of our common stock will be required to constitute a quorum. Abstentions, withhold votes, and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

|

|

●

|

by Internet at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on March 10, 2022 (have your proxy card in hand when you visit the website);

|

|

|

●

|

by toll-free telephone at 1-800-690-6903 (have your proxy card in hand when you call);

|

|

|

●

|

by completing and mailing your proxy card (if you received printed proxy materials); or

|

|

|

●

|

by written ballot at the Special Meeting.

|

Even if you plan to attend the Special Meeting in person, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend. We are carefully monitoring the public health impact of the coronavirus (COVID-19) on a daily basis, and may decide to forego the physical, in person Special Meeting in favor of a virtual-only Special Meeting or some other alternative depending on the situation. In the event we decide to hold a virtual-only Special Meeting or some other alternative, stockholders will be notified and provided with additional details in a press release, at our website at www.avinger.com and pursuant to filings we make with the SEC. At any virtual-only Special Meeting, we will ensure that all stockholders or their proxyholder have the ability to participate, ask questions and vote their shares. As always, we encourage you to vote your shares prior to the Special Meeting.

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning an instruction card, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares in person at the Special Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

Pursuant to that certain Securities Purchase Agreement between us and the holders of the Series D preferred stock, the holders of the outstanding shares of Series D preferred stock have agreed that their shares of Series D preferred stock shall be voted on the Reverse Stock Split Proposal in the same proportion as the shares of common stock that are voted at the Special Meeting. As an example, if 50.5% of the shares of common stock voted at the Special Meeting are voted in favor of the Reverse Stock Split Proposal, the Company can count 50.5% of the votes cast by the holders of the Series D Preferred Stock as votes in favor of the Reverse Stock Split Proposal. The Supermajority Voting Rights of the Series D preferred stock mean that the Reverse Stock Split Proposal could be approved if a majority of the shares of common stock voting at the Special Meeting vote in favor of the Reverse Stock Split Proposal, even if less than a majority of the outstanding shares of common stock vote in favor of the Reverse Stock Split Proposal.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Special Meeting by:

|

|

●

|

entering a new vote by Internet or by telephone;

|

|

|

●

|

completing and mailing a later-dated proxy card;

|

|

|

●

|

notifying the Secretary of Avinger, Inc., in writing, at 400 Chesapeake Drive, Redwood City, California 94063; or

|

|

|

●

|

completing a written ballot at the Special Meeting.

|

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

What do I need to do to attend the Special Meeting in person?

Space for the Special Meeting is limited. Therefore, admission will be on a first-come, first-served basis. Registration will open at 12:40 p.m. Pacific Time and the Special Meeting will begin at 1:00 p.m. Pacific Time. Each stockholder should be prepared to present:

|

|

●

|

valid government photo identification, such as a driver’s license or passport; and

|

|

|

●

|

if you are a street name stockholder, proof of beneficial ownership as of January 18, 2022, the record date, such as your most recent account statement reflecting your stock ownership prior to January 18, 2022, along with a copy of the voting instruction card provided by your broker, bank, trustee or other nominee or similar evidence of ownership.

|

Use of cameras, recording devices, computers and other electronic devices, such as smart phones and tablets, will not be permitted at the Special Meeting. Please allow ample time for check-in. Parking is limited. For stockholders who plan to attend in person, directions to the Special Meeting may be obtained by contacting our investor relations department at (650) 241-7916 or ir@avinger.com.

We are carefully monitoring the public health impact of the coronavirus (COVID-19) on a daily basis, and may decide to forego the physical, in person Special Meeting in favor of a virtual-only Special Meeting or some other alternative depending on the situation. In the event we decide to hold a virtual-only Special Meeting or some other alternative, stockholders will be notified and provided with additional details in a press release, at our website at www.avinger.com and pursuant to filings we make with the SEC. At any virtual-only Special Meeting, we will ensure that all shareholders or their proxyholder have the ability to participate, ask questions and vote their shares. As always, we encourage you to vote your shares prior to the Special Meeting.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Jeffrey M. Soinski and Mark Weinswig have been designated as proxy holders by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Special Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in this proxy statement are properly presented at the Special Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Special Meeting is adjourned, the proxy holders can vote the shares on the new Special Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

How are proxies solicited for the Special Meeting?

Our board of directors is soliciting proxies for use at the Special Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies. In addition, the Company has engaged Kingsdale Shareholder Services, U.S., Inc. (“Kingsdale”) to assist in the solicitation of proxies and provide related advice and informational support, for which Kingsdale will receive a base services fee of $8,600 and reimbursement of customary costs and expenses up to $5,000. If the Reverse Stock Split Proposal is approved, we will pay to Kingsdale an additional fee of $8,000.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on “routine” matters. We believe that approval of the Reverse Stock Split Proposal and the Adjournment Proposal are “routine” matters. If the Reverse Stock Split Proposal and the Adjournment Proposal are treated as “routine matters,” your broker will have discretion to vote your shares on such matters, in the absence of timely direction from you.

Where can I find the voting results of the Special Meeting?

We will announce preliminary voting results at the Special Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Special Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Special Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K as soon as they become available.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of our proxy materials to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy our proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of our proxy materials, such stockholder may contact us at the following address:

Avinger, Inc.

Attention: Investor Relations

400 Chesapeake Drive

Redwood City, California 94063

Tel: (650) 241-7916

Email: ir@avinger.com

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

What is the deadline to propose actions for consideration at the Company’s next annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to our Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2022 annual meeting of stockholders, our Secretary must receive the written proposal at our principal executive offices, at the address below, not later than July 8, 2022. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

Avinger, Inc.

Attention: Secretary

400 Chesapeake Drive

Redwood City, California 94063

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such meeting, (ii) otherwise properly brought before such meeting by or at the direction of our board of directors, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice to our Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for our 2022 annual meeting of stockholders, our Secretary must receive the written notice at our principal executive offices:

|

|

●

|

not earlier than August 22, 2022; and

|

|

|

●

|

not later than the close of business on September 21, 2022.

|

In the event that we hold our 2022 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the 2021 annual meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before our 2022 annual meeting of stockholders and no later than the close of business on the later of the following two dates:

|

|

●

|

the 90th day prior to our 2022 annual meeting of stockholders; or

|

|

|

●

|

the 10th day following the day on which public announcement of the date of our 2022 annual meeting of stockholders is first made.

|

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Nomination of Director Candidates

You may propose director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directors and should be directed to our Secretary at the address set forth above.

In addition, our amended and restated bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Secretary within the time periods described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Our nominating and corporate governance committee will consider candidates for director recommended by stockholders, so long as such recommendations comply with our Certificate of Incorporation, amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws, our policies and procedures for director candidates, as well as the regular director nominee criteria described above. This process is designed to ensure that our board of directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should contact our Secretary in writing. Such recommendations must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate confirming willingness to serve on our board of directors. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also nominate candidates for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and should be sent in writing to our Secretary at 400 Chesapeake Drive, Redwood City, California 94063. To be timely for our 2022 annual meeting of stockholders, our Secretary must receive the nomination no earlier than August 22, 2022 and no later than September 21, 2022.

Availability of Bylaws

A copy of our amended and restated bylaws, as amended, may be obtained by accessing our public filings on the SEC’s website at www.sec.gov. You may also contact our Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

Who can help answer my questions?

If you have any questions concerning the Special Meeting or this proxy statement, would like additional copies of this proxy statement or need help voting your shares of common stock, please contact our proxy solicitor:

Kingsdale Advisors

Strategic Shareholder Advisor and Proxy Solicitation Agent

745 Fifth Avenue, 5th Floor, New York, NY 10151

North American Toll Free Phone:

1-855-476-7986

Email: contactus@kingsdaleadvisors.com

Call Collect Outside North America: 416-867-2272

If your broker, bank or other nominee holds your shares of common stock, you should also call your broker, bank or other nominee for additional information.

PROPOSAL NO. 1

APPROVAL OF AMENDMENT OF THE CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

The board of directors has unanimously adopted a resolution seeking stockholder approval to amend the Company’s Certificate of Incorporation to effect a reverse stock split of the Company’s outstanding common stock, which we refer to as the “Reverse Stock Split.” If this proposal is approved by the stockholders, the board of directors may subsequently effect, in its sole discretion, the Reverse Stock Split using a split ratio of between, and including, 1-for-5 and 1-for-20 (for example, 1-for-5, 1-for-10, or 1-for-20). Approval of this proposal by the stockholders would give the board of directors authority to implement the Reverse Stock Split at any time. Under that certain Securities Purchase Agreement dated January 12, 2022 between the Company and the investors party thereto (the “Securities Purchase Agreement”), the Company is obligated to file the Reverse Split Amendment within one business day of receiving stockholder approval.

The form of the proposed amendment to our Certificate of Incorporation to effect the Reverse Stock Split is attached to this proxy statement as Appendix A. The amendment will effect a Reverse Stock Split of the Company’s common stock using a split ratio between, and including, 1-for-5 and 1-for-20, with the actual ratio within this range to be selected by the board of directors following stockholder approval. The board of directors believes that stockholder approval of a range of potential split ratios (rather than a single split ratio) provides the board of directors with the flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split, if approved and implemented, would not have any effect on the authorized number of shares of our common stock or preferred stock. If the stockholders approve this proposal, the Reverse Stock Split will be effected only upon a determination by the board of directors that the Reverse Stock Split is in the best interests of the stockholders at that time. In connection with any determination to effect the Reverse Stock Split, the board of directors will set the timing for such a split and select the specific ratio from within the range of ratios set forth herein.

In determining which Reverse Stock Split ratio to implement, if any, following the receipt of stockholder approval, the board of directors may consider, among other things, factors such as:

|

|

•

|

the historical trading price and trading volume of the Company’s common stock;

|

|

|

•

|

the then prevailing trading price and trading volume of the Company’s common stock and the anticipated impact of the Reverse Stock Split on the trading market for the Company’s common stock;

|

|

|

•

|

our ability to continue our listing on the NASDAQ;

|

|

|

•

|

which of the alternative reverse split ratios would result in the greatest overall reduction in our administrative costs;

|

|

|

•

|

prevailing general market and economic conditions; and

|

|

|

•

|

our market capitalization before and after the Reverse Stock Split

|

No fractional shares will be issued in connection with the Reverse Stock Split. To avoid the existence of fractional shares of the Company’s common stock, any fractional shares that would otherwise be issued as a result of the Reverse Stock Split will be rounded up to the nearest whole share. Where shares are held in certificated form, the surrender of all old certificate(s) and receipt by American Stock Transfer & Trust Company, LLC (the “Exchange Agent”) of a properly completed and duly executed transmittal letter will be required.

As of January 18, 2022, 95,565,237 shares of the Company’s common stock were issued and outstanding, 56,366 shares of Series A preferred stock were issued and outstanding, 85 shares of Series B preferred stock were issued and outstanding, and 7,600 shares of Series D preferred stock were issued and outstanding. Based on that number of shares of capital stock issued and outstanding, immediately following the completion of the Reverse Stock Split, and, for illustrative purposes only, assuming a 1-for-10 Reverse Stock Split, we would have approximately 9,556,524 shares of common stock issued and outstanding (without giving effect to the treatment of fractional shares). The number of shares of preferred stock issued and outstanding would not be affected by the Reverse Stock Split. The actual number of shares outstanding after giving effect to the Reverse Stock Split will depend on the reverse split ratio that is ultimately selected by the board of directors. We do not expect the Reverse Stock Split itself to have any immediate economic effect on the stockholders, debt holders or holders of stock options, except to the extent any fractional shares that would otherwise be issued as a result of the Reverse Stock Split are rounded up to the nearest whole share as discussed in “Exchange Procedures—Fractional Shares” below. However, because the Reverse Stock Split would not have any effect on the authorized number of shares of our common stock or preferred stock, the Reverse Stock Split would increase the ratio between our authorized capital stock and our issued capital stock. This means that, subject to the limits imposed by NASDAQ Stock Market Rule 5635(d), our board of directors could issue a relatively larger amount of capital stock without additional action by our stockholders.

Background for the Proposal

At the Company’s 2019 Annual Meeting held in June 2019, we presented proposals to (i) increase the authorized shares of common stock from 100,000,000 shares to 125,000,000 shares (the “2019 Increase Proposal”) and (ii) to effect a reverse stock split at a ratio not less than 1-for-3 and not greater than 1-for-10 (the “2019 Reverse Stock Split Proposal”). Although a majority of the shareholders who voted on the 2019 Increase Proposal, for which discretionary voting by brokers was not permitted, voted in favor of the transaction, the proposal was not approved because it was not approved by a majority of the outstanding shares of common stock, as required under Delaware law (with a total of 17,119,441 shares voting out of 64,186,127 outstanding, comprised of 9,275,941 votes for, 7,714,501 votes against, and 128,999 abstentions). Given that the vast majority of the Company’s outstanding shares of common stock were held by a large number of retail stockholders, we determined that adjournment of the 2019 Annual Meeting for additional solicitation of votes would likely not result in sufficient voting in favor of the 2019 Increase Proposal. The 2019 Reverse Stock Split Proposal was approved by approximately 52% of the outstanding shares of common stock (with 33,400,914 votes for and 16,108,372 votes against). A significant portion of the shares voted in favor of the 2019 Reverse Stock Split Proposal represented discretionary votes by brokers. Following the meeting, we effected a reverse stock split at a ratio of 1-for-10. Following the 2019 Annual Meeting, several large brokers, including brokers such as TD Ameritrade and Charles Schwab, announced that they were eliminating the practice of discretionary voting of uninstructed shares, including on matters identified as “routine” under the rules and guidance of the New York Stock Exchange, such as reverse stock splits.

At our 2020 Annual Meeting held in December 2020, we presented a proposal to effect a reverse stock split at a ratio not less than 1-for-5 and not greater than 1-for-20 (the “2020 Reverse Split Proposal”). The 2020 Reverse Split Proposal was not approved, because it was not approved by a majority of the outstanding shares of common stock, as required under Delaware law (with a total of 54,087,919 shares voting out of 84,922,079 outstanding, comprised of 30,428,326 votes for, 23,367,309 votes against, and 292,284 abstentions). The 2020 Annual Meeting was originally scheduled for December 10, 2020, but was adjourned to December 23, 2020 in order to solicit votes in favor of the 2020 Reverse Split Proposal. However, we were not able to obtain a sufficient number of votes in favor of the 2020 Reverse Split Proposal by the time of the adjourned meeting. We determined that further adjournments of the 2020 Annual Meeting and solicitation of votes were unlikely to result in sufficient voting, given the significant number of retail stockholders and did not further adjourn the 2020 Annual Meeting.

With respect to both the 2019 Increase Proposal and the 2020 Reverse Split Proposal, a majority of the shares voted were voted in favor of such proposals. However, because the number of shares voted for such proposals did not represent a majority of the outstanding shares, the proposals were not approved.

We continue to need stockholder approval of a proposal to increase our ability to finance the Company through equity offerings. At present we do not receive sufficient cash flow from operations to support our business activities, and equity financings remain as a vital tool for raising capital. Without a substantial increase in the number of shares available for future issuances we are concerned that the Company will be unable to meet its obligations, continue to grow its business and may become insolvent.

Because we have been unable to procure the votes necessary to increase the number of shares of common stock available for issuance, on January 14, 2022 we closed a preferred stock financing, in which we issued 7,600 shares of Series D Convertible Preferred Stock (the “Series D Preferred Stock”), with an aggregate stated value of $7.6 million. Each share of Preferred Stock is initially convertible into 2,500 shares of common stock. The terms of the Preferred Stock are set forth in a Certificate of Designation of Preferences, Rights and Limitations of the Series D Preferred Stock (the “Certificate of Designation”), filed with the State of Delaware and effective on January 14, 2022. The Series D Preferred Stock is not convertible until we file an amendment to our Certificate of Incorporation effecting the Reverse Stock Split. In addition, the shares of Series D Preferred Stock do not have any voting rights except with respect to the Reverse Stock Split Proposal, certain amendments to the Certificate of Designation, or otherwise as required by law. The holders of Series D Preferred Stock are not entitled to vote on the Adjournment Proposal. With respect to the Reverse Stock Split Proposal, each share of Series D Preferred Stock is entitled to 750,000 votes (the “Supermajority Voting Rights”), provided that the votes by the Series D Preferred Stock holders will be counted in the same proportion as the aggregate votes cast by the holders of common stock who vote on the Reverse Stock Split Proposal. As an example, if 50.5% of the shares of common stock voted at the Special Meeting are voted at the Special Meeting in favor of the Reverse Stock Split Proposal, the Company can count 50.5% of the votes cast by the holders of the Series D Preferred Stock as votes in favor of the Reverse Stock Split Proposal. Holders of common stock and Series D Preferred Stock will vote on the Reverse Stock Split Proposal as a single class.

We needed to provide the investors purchasing the Series D Preferred Stock with these negotiated terms, including the Supermajority Voting Rights, in order to provide needed financing to the Company to fund its operations and to secure investors committed to voting for the Reverse Stock Split Proposal presented at this Special Meeting. The shares of Series D Preferred Stock are outstanding as of the record date for this Special Meeting. In addition, as part of the Series D Preferred Stock financing, the Company issued warrants to acquire 16,150,000 shares of common stock at an exercise price of $0.48 per share (the “Common Warrants”), and warrants to acquire 1,330,000 shares of common stock at an exercise price of $0.50 per share (the “Placement Agent Warrants” and together with the Common Warrants the “January 2022 Warrants”). The January 2022 Warrants are not exercisable until the later of (i) six months from their date of issuance or (ii) the date that we file an amendment to our Certificate of Incorporation to effect the Reverse Stock Split. The Common Warrants have a five year term from their initial exercise date, and the Placement Agent Warrants expire on January 12, 2027. If the January 2022 Warrants become exercisable, they can be exercised for cash or, if no effective registration statement is available registering the issuance of the shares of common stock underlying the January 2022 Warrants, by cashless exercise.

If the Reverse Stock Split Proposal is approved, the Series D Preferred Stock holder will no longer be entitled to vote on matters presented to the common stock holders, without converting its Series D Preferred Stock, thereby eliminating the Supermajority Voting Rights of the Series D Preferred Stock.

Reasons for the Reverse Stock Split

Availability of Capital

Our board of directors believes that a reverse stock split is in the best interests of our stockholders. A reverse stock split would result in a decrease in the number of shares of common stock outstanding, without decreasing the number of authorized shares of common stock, thereby increasing the number of shares available for issuance. Increasing the number of authorized shares of common stock available for issuance will enable us to engage in capital raising transactions and other strategic transactions involving the issuance of equity securities. We have limited capital and in order for us to execute on our business plan and remain viable as a going concern. We must have the flexibility to engage in capital raising transactions until we are able to generate sufficient revenue and cash flow. Investors in prior transactions have purchased our derivative securities, such as warrants and convertible preferred stock, for which we must reserve unissued common stock.

We significantly rely on our authorized common stock to execute our business strategy, including, for example, to raise capital, repurchase debt, provide equity awards to employees, officers, directors, consultants, and/or advisors, expand our business through the acquisition of other business, and for other purposes. At present, we do not have any plans, arrangements, understandings or commitments for the authorized but unissued shares of our common stock that would become available following the implementation of an amendment to increase our authorized shares of common stock, other than to accommodate additional shares of our common stock to be authorized and reserved for future equity awards under our Amended and Restated 2015 Equity Incentive Plan and for conversion or exercise of existing securities. However, our board of directors desires to maintain flexibility to take such action necessary to execute our business strategy.

As discussed in more detail below in the section titled “Possible Effects of the Reverse Stock Split,” we presently have less than 1 million shares of common stock available for issuance. We therefore are limited in our ability to use our available capital stock to execute our business strategies, including, but not limited to, taking advantage of future capital raising opportunities that would require the issuance of shares of our common stock or derivative securities exercisable or convertible for shares of our common stock. Increasing the number of shares of common stock available for issuance through a reverse stock split will enable us to issue common stock or securities convertible or exercisable into common stock to investors and other strategic partners. These transactions, if they can be successfully negotiated and consummated, will help us fund our business plan, including the funding of our clinical trials and expansion of our sales efforts. You should be aware that these potential capital raising transactions or other strategic transactions involving the issuance of additional shares of common stock will have a dilutive effect on our existing stockholders, as further described in the section below titled “Possible Effects of the Reverse Stock Split.”

If the Reverse Stock Split Proposal is not approved, we will be limited in our efforts to raise additional capital. In such event, our operations, financial condition and our ability to continue as a going concern may be materially and adversely affected.

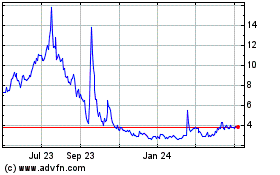

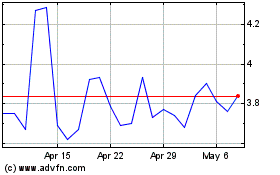

Reduce the risk of future non-compliance and/or delisting on the NASDAQ Capital Market

On September 22, 2021, we received a letter from the Listing Qualifications Department of NASDAQ notifying us that we were not in compliance with NASDAQ Listing Rule 5550(a)(2), as the minimum bid price for our listed securities was less than $1 for the previous 30 consecutive business days. We have a period of 180 calendar days, or until March 21, 2022, to regain compliance with the rule referred to in this paragraph. To regain compliance, during the 180 day period, the bid price of our Common Stock must close at $1 or more for a minimum of ten consecutive business days. The notice has no present impact on the listing of our securities on Nasdaq.

If we do not regain compliance during such 180-day period, we may be eligible for an additional 180 calendar days, provided that we meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq except for Nasdaq Listing Rule 5550(a)(2), and provide a written notice of our intention to cure this deficiency during the second compliance period. If it appears to Nasdaq that we will not be able to cure the deficiency, or if we are otherwise not eligible, we will receive written notification that our securities are subject to delisting. At that time, we may appeal the delisting determination to a hearings panel pursuant to the procedures set forth in the applicable Nasdaq Listing Rules.

Our board of directors believes that effecting the Reverse Stock Split could be an effective means of ensuring continued compliance with the minimum $1.00 bid price requirement for continued listing of our common stock on the NASDAQ Capital Market and minimize the risk of future delisting from the NASDAQ Capital Market. Assuming stockholders have approved the Reverse Stock Split, we may implement the Reverse Stock Split utilizing a ratio the board of directors believes will position us to ensure compliance with the NASDAQ minimum bid price requirements. If, in the future, we again become non-compliant with the minimum bid price requirement, NASDAQ may suspend trading of our common stock on the NASDAQ Capital Market and commence delisting proceedings before we are able to implement the Reverse Stock Split.

While we intend to monitor the average closing price of our common stock and consider available options depending on the trading price of our common stock, no assurances can be made that we will in fact be able to continue to comply and that our common stock will continue to remain listed on the NASDAQ Capital Market. If our common stock is subsequently delisted, we could experience significant negative impacts including the acceleration of our outstanding debt with CRG Partners III L.P. and certain of its affiliated funds due to the invoking of a material adverse change clause. In addition, if our stock is delisted it will significantly and negatively affect our ability to obtain alternative debt or equity financing in order to support our operations. Such delisting could also negatively affect the market price of our common stock, reduce the number of investors willing to hold or acquire our common stock, limit our ability to issue additional securities or obtain additional financing in the future, affect our ability to provide equity awards to our employees, and might negatively impact our reputation and, as a consequence, our business. Moreover, our board of directors believes that some potential employees are less likely to work for the Company if we have a low stock price or are no longer listed on the NASDAQ Capital Market, regardless of the size of our overall market capitalization.

To potentially improve the marketability of our common stock

In addition to establishing a mechanism for the price of our common stock to maintain compliance with NASDAQ’s minimum price requirement, we also believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional and other investors. It is our understanding that the current market price of our common stock may affect our acceptability to certain institutional investors, professional investors and other members of the investing public. It is also our understanding that many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. However, some investors may view the Reverse Stock Split negatively because it reduces the number of shares of common stock available in the public market.

Reducing the number of outstanding shares of the Company’s common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of the Company’s common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the market price of the Company’s common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of the Company’s common stock will increase following the Reverse Stock Split, that the market price of the Company’s common stock will not decrease in the future, or that our common stock will maintain a high enough price per share to permit its continued listing by NASDAQ.

Possible Effects of the Reverse Stock Split

General

If the Reverse Stock Split is approved and implemented, the principal effect will be to proportionately decrease the number of outstanding shares of the Company’s common stock based on the Reverse Stock Split ratio selected by the board of directors. The Reverse Stock Split will not have any impact on the number of shares of our preferred stock outstanding. The Company’s common stock is currently registered under Section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split will not affect the registration of the Company’s common stock under the Exchange Act, or the listing of the Company’s common stock on the NASDAQ Capital Market. Following the Reverse Stock Split, we expect that the Company’s common stock will continue to be listed on the NASDAQ Capital Market or another market tier administered by NASDAQ under the symbol “AVGR,” although it will have a new CUSIP number.

Proportionate voting rights and other rights of the holders of the Company’s common stock will not be affected by the Reverse Stock Split, other than as a result of the treatment of fractional shares as described in ”Exchange Procedures—Fractional Shares” below. For example, a holder of 2% of the voting power of the outstanding shares of the Company’s common stock immediately prior to the effectiveness of the Reverse Stock Split will generally continue to hold 2% of the voting power of the outstanding shares of the Company’s common stock after the Reverse Stock Split. The number of stockholders of record will not be affected by the Reverse Stock Split. If approved and implemented, the Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of the Company’s common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares. The board of directors believes, however, that these potential effects are outweighed by the benefits of the Reverse Stock Split.

Because the number of authorized shares of our common stock and preferred stock will not be reduced in connection with the Reverse Stock Split, the Reverse Stock Split will increase the board of directors’ ability to issue authorized and unissued shares of our common stock or preferred stock without further stockholder action. The issuance of these shares would have a potentially more dilutive effect on our existing stockholders if the Reverse Stock Split is effected, and could also allow the Company to resist a hostile takeover attempt or other changes in management. The Company has not entered into any agreements providing for the issuance of any of the authorized but unissued shares, whether available as a result of the Reverse Stock Split or otherwise.

The table below sets forth, as of January 18, 2022 and for illustrative purposes only, certain effects of potential Reverse Stock Split ratios of between 1-for-5 and 1-for-20, inclusive, including on our total outstanding common stock equivalents.

|

|

|

Common Stock and Equivalents

Outstanding Prior to

Reverse Stock Split

|

|

|

Common Stock

and Equivalents

Outstanding Assuming

Certain Reverse

Stock Split Ratios

|

|

|

|

|

Shares

|

|

|

Percent of

Total

|

|

|

1-for-5

|

|

|

1-for-10

|

|

|

1-for-20

|

|

|

Common stock outstanding

|

|

|

95,565,237

|

|

|

|

96.5

|

%

|

|

|

19,113,048

|

|

|

|

9,556,524

|

|

|

|

4,778,262

|

|

|

Common stock underlying preferred stock

|

|

|

340,000(1)

|

|

|

|

0.3

|

%

|

|

|

3,868,000(2)

|

|

|

|

1,934,000(2)

|

|

|

|

967,000(2)

|

|

|

Common stock underlying warrants

|

|

|

2,645,690(3)

|

|

|

|

2.7

|

%

|

|

|

4,025,138(4)

|

|

|

|

2,012,569(4)

|

|

|

|

1,006,285(4)

|

|

|

Common stock underlying restricted stock units and options

|

|

|

207,626

|

|

|

|

0.2

|

%

|

|

|

41,526

|

|

|

|

20,763

|

|

|

|

10,382

|

|

|

Common stock reserved for issuance under our 2015 Equity Incentive Plan

|

|

|

169,605

|

|

|

|

0.2

|

%

|

|

|

33,921

|

|

|

|

16,961

|

|

|

|

8,481

|

|

|

Common stock reserved for issuance under our Officer and Director Share Purchase Plan

|

|

|

92,170

|

|

|

|

0.1

|

%

|

|

|

18,434

|

|

|

|

9,217

|

|

|

|

4,609

|

|

|

Total common stock and equivalents

|

|

|

99,020,328

|

|

|

|

|

|

|

|

27,100,067

|

|

|

|

13,550,034

|

|

|

|

6,775,019

|

|

|

Common stock available for future issuance

|

|

|

979,672

|

|

|

|

|

|

|

|

72,899,933

|

|

|

|

86,449,966

|

|

|

|

93,224,981

|

|

|

(1) Includes 340,000 shares of common stock issuable upon conversion of outstanding Series B preferred stock. Does not include 2,818,300 shares of common stock issuable upon conversion of outstanding Series A preferred stock and 19,000,000 shares of common stock issuable upon conversion of outstanding shares of Series D preferred stock. The Series A preferred stock is not convertible unless we amend our Certificate of Incorporation to increase the number of authorized shares of common stock to at least 125,000,000 shares. The Series D preferred stock is not convertible unless we amend our Certificate of Incorporation to effect the Reverse Stock Split.

|

|

|

|

(2) Includes shares of common stock issuable upon conversion of outstanding Series B preferred stock and Series D preferred stock.

|

|

|

|

(3) Does not include an aggregate of 17,480,000 shares of common stock issuable upon the exercise of the January 2022 Warrants. The January 2022 Warrants are not exercisable until the later of (i) six months from the date of issuance and (ii) the effective date of an amendment to our Certificate of Incorporation to effect the Reverse Stock Split.

|

|

|

|

(4) Include shares of common stock issuable upon the exercise of the January 2022 Warrants.

|

As illustrated by the table above, the Reverse Stock Split would significantly increase the ability of the board of directors to issue authorized and unissued shares in the future without further stockholder action. As of September 30, 2021, we had cash and cash equivalents of $23.1 million and total current assets of $29.7 million. In January 2022, we received net proceeds of approximately $6.7 million from the offering of the Series D preferred stock and January 2022 Warrants. However, we believe that we will continue to need additional funding sources to fund our operations. Our current strategy involves significant efforts to expand our product offerings and sales. To become profitable we will need to significantly increase our revenues. We do not expect that sales will increase sufficiently to cover our total costs of operations in 2022. We believe additional funding will be required during 2022 and that such funding would require authorized shares beyond what is currently authorized without effecting this Reverse Stock Split. This Proxy Statement does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. We do not have any plans, proposals or arrangements, whether written or oral, to issue and sell any of the newly available shares of common stock resulting from the Reverse Stock Split for general corporate or any other purposes.

Effect on the Company’s Stock Plans

The Company’s 2009 Stock Plan and 2015 Equity Incentive Plan each provide for proportionate adjustments to the number of shares subject to the applicable plan in the event of a reverse stock split. With respect to outstanding, unexercised awards, the Reverse Stock Split will result in an increase in the applicable price per share corresponding to the ultimate reverse stock split ratio. As of January 18, 2022, the Company had 377,231 shares of common stock reserved for issuance pursuant to the 2015 Equity Incentive Plan, consisting of (i) 207,626 shares subject to previously granted awards and (ii) 169,605 shares remaining available for grant.

Should the Reverse Stock Split be effected, each of the above stock plans provides for proportionate adjustments to the number of shares available for issuance and awardable, and as applicable, automatic proportionate adjustments to the shares awarded and the exercise price, grant price or purchase price relating to awards under such plan.

Accordingly, if this proposal is approved by the stockholders and the Reverse Stock Split is implemented by the board of directors, upon the filing of an amendment in the form attached as Appendix A to our Certificate of Incorporation with the Delaware Secretary of State, the number of all outstanding equity awards, the number of shares available for issuance and awardable and the exercise price, grant price or purchase price relating to any award under the Company’s stock plans will be proportionately adjusted using the split ratio selected by the board of directors (subject to the treatment of fractional shares as described above). The compensation committee has also authorized the Company to effect any other changes necessary, desirable or appropriate to give effect to the Reverse Stock Split, including any applicable technical, conforming changes to our stock plans. For example, if a 1-for-10 reverse stock split is effected, the 169,605 shares that remain available for issuance under the 2015 Equity Incentive Plan as of January 18, 2022, would be adjusted to 16,961 shares. In addition, the exercise price per share under each stock option would be increased by 10 times, such that upon an exercise, the aggregate exercise price payable by the optionee to the Company would remain the same. For illustrative purposes only, an outstanding stock option for 4,000 shares of common stock, exercisable at $1.00 per share, would be adjusted as a result of a 1-for-10 split ratio into an option exercisable for 400 shares of common stock at an exercise price of $10.00 per share.

Effect on Authorized but Unissued Shares of Capital Stock

Currently, we are authorized to issue up to a total of 100,000,000 shares of common stock, of which 95,565,237 shares were issued and outstanding as of January 18, 2022, and 5,000,000 shares of preferred stock. As of January 18, 2022, 60,000 shares of preferred stock were designated Series A preferred stock, 85 shares of preferred stock were designated Series B preferred stock, and 7,600 of preferred stock were designated Series D preferred stock. As of January 18, 2022, 56,366 shares of Series A preferred stock were issued and outstanding, 85 shares of Series B preferred stock were issued and outstanding, and 7,600 shares of Series D preferred stock were issued and outstanding.

The Reverse Stock Split, if approved and implemented, would not have any effect on the authorized number of shares of our common stock or preferred stock. Proportionately, the Reverse Stock Split would increase the ratio between our authorized capital stock and our issued capital stock. This means that, subject to the limits imposed by NASDAQ Stock Market Rule 5635(d), our board of directors could issue a relatively larger amount of capital stock without additional action by our stockholders. The issuance of additional shares of our capital stock would dilute the voting and economic rights of our existing stockholders. Additionally, the ability to issue a relatively larger amount of capital stock could allow our board of directors to take certain actions which would discourage hostile takeover attempts. The ability to resist takeover attempts could also allow our board of directors greater power to resist or delay changes in control or the removal of our management team. Our board of directors would consider any takeover attempts and proposed changes in control or management, and would act in accordance with our stockholders’ best interests, as determined by the exercise of the directors’ business judgment.

Effect on Par Value

The certificate of amendment attached as Appendix A does not contemplate any change to the par value of our common stock or preferred stock, which are both currently $0.001 per share.

Reduction in Stated Capital

Upon the effectiveness of the Reverse Stock Split, the stated capital on our balance sheet attributable to the Company’s common stock, which consists of the par value per share of the Company’s common stock multiplied by the aggregate number of shares of the Company’s common stock issued and outstanding, will be reduced in proportion to the size of the Reverse Stock Split. Correspondingly, our paid-in capital account, which consists of the difference between our stated capital and the aggregate amount paid to us upon issuance of all currently outstanding shares of the Company’s common stock, will be increased by the same amount by which the stated capital is reduced. The stockholders’ equity, in the aggregate, will remain unchanged.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the proposed Reverse Stock Split, this transaction is not the first step in a “going private transaction,” within the meaning of Rule 13e-3 of the Exchange Act, and will not produce, either directly or indirectly, any of the effects described in paragraph (a)(3)(ii) of Rule 13e-3.

Certain Material U.S. Federal Income Tax Consequences

The following paragraphs are intended as a summary of certain U.S. federal income tax consequences to U.S. Holders (as defined below) with respect to the Reverse Stock Split, if effected. This summary does not attempt to describe all possible federal or other tax consequences of such actions nor does it address the particular circumstances of any U.S. Holder of shares of the Company’s common stock. In addition, it does not describe any state, local or non-U.S. tax consequences.

The following discussion is a general summary of certain U.S. federal income tax consequences of the Reverse Stock Split that may be relevant to holders of shares of the Company’s common stock that are U.S. Holders (as defined below) who hold such stock as a capital asset within the meaning of Section 1221 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) for federal income tax purposes. This summary is based upon the provisions of the Code, Treasury regulations promulgated thereunder, administrative rulings and judicial decisions as of the date hereof, all of which may change, possibly with retroactive effect, resulting in U.S. federal income tax consequences that may differ from those discussed below. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation that, if enacted, could be applied on a retroactive or prospective basis. This discussion does not address all aspects of federal income taxation that may be relevant to U.S. Holders in light of their particular circumstances or to holders that may be subject to special tax rules, including, without limitation: (i) holders subject to the alternative minimum tax; (ii) banks, insurance companies, underwriters, or other financial institutions; (iii) tax-exempt organizations, qualified retirement plans, individual retirement accounts or other tax-deferred accounts; (iv) dealers in securities or commodities; (v) regulated investment companies or real estate investment trusts; (vi) partnerships (or other flow-through entities for U.S. federal income tax purposes and their partners or members); (vii) traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; (viii) U.S. Holders (as defined below) whose “functional currency” is not the U.S. dollar; (ix) persons holding shares of the Company’s common stock as a position in a hedging transaction, “straddle,” “conversion transaction” or other risk reduction transaction; (x) persons who acquire shares of the Company’s common stock in connection with employment or other performance of services including pursuant to the exercise of compensatory stock options or the vesting of restricted shares of the Company’s common stock; (xi) persons who hold shares of the Company’s common stock as qualified small business stock within the meaning of Section 1202 of the Code; (xii) U.S. expatriates or former long-term residents of the U.S.; (xiii) holders which own, have owned or will own (directly, indirectly or by attribution) 10% or more of the total vote or value of the Company’s stock; (xiv) holders that are subject to special tax accounting rules with respect to shares of the Company’s common stock; or (xv) holders that are subject to taxing jurisdictions other than, or in addition to, the U.S. In addition, this summary does not address the tax consequences arising under the laws of any foreign, state or local jurisdiction and U.S. federal tax consequences other than federal income taxation. If a partnership (including any entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds shares of the Company’s common stock, the tax treatment of a holder that is a partner in the partnership generally will depend upon the status of the partner and the activities of the partnership. Owners of entities or arrangements that are classified as partnerships for U.S. federal income tax purposes should consult their own tax advisor regarding the U.S. federal income tax consequences arising from and relating to the Reverse Stock Split. This summary does not discuss any U.S. federal income tax consequences applicable to holders of Series D Preferred Stock. Holders of Series D Preferred Stock should consult their own tax advisors regarding the U.S. federal, state and local and non-U.S. tax consequences of the Reverse Stock Split and any related transactions to them in light of their own particular circumstances.

We have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service (“IRS”) regarding the United States federal income tax consequences of the Reverse Stock Split and there can be no assurance the IRS will not challenge the statements and conclusions set forth in this discussion or that a court would not sustain any such challenge. EACH HOLDER OF COMMON STOCK SHOULD CONSULT SUCH HOLDER’S OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH HOLDER.

For purposes of the discussion below, a “U.S. Holder” is a beneficial owner of shares of the Company’s common stock that for U.S. federal income tax purposes is: (i) an individual citizen or resident of the United States; (ii) a corporation (including any entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state or political subdivision thereof; (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (iv) a trust, the administration of which is subject to the primary supervision of a U.S. court and as to which one or more U.S. persons have the authority to control all substantial decisions of the trust, or that has a valid election in effect to be treated as a U.S. person.

This summary does not address the tax consequences of transactions effected prior or subsequent to, or concurrently with, the Reverse Stock Split (whether or not such transactions are undertaken in connection with the Reverse Stock Split).