Current Report Filing (8-k)

15 August 2022 - 10:27PM

Edgar (US Regulatory)

0000727207

false

0000727207

2022-08-15

2022-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event

reported) August 15, 2022

Accelerate Diagnostics, Inc.

(Exact name of registrant as specified in

charter)

Delaware

(State or other jurisdiction

of incorporation)

| 001-31822 |

|

84-1072256 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 3950 South Country Club Road, Suite 470, Tucson, Arizona |

|

85714 |

| (Address of principal executive offices) |

|

(Zip Code) |

(520) 365-3100

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

AXDX |

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

On August 15, 2022, Accelerate

Diagnostics, Inc. (the “Company”) entered into an exchange agreement (the “Exchange Agreement”) with the Jack

W. Schuler Living Trust (the “Schuler Trust”), a holder of the Company’s 2.50% Convertible Senior Notes due 2023 (the

“Notes”). Jack Schuler, who serves as a member of the Company’s board of directors, is the sole trustee of the Schuler

Trust. Under the terms of the Exchange Agreement, the Schuler Trust has agreed to exchange with the Company (the “Exchange”)

$49,905,000 in aggregate principal amount of Notes held by it for (a) a secured promissory note in an aggregate principal amount of $34,933,500

(the “Secured Note”) and (b) a warrant (the “Warrant”) to acquire the Company’s common stock at an exercise

price of $2.12 per share (the “Exercise Price”), which represents the closing price of the Company’s common stock as

of August 12, 2022.

The Secured Note has a scheduled maturity date of August 15, 2027 and

will be repayable upon written demand at any time on or after such date. The Company may, at its option, repay the note in (i) United

States dollars or (ii) in the form of common stock of the Company, in a number of shares that is obtained by dividing the total amount

of such payment by $2.12, subject to certain adjustments as more fully described in the Secured Note. The Secured Note bears interest

at a rate of 5.0% per annum, payable at the option of the Company in the same form, at the earlier of (i) any prepayment of principal

and (ii) maturity. The Company may prepay the Secured Note at any time without premium or penalty. The Secured Note contains customary

representations and warranties and events of default, including certain “change of control” events involving the Company.

The Secured Note is secured by substantially all of the assets of the Company, subject to customary exceptions and limitations, pursuant

to a security agreement (the “Security Agreement”), dated as of August 15, 2022, entered into between the Company and the

Schuler Trust in connection with the Secured Note. The Secured Note does not restrict the incurrence of future indebtedness by the Company

but shall become subordinated in right of payment and lien priority upon the request of any future senior lender.

The Warrant may

be exercised from February 15, 2023 through the earlier of (i) August 15, 2029 and (ii) the consummation of certain acquisition transactions

involving the Company, as set forth in the Warrant. The Warrant is exercisable for up to 2,471,710 shares, or 15% of the principal amount

of the Secured Note, divided by the Exercise Price. Such number of shares and the Exercise Price are subject to certain customary proportional

adjustments for fundamental events, including stock splits and recapitalizations, as set forth in the Warrant.

The Secured Note and the

Warrant, and any shares of common stock issuable upon conversion of the Secured Note and/or exercise of the Warrant, are being made in

reliance on the exemption from registration pursuant to Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities

Act”). Pursuant to the terms of the Secured Note and the Warrant, the aggregate number of shares issuable upon conversion of the

Secured Note and/or exercise of the Warrant may not exceed 19.99% of the Company’s outstanding shares of common stock (calculated

prior to giving effect to such exercise or delivery, as applicable).

The foregoing description

of the Exchange Agreement, the Secured Note, the Warrant and the Security Agreement is not complete and is qualified in its entirety by

reference to the full text of such agreements, which are filed herewith as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively, and incorporated

herein by reference in their entirety.

| Item 2.02. | Results of Operations and Financial Condition. |

On August 15, 2022, the

Company issued a press release announcing its financial results for the quarter ending June 30, 2022. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference in its entirety.

In accordance with General

Instruction B.2 for Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as

expressly set forth by specific reference in such filing.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth

in Item 1.01 of this Current Report on Form 8-K (this “Report”) is incorporated by reference into this Item 2.03.

| Item 3.02. | Unregistered Sales of Equity Securities. |

The information set forth

in Item 1.01 of this Report is incorporated by reference into this Item 3.02.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit | |

|

| Number | |

Description |

| 10.1 | |

Exchange Agreement, dated as of August 15, 2022, by and between the Company and the Jack W. Schuler Living Trust |

| | |

|

| 10.2 | |

Secured Promissory Note, dated as of August 15, 2022, by the Company in favor of the Jack W. Schuler Living Trust |

| | |

|

| 10.3 | |

Warrant, dated as of August 15, 2022, issued to the Jack W. Schuler Living Trust |

| | |

|

| 10.4 | |

Security Agreement, dated as of August 15, 2022, by and between the Company and the Jack W. Schuler Living Trust |

| | |

|

| 99.1 | |

Press Release, dated August 15, 2022 |

| | |

|

| 104 | |

Cover Page Interactive Data File (cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ACCELERATE DIAGNOSTICS, INC.

(Registrant) |

| Date: August 15, 2022 |

|

| |

|

| |

/s/ Steve Reichling |

| |

Steve Reichling |

| |

Chief Financial Officer |

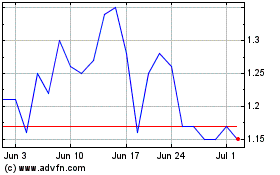

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From Apr 2023 to Apr 2024