Aspen Technology, Inc. (AspenTech) (NASDAQ: AZPN), a global

leader in industrial software, today announced financial results

for its second-quarter fiscal 2023, ended December 31, 2022.

“AspenTech’s second quarter results reflected continued, strong

end market demand and the benefit of the addition of the OSI and

SSE businesses to heritage AspenTech. We made significant progress

on our integration and transformation initiatives and we believe we

are well positioned to deliver on our full year operational and

financial objectives,” said Antonio Pietri, President and Chief

Executive Officer of AspenTech.

“AspenTech is playing an essential role in helping our customers

meet the demand for the products that support greater global

prosperity while achieving their sustainability goals and

ambitions,” Pietri added. “Delivering on both goals is the core of

our Dual Challenge mission. Our customers have validated this value

proposition and recognize our unique position to help them achieve

it. We are confident these imperatives will enable AspenTech to

deliver attractive growth and profitability over the

long-term.”

Second Quarter and Fiscal Year 2023 Recent Business

Highlights

- Annual contract value, which we define as the estimate of the

annual value of our portfolio of term license and software

maintenance and support, or SMS, contracts, the annual value of SMS

agreements purchased with perpetual licenses and the annual value

of standalone SMS agreements purchased with certain legacy term

license agreements, which have become an immaterial part of our

business, was $833.7 million at the end of the second quarter of

fiscal 2023, which increased 8.7% compared to the second quarter of

fiscal 2022.

- Annual spend for heritage AspenTech, which the company defines

as the annualized value of all term license and maintenance

contracts at the end of the quarter for the businesses other than

OSI and SSE, was $697.5 million at the end of the second quarter of

fiscal 2023, which increased 9.0% compared to the second quarter of

fiscal 2022 and 2.2% sequentially.

Summary of Second Quarter Fiscal Year 2023 Financial

Results

As a result of the transaction between AspenTech and Emerson

Electric Co.(“Emerson”), EmerSubCX, the subsidiary Emerson created

as part of the transaction, became the surviving entity when the

transaction closed on May 16th, 2022. The comparable periods shown

in the financial statements below for fiscal year 2022 reflect only

the historical results of the OSI and SSE businesses that were

contributed to new AspenTech.

AspenTech’s total revenue of $242.8 million included:

- License and solutions revenue, which represents the

portion of a term license agreement allocated to the initial

license and OSI revenue recognized on a percentage of completion

basis, was $149.8 million in the second quarter of fiscal 2023,

compared to $48.5 million in the second quarter of fiscal

2022.

- Maintenance revenue, which represents the portion of

customer agreements related to ongoing support and the right to

future product enhancements, was $78.6 million in the second

quarter of fiscal 2023, compared to $26.3 million in the second

quarter of fiscal 2022.

- Services and other revenue was $14.4 million in the

second quarter of fiscal 2023, compared to $7.0 million in the

second quarter of fiscal 2022.

For the quarter ended December 31, 2022, AspenTech reported loss

from operations of $59.4 million, compared to loss from operations

of $254,000 in the second quarter of fiscal 2022.

Net loss was $66.2 million for the quarter ended December 31,

2022, leading to net loss per share of $1.02 compared to net loss

per share of $0.02 in the same period last fiscal year.

Non-GAAP income from operations was $86.6 million for the second

quarter of fiscal 2023. Non-GAAP net income was $22.8 million, or

$0.35 per share, for the second quarter of fiscal 2023. These

non-GAAP results add back the impact of stock-based compensation

expense, amortization of intangibles, fees related to acquisitions

and integration planning and unrealized gain on derivatives

associated with acquisitions. A reconciliation of GAAP to non-GAAP

results is presented in the financial tables included in this press

release.

AspenTech had cash and cash equivalents of $446.1 million and

total borrowings of $264.0 million at December 31, 2022. During the

quarter the company entered into a Credit Agreement with Emerson

for an aggregate loan commitment of $630 million. The proceeds from

borrowings under the Agreement will principally be used to fund the

pending acquisition of Micromine.

During the second quarter, AspenTech generated $49.5 million in

cash flow from operations and generated $53.1 million in free cash

flow. Free cash flow is calculated as net cash provided by

operating activities adjusted for the net impact of: purchases of

property, equipment and leasehold improvements; payments for

capitalized computer software development costs; and other

nonrecurring items, such as payments related to acquisitions and

integration planning.

Business Outlook

Based on information as of today, January 25, 2023, AspenTech is

issuing the following guidance for fiscal year 2023. Please note

this guidance does not include any contribution from the pending

acquisition of Micromine, which is expected to close as soon as the

remaining regulatory approval is obtained.

- Annual Contract Value (“ACV”) growth of 10.5-13.5%

year-over-year. The company defines ACV as the estimate of the

annual value of our portfolio of term license and software

maintenance and support (SMS) agreements

- Free cash flow of $347 to $362 million

- Total bookings of $1.07 to $1.17 billion

- Total revenue of $1.14 to $1.20 billion

- GAAP total expense of $1.207 to $1.217 billion

- Non-GAAP total expense of $637 to $647 million

- GAAP operating loss of $67 million to $15 million

- Non-GAAP operating income of $503 to $555 million

- GAAP net loss of $7.5 million to net income of $32.5

million

- Non-GAAP net income of $451 to $491 million

- GAAP net loss per share of $0.11 to income per share of

$0.49

- Non-GAAP net income per share of $6.83 to $7.43

These statements are forward-looking and actual results may

differ materially. Refer to the Forward-Looking Statements safe

harbor below for information on the factors that could cause

AspenTech’s actual results to differ materially from these

forward-looking statements.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under

the rules of the U.S. Securities and Exchange Commission. Non-GAAP

financial measures are not based on a comprehensive set of

accounting rules or principles. This non-GAAP information

supplements, and is not intended to represent a measure of

performance in accordance with, disclosures required by generally

accepted accounting principles, or GAAP. Non-GAAP financial

measures should be considered in addition to, not as a substitute

for or superior to, financial measures determined in accordance

with GAAP. A reconciliation of GAAP to non-GAAP results is included

in the financial tables included in this press release.

Management considers both GAAP and non-GAAP financial results in

managing AspenTech’s business. As the result of adoption of new

licensing models, management believes that a number of AspenTech’s

performance indicators based on GAAP, including revenue, gross

profit, operating income and net income, should be viewed in

conjunction with certain non-GAAP and other business measures in

assessing AspenTech’s performance, growth and financial condition.

Accordingly, management utilizes a number of non-GAAP and other

business metrics, including the non-GAAP metrics set forth in this

press release, to track AspenTech’s business performance. None of

these non-GAAP metrics should be considered as an alternative to

any measure of financial performance calculated in accordance with

GAAP.

Conference Call and Webcast

AspenTech will host a conference call and webcast presentation

on January 25, 2023 at 4:30 p.m. (Eastern Time) to discuss the

company's financial results, business outlook, and related

corporate and financial matters. A live webcast of the call will be

available on the Investor Relations section of AspenTech’s website,

http://ir.aspentech.com/, and clicking on the “webcast” link. To

access the call by phone, please go to this link (registration

link) and you will be provided with dial in details. To avoid

delays, we encourage participants to dial into the conference call

fifteen minutes ahead of the scheduled start time. A replay of the

webcast will also be available for a limited time at

http://ir.aspentech.com/.

About AspenTech

Aspen Technology, Inc. (NASDAQ: AZPN) is a global software

leader helping industries at the forefront of the world’s dual

challenge meet the increasing demand for resources from a rapidly

growing population in a profitable and sustainable manner.

AspenTech solutions address complex environments where it is

critical to optimize the asset design, operation and maintenance

lifecycle. Through our unique combination of deep domain expertise

and innovation, customers in capital-intensive industries can run

their assets safer, greener, longer and faster to improve their

operational excellence. To learn more, visit AspenTech.com.

Forward-Looking Statements

This press release contains forward-looking statements for

purposes of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including the statements contained

in the Business Outlook section as well as those related to our

ability to deliver on our financial objectives. Forward-looking

statements are based upon current plans, estimates and expectations

that are subject to risks, uncertainties and assumptions. Should

one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those indicated or anticipated by such

forward-looking statements. We can give no assurance that such

plans, estimates or expectations will be achieved and therefore,

actual results may differ materially from any plans, estimates or

expectations in such forward-looking statements.

Actual results may vary significantly from AspenTech’s

expectations based on a number of risks and uncertainties,

including, without limitation: delays or reductions in demand for

AspenTech solutions due to the COVID-19 pandemic; AspenTech’s

failure to increase usage and product adoption of aspenONE or other

offerings or grow the aspenONE APM, OSI and SSE businesses, and

failure to continue to provide innovative, market-leading

solutions; declines in the demand for, or usage of, aspenONE

software for any reason, including declines due to adverse changes

in the process or other capital-intensive industries and materially

reduced industry spending budgets due to the drop in demand for oil

due to the COVID-19 pandemic; the consummation and the anticipated

benefits of the acquisition of Micromine; unfavorable economic and

market conditions or a lessening demand in the market for asset

process optimization software, including materially reduced

industry spending budgets due to the significant drop in oil prices

arising from drop in demand due to the COVID-19 pandemic; risks of

foreign operations or transacting business with customers outside

the United States; risks of competition; risks that acquisitions

could be difficult to consummate and integrate into our operations,

which could disrupt our business, dilute stockholder value or

impair our financial results; and other risk factors described from

time to time in AspenTech’s periodic reports filed with the

Securities and Exchange Commission.

Furthermore, there are additional factors relating to the

transaction with Emerson that could cause actual results to differ

materially from AspenTech’s plans, estimates or expectations

regarding the transaction include, among others: (1) unexpected

costs, charges or expenses resulting from the transaction; (2)

failure to realize the anticipated benefits of the transaction,

including as a result of delay in integrating the industrial

software business of Emerson with AspenTech’s business; (3) the

ability of AspenTech to implement its business strategy; (4)

difficulties and delays in achieving revenue and cost synergies;

(5) inability to retain and hire key personnel; (6) potential

litigation in connection with the transaction or other settlements

or investigations that may result in significant costs of defense,

indemnification and liability; (7) AspenTech’s ability to recover

successfully from a disaster or other business continuity problem

due to a hurricane, flood, earthquake, terrorist attack, war,

pandemic, security breach, cyber-attack, power loss,

telecommunications failure or other natural or man-made event,

including the ability to function remotely during long-term

disruptions such as the COVID-19 pandemic; and (8) other risk

factors as detailed from time to time in AspenTech’s reports filed

with the SEC, including AspenTech’s annual reports on Form 10-K,

periodic quarterly reports on Form 10-Q, and current reports on

Form 8-K.

While the list of factors presented here is considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realization of forward-looking statements.

AspenTech cannot guarantee any future results, levels of

activity, performance, or achievements. AspenTech expressly

disclaims any obligation to update forward-looking statements after

the date of this press release.

© 2023 Aspen Technology, Inc. AspenTech, aspenONE, asset

optimization and the Aspen leaf logo are trademarks of Aspen

Technology, Inc. All rights reserved. All other trademarks are

property of their respective owners.

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

CONSOLIDATED AND COMBINED

STATEMENTS OF OPERATIONS

(Unaudited in Thousands, Except

per Share Data)

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

Revenue: License and solutions

$

149,843

$

48,491

$

310,068

$

92,706

Maintenance

78,628

26,272

156,994

50,807

Services and other

14,367

7,012

26,595

15,277

Total revenue

242,838

81,775

493,657

158,790

Cost of revenue: License and solutions

70,833

33,221

140,346

67,609

Maintenance

9,567

4,074

18,784

8,308

Services and other

12,698

4,282

25,098

9,180

Total cost of revenue

93,098

41,577

184,228

85,097

Gross profit

149,740

40,198

309,429

73,693

Operating expenses: Selling and marketing

117,951

17,995

236,225

42,995

Research and development

49,954

15,383

99,695

30,938

General and administrative

41,230

7,036

84,086

13,653

Restructuring costs

—

38

—

245

Total operating expenses

209,135

40,452

420,006

87,831

(Loss) from operations

(59,395

)

(254

)

(110,577

)

(14,138

)

Other income (expense), net

38,643

(1,419

)

(19,989

)

(2,778

)

Interest income (expense), net

4,120

(20

)

9,143

(292

)

(Loss) before provision for income taxes

(16,632

)

(1,693

)

(121,423

)

(17,208

)

Provision (benefit) for income taxes

49,565

(933

)

(43,982

)

(5,246

)

Net (loss)

$

(66,197

)

$

(760

)

$

(77,441

)

$

(11,962

)

Net (loss) per common share: Basic

$

(1.02

)

$

(0.02

)

$

(1.20

)

$

(0.33

)

Diluted

$

(1.02

)

$

(0.02

)

$

(1.20

)

$

(0.33

)

Weighted average shares outstanding: Basic

64,621

36,308

64,538

36,308

Diluted

64,621

36,308

64,538

36,308

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

CONSOLIDATED AND COMBINED

BALANCE SHEETS

(Unaudited in Thousands, Except

Share and Per Share Data)

December 31,

2022

June 30,

2022

ASSETS Current assets: Cash and cash equivalents

$

446,088

$

449,725

Accounts receivable, net

140,746

111,027

Current contract assets, net

419,714

428,833

Prepaid expenses and other current assets

23,750

23,461

Receivables from related parties

15,099

16,941

Prepaid income taxes

—

17,503

Total current assets

1,045,397

1,047,490

Property, equipment and leasehold improvements, net

17,138

17,148

Goodwill

8,328,846

8,266,809

Intangible assets, net

4,902,442

5,112,781

Non-current contract assets, net

515,820

428,232

Contract costs

9,042

5,473

Operating lease right-of-use assets

71,426

78,286

Deferred tax assets

2,328

4,937

Other non-current assets

8,214

8,766

Total assets

$

14,900,653

$

14,969,922

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable

$

12,975

$

21,416

Accrued expenses and other current liabilities

95,407

90,123

Liability from foreign currency forward contract

15,319

—

Due to related parties

32,284

4,111

Current operating lease liabilities

12,627

7,191

Income taxes payable

25,704

6,768

Current borrowings

264,000

28,000

Current contract liabilities

146,887

143,327

Total current liabilities

605,203

300,936

Non-current contract liabilities

29,707

21,081

Deferred income tax liabilities

1,040,094

1,145,408

Non-current operating lease liabilities

60,005

71,933

Non-current borrowings, net

—

245,647

Other non-current liabilities

18,579

15,560

Stockholders’ equity:

Common stock, $0.0001 par value

Authorized—600,000,000 shares Issued— 64,767,755 shares at December

31, 2022 and 64,425,378 shares at June 30, 2022 Outstanding—

64,767,755 shares at December 31, 2022 and 64,425,378 shares at

June 30, 2022

6

6

Additional paid-in capital

13,164,874

13,107,570

Retained earnings

(11,072

)

66,369

Accumulated other comprehensive (loss)

(6,743

)

(4,588

)

Total stockholders’ equity

13,147,065

13,169,357

Total liabilities and stockholders’ equity

$

14,900,653

$

14,969,922

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES

CONSOLIDATED AND COMBINED

STATEMENTS OF CASH FLOWS

(Unaudited in Thousands)

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

Cash flows from operating activities: Net (loss)

$

(66,197

)

$

(760

)

$

(77,441

)

$

(11,962

)

Adjustments to reconcile net (loss) to net cash provided by (used

in) operating activities: Depreciation and amortization

122,556

23,664

245,102

54,084

Reduction in the carrying amount of right-of-use assets

3,271

1,355

6,562

3,067

Net foreign currency (gain) losses

(3,588

)

1,475

4,744

3,013

Stock-based compensation

23,441

458

41,177

826

Deferred income taxes

(35,946

)

(2,355

)

(106,384

)

(8,047

)

Provision for uncollectible receivables

(381

)

(16

)

3,228

43

Other non-cash operating activities

(3,820

)

23

(593

)

84

Changes in assets and liabilities: Accounts receivable

(41,700

)

(31,371

)

(33,691

)

(47,061

)

Contract assets

(9,507

)

(8,258

)

(77,864

)

(13,034

)

Contract costs

(96

)

—

(3,547

)

—

Lease liabilities

(4,949

)

(1,390

)

(6,609

)

(1,811

)

Prepaid expenses, prepaid income taxes, and other assets

81,184

(2,978

)

34,177

(1,167

)

Liability from foreign currency forward contract

(34,940

)

—

15,319

—

Accounts payable, accrued expenses, income taxes payable and other

liabilities

11,983

(10,571

)

(1,490

)

(12,805

)

Contract liabilities

8,223

15,926

11,922

10,786

Net cash provided by (used in) operating activities

49,534

(14,798

)

54,612

(23,984

)

Cash flows from investing activities: Purchases of property,

equipment and leasehold improvements

(1,523

)

(786

)

(2,844

)

(3,393

)

Payments for business acquisitions, net of cash acquired

—

—

(74,947

)

(1,065

)

Payments for equity method investments

(465

)

—

(465

)

—

Payments for capitalized computer software development costs

(230

)

—

(329

)

—

Purchases of other assets

—

(2

)

—

(287

)

Net cash used in investing activities

(2,218

)

(788

)

(78,585

)

(4,745

)

Cash flows from financing activities: Issuance of shares of

common stock

17,135

—

25,605

—

Payment of tax withholding obligations related to restricted stock

(8,276

)

—

(11,698

)

—

Deferred business acquisition payments

—

—

(1,363

)

—

Repayments of amounts borrowed under term loan

(6,000

)

—

(12,000

)

—

Net transfers from Parent Company

17,426

17,660

29,872

32,855

Payments of debt issuance costs

—

—

(2,375

)

—

Net cash provided by financing activities

20,285

17,660

28,041

32,855

Effect of exchange rate changes on cash and cash equivalents

(3,970

)

(136

)

(7,705

)

(134

)

Increase (decrease) in cash and cash equivalents

63,631

1,938

(3,637

)

3,992

Cash and cash equivalents, beginning of period

382,457

25,713

449,725

23,659

Cash and cash equivalents, end of period

$

446,088

$

27,651

$

446,088

$

27,651

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

Reconciliation of GAAP to

Non-GAAP Results of Operations and Cash Flows

(Unaudited in Thousands, Except

per Share Data)

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

Total expenses GAAP total

expenses (a)

$

302,233

$

82,029

$

604,234

$

172,928

Less: Stock-based compensation (b)

(23,441

)

(458

)

(41,177

)

(826

)

Amortization of intangibles (c)

(121,161

)

(22,176

)

(242,321

)

(50,985

)

Acquisition and integration planning related fees

(1,411

)

—

(6,269

)

(54

)

Non-GAAP total expenses

$

156,220

$

59,395

$

314,467

$

121,063

Income from operations

GAAP (loss) from operations

$

(59,395

)

$

(254

)

$

(110,577

)

$

(14,138

)

Plus: Stock-based compensation (b)

23,441

458

41,177

826

Amortization of intangibles (c)

121,161

22,176

242,321

50,985

Acquisition and integration planning related fees

1,411

—

6,269

54

Non-GAAP income from operations

$

86,618

$

22,380

$

179,190

$

37,727

Net income GAAP net

(loss)

$

(66,197

)

$

(760

)

$

(77,441

)

$

(11,962

)

Plus: Stock-based compensation (b)

23,441

458

41,177

826

Amortization of intangibles (c)

121,161

22,176

242,321

50,985

Acquisition and integration planning related fees

1,411

—

6,269

54

Unrealized (gain) loss on foreign currency forward contract

(34,940

)

—

15,319

—

Less: Income tax effect on Non-GAAP items (d)

(22,075

)

(5,145

)

(62,591

)

(12,033

)

Non-GAAP net income

$

22,801

$

16,729

$

165,054

$

27,870

Diluted loss per share

GAAP diluted (loss) per share

$

(1.02

)

$

(0.02

)

$

(1.20

)

$

(0.33

)

Plus: Stock-based compensation (b)

0.36

0.01

0.64

$

0.02

Amortization of intangibles (c)

1.87

0.61

3.75

$

1.41

Acquisition and integration planning related fees

0.02

—

0.10

$

—

Unrealized loss on foreign currency forward contract

(0.54

)

—

0.24

$

—

Less: Income tax effect on Non-GAAP items (d)

(0.34

)

(0.14

)

(0.97

)

$

(0.33

)

Non-GAAP diluted income per share

$

0.35

$

0.46

$

2.56

$

0.77

Shares used in computing Non-GAAP diluted income per share

64,621

36,308

64,538

36,308

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

Free Cash Flow Net cash

provided by operating activities (GAAP)

$

49,534

$

(14,798

)

$

54,612

$

(23,984

)

Purchases of property, equipment and leasehold improvements

(1,523

)

(786

)

(2,844

)

(3,393

)

Payments for capitalized computer software development costs

(230

)

—

(329

)

—

Acquisition and integration planning related payments

5,321

—

12,380

54

Free cash flow (non-GAAP)

$

53,102

$

(15,584

)

$

63,819

$

(27,323

)

(a) GAAP total expenses

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

Total costs of revenue

$

93,098

$

41,577

$

184,228

$

85,097

Total operating expenses

209,135

40,452

420,006

87,831

GAAP total expenses

$

302,233

$

82,029

$

604,234

$

172,928

(b) Stock-based compensation expense was as follows:

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

Cost of license and solutions

$

1,200

$

—

$

1,919

$

—

Cost of maintenance

474

—

1,035

—

Cost of services and other

428

—

858

—

Selling and marketing

3,826

—

7,191

—

Research and development

4,240

—

7,858

—

General and administrative

13,273

458

22,316

826

Total stock-based compensation

$

23,441

$

458

$

41,177

$

826

(c) Amortization of intangible assets was as follows:

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

Cost of license and solutions

$

47,671

$

13,193

$

95,342

$

26,385

Selling and marketing

73,490

8,983

146,979

24,600

Total amortization of intangible assets

$

121,161

$

22,176

$

242,321

$

50,985

(d) The income tax effect on non-GAAP items

for the three and six months ended December 31, 2022 and 2021,

respectively, is calculated utilizing the Company's combined US

federal and state statutory tax rate as following:

Three Months Ended

December 31,

Six Months Ended

December 31,

2022

2021

2022

2021

U.S. statutory rate

21.79

%

22.73

%

21.79

%

23.20

%

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

Reconciliation of

Forward-Looking Guidance Range

(Unaudited in Thousands, Except

per Share Data)

Twelve Months Ended June 30,

2023 (a)

Range

Low

High

Guidance - Total expenses GAAP expectation - total expenses

$

1,207,000

$

1,217,000

Less: Stock-based compensation

(77,000

)

(77,000

)

Amortization of intangible assets

(486,500

)

(486,500

)

Acquisition and integration planning related fees

(6,500

)

(6,500

)

Non-GAAP expectation - total expenses

$

637,000

$

647,000

Guidance - Income from operations GAAP expectation -

(loss) from operations

$

(67,000

)

$

(15,000

)

Plus: Stock-based compensation

77,000

77,000

Amortization of intangible assets

486,500

486,500

Acquisition and integration planning related fees

6,500

6,500

Non-GAAP expectation - income from operations

$

503,000

$

555,000

Guidance - Net income and diluted income per share

GAAP expectation - net (loss) and diluted (loss) per share

$

(7,500

)

$

(0.11

)

$

32,500

$

0.49

Plus: Stock-based compensation

77,000

77,000

Amortization of intangible assets

486,500

486,500

Acquisition and integration planning related fees

6,500

6,500

Unrealized loss on foreign currency forward contract

15,500

15,500

Less: Income tax effect on Non-GAAP items (b)

(127,500

)

(127,500

)

Non-GAAP expectation - net income and diluted income per

share

$

450,500

$

6.83

$

490,500

$

7.43

Shares used in computing guidance for Non-GAAP diluted

income per share

66,000

66,000

Guidance - Free Cash Flow GAAP expectation - Net cash

provided by operating activities

$

351,000

$

366,000

Less: Purchases of property, equipment and leasehold improvements

(1,000

)

(1,000

)

Payments for capitalized computer software development costs

(9,500

)

(9,500

)

Plus: Acquisition and integration planning related fees

6,500

6,500

Free cash flow expectation (non-GAAP)

$

347,000

$

362,000

(a) Rounded amount used, except per share data. (b) The

income tax effect on non-GAAP items for the twelve months ended

June 30, 2023 is calculated utilizing the Company's statutory tax

rate of 21.79 percent.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230125005665/en/

Media Contact Len Dieterle Aspen Technology +1

781-221-4291 len.dieterle@aspentech.com

Investor Contact Brian Denyeau ICR for Aspen Technology

+1 646-277-1251 brian.denyeau@icrinc.com

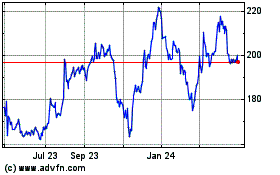

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

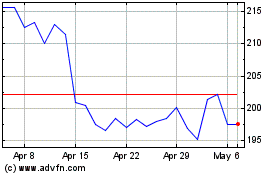

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Apr 2023 to Apr 2024