UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Core

Scientific, Inc.

(Name of Issuer)

Common Stock

(Title of

Class of Securities)

21873J108

(CUSIP Number)

Richard

A. Miller, III, Manager

Gullane Capital LLC

640 S Perkins Road

Memphis, TN 38117

(901) 766-1969

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications)

December 22, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of

securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 21873J108

|

|

|

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Gullane Mining Partners, LLC |

| 2. |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see

instructions) OO |

| 5. |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

4,028,106 |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

4,028,106 |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,028,106 |

| 12. |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ See Item 5 herein. |

| 13. |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 1.1% |

| 14. |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

2

CUSIP No. 21873J108

|

|

|

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Gullane Mining Partners II, LLC |

| 2. |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see

instructions) OO |

| 5. |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

169,955 |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

169,955 |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

169,955 |

| 12. |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ See Item 5 herein. |

| 13. |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 0.05% |

| 14. |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

3

CUSIP No. 21873J108

|

|

|

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Gullane Mining Partners III, LLC |

| 2. |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see

instructions) OO |

| 5. |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

3,931,635 |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

3,931,635 |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,931,635 |

| 12. |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ See Item 5 herein. |

| 13. |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 1.1% |

| 14. |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

4

CUSIP No. 21873J108

|

|

|

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Gullane Digital Asset Partners, LLC |

| 2. |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see

instructions) OO |

| 5. |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

3,209,315 |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

3,209,315 |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,209,315 |

| 12. |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ See Item 5 herein. |

| 13. |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 0.9% |

| 14. |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

5

CUSIP No. 21873J108

|

|

|

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Gullane Digital Asset Partners QP, LLC |

| 2. |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see

instructions) OO |

| 5. |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

4,639,777 |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

4,639,777 |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,639,777 |

| 12. |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ See Item 5 herein. |

| 13. |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 1.2% |

| 14. |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

6

CUSIP No. 21873J108

|

|

|

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Gullane Capital Partners LLC |

| 2. |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see

instructions) OO |

| 5. |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

338,413 |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

338,413 |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

338,413 |

| 12. |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ See Item 5 herein. |

| 13. |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 0.09% |

| 14. |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

7

Item 1. Security and Issuer.

This Schedule 13D (this “Schedule 13D”) relates to the common stock, par value $0.0001 per share (the “Common

Stock”), of Core Scientific, Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 210 Barton Springs Road, Suite 300, Austin, Texas 78704.

Item 2. Identity and Background.

This Schedule 13D is being filed by Gullane Mining Partners, LLC, Gullane Mining Partners II, LLC, Gullane Mining Partners III, LLC, Gullane

Digital Asset Partners, LLC, Gullane Digital Asset Partners QP, LLC and Gullane Capital Partners LLC. (collectively, the “Gullane Entities” and each, a “Gullane Entity”). Each Gullane Entity is organized as a

Delaware limited liability company and was formed for the purpose of making an investment in equity and/or debt securities issued by the Issuer. The principal office and business address of each Gullane Entity is c/o Gullane Capital LLC, 640 S.

Perkins Road, Memphis, TN 38117. The manager of each Gullane Entity is Gullane Capital LLC (“Gullane Capital”). Gullane Capital LLC is managed by Richard A. Miller, III (“Mr. Miller”).

None of the Gullane Entities acquired beneficial ownership of the securities of the Issuer with the purpose or effect of changing or

influencing the control of the Issuer or as a participant in any transaction having such purpose or effect, or in connection with any plan or proposal that would be subject to disclosure under Item 4 of Schedule 13D with respect to the Issuer.

Each of the Gullane Entities, continue to hold Common Stock or secured convertible notes convertible into Common Stock, as applicable, in

their ordinary course of business, not with the purpose or effect of changing or influencing the control of the Issuer or as a participant in any transaction having such purpose or effect, and not in connection with any plan or proposal that would

be subject to disclosure under Item 4 of Schedule 13D with respect to the Issuer. However, each Gullane Entity is filing this Schedule 13D because of the actions described in Item 4 below.

(b) – (c) and (f)

The

business address of Mr. Miller is 640 S. Perkins Road, Memphis, TN 38117.

Mr. Miller’s present principal occupation is the

manager of Gullane Capital, a registered investment adviser. Gullane Capital’s principal business address is 640 S. Perkins Road, Memphis, TN 38117.

Mr. Miller is a citizen of the United States of America.

(d) and (e) During the last five years, none of the Gullane Entities nor Mr. Miller has been convicted in any criminal proceedings

(excluding traffic violations or similar misdemeanors) or has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of which such person was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Neither the present filing nor anything contained herein shall be construed as an admission that any Gullane Entity or Gullane Capital

constitutes a “person” for any purposes other than Section 13(d) of the Exchange Act.

Item 3. Source and Amount of Funds or Other

Consideration.

As of December 22, 2022, the Gullane Entities, in the aggregate, held beneficial ownership of 16,024,247 shares of

Common Stock, including 7,726,501 shares of Common Stock that are issuable upon conversion of approximately $61.8 million in aggregate principal amount of secured convertible notes acquired for an aggregate purchase price of approximately

$57 million. Such acquisitions were made for investment purposes with available funds in the ordinary course of business of each Gullane Entity.

Item 4. Purpose of Transaction.

All

of the Common Stock of the Issuer reported on this Schedule 13D was acquired in the ordinary course of business for investment purposes by funds and accounts for which certain of the Advisory Subsidiaries act as investment advisers.

In connection with the filing by the Issuer and certain of its affiliates (collectively, the “Debtors”) of voluntary

petitions (the “Chapter 11 Cases”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) seeking relief under Chapter 11 of Title 11 of the United States Code (the

“Bankruptcy Code”), the Debtors entered into a Senior Secured Super-Priority Debtor-in-Possession Loan and Security Agreement, dated as of

December 22, 2022 (the “DIP Credit Agreement”), with Wilmington Savings Fund Society, FSB, as administrative agent (the “Administrative Agent”), and the lenders from time to time party thereto (collectively,

the “DIP Lenders”).

8

Pursuant to the terms of the DIP Credit Agreement, the DIP Lenders provided new financing

commitments to the Issuer under a new money multiple draw term loan facility (the “New Money DIP Facility”) in an initial aggregate principal amount of up to $75 million, approximately $57 million of which was committed to

by the initial DIP Lenders. Under the New Money DIP Facility, (i) $37.5 million will be available following Bankruptcy Court approval on an interim basis (the “Interim DIP Order”), and (ii) up to $37.5 million will be

available following Bankruptcy Court approval on a final basis (the “Final DIP Order”), subject to obtaining commitments for the full amount of the New Money DIP Facility.

The DIP Credit Agreement provides for a credit facility pursuant to which up to $75 million of aggregate claims of the holders of the

Issuer’s secured convertible notes who are DIP Lenders (or affiliates, partners or investors of the DIP Lenders) will, upon entry of the Final DIP Order, automatically be deemed substituted and exchanged for, and converted, into (such

conversion, the “Roll Up”) debtor-in-possession loans (the “Roll Up Loans”) (such credit facility, together with the New Money DIP

Facility, the “DIP Facility”) on a cashless dollar for dollar basis, in each case, in accordance with and subject to the terms and conditions in the DIP Credit Agreement.

Borrowings under the New Money DIP Facility will bear interest at a rate of 10% which, together with certain fees payable in connection with

the DIP Facility, will be payable in kind. Roll Up Loans will not bear interest. The DIP Lenders will receive upfront commitment fees equal to 2% of the aggregate commitments under the New Money DIP Facility when drawn, payable in kind, and exit

fees equal to (i) in the case of an acceptable exit roll transaction, (x) 3% of the accreted outstanding principal amount of the New Money Loans at such time, and (y) 2% of the outstanding principal amount of the Roll Up Loans as set forth in

the DIP Credit Agreement, or (ii) otherwise (x) 15% of the accreted outstanding principal amount of the New Money Loans at such time and (y) 2% of the outstanding principal amount of the Roll Up Loans at such time as set forth in the DIP Credit

Agreement. The DIP Credit Agreement includes milestones, representations and warranties, covenants applicable to the Debtors, and events of default. If an event of default under the DIP Credit Agreement occurs, the Administrative Agent may, among

other things, permanently reduce any remaining commitments and declare the outstanding obligations under the DIP Credit Agreement to be immediately due and payable.

The DIP Credit Agreement has a maturity date of June 21, 2023, which can be extended, under certain conditions, by an additional three

months to September 21, 2023. The DIP Credit Agreement will also terminate on the date that is the earliest of the following (i) January 25, 2023, if no Final DIP Order is entered (or such later date as may be agreed in writing by the

Required Lenders (as defined in the DIP Credit Agreement)), (ii) the maturity date, (ii) the date of consummation of any transaction pursuant to which all or substantially all of the assets of the Issuer and the other credit parties will be

sold, transferred or otherwise disposed, (iii) the effective date of a plan in the Chapter 11 Cases, and (iv) the date on which all amounts owed thereunder become due and payable and the commitments are terminated.

None of the Gullane Entities are a party to the DIP Credit Agreement. However, it is anticipated that certain newly formed entities affiliated

with the Gullane Entities and managed by Gullane Capital may join as a lender to the DIP Credit Agreement in the future.

The foregoing

description of the DIP Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the DIP Credit Agreement, which is filed as Exhibit 1 to this Schedule 13D and is incorporated by reference

herein.

On December 22, 2022, certain of the Gullane Entities also entered into a Restructuring Support Agreement (the

“Support Agreement”), with the Issuer and certain other holders of (x) the Issuer’s secured convertible notes and/or (y) DIP Commitments (as defined in the Support Agreement) or loans under the DIP Facility (the

“Consenting Creditors”), pursuant to which, among other things, the Consenting Creditors agreed, for the duration of the Support Period (as defined in the Support Agreement), to vote in favor a joint plan of reorganization (the

“Plan”) of the Debtors under the Bankruptcy Code and not to take certain other actions, including those that would reasonably be expected to prevent, interfere with, delay or impede the consummation of the Plan and the restructuring

contemplated by the Support Agreement.

The Support Agreement, together with the restructuring term sheet included therein, and Plan

contemplate, among other things:

| |

• |

|

At emergence, (i) the refinancing of the DIP Facility with third-party exit financing for an amount not to

exceed the sum of (a) 112% of the then-outstanding principal amount of the DIP Facility on the Effective Date (as defined in the Support Agreement), and (b) interest, fees, and other amounts arising thereunder or payable pursuant thereto (and

in any event an amount sufficient to repay the DIP Facility in full, in cash) or (ii) the rolling of the DIP Facility into 4-year exit term loan facility on the same terms and the issuance of warrants to

the DIP Lenders for up to 30% of the New Common Shares (as defined in the Support Agreement), subject to dilution by the Management Incentive Plan (as defined in the Support Agreement) and warrants issued to holders of general unsecured claims and

existing equityholders. |

9

| |

• |

|

The equitization of the Issuer’s secured convertible notes in exchange for 97% of the New Common Shares,

subject to dilution by the Management Incentive Plan, the warrants issued in connection with the rolling of the DIP Facility and the warrants issued to holders of general unsecured claims and existing equityholders; |

| |

• |

|

The issuance of up to $75 million in New Second Lien Notes (as defined in the Support Agreement) to certain

holders of the Issuer’s secured convertible notes at their option; |

| |

• |

|

The issuance of Miner Equipment Takeback Debt (as defined in the Support Agreement) to holders of Miner Equipment

Financing Claims (as defined in the Support Agreement), for the secured portion of their claims; |

| |

• |

|

The reinstatement of secured Non-Miner Financing Claims (as defined in

the Support Agreement); and |

| |

• |

|

recoveries to holders of General Unsecured Claims (as defined in the Support Agreement) and existing equity in

the form of New Common Shares and warrants exercisable as certain enterprise values are achieved. |

The Support Agreement

also contemplates the following milestones with respect to the Chapter 11 Cases:

| |

• |

|

No later than 5 days after the Petition Date (as defined in the Support Agreement), the Bankruptcy Court shall

have entered the Interim DIP Order; |

| |

• |

|

No later than 35 days after the Petition Date, the Bankruptcy Court shall have entered the Final DIP Order;

|

| |

• |

|

No later than 75 days after the Petition Date, the Issuer shall have filed with the Bankruptcy Court the Plan and

the Disclosure Statement (as defined in the Support Agreement); |

| |

• |

|

No later than 150 days after the Petition Date, the Bankruptcy Court shall have entered the Confirmation Order

(as defined in the Support Agreement), subject to extension in accordance with the Support Agreement; and |

| |

• |

|

No later than 165 days after the Petition Date (subject to extension in accordance with the Support Agreement),

the Plan Effective Date (as defined in the Support Agreement) shall have occurred. |

During the Support Period, the

Consenting Creditors, including certain of the Gullane Entities, have agreed not to Transfer (as defined in the Support Agreement), directly or indirectly, in whole or in part, any of their Claims (as defined in the Support Agreement), including

granting any proxies, depositing any Claims into a voting trust or entering into a voting agreement with respect to any such Claims, unless the transferee thereof is a Consenting Creditor or, prior to such Transfer, the transferee agrees to become a

Consenting Creditor by entering into a joinder to the Support Agreement.

Under the terms of the Support Agreement, the Requisite

Consenting Creditors (as defined in the Support Agreement) have the right to designate four out of the five members of the initial board of directors of the Reorganized Debtors (as defined in the Support Agreement). In addition, the Support

Agreement contemplates that the Reorganized Debtors will enter into one or more registration rights agreements with the holders of (i) Prepetition Secured Convertible Notes Claims (as defined in the Support Agreement) who receive New Common

Shares, and (ii) holders of DIP Claims (as defined in the Support Agreement) who receive DIP Warrants (as defined in the Support Agreement), which registration rights agreements shall include (a) demand registration rights for a holder or

holders who hold an aggregate of more than 5% of the equity of the Reorganized Debtors (on a diluted basis treating the DIP Warrants as if exercised), such demand to be exercisable up to two times per year, subject to minimum expected proceeds of

$5 million and (b) piggyback registration rights for all holders of New Common Stock or DIP Warrants that are party to the registration rights agreement. Pursuant to the Support Agreement, the Reorganized Debtors have agreed to take the

steps necessary to continue to be a public company that is listed on the Nasdaq or the NYSE on or as soon as reasonable practicable after the Effective Date.

The foregoing description of the Support Agreement and the transactions and documents contemplated thereby does not purport to be complete and

is qualified in its entirety by reference to the Support Agreement as filed as Exhibit 2 hereto and incorporated by reference herein.

As

a result of the foregoing, the Gullane Entities may be deemed to have formed a “group,” as such term is used in Regulation 13D under the Act among themselves and with the other parties to the Support Agreement and the DIP Credit Agreement

who beneficially own shares of the Issuer’s Common Stock. Each Gullane Entity disclaims any membership or participation in a “group” with such other parties to the Support Agreement and the DIP Credit Agreement or their affiliates and

further disclaims beneficial ownership of any shares of Common Stock beneficially owned by any such parties or their affiliates, including approximately 4.7 million shares of Common Stock believed to be beneficially owned by funds and accounts

managed or advised by BlackRock, Inc. or its affiliates on the date hereof.

10

Except as set forth in this Schedule 13D and in the Support Agreement, the activities

described herein will not restrict the Gullane Entities’ exercise of investment or voting power with respect to the Common Stock to which this Schedule 13D relates. Except as set forth in this Schedule 13D, no Gullane Entity has any present

plans or proposals that relate to or would result in any of the actions described in Item 4(a) through (j) of Schedule 13D. Each of the Gullane Entities may evaluate on a continuing basis its investment in the Issuer and each Gullane Entity

expects that it may, subject to the terms of the Support Agreement where applicable, from time to time acquire or dispose of Common Stock or other securities of the Issuer from time to time. Any acquisitions or dispositions will depend upon

(i) the price and availability of the Issuer’s securities; (ii) subsequent developments concerning the Issuer’s business and prospects and the industry in which the Issuer operates; (iii) the Gullane Entities’ general

investment policies; (iv) other investment and business opportunities available to the Gullane Entities; (v) general market and economic conditions; (vi) tax considerations; and (vii) such other factors as the Gullane Entities

may consider relevant. Any such acquisitions or dispositions may be made, subject to applicable law, in open market transactions or privately negotiated transactions.

Item 5. Interest in Securities of the Issuer.

(a) and (b) The responses of each Gullane Entity to Rows (7) through (11), and (13) of the cover page of this Schedule 13D are

incorporated herein by reference; provided, however, that:

(i) with respect to the 169,955 shares of Common Stock beneficially owned by

Gullane Mining Partners II, LLC, 5,900 of such shares consist of shares that may be purchased pursuant to call options;

(ii) with respect

to the 3,931,635 shares of Common Stock beneficially owned by Gullane Mining Partners III, LLC, 280,700 of such shares consist of shares that may be purchased pursuant to call options;

(iii) with respect to the 3,209,315 shares of Common Stock beneficially owned by Gullane Digital Asset Partners, LLC, 3,045,221 of such shares

consist of shares of Common Stock issuable upon the conversion of secured convertible notes and 1,800 of such shares consist of shares that may be purchased pursuant to call options;

(iv) with respect to the 4,639,777 shares of Common Stock beneficially owned by Gullane Digital Asset Partners QP, LLC, 4,343,627 of such

shares consist of shares of Common Stock issuable upon the conversion of secured convertible notes and 3,300 of such shares consist of shares that may be purchased pursuant to call options; and

(v) all of the shares beneficially owned by Gullane Capital Partners LLC consists of shares of Common Stock issuable upon the conversion of

secured convertible notes.

The aggregate percentage of shares of Common Stock reported as beneficially owned by the Gullane Entities was

calculated based on 374,527,988 shares of Common Stock issued and outstanding as of November 14, 2022, as disclosed in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended

September 30, 2022 filed with the U.S. Securities and Exchange Commission on November 22, 2022.

In addition, pursuant to

Section 13(d)(3) of the Exchange Act, the Gullane Entities and the other parties to the Support Agreement and/or the DIP Credit Agreement who beneficially own shares of the Issuer’s Common Stock may, on the basis of the facts described

elsewhere in this Schedule 13D, be considered to be a “group.” Each Gullane Entity, together with Gullane Capital and Mr. Miller, disclaims any membership or participation in a “group” with such other parties to the Support

Agreement and/or the DIP Credit Agreement or their affiliates and further disclaims beneficial ownership of any shares of Common Stock beneficially owned by such parties or their affiliates, including approximately 4.7 million shares of Common

Stock believed to be beneficially owned by funds and accounts managed or advised by BlackRock, Inc. or its affiliates on the date hereof.

(c) None

(d) Except for

Mr. Miller, in his capacity as manager of Gullane Capital, the manager of each Gullane Entity, no other person is known by the Gullane Entities to have the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, any Common Stock that may be beneficially owned by the Gullane Entities.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

The information set forth in Item 4 is hereby incorporated herein by reference.

In August 2021, each of Gullane Digital Asset Partners, LLC, Gullane Digital Asset Partners QP, LLC and Gullane Capital Partners LLC

(collectively, the “Gullane Note Holders”) entered into a secured convertible note purchase agreement with the Issuer and the other investors thereunder pursuant to which the Issuer issued $299.8 million of convertible notes in

August through November 2021, including approximately $57 million to such Gullane Note Holders, which notes became secured notes upon consummation of the business combination transaction in January 2022.

11

The secured convertible notes have a minimum payoff based on the face value plus accrued

interest and are secured by a lien on the same collateral securing the $215 million of secured convertible notes issued by the Issuer in April 2021. The secured convertible notes have a maturity date of April 2025 and bear interest at a rate of

10% per annum, of which 4% is payable in cash and 6% is payable in kind. The convertible notes are convertible into shares of Common Stock at the option of the holder at a conversion price equal to $8.00 per share.

As of December 20, 2022, after giving effect to the receipt by the Gullane Note Holders of the interest payable in kind on such secured

convertible notes through such date, the Gullane Note Holders held approximately $61.8 million in aggregate principal amount of secured convertible notes. The foregoing description of the secured convertible note purchase agreement in this Item

6 do not purport to be complete and is qualified in its entirety by reference to the Convertible Note Purchase Agreement, as amended, and the form of Convertible Promissory Note as filed as Exhibits 3 through 5 hereto and incorporated by reference

herein.

Except as set forth in this Schedule 13D and in the Support Agreement, there are no contracts, arrangements, understandings or

relationships between the Gullane Entities with respect to any securities of the Issuer, including but not limited to transfer or voting of any securities of the Issuer, finder’s fees, joint ventures, loan or option arrangements, puts or calls,

guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

Item 7. Materials to Be Filed as Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 1. |

|

Senior Secured Super-Priority Debtor-In-Possession Loan and Security Agreement dated December 22, 2022 among the Issuer, certain subsidiaries of

the Issuer, the lenders party thereto and Wilmington Savings Fund Society, FSB, as administrative agent (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed by the Issuer with the

Securities and Exchange Commission on December 27, 2022). |

|

|

| 2. |

|

Restructuring Support Agreement dated December 22, 2022 by and among the Issuer and the convertible noteholders and/or lenders under the DIP Credit Agreement party thereto (incorporated by reference to Exhibit 10.2 to the

Current Report on Form 8-K filed by the Issuer with the Securities and Exchange Commission on December 27, 2022). |

|

|

| 3. |

|

Convertible Note Purchase Agreement by and among Core Scientific Holding Co., the Guarantors thereto, the Purchasers thereto and U.S. Bank National Association as note agent and collateral agent, dated August 20, 2021

(incorporated by reference to Exhibit 4.7 to Amendment No. 3 to the Registration Statement on Form S-4 (Registration Number 333-258720) filed by the Issuer with the

Securities and Exchange Commission on November 19, 2021). |

|

|

| 4. |

|

First Amendment to Convertible Note Purchase Agreement by and among Core Scientific Holding Co., the Guarantors thereto, the Purchasers thereto and U.S. Bank National Association as note agent and collateral agent dated

September 23, 2021(incorporated by reference to Exhibit 4.8 to Amendment No. 3 to the Registration Statement on Form S-4 (Registration Number 333-258720) filed

by the Issuer with the Securities and Exchange Commission on November 19, 2021). |

|

|

| 5. |

|

Form of Convertible Promissory Note (included in Exhibit 3 hereto (as Exhibit A thereto) and incorporated by reference to Exhibit 4.7 to Amendment No. 3 to the Registration Statement on Form

S-4 (Registration Number 333-258720) filed by the Issuer with the Securities and Exchange Commission on November 19, 2021). |

12

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: January 4, 2023

|

|

|

| Gullane Mining Partners, LLC

Gullane Mining Partners II, LLC Gullane Mining Partners

III, LLC Gullane Digital Asset Partners, LLC

Gullane Digital Asset Partners QP, LLC Gullane Capital

Partners LLC By: Gullane Capital LLC, its manager |

|

|

| By: |

|

/s/ Richard A. Miller, III |

|

|

Name: Richard A. Miller, III |

|

|

Title: Manager |

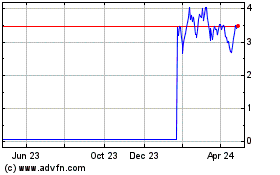

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

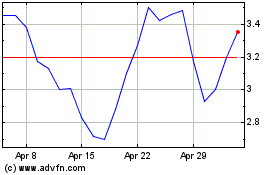

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Apr 2023 to Apr 2024