AvePoint Announces First Quarter 2022 Financial Results

13 May 2022 - 6:05AM

AvePoint (NASDAQ: AVPT), the most advanced SaaS and data management

platform provider, today announced financial results for the first

quarter ended March 31, 2022.

“AvePoint’s first quarter results were a good start to 2022,

with robust SaaS revenue growth of 45%, solid ARR growth of 30% and

profitability that was ahead of expectations,” said Dr. Tianyi

Jiang (TJ), CEO and Co-Founder, AvePoint. “Underpinning our strong

revenue growth is the continued evolution of our full suite of SaaS

solutions that enable organizations worldwide to collaborate with

confidence in the cloud by securing collaboration data, sustaining

the connections between people, and ensuring business continuity.

I'm thankful to our AvePoint team for its continued focus on

execution through extending innovative product offerings, expanding

our channel business, and quickly responding to the evolving market

trends our existing customers face as they continue their cloud

transformations.”

First Quarter 2022 Financial Highlights

- Revenue: Total

revenue for the first quarter of 2022 was $50.3 million, up 30%

from the first quarter of 2021. Within total revenue, SaaS revenue

was $26.6 million, up 45% from the first quarter of 2021, and term

license and support revenue was $10.2 million, up 17% from the

first quarter of 2021.

- Gross Profit: Gross

profit for the first quarter of 2022 was $35.7 million, compared to

$28.0 million for the first quarter of 2021. Gross margin for the

first quarter of 2022 was 70.9%, compared to 72.2% for the first

quarter of 2021. Non-GAAP gross profit for the first quarter of

2022 was $36.2 million, compared to $28.1 million for the first

quarter of 2021. Non-GAAP gross margin was 72.1% for the first

quarter of 2022, compared to 72.5% for the first quarter of

2021.

- Operating

Income/(Loss): Operating loss for the first quarter of

2022 was $(13.8) million, compared to $(5.9) million for the first

quarter of 2021. Non-GAAP operating loss for the first quarter of

2022 was $(5.6) million, compared to $(2.6) million for the first

quarter of 2021.

- Cash and Short-Term

Investments: $260 million as of March 31, 2022.

First Quarter Key Highlights

- Grew total ARR 30% year-over-year to

$167.4 million.

- Reported dollar-based net retention

rate of 108%.

- Expanded robust data protection

capabilities with the introduction of ransomware detection.

- Introduced AvePoint Entrust, which

manages administrative users, processes, and data insights across

multi-cloud tenants, and Confide, AvePoint’s secure virtual data

room workspace designed to help business users with swift and

secure collaboration on confidential projects.

- To date, repurchased 945,000 shares

under the share repurchase program at a cost of approximately $4.8

million.

Financial Outlook

AvePoint is providing guidance for its second quarter and full

year 2022 as follows:

- Second Quarter 2022

Guidance: Total revenue is expected to be in the range of

$54.0 million to $56.0 million or approximately 21% year-over-year

growth. Non-GAAP operating loss is expected to be in the range of

$(1.5) to $(2.5) million.

- Full Year 2022

Guidance: Total revenue is expected to be in the range of

$238.0 million to $244.0 million or approximately 26%

year-over-year growth. Non-GAAP operating income/loss is expected

to be in the range of a loss of $(3.5) million to income of $1.0

million. ARR is expected to be in the range of $212 million to $216

million or approximately 34% year-over-year growth.

Quarterly Conference Call

AvePoint will host a conference call today, May 12, 2022, to

review its first quarter 2022 financial results and to discuss its

financial outlook. The call is scheduled to begin at 4:30pm ET. You

may access the call and register with a live operator by dialing 1

(877) 224-6304 for US participants and 1 (416) 981-9015 for those

outside the US. The conference ID for the call is 22018544.

Investors can also join by webcast by visiting

https://ir.avepoint.com/events. The webcast will be available live,

and a replay will be available following the completion of the live

broadcast for approximately 90 days.

About AvePoint

Collaborate with confidence. AvePoint provides the most advanced

platform for SaaS and data management to optimize SaaS operations

and secure collaboration. More than 9 million cloud users rely on

our solutions. Our SaaS solutions are also available to managed

service providers via more than 100 cloud marketplaces, so they can

better support and manage their small and mid-sized business

customers. Founded in 2001, AvePoint is a five-time Global

Microsoft Partner of the Year and headquartered in Jersey City, New

Jersey. For more information, visit www.avepoint.com.

Non-GAAP Financial Measures

To supplement AvePoint’s consolidated financial statements

presented in accordance with GAAP, the company uses non-GAAP

measures of certain components of financial performance. These

non-GAAP measures include non-GAAP gross profit, non-GAAP gross

margin, non-GAAP operating expenses (including percentage of

revenue figures), non-GAAP operating income and non-GAAP operating

margin. In order for AvePoint’s investors to be better able to

compare its current results with those of previous periods, the

company has included a reconciliation of GAAP to non-GAAP financial

measures at the end of this press release. These reconciliations

adjust the related GAAP financial measures to exclude stock-based

compensation expense. AvePoint believes the presentation of its

non-GAAP financial measures enhances the user’s overall

understanding of its historical financial performance. The

presentation of AvePoint’s non-GAAP financial measures is not meant

to be considered in isolation or as a substitute for its financial

results prepared in accordance with GAAP, and AvePoint’s non-GAAP

measures may be different from non-GAAP measures used by other

companies.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the “safe harbor” provisions of the United

States Private Securities Litigation Reform Act of 1995 and other

federal securities laws including statements regarding the future

performance of and market opportunities for AvePoint. These

forward-looking statements generally are identified by the words

"believe," "project," "expect," "anticipate," "estimate," "intend,"

"strategy," "future," "opportunity," "plan," "may," "should,"

"will," "would," "will be," "will continue," "will likely result,"

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: changes in the competitive and regulated industries in

which AvePoint operates, variations in operating performance across

competitors, changes in laws and regulations affecting AvePoint's

business and changes in AvePoint’s ability to implement business

plans, forecasts, and ability to identify and realize additional

opportunities, and the risk of downturns in the market and the

technology industry. You should carefully consider the foregoing

factors and the other risks and uncertainties described in the

"Risk Factors" section of AvePoint’s most

recent Annual Report on Form 10-K and its

registration statement on Form S-1 and related prospectus and

prospectus supplements filed with the SEC. Copies of these and

other documents filed by AvePoint from time to time are available

on the SEC's website, www.sec.gov. These filings identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak

only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and AvePoint does not

assume any obligation and does not intend to update or revise these

forward-looking statements after the date of this release, whether

as a result of new information, future events, or otherwise, except

as required by law. AvePoint does not give any assurance that it

will achieve its expectations.

Investor Contact: ICR for AvePoint, Inc.Marc P.

Griffinir@avepoint.com646-277-1290

Media Contact:AvePoint, Inc.Nicole

Cacipr@avepoint.com 201-201-8143

AvePoint, Inc. and SubsidiariesCondensed

Consolidated Statements of Operations(In thousands, except per

share amounts)(Unaudited)

| |

|

For the Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

SaaS |

|

$ |

26,553 |

|

|

$ |

18,259 |

|

|

Term license and support |

|

|

10,202 |

|

|

|

8,727 |

|

|

Services |

|

|

8,925 |

|

|

|

5,916 |

|

|

Maintenance |

|

|

4,441 |

|

|

|

5,409 |

|

|

Perpetual license |

|

|

170 |

|

|

|

489 |

|

| Total revenue |

|

|

50,291 |

|

|

|

38,800 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

SaaS |

|

|

5,520 |

|

|

|

4,440 |

|

|

Term license and support |

|

|

576 |

|

|

|

273 |

|

|

Services |

|

|

8,259 |

|

|

|

5,585 |

|

|

Maintenance |

|

|

275 |

|

|

|

480 |

|

| Total cost of revenue |

|

|

14,630 |

|

|

|

10,778 |

|

| Gross profit |

|

|

35,661 |

|

|

|

28,022 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

27,054 |

|

|

|

19,301 |

|

|

General and administrative |

|

|

15,542 |

|

|

|

10,292 |

|

|

Research and development |

|

|

6,402 |

|

|

|

4,102 |

|

|

Depreciation and amortization |

|

|

511 |

|

|

|

258 |

|

| Total operating expenses |

|

|

49,509 |

|

|

|

33,953 |

|

| Loss from operations |

|

|

(13,848 |

) |

|

|

(5,931 |

) |

| Gain on earn-out and warrant

liabilities |

|

|

3,267 |

|

|

|

— |

|

| Interest income, net |

|

|

14 |

|

|

|

13 |

|

| Other expense, net |

|

|

(177 |

) |

|

|

(63 |

) |

| Loss before income taxes |

|

|

(10,744 |

) |

|

|

(5,981 |

) |

| Income tax expense

(benefit) |

|

|

309 |

|

|

|

(1,039 |

) |

| Net loss |

|

$ |

(11,053 |

) |

|

$ |

(4,942 |

) |

| Net income attributable to and

accretion of redeemable noncontrolling interest |

|

|

(617 |

) |

|

|

(397 |

) |

| Net loss attributable to

AvePoint, Inc. |

|

$ |

(11,670 |

) |

|

$ |

(5,339 |

) |

| Deemed dividends on preferred

stock |

|

|

— |

|

|

|

(8,794 |

) |

| Net loss available to common

shareholders |

|

$ |

(11,670 |

) |

|

$ |

(14,133 |

) |

| Loss per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.06 |

) |

|

$ |

(0.14 |

) |

|

Diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.14 |

) |

| Shares used in computing loss

per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

182,833 |

|

|

|

100,773 |

|

|

Diluted |

|

|

182,833 |

|

|

|

100,773 |

|

AvePoint, Inc. and SubsidiariesCondensed

Consolidated Balance Sheets(In thousands, except par

value)(Unaudited)

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

78,764 |

|

|

$ |

268,217 |

|

|

Short-term investments |

|

|

181,292 |

|

|

|

2,411 |

|

|

Accounts receivable, net of allowance of $805 and $838 at March 31,

2022 and December 31, 2021, respectively |

|

|

48,039 |

|

|

|

55,067 |

|

|

Prepaid expenses and other current assets |

|

|

7,575 |

|

|

|

8,461 |

|

| Total current assets |

|

|

315,670 |

|

|

|

334,156 |

|

| Property and equipment,

net |

|

|

4,457 |

|

|

|

3,922 |

|

| Goodwill and other intangible

assets, net |

|

|

8,492 |

|

|

|

— |

|

| Operating lease right-of-use

assets |

|

|

13,409 |

|

|

|

— |

|

| Deferred contract costs |

|

|

39,090 |

|

|

|

38,926 |

|

| Other assets |

|

|

10,350 |

|

|

|

11,734 |

|

| Total assets |

|

$ |

391,468 |

|

|

$ |

388,738 |

|

| Liabilities, mezzanine

equity, and

stockholders’ deficiency |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,795 |

|

|

$ |

1,824 |

|

|

Accrued expenses and other liabilities |

|

|

27,277 |

|

|

|

35,062 |

|

|

Current portion of deferred revenue |

|

|

76,077 |

|

|

|

74,294 |

|

| Total current liabilities |

|

|

105,149 |

|

|

|

111,180 |

|

| Long-term operating lease

liabilities |

|

|

10,177 |

|

|

|

— |

|

| Long-term portion of deferred

revenue |

|

|

7,886 |

|

|

|

8,038 |

|

| Earn-out shares

liabilities |

|

|

12,801 |

|

|

|

10,012 |

|

| Other non-current

liabilities |

|

|

4,400 |

|

|

|

3,943 |

|

| Total liabilities |

|

|

140,413 |

|

|

|

133,173 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Mezzanine equity |

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

5,818 |

|

|

|

5,210 |

|

| Total mezzanine equity |

|

|

5,818 |

|

|

|

5,210 |

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value; 1,000,000 shares authorized,

182,493 and 181,822 shares issued and outstanding, at March 31,

2022 and December 31, 2021, respectively |

|

|

18 |

|

|

|

18 |

|

|

Additional paid-in capital |

|

|

634,070 |

|

|

|

625,056 |

|

|

Treasury stock |

|

|

(2,482 |

) |

|

|

(1,739 |

) |

|

Accumulated other comprehensive income |

|

|

598 |

|

|

|

2,317 |

|

|

Accumulated deficit |

|

|

(386,967 |

) |

|

|

(375,297 |

) |

| Total stockholders’

equity |

|

|

245,237 |

|

|

|

250,355 |

|

| Total liabilities, mezzanine

equity, and stockholders’ equity |

|

$ |

391,468 |

|

|

$ |

388,738 |

|

AvePoint, Inc. and SubsidiariesCondensed

Consolidated Statements of Cash Flows(In thousands)(Unaudited)

| |

|

For the Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

Operating activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(11,053 |

) |

|

$ |

(4,942 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,662 |

|

|

|

258 |

|

|

Foreign currency remeasurement loss (gain) |

|

|

194 |

|

|

|

(71 |

) |

|

Provision for doubtful accounts |

|

|

(9 |

) |

|

|

(393 |

) |

|

Stock-based compensation |

|

|

8,274 |

|

|

|

3,289 |

|

|

(Gain) loss on disposal of property and equipment |

|

|

(12 |

) |

|

|

1 |

|

|

Deferred income taxes |

|

|

(9 |

) |

|

|

— |

|

|

Change in value of earn-out and warrant liabilities |

|

|

(3,252 |

) |

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable and long-term unbilled receivables |

|

|

9,248 |

|

|

|

6,224 |

|

|

Prepaid expenses and other current assets |

|

|

205 |

|

|

|

(379 |

) |

|

Deferred contract costs and other assets |

|

|

(2,090 |

) |

|

|

(969 |

) |

|

Accounts payable, accrued expenses and other liabilities |

|

|

(11,725 |

) |

|

|

(7,462 |

) |

|

Deferred revenue |

|

|

2,444 |

|

|

|

179 |

|

| Net cash used in operating

activities |

|

|

(6,123 |

) |

|

|

(4,265 |

) |

| Investing

activities |

|

|

|

|

|

|

|

|

| Maturities of investments |

|

|

861 |

|

|

|

— |

|

| Purchases of investments |

|

|

(179,890 |

) |

|

|

(268 |

) |

| Acquisition of I-Access, net

of cash acquired |

|

|

(1,473 |

) |

|

|

— |

|

| Purchase of property and

equipment |

|

|

(969 |

) |

|

|

(266 |

) |

| Net cash used in investing

activities |

|

|

(181,471 |

) |

|

|

(534 |

) |

| Financing

activities |

|

|

|

|

|

|

|

|

| Payments of transaction

fees |

|

|

— |

|

|

|

(1,255 |

) |

| Purchase of common stock |

|

|

(744 |

) |

|

|

— |

|

| Proceeds from stock option

exercises |

|

|

1,036 |

|

|

|

1,126 |

|

| Proceeds from sale of common

shares of subsidiary |

|

|

— |

|

|

|

753 |

|

| Repayments of finance

leases |

|

|

(5 |

) |

|

|

(7 |

) |

| Net cash provided by financing

activities |

|

|

287 |

|

|

|

617 |

|

| Effect of exchange rates on

cash |

|

|

(2,146 |

) |

|

|

(365 |

) |

| Net decrease in cash and cash

equivalents |

|

|

(189,453 |

) |

|

|

(4,547 |

) |

| Cash and cash equivalents at

beginning of period |

|

|

268,217 |

|

|

|

69,112 |

|

| Cash and cash equivalents at

end of period |

|

$ |

78,764 |

|

|

$ |

64,565 |

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

$ |

335 |

|

|

$ |

304 |

|

|

Noncash acquisition of I-Access |

|

$ |

5,636 |

|

|

$ |

— |

|

AvePoint, Inc. and SubsidiariesNon-GAAP

Reconciliations(In thousands)(Unaudited)

| |

|

For the Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

Non-GAAP operating income |

|

|

|

|

|

|

|

|

| GAAP operating loss |

|

$ |

(13,848 |

) |

|

$ |

(5,931 |

) |

| Stock-based compensation

expense |

|

|

8,274 |

|

|

|

3,289 |

|

| Non-GAAP operating income |

|

$ |

(5,574 |

) |

|

$ |

(2,642 |

) |

| Non-GAAP operating margin |

|

|

-11.1 |

% |

|

|

-6.8 |

% |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP gross

profit |

|

|

|

|

|

|

|

|

| GAAP gross profit |

|

$ |

35,661 |

|

|

$ |

28,022 |

|

| Stock-based compensation

expense |

|

|

578 |

|

|

|

90 |

|

| Non-GAAP gross profit |

|

$ |

36,239 |

|

|

$ |

28,112 |

|

| Non-GAAP gross margin |

|

|

72.1 |

% |

|

|

72.5 |

% |

| |

|

|

|

|

|

|

|

|

| Non-GAAP sales and

marketing |

|

|

|

|

|

|

|

|

| GAAP sales and marketing |

|

$ |

27,054 |

|

|

$ |

19,301 |

|

| Stock-based compensation

expense |

|

|

(2,462 |

) |

|

|

(1,111 |

) |

| Non-GAAP sales and

marketing |

|

$ |

24,592 |

|

|

$ |

18,190 |

|

| Non-GAAP sales and marketing

as a % of revenue |

|

|

48.9 |

% |

|

|

46.9 |

% |

| |

|

|

|

|

|

|

|

|

| Non-GAAP general and

administrative |

|

|

|

|

|

|

|

|

| GAAP general and

administrative |

|

$ |

15,542 |

|

|

$ |

10,292 |

|

| Stock-based compensation

expense |

|

|

(4,484 |

) |

|

|

(1,991 |

) |

| Non-GAAP general and

administrative |

|

$ |

11,058 |

|

|

$ |

8,301 |

|

| Non-GAAP general and

administrative as a % of revenue |

|

|

22.0 |

% |

|

|

21.4 |

% |

| |

|

|

|

|

|

|

|

|

| Non-GAAP research and

development |

|

|

|

|

|

|

|

|

| GAAP research and

development |

|

$ |

6,402 |

|

|

$ |

4,102 |

|

| Stock-based compensation

expense |

|

|

(750 |

) |

|

|

(97 |

) |

| Non-GAAP research and

development |

|

$ |

5,652 |

|

|

$ |

4,005 |

|

| Non-GAAP research and

development as a % of revenue |

|

|

11.2 |

% |

|

|

10.3 |

% |

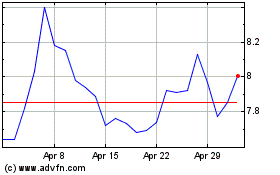

AvePoint (NASDAQ:AVPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

AvePoint (NASDAQ:AVPT)

Historical Stock Chart

From Apr 2023 to Apr 2024