0001658247false00016582472025-02-212025-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 21, 2025 |

Crinetics Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38583 |

26-3744114 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

6055 Lusk Boulevard |

|

San Diego, California |

|

92121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 450-6464 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

CRNX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors, Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Mr. Schilke

On February 24, 2025, Crinetics Pharmaceuticals, Inc. (the “Company” or “Crinetics”) announced the appointment of Tobin “Toby” Schilke as Chief Financial Officer, which will be effective as of February 28, 2025. Mr. Schilke, 50, is a seasoned biopharma executive with over 25 years of global pharmaceutical experience. In prior roles, his leadership was instrumental in transforming several biotech companies from R&D-focused entities into fully integrated commercial organizations. Prior to joining Crinetics, Mr. Schilke served as chief financial officer at Revance Therapeutics, Inc. from November 2018 to February 2025 , where he oversaw finance, investor relations, IT, and technical operations, supporting the transformation to a commercial company. From 2016 to 2018, Mr. Schilke served as Chief Financial Officer at Achaogen, Inc., where he built out the financial planning and analysis, accounting, procurement, information technology, and facilities management functions to support the approval and launch of the company’s first product. Earlier in his career, he spent more than a decade in increasing roles of responsibility at Roche/Genentech in corporate development, commercial finance, marketing and global operations. Mr. Schilke holds a bachelor’s degree in chemical engineering from Lafayette College, a master’s degree in chemical engineering from the University of California, Berkeley, and a master’s degree in business administration from Cornell University.

In connection with his appointment, on February 21, 2025, Mr. Schilke entered into an employment agreement with the Company, (the “Employment Agreement”), which provides that, among other things, Mr. Schilke’s annual base salary will be $540,000, and his target annual cash incentive bonus opportunity will be 40% of his base salary. He will also be eligible for reimbursement of certain relocation expenses.

Pursuant to the Employment Agreement, if Mr. Schilke’s employment is terminated by the Company other than for cause or by him for good reason, he is entitled to the following payments and benefits, subject to his timely execution and non-revocation of a general release of claims in favor of the Company and his continued compliance with the restrictive covenants set forth in his Employment Agreement: (1) his fully earned but unpaid base salary and accrued and unused paid time off through the date of termination at the rate then in effect, plus all other amounts under any compensation plan or practice to which he is entitled (the “Accrued Amounts”); (2) a cash payment equal to nine months of his then-current base salary, payable in a lump sum payment 60 days following the termination date; (3) a cash payment equal to a pro rata portion of his then-current target annual bonus opportunity, payable on the earlier of the date annual bonuses are paid to similarly situated executives or two-and-a-half months following the end of the year in which the termination occurs; and (4) payment for continued health plan coverage for up to nine months following the date of termination or, if earlier, up to the date he becomes eligible to receive equivalent or increased health plan coverage by means of subsequent employment or self-employment.

If Mr. Schilke’s employment is terminated by us other than for cause or by him for good reason within 12 months after a change in control, in lieu of the severance benefits described above, he is entitled to the following payments and benefits, subject to his timely execution and non-revocation of a general release of claims in favor of the Company and his continued compliance with the restrictive covenants set forth in his Employment Agreement: (1) the Accrued Amounts; (2) a cash payment equal to 12 months of his then-current base salary and his then-current target annual bonus opportunity, payable in a lump sum payment 60 days following the termination date; (3) reimbursement of continued health plan coverage for up to 12 months following the date of termination or, if earlier, up to the date he becomes eligible to receive equivalent or increased health plan coverage by means of subsequent employment or self-employment; (4) a cash payment equal to a pro rata portion of his then-current target annual bonus opportunity, payable in a lump sum payment 60 days following the date of termination; and (5) all outstanding unvested stock options and all equity-based compensation awards that vest based on continued service shall become fully vested and exercisable upon such date, and all equity-based compensation awards that vest based on the achievement of applicable performance goals shall remain outstanding in accordance with the terms of the applicable award agreements.

In the event we terminate Mr. Schilke’s employment for cause or he terminates his employment without good reason, he is entitled to receive only the Accrued Amounts.

In the event Mr. Schilke’s employment terminates upon his death or permanent disability, he is entitled to: (1) the Accrued Amounts; (2) a payment equal to a pro rata portion of Mr. Schilke’s then-current annual bonus based on the achievement of applicable performance goals for such year, payable on the earlier of the date annual bonuses are paid to similarly situated executives or two-and-a-half months following the end of the year in which the termination occurs; and (3) all outstanding unvested equity-based compensation awards shall become fully vested and exercisable, with all such awards that vest based on the achievement of performance conditions being deemed vested at target levels.

On March 10, 2025, the Company expects to grant Mr. Schilke 52,000 restricted stock units (“RSUs”) and a stock option to purchase 80,000 shares of common stock under the Crinetics Pharmaceuticals, Inc. 2021 Employment Inducement Incentive Award Plan (the

“2021 Inducement Plan”). The shares subject to the stock options will vest over four years, with 25% of the shares vesting on the one-year anniversary of the applicable vesting commencement date and the balance of the shares vesting in a series of 36 successive equal monthly installments thereafter, subject to Mr. Schilke’s continued employment with Crinetics on such vesting dates. The RSUs will vest over four years in equal annual installments beginning on the one-year anniversary of the applicable vesting commencement date, also subject to Mr. Schilke’s continued employment with Crinetics on such vesting dates. The stock option and RSU awards are subject to the terms and conditions of the 2021 Inducement Plan and the terms and conditions of an applicable stock option award agreement or RSU award agreement covering the respective grant. The RSUs and stock option will be granted as an inducement material to Mr. Schilke entering into employment with Crinetics in accordance with Nasdaq Listing Rule 5635(c)(4).

The Employment Agreement incorporates applicability of the Company’s Policy for Recovery of Erroneously Awarded Compensation, which provides the Company the ability to seek recovery of all incentive awards.

There are no reportable family relationships or related party transactions (as defined in Item 404(a) of Regulation S-K) involving the Company and Mr. Schilke.

The description of the Employment Agreement contained in this Item 5.02 is qualified in its entirety by reference to the full text of the Employment Agreement, a copy of which will be filed with the Securities and Exchange Commission as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025.

Departure of Mr. Wilson

As previously reported on the Current Report on Form 8-K filed by the Company on August 8, 2024, Marc Wilson notified the Company of his decision to step down from his position as Chief Financial Officer of the Company. His resignation will be effective February 28, 2025. Mr. Wilson is departing for personal reasons, not because of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. Mr. Wilson will remain with the Company for a period of time to assist with the transition of his duties to Mr. Schilke and others within the Company and to ensure the continuity of its programs.

Item 7.01 Regulation FD Disclosure.

On February 24, 2025, the Company issued a press release announcing the appointment of Mr. Schilke. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 7.01, including in Exhibit 99.1 hereto, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements other than statements of historical facts contained in this Current Report on Form 8-K are forward-looking statements. These forward-looking statements speak only as of the date of this Current Report on Form 8-K and are subject to a number of known and unknown risks, uncertainties and assumptions, including, without limitation, the risks and uncertainties described in the Company’s periodic filings with the Securities and Exchange Commission (“SEC”). The events and circumstances reflected in the Company’s forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Additional information on risks facing Crinetics can be found under the heading “Risk Factors” in Crinetics’ periodic filings with the SEC, including its annual report on Form 10-K for the year ended December 31, 2023 and quarterly reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024, and September 30, 2024. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by applicable law, Crinetics does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Crinetics Pharmaceuticals, Inc. |

|

|

|

|

Date: |

February 24, 2025 |

By: |

/s/ R. Scott Struthers, Ph.D. |

|

|

|

R. Scott Struthers, Ph.D.

President and Chief Executive Officer

(Principal Executive Officer) |

Crinetics Pharmaceuticals Appoints Tobin Schilke as Chief Financial Officer

SAN DIEGO –February 24, 2025 – Crinetics Pharmaceuticals, Inc. (Nasdaq: CRNX), today announced the appointment of Tobin “Toby” Schilke as chief financial officer, effective February 28, 2025. Mr. Schilke is a seasoned biopharma executive with over 25 years of global pharmaceutical experience. In prior roles, his leadership was instrumental in transforming several biotech companies from R&D-focused entities into fully integrated commercial organizations.

“I am excited to welcome Toby to our senior leadership team during this transformational stage of our evolution into a global pharmaceutical company,” said Scott Struthers, Ph.D., founder and chief executive officer of Crinetics. “Toby’s deep finance experience in commercial-stage global pharmaceutical companies and emerging biotech is essential as we prepare for our first commercial launch and advance numerous promising candidates through development. I would also like to thank Marc Wilson for his invaluable leadership and financial stewardship during his tenure, guiding the company through critical phases of growth.”

“I am honored to join Crinetics at such a pivotal time in the company’s journey and am deeply inspired by its mission to improve the lives of people living with endocrine-related conditions,” said Mr. Schilke. “I look forward to collaborating with the Crinetics team and stakeholders to accelerate our growth objectives and create long-term value.”

Prior to joining Crinetics, Mr. Schilke served as chief financial officer at Revance Therapeutics, where he oversaw finance, investor relations, IT, and technical operations for a public company with 650 employees, supporting the transformation to a commercial company with two product launches and over $700 million in cumulative revenue. Previously, Mr. Schilke served as Chief Financial Officer at Achaogen, where he built out the financial planning and analysis, accounting, procurement, information technology, and facilities management functions to support the approval and launch of the company’s first product. In these roles, Mr. Schilke successfully executed over $1.5 billion in equity, convertible debt, and structured debt financing, while also leading numerous partnerships and M&A deals. Earlier in his career, he spent more than a decade in increasing roles of responsibility at Roche/Genentech in corporate development, commercial finance, marketing and global operations. Mr. Schilke holds a bachelor’s degree in chemical engineering from Lafayette College, a master’s degree in chemical engineering from the University of California, Berkeley, and a master’s degree in business administration from Cornell University.

On March 10, 2025, the Company expects to grant Mr. Schilke 52,000 restricted stock units (RSUs) and a stock option to purchase 80,000 shares of common stock under the Crinetics Pharmaceuticals, Inc. 2021 Employment Inducement Incentive Award Plan (the “2021 Inducement Plan”). The shares subject to the stock options will vest over four years, with 25% of the shares vesting on the one-year anniversary of the applicable vesting commencement date and the balance of the shares vesting in a series of 36 successive equal monthly installments thereafter, subject to each employee’s continued employment with Crinetics on such vesting dates. The RSUs will vest over four years in equal annual installments beginning on the one-year anniversary of the applicable vesting commencement date, also subject to each employee’s continued employment with Crinetics on such vesting dates. The stock option and RSU awards are subject to the terms and conditions of the 2021

Inducement Plan and the terms and conditions of an applicable stock option award agreement or RSU award agreement covering the respective grant. The RSUs and stock option will be granted as an inducement material to Mr. Schilke entering into employment with Crinetics in accordance with Nasdaq Listing Rule 5635(c)(4).

ABOUT CRINETICS PHARMACEUTICALS

Crinetics Pharmaceuticals is a clinical stage pharmaceutical company focused on the discovery, development, and commercialization of novel therapeutics for endocrine diseases and endocrine-related tumors. Crinetics’ lead development candidate, paltusotine, is the first investigational once-daily, oral, selective somatostatin receptor type 2 (SST2) nonpeptide agonist that is in clinical development for acromegaly and carcinoid syndrome associated with neuroendocrine tumors. Atumelnant is currently in development for congenital adrenal hyperplasia and ACTH-dependent Cushing’s syndrome. All of the company’s drug candidates are orally delivered, small molecule, new chemical entities resulting from in-house drug discovery efforts, including additional discovery programs addressing a variety of endocrine conditions such as hyperparathyroidism, polycystic kidney disease, Graves’ disease (including thyroid eye disease), diabetes, obesity and GPCR-targeted oncology indications.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this press release are forward-looking statements, including the plans and timelines for the commercial launch of paltusotine for acromegaly, if approved, and the potential of our other research, discovery, and clinical trial programs. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “upcoming” or “continue” or the negative of these terms or other similar expressions. These forward-looking statements speak only as of the date of this press release and are subject to a number of risks, uncertainties and assumptions, including, without limitation, clinical studies and preclinical studies may not proceed at the time or in the manner expected, or at all; the timing and outcome of research, development and regulatory review is uncertain, and Crinetics’ drug candidates may not advance in development or be approved for marketing; and the other risks and uncertainties described in the company’s periodic filings with the Securities and Exchange Commission (SEC). The events and circumstances reflected in the company’s forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Additional information on risks facing Crinetics can be found under the heading “Risk Factors” in Crinetics’ periodic filings with the SEC, including its annual report on Form 10-K for the year ended December 31, 2023 and its Quarterly report on Form 10-Q for the quarter ended March 31, 2024, June 30, 2024, and September 30, 2024. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by applicable law, Crinetics does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Investors:

Gayathri Diwakar

Head of Investor Relations

gdiwakar@crinetics.com

(858) 345-6340

Media:

Natalie Badillo

Head of Corporate Communications

nbadillo@crinetics.com

(858) 345-6075

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

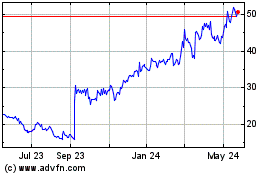

Crinetics Pharmaceuticals (NASDAQ:CRNX)

Historical Stock Chart

From Jan 2025 to Feb 2025

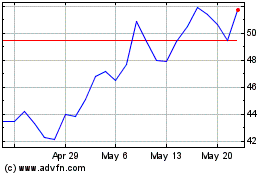

Crinetics Pharmaceuticals (NASDAQ:CRNX)

Historical Stock Chart

From Feb 2024 to Feb 2025