false

0001282224

0001282224

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 14,

2024

DOLPHIN

ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| Florida |

001-38331 |

86-0787790 |

| (State

or other jurisdiction |

(Commission

|

(IRS

Employer |

| of

incorporation) |

File

Number) |

Identification

No.) |

150

Alhambra Circle, Suite 1200,

Coral Gables, Florida

33134

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area

code (305) 774

-0407

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.015 par value per share |

|

DLPN |

|

The Nasdaq

Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On November 14, 2024, Dolphin Entertainment,

Inc., a Florida corporation (the “Company”), issued a press release announcing its financial results for the three

and nine months ended September 30, 2024. A copy of the Company’s earnings press release is furnished as Exhibit 99.1 to this Current

Report on Form 8-K and incorporated herein by reference.

The information contained in this Current Report

on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor incorporated by reference

in any registration statement filed by the Company under the Securities Act of 1933, as amended.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

DOLPHIN ENTERTAINMENT, INC. |

| |

|

|

|

| Date: November 14, 2024 |

|

|

|

By: |

|

/s/

Mirta A. Negrini |

| |

|

|

|

|

|

Mirta A. Negrini |

| |

|

|

|

|

|

Chief Financial and Operating Officer |

Exhibit 99.1

Dolphin Q3 Revenue

Increases 24.5% YoY to $12.7M, Reports Adjusted Operating Income of $0.5M and Highlights Market Valuation Disconnect

| · | Q3 2024 Revenue grew 24.5% to $12.7M from $10.2M in Q3 2023 |

| · | Q3 2024 Adjusted Operating Income of $0.5M as opposed to

Adjusted Operating Loss of $(0.8M) in Q3 2023 |

| · | Nine-Month 2024 Revenue increased 26.6% to $39.4M |

| · | Nine-Month 2024 Adjusted Operating Income of $1.4M, versus

a $(2.7M) Adjusted Operating Loss in the same period last year |

| · | Market Cap (1) trading at approximately 0.25x

Current Year 2024 estimated revenue guidance of $50.0M |

| · | CEO sees Dolphin as undervalued; supports view with $100,000

in stock purchases in last 12 months |

| (1) | Based on market cap at the close of trading on Nov 13, 2024 |

MIAMI, FL - Dolphin (NASDAQ:DLPN), an independent leader in content

production, entertainment marketing, and related ventures, announces its financial results for the quarter ended September 30, 2024.

Bill O'Dowd, CEO of Dolphin Entertainment commented:

"During Q3, revenue increased by 24.5% year over year and we achieved

$0.5 million in adjusted operating income, setting us on track to deliver on our goals of surpassing $50 million in revenue and achieving

adjusted operating income for full year 2024. With promising ventures like Rachael Ray's Staple Gin - - alongside the acquisition of Elle

Communications, the launch of Always Alpha and our new partnership with Loti AI, we see a stark mismatch between our current market cap

and the intrinsic value of our assets. I am committed to further increasing my stake in Dolphin, confident that the market will soon recognize

the adjusted operating income we are creating and the true potential of our expanding portfolio of assets."

Q3 2024 and Recent Highlights

| · | Total revenue for the quarter ended September 30, 2024 was

$12.7 million, an increase of 24.5% over the same period in 2023. |

| · | Operating loss of $8.2 million for the quarter ended September

30, 2024 as compared to an operating loss of $2.1 million for the quarter ended September 30, 2023. Operating loss of $9.1 million for

the nine months ended September 30, 2024 as compared to an operating loss of $12.1 million for the nine months ended September 30, 2023. |

| · | Adjusted operating income(1) of $0.5 million

for the three months ended September 30, 2024 as compared to an adjusted operating loss of $0.8 million for the three months ended September

30, 2023. Adjusted operating income of $1.4 million for the nine months ended September 30, 2024 as compared to an adjusted operating

loss of $2.7 million for the nine months ended September 30, 2023. |

| · | Operating expenses for the third quarter of 2024 were $20.8

million, including both non-cash and one-time charges of depreciation and amortization of $0.6 million, goodwill impairment of $6.5 million,

a write-off of notes receivable of $1.3 million and transaction costs of $0.1 million. Operating expenses for the third quarter of 2023

were $12.3 million, including depreciation and amortization of $0.5 million, and impairment of intangible assets of $0.3 million. |

| · | Net loss for the quarter was $8.7 million, including depreciation

and amortization of $0.6 million, goodwill impairment of $6.5 million, a write-off of notes receivable of $1.3 million, and interest expense

of $0.5 million. Net loss for the same period in the prior year was $3.9 million, including depreciation and amortization of $0.5 million,

impairment of intangible assets of $0.3 million, interest expense of $0.6 million, and equity losses in unconsolidated affiliates of $1.2

million. |

| · | Cash and cash equivalents of $6.6 million as of September

30, 2024, as compared to $7.6 million as of December 31, 2023. |

(1)The Company has provided adjusted operating income information

that has not been prepared in accordance with GAAP. This measure is defined below in the section "Use of non-GAAP measures."

Acquisition

| o | Acquired by Dolphin in July 2024 |

| o | Profitable, high margin, pioneering social impact PR firm |

| o | 16-year track record representing high-profile clients including

|

| o | Provides access to estimated $1.164 trillion global impact

investing industry |

| o | With offices in Los Angeles and New York, tremendous expansion

opportunities with celebrity and entertainment foundations |

| o | Joining as a division of 42West |

Company Launch

| o | First management firm dedicated to women's sports |

| o | Founded by Olympic legend Allyson Felix and CEO Cosette

Chaput |

| o | Aiming to revolutionize talent management for female athletes,

broadcasters, and coaches |

| o | Leveraging Dolphin's entertainment marketing expertise to

unlock the industry's potential. |

Ventures

| o | Created by Rachael Ray and Do Good Spirits, won Double Gold

with a 96-point rating at the 2024 NY International Spirits Competition, also receiving silver medals from Bartender Spirits Awards and

New Orleans Spirits Competition. |

| o | The gin is now distributed nationally via e-commerce and

in New York State through Southern Glazer's Wine & Spirits, with plans to expand to additional markets. |

| o | Combatting unauthorized digital content and deepfakes |

| o | Offering Dolphin clients access to Loti's AI-powered protection

|

| o | Loti AI tools scan over 450 million daily images |

| o | 95% takedown success rate |

| o | Marks Dolphin's strategic entry into AI technology |

| o | Creates new revenue streams in brand safety and content

protection services. |

| o | In success, opportunity to become a “venture”

with Dolphin participating in upside via an ownership stake. |

Dolphin + IMAX documentary slate

| · | Dolphin received the second cash installment of $2.6M from

its content licensing agreement related to The Blue Angels. |

| · | Box office numbers have surpassed initial projections |

| · | Upcoming screenings at institutional venues, beginning in

January 2025 |

| · | To build on this momentum, the team is actively exploring

options and making decisions for its next production |

42West

| · | Led successful campaigns at the 49th Annual Toronto International

Film Festival |

| · | Handled Venice Film Festival World Premiere for Tim Burton's

BEETLEJUICE BEETLEJUICE |

| · | Dominated San Diego Comic-Con 2024, representing 13 major

entertainment clients |

| · | Clients earned 60 Primetime Emmy Awards nominations |

| · | Represented Pop Culture companies Crunchyroll, Gkids and

TOHO at Anime Expo |

| · | Represented artists and projects garnered 9 nominations

for the upcoming GRAMMY Awards® |

Shore Fire Media

| · | Clients Dave Matthews Band, Kool & The Gang and MC5

inducted into Rock & Roll Hall of Fame |

| · | Led successful campaigns at Toronto International Film Festival

(alongside 42West) |

| · | Represented artists and projects garnered 25 nominations

for the upcoming GRAMMY Awards® |

The Door

| · | Client NYC's Bungalow earned three-star review from The

New York Times |

| · | Selected by Newman's Own® to launch "Pay What You

Want" Pizza Program |

The Digital Dept.

| · | Achieved 137 new talent signings so far in 2024 |

| · | Brought BRANDEdit Influencer Showroom to New York Fashion

Week for the first time |

Special Projects

| · | Curated star-studded lineup for WSJ. Magazine's Innovator

Awards at MoMA for ninth consecutive year |

| · | Booked Talent for Academy Museum of Motion Pictures Fourth

Annual Gala helping honor Paul Mescal, Rita Moreno, and Quentin Tarantino and raise over $11 million at the gala |

Conference Call Details

Date: November 14, 2024

Time: 4:30 p.m. Eastern Time

Domestic 877-545-0320; International: 973-528-0002 Access Code: 345281

Webcast: https://www.webcaster4.com/Webcast/Page/2225/51624

Replay Information

Domestic 877-481-4010 International: 919-882-2331 Passcode: 51624

Replay webcast: https://www.webcaster4.com/Webcast/Page/2225/51624

About Dolphin:

Dolphin (NASDAQ:DLPN), founded in 1996 by Bill O'Dowd, has evolved from its origins as an Emmy-nominated television, digital, and feature

film content producer to a company with three dynamic divisions: Dolphin Entertainment, Dolphin Marketing, and Dolphin Ventures.

Dolphin Entertainment: This legacy division, where it all began,

has a rich history of producing acclaimed television shows, digital content, and feature films. With high-profile partners like IMAX and

notable projects including "The Blue Angels," Dolphin Entertainment continues to set the standard in quality storytelling and

innovative content creation.

Dolphin Marketing: Established in 2017, this division has become

a powerhouse in public relations, influencer marketing, branding strategy, talent booking, and special events. Comprising top-tier companies

such as 42West, The Door, Shore Fire, Special Projects, and The Digital Dept., Dolphin Marketing serves a wide range of industries, from

entertainment, music and sports to hospitality, fashion and consumer products.

Dolphin Ventures: This division leverages Dolphin's best-in-class

cross-marketing acumen and business development relationships to create, launch and/or accelerate innovative ideas and promising products,

events and content in our areas of expertise. Key ventures include collaborations with Rachael Ray for Staple Gin and Mastercard Midnight

Theatre.

Forward-Looking Statements

This press release contains 'forward-looking statements' within the meaning

of the Private Securities Litigation Reform Act. These forward-looking statements may address, among other things, Dolphin Entertainment

Inc.'s offering of common stock as well as expected financial and operational results and the related assumptions underlying its expected

results. These forward-looking statements are distinguished by the use of words such as "will," "would," "anticipate,"

"expect," "believe," "designed," "plan," or "intend," the negative of these terms, and

similar references to future periods. These views involve risks and uncertainties that are difficult to predict and, accordingly, Dolphin

Entertainment's actual results may differ materially from the results discussed in its forward-looking statements. Dolphin Entertainment's

forward-looking statements contained herein speak only as of the date of this press release. Factors or events Dolphin Entertainment cannot

predict, including those described in the risk factors contained in its filings with the Securities and Exchange Commission, may cause

its actual results to differ from those expressed in forward-looking statements.

Although Dolphin Entertainment believes the expectations reflected in such

forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be achieved, and Dolphin

Entertainment undertakes no obligation to update publicly any forward-looking statements as a result of new information, future events,

or otherwise, except as required by applicable law.

CONTACT:

James Carbonara

HAYDEN IR

(646)-755-7412

james@haydenir.com

DOLPHIN ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

September

30, 2024 | | |

December

31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 5,659,883 | | |

$ | 6,432,731 | |

| Restricted cash | |

| 925,004 | | |

| 1,127,960 | |

| Accounts receivable: | |

| | | |

| | |

| Trade, net of allowance of $1,450,093 and $1,456,752, respectively | |

| 5,623,999 | | |

| 5,817,615 | |

| Other receivables | |

| 6,073,074 | | |

| 6,643,960 | |

| Other current assets | |

| 569,572 | | |

| 701,335 | |

| Total current assets | |

| 18,851,532 | | |

| 20,723,601 | |

| | |

| | | |

| | |

| Capitalized production costs, net | |

| 568,929 | | |

| 2,295,275 | |

| Employee receivable | |

| 960,668 | | |

| 796,085 | |

| Right-of-use asset | |

| 4,140,985 | | |

| 5,599,736 | |

| Goodwill | |

| 21,622,279 | | |

| 25,220,085 | |

| Intangible assets, net | |

| 10,808,498 | | |

| 11,209,664 | |

| Property, equipment and leasehold improvements, net | |

| 131,321 | | |

| 194,223 | |

| Other long-term assets | |

| 216,305 | | |

| 216,305 | |

| Total Assets | |

$ | 57,300,517 | | |

$ | 66,254,974 | |

| LIABILITIES | |

| | |

| |

| Current | |

| | |

| |

| Accounts payable | |

$ | 1,555,959 | | |

$ | 6,892,349 | |

| Term loan, current portion | |

| 1,045,152 | | |

| 980,651 | |

| Notes payable, current portion | |

| 3,900,000 | | |

| 3,500,000 | |

| Revolving line of credit | |

| — | | |

| 400,000 | |

| Accrued interest – related party | |

| 1,910,915 | | |

| 1,718,009 | |

| Accrued compensation – related party | |

| 2,625,000 | | |

| 2,625,000 | |

| Lease liability, current portion | |

| 1,839,587 | | |

| 2,192,213 | |

| Deferred revenue | |

| 745,489 | | |

| 1,451,709 | |

| Contingent consideration | |

| 436,000 | | |

| — | |

| Other current liabilities | |

| 10,747,662 | | |

| 7,694,114 | |

| Total current liabilities | |

| 24,805,764 | | |

| 27,454,045 | |

| | |

| | | |

| | |

| Term loan, noncurrent portion | |

| 3,710,233 | | |

| 4,501,963 | |

| Revolving line of credit, noncurrent portion | |

| 400,000 | | |

| — | |

| Notes payable | |

| 2,980,000 | | |

| 3,380,000 | |

| Convertible notes payable | |

| 5,100,000 | | |

| 5,100,000 | |

| Convertible note payable at fair value | |

| 300,000 | | |

| 355,000 | |

| Loan from related party | |

| 3,217,873 | | |

| 1,107,873 | |

| Lease liability | |

| 2,844,526 | | |

| 4,068,642 | |

| Deferred tax liability | |

| 322,137 | | |

| 306,691 | |

| Warrant liability | |

| — | | |

| 5,000 | |

| Other noncurrent liabilities | |

| 18,915 | | |

| 18,915 | |

| Total Liabilities | |

| 43,699,448 | | |

| 46,298,129 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | |

| |

| Preferred Stock, Series C, $0.001 par value, 50,000 shares authorized, 50,000 shares issued and outstanding at September 30, 2024 and December 31, 2024 | |

| 1,000 | | |

| 1,000 | |

| Common stock, $0.015 par value, 200,000,000 shares authorized, 11,112,492 and 9,109,766 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 166,687 | | |

| 136,646 | |

| Additional paid-in capital | |

| 157,688,200 | | |

| 153,430,403 | |

| Accumulated deficit | |

| (144,254,818 | ) | |

| (133,611,204 | ) |

| Total Stockholders’ Equity | |

| 13,601,069 | | |

| 19,956,845 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 57,300,517 | | |

$ | 66,254,974 | |

DOLPHIN ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | |

Three

Months Ended September

30, | | |

Nine

Months Ended September

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 12,682,437 | | |

$ | 10,184,511 | | |

$ | 39,367,418 | | |

$ | 31,100,867 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct costs | |

| 254,574 | | |

| 185,308 | | |

| 2,790,043 | | |

| 621,449 | |

| Payroll and benefits | |

| 9,575,596 | | |

| 8,382,659 | | |

| 28,344,865 | | |

| 26,114,881 | |

| Selling, general and administrative | |

| 1,838,765 | | |

| 2,150,889 | | |

| 5,665,365 | | |

| 6,023,954 | |

| Acquisition costs | |

| 148,798 | | |

| 4,666 | | |

| 164,044 | | |

| 8,823 | |

| Depreciation and amortization | |

| 636,782 | | |

| 535,740 | | |

| 1,745,579 | | |

| 1,612,776 | |

| Impairment of goodwill | |

| 6,480,992 | | |

| — | | |

| 6,671,557 | | |

| 6,517,400 | |

| Impairment of intangible assets | |

| — | | |

| 341,417 | | |

| — | | |

| 341,417 | |

| Impairment of notes receivable | |

| 1,270,000 | | |

| — | | |

| 1,270,000 | | |

| — | |

| Change in fair value of contingent consideration | |

| — | | |

| — | | |

| — | | |

| 33,226 | |

| Legal and professional | |

| 631,629 | | |

| 695,188 | | |

| 1,825,588 | | |

| 1,955,037 | |

| Total expenses | |

| 20,837,136 | | |

| 12,295,867 | | |

| 48,477,041 | | |

| 43,228,963 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (8,154,699 | ) | |

| (2,111,356 | ) | |

| (9,109,623 | ) | |

| (12,128,096 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (expenses) income: | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of convertible note | |

| (10,000 | ) | |

| — | | |

| 55,000 | | |

| (6,444 | ) |

| Change in fair value of warrants | |

| — | | |

| — | | |

| 5,000 | | |

| 5,000 | |

| Interest income | |

| 3,391 | | |

| 104,303 | | |

| 9,991 | | |

| 309,424 | |

| Interest expense | |

| (533,454 | ) | |

| (604,669 | ) | |

| (1,559,276 | ) | |

| (1,413,177 | ) |

| Total other (expenses) income, net | |

| (540,063 | ) | |

| (500,366 | ) | |

| (1,489,285 | ) | |

| (1,105,197 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes and equity in losses of unconsolidated affiliates | |

| (8,694,762 | ) | |

| (2,611,722 | ) | |

| (10,598,908 | ) | |

| (13,233,293 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit (expense) | |

| 2,373 | | |

| (31,059 | ) | |

| (44,706 | ) | |

| (91,243 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before equity in losses of unconsolidated affiliates | |

| (8,692,389 | ) | |

| (2,642,781 | ) | |

| (10,643,614 | ) | |

| (13,324,536 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Equity in losses of unconsolidated affiliates | |

| — | | |

| (1,220,547 | ) | |

| — | | |

| (1,467,356 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (8,692,389 | ) | |

$ | (3,863,328 | ) | |

$ | (10,643,614 | ) | |

$ | (14,791,892 | ) |

| Loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.80 | ) | |

$ | (0.55 | ) | |

$ | (1.07 | ) | |

$ | (2.22 | ) |

| Diluted | |

$ | (0.80 | ) | |

$ | (0.55 | ) | |

$ | (1.07 | ) | |

$ | (2.22 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 10,930,286 | | |

| 7,060,638 | | |

| 9,964,607 | | |

| 6,664,069 | |

| Diluted | |

| 10,930,286 | | |

| 7,060,638 | | |

| 9,964,607 | | |

| 6,664,069 | |

Use of Non-GAAP Financial Measures

In order to provide greater transparency regarding our operating performance,

the financial results in this press release refer to a non-GAAP financial measure that involves adjustments to GAAP results. Non-GAAP

financial measures exclude certain income and/or expense items that management deems are not directly attributable to the Company’s

core operating results and/or certain items that are inconsistent in amounts and frequency, making it difficult to perform a meaningful

evaluation of our current or past operating performance.

Adjusted operating income or loss is defined by Dolphin as (loss) income

from operations before: (i) depreciation and amortization, (ii) write-off of assets, (iii) impairment of goodwill or intangible assets,

(iv) acquisition costs, (v) employee stock compensation, (vi) change in fair value of contingent consideration, (vii) bad debt expense

and (viii) and impairment of capitalized production costs.

Management believes that the presentation of operating results using this

non-GAAP financial measure provides useful supplemental information for investors by providing them with the non-GAAP financial measure

used by management for financial and operational decision making, planning and forecasting and in managing the business. This non-GAAP

financial measure does not replace the presentation of financial information in accordance with U.S. GAAP financial results, should not

be considered a measure of liquidity and is unlikely to be comparable to non-GAAP financial measures provided by other companies.

Reconciliation of GAAP loss from operations to non-GAAP

income from operations

| | |

| | |

| | |

| | |

| |

| | |

Three

Months Ended September

30, | | |

Nine

Months Ended September

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues (GAAP) | |

$ | 12,682,437 | | |

$ | 10,184,511 | | |

$ | 39,367,418 | | |

$ | 31,100,867 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct costs | |

| 254,574 | | |

| 185,308 | | |

| 2,790,043 | | |

| 621,449 | |

| Payroll and benefits | |

| 9,575,596 | | |

| 8,382,659 | | |

| 28,344,865 | | |

| 26,114,881 | |

| Selling, general and administrative | |

| 1,838,765 | | |

| 2,150,889 | | |

| 5,665,365 | | |

| 6,023,954 | |

| Acquisition costs | |

| 148,798 | | |

| 4,666 | | |

| 164,044 | | |

| 8,823 | |

| Depreciation and amortization | |

| 636,782 | | |

| 535,740 | | |

| 1,745,579 | | |

| 1,612,776 | |

| Impairment of goodwill | |

| 6,480,992 | | |

| — | | |

| 6,671,557 | | |

| 6,517,400 | |

| Impairment of intangible assets | |

| — | | |

| 341,417 | | |

| — | | |

| 341,417 | |

| Impairment of notes receivable | |

| 1,270,000 | | |

| — | | |

| 1,270,000 | | |

| — | |

| Change in fair value of contingent consideration | |

| — | | |

| — | | |

| — | | |

| 33,226 | |

| Legal and professional | |

| 631,629 | | |

| 695,188 | | |

| 1,825,588 | | |

| 1,955,037 | |

| Total expenses (GAAP) | |

| 20,837,136 | | |

| 12,295,867 | | |

| 48,477,041 | | |

| 43,228,963 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations (GAAP) | |

| (8,154,699 | ) | |

| (2,111,356 | ) | |

| (9,109,623 | ) | |

| (12,128,096 | ) |

| Adjustments to GAAP measure: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 636,782 | | |

| 535,740 | | |

| 1,745,579 | | |

| 1,612,776 | |

| Bad debt expense | |

| 14,051 | | |

| 311,578 | | |

| 301,030 | | |

| 566,610 | |

| Acquisition costs | |

| 148,798 | | |

| 4,666 | | |

| 164,044 | | |

| 8,823 | |

| Impairment of goodwill | |

| 6,480,992 | | |

| — | | |

| 6,671,557 | | |

| 6,517,400 | |

| Impairment of intangible assets | |

| — | | |

| 341,417 | | |

| — | | |

| 341,417 | |

| Impairment of notes receivable | |

| 1,270,000 | | |

| — | | |

| 1,270,000 | | |

| — | |

| Impairment of capitalized production costs | |

| — | | |

| — | | |

| — | | |

| 49,412 | |

| Change in fair value of contingent consideration | |

| — | | |

| — | | |

| — | | |

| 33,226 | |

| Stock compensation | |

| 96,696 | | |

| 102,954 | | |

| 346,440 | | |

| 268,154 | |

| Adjusted income (loss) from operations (non-GAAP) | |

| 492,620 | | |

| (815,001 | ) | |

| 1,389,027 | | |

| (2,730,278 | ) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

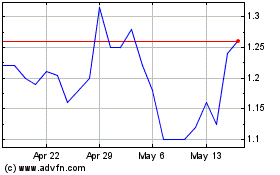

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Nov 2023 to Nov 2024