Colliers extends contract with Global Chairman & CEO

01 October 2024 - 9:00PM

Colliers International Group Inc. (TSX, NASDAQ: CIGI) is pleased to

announce that it has extended the term of the existing management

services agreement with its Global Chairman and Chief Executive

Officer and largest shareholder, Jay S. Hennick, to January 1,

2029. The agreement was due to expire in April 2026.

Mr. Hennick has been instrumental in shaping

Colliers since its initial acquisition in 2004. Under his

leadership, the company has expanded operations globally,

diversified its business adding new growth engines while increasing

recurring earnings to 70%. Since Colliers became a standalone

public company in 2015, its market capitalization has grown from

approximately US$1.5 billion to US$6.1 billion as of December 31,

2023.

In connection with this extension, Colliers has

created a new performance-based long term incentive plan that ties

a significant proportion of Mr. Hennick’s total compensation to the

achievement of certain market capitalization-based growth targets.

Under this arrangement, Mr. Hennick has been granted a total of

428,174 cash-settled performance units that are subject to the

satisfaction of certain performance-based vesting conditions during

the period ending January 1, 2029. To the extent incentives are

earned, Colliers will be obligated to make a one-time cash payment

equal to the number of vested units multiplied by the twenty-day

volume-weighted average trading price of the Colliers subordinate

voting shares at such time. For the full amount of the units

to vest, Colliers’ market capitalization would have to increase to

approximately US$12.3 billion, an amount that is double Colliers’

market capitalization as at December 31, 2023. A smaller

portion of the performance units may vest and be paid if certain

lower market capitalization hurdles are satisfied during the term.

The performance units cannot be share settled and do not give Mr.

Hennick any rights as a shareholder of Colliers.

“On behalf of the Board, we are excited about

securing Jay’s continued leadership, vision and tireless devotion

to Colliers’ growth and value creation over the next five years,”

said Jack Curtin, Colliers’ lead director. “With the

implementation of this new long-term performance-based compensation

plan, we believe that Colliers will be best positioned to continue

delivering exceptional shareholder returns for many years to

come.”

Further details regarding this performance-based

long term incentive plan will be provided in the management

information circular for the next annual meeting of shareholders in

early 2025.

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading

diversified professional services and investment management

company. With operations in 68 countries, our 22,000

enterprising professionals work collaboratively to provide expert

real estate and investment advice to clients. For more than 29

years, our experienced leadership with significant inside ownership

has delivered compound annual investment returns of approximately

20% for shareholders. With annual revenues of more than $4.4

billion and $96 billion of assets under management, Colliers

maximizes the potential of property and real assets to accelerate

the success of our clients, our investors and our people. Learn

more at corporate.colliers.com,

X @Colliers or LinkedIn.

Forward-looking Statements

This press release includes forward-looking

statements. Forward-looking statements include the Company’s

financial performance outlook and statements regarding goals,

beliefs, strategies, objectives, plans or current expectations.

These statements involve known and unknown risks, uncertainties and

other factors which may cause the actual results to be materially

different from any future results, performance or achievements

contemplated in the forward-looking statements. Such factors

include: economic conditions, especially as they relate to

commercial and consumer credit conditions and consumer spending,

particularly in regions where our business may be concentrated;

commercial real estate property values, vacancy rates and general

conditions of financial liquidity for real estate transactions;

trends in pricing and risk assumption for commercial real estate

services; the effect of significant movements in average

capitalization rates across different property types; a reduction

by companies in their reliance on outsourcing for their commercial

real estate needs, which would affect revenues and operating

performance; competition in the markets served by the Company; the

ability to attract new clients and to retain major clients and

renew related contracts; the ability to retain and incentivize

producers; increases in wage and benefit costs; the effects of

changes in interest rates on the cost of borrowing; unexpected

increases in operating costs, such as insurance, workers’

compensation and health care; changes in the frequency or severity

of insurance incidents relative to historical experience; the

effects of changes in foreign exchange rates in relation to the US

dollar on the Company’s Canadian dollar, Euro, Australian dollar

and UK pound sterling denominated revenues and expenses; the impact

of pandemics on client demand for the Company’s services, the

ability of the Company to deliver its services and the health and

productivity of its employees; the impact of global climate change;

the impact of political events including elections, referenda,

trade policy changes, immigration policy changes, hostilities and

terrorism on the Company’s operations; the ability to identify and

make acquisitions at reasonable prices and successfully integrate

acquired operations; the ability to execute on, and adapt to,

information technology strategies and trends; the ability to comply

with laws and regulations related to our global operations,

including real estate and mortgage banking licensure, labour and

employment laws and regulations, as well as the anti-corruption

laws and trade sanctions; and changes in government laws and

policies at the federal, state/provincial or local level that may

adversely impact the business.

Additional information and risk factors are

identified in the Company’s other periodic filings with Canadian

and US securities regulators (which factors are adopted herein and

a copy of which can be obtained at www.sedar.com). Forward

looking statements contained in this press release are made as of

the date hereof and are subject to change. All forward-looking

statements in this press release are qualified by these cautionary

statements. Except as required by applicable law, Colliers

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Company Contact:Christian Mayer, CFOColliers

International Group Inc.(416) 960-9500

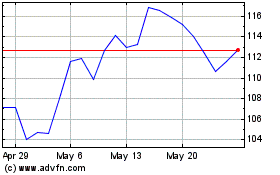

Colliers (NASDAQ:CIGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

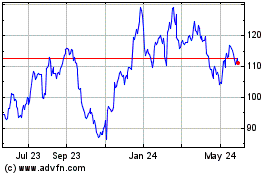

Colliers (NASDAQ:CIGI)

Historical Stock Chart

From Nov 2023 to Nov 2024