Current Report Filing (8-k)

31 December 2022 - 8:20AM

Edgar (US Regulatory)

0001897982false00018979822022-12-232022-12-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 23, 2022

ASPEN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 333-262106 | | 87-3100817 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 20 Crosby Drive, | Bedford, | MA | | 01730 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (781) 221-6400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.0001 per share | | AZPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On December 23, 2022, we entered into a Credit Agreement with Emerson Electric Co. (the “Agreement”). The Agreement provides for an aggregate term loan commitment of $630 million. Under the terms of the Agreement, we will use the proceeds from borrowings under the Agreement to (i) pay in part the cash consideration for funding acquisitions, (ii) consummate certain other loan repayments, (iii) pay the fees and expenses incurred in connection with the Agreement and (iv) for other working capital and general corporate purposes.

Principal outstanding under the Agreement bears interest at a rate per annum equal to Term SOFR Rate (as such term is defined in the Agreement) plus an amount ranging from 1.25% to 1.75%.

The term loan to be made under the Agreement is unsecured and matures on the fifth anniversary of the date the term loan is funded. We are permitted to prepay the term loan in whole or in part upon provision of notice in accordance with the Agreement. Upon an event of default (as such term is defined in the Agreement), the loan may become due and payable in full upon provision of notice in accordance with the Agreement.

The Agreement contains affirmative and negative covenants customary for facilities of this type, including restrictions on incurrence of additional debt, liens, fundamental changes, asset sales, restricted payments and transactions with affiliates. The Agreement also contains financial covenants regarding maintenance as of the end of each fiscal quarter of a maximum leverage ratio of 3.50 to 1.00 and a minimum interest coverage ratio of 2.50 to 1.00.

The foregoing description of the Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Agreement, which is included as Exhibit 10.1 to this report and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASPEN TECHNOLOGY, INC. |

| |

| | |

| Date: December 30, 2022 | By: | /s/ CHANTELLE BREITHAUPT |

| | Chantelle Y. Breithaupt |

| | Senior Vice President, Chief Financial Officer and Treasurer |

| | (Principal Financial Officer) |

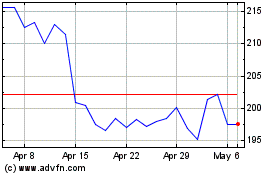

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

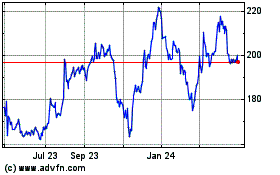

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Apr 2023 to Apr 2024