Announces Path to Positive Free Cash Flow

Digimarc Corporation (NASDAQ: DMRC) reported financial results

for the fourth quarter and fiscal year ended December 31, 2024.

“Digital watermarks excel at the identification and

authentication of physical goods and digital assets. Recent

invention and market development have opened exciting near-term

opportunities for us, concentrated around our authentication use

cases. In response, we are prioritizing our authentication

Go-To-Market efforts for the time being,” said Riley McCormack,

Digimarc CEO. “To ensure we fully capitalize on the opportunities

immediately in front of us, we have reorganized the company to

reflect this near-term focus. We expect these efforts will allow us

to achieve positive non-GAAP net income no later than the Fourth

Quarter of 2025 and set us up to deliver meaningfully positive free

cash flow in Fiscal Year 2026 and beyond.”

Fourth Quarter 2024 Financial Results

Annual recurring revenue (ARR)(1) as of December 31, 2024

decreased to $20.0 million compared to $22.3 million as of December

31, 2023. The $2.3 million decrease primarily reflects a $5.8

million decrease in ARR due to the expiration of a commercial

contract in June 2024, partially offset by an increase in ARR from

new and existing commercial contracts.

Subscription revenue for the fourth quarter of 2024 decreased to

$5.0 million compared to $5.6 million for the fourth quarter of

2023, primarily reflecting the expiration of a commercial contract

in June 2024, partially offset by higher subscription revenue from

new and existing commercial contracts.

Service revenue for the fourth quarter of 2024 decreased to $3.6

million compared to $3.7 million for the fourth quarter of 2023,

primarily reflecting $0.4 million of lower government service

revenue, partially offset by $0.3 million of higher service revenue

from HolyGrail 2.0 recycling projects.

Total revenue for the fourth quarter of 2024 decreased to $8.7

million compared to $9.3 million for the fourth quarter of

2023.

Gross profit margin for the fourth quarter of 2024 decreased to

61% compared to 63% for the fourth quarter of 2023. Excluding

amortization expense on acquired intangible assets, subscription

gross profit margin for the fourth quarter of 2024 decreased to 85%

from 87% for the fourth quarter of 2023, while service gross profit

margin for the fourth quarter of 2024 increased to 59% from 56% for

the fourth quarter of 2023.

Non-GAAP gross profit margin for the fourth quarter of 2024

decreased to 77% compared to 79% for the fourth quarter of

2023.

Operating expenses for the fourth quarter of 2024 decreased to

$14.4 million compared to $16.8 million for the fourth quarter of

2023, primarily reflecting lower cash compensation costs of $1.1

million and lower stock compensation costs of $0.8 million.

Non-GAAP operating expenses for the fourth quarter of 2024

decreased to $11.9 million compared to $13.4 million for the fourth

quarter of 2023.

Net loss for the fourth quarter of 2024 was $8.6 million or

($0.40) per share compared to $10.6 million or ($0.52) per share

for the fourth quarter of 2023.

Non-GAAP net loss for the fourth quarter of 2024 was $4.7

million or ($0.22) per share compared to $5.6 million or ($0.28)

per share for the fourth quarter of 2023.

Fiscal Year 2024 Financial Results

Subscription revenue for fiscal year 2024 increased to $22.4

million compared to $19.0 million for fiscal year 2023, primarily

reflecting higher subscription revenue from new and existing

commercial contracts, partially offset by the expiration of a

commercial contract in June 2024.

Service revenue for fiscal year 2024 increased to $16.0 million

compared to $15.9 million for fiscal year 2023, primarily

reflecting $0.6 million of higher service revenue from HolyGrail

2.0 recycling projects, partially offset by $0.4 million of lower

other commercial service revenue and $0.2 million of lower

government service revenue.

Total revenue for fiscal year 2024 increased to $38.4 million

compared to $34.9 million for fiscal year 2023.

Gross profit margin for fiscal year 2024 increased to 63%

compared to 58% for fiscal year 2023. Excluding amortization

expense on acquired intangible assets, subscription gross profit

margin for fiscal year 2024 increased to 87% from 84% for fiscal

year 2023, while service gross profit margin for fiscal year 2024

increased to 59% from 54% for fiscal year 2023.

Non-GAAP gross profit margin for the fiscal year 2024 increased

to 78% compared to 76% for fiscal year 2023.

Operating expenses for fiscal year 2024 decreased to $65.5

million compared to $68.4 million for fiscal year 2023, primarily

reflecting lower cash compensation costs of $1.5 million, lower

stock compensation costs of $0.7 million, lower depreciation and

amortization costs of $0.5 million, and lower lease impairment

costs of $0.3 million, partially offset by $0.5 million of higher

professional services and consulting costs.

Non-GAAP operating expenses for fiscal year 2024 decreased to

$53.8 million compared to $55.0 million for fiscal year 2023.

Net loss for fiscal year 2024 was $39.0 million or ($1.83) per

share compared to a net loss of $46.0 million or ($2.26) per share

for fiscal year 2023.

Non-GAAP net loss for fiscal year 2024 was $21.4 million or

($1.01) per share compared to a net loss of $26.4 million or

($1.30) per share for fiscal year 2023.

At December 31, 2024, cash, cash equivalents, and marketable

securities totaled $28.7 million compared to $27.2 million at

December 31, 2023.

______________ (1) Annual Recurring Revenue (ARR) is a company

performance metric calculated as the aggregation of annualized

subscription fees from all of our commercial contracts as of the

measurement date.

Conference Call

Digimarc will hold a conference call today (Wednesday, February

26, 2025) to discuss these financial results and to provide a

business update. CEO Riley McCormack, CFO Charles Beck and CLO

George Karamanos will host the call starting at 5:00 p.m. Eastern

time (2:00 p.m. Pacific time). A question and answer session will

follow management’s prepared remarks.

The conference call will be broadcast live and available for

replay here and in the investor section of the company’s website.

The conference call script will also be posted to the company’s

website shortly before the call.

For those who wish to call in via telephone to ask a question,

please dial the number below at least five minutes before the

scheduled start time:

Toll-Free number: 877-407-0832 International number:

201-689-8433 Conference ID number: 13748469

About Digimarc

Digimarc Corporation (NASDAQ: DMRC) is the pioneer and global

leader in digital watermarking technologies. For nearly 30 years,

Digimarc innovations and intellectual property in digital

watermarking have been deployed at a massive scale for the

identification and the authentication of physical and digital

items. A notable example is our partnership with a consortium of

the world’s central banks to deter counterfeiting of global

currency. Digimarc is also instrumental in supporting global

industry standards efforts spanning both the physical and digital

worlds. In 2023, Digimarc was named to the Fortune 2023 Change the

World list and honored as a 2023 Fast Company World Changing Ideas

finalist. Learn more at Digimarc.com.

Forward-Looking Statements

Except for historical information contained in this release, the

matters described in this release contain various “forward-looking

statements.” These forward-looking statements include statements

identified by terminology such as “will,” “should,” “expects,”

“estimates,” “predicts” and “continue” or other derivations of

these or other comparable terms, and include, among others,

statements regarding the impact of business restructuring and cost

control initiatives and the estimated amounts and timing of

anticipated cost reductions. These forward-looking statements are

statements of management’s opinion and are subject to various

assumptions, risks, uncertainties and changes in circumstances.

Actual results may vary materially from those expressed or implied

from the statements in this release as a result of changes in

economic, business and regulatory factors, including, without

limitation, the terms and timing of anticipated contract renewals.

More detailed information about risk factors that may affect actual

results are outlined in the company’s Form 10-K for the year ended

December 31, 2023, and in subsequent periodic reports filed with

the SEC. Readers are cautioned not to place undue reliance on these

forward-looking statements, which reflect management’s opinions

only as of the date of this release. Except as required by law,

Digimarc undertakes no obligation to publicly update or revise any

forward-looking statements to reflect events or circumstances that

may arise after the date of this release.

Non-GAAP Financial Measures

This release contains the following non-GAAP financial measures:

Non-GAAP gross profit, Non-GAAP gross profit margin, Non-GAAP

operating expenses, Non-GAAP net loss, Non-GAAP loss per share

(diluted), and free cash flow. See below for a reconciliation of

each non-GAAP financial measure to the most directly comparable

GAAP financial measure. These non-GAAP financial measures are an

important measure of our operating performance because they allow

management, investors and analysts to evaluate and assess our core

operating results from period-to-period after removing non-cash and

non-recurring activities that affect comparability. Our management

uses these non-GAAP financial measures in evaluating its financial

and operational decision making and as a means to evaluate

period-to-period comparisons.

Digimarc believes that providing these non-GAAP financial

measures, together with the reconciliation to GAAP, helps

management and investors make comparisons between us and other

companies. In making any comparisons to other companies, investors

need to be aware that companies use different non-GAAP measures to

evaluate their financial performance. Investors should pay close

attention to the specific definition being used and to the

reconciliation between such measures and the corresponding GAAP

measures provided by each company under applicable SEC rules. These

non-GAAP financial measures are not measurements of financial

performance or liquidity under GAAP. In order to facilitate a clear

understanding of its consolidated historical operating results,

investors should examine Digimarc’s non-GAAP financial measures in

conjunction with its historical GAAP financial information, and

investors should not consider non-GAAP financial measures in

isolation or as substitutes for performance measures calculated in

accordance with GAAP. Non-GAAP financial measures should be viewed

as supplemental to, and should not be considered as alternatives

to, GAAP financial measures. Non-GAAP financial measures may not be

indicative of the historical operating results of the Company nor

are they intended to be predictive of potential future results.

Digimarc Corporation

Consolidated Income Statement

Information

(in thousands, except per

share amounts)

(Unaudited)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

Revenue:

Subscription

$

5,024

$

5,599

$

22,418

$

18,973

Service

3,634

3,685

16,000

15,878

Total revenue

8,658

9,284

38,418

34,851

Cost of revenue:

Subscription (1)

754

711

2,959

2,975

Service (1)

1,490

1,631

6,628

7,252

Amortization expense on acquired

intangible assets

1,147

1,113

4,592

4,459

Total cost of revenue

3,391

3,455

14,179

14,686

Gross profit

Subscription (1)

4,270

4,888

19,459

15,998

Service (1)

2,144

2,054

9,372

8,626

Amortization expense on acquired

intangible assets

(1,147

)

(1,113

)

(4,592

)

(4,459

)

Total gross profit

5,267

5,829

24,239

20,165

Gross profit margin:

Subscription (1)

85

%

87

%

87

%

84

%

Service (1)

59

%

56

%

59

%

54

%

Total

61

%

63

%

63

%

58

%

Operating expenses:

Sales and marketing

4,378

5,639

21,167

22,409

Research, development and engineering

6,336

6,282

26,209

26,577

General and administrative

3,378

4,659

17,073

18,071

Amortization expense on acquired

intangible assets

274

265

1,097

1,065

Impairment of lease right of use assets

and leasehold improvements

—

—

—

250

Total operating expenses

14,366

16,845

65,546

68,372

Operating loss

(9,099

)

(11,016

)

(41,307

)

(48,207

)

Other income, net

473

582

2,341

2,452

Loss before income taxes

(8,626

)

(10,434

)

(38,966

)

(45,755

)

Provision for income taxes

(22

)

(139

)

(44

)

(204

)

Net loss

$

(8,648

)

$

(10,573

)

$

(39,010

)

$

(45,959

)

Loss per share:

Loss per share — basic

$

(0.40

)

$

(0.52

)

$

(1.83

)

$

(2.26

)

Loss per share — diluted

$

(0.40

)

$

(0.52

)

$

(1.83

)

$

(2.26

)

Weighted average shares outstanding —

basic

21,480

20,369

21,261

20,322

Weighted average shares outstanding —

diluted

21,480

20,369

21,261

20,322

_______________

(1) Cost of revenue, Gross profit and

Gross profit margin for Subscription and Service excludes

amortization expense on acquired intangible assets.

Digimarc Corporation

Reconciliation of GAAP to

Non-GAAP Financial Measures

(in thousands, except per

share amounts)

(Unaudited)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

GAAP gross

profit

$

5,267

$

5,829

$

24,239

$

20,165

Amortization of acquired intangible

assets

1,147

1,113

4,592

4,459

Amortization and write-off of other

intangible assets

134

140

544

573

Stock-based compensation

143

260

706

1,126

Non-GAAP gross profit

$

6,691

$

7,342

$

30,081

$

26,323

Non-GAAP gross profit margin

77

%

79

%

78

%

76

%

GAAP operating

expenses

$

14,366

$

16,845

$

65,546

$

68,372

Depreciation and write-off of property and

equipment

(158

)

(210

)

(728

)

(1,121

)

Amortization of acquired intangible

assets

(274

)

(265

)

(1,097

)

(1,065

)

Amortization and write-off of other

intangible assets

(35

)

(117

)

(276

)

(393

)

Amortization of lease right of use assets

under operating leases

(95

)

(91

)

(358

)

(517

)

Stock-based compensation

(1,947

)

(2,752

)

(9,323

)

(10,032

)

Impairment of lease right of use assets

and leasehold improvements

—

—

—

(250

)

Non-GAAP operating expenses

$

11,857

$

13,410

$

53,764

$

54,994

GAAP net

loss

$

(8,648

)

$

(10,573

)

$

(39,010

)

$

(45,959

)

Total adjustments to gross profit

1,424

1,513

5,842

6,158

Total adjustments to operating

expenses

2,509

3,435

11,782

13,378

Non-GAAP net loss

$

(4,715

)

$

(5,625

)

$

(21,386

)

$

(26,423

)

GAAP loss per share

(diluted)

$

(0.40

)

$

(0.52

)

$

(1.83

)

$

(2.26

)

Non-GAAP net loss

$

(4,715

)

$

(5,625

)

$

(21,386

)

$

(26,423

)

Non-GAAP loss per share (diluted)

$

(0.22

)

$

(0.28

)

$

(1.01

)

$

(1.30

)

Free cash

flow

Cash flows from operating activities

$

(4,235

)

$

(5,316

)

$

(26,572

)

$

(21,995

)

Purchase of property and equipment

(13

)

(106

)

(212

)

(314

)

Capitalized patent costs

(118

)

(131

)

(431

)

(426

)

Free cash flow

$

(4,366

)

$

(5,553

)

$

(27,215

)

$

(22,735

)

Digimarc Corporation

Consolidated Balance Sheet

Information

(in thousands)

(Unaudited)

December 31,

December 31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents (1)

$

12,365

$

21,456

Marketable securities (1)

16,365

5,726

Trade accounts receivable, net

6,412

5,813

Other current assets

4,189

4,085

Total current assets

39,331

37,080

Property and equipment, net

1,040

1,570

Intangibles, net

22,191

28,458

Goodwill

8,532

8,641

Lease right of use assets

3,659

4,017

Other assets

1,013

786

Total assets

$

75,766

$

80,552

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable and other accrued

liabilities

$

5,118

$

6,672

Deferred revenue

4,020

5,853

Total current liabilities

9,138

12,525

Long-term lease liabilities

5,213

5,994

Other long-term liabilities

56

106

Total liabilities

14,407

18,625

Shareholders’ equity:

Preferred stock

50

50

Common stock

21

20

Additional paid-in capital

415,049

376,189

Accumulated deficit

(350,778

)

(311,768

)

Accumulated other comprehensive loss

(2,983

)

(2,564

)

Total shareholders’ equity

61,359

61,927

Total liabilities and shareholders’

equity

$

75,766

$

80,552

_______________

(1) Aggregate cash, cash equivalents, and

marketable securities was $28.7 million and $27.2 million at

December 31, 2024 and 2023, respectively.

Digimarc Corporation

Consolidated Cash Flow

Information

(in thousands)

(Unaudited)

Year Ended

December 31,

2024

2023

Cash flows from operating activities:

Net loss

$

(39,010

)

$

(45,959

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and write-off of property and

equipment

728

1,121

Amortization of acquired intangible

assets

5,689

5,524

Amortization and write-off of other

intangible assets

820

966

Amortization of lease right of use assets

under operating leases

358

517

Stock-based compensation

10,029

11,158

Impairment of lease right of use assets

and leasehold improvements

—

250

Increase (decrease) in allowance for

doubtful accounts

17

20

Changes in operating assets and

liabilities:

Trade accounts receivable

(687

)

(335

)

Other current assets

(128

)

2,200

Other assets

(156

)

299

Accounts payable and other accrued

liabilities

(1,608

)

660

Deferred revenue

(1,838

)

1,627

Lease liability and other long-term

liabilities

(786

)

(43

)

Net cash provided by (used in) operating

activities

(26,572

)

(21,995

)

Cash flows from investing activities:

Purchase of property and equipment

(212

)

(314

)

Capitalized patent costs

(431

)

(426

)

Proceeds from maturities of marketable

securities

22,555

27,664

Purchases of marketable securities

(33,194

)

(14,363

)

Net cash provided by (used in) investing

activities

(11,282

)

12,561

Cash flows from financing activities:

Issuance of common stock, net of issuance

costs

32,218

—

Purchase of common stock

(3,416

)

(2,724

)

Repayment of loans

(37

)

(36

)

Net cash provided by (used in) financing

activities

28,765

(2,760

)

Effect of exchange rate on cash

(2

)

52

Net increase (decrease) in cash and cash

equivalents

$

(9,091

)

$

(12,142

)

Cash, cash equivalents and marketable

securities at beginning of period

27,182

52,542

Cash, cash equivalents and marketable

securities at end of period

28,730

27,182

Net increase (decrease) in cash, cash

equivalents and marketable securities

$

1,548

$

(25,360

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226021359/en/

Company Contact: Charles Beck Chief Financial Officer

Charles.Beck@digimarc.com +1 503-469-4721

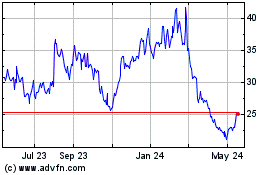

Digimarc (NASDAQ:DMRC)

Historical Stock Chart

From Jan 2025 to Feb 2025

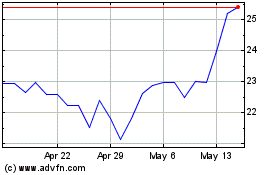

Digimarc (NASDAQ:DMRC)

Historical Stock Chart

From Feb 2024 to Feb 2025