false

0001761612

X0

00-0000000

true

0001761612

2025-02-25

2025-02-25

0001761612

us-gaap:CommonStockMember

2025-02-25

2025-02-25

0001761612

bcyc:AmericanDepositarySharesMember

2025-02-25

2025-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

February 25, 2025

Date of Report (Date of earliest event reported)

Bicycle

Therapeutics plc

(Exact name of registrant as specified in its

charter)

| England

and Wales |

|

001-38916 |

|

Not

applicable |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Blocks

A & B, Portway Building,

Granta

Park Great Abington, Cambridge

United Kingdom |

CB21

6GS |

| (Address of principal

executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: +44

1223 261503

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol (s) |

Name

of each exchange on which registered |

| Ordinary

shares, nominal value £0.01 per share |

n/a |

The

Nasdaq

Stock Market LLC* |

| American

Depositary Shares, each representing one ordinary share, nominal value £0.01 per share |

BCYC |

The

Nasdaq

Stock Market LLC |

* Not

for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition |

On February 25, 2025, Bicycle Therapeutics plc issued a press

release announcing financial results for the fiscal quarter and the year ended December 31, 2024 and other business highlights. A

copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by

reference.

The information contained in Item 2.02 in this Current Report

on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: February 25, 2025 |

BICYCLE THERAPEUTICS PLC |

| |

|

| |

By: |

/s/ Alethia Young |

| |

Name: |

Alethia Young |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Bicycle Therapeutics Reports Recent Business

Progress and Fourth Quarter and Full

Year 2024 Financial Results

Updated topline Phase 1 combination data for

zelenectide pevedotin plus pembrolizumab continue to show promising anti-tumor activity and a differentiated safety profile in first-line

metastatic urothelial cancer; Duravelo-2 dose selection data expected in 2H 2025

Enhanced response to zelenectide pevedotin seen

in NECTIN4 gene-amplified late-line breast cancer and non-small cell lung cancer (NSCLC), resulting in U.S. FDA Fast Track designations

for triple-negative breast cancer and NSCLC; several Phase 1/2 trials expected to start in 2025

Advancing radiopharmaceuticals pipeline, with

additional MT1-MMP human imaging data expected in mid-2025 and first EphA2 human imaging data planned for 2H 2025

Cash and cash equivalents of $879.5 million

as of December 31, 2024, expected to provide financial runway into 2H 2027

CAMBRIDGE, England & BOSTON, February 25, 2025 –

Bicycle Therapeutics plc (NASDAQ: BCYC), a pharmaceutical company pioneering a new and differentiated class of therapeutics based on

its proprietary bicyclic peptide (Bicycle®) technology, today reported

financial results for the fourth quarter and full year ended December 31, 2024, and provided recent corporate updates.

“In 2024, the significant progress across our pipeline and business

continued to validate our approach to developing next-generation precision-guided therapeutics. We believe that zelenectide pevedotin’s

promising anti-tumor activity and differentiated safety profile could transform the treatment landscape not only for patients with metastatic

urothelial cancer but also NECTIN4 gene-amplified solid tumors. Additionally, our encouraging first human imaging data for MT1-MMP demonstrates

the potential of our technology platform to produce radiopharmaceutical medicines to novel targets,” said Bicycle Therapeutics

CEO Kevin Lee, Ph.D. “With a clear strategy to build on this foundation and financial runway into the second half of 2027, we are

strongly positioned for another year of execution across our research and development pipeline of oncology, radiopharmaceuticals and

partnered programs as we work to bring innovative therapies to cancer patients.”

Fourth Quarter 2024 and Recent Events

| · | Announced

updated topline combination data for zelenectide pevedotin plus pembrolizumab in first-line

metastatic urothelial cancer (mUC). As of Jan. 3, 2025, updated topline results

from the ongoing Phase 1 Duravelo-1 trial evaluating zelenectide pevedotin 5 mg/m2

weekly plus pembrolizumab 200 mg once every 3 weeks in 22 first-line cisplatin-ineligible

patients with mUC continued to show promising anti-tumor activity and a differentiated safety

profile. |

| o | Among 20 efficacy evaluable patients, a 65% overall response rate

(ORR) (13/20) was achieved, and a 50% ORR (10/20) was reached among patients with confirmed

responses. Of the 3 unconfirmed responses, 1 patient remained on treatment at the time of

the reported clinical results. |

| o | Median duration of response (mDOR) is not yet mature, with 12 patients

still on treatment at the time of the reported clinical results. |

| o | The safety and tolerability profile continues to be broadly consistent

with other Phase 1 zelenectide pevedotin monotherapy and combination cohorts. Adverse events

of clinical interest such as peripheral neuropathy, skin reactions and eye disorders were

primarily low grade. All cases of Grade 3 treatment-related adverse events (TRAEs) of clinical

interest were reversible, and there were no Grade 4 or Grade 5 TRAEs of clinical interest. |

Bicycle Therapeutics is currently conducting the Phase

2/3 Duravelo-2 registrational trial evaluating zelenectide pevedotin plus pembrolizumab versus chemotherapy in first-line mUC (Cohort

1), and zelenectide pevedotin monotherapy and in combination with pembrolizumab in late-line mUC (Cohort 2). In each cohort, two doses

of zelenectide pevedotin – 5 mg/m2 weekly and 6 mg/m2 two weeks on, one week off – are being assessed

before a planned final dose selection in 2H 2025.

| · | Announced

development strategy leveraging NECTIN4 gene amplification for zelenectide pevedotin in breast

cancer, lung cancer and multiple tumor types. During the 2024 San Antonio Breast Conference

Symposium, Bicycle Therapeutics presented data from post-hoc analyses of late-line breast

cancer and lung cancer patients enrolled in the Phase 1/2 Duravelo-1 trial evaluating zelenectide

pevedotin 5 mg/m2 weekly. Results showed enhanced anti-tumor activity of zelenectide

pevedotin monotherapy in patients with NECTIN4 gene amplification and/or polysomy. |

| o | Among 38 breast cancer patients

enrolled, 35 patients were efficacy evaluable. Additionally, 23 breast cancer patient samples

were available for NECTIN4 testing, of which

8 demonstrated NECTIN4 gene amplification

or harbored NECTIN4 polysomy. Results showed

a 62.5% ORR (5/8) in patients with NECTIN4 gene amplification and/or polysomy versus

14.3% ORR (5/35) in efficacy-evaluable patients. All

responses were seen in patients with NECTIN4 gene

amplification and/or polysomy. |

| o | Among 32 triple-negative breast cancer (TNBC) patients enrolled, 30

patients were efficacy evaluable. Additionally, 19 TNBC patient samples were available for

NECTIN4 testing, of which 7 demonstrated NECTIN4 gene amplification or harbored a NECTIN4

polysomy. Results showed a 57.1% ORR (4/7) in patients

with NECTIN4 gene amplification and/or polysomy

versus 13.3% ORR (4/30) in efficacy-evaluable patients. All responses were

seen in patients with NECTIN4 gene amplification

and/or polysomy. Notably, all 3 patients with NECTIN4 gene

amplification who responded to zelenectide pevedotin had prior treatment with sacituzumab

govitecan. |

| o | Among 40

non-small cell lung cancer (NSCLC) patients enrolled, 34 patients were efficacy evaluable.

Additionally, 19 NSCLC patient samples were available for NECTIN4

testing, of which 6 demonstrated NECTIN4 gene

amplification. Five out of 6 patients with NECTIN4 gene

amplification were efficacy evaluable. Results showed a 40.0% ORR (2/5) in patients with

NECTIN4 gene amplification versus 8.8% ORR

(3/34) among efficacy-evaluable patients. Of the 3 partial responses, 2 were confirmed and

1 was unconfirmed. Two out of 3 responses were seen in patients with NECTIN4 gene

amplification. |

Zelenectide pevedotin was generally well tolerated, demonstrating

a safety and tolerability profile consistent with data from other Duravelo-1 cohorts, and TRAEs were primarily low grade, further supporting

the potential for NECTIN4 gene amplification to serve as a biomarker for therapy stratification. Based on these data, the U.S. Food and

Drug Administration (FDA) granted Fast Track designation to zelenectide pevedotin for the treatment of adult patients with previously

treated, NECTIN4 gene-amplified, advanced or metastatic TNBC and NSCLC.

Bicycle Therapeutics has continued to build a robust patent

estate related to the use of NECTIN4 gene amplification as a biomarker for patient selection. The company plans to initiate several additional

Phase 1/2 trials evaluating zelenectide pevedotin in NECTIN4 gene-amplified cancer, including breast cancer (Duravelo-3) in 1H 2025 and

lung cancer (Duravelo-4) and multi-tumor (Duravelo-5) in 2H 2025.

| · | Announced

first human imaging data for a Bicycle® Radionuclide Conjugate (BRC®)

targeting MT1-MMP and outlined strategy for leadership in next-generation radiopharmaceuticals.

Data presented at the European Association of Nuclear Medicine 2024 Congress validate

the potential of MT1-MMP as a novel target in the treatment of cancer, demonstrate the translatability

of BRC preclinical data and highlight the potential of Bicycle® molecules

for targeted radionuclide therapy. |

| o | In an oral presentation, the German Cancer Consortium (DKTK) shared

results of fluorine-18-labelled FDG-PET/CT imaging and gallium-68-labelled BRC MT1-MMP PET/CT

imaging in a 65-year-old male diagnosed with advanced pulmonary adenocarcinoma, the most

common type of NSCLC, in the lung and lymph nodes. MT1-MMP imaging demonstrated tracer uptake

in the primary tumor in the lung and lymph node and bone metastases, consistent with FDG

imaging. Additionally, the MT1-MMP BRC tracer showed renal excretion, with all other organs

showing only a negligible tracer uptake. |

| o | Preclinical data presented by Bicycle Therapeutics demonstrated the

suitability of Bicycle molecules to deliver indium to tumors in vivo due to their

favorable properties, including specific tumor uptake, rapid tumor penetration and rapid

renal elimination. Additionally, imaging showed how the biodistribution profile of BRCs can

be optimized to maintain high tumor uptake and retention while significantly reducing kidney

levels. |

Bicycle Therapeutics continues to advance its emerging

BRC pipeline, with additional MT1-MMP human imaging data anticipated in mid-2025 and initial EphA2 human imaging data expected in 2H

2025. The company is targeting clinical trials for its first radiotherapeutic program to begin in 2026.

| · | Expanded

Clinical Advisory Board with the appointment of three distinguished oncology experts to further

support the advancement of the company’s clinical programs. Bicycle Therapeutics

welcomed Howard A. “Skip” Burris, III, M.D., president and chief medical

officer of Sarah Cannon Research Institute; Markus Eckstein, M.D., a board-certified

senior consultant pathologist at the University Hospital Erlangen (FAU Erlangen-Nürnberg);

and Niklas Klümper, M.D., senior consultant for Urology & Genitourinary Oncology

at the University Hospital Bonn. |

Participation in Upcoming Investor Conferences

Bicycle Therapeutics management will

participate in a fireside chat at the TD Cowen 45th Annual Health Care Conference on Tuesday, March 4, at 9:50

a.m. ET. A live webcast of the fireside chat will be accessible from the Investor section of the company’s website

at www.bicycletherapeutics.com. A replay of the webcast will be archived and available

following the event.

Fourth Quarter and Year End 2024 Financial Results

| · | Cash

and cash equivalents were $879.5 million as of December 31, 2024, compared to $526.4

million as of December 31, 2023. The increase in cash and cash equivalents is primarily

due to net proceeds from the company’s private investment in public equity (PIPE) financing

in May 2024 and share option exercises, offset by the repayment of the company’s

debt facility with Hercules Capital, Inc. in July 2024 and cash used in operating

activities. |

| · | Research

and development (R&D) expenses were $49.8 million for the three months ended

December 31, 2024, and $173.0 million for the year ended December 31, 2024, compared

to $44.7 million for the three months ended December 31, 2023, and $156.5 million for

the year ended December 31, 2023. The increases in expense of $5.1 million and $16.5

million for the three months and year ended December 31, 2024, respectively, were primarily

due to increased clinical program expenses for zelenectide pevedotin development and increased

personnel-related expenses, including incremental share-based compensation expense of $2.2

million and $3.8 million for the three months and year ended December 31, 2024, respectively,

offset by decreased clinical program expenses for Bicycle Tumor-Targeted Immune Cell Agonist®

molecule development, lower discovery, platform and other expenses, and higher U.K.

R&D tax credits period over period. |

| · | General

and administrative expenses were $21.6 million for the three months ended December 31,

2024, and $72.2 million for the year ended December 31, 2024, compared to $14.9 million

for the three months ended December 31, 2023, and $60.4 million for the year ended December 31,

2023. The increases of $6.7 million and $11.8 million for the three months and year ended

December 31, 2024, respectively, were primarily due to increased personnel-related expenses,

including incremental share-based compensation expense $0.3 million and $1.8 million for

the three months and year ended December 31, 2024, respectively, as well as increased

professional and consulting fees. |

| · | Net

loss was $51.9 million, or $(0.75) basic and diluted net loss per share, for the

three months ended December 31, 2024, and net loss was $169.0 million, or $(2.90)

basic and diluted net loss per share, for the year ended December 31, 2024, compared

to net loss of $49.1 million or $(1.16) basic and diluted net loss per share, for three months

ended December 31, 2023, and net loss of $180.7 million or $(5.08) basic and diluted

net loss per share, for the year ended December 31, 2023. |

About Bicycle Therapeutics

Bicycle Therapeutics is a clinical-stage pharmaceutical company developing

a novel class of medicines, referred to as Bicycle® molecules, for diseases that are underserved by existing therapeutics.

Bicycle molecules are fully synthetic short peptides constrained with small molecule scaffolds to form two loops that stabilize their

structural geometry. This constraint facilitates target binding with high affinity and selectivity, making Bicycle molecules attractive

candidates for drug development. The company is evaluating zelenectide pevedotin (formerly BT8009), a Bicycle® Toxin Conjugate

(BTC®) targeting Nectin-4, a well-validated tumor antigen; BT5528, a BTC molecule targeting EphA2, a historically undruggable

target; and BT7480, a Bicycle Tumor-Targeted Immune Cell Agonist® (Bicycle TICA®) targeting Nectin-4 and

agonizing CD137, in company-sponsored clinical trials. Additionally, the company is developing Bicycle® Radionuclide Conjugates

(BRC®) for radiopharmaceutical use and, through various partnerships, is exploring the use of Bicycle®

technology to develop therapies for diseases beyond oncology.

Bicycle Therapeutics is headquartered in Cambridge, UK, with many

key functions and members of its leadership team located in Cambridge, Mass. For more information, visit www.bicycletherapeutics.com.

Forward Looking Statements

This press release may contain forward-looking statements made pursuant

to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such

as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,”

“seeks,” “will” and variations of these words or similar expressions that are intended to identify forward-looking

statements, although not all forward-looking statements contain these words. Forward-looking statements in this press release include,

but are not limited to, statements regarding the potential for zelenectide pevedotin to transform the treatment landscape for patients

with mUC and NECTIN4 gene-amplified solid tumors; the potential for Bicycle Therapeutics’ technology to produce radiopharmaceutical

medicines; the company’s ability to build on its foundation, including with respect to execution across its pipeline; the planned

dose selection for Duravelo-2; the anticipated initiation of clinical trials of zelenectide pevedotin in breast cancer, lung cancer and

multi-tumor types and of the company’s first radiotherapeutic program; the timing of announcement of human imaging data for MT1-MMP

and EphA2 targeting BRCs; expectations with respect to Bicycle Therapeutics’ financial runway; and the use of Bicycle Therapeutics’

technology through various partnerships to develop potential therapies in diseases beyond oncology. Bicycle Therapeutics may not actually

achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance

on these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed

in these forward-looking statements as a result of various factors, including: uncertainties inherent in research and development and

in the initiation, progress and completion of clinical trials and clinical development of Bicycle Therapeutics’ product candidates;

the risk that Bicycle Therapeutics may not realize the intended benefits of its technology, partnerships or NECTIN4 gene-amplification

strategy; the risk that Bicycle Therapeutics may not achieve any of its clinical development strategies; timing of results from clinical

trials; whether the outcomes of preclinical studies and prior clinical trials will be predictive of future clinical trial results; the

risk that trials may have unsatisfactory outcomes; potential adverse effects arising from the testing or use of Bicycle Therapeutics’

product candidates; the risk that Bicycle Therapeutics’ projections regarding its expected cash runway are inaccurate or that its

conduct of its business requires more cash than anticipated; and other important factors, any of which could cause Bicycle Therapeutics’

actual results to differ from those contained in the forward-looking statements, are described in greater detail in the section entitled

“Risk Factors” in Bicycle Therapeutics’ Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission

(SEC) on October 31, 2024, as well as in other filings Bicycle Therapeutics may make with the SEC in the future. Any forward-looking

statements contained in this press release speak only as of the date hereof, and Bicycle Therapeutics expressly disclaims any obligation

to update any forward-looking statements contained herein, whether because of any new information, future events, changed circumstances

or otherwise, except as otherwise required by law.

Bicycle Therapeutics plc

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(In thousands, except share and per share data)

(Unaudited)

| | |

Three Months Ended | | |

Year Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Collaboration revenue | |

$ | 3,708 | | |

$ | 5,331 | | |

$ | 35,275 | | |

$ | 26,976 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 49,778 | | |

| 44,697 | | |

| 172,966 | | |

| 156,496 | |

| General and administrative | |

| 21,593 | | |

| 14,869 | | |

| 72,181 | | |

| 60,426 | |

| Total operating expenses | |

| 71,371 | | |

| 59,566 | | |

| 245,147 | | |

| 216,922 | |

| Loss from operations | |

| (67,663 | ) | |

| (54,235 | ) | |

| (209,872 | ) | |

| (189,946 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest and other income | |

| 10,303 | | |

| 6,276 | | |

| 34,284 | | |

| 14,002 | |

| Interest expense | |

| (52 | ) | |

| (820 | ) | |

| (1,730 | ) | |

| (3,263 | ) |

| Loss on extinguishment of debt | |

| — | | |

| — | | |

| (954 | ) | |

| — | |

| Gain on extinguishment

of research and development funding liability | |

| 4,476 | | |

| — | | |

| 4,476 | | |

| — | |

| Total other income,

net | |

| 14,727 | | |

| 5,456 | | |

| 36,076 | | |

| 10,739 | |

| Net loss before income tax provision | |

| (52,936 | ) | |

| (48,779 | ) | |

| (173,796 | ) | |

| (179,207 | ) |

| (Benefit from) provision

for income taxes | |

| (1,082 | ) | |

| 320 | | |

| (4,765 | ) | |

| 1,457 | |

| Net loss | |

$ | (51,854 | ) | |

$ | (49,099 | ) | |

$ | (169,031 | ) | |

$ | (180,664 | ) |

| Net loss per share, basic and diluted | |

$ | (0.75 | ) | |

$ | (1.16 | ) | |

$ | (2.90 | ) | |

$ | (5.08 | ) |

| Weighted average ordinary shares outstanding,

basic and diluted | |

| 69,051,745 | | |

| 42,419,326 | | |

| 58,207,593 | | |

| 35,592,362 | |

Balance Sheets Data

(In thousands)

(Unaudited)

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Cash and cash equivalents | |

$ | 879,520 | | |

$ | 526,423 | |

| Working capital | |

| 861,375 | | |

| 492,331 | |

| Total assets | |

| 956,868 | | |

| 595,344 | |

| Total shareholders’ equity | |

| 793,060 | | |

| 370,932 | |

Investors:

Stephanie Yao

SVP, Investor Relations and Corporate Communications

ir@bicycletx.com

857-523-8544

Matthew DeYoung

Argot Partners

ir@bicycletx.com

212-600-1902

Media:

Jim O’Connell

Weber Shandwick

media@bicycletx.com

312-988-2343

v3.25.0.1

Cover

|

Feb. 25, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 25, 2025

|

| Entity File Number |

001-38916

|

| Entity Registrant Name |

Bicycle

Therapeutics plc

|

| Entity Central Index Key |

0001761612

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

Blocks

A & B, Portway Building

|

| Entity Address, Address Line Two |

Granta

Park Great Abington

|

| Entity Address, City or Town |

Cambridge

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

CB21

6GS

|

| City Area Code |

+44

|

| Local Phone Number |

1223 261503

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary

shares, nominal value £0.01 per share

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| American Depositary Shares [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

American

Depositary Shares, each representing one ordinary share, nominal value £0.01 per share

|

| Trading Symbol |

BCYC

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bcyc_AmericanDepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

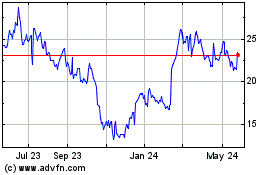

Bicycle Therapeutics (NASDAQ:BCYC)

Historical Stock Chart

From Jan 2025 to Feb 2025

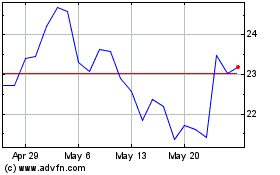

Bicycle Therapeutics (NASDAQ:BCYC)

Historical Stock Chart

From Feb 2024 to Feb 2025