Conifer Holdings, Inc. (Nasdaq: CNFR) (“Conifer”

or the “Company”) today announced results for the second quarter

ended June 30, 2024.

Second Quarter 2024 Financial Highlights

(compared to the prior year period)

- Expense ratio

improved 5.8 percentage points to 32.1%

- Net investment

income increased 11.2% over the prior year period to $1.5

million

- Significant progress in planned

gross written premium shift toward MGA model

Management Comments

Nick Petcoff, CEO of Conifer, commented, "We are

pleased to report significant advances in our strategic

transformation. Our main focus is shifting premium away from the

traditional risk-bearing carrier revenue model to a more

sustainable and scalable production-based revenue approach. This

change reflects our commitment to aligning our business model with

market demands by creating long-term value.”

Strategic Turn toward Non-Risk Bearing

Revenue

Conifer saw significant progress in the second

quarter of 2024 in its initiative to run commercial gross written

premium through its wholly owned managing general agency (“MGA”),

Conifer Insurance Services (CIS). This strategic shift away from a

traditional risk-bearing revenue model to focus instead on a

wholesale agency, production-based approach began in late 2023, and

the Company expects 100% of future commercial gross written premium

to flow through its MGA.

This approach is intended to optimize Conifer’s

resources and will complement the Company’s shift to primarily

focus on commission revenues within its MGA. Accordingly, Conifer

anticipates that substantially all commercial lines business will

be directly written by third-party insurers with A.M. Best ratings

of A- or better by the end of the third quarter in 2024.

During the second quarter of 2024, Conifer

continued advancing its plan to direct premium to capacity

providers for coverage across multiple commercial lines of

business. Furthermore, the transfer of cannabis premium to capacity

providers has progressed at a steady pace, and the Company expects

to ultimately shift all premium for this line of business to its

capacity partners as well. The Company expects that this and other

capacity initiatives will significantly boost the premiums placed

by its agency segment, ultimately driving higher commission revenue

over time.

The Company has continued to underwrite

low-value homeowners business in Texas and the Midwest. As detailed

in the Personal Lines results overview below, premium for the

second quarter of 2024 increased 23.0% from the prior year

period.

2024 Second Quarter Financial Results

Overview

| |

At and for

the Three Months Ended June 30, |

|

At and for

the Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

% Change |

|

2024 |

|

2023 |

|

% Change |

| |

(dollars in

thousands, except share and per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross written premiums |

$ |

18,971 |

|

|

$ |

44,674 |

|

|

-57.5% |

|

$ |

43,284 |

|

|

$ |

80,888 |

|

|

-46.5% |

|

Net written premiums |

|

13,247 |

|

|

|

29,328 |

|

|

-54.8% |

|

|

28,638 |

|

|

|

47,670 |

|

|

-39.9% |

|

Net earned premiums |

|

16,666 |

|

|

|

23,183 |

|

|

-28.1% |

|

|

33,553 |

|

|

|

45,135 |

|

|

-25.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

1,505 |

|

|

|

1,354 |

|

|

11.2% |

|

|

3,057 |

|

|

|

2,661 |

|

|

14.9% |

|

Net realized investment gains (losses) |

|

(118 |

) |

|

|

- |

|

|

** |

|

|

(118 |

) |

|

|

- |

|

|

** |

|

Change in fair value of equity investments |

|

(196 |

) |

|

|

(12 |

) |

|

** |

|

|

(153 |

) |

|

|

682 |

|

|

** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) allocable to common shareholders |

|

(3,950 |

) |

|

|

(4,739 |

) |

|

|

|

|

(3,876 |

) |

|

|

(3,738 |

) |

|

|

|

Earnings (loss) per share, diluted |

$ |

(0.32 |

) |

|

$ |

(0.39 |

) |

|

|

|

$ |

(0.32 |

) |

|

$ |

(0.31 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted operating income (loss)* |

|

(3,636 |

) |

|

|

(4,727 |

) |

|

|

|

|

(3,605 |

) |

|

|

(4,420 |

) |

|

|

|

Adjusted operating income (loss) per share* |

$ |

(0.30 |

) |

|

$ |

(0.39 |

) |

|

|

|

$ |

(0.30 |

) |

|

$ |

(0.36 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per common share outstanding |

$ |

(0.10 |

) |

|

$ |

1.38 |

|

|

|

|

$ |

(0.10 |

) |

|

$ |

1.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted |

|

12,222,881 |

|

|

|

12,220,331 |

|

|

|

|

|

12,222,881 |

|

|

|

12,218,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underwriting ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss ratio (1) |

|

91.5 |

% |

|

|

83.0 |

% |

|

|

|

|

76.6 |

% |

|

|

72.9 |

% |

|

|

|

Expense ratio (2) |

|

32.1 |

% |

|

|

37.9 |

% |

|

|

|

|

33.4 |

% |

|

|

37.6 |

% |

|

|

|

Combined ratio (3) |

|

123.6 |

% |

|

|

120.9 |

% |

|

|

|

|

110.0 |

% |

|

|

110.5 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

* The "Definitions of Non-GAAP Measures" section of this release

defines and reconciles data that are not based on generally

accepted accounting principles. |

|

** Percentage is not meaningful |

|

(1) The loss ratio is the ratio, expressed as a percentage, of net

losses and loss adjustment expenses to net earned premiums and

other income from underwriting operations. |

|

(2) The expense ratio is the ratio, expressed as a percentage, of

policy acquisition costs and other underwriting expenses to net

earned premiums and other income from underwriting operations. |

|

(3) The combined ratio is the sum of the loss ratio and the expense

ratio. A combined ratio under 100% indicates an underwriting

profit. A combined ratio over 100% indicates an underwriting

loss. |

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 Second Quarter Gross Written

Premium

Gross written premiums decreased 57.5% in the second quarter of

2024 to $19.0 million, compared to $44.7 million in the prior year

period. This decrease reflects the Company’s continued progress

toward its goal to reduce premium leverage on operating

subsidiaries and focus on non-risk bearing revenue.

Commercial Lines Financial and Operational

Review

| Commercial

Lines Financial Review |

| |

| |

Three Months

Ended June 30, |

|

Six Months

Ended June 30, |

| |

2024 |

|

2023 |

|

% Change |

|

2024 |

|

2023 |

|

% Change |

| |

(dollars in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross written premiums |

$ |

6,782 |

|

|

$ |

34,761 |

|

|

-80.5 |

% |

|

$ |

19,544 |

|

|

$ |

63,736 |

|

|

-69.3 |

% |

|

Net written premiums |

|

4,285 |

|

|

|

20,485 |

|

|

-79.1 |

% |

|

|

12,572 |

|

|

|

32,726 |

|

|

-61.6 |

% |

|

Net earned premiums |

|

8,681 |

|

|

|

17,487 |

|

|

-50.4 |

% |

|

|

17,478 |

|

|

|

34,610 |

|

|

-49.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underwriting ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss ratio |

|

79.4 |

% |

|

|

77.5 |

% |

|

|

|

|

77.9 |

% |

|

|

69.5 |

% |

|

|

|

Expense ratio |

|

25.3 |

% |

|

|

37.4 |

% |

|

|

|

|

29.1 |

% |

|

|

36.8 |

% |

|

|

|

Combined ratio |

|

104.7 |

% |

|

|

114.9 |

% |

|

|

|

|

107.0 |

% |

|

|

106.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution to combined ratio from net |

|

|

|

|

|

|

|

|

|

|

|

|

(favorable) adverse prior year development |

|

23.6 |

% |

|

|

5.0 |

% |

|

|

|

|

12.0 |

% |

|

|

0.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accident year combined ratio (1) |

|

81.1 |

% |

|

|

109.9 |

% |

|

|

|

|

95.0 |

% |

|

|

106.1 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) The accident year combined ratio is the sum of the loss ratio

and the expense ratio, less changes in net ultimate loss estimates

from prior accident year loss reserves. The accident year combined

ratio provides management with an assessment of the specific policy

year's profitability and assists management in their evaluation of

product pricing levels and quality of business written. |

| |

|

|

|

|

|

|

|

|

|

|

|

The Company’s commercial lines of business

represented 35.7% of total gross written premium in the second

quarter of 2024. As noted above, premium decreased considerably

year over year in keeping with the strategic shift to a

commission-based revenue model through Conifer’s managing general

agency, CIS.

Personal Lines Financial and Operational

Review

| Personal

Lines Financial Review |

| |

| |

Three Months

Ended June 30, |

|

Six Months

Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

| |

(dollars in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross written premiums |

$ |

12,189 |

|

|

$ |

9,913 |

|

|

23.0 |

% |

|

$ |

23,740 |

|

|

$ |

17,152 |

|

|

38.4 |

% |

|

Net written premiums |

|

8,962 |

|

|

|

8,843 |

|

|

1.3 |

% |

|

|

16,066 |

|

|

|

14,944 |

|

|

7.5 |

% |

|

Net earned premiums |

|

7,985 |

|

|

|

5,696 |

|

|

40.2 |

% |

|

|

16,075 |

|

|

|

10,525 |

|

|

52.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underwriting ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss ratio |

|

104.6 |

% |

|

|

100.1 |

% |

|

|

|

|

75.2 |

% |

|

|

84.1 |

% |

|

|

|

Expense ratio |

|

39.5 |

% |

|

|

39.2 |

% |

|

|

|

|

38.1 |

% |

|

|

40.0 |

% |

|

|

|

Combined ratio |

|

144.1 |

% |

|

|

139.3 |

% |

|

|

|

|

113.3 |

% |

|

|

124.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution to combined ratio from net |

|

|

|

|

|

|

|

|

|

|

|

|

(favorable) adverse prior year development |

|

9.3 |

% |

|

|

-6.4 |

% |

|

|

|

|

1.4 |

% |

|

|

-7.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accident year combined ratio |

|

134.8 |

% |

|

|

145.7 |

% |

|

|

|

|

111.9 |

% |

|

|

131.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal lines, representing 64.3% of total

gross written premium for the quarter. Personal lines gross written

premium increased 23.0% from the prior year period to $12.2 million

for the second quarter of 2024, led by growth in the Company’s

low-value dwelling line of business in Texas and the Midwest.

Seasonal spring storms significantly impacted our personal lines

results for the quarter, mainly from the Oklahoma based business,

which is in run-off. The run-off for that book is expected to be

largely complete by the end of this year.

Combined Ratio Analysis

| |

Three Months

Ended June 30, |

|

Six Months

Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

Underwriting ratios: |

|

|

|

|

|

|

|

|

Loss ratio |

91.5 |

% |

|

83.0 |

% |

|

76.6 |

% |

|

72.9 |

% |

|

Expense ratio |

32.1 |

% |

|

37.9 |

% |

|

33.4 |

% |

|

37.6 |

% |

|

Combined ratio |

123.6 |

% |

|

120.9 |

% |

|

110.0 |

% |

|

110.5 |

% |

|

|

|

|

|

|

|

|

|

|

Contribution to combined ratio from net (favorable) |

|

|

|

|

|

|

|

|

adverse prior year development |

16.8 |

% |

|

2.2 |

% |

|

6.9 |

% |

|

-1.5 |

% |

|

|

|

|

|

|

|

|

|

|

Accident year combined ratio |

106.8 |

% |

|

118.7 |

% |

|

103.1 |

% |

|

112.0 |

% |

|

|

|

|

|

|

|

|

|

Net Investment IncomeNet

investment income was $1.5 million for the quarter ended June 30,

2024, compared to $1.4 million in the prior year period.

Change in Fair Value of Equity

SecuritiesDuring the quarter, the Company reported a loss

from the change in fair value of equity investments of $196,000,

compared to a $12,000 loss in the prior year period.

Net Income (Loss) allocable to common

shareholdersThe Company reported net loss allocable to

common shareholders of $4.0 million, or $0.32 per share, for the

second quarter of 2024.

Adjusted Operating Income (Loss)In the second

quarter of 2024, the Company reported an adjusted operating loss of

$3.6 million, or $0.30 per share. See Definitions of Non-GAAP

Measures.

Earnings Conference Call with

Accompanying Slide PresentationThe Company will hold a

conference call/webcast on Wednesday, August 14, 2024, at 8:30 a.m.

ET to discuss results for the second quarter ended June 30,

2024.

Investors, analysts, employees and the general

public are invited to listen to the conference call via:

| |

Webcast: |

On the Event

Calendar at IR.CNFRH.com |

| |

Conference Call: |

844-868-8843 (domestic) or 412-317-6589 (international) |

| |

|

|

The webcast will be archived on the Conifer

Holdings website and available for replay for at least one

year.

About Conifer HoldingsConifer

Holdings, Inc. is a Michigan-based property and casualty holding

company. Through its subsidiaries, Conifer offers specialty

insurance coverage for both commercial and personal lines,

marketing through independent agents in all 50 states. The Company

is traded on the Nasdaq Global Market under the symbol CNFR.

Additional information is available on the Company's website at

www.ir.cnfrh.com.

Forward-Looking Statement

This press release contains forward-looking

statements made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements give current expectations or forecasts of future events

or our future financial or operating performance, and include

Conifer’s expectations regarding premiums, earnings, its capital

position, expansion, and growth strategies. The forward-looking

statements contained in this press release are based on

management’s good-faith belief and reasonable judgment based on

current information. The forward-looking statements are qualified

by important factors, risks and uncertainties, many of which are

beyond our control, that could cause our actual results to differ

materially from those in the forward-looking statements, including

those described in our form 10-K (“Item 1A Risk Factors”) filed

with the SEC on April 1, 2024 and subsequent reports filed with or

furnished to the SEC. Any forward-looking statement made by us in

this report speaks only as of the date hereof or as of the date

specified herein. We undertake no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by any

applicable laws or regulations.

Definitions of Non-GAAP

MeasuresConifer prepares its public financial statements

in conformity with accounting principles generally accepted in the

United States of America (GAAP). Statutory data is prepared in

accordance with statutory accounting rules as defined by the

National Association of Insurance Commissioners' (NAIC) Accounting

Practices and Procedures Manual, and therefore is not reconciled to

GAAP data.

We believe that investors’ understanding of

Conifer’s performance is enhanced by our disclosure of adjusted

operating income. Our method for calculating this measure may

differ from that used by other companies and therefore

comparability may be limited. We define adjusted operating income

(loss), a non-GAAP measure, as net income (loss) excluding: 1) net

realized investment gains and losses and 2) change in fair value of

equity securities. We use adjusted operating income as an internal

performance measure in the management of our operations because we

believe it gives our management and other users of our financial

information useful insight into our results of operations and our

underlying business performance.

Reconciliations of adjusted operating income (loss) and

adjusted operating income (loss) per share:

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(dollar in

thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

Net income (loss) allocable to common shareholders |

$ |

(3,950 |

) |

|

$ |

(4,739 |

) |

|

$ |

(3,876 |

) |

|

$ |

(3,738 |

) |

|

Less: |

|

|

|

|

|

|

|

|

Net realized investment gains (losses) |

|

(118 |

) |

|

|

- |

|

|

|

(118 |

) |

|

|

- |

|

|

Change in fair value of equity securities, net of tax |

|

(196 |

) |

|

|

(12 |

) |

|

|

(153 |

) |

|

|

682 |

|

|

Impact of income tax expense (benefit) from adjustments * |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Adjusted operating income (loss) |

$ |

(3,636 |

) |

|

$ |

(4,727 |

) |

|

$ |

(3,605 |

) |

|

$ |

(4,420 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average common shares, diluted |

|

12,222,881 |

|

|

|

12,220,331 |

|

|

|

12,222,881 |

|

|

|

12,218,102 |

|

|

|

|

|

|

|

|

|

|

|

Diluted income (loss) per common share: |

|

|

|

|

|

|

|

|

Net income (loss) allocable to common shareholders |

$ |

(0.32 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.31 |

) |

|

Less: |

|

|

|

|

|

|

|

|

Net realized investment gains (losses) |

|

(0.01 |

) |

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

|

Change in fair value of equity securities |

|

(0.01 |

) |

|

|

- |

|

|

|

(0.01 |

) |

|

|

0.05 |

|

|

Impact of income tax expense (benefit) from adjustments * |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Adjusted operating income (loss), per share |

$ |

(0.30 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.36 |

) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| Conifer

Holdings, Inc. and Subsidiaries |

| Consolidated

Balance Sheets |

| (dollars in

thousands) |

| |

|

|

|

|

| |

|

June

30, |

|

December

31, |

| |

|

2024 |

|

2023 |

|

Assets |

|

(Unaudited) |

|

|

|

Investment securities: |

|

|

|

|

|

Debt securities, at fair value (amortized cost of $132,889

and $135,370, respectively) |

|

$ |

119,371 |

|

|

$ |

122,113 |

|

|

Equity securities, at fair value (cost of $1,844 and $2,385,

respectively) |

|

|

1,660 |

|

|

|

2,354 |

|

|

Short-term investments, at fair value |

|

|

23,339 |

|

|

|

20,838 |

|

|

Total investments |

|

|

144,370 |

|

|

|

145,305 |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

9,697 |

|

|

|

11,125 |

|

|

Premiums and agents' balances receivable, net |

|

|

30,583 |

|

|

|

29,369 |

|

|

Receivable from Affiliate |

|

|

1,174 |

|

|

|

1,047 |

|

|

Reinsurance recoverables on unpaid losses |

|

|

74,358 |

|

|

|

70,807 |

|

|

Reinsurance recoverables on paid losses |

|

|

8,614 |

|

|

|

12,619 |

|

|

Prepaid reinsurance premiums |

|

|

13,494 |

|

|

|

28,908 |

|

|

Deferred policy acquisition costs |

|

|

4,606 |

|

|

|

6,285 |

|

|

Other assets |

|

|

6,038 |

|

|

|

6,339 |

|

|

Total assets |

|

$ |

292,934 |

|

|

$ |

311,804 |

|

| |

|

|

|

|

| Liabilities

and Shareholders' Equity |

|

|

|

|

|

Liabilities: |

|

|

|

|

|

Unpaid losses and loss adjustment expenses |

|

$ |

174,786 |

|

|

$ |

174,612 |

|

|

Unearned premiums |

|

|

44,820 |

|

|

|

65,150 |

|

|

Reinsurance premiums payable |

|

|

1,408 |

|

|

|

246 |

|

|

Debt |

|

|

24,832 |

|

|

|

25,061 |

|

|

Funds held under reinsurance agreements |

|

|

23,602 |

|

|

|

24,550 |

|

|

Premiums payable to other insureds |

|

|

19,299 |

|

|

|

13,986 |

|

|

Accounts payable and accrued expenses |

|

|

5,352 |

|

|

|

5,310 |

|

|

Total liabilities |

|

|

294,099 |

|

|

|

308,915 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

Preferred stock, no par value (10,000,000 shares authorized;

1,000 issued and outstanding, respectively) |

|

|

6,000 |

|

|

|

6,000 |

|

|

Common stock, no par value (100,000,000 shares authorized;

12,222,881 issued and outstanding, respectively) |

|

|

98,170 |

|

|

|

98,100 |

|

|

Accumulated deficit |

|

|

(90,559 |

) |

|

|

(86,683 |

) |

|

Accumulated other comprehensive income (loss) |

|

|

(14,776 |

) |

|

|

(14,528 |

) |

|

Total shareholders' equity |

|

|

(1,165 |

) |

|

|

2,889 |

|

|

Total liabilities and shareholders' equity |

|

$ |

292,934 |

|

|

$ |

311,804 |

|

|

|

|

|

|

|

| Conifer

Holdings, Inc. and Subsidiaries |

| Consolidated

Statements of Operations (Unaudited) |

| (dollars in

thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

Six Months

Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Revenue and Other Income |

|

|

|

|

|

|

|

|

|

Premiums |

|

|

|

|

|

|

|

|

|

Gross earned premiums |

|

$ |

29,381 |

|

|

$ |

36,013 |

|

|

$ |

63,613 |

|

|

$ |

70,307 |

|

|

Ceded earned premiums |

|

|

(12,715 |

) |

|

|

(12,830 |

) |

|

|

(30,060 |

) |

|

|

(25,172 |

) |

|

Net earned premiums |

|

|

16,666 |

|

|

|

23,183 |

|

|

|

33,553 |

|

|

|

45,135 |

|

|

Net investment income |

|

|

1,505 |

|

|

|

1,354 |

|

|

|

3,057 |

|

|

|

2,661 |

|

|

Net realized investment gains (losses) |

|

|

(118 |

) |

|

|

- |

|

|

|

(118 |

) |

|

|

- |

|

|

Change in fair value of equity securities |

|

|

(196 |

) |

|

|

(12 |

) |

|

|

(153 |

) |

|

|

682 |

|

|

Agency commission income |

|

|

8,831 |

|

|

|

211 |

|

|

|

13,167 |

|

|

|

641 |

|

|

Other income |

|

|

160 |

|

|

|

187 |

|

|

|

420 |

|

|

|

383 |

|

|

Total revenue and other income |

|

|

26,848 |

|

|

|

24,923 |

|

|

|

49,926 |

|

|

|

49,502 |

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Losses and loss adjustment expenses, net |

|

|

15,281 |

|

|

|

19,319 |

|

|

|

25,801 |

|

|

|

33,032 |

|

|

Policy acquisition costs |

|

|

10,480 |

|

|

|

4,413 |

|

|

|

17,493 |

|

|

|

9,134 |

|

|

Operating expenses |

|

|

4,256 |

|

|

|

5,114 |

|

|

|

8,751 |

|

|

|

9,393 |

|

|

Interest expense |

|

|

869 |

|

|

|

820 |

|

|

|

1,746 |

|

|

|

1,506 |

|

|

Total expenses |

|

|

30,886 |

|

|

|

29,666 |

|

|

|

53,791 |

|

|

|

53,065 |

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before equity earnings in Affiliate and income

taxes |

|

|

(4,038 |

) |

|

|

(4,743 |

) |

|

|

(3,865 |

) |

|

|

(3,563 |

) |

|

Equity earnings (loss) in Affiliate, net of tax |

|

|

228 |

|

|

|

4 |

|

|

|

286 |

|

|

|

(175 |

) |

|

Income tax expense (benefit) |

|

|

(18 |

) |

|

|

- |

|

|

|

(18 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

|

(3,792 |

) |

|

|

(4,739 |

) |

|

|

(3,561 |

) |

|

|

(3,738 |

) |

|

Preferred stock dividends |

|

|

158 |

|

|

|

- |

|

|

|

315 |

|

|

|

- |

|

|

Net income (loss) allocable to common shareholders |

|

|

(3,950 |

) |

|

|

(4,739 |

) |

|

|

(3,876 |

) |

|

|

(3,738 |

) |

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per common share, |

|

|

|

|

|

|

|

|

|

basic and diluted |

|

$ |

(0.32 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.31 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding, |

|

|

|

|

|

|

|

|

|

basic and diluted |

|

|

12,222,881 |

|

|

|

12,220,331 |

|

|

|

12,222,881 |

|

|

|

12,218,102 |

|

|

|

|

|

|

|

|

|

|

|

For Further Information:Jessica Gulis,

248.559.0840ir@cnfrh.com

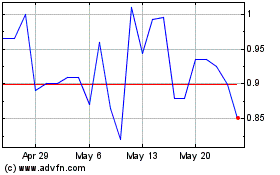

Conifer (NASDAQ:CNFR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Conifer (NASDAQ:CNFR)

Historical Stock Chart

From Nov 2023 to Nov 2024