CPS Announces Fourth Quarter and Full Year 2024 Earnings

26 February 2025 - 8:31AM

Consumer Portfolio Services, Inc. (Nasdaq: CPSS) (“CPS” or the

“Company”) today announced earnings of $5.1 million, or $0.21 per

diluted share, for its fourth quarter ended December 31, 2024.

Revenues for the fourth quarter of 2024 were

$105.3 million, an increase of $13.3 million, or 14.5%, compared to

$92.0 million for the fourth quarter of 2023. Total operating

expenses for the fourth quarter of 2024 were $98.0 million compared

to $82.1 million for the 2023 period. Pretax income for

the fourth quarter of 2024 was $7.4 million compared to pretax

income of $9.8 million in the fourth quarter of 2023.

For the twelve months ended December 31, 2024

total revenues were $393.5 million compared to $352.0 million for

the twelve months ended December 31, 2023, an increase of

approximately $41.5 million, or 11.8%. Total operating expenses for

the twelve months ended December 31, 2024 were $366.1 million,

compared to $290.9 million for the twelve months ended December 30,

2023. Pretax income for the twelve months ended December 31, 2024

was $27.4 million, compared to $61.1 million for the twelve months

ended December 31, 2023. Net income for the twelve months ended

December 31, 2024 was $19.2 million compared to $45.3 million for

the twelve months ended December 31, 2023.

During the fourth quarter of 2024, CPS purchased

$457.8 million of new contracts compared to $445.9 million during

the third quarter of 2024 and $301.8 million during the fourth

quarter of 2023. The total number of contracts purchased for 2024

totaled $1.682 billion compared to $1.358 billion in 2023. The

Company's receivables totaled $3.491 billion as of December 31,

2024, an increase from $3.330 billion as of September 31, 2024

and an increase from $2.970 billion as of December 31, 2023.

Annualized net charge-offs for the fourth

quarter of 2024 were 8.02% of the average portfolio as compared to

7.74% for the fourth quarter of 2023. Delinquencies greater than 30

days (including repossession inventory) were 14.85% of the total

portfolio as of December 31, 2024, compared to 14.55% as of

December 31, 2023.

“New loan originations grew by 24% in 2024 over

the prior year, leading to solid top line revenue growth,” said

Charles E. Bradley, Chief Executive Officer. “With positive trends

in loan originations and operating efficiencies, we remain

optimistic in all aspects of our business going into 2025.”

Conference Call

CPS announced that it will hold a conference

call on February 26, 2025 at 1:00 p.m. ET to discuss its fourth

quarter 2024 operating results.

Those wishing to participate can pre-register

for the conference call at the following link

https://register.vevent.com/register/BI34e818cf84a24e118241657af74dd2d4.

Registered participants will receive an email containing conference

call details for dial-in options. To avoid delays, we encourage

participants to dial into the conference call fifteen minutes ahead

of the schedule start time. A replay will be available beginning

two hours after conclusion of the call for 12 months via the

Company’s website at

https://ir.consumerportfolio.com/investor-relations.

About Consumer Portfolio Services,

Inc.

Consumer Portfolio Services, Inc. is an

independent specialty finance company that provides indirect

automobile financing to individuals with past credit problems or

limited credit histories. We purchase retail installment sales

contracts primarily from franchised automobile dealerships secured

by late model used vehicles and, to a lesser extent, new vehicles.

We fund these contract purchases on a long-term basis primarily

through the securitization markets and service the contracts over

their lives.

Forward-looking statements in this news release

include the Company's recorded figures representing allowances for

remaining expected lifetime credit losses, its estimates of fair

value (most significantly for its receivables accounted for at fair

value), its provision for credit losses, its entries offsetting the

preceding, and figures derived from any of the preceding. In each

case, such figures are forward-looking statements because they are

dependent on the Company’s estimates of losses to be incurred in

the future. The accuracy of such estimates may be adversely

affected by various factors, which include the following: possible

increased delinquencies; repossessions and losses on retail

installment contracts; incorrect prepayment speed and/or discount

rate assumptions; possible unavailability of qualified personnel,

which could adversely affect the Company’s ability to service its

portfolio; possible increases in the rate of consumer bankruptcy

filings, which could adversely affect the Company’s rights to

collect payments from its portfolio; other changes in government

regulations affecting consumer credit; possible declines in the

market price for used vehicles, which could adversely affect the

Company’s realization upon repossessed vehicles; and economic

conditions in geographic areas in which the Company's business is

concentrated. Any or all of such factors also may affect the

Company’s future financial results, as to which there can be no

assurance. Any implication that the results of the most recently

completed quarter are indicative of future results is disclaimed,

and the reader should draw no such inference. Factors such as those

identified above in relation to losses to be incurred in the future

may affect future performance.

Investor Relations Contact

Danny Bharwani, Chief Financial Officer

949-753-6811

|

Consumer Portfolio Services, Inc. and

SubsidiariesCondensed Consolidated Statements of

Operations(In thousands, except per share

data)(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

Three months ended |

|

Twelve months ended |

|

|

December 31, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

| Interest income |

$ |

98,150 |

|

|

$ |

83,260 |

|

|

$ |

363,962 |

|

|

$ |

329,219 |

|

| Mark to finance receivables

measured at fair value |

|

5,000 |

|

|

|

6,000 |

|

|

|

21,000 |

|

|

|

12,000 |

|

| Other income |

|

2,153 |

|

|

|

2,718 |

|

|

|

8,544 |

|

|

|

10,795 |

|

| |

|

105,303 |

|

|

|

91,978 |

|

|

|

393,506 |

|

|

|

352,014 |

|

|

Expenses: |

|

|

|

|

|

|

|

| Employee costs |

|

23,889 |

|

|

|

23,157 |

|

|

|

96,192 |

|

|

|

88,148 |

|

| General and

administrative |

|

14,422 |

|

|

|

13,777 |

|

|

|

54,710 |

|

|

|

50,001 |

|

| Interest |

|

52,522 |

|

|

|

40,277 |

|

|

|

191,257 |

|

|

|

146,631 |

|

| Provision for credit

losses |

|

(728 |

) |

|

|

(1,600 |

) |

|

|

(5,307 |

) |

|

|

(22,300 |

) |

| Other expenses |

|

7,847 |

|

|

|

6,523 |

|

|

|

29,223 |

|

|

|

28,437 |

|

| |

|

97,952 |

|

|

|

82,134 |

|

|

|

366,075 |

|

|

|

290,917 |

|

| Income before income

taxes |

|

7,351 |

|

|

|

9,844 |

|

|

|

27,431 |

|

|

|

61,097 |

|

| Income tax expense |

|

2,206 |

|

|

|

2,657 |

|

|

|

8,228 |

|

|

|

15,754 |

|

|

Net income |

$ |

5,145 |

|

|

$ |

7,187 |

|

|

$ |

19,203 |

|

|

$ |

45,343 |

|

| |

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.24 |

|

|

$ |

0.34 |

|

|

$ |

0.90 |

|

|

$ |

2.17 |

|

|

Diluted |

$ |

0.21 |

|

|

$ |

0.29 |

|

|

$ |

0.79 |

|

|

$ |

1.80 |

|

| |

|

|

|

|

|

|

|

| Number of shares used in

computing earnings per share: |

|

|

|

|

|

|

|

|

Basic |

|

21,412 |

|

|

|

21,136 |

|

|

|

21,292 |

|

|

|

20,896 |

|

|

Diluted |

|

24,274 |

|

|

|

24,879 |

|

|

|

24,325 |

|

|

|

25,218 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

| |

December 31, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Assets: |

|

|

|

| Cash and cash equivalents |

$ |

11,713 |

|

|

$ |

6,174 |

|

| Restricted cash and

equivalents |

|

125,684 |

|

|

|

119,257 |

|

| Finance receivables measured

at fair value |

|

3,313,767 |

|

|

|

2,722,662 |

|

| |

|

|

|

| Finance receivables |

|

5,420 |

|

|

|

27,553 |

|

| Allowance for finance credit

losses |

|

(433 |

) |

|

|

(2,869 |

) |

| Finance receivables, net |

|

4,987 |

|

|

|

24,684 |

|

| |

|

|

|

| |

|

|

|

| Deferred tax assets, net |

|

1,010 |

|

|

|

3,736 |

|

| Other assets |

|

36,707 |

|

|

|

27,233 |

|

| |

$ |

3,493,868 |

|

|

$ |

2,903,746 |

|

| |

|

|

|

| Liabilities and

Shareholders' Equity: |

|

|

|

| Accounts payable and accrued

expenses |

$ |

70,151 |

|

|

$ |

62,544 |

|

| Warehouse lines of credit |

|

410,898 |

|

|

|

234,025 |

|

| Residual interest

financing |

|

99,176 |

|

|

|

49,875 |

|

| Securitization trust debt |

|

2,594,384 |

|

|

|

2,265,446 |

|

| Subordinated renewable

notes |

|

26,489 |

|

|

|

17,188 |

|

| |

|

3,201,098 |

|

|

|

2,629,078 |

|

| |

|

|

|

| Shareholders' equity |

|

292,770 |

|

|

|

274,668 |

|

| |

$ |

3,493,868 |

|

|

$ |

2,903,746 |

|

| |

|

|

|

|

|

|

|

Operating and Performance Data ($ in millions)

| |

|

At and for the |

|

At and for the |

| |

|

Three months ended |

|

Twelve months ended |

| |

|

December 31, |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| Contracts purchased |

|

$ |

457.81 |

|

|

$ |

301.80 |

|

|

$ |

1,681.94 |

|

|

$ |

1,357.75 |

|

| Contracts securitized |

|

$ |

298.42 |

|

|

$ |

306.70 |

|

|

|

1,256.13 |

|

|

|

1,352.11 |

|

| |

|

|

|

|

|

|

|

|

| Total portfolio balance

(1) |

|

$ |

3,490.96 |

|

|

$ |

2,970.07 |

|

|

$ |

3,490.96 |

|

|

$ |

2,970.07 |

|

| Average portfolio balance

(1) |

|

$ |

3,445.52 |

|

|

$ |

2,958.95 |

|

|

|

3,209.99 |

|

|

|

2,913.57 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Delinquencies (1) |

|

|

|

|

|

|

|

|

|

31+ Days |

|

|

12.11 |

% |

|

|

12.29 |

% |

|

|

|

|

|

Repossession Inventory |

|

|

2.74 |

% |

|

|

2.26 |

% |

|

|

|

|

|

Total Delinquencies and Repo. Inventory |

|

|

14.85 |

% |

|

|

14.55 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Annualized Net Charge-offs as

% of Average Portfolio (1) |

|

|

8.02 |

% |

|

|

7.74 |

% |

|

|

7.62 |

% |

|

|

6.53 |

% |

| |

|

|

|

|

|

|

|

|

| Recovery rates (1), (2) |

|

|

27.2 |

% |

|

|

34.3 |

% |

|

|

30.1 |

% |

|

|

39.2 |

% |

| |

|

|

|

|

|

|

|

|

| |

For the |

|

For the |

|

|

Three months ended |

|

Twelve months ended |

|

|

December 31, |

|

December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

$ (3) |

|

|

% (4) |

|

|

$ (3) |

|

|

% (4) |

|

|

$ (3) |

|

|

% (4) |

|

|

$ (3) |

|

|

% (4) |

|

Interest income |

$ |

98.15 |

|

|

11.4 |

% |

|

$ |

83.26 |

|

|

11.3 |

% |

|

$ |

363.96 |

|

|

11.3 |

% |

|

$ |

329.22 |

|

|

11.3 |

% |

| Mark to finance receivables

measured at fair value |

|

5.00 |

|

|

0.6 |

% |

|

|

6.00 |

|

|

0.8 |

% |

|

|

21.00 |

|

|

0.7 |

% |

|

|

12.00 |

|

|

0.4 |

% |

| Other income |

|

2.15 |

|

|

0.2 |

% |

|

|

2.72 |

|

|

0.4 |

% |

|

|

8.54 |

|

|

0.3 |

% |

|

|

10.80 |

|

|

0.4 |

% |

| Interest expense |

|

(52.52 |

) |

|

-6.1 |

% |

|

|

(40.28 |

) |

|

-5.4 |

% |

|

|

(191.26 |

) |

|

-6.0 |

% |

|

|

(146.63 |

) |

|

-5.0 |

% |

| Net interest margin |

|

52.78 |

|

|

6.1 |

% |

|

|

51.70 |

|

|

7.0 |

% |

|

|

202.25 |

|

|

6.3 |

% |

|

|

205.38 |

|

|

7.0 |

% |

| Provision for credit

losses |

|

0.73 |

|

|

0.1 |

% |

|

|

1.60 |

|

|

0.2 |

% |

|

|

5.31 |

|

|

0.2 |

% |

|

|

22.30 |

|

|

0.8 |

% |

| Risk adjusted margin |

|

53.51 |

|

|

6.2 |

% |

|

|

53.30 |

|

|

7.2 |

% |

|

|

207.56 |

|

|

6.5 |

% |

|

|

227.68 |

|

|

7.8 |

% |

| Other operating expenses

(5) |

|

(46.16 |

) |

|

-5.4 |

% |

|

|

(43.46 |

) |

|

-5.9 |

% |

|

|

(180.13 |

) |

|

-5.6 |

% |

|

|

(166.59 |

) |

|

-5.7 |

% |

| Pre-tax income |

$ |

7.35 |

|

|

0.9 |

% |

|

$ |

9.84 |

|

|

1.3 |

% |

|

$ |

27.43 |

|

|

0.9 |

% |

|

$ |

61.10 |

|

|

2.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| (1) Excludes

third party portfolios. |

| (2) Wholesale

auction liquidation amounts (net of expenses) as a percentage of

the account balance at the time of sale. |

| (3) Numbers may

not add due to rounding. |

| (4) Annualized

percentage of the average portfolio balance. Percentages may not

add due to rounding. |

| (5) Total pre-tax

expenses less provision for credit losses and interest

expense. |

| |

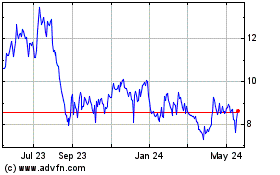

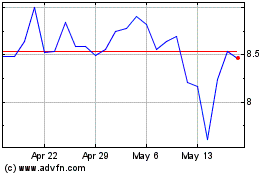

Consumer Portfolio Servi... (NASDAQ:CPSS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Consumer Portfolio Servi... (NASDAQ:CPSS)

Historical Stock Chart

From Feb 2024 to Feb 2025