Current Report Filing (8-k)

21 March 2023 - 7:46AM

Edgar (US Regulatory)

false

0001506928

0001506928

2023-03-17

2023-03-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 17, 2023

Avinger, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36817

|

|

20-8873453

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

400 Chesapeake Drive

Redwood City, California 94063

(Address of principal executive offices, including zip code)

(650) 241-7900

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each

class:

|

|

Trading

Symbol(s):

|

|

Name of each exchange on which registered:

|

|

Common Stock, par value $0.001 per share

|

|

AVGR

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events

As previously disclosed, on May 20, 2022, Avinger, Inc., (the “Company”), entered into an At the Market Offering Agreement (the “ATM Agreement”) with H.C. Wainwright & Co., LLC (the “Agent”), as sales agent, pursuant to which the Company may offer and sell shares of the Company’s common stock, par value $0.001 per share (the “Shares”), initially up to an aggregate offering price of $7,000,000, from time to time in an at-the-market public offering. On August 3, 2022, the Company determined to suspend sales under the ATM Agreement and terminated the continuous offering of the initial aggregate offering price of $7,000,000. As of August 3, 2022, the Company had sold an aggregate of $979,303 in shares of its common stock under the ATM Agreement.

The Company has determined to resume sales under the ATM Agreement, up to an aggregate offering price of $1,149,028. The Shares sold under the ATM Agreement will be offered and sold pursuant to the Company’s shelf registration statement on Form S-3 (Registration No. 333-263922), which was initially filed with the Securities and Exchange Commission (the “SEC”) on March 29, 2022 and declared effective on April 7, 2022, and a prospectus supplement and the accompanying prospectus relating to the at-the-market offering filed with the SEC on March 17, 2023.

Because there is no minimum offering amount required pursuant to the ATM Agreement, the total number of Shares to be sold under the ATM agreement, if any, and proceeds to the Company, if any, are not determinable at this time. The Company expects to use any net proceeds for primarily for working capital and general corporate purposes, which may include research and development of the Company’s Lumivascular platform products, preclinical and clinical trials and studies, regulatory submissions, expansion of its sales and marketing organizations and efforts, intellectual property protection and enforcement and capital expenditures. The Company has not yet determined the amount of net proceeds to be used specifically for any particular purpose or the timing of these expenditures. The Company may use a portion of the net proceeds to acquire complementary products, technologies or businesses or to repay principal on its debt; however, it currently has no binding agreements or commitments to complete any such transactions or to make any such principal repayments from the proceeds of this offering, although it does look for such acquisition opportunities. Accordingly, the Company’s management will have significant discretion and flexibility in applying the net proceeds from the sale of these securities.

A copy of the opinion of the Company’s counsel relating to the validity of the Shares that may be sold pursuant to the ATM Agreement is filed herewith as Exhibit 5.1.

This Current Report on Form 8-K, including the exhibits filed herewith, shall not constitute an offer to sell or the solicitation of an offer to buy the Shares that may be sold pursuant to the ATM Agreement, nor shall there be any offer, solicitation or sale of the Shares in any state or country in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or country.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits:

|

Exhibit No.

|

|

Description

|

|

5.1

|

|

|

|

23.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

AVINGER, INC.

|

| |

|

|

|

| |

|

|

|

|

Date: March 20, 2023

|

By:

|

/s/ Jeffrey M. Soinski

|

|

| |

|

Jeffrey M. Soinski

Chief Executive Officer

|

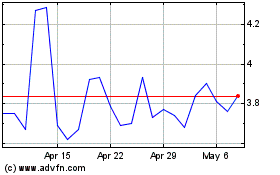

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

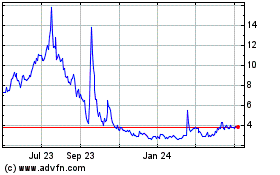

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Apr 2023 to Apr 2024