Combined Business Strategies of Allied

Esports and World Poker Tour to Drive Company’s Global Esports

Growth with Capital and Management Expertise

Black Ridge Acquisition Corp. (“Black Ridge”) (NASDAQ: BRAC

(Common Stock), BRACU, BRACW, BRACR) and Ourgame International

Holdings Ltd. (“Ourgame”) today announced they have entered into a

definitive agreement whereby Black Ridge will acquire two of

Ourgame’s global esports and entertainment assets, Allied Esports

International, Inc. (“Allied Esports”) and WPT Enterprises, Inc.

(“WPT”). At close, the combined company will be renamed Allied

Esports Entertainment, Inc. (“AESE”) and is expected to trade on

the NASDAQ Capital Market under the ticker symbol “AESE.”

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20181219005845/en/

Frank Ng (Photo: Business Wire

Upon completion of the transaction, AESE will be an esports

entertainment company dedicated to providing world-class in-person

experiences, multiplatform content and interactive services to the

global video gaming community through a unique fusion of two

leaders in the esports and entertainment industries, Allied

Esports™ and WPT®. By strategically combining Allied Esports’

global network of properties and content creation facilities with

WPT’s nearly two decades of international expertise in live events,

content distribution and customer engagement, AESE will provide

esports audiences with offerings unparalleled in the industry

today.

Lyle Berman, Director of Black Ridge, who is expected to be the

Chairman of the Board of AESE upon closing of the transaction

stated, “In more than 40 years in the gaming and entertainment

business, this is the most exciting opportunity I have seen. The

capital from the Black Ridge SPAC will be used to expand AESE’s

global property network, accelerating their first-mover advantage

as the company continues to build a brand that is synonymous with

Esports.”

“This transaction will be transformational for our rapidly

expanding company and provide the esports community with a fully

capitalized, globally connected esports enterprise capable of

producing the volume and breadth of esports entertainment products

the industry is increasingly demanding,” said Frank Ng, who will

step down as CEO of Ourgame to lead AESE under the same title. “By

applying WPT’s proven business model to the much bigger,

higher-growth global Esports business, we are creating an esports

entertainment platform that is long-lasting and positioned to

capture the esports monetization opportunity.”

Upon completion of the transaction, AESE is expected to be led

by Lyle Berman, Chairman; Eric Yang, Vice Chairman; Frank Ng, Chief

Executive Officer; Ken DeCubellis, Chief Financial Officer; David

Moon, Chief Operating Officer; and Adam Pliska, President. This

leadership group brings AESE a wealth of experience across gaming,

entertainment and esports, with a proven track record of

successfully operating high-growth public companies. Jud Hannigan

will continue his role as CEO of Allied Esports and Pliska will

continue to serve as president and CEO of WPT.

Allied Esports Entertainment Business Model

Highlights

AESE will strategically combine the globally recognized Allied

Esports brand with the proven three-pronged business model of the

iconic World Poker Tour, featuring in-person experiences,

multiplatform content and interactive services, to leverage the

high-growth opportunities in the global esports industry with an

addressable market of 2.2 billion people worldwide.

AESE will seek to amplify Allied Esports’ ongoing efforts in

setting the standard in esports entertainment through the

development of authentic in-person experiences from its iconic

global property network, including flagship arenas, mobile esports

trucks and affiliate arenas. Through those experiences, the company

will look to continue to create original content that is shared

with millions of viewers across partner distribution platforms,

including digital, traditional and social media. Finally, AESE

plans to scale its interactive services through the development of

a proprietary online platform to deliver branded entertainment for

participants and viewers globally.

Allied Esports has generated considerable attention in the

global esports entertainment landscape spanning North America,

Europe and China. In March, the company debuted its global flagship

arena, HyperX Esports Arena Las Vegas, a state-of-the-art,

dedicated esports venue and world-class production facility, where

it has produced events and content across a variety of esports and

entertainment genres. Allied Esports announced the industry’s first

major naming rights partnership for a purpose-built dedicated

esports arena with leading gaming product developer HyperX in

November and was named Venue of the Year at the 2018 Tempest

Awards, a part of the Esports Business Summit.

Allied Esports also recently announced the formation of the

world’s first esports venue affiliate program – the Allied Esports

Property Network – created for operators around the world

interested in participating in Allied Esports’ global event

programming, and licensing Allied Esports’ design, development and

operations expertise for their own dedicated esports venues. The

Allied Esports Property Network will provide members with access to

Allied Esports’ global platform of events and content production,

providing participants and viewers with integrated experiences

in-person and online. Affiliate members will also be fully

incorporated into Allied Esports’ global tournament ecosystem,

offering teams and players the opportunity to participate in

high-stakes events worldwide, culminating in live events held at

Allied Esports’ flagship location, HyperX Esports Arena Las

Vegas.

Following the success and popularity of its European esports

truck “Big Betty,” in 2018 Allied Esports launched North America’s

HyperX Esports Truck, a state-of-the-art, 80-foot, 18-wheel, 35-ton

semi-trailer that transforms into a self-contained mobile stage and

production studio, bringing esports competition directly to

fans.

Allied Esports’ popular tournament brand, Esport Superstars,

made its debut in China with the third annual edition of Esport

Superstars: Hearthstone in December. The Esport Superstars:

Hearthstone franchise totaled more than 16 million global viewers

over the course of its first two events in Germany and the United

States.

Through nearly two decades, WPT has successfully executed its

three-pronged business strategy to monetize the game of poker.

Today, WPT licenses its brand to approximately 65 poker events

globally on an annual basis that are viewed by millions worldwide

via an international distribution network including FOX Sports

Network and numerous global online platforms. Currently producing

its 17th season, the World Poker Tour is one of the longest-running

television shows in U.S. history. In addition, WPT reaches millions

of fans on a daily basis via its social media reach, its unique

online membership site, ClubWPT, which offers inside access to the

WPT, and a sweepstakes-based poker club available in 35 states

across the U.S. In recent years, interactive services like ClubWPT

have consistently contributed to a significant portion of WPT

revenues.

After holding four Season 16 poker events at HyperX Esports

Arena Las Vegas in 2018, including the legendary WPT Tournament of

Champions final table, WPT announced that all televised final

tables in Season 17 will take place at the Las Vegas venue.

Transaction Summary

Under terms of the definitive agreement for the transaction, at

closing, in exchange for 100% of the equity in the entities

comprising the Allied Esports business and WPT business, Black

Ridge will issue approximately 11.6 million shares, with a value of

$118 million, to Ourgame, as well as some of the management team

members of Allied Esports and additional Ourgame-related investors.

Black Ridge will also issue the Ourgame investor group warrants to

purchase a total of 3.8 million shares of Black Ridge common stock

at a price per share of $11.50. An additional $50 million of

contingent stock consideration is available to Ourgame subject to

certain milestones as set forth in the transaction documents.

The transaction reflects an anticipated initial enterprise value

of approximately $213.8 million. Assuming no shareholder

redemptions, the company will have $98.7 million in cash on the

balance sheet after transaction costs and payment of $35 million

for debt owed to Ourgame. The company will have zero debt at

closing.

The transaction has been unanimously approved by the board of

directors of Black Ridge and Ourgame, and is expected to close in

the first quarter of 2019. The closing is subject to receipt of all

requisite regulatory approvals, approval of Ourgame’s and Black

Ridge’s stockholders, Black Ridge having at least $80 million of

cash on hand remaining at the closing, and other customary

conditions.

The description of the transaction contained herein is only a

summary and is qualified in its entirety by reference to the

definitive transaction documents, copies of which will be filed by

Black Ridge as an exhibit to a Current Report on Form 8-K and which

can be obtained, without charge, at the Securities and Exchange

Commission's internet site (http://www.sec.gov). For additional

information on the terms of the transaction, investors are directed

to review the Current Report on Form 8-K.

Macquarie Capital acted as M&A and capital markets advisor

to Black Ridge. EarlyBird Capital acted as capital markets advisor.

Graubard Miller provided legal counsel to Black Ridge. Maslon LLP

provided legal counsel to Allied Esports and WPT. Skadden, Arps,

Slate, Meagher & Flom LLP provided legal counsel to

Ourgame.

Audio Webcast Information

Management will post an audio webcast with presentation slides

at 6 a.m. PT (9 a.m. ET) on December 20, 2018 that will discuss the

transaction. Investment professionals and all current and

prospective stockholders are invited to access the webcast online

by visiting the Investor Relations section of Black Ridge’s website

at ir.blackridgeacq.com. The webcast will be available through

February 1, 2019.

About Ourgame International Holdings Ltd.

Ourgame International Holdings Ltd. is a leading mind sports

entertainment company with products, operations and investments

across card and board games, mind sports and esports in China and

globally. The Company is a pioneer of online card and board games

in China, offering more than 200 online games, and is an industry

leader in integrated online and offline platforms, reaching more

than 700 million total users. Ourgame acquired the World Poker

Tour, a premiere gaming entertainment company, in 2015 and has

since significantly expanded its operations. Ourgame has developed

its esports business through its Allied Esports subsidiary with

arenas and operations in China, the United States and Europe.

Ourgame is listed in the Hong Kong Stock Exchange main board with a

stock code of 06899.

About Black Ridge Acquisition Corp.

Black Ridge Acquisition Corp. is a special purpose acquisition

company sponsored by Black Ridge Oil & Gas, Inc. (OTCQB: ANFC)

for the purpose of effecting a merger, capital stock exchange,

asset acquisition, stock purchase, reorganization or similar

business combination with one or more businesses or assets. Black

Ridge Acquisition Corp. completed its initial public offering in

October 2017, raising $138 million in cash proceeds.

About Allied Esports International, Inc.

Allied Esports is a premier esports entertainment company with a

global network of dedicated esports properties and content

production facilities. Its mission is to connect players, streamers

and fans via integrated arenas and mobile esports trucks around the

world that serve as both gaming battlegrounds and every day content

generation hubs. Allied Esports is a subsidiary of Ourgame

International (SEHK:899), owner of WPT Enterprises, Inc., the

operator of The World Poker Tour®.

Through direct operation and affiliate relationships via the

Allied Esports Property Network, the first esports venue affiliate

program available to partners looking to open new esports

facilities around the world, Allied Esports locations currently

include 11 properties in the top three esports markets across the

globe: North America’s HyperX Esports Arena Las Vegas, Esports

Arena Orange County, Esports Arena Oakland and Esports Truck “Big

Meta”; Europe’s ELC Gaming Esports Truck “Big Betty” and Esports

Studio in Hamburg, Germany; and China’s Lianmeng Dianjing in

Beijing, Lianmeng Dianjing SEG Arena in Shenzhen, Lianmeng Dianjing

Tianjin Arena, Lianmeng Dianjing Gui’an Arena and Lianmeng Dianjing

LGD Hangzhou Arena. The Allied Esports Property Network’s 12th

property, run by Fortress Esports, is expected to open in

Melbourne, Australia in 2019.

About WPT Enterprises, Inc. (World Poker Tour)

WPT Enterprises, Inc. is the creator of the World Poker Tour®

(WPT®) – the premier name in internationally televised gaming and

entertainment with brand presence in land-based tournaments,

television, online and mobile. Leading innovation in the sport of

poker since 2002, WPT ignited the global poker boom with the

creation of a unique television show based on a series of

high-stakes poker tournaments. WPT has broadcast globally in more

than 150 countries and territories, and is currently producing its

17th season, which airs on FOX Sports Regional Networks in the

United States. Season XVII of WPT is sponsored by ClubWPT.com. ClubWPT.com is a unique online

membership site that offers inside access to the WPT, as well as a

sweepstakes-based poker club available in 35 states across the

United States with innovative features and state-of-the-art

creative elements inspired by WPT’s 16 years of experience in

gaming entertainment. WPT also participates in strategic brand

license, partnership, and sponsorship opportunities. WPT

Enterprises, Inc. is a subsidiary of Allied Esports Entertainment,

Inc.

Additional Information about the Transaction and Where to

Find It

This communication relates to a proposed business combination

(the “Proposed Transaction”) between Black Ridge and Ourgame and

may be deemed to be solicitation material in respect of the

Proposed Transaction. The Proposed Transaction will be submitted to

the stockholders of Black Ridge and Ourgame for their approval. In

connection with the Black Ridge stockholder vote on the Proposed

Transaction, Black Ridge intends to file with the SEC a proxy

statement on Schedule 14A. This communication is not a substitute

for the proxy statement that Black Ridge will file with the SEC or

any other documents that Black Ridge may file with the SEC or send

to its stockholders in connection with the Proposed Transaction.

When completed, Black Ridge will mail a definitive proxy statement

to its stockholders in connection with Black Ridge’s solicitation

of proxies for the special meeting of Black Ridge stockholders to

be held to approve the Proposed Transaction. This presentation does

not contain all the information that should be considered

concerning the Proposed Transaction, including relevant risk

factors that may be included in the proxy statement. It is not

intended to provide the basis for any investment decision or any

other decision in respect to the Proposed Transaction. Black Ridge

stockholders and other interested persons are advised to read, when

available, Black Ridge’s preliminary proxy statement, the

amendments thereto, and the definitive proxy statement, as these

materials will contain important information about the Proposed

Transaction. A copy of the definitive proxy statement will be sent

when available to all stockholders of record of Black Ridge seeking

the required stockholder approvals. Investors and stockholders can

obtain free copies of the preliminary proxy statement once it is

available and other documents filed with the SEC by Black Ridge

through the web site maintained by the SEC at www.sec.gov. In

addition, investors and stockholders can obtain free copies of the

preliminary proxy statement once it is available from Black Ridge

by accessing Black Ridge’s website at www.blackridgeacq.com.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the Private Securities Litigation Reform Act of

1995. Forward-looking statements may relate to the Proposed

Transaction and any other statements relating to future results,

strategy and plans of Black Ridge and Ourgame (including certain

projections and business trends, and statements which may be

identified by the use of the words “plans”, “expects” or “does not

expect”, “estimated”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates” or “does not

anticipate”, or “believes”, or variations of such words and phrases

or state that certain actions, events or results “may”, “could”,

“would”, “might”, “projects”, “will” or “will be taken”, “occur” or

“be achieved”). Forward-looking statements are based on the

opinions and estimates of management of Black Ridge or Ourgame, as

the case may be, as of the date such statements are made, and they

are subject to known and unknown risks, uncertainties, assumptions

and other factors that may cause the actual results, level of

activity, performance or achievements to be materially different

from those expressed or implied by such forward-looking statements.

For Ourgame, these risks and uncertainties include, but are not

limited to, its revenues and operating performance, general

economic conditions, industry trends, legislation or regulatory

requirements affecting the business in which it is engaged,

management of growth, its business strategy and plans, the result

of future financing efforts and its dependence on key personnel. For

Black Ridge, factors include, but are not limited to, the

successful combination of Black Ridge with Ourgame’s business,

amount of redemptions, the ability to retain key personnel and the

ability to achieve stockholder and regulatory approvals and to

successfully close the Proposed Transaction. Additional information

on these and other factors that may cause actual results and Black

Ridge’s performance to differ materially is included in Black

Ridge’s periodic reports filed with the SEC, including but not

limited to Black Ridge’s Form 10-K for the year ended December 31,

2017 and subsequent Forms 10-Q. Copies may be obtained by

contacting Black Ridge or the SEC. Readers are cautioned not to

place undue reliance upon any forward-looking statements, which

speak only as of the date made. These forward-looking statements

are made only as of the date hereof, and Black Ridge undertakes no

obligations to update or revise the forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

No Offer or Solicitation

This communication is for informational purposes only and is

neither an offer to sell or purchase, nor the solicitation of an

offer to buy or sell any securities, nor is it a solicitation of

any vote, consent, or approval in any jurisdiction pursuant to or

in connection with the Proposed Transaction or otherwise, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law.

Participants in Solicitation

Black Ridge and Ourgame, and their respective directors and

executive officers, may be deemed participants in the solicitation

of proxies of Black Ridge stockholders in respect of the Proposed

Transaction. Information about the directors and executive officers

of Black Ridge is set forth in Black Ridge’s Form 10-K for the year

ended December 31, 2017. Information about the directors and

executive officers of Ourgame and more detailed information

regarding the identity of all potential participants, and their

direct and indirect interests, by security holdings or otherwise,

will be set forth in Black Ridge’s proxy statement, when available.

Investors may obtain additional information about the interests of

such participants by reading such proxy statement when it becomes

available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181219005845/en/

Investor Contact: Lasse Glassen Addo Investor Relations

lglassen@addoir.com 424-238-6249

Media Contact: Brian Fisher Allied Esports Entertainment

brian@esportsallied.com 714-975-8368

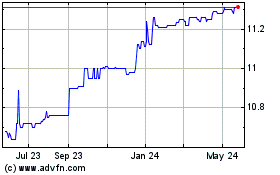

Broad Capital Acquisition (NASDAQ:BRAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

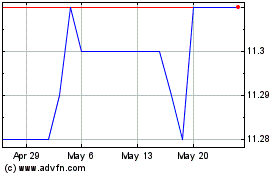

Broad Capital Acquisition (NASDAQ:BRAC)

Historical Stock Chart

From Feb 2024 to Feb 2025