UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

(Amendment

No. 1)

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under § 240.14a-12 |

| CareCloud,

Inc. |

| (Name

of Registrant as Specified In Its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CareCloud,

Inc.

7

Clyde Road

Somerset,

NJ 08873

December

10, 2024

Dear

Fellow Shareholder:

It

is my pleasure to invite you to attend the Special Meeting of Common Stock Shareholders of CareCloud, Inc. (the “Company”)

at 11:00 a.m., Eastern Time, on Monday, January 20, 2025 at our principal executive offices at 7 Clyde Road, Somerset,

NJ 08873.

The

following pages contain the formal Notice of the Special Meeting and the Proxy Statement. If you plan to attend the Special Meeting,

please detach the Admission Ticket from your proxy card and bring it to the Special Meeting. The proxy materials will be first sent or

given to shareholders on or about December 10, 2024.

At

this Special Meeting, you will be asked to vote on the proposals set forth in the Notice of Special Meeting of Shareholders and proxy

statement, which describes the formal business to be conducted at the Special Meeting and follows this letter.

Your

vote is important. Whether you plan to attend the Special Meeting in person or not, we hope you will vote your shares as soon as possible.

Please mark, sign, date, and return the accompanying card in the provided postage-paid envelope or instruct us via the Internet as to

how you would like your shares voted. Instructions are on the proxy card. This will ensure representation of your shares if you are unable

to attend.

| |

Sincerely, |

| |

|

| |

/s/

Norman Roth |

| |

Norman

Roth |

| |

Interim

Chief Financial Officer and Assistant Corporate Secretary |

NOTICE

OF SPECIAL MEETING OF COMMON STOCK SHAREHOLDERS

TO

BE HELD ON JANUARY 20, 2025

TIME

11:00

a.m., Eastern Time, on

Monday,

January 20, 2025

PURPOSE

| ● | To

amend CareCloud, Inc.’s Certificate of Amendment of Amended and Restated Certificate

of Incorporation (the “Certificate of Incorporation”) to increase the Company’s

authorized shares of Common Stock from thirty-five million shares to eighty-five million

shares (the “Authorized Share Increase Proposal”). |

| | | |

| ● | Approve

one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit

additional proxies if there are insufficient votes at the time of the Special Meeting to

approve the Authorized Share Increase Proposal (the “Adjournment

Proposal”). |

DOCUMENTS

This

Notice is only an overview of the proxy statement and proxy card included in this mailing which is also available at https://ir.carecloud.com/sec-filings.

The Notice of Internet Availability will be mailed to shareholders on or about December 10, 2024.

PLACE

The

Company’s principal executive offices located at 7 Clyde Road, Somerset, NJ 08873.

RECORD

DATE

Owners

of shares of the Company’s Common Stock, as of the close of business on November 12, 2024, will receive notice of and be entitled

to vote at the Special Meeting and any adjournments.

VOTING

Even

if you plan to attend the Special Meeting, please mark, sign, date, and return the enclosed proxy card in the enclosed postage-paid envelope.

You may revoke your proxy by filing with the Assistant Secretary of the Company a written revocation or by submitting a duly executed

proxy bearing a later date. If you are present at the Special Meeting, you may revoke your proxy and vote in person on each matter brought

before the Special Meeting. You may also vote over the Internet using the Internet address on the proxy card. To be considered, all votes

must be received by midnight on January 16, 2025.

Norman

Roth

Interim

Chief Financial Officer and Assistant Corporate Secretary

Dated:

December 10, 2024

TABLE

OF CONTENTS

QUESTIONS

AND ANSWERS

Q:

When and where is the Special Meeting?

A:

The Company’s Special Meeting of Common Stock Shareholders will be held at 11:00 a.m., Eastern Time, Monday, January

20, 2025, at our principal executive offices at 7 Clyde Road, Somerset, NJ 08873.

Q:

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

A:

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this proxy statement and our Annual and Quarterly

Reports, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders

will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy

Materials, which was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials

on the Internet. The Notice of Internet Availability also instructs you as to how you may submit your proxy on the Internet. If you would

like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the

Notice.

Q:

Who is entitled to vote?

A:

You are entitled to vote at the Special Meeting if the Company’s records on November 12, 2024 (the “record date”) show

that you owned the Company’s Common Stock, par value $0.001 (the “Common Stock”) on such date. As of November 12, 2024,

there were 16,252,017 shares of Common Stock outstanding.

Q:

What will I likely be voting on?

A:

There are two proposals that are expected to be voted on at the Special Meeting, which are (i) to amend the Company’s Certificate

of Incorporation to increase the Company’s authorized shares of Common Stock from thirty-five million shares to eighty-five million

shares (the “Authorized Share Increase Proposal”) and (ii) approve one or more adjournments of the Special Meeting,

if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve

the Authorized Share Increase Proposal (the “Adjournment Proposal”). As of the date of this Proxy

Statement, the Company was not aware of any additional matters to be raised at the Special Meeting.

Q:

What is the Board’s recommendation?

A:

The Board of Directors recommends that you vote your shares:

| |

_ |

FOR

the Authorized Share Increase Proposal |

| |

_ |

FOR

the Adjournment Proposal |

Q:

How many votes is each share entitled to?

A:

Each share of Common Stock has one vote. The enclosed proxy card shows the number of shares that you are entitled to vote.

Q:

Do I need a ticket to attend the Special Meeting?

A:

Yes. Retain the top of the proxy card as your admission ticket. One ticket will permit two persons to attend. If your shares are held

through a broker, contact your broker and request that the broker provide you with evidence of share ownership. This documentation, when

presented at the registration desk at the Special Meeting, will enable you to attend the Special Meeting.

Q:

How do proxies work?

A:

The Board of Directors is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Special

Meeting in the manner you direct. You may also abstain from voting. If you sign and return the enclosed proxy card but do not specify

how to vote, we will vote your shares in accordance with our recommendations above.

Q:

How do I vote?

A:

You may:

| |

● |

Vote

by marking, signing, dating, and returning a proxy card; |

| |

|

|

| |

● |

Vote

via the Internet by following the voting instructions on the proxy card or the voting instructions provided by your broker, bank,

or other holder of record. Internet voting procedures are designed to authenticate your identity, allow you to vote your shares,

and confirm that your instructions have been properly recorded. If you submit your vote via the Internet, you may incur costs associated

with electronic access, such as usage charges from Internet access providers and telephone companies; |

| |

|

|

| |

● |

Vote

in person by attending the Special Meeting. We will distribute written ballots to any shareholder who wishes to vote in person at

the Special Meeting. |

If

your shares are held in street name, your broker, bank, or other holder of record will include a voting instruction form with this Proxy

Statement. We strongly encourage you to vote your shares by following the instructions provided on the voting instruction form. Please

return your voting instruction form to your broker, bank, or other holder of record to ensure that a proxy card is voted on your behalf.

Q:

Do I have to vote?

A:

No. However, we strongly encourage you to vote.

Q:

What does it mean if I receive more than one proxy card?

A:

If you hold your shares in multiple registrations, or in both registered and street name, you will receive a proxy card for each account.

Please mark, sign, date, and return each proxy card you receive. If you choose to vote by Internet, please vote each proxy card you receive.

Q:

Will my shares be voted if I do not sign and return my proxy card?

A:

If your shares are held in street name and you do not instruct your broker or other nominee how to vote your shares, your broker or nominee

may use its discretion to vote your shares on “routine matters”. For any “non-routine matters” being considered

at the Special Meeting, your broker or other nominee would not be able to vote on such matters.

Under

the rules and interpretations of the NYSE (which by extension apply to all United States brokers, even though the Company’s Common

Stock is listed on The Nasdaq Global Market), “non-routine matters” are matters that may substantially affect the rights

or privileges of shareholders, such as mergers, shareholder proposals, elections of directors (even if not contested) and executive compensation,

including say-on-pay advisory shareholder votes on executive compensation and say-on-frequency advisory shareholder votes on executive

compensation.

The

Authorized Share Increase proposal in this proxy statement is expected to be considered a “non-routine matter,” therefore,

your broker or other nominee is not entitled to vote your shares on this proposal without your instructions. The Adjournment

Proposal is considered a “routine matter,” therefore, your broker or other nominee will have discretion to

vote without your instruction.

Q:

Can I change my vote?

A:

Yes. You may revoke your proxy and change your vote before the Special Meeting by submitting a new proxy card with a later date, by casting

a new vote via the Internet, by notifying the Company’s Assistant Corporate Secretary in writing, or by voting in person at the

Special Meeting. If you do not properly revoke your proxy, properly executed proxies will be voted as you specified in your earlier proxy.

Q:

What is a quorum?

A:

A quorum is the number of shares that must be present, in person or by proxy, in order for business to be transacted at the Special Meeting.

At least a majority of the outstanding shares eligible to vote must be represented at the Special Meeting, either in person or by proxy,

in order to transact business.

Q:

Who will tabulate the votes?

A:

A representative from our Company, Norman Roth, will tabulate the votes and act as inspector of election.

Votes

cast by proxy or in person at the Special Meeting will be tabulated by the inspector of election. The inspector will also determine whether

a quorum is present at the Special Meeting.

The

shares represented by the proxy cards received, properly marked, dated, signed, and not revoked, will be voted at the Special Meeting.

If the proxy card specifies a choice with respect to any matter to be acted on, the shares will be voted in accordance with that specified

choice. Any proxy card that is returned signed but not marked will be voted as recommended by the Board of Directors.

Q:

How do I find out the voting results?

A:

Preliminary results are typically announced at the Special Meeting. Final voting results will be reported on a Form 8-K filed with the

SEC following the Special Meeting.

Q:

How are proposals approved by the security holders?

A:

In the approval of the Authorized Share Increase Proposal, you may vote “For,” ‘Against” or expressly

“Abstain”. This proposal is considered a non-routine matter and, as such, brokers do not have discretion to vote on

this proposal without your instruction. If you do not instruct your broker how to vote on this proposals, your broker will deliver a

broker non-vote on this proposal. Abstentions and broker non-votes will have the effect of votes “against” this proposal.

In

the approval of the Adjournment Proposal, you may vote “For,” “Against” or expressly “Abstain”

with respect to this proposal. This proposal is considered a routine matter and, as such, brokers have discretion

to vote on this proposal without your instruction. Abstentions and broker non-votes will have the effect of a vote “against”

this proposal.

Q:

Who will bear the costs of this solicitation?

A:

Our Board of Directors is making this solicitation on behalf of the Company, and the Company will pay the entire cost of preparing, assembling,

printing, mailing and distributing these proxy materials. If you choose to access the proxy materials over the Internet; however, you

are responsible for Internet access charges you may incur. The solicitation of proxies or votes may be made in person. We will also reimburse

brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and

solicitation materials to shareholders.

Q:

What should I do now?

A:

You should read this proxy statement carefully and promptly submit your proxy card or vote by the Internet as provided on the proxy card

to ensure that your vote is counted at the Special Meeting.

Q:

How will shares in the Company’s employee benefit plans be voted?

A:

If you are or were a participant in the Company’s employee benefit plans, this Proxy Statement is being used to solicit voting

instructions from you with respect to shares of our stock that you own but which are held by the trustees of our benefit plans for the

benefit of you and other plan participants. Shares held in our benefit plans that you are entitled to vote will be voted by the plan

trustees pursuant to your instructions. Shares held in any employee benefit plan that you are entitled to vote, but do not vote, will

be voted by the plan trustees in proportion to the voting instructions received for other shares. You must instruct the plan trustees

to vote your shares by utilizing one of the voting methods described above.

Q:

How do I obtain a copy of the Company’s materials related to corporate governance?

A:

The Company’s Corporate Governance materials, charters of each standing Board Committee, Code of Conduct, and other materials related

to our corporate governance can be found in the Corporate Governance section of the Company’s website at https://ir.carecloud.com/corporate-governance/governance-documents.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth information, as of November 12, 2024, concerning:

| |

- |

Each

person or group of persons known by the Company to own beneficially more than five percent of the outstanding shares of Common Stock,

based on information provided by the beneficial owner in public filings made with the Securities and Exchange Commission (“SEC”). |

| |

|

|

| |

- |

Each

person who has been a director or executive officer of the Company since the beginning of the last fiscal year. |

| |

|

|

| |

- |

Each

nominee for the Board of Directors. |

| |

|

|

| |

- |

Each

associate of any of the foregoing persons. |

Unless

otherwise noted below, the address of each beneficial owner listed in the table is c/o CareCloud, Inc., 7 Clyde Road, Somerset, NJ 08873.

Beneficial ownership is determined in accordance with the rules of the SEC, which deem a person to beneficially own any shares the person

has or shares voting or dispositive power over and any additional shares obtainable within 60 days through the exercise of options, warrants

or other purchase rights. Shares of Common Stock subject to options, warrants or other rights to purchase that are currently exercisable

or are exercisable within 60 days of November 12, 2024 (including shares subject to restrictions that lapse within 60 days of the record

date) are deemed outstanding for purposes of computing the percentage ownership of the person holding such shares, options, warrants

or other rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise

indicated, each person possesses sole voting and investment power with respect to the shares identified as beneficially owned. The percentages

are based on 16,252,017 shares of Common Stock outstanding as of November 12, 2024 and 1,482,792 shares of Series B Preferred Stock outstanding

as of November 12, 2024. None of the directors or named executive officers owned Series A Preferred Stock as of November 12, 2024. Each

share of Common Stock has one vote.

| Name of Beneficial Owner | |

Common Stock Beneficially Owned | | |

Percent of Class | | |

Preferred

Stock - Series A

Beneficially Owned | | |

Percent of Class | | |

Preferred

Stock - Series B

Beneficially Owned | | |

Percent of Class | |

| Directors and Named Executive Officers | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mahmud Haq, Executive Chairman | |

| 5,034,520 | | |

| 31.0 | % | |

| - | | |

| - | | |

| 5,480 | | |

| 0.4 | % |

| A. Hadi Chaudhry, CEO | |

| 114,892 | | |

| 0.7 | % | |

| - | | |

| - | | |

| - | | |

| - | |

| Stephen Snyder, President | |

| 229,495 | | |

| 1.4 | % | |

| - | | |

| - | | |

| 22,990 | | |

| 1.6 | % |

| Norman Roth, Interim CFO | |

| 98,975 | | |

| 0.6 | % | |

| - | | |

| - | | |

| - | | |

| - | |

| Anne M. Busquet | |

| 251,388 | | |

| 1.5 | % | |

| - | | |

| - | | |

| - | | |

| - | |

| John N. Daly | |

| 76,750 | | |

| 0.5 | % | |

| - | | |

| - | | |

| - | | |

| - | |

| Bill Korn | |

| 167,883 | | |

| 1.0 | % | |

| - | | |

| - | | |

| 10,800 | | |

| 0.7 | % |

| Cameron P. Munter | |

| 189,000 | | |

| 1.2 | % | |

| - | | |

| - | | |

| - | | |

| - | |

| Lawrence S. Sharnak | |

| 84,000 | | |

| 0.5 | % | |

| - | | |

| - | | |

| - | | |

| - | |

| All current directors and executive officers as a group (9 persons) | |

| 6,246,903 | | |

| 38.4 | % | |

| - | | |

| - | | |

| 39,270 | | |

| 2.7 | % |

Matters

to Be Acted Upon

| 1. |

Amend

the Company’s Certificate of Incorporation to increase the Company’s authorized shares of Common Stock from thirty-five

million shares to eighty-five million shares. |

(Item

1 on proxy card)

Our

Board of Directors has authorized, approved and declared advisable an amendment to our Certificate of Incorporation that increases the

number of authorized shares of our Common Stock from thirty-five million shares to eighty-five million shares. The proposed amendment

is subject to approval by our shareholders.

Our

Board of Directors believes that it is advisable and in our best interests and the best interests of our shareholders to amend the Certificate

of Incorporation in order to have available additional authorized but unissued shares of Common Stock in an amount adequate to provide

for our future needs including acquisitions, conversion of the Company’s outstanding Preferred Stock and other general corporate

purposes.

The

proposed amendment is attached hereto as Appendix A.

Required

Vote

The

affirmative vote of the holders of more than 50% of the Common Stock that is outstanding and entitled to vote at the Special Meeting

is required to approve the Authorized Share Increase Proposal. You may vote for, against or expressly abstain with respect to this proposal.

The Authorized Share Increase Proposal is considered a non-routine matter and, as such, brokers do not have discretion to vote on this

proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will deliver a broker

non-vote on this proposal. Abstentions and broker non-votes will have the effect of votes “against” this proposal.

The

Board of Directors unanimously recommends a vote FOR the approval of the Authorized Shares Increase Proposal.

| 2. |

Approve

one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient

votes at the time of the Special Meeting to approve the Authorized Share Increase Proposal. |

(Item

2 on proxy card)

Our

shareholders will be asked to approve a proposal to approve one or more adjournments of the Special Meeting to a later date or time,

if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve

the Authorized Share Increase Proposal.

If

the Common Stock shareholders approve the Adjournment Proposal, we could adjourn the Special Meeting and any adjourned session of the

Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from Common Stock shareholders

that have previously returned properly executed proxies voting against the approval of the Authorized

Share Increase Proposal.

We

do not intend to call a vote on this proposal if the Authorized Share Increase Proposal is approved at the Special Meeting.

Required

Vote

The

affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy at the Special Meeting is

required for the Adjournment Proposal; provided, that in the absence of a quorum, the affirmative vote of the holders of a majority of

the shares of Common Stock represented thereat is required for the Adjournment Proposal. Approval of the Adjournment Proposal

is not a condition to the approval of the other proposal. You may vote for, against or expressly abstain with respect to this proposal.

Abstentions will have no effect with respect to the vote on the Adjournment Proposal (assuming the presence of a quorum), or, in the

absence of a quorum, will have the effect of a vote “against” this proposal.

The

Board of Directors unanimously recommends a vote FOR the approval of the Adjournment Proposal.

OTHER

BUSINESS

Our

Board of Directors does not presently intend to bring any other business before the Special Meeting, and, so far as is known to the Board

of Directors, no matters are to be brought before the Special Meeting except as specified in the Notice of Special Meeting of Common

Stock Shareholders. We have not been informed by any of our Common Stock shareholders of any intention to propose any other

matter to be acted upon at the Special Meeting. The persons named in the accompanying Proxy are allowed to exercise their discretionary

authority to vote upon any other business as may properly come before the Special Meeting. As to any such other business that may properly

come before the meeting, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment

of the persons voting such proxies.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only

one Notice of Internet Availability is being delivered to multiple security holders sharing an address unless we receive contrary instructions

from one or more of the security holders. We shall deliver promptly, upon written or oral request, a separate copy of the Notice of Internet

Availability to a security holder at a shared address to which a single copy of the document was delivered. A security holder can notify

us that the security holder wishes to receive a separate copy of the Notice of Internet Availability by sending a written request to

us at Investor Relations, CareCloud, Inc., 7 Clyde Road, Somerset, NJ 08873, or by calling us at (732) 873-5133. A security holder may

utilize the same address and telephone number to request either separate copies or a single copy for a single address for all future

proxy statements, if any, Notices of Internet Availability, and Special reports of the Company.

SHAREHOLDER

PROPOSALS FOR 2025 ANNUAL MEETING OF SHAREHOLDERS

Shareholder

proposals intended for inclusion in our proxy statement and form of proxy relating to our 2025 Annual Meeting of Shareholders must be

received by us not later than December 11, 2024. If we hold our 2025 Annual Meeting of Shareholders more than 30 days before or after

June 17, 2025 (the one-year anniversary date of the 2024 Annual Meeting of Shareholders), we will disclose the new deadline by which

shareholder proposals must be received under Item 5 of Part II of our earliest possible Quarterly Report on Form 10-Q or, if impracticable,

by any means reasonably determined to inform shareholders. In addition, shareholder proposals must otherwise comply with the requirements

of Rule 14a-8 under the Exchange Act. Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of

shareholder proposals in company-sponsored proxy materials. Proposals should be addressed to: Assistant Corporate Secretary, CareCloud,

Inc., 7 Clyde Road, Somerset, New Jersey 08873.

Our

bylaws also establish an advance notice procedure for shareholders who wish to present a proposal before an Annual meeting of shareholders

but do not intend for the proposal to be included in our proxy statement. Under our bylaws, director nominations and other business may

be brought at an Annual Meeting of Shareholders only by or at the direction of our Board of Directors or by a shareholder entitled to

vote who has submitted a proposal in accordance with the requirements of our bylaws as in effect from time to time. Notice of Shareholder

proposals for the 2025 Annual Meeting of Shareholders, other than proposals intended for inclusion in our proxy statement as set forth

in the preceding paragraph, must be received by the Assistant Corporate Secretary at our principal executive offices between January

23, 2025 and February 27, 2025. This advance notice period is intended to allow all shareholders an opportunity to consider all business

and nominees expected to be considered at the meeting. Please refer to the full text of our advance notice bylaw provisions for additional

information and requirements. In addition to satisfying the deadlines in the advance notice provision of our bylaws, a shareholder who

intends to solicit proxies in support of director nominees, other than our nominees, for our 2025 Annual Meeting of Shareholders must

provide the notice required under Rule 14a-19 under the Exchange Act to our Assistant Corporate Secretary no later than March 23, 2025.

Only

such proposals as are (1) required by the rules of the SEC and (2) permissible under the Delaware General Corporation Law will be included

on the 2025 Annual Meeting of Shareholders agenda. If a shareholder who has notified us of his or her intention to present a proposal

at an Annual meeting does not appear to present his or her proposal at such meeting, we are not required to present the proposal for

a vote at such meeting.

ANNUAL

REPORT ON FORM 10-K AND QUARTERLY REPORT ON FORM 10-Q

A

copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and a copy of our Quarterly Report on Form 10-Q for

the three and nine months ended September 30, 2024, as filed with the SEC, accompanies this Proxy Statement. Such reports include our

financial statements and certain other financial information, which are incorporated by reference herein.

A

copy of our Annual Report on Form 10-K and our Quarterly Report on Form 10-Q will be mailed without charge to any beneficial owner of

our Common Stock, upon written or oral request. Requests for the Annual Report on Form 10-K and/or the Quarterly Report on Form 10-Q

should be addressed to: Investor Relations, CareCloud, Inc., 7 Clyde Road, Somerset, NJ 08873 or by telephone at (732) 873-5133, x134;

please make your request for a copy on or before December 15, 2024 to facilitate a timely delivery. The Form 10-K and Form 10-Q include

certain exhibits. Copies of the exhibits will be provided only upon receipt of payment covering our reasonable expenses for such copies.

The Form 10-K and Form 10-Q and exhibits therein may also be obtained from our investor relations website, http://www.viewproxy.com/carecloud/2024sm

or directly from the SEC’s website, http://www.sec.gov/edgar.shtml.

Appendix

A

CERTIFICATE

OF SECOND AMENDMENT OF

AMENDED

AND RESTATED CERTIFICATE OF INCORPORATION OF

CARECLOUD, INC.

CareCloud,

Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware does hereby certify:

FIRST:

That at a meeting of the Board of Directors of CareCloud, Inc., resolutions were duly adopted setting forth a proposed amendment of the

Amended and Restated Certificate of Incorporation of said corporation, declaring said amendment to be advisable and calling a meeting

of the shareholders of said corporation for consideration thereof. The resolution setting forth the proposed amendment is as follows:

RESOLVED,

that the Amended and Restated Certificate of Incorporation of this corporation be amended by changing the Article thereof numbered “4.1”

so that, as amended said Article shall be and read as follows:

4.1

Classes of Stock. The Corporation is authorized to issue two classes of stock to be designated, respectively, “Common

Stock” and “Preferred Stock.” The total number of shares which the Corporation is authorized to issue is

92,000,000 shares, consisting of 85,000,000 shares of Common Stock and 7,000,000 shares of Preferred Stock, each with a par value of

$0.001 per share.

SECOND:

That thereafter, pursuant to resolution of its Board of Directors, a meeting of the shareholders of said corporation was duly called

and held upon notice in accordance with Section 222 of the General Corporation Law of the State of Delaware at which meeting the necessary

number of shares as required by statute were voted in favor of the amendment.

THIRD:

That said amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of

Delaware.

IN

WITNESS HEREOF, said corporation has caused this certificate to be signed this xth day of January, 2025.

| |

By: |

|

| |

Name: |

A. Hadi Chaudhry |

| |

Title: |

Chief Executive Officer |

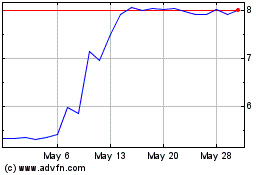

CareCloud (NASDAQ:CCLDP)

Historical Stock Chart

From Nov 2024 to Dec 2024

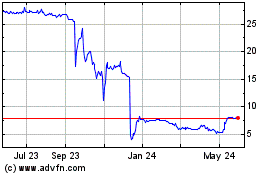

CareCloud (NASDAQ:CCLDP)

Historical Stock Chart

From Dec 2023 to Dec 2024