We are offering 6,372,530 shares of our common

stock at a price of $1.02 per share, to selected institutional investors pursuant to this prospectus supplement and the accompanying prospectus

and a securities purchase agreement (the “Purchase Agreement”) with such investors. In a concurrent private placement, we

are selling to such investors warrants to purchase up to 6,372,530 shares (the “Warrants”). The

Warrants will be exercisable commencing six months after the date of their issuance, have an exercise price of $1.02 per share and will

expire five years from the initial exercise date. The Warrants and the shares of our common stock issuable upon the exercise

of the Warrants are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act of 1933, as amended (“Securities

Act”), and/or Regulation D promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the

accompanying prospectus.

We have retained WestPark Capital, Inc. (“WestPark”)

to act as placement agent in connection with the securities offered by this prospectus supplement and the accompanying prospectus. The

placement agent has agreed to use its reasonable best efforts to sell the securities offered by this prospectus supplement and the accompanying

prospectus.

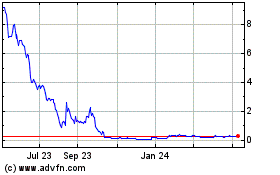

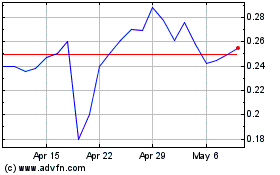

Our common stock is listed on The Nasdaq Capital

Market, or Nasdaq, under the symbol “EBET.” On February 1, 2023, the last reported sale price of our common stock on Nasdaq

was $1.36 per share. The Warrants being issued in the concurrent private placement are not listed on any securities exchange, and we do

not expect to list the Warrants.

We are an “emerging growth company”

under the federal securities laws and are subject to reduced public company reporting requirements for this prospectus and future filings.

As of February 1, 2023, the aggregate market value

of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last

sold on February 1, 2023, was $22,550,939.28, based on 17,281,573 shares of outstanding common stock as of such date, of which 16,581,573

were held by non-affiliates. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary

offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below

$75.0 million. During the 12 calendar months prior to and including the date of this prospectus, we have not sold any securities pursuant

to General Instruction I.B.6 of Form S-3.

We anticipate delivery of the shares will take

place on or about February 6, 2023, subject to the satisfaction of certain conditions.

About This Prospectus Supplement

This prospectus supplement and the accompanying

prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing

a “shelf” registration process. Each time we conduct an offering to sell securities under the accompanying prospectus we will

provide a prospectus supplement that will contain specific information about the terms of that offering, including the price, the amount

of securities being offered and the plan of distribution. The shelf registration statement on Form S-3 (File No. 333-265538) was initially

filed with the SEC on June 10, 2022, and was declared effective by the SEC on June 22, 2022. This prospectus supplement describes the

specific details regarding this offering and may add, update or change information contained in the accompanying prospectus. The accompanying

prospectus provides general information about us and our securities, some of which, such as the section entitled “Plan of Distribution,”

may not apply to this offering. This prospectus supplement and the accompanying prospectus are an offer to sell only the securities offered

hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making offers to sell or solicitations

to buy our common stock in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer

or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

If information in this prospectus supplement is

inconsistent with the accompanying prospectus or the information incorporated by reference with an earlier date, you should rely on this

prospectus supplement. This prospectus supplement, together with the base prospectus, the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus and any free writing prospectus we have authorized for use in connection with this

offering include all material information relating to this offering. We have not, and the placement agent has not, authorized anyone to

provide you with different or additional information and you must not rely on any unauthorized information or representations. You should

assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference

in this prospectus supplement and the accompanying prospectus and any free writing prospectus we have authorized for use in connection

with this offering is accurate only as of the respective dates of those documents. Our business, financial condition, results of operations

and prospects may have changed since those dates. You should carefully read this prospectus supplement, the accompanying prospectus and

the information and documents incorporated herein by reference herein and therein, as well as any free writing prospectus we have authorized

for use in connection with this offering, before making an investment decision. See “Incorporation by Reference” and “Where You Can Find More Information” in this prospectus supplement and in the accompanying prospectus.

No action is being taken in any jurisdiction outside

the United States to permit a public offering of these securities or possession or distribution of this prospectus supplement or the accompanying

prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement and the accompanying prospectus in jurisdictions

outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution

of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

This prospectus supplement and the accompanying

prospectus contain summaries of certain provisions contained in some of the documents described herein which are summaries only and are

not intended to be complete. Reference is made to the actual documents for complete information. All of the summaries are qualified in

their entirety by the full text of the actual documents, some of which have been filed or will be filed and incorporated by reference

herein. See “Where You Can Find More Information” in this prospectus supplement. We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into

this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement and the accompanying

prospectus contain and incorporate by reference certain market data and industry statistics and forecasts that are based on Company-sponsored

studies, independent industry publications and other publicly available information. Although we believe these sources are reliable, estimates

as they relate to projections involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on

various factors, including those discussed under “Risk Factors” in this prospectus supplement and the accompanying prospectus

and under similar headings in the documents incorporated by reference herein and therein. Accordingly, investors should not place undue

reliance on this information.

Unless otherwise stated or the context requires

otherwise, all references in this prospectus supplement to the “Company,” “we,” “us,” “our”,

and “EBET” refer to EBET, Inc., a Nevada corporation, and its wholly-owned subsidiaries.

Prospectus Supplement Summary

This summary highlights information contained

elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. This

summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read

this entire prospectus supplement and the accompanying prospectus carefully, including the section entitled “Risk Factors”

beginning on page S-6 and our consolidated financial statements and the related notes and the other information incorporated by reference

into this prospectus supplement and the accompanying prospectus, before making an investment decision.

Overview

We operate platforms to provide a real money online

gambling experience focused on i-gaming including casino, sportsbook and esports events. We operate under a Curacao gaming sublicense

and under a strategic partnership with Aspire Global plc (“Aspire”) allowing us to provide online betting services to various

countries around the world.

On November 29, 2021, we acquired the Business

to Consumer (“B2C”) business of Aspire. The B2C business offers a portfolio of distinctive proprietary brands focused primarily

on igaming, which is online casino and table games such as blackjack, virtual sport computer simulated games and slot machines, as well

as traditional sports betting, in the locations where we are licensed to do so, to a diverse customer base operating across regulated

markets.

Recent Developments

Credit Agreement

On November 29, 2021, we entered a credit agreement

(the “Credit Agreement”) with CP BF Lending, LLC (“Lender”), pursuant to which the Lender agreed to make a single

loan to us of $30,000,000 (the “Loan”). The Loan required us to maintain certain minimum liquidity and other financial and

other covenants. On January 31, 2023, the Lender provided us with a limited waiver of these covenants until February 17, 2023. On February

1, 2023, the Lender provided us with a further limited waiver of these covenants until April 28, 2023. We do not expect to satisfy certain

of these covenants prior to April 28, 2023 and are currently in discussions with the Lender on modifying the financial covenants, although

there is no assurance that we will be successful in making such modifications to the Loan.

Management Changes

On February 1, 2023, Mark Thorne, our Chief Marketing

Officer, resigned from his position and we have accepted such resignation which has effectively terminated his employment.

Series A Preferred Stock

On November 29, 2021, we issued 37,700 shares

of our Series A Convertible Preferred Stock (the “Preferred Stock”) for a purchase price of $1,000.00 per share. The Preferred

Stock is convertible into common Stock at an initial conversion price of $28.00 per share (“Preferred Conversion Price”);

provided that the Preferred Conversion Price is subject to anti-dilution protection upon any subsequent transaction at a price lower than

the Preferred Conversion Price then in effect. On January 31, 2023 and April 15, 2023 (the “Adjustment Dates”),

the Preferred Conversion Price was to be adjusted to the lesser of: (i) the Preferred Conversion Price in effect on the Adjustment Date,

or (ii) 85% of the average closing price of the Company’s common stock for the fifteen trading days prior to the Adjustment Date.

On January 30, 2023, the holders of a majority of the Preferred Stock approved an amendment to the terms of the Preferred Stock to: (i) extend the initial Adjustment Date from January 31, 2023 to April 28, 2023; and (ii) to extend the second Adjustment Date from April 15, 2023 to July 31, 2023; and (iii) to add a third Adjustment Date of October 31, 2023. Notwithstanding the foregoing, the adjusted Preferred Conversion Price may not be less than $0.71, unless the terms of the new adjustment dates are approved by our stockholders, as required pursuant to applicable rules and regulations of Nasdaq. We agreed to submit for a vote the approval the terms of the new adjustment dates at our next meeting of stockholders and use our reasonable best efforts to solicit our stockholders' approval of such vote. On January 31, 2023, the Amended and Restated Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Preferred Stock was filed in the State of Nevada.

On February 1, 2023, the holders of a majority

of the Preferred Stock approved an additional amendment to the terms of the Preferred Stock to amend the definition of “Exempt Issuance”

to permit the issuance of up to $10.0 million in securities (excluding amounts received upon the exercise of warrants issued in connection

with such securities) issued prior to April 28, 2023 in public or private offerings of our common stock (or common stock equivalents)

at a price per security that is not less than the “Minimum Price” as defined in Nasdaq Rule 5635(d) on the date of the offering,

which issuances may include warrant coverage in such amounts as determined by us. . On February 1, 2023, the Amended

and Restated Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Preferred Stock was filed in

the State of Nevada.

Corporate Information

Our principal executive offices are located at

3960 Howard Hughes Parkway, Suite 500, Las Vegas, NV 89169. Our website address is ebet.gg. The information on or accessible through our

website is not part of this prospectus supplement and the accompanying prospectus.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012, and we may remain an emerging company for

up to five years from the closing of our initial public offering in April 2021. For so long as we remain an emerging growth company, we

are permitted and intend to rely on certain exemptions from various public company reporting requirements, including not being required

to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section

404(b) of the Sarbanes-Oxley Act of 2002, as amended, reduced disclosure obligations regarding executive compensation in our periodic

reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and

any golden parachute payments not previously approved.

Risks Affecting Our Company

In evaluating an investment in our securities,

you should carefully read this prospectus supplement and especially consider the factors incorporated by reference in the sections titled

“Risk Factors” commencing on page S-6 of this prospectus supplement and in our accompanying prospectus and our Annual Report

on Form 10-K for the year ended September 30, 2022 incorporated by reference herein.

The Offering

| Common Stock Offered by Us |

6,372,530 shares of common stock (the “Shares”). |

| |

|

| Common Stock to be Outstanding After this Offering |

23,654,103, assuming no exercise of the Warrants issued in the concurrent private placement. |

| |

|

| Concurrent Offering |

In a concurrent private placement, we are selling to the investors of shares of our common stock in this offering Warrants to purchase up to 6,372,530 shares of common stock, which represent 100% of the number of shares of our common stock being purchased in this offering. We will receive gross proceeds from the concurrent private placement transaction solely to the extent such warrants are exercised for cash. The warrants will be exercisable at any time after the six-month anniversary of the issuance date at an exercise price of $1.02 per share and will expire five years from the initial exercise date of the warrants. The Warrants and the shares of our common stock issuable upon the exercise of the warrants are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. See “Private Placement of Warrants” on page S-10 of this prospectus supplement for a more complete description of the concurrent offering. |

| |

|

| Use of Proceeds |

We expect to receive net proceeds of approximately $5.9 million from this offering, excluding the proceeds, if any, for the exercise of the Warrants issued in the concurrent private placement, after deducting the placement agent’s fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” on page S-9 of the prospectus supplement for a more complete description of the intended use of proceeds from this offering. |

| |

|

| Lock-Up Agreements |

Subject to certain exceptions, we have agreed not to (i) issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of our common stock (or securities convertible into or exercisable for our common stock), (ii) file any registration statement or any amendment or supplement (other than the prospectus supplement, registration statement or amendment to the registration statement relating to the securities offered hereunder), (iii) complete any offering of debt securities, (iv) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of capital stock of, whether any such transaction described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of shares of capital stock or such other securities, in cash or otherwise or (v) enter into a Variable Rate Transaction (as defined in the Placement Agent Agreement (as defined herein)) until 90 days after the closing date of this offering. |

| Risk Factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement and the risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus. |

| |

|

| Nasdaq Capital Market Symbol |

EBET. |

The number of shares of common stock expected to be outstanding after this offering is based on 17,281,573 shares of common stock outstanding as of February 2, 2023 and excludes, as of that date, the following:

| |

· |

1,798,750 shares of common stock issuable upon the exercise of outstanding vested and unvested stock options at a weighted average exercise price of $1.81 per share; |

| |

|

|

| |

· |

6,691,276 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average exercise price of $6.83 per share; |

| |

|

|

| |

· |

434,625 shares of common stock issuable upon the vesting of restricted stock units; |

| |

|

|

| |

· |

4,412,324 shares of common stock issuable upon the conversion of convertible notes and accrued interest in the amount of

$6,507,838 at a weighted average conversion price of $2.87 per share; |

| |

|

|

| |

· |

1,563,689 shares of our common stock issuable upon the conversion of 37,700 shares of Preferred

Stock; |

| |

|

|

| |

· |

up to an aggregate of 2,271,231 shares of common stock reserved for future issuance under our 2020 Stock Plan, as amended; and |

| |

|

|

| |

· |

6,372,530 shares of our common stock issuable upon the exercise of the Warrants offered in the concurrent private placement. |

Risk Factors

An investment in our securities involves risks.

We urge you to consider carefully the risks described below, and in the documents incorporated by reference in this prospectus supplement

and the accompanying prospectus, before making an investment decision, including those risks identified under “Item IA. Risk Factors”

in our Annual Report on Form 10-K for the year ended September 30, 2022, as amended, which is incorporated by reference in this prospectus

supplement and which may be amended, supplemented or superseded from time to time by other reports that we subsequently file with the

SEC. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed.

This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also

read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements”.

Risks Related to this Offering

You will experience immediate and substantial

dilution in the book value per Share of the common stock you purchase in the offering.

Because the public offering price per Share being

offered is substantially higher than the net tangible book value per share of our outstanding common stock, you will suffer immediate

and substantial dilution in the net tangible book value of the common stock you purchase in this offering. After giving effect to the

sale of 6,372,530 Shares in this offering at the public offering price of $1.02 per Share, and after deducting placement agent fees and

estimated offering expenses, our as adjusted net tangible book value as of September 30, 2022 would have been approximately $16.6 million,

or approximately $0.72 per Share. This represents an immediate increase in net tangible book value of approximately $0.08 per Share to

our existing stockholders and an immediate dilution in as adjusted net tangible book value of approximately $0.30 per Share to purchasers

of the Shares in this offering. See “Dilution” on page S-9 of this prospectus supplement for a more detailed discussion of

the dilution you will incur if you purchase Shares in this offering.

In addition, we may choose to raise additional

capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating

plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these

securities could result in further dilution to our stockholders or result in downward pressure on the price of our common stock.

Our management will have broad discretion over

the use of the net proceeds from this offering, you may not agree with how we use the proceeds, and the proceeds may not be invested successfully.

Our management will have broad discretion in the

application of the net proceeds from this offering, and our stockholders will not have the opportunity as part of their investment decision

to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine

our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure

by our management to apply these funds effectively could harm our business. See “Use of Proceeds” on page S-9 of this prospectus

supplement for a description of our proposed use of proceeds from this offering.

We will require additional capital funding,

the receipt of which may impair the value of our common stock.

Our future capital requirements depend on many

factors. We will need to raise additional capital through public or private equity or debt offerings to continue to expand our business.

There can be no assurance that additional capital will be available when needed or on terms satisfactory to us, if at all. To the extent

we raise additional capital by issuing equity securities, our stockholders may experience substantial dilution and the new equity securities

may have greater rights, preferences or privileges than our existing common stock.

Our stock price is and may continue to be volatile

and you may not be able to resell our securities at or above the price you paid.

The market price for our common stock is volatile

and may fluctuate significantly in response to a number of factors, most of which we cannot control, such as quarterly fluctuations in

financial results or changes in securities analysts’ recommendations could cause the price of our stock to fluctuate substantially.

Each of these factors, among others, could harm your investment in our common stock and could result in your being unable to resell the

common stock that you purchase at a price equal to or above the price you paid. The stock market in general has experienced extreme volatility

that has often been unrelated to the operating performance of particular companies.

If securities or industry analysts do not publish

research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock depends

in part on the research and reports that securities or industry analysts publish about us or our business. If one or more of the analysts

who covers us downgrades our stock or publishes inaccurate or unfavorable research about our business, our stock price may decline. If

one or more of these analysts ceases coverage of our company or fails to publish reports on us regularly, demand for our stock could decrease,

which might cause our stock price and trading volume to decline.

We do not intend to pay dividends in the foreseeable

future.

We have never paid cash dividends on our common

stock and currently do not plan to pay any cash dividends in the foreseeable future. We expect to retain future earnings, if any, to fund

the development and growth of our business. Any future determination to pay dividends on our common stock will be at the discretion of

our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements

and any contractual restrictions. As such investors in our common stock should not expect to receive dividend income on their investment,

and investors will be dependent on the appreciation of our common stock, if any, to earn a return on their investment.

Cautionary Note Regarding Forward-Looking Statements

This prospectus supplement, the accompanying prospectus

and the documents we have filed with the SEC that are incorporated by reference herein and therein contain forward-looking statements

within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Forward-looking statements concern our current plans, intentions, beliefs, expectations and statements of future economic

performance. Statements containing terms such as “will,” “may,” “believe,” “do not believe,”

“plan,” “expect,” “intend,” “estimate,” “anticipate” and other phrases of

similar meaning are considered to be forward-looking statements.

Forward-looking statements include, but are not

limited to, statements about:

| · | our ability to successfully integrate our asset acquisitions; |

| · | our ability to obtain additional funding to develop additional services and offerings and to service our

debt obligations; |

| · | compliance with obligations under intellectual property licenses with third parties; |

| · | market acceptance of our new offerings; |

| · | competition from existing online offerings or new offerings that may emerge; |

| · | our ability to establish or maintain collaborations, licensing or other arrangements; |

| · | our ability and third parties’ abilities to protect intellectual property rights; |

| · | our ability to adequately support future growth; and |

| · | our ability to attract and retain key personnel to manage our business effectively. |

Forward-looking statements are based on our assumptions

and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those reflected

in or implied by these forward-looking statements. Factors that might cause actual results to differ include, among others, those set

forth under “Risk Factors” in this prospectus supplement and those discussed in “Management’s Discussion and Analysis

of Financial Condition and Results of Operation” in our most recent Annual Report on Form 10-K, as amended, and in our future reports

filed with the SEC, all of which are incorporated by reference herein. Readers are cautioned not to place undue reliance on any forward-looking

statements contained in this prospectus supplement, the accompanying prospectus or the documents we have filed with the SEC that are incorporated

by reference herein and therein, which reflect management’s views and opinions only as of their respective dates. We assume no obligation

to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking

statements, except to the extent required by applicable securities laws.

You should carefully read this prospectus supplement,

the accompanying prospectus and the information incorporated herein by reference as described under the heading “Incorporation of Documents by Reference,” and the documents that we reference in this prospectus supplement and the accompanying prospectus and have

filed as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus are a part with the

understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we

expect. We qualify all of our forward-looking statements by these cautionary statements.

Use of Proceeds

We estimate that the net proceeds from this offering

will be approximately $5.9 million, after deducting the estimated placement agent fees and estimated offering expenses payable by us and

excluding the proceeds from the exercise of the Warrants, if any. We will only receive additional proceeds from the exercise of the Warrants

issuable in connection with the private placement if the Warrants are exercised and the holders of such Warrants pay the exercise price

in cash upon such exercise.

We intend to use the net proceeds from this offering

for general corporate purposes. Amounts and timing of our actual expenditures will depend on numerous factors. Our management will have

broad discretion in applying the net proceeds from this offering.

Pending application of the net proceeds as described

above, we intend to invest the proceeds to us in investment-grade, interest-bearing securities such as money market funds, certificates

of deposit, or direct or guaranteed obligations of the U.S. government, or hold as cash. We cannot predict whether the proceeds invested

will yield a favorable, or any, return.

Dividend Policy

We have never declared or paid any cash dividends on our capital stock,

and we do not currently intend to pay any cash dividends on our common stock for the foreseeable future. We expect to retain future earnings,

if any, to fund the development and growth of our business. Any future determination to pay dividends on our common stock will be at the

discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital

requirements and any contractual restrictions.

Dilution

If you invest in our securities in this offering,

your ownership interest will be diluted immediately to the extent of the difference between the public offering price per Share and the

as adjusted net tangible book value per share of our common stock immediately after this offering.

Our net tangible book value as of September 30,

2022 was approximately $10.6 million, or approximately $0.64 per share. Net tangible book value is determined by subtracting our total

liabilities from our total tangible assets, and net tangible book value per share is determined by dividing our net tangible book value

by the number of shares of our common stock outstanding. After giving effect to the sale of 6,372,530 Shares in this offering at the public

offering price of $1.02 per Share, and after deducting the placement agent fees and estimated offering expenses payable by us, our as

adjusted net tangible book value as of September 30, 2022 would have been approximately $16.5 million, or approximately $0.72 per share.

This represents an immediate increase in net tangible book value of approximately $0.08 per share to our existing stockholders and an

immediate dilution of approximately $0.30 per share to new investors participating in this offering. The following table illustrates this

dilution on a per share basis:

| Public offering price per Share | |

| | | $ |

1.02 |

| Historical net tangible book value per share as of September 30, 2022 | |

$ | 0.64 | |

| Increase in net tangible value per share attributable to this offering | |

$ | 0.08 | |

| As adjusted net tangible book value per share after giving effect to this offering | |

| | | $ |

0.72 |

| Dilution per Share to new investors participating in this offering | |

| | | $ |

0.30 |

The above discussion and table are based on 16,654,573

shares of common stock outstanding as of September 30, 2022 and excludes each of the following as of September 30, 2022:

| · | 1,977,000 shares of common stock issuable upon the exercise of vested and unvested outstanding stock options,

at a weighted average exercise price of $2.25 per share; |

| · | 6,033,365 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average

exercise price of $9.62 per share; |

| · | 461,625 shares of common stock issuable upon the vesting of restricted stock units; |

| · | 3,615,676 shares of common stock issuable upon the conversion of convertible notes and accrued

interest in the amount of $1,807,838 at a weighted average conversion price of $0.50 per share; |

| · | 1,510,806 shares of our common stock issuable upon the conversion of 37,700 shares of Preferred Stock; |

| · | up to an aggregate of 2,092,981 shares of common stock reserved for future issuance under our 2020 Stock

Plan, as amended; and |

| · | 6,372,530 shares of our common stock issuable upon the exercise of the Warrants offered in the concurrent

private placement. |

The above illustration of dilution per share to

investors participating in this offering assumes no exercise or conversion of the securities described above. The exercise or conversion

of any of the securities described above, having an exercise or conversion price less than the public offering price would increase dilution

to investors participating in this offering. In addition, we may choose to raise additional capital depending on market conditions, our

capital requirements and strategic considerations, even if we believe we have sufficient funds for our current or future operating plans.

To the extent that additional capital is raised through our sale of equity or convertible debt securities, the issuance of these securities

could result in further dilution to our stockholders.

Private Placement of Warrants

Concurrently with the closing of the sale of Shares

of common stock in this offering, we also expect to issue and sell to the investors, Warrants to purchase an aggregate of up to 6,372,530

shares of our common stock, at an initial exercise price equal to $1.02 per share.

Each Warrant shall be initially exercisable after

the six-month anniversary of the issuance date and have a term of exercise equal to five years from the initial exercise date. Subject

to limited exceptions, a holder of Warrants will not have the right to exercise any portion of its Warrants if the holder, together with

its affiliates, would beneficially own in excess of 4.99% (or, at the election of the purchaser prior to issuance of the Warrants, 9.99%)

of the number of shares of our common stock outstanding immediately after giving effect to such exercise. A holder may increase or decrease

the beneficial ownership limitation up to 19.99%, provided, however, that any increase in the beneficial ownership limitation shall not

be effective until 61 days following notice of such change to the Company.

In the event of a Fundamental Transaction (as

defined in the Warrant), we or any successor entity shall, at the holder’s option, purchase the holder’s Warrants for an amount

of cash equal to the value of the Warrants as determined in accordance with the Black Scholes Value (as defined in the Warrant), provided

that if the Fundamental Transaction is not within our control, including not approved by our Board of Directors, a holder shall only be

entitled to receive the same type or form of consideration at the Black Scholes Value of the unexercised portion of the Warrant, that

is being offered and paid to the holders of our common stock in connection with the Fundamental Transaction.

Such securities will be issued and sold without

registration under the Securities Act, or state securities laws, in reliance on the exemptions provided by Section 4(a)(2) of the Act

and/or Regulation D promulgated thereunder and in reliance on similar exemptions under applicable state laws. Accordingly, the investor

may exercise those Warrants and sell the underlying shares only pursuant to an effective registration statement under the Securities Act

covering the resale of those shares, an exemption under Rule 144 under the Securities Act, or another applicable exemption under the Securities

Act. We have agreed to file a registration statement with the SEC registering the resale of the

shares of common stock underlying the Warrants as soon as practicable (and in any event within 45 calendar days of the date of the Purchase

Agreement).

Plan of Distribution

WestPark Capital, Inc. has agreed to act as our

exclusive placement agent in connection with this offering subject to the terms and conditions of the placement agent agreement dated

February 2, 2023 (the “Placement Agent Agreement”). The placement agent is not purchasing or selling any of the securities

offered by this prospectus supplement, nor are they required to arrange the purchase or sale of any specific number or dollar amount of

securities, but will use its reasonable best efforts to arrange for the sale of the Shares of common stock offered by this prospectus

supplement. We have entered into Purchase Agreements directly with investors in connection with this offering and we may not sell the

entire amount of securities offered pursuant to this prospectus supplement. We will make offers only to a limited number of qualified

institutional and accredited investors. The placement agent may retain sub-agents and selected dealers in connection with this offering.

We have agreed to indemnify the placement agent

against specified liabilities, including liabilities under the Securities Act and the Exchange Act, and to contribute to payments the

placement agent may be required to make in respect thereof.

The placement agent may be deemed to be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by the placement agent and any profit realized

on the resale of the securities sold by the placement agent while acting as principal might be deemed to be underwriting discounts or

commissions under the Securities Act. As underwriters, the placement agent would be required to comply with the requirements of the Securities

Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under

the Exchange Act. These rules and regulations may limit the timing of purchases and sales of securities by the placement agent acting

as principal. Under these rules and regulations, the placement agent:

| § | may not engage in any stabilization activity in connection with our securities; and |

| § | may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our

securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

Fees and Expenses

We have agreed to pay the placement agent a cash

fee equal to 7.0% of the gross proceeds we receive from the sale of securities in this offering. In addition, we have agreed to pay to

the placement agent a cash fee equal to 1.0% of the gross proceeds we receive from the sale of securities in this offering for non-accountable

expenses. We will also pay the placement agent up to $50,000 fees and other expenses.

Discretionary Accounts

The placement agent does not intend to confirm

sales of the securities offered hereby to any accounts over which it has discretionary authority.

Lock-Up Agreements

Our directors and officers have entered into lock-up

agreements. Under these agreements, these individuals agreed, subject to specified exceptions, not to sell or transfer any shares of our

common stock or securities convertible into, or exchangeable or exercisable for, our common stock during a period ending 90 days after

the closing date of this offering, without first obtaining the written consent of the placement agent.

In addition, subject to certain exceptions, we

have agreed not to (i) issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of our common

stock (or securities convertible into or exercisable for our common stock), (ii) file any registration statement or any amendment or supplement

(other than the prospectus supplement, registration statement or amendment to the registration statement relating to the securities offered

hereunder), (iii) complete any offering of debt securities, (iv) enter into any

swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of capital stock

of, whether any such transaction described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of shares of capital

stock or such other securities, in cash or otherwise or (v) enter into a Variable Rate Transaction (as defined in the Placement Agent

Agreement) until 90 days after the closing date of this offering.

Other Relationships

The placement agent or its affiliates have in

the past and may in the future engage in transactions with, and may perform, from time to time, investment banking and advisory services

for us in the ordinary course of their business and for which they have in the past and may in the future receive customary fees and expenses.

In the ordinary course of its various business

activities, the placement agent and certain of its respective affiliates may make or hold a broad array of investments and actively trade

debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and

for the accounts of its customers, and such investment and securities activities may involve securities and/or instruments issued by us

and our affiliates. If the placement agent or its respective affiliates have a lending relationship with us, they routinely hedge their

credit exposure to us consistent with their customary risk management policies. The placement agent and its respective affiliates may

hedge such exposure by entering into transactions that consist of either the purchase of credit default swaps or the creation of short

positions in our securities or the securities of our affiliates, including potentially the securities offered hereby. Any such short positions

could adversely affect future trading prices of the securities offered hereby. The placement agent and certain of its respective affiliates

may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research

views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short

positions in such securities and instruments.

Legal Matters

The validity of the securities offered hereby

will be passed upon for us by ArentFox Schiff LLP, Washington, DC. Sheppard, Mullin, Richter & Hampton, LLP, New York, New York, is

acting as counsel for the placement agent in connection with this offering.

Experts

The audited financial statements as

of September 30, 2022, and the related consolidated statements of operations, shareholders’ equity and cash flows for the year ended

September 30, 2022, incorporated by reference in this prospectus and elsewhere in the registration statement have been incorporated

by reference in reliance upon the report of BF Borgers CPA PC, independent registered public accountants, upon the authority of said firm

as experts in accounting and auditing.

The audited financial statements as

of September 30, 2021, and the related consolidated statements of operations, shareholders’ equity and cash flows for the year ended

September 30, 2021, incorporated by reference in this prospectus and elsewhere in the registration statement have been incorporated

by reference in reliance upon the report of PWR CPA, LLP, independent registered public accountants, upon the authority of said firm as

experts in accounting and auditing.

Incorporation by Reference

The SEC allows us to “incorporate by reference”

into this prospectus supplement the information we file with it, which means that we can disclose important information to you by referring

you to those documents. Later information filed with the SEC will update and supersede this information.

The following documents are incorporated by reference

into this prospectus supplement:

| · | Our Annual Report on Form 10-K for the year ended September 30, 2022 filed on January 13, 2023; |

| | |

| · | Our amendment to our Annual Report on Form 10-K/A for the year ended September 30, 2022 filed on January

27, 2023; |

| | |

| · | Our Current Reports on Form 8-K filed with the SEC on October 6, 2022; November 4, 2022; November 23,

2022; December 6, 2022; December 22, 2022; January 3, 2023; February 1, 2023; and February 2, 2023, in each case to the extent the information

in such reports is filed and not furnished; and |

| | |

| · | the description of our common stock, par value $0.001 per share, contained in our Registration Statement

on Form 8-A, dated and filed with the SEC on April 14, 2021, and any amendment or report filed with the SEC for the purpose of updating

the description. |

An updated description of our capital stock is

included in the accompanying prospectus under “Description of Common Stock” and “Description of Preferred Stock”.

We also incorporate by reference into this prospectus

supplement all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form

that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i)

after the date of the filing of this prospectus supplement, or (ii) after the date of this prospectus supplement but prior to the termination

of the offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K, as well as information and proxy statements.

We will provide to each person, including any

beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no cost to the requester, a copy of any and all

of the information that is incorporated by reference in this prospectus, including exhibits which are specifically incorporated by reference

into such documents. You may request a copy of these filings, at no cost, by contacting us at:

EBET, Inc.

Attn: Corporate Secretary

3960 Howard Hughes Parkway, Suite 500

Las Vegas, NV 89169

Telephone: (888) 411-2726

Any statement contained herein or in a document

incorporated or deemed to be incorporated by reference into this document will be deemed to be modified or superseded for purposes of

the document to the extent that a statement contained in this document or any other subsequently filed document that is deemed to be incorporated

by reference into this document modifies or supersedes the statement.

Where You Can Find More Information

This prospectus supplement and the accompanying

prospectus are part of a registration statement on Form S-3 we filed with the SEC under the Securities Act and do not contain all the

information set forth or incorporated by reference in the registration statement. Whenever a reference is made in this prospectus supplement

or the accompanying prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should

refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by

reference into this prospectus supplement or the accompanying prospectus for a copy of such contract, agreement or other document. Because

we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy

statements and other information with the SEC. You may read and copy information filed by us with the SEC at the SEC’s public reference

section, 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operation of the public reference section can be obtained

by calling 1-800-SEC-0330. The SEC also maintains an Internet site at http://www.sec.gov that contains reports, statements and other information

about issuers, such as us, who file electronically with the SEC.

$100,000,000

EBET, Inc.

Common

Stock

Preferred

Stock

Debt

Securities

Warrants

Units

____________________

We

may from time to time issue up to $100,000,000 aggregate dollar amount of common stock, preferred stock, debt securities, warrants or

units of securities consisting of some or all of these securities, in any combination, together or separately, in one or more offerings,

in amounts, at prices and on the terms determined at the time of the offering. We will specify in the accompanying prospectus supplement

the terms of the securities to be offered and sold. We may sell these securities directly to you, through underwriters, dealers or agents

we select, or through a combination of these methods. We will describe the plan of distribution for any particular offering of these

securities in the applicable prospectus supplement.

This

prospectus may not be used to consummate a sale of any securities unless it is accompanied by a prospectus supplement.

Our

common stock is listed on The NASDAQ Capital Market and is traded under the symbol “EBET”. On June 8, 2022, the closing price

of the common stock, as reported on NASDAQ, was $4.27 per share.

As

of June 9, 2022, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $75.7 million, based

on 14,666,830 shares of outstanding common stock, of which approximately 14,166,830 shares were held by non-affiliates, and a per share

price of $5.34 based on the closing sale price of our common stock on April 19, 2022.

Investing

in our securities is highly speculative and involves a high degree of risk. You should purchase these securities only if you can

afford a complete loss of your investment. You should carefully consider the risks and uncertainties described under the heading

“Risk Factors” beginning on page 5 of this prospectus before making a decision to purchase our

securities.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date

of this prospectus is June 22, 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf”

registration process. Under this shelf registration process, we may sell the securities described in this prospectus in one or more offerings

up to a total dollar amount of $100,000,000.

We

have provided to you in this prospectus a general description of the securities we may offer. Each time we sell securities under this

shelf registration process, we will provide a prospectus supplement that will contain specific information about the terms of that offering.

That prospectus supplement may include additional risk factors or other special considerations applicable to the securities being offered.

We may also add, update or change in the prospectus supplement any of the information contained in this prospectus. To the extent there

is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information

in the prospectus supplement, provided that if a statement in any document is inconsistent with a statement in another document having

a later date - for example, a document incorporated by reference in this prospectus or any prospectus supplement - the statement in the

document having the later date modifies or supersedes the earlier statement. You should read both this prospectus and the prospectus

supplement together with the additional information described under “Where You Can Find More Information.”

THIS

PROSPECTUS MAY NOT BE USED TO CONSUMMATE A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the securities offered under this prospectus. The registration statement, including the exhibits, can be read at the SEC

website or at the SEC offices mentioned under the heading “Where You Can Find More Information.”

You

should rely only on the information incorporated by reference or provided in this prospectus and the accompanying prospectus supplement.

We have not authorized anyone to provide you with different information. We are not making an offer to sell or soliciting an offer to

buy these securities in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer

or solicitation is not qualified to do so or to anyone to whom it is unlawful to make the offer or solicitation. You should not assume

that the information in this prospectus or the accompanying prospectus supplement is accurate as of any date other than the date on the

front of the document.

Unless

the context requires otherwise, references to the “Company,” “we,” “our,” and “us,” refer

to EBET, Inc. and its subsidiaries, except that such terms refer to only EBET, Inc. and not its subsidiaries

in the sections entitled “Description of Common Stock,” “Description of Preferred Stock,” “Description of Warrants,” “Description of the Debt Securities,” and “Description of the Stock Purchase Contracts and Stock Purchase Units.”

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does not

contain all of the information you should consider before investing in our securities. You should carefully read the prospectus, the

information incorporated by reference and the registration statement of which this prospectus is a part in their entirety before investing

in our securities, including the information discussed under “Risk Factors” in this prospectus and the documents incorporated

by reference and our financial statements and notes thereto that are incorporated by reference in this prospectus. As used in this prospectus,

unless the context otherwise indicates, the terms “we,” “our,” “us,” the “Company,” or

“EBET” refer to EBET Technologies, Inc., a Nevada corporation.

OUR COMPANY

We

develop products and operate platforms to provide a real money online gambling experience focused on esports, online casino and traditional

sportsbook. We operate licensed online gambling platforms and websites which are real money betting platforms. Our mission is to define,

shape and drive growth of the current and future esports wagering ecosystem by providing advanced product, platform and marketing solutions

directly to service providers and customers. We accept wagers on major esports titles including: Counter-Strike: GO, League of Legends,

Dota 2, StarCraft 2, Rocket League, Rainbow Six, Warcraft 3, King of Glory and FIFA; as well as professional sports including the National

Football League, National Basketball Association, Major League Baseball, soccer and more.

On

November 29, 2021, we acquired the Business to Consumer (“B2C”) business of Aspire Global plc (“Aspire”). The

B2C business offers a portfolio of distinctive proprietary brands focused primarily on igaming, which is online casino and table games

such as blackjack, virtual sport computer simulated games and slot machines, as well as traditional sports betting, in the locations

where we are licensed to do so, to a diverse customer base operating across regulated markets. (See additional information on the acquisition

of the Aspire B2C business below).

Esports

is the competitive playing of video games by amateur and professional individuals and teams in competitive tournaments for cash prizes.

Although official competitions have long been a part of video game culture, participation and spectatorship of esports events have seen

a global surge in popularity over the past few years with the growth of online streaming of live esports events. As these esports matches

are widely broadcasted and watched predominately online, live betting and wagering can occur on these matches, where it is legal and

regulated.

Acquisition

of Aspire Global Plc’s Business to Consumer Business

In

order to accelerate the growth and expand market access for our esports product offerings, on November 29, 2021, we acquired Aspire’s

B2C business, for €65,000,000 paid as follows: (i) a cash amount of €50,000,000; (ii) €10,000,000, payable in accordance

with the terms of an unsecured subordinated promissory note; and (iii) 186,838 shares of our common stock, which were valued at €5,000,000.

This

acquisition expands our product offerings and increases the number of markets in which we can operate. The B2C business offers a portfolio

of distinctive proprietary brands to a diverse customer base operating across regulated markets. The B2C segment generated revenues of

€69.3 million in the twelve-month period ended September 30, 2021.

The

acquisition of Aspire’s B2C business provides the following strategic benefits:

| · | ownership

of Aspire’s portfolio of B2C proprietary online casino and sportsbook brands consisting

of Karamba, Hopa, Griffon Casino, BetTarget, Dansk777, and GenerationVIP; |

| | | |

| · | market

access for our esports products in key regulated markets including the United Kingdom, Germany,

Ireland, Malta, and Denmark, among others, allowing us to cross-sell esports wagering opportunities; |

| | | |

| · | ability

during 2022 to potentially launch additional esports focused online gaming websites that

target these additional markets; and |

| | | |

| · | enhanced

strategic partnership with Aspire that will provide the on-line gaming platform and a managed

services offering, including customer service, customer on-boarding and payment processing,

thereby ensuring operational stability and continuity. |

Our

gaming license from the Curacao Gaming Authority and the licenses made available to us from the acquisition of the Aspire B2C business

allows us to accept esports and sports wagers from residents of more than 160 jurisdictions.

CORPORATE

INFORMATION

Our

principal executive offices are located at 197 E. California Ave. Ste. 302, Las Vegas, NV 89104. Our telephone number is (888) 411-2726.

Our website address is https://ebet.gg. Information contained in, or accessible through, our website does not constitute part of

this prospectus and inclusions of our website address in this prospectus are inactive textual references only.

SECURITIES

WE MAY OFFER

With

this prospectus, we may offer common stock, preferred stock, debt securities, warrants, and/or units consisting of some or all of these

securities in any combination. The aggregate offering price of securities that we offer with this prospectus will not exceed $100,000,000.

Each time we offer securities with this prospectus, we will provide offerees with a prospectus supplement that will contain the specific

terms of the securities being offered. The following is a summary of the securities we may offer with this prospectus.

Common

Stock

We

may offer shares of our common stock, par value $0.001 per share.

Preferred

Stock

We

may offer shares of our preferred stock, par value $0.001 per share, in one or more series. Our board of directors or a committee designated

by the board will determine the dividend, voting, conversion and other rights of the series of shares of preferred stock being offered.

Each series of preferred stock will be more fully described in the particular prospectus supplement that will accompany this prospectus,

including redemption provisions, rights in the event of our liquidation, dissolution or the winding up, voting rights and rights to convert

into common stock.

Debt

Securities

We

may offer general obligations, which may be secured or unsecured, senior or subordinated and convertible into shares of our common stock

or preferred stock. In this prospectus, we refer to the senior debt securities and the subordinated debt securities together as the “debt

securities.” Our board of directors will determine the terms of each series of debt securities being offered. We will issue the

debt securities under an indenture between us and a trustee. In this document, we have summarized general features of the debt securities

from the indenture. We encourage you to read the indenture, which is an exhibit to the registration statement of which this prospectus

is a part.

Warrants

We

may offer warrants for the purchase of debt securities, shares of preferred stock or shares of common stock. We may issue warrants independently

or together with other securities. Our board of directors will determine the terms of the warrants.

Units

We

may offer units consisting of some or all of the securities described above, in any combination, including common stock, preferred stock,

warrants and/or debt securities. The terms of these units will be set forth in a prospectus supplement. The description of the terms

of these units in the related prospectus supplement will not be complete. You should refer to the applicable form of unit and unit agreement

for complete information with respect to these units.

RISK

FACTORS

Before

making an investment decision, you should consider the “Risk Factors” included under Item 1A of our most recent Annual Report

on Form 10-K and in our updates to those Risk Factors in our Quarterly Reports on Form 10-Q, all of which are incorporated by reference

in this prospectus, as updated by our future filings with the SEC. The market or trading price of our common stock could decline due

to any of these risks. In addition, please read “Forward-Looking Statements” in this prospectus, where we describe additional

uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus.

Please note that additional risks not currently known to us or that we currently deem immaterial may also impair our business and operations.

The accompanying prospectus supplement may contain a discussion of additional risks applicable to an investment in us and the particular

type of securities we are offering under that prospectus supplement.

FORWARD-LOOKING

STATEMENTS

Some

of the information in this prospectus, and the documents we incorporate by reference, contain forward-looking statements within the meaning

of the federal securities laws. You should not rely on forward-looking statements in this prospectus, and the documents we incorporate

by reference. Forward-looking statements typically are identified by use of terms such as “anticipate,” “believe,”

“plan,” “expect,” “future,” “intend,” “may,” “will,” “should,”

“estimate,” “predict,” “potential,” “continue,” and similar words, although some forward-looking

statements are expressed differently. This prospectus, and the documents we incorporate by reference, may also contain forward-looking

statements attributed to third parties relating to their estimates regarding the markets we may enter in the future. All forward-looking

statements address matters that involve risk and uncertainties, and there are many important risks, uncertainties and other factors that

could cause our actual results to differ materially from the forward-looking statements contained in this prospectus, and the documents

we incorporate by reference.

You

should also consider carefully the statements under “Risk Factors” and other sections of this prospectus, and the documents

we incorporate by reference, which address additional facts that could cause our actual results to differ from those set forth in the

forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this

prospectus, and the documents we incorporate by reference. We undertake no obligation to publicly update or review any forward-looking

statements, whether as a result of new information, future developments or otherwise.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered in this

offering. We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission.

You may read and copy the registration statement and any other documents we have filed at the Securities and Exchange Commission’s

Public Reference Room 100 F Street, N.E., Washington, D.C. 20549. Please call the Securities and Exchange Commission at 1-800-SEC-0330

for further information on the Public Reference Room. Our Securities and Exchange Commission filings are also available to the public

at the Securities and Exchange Commission’s Internet site at www.sec.gov.

This

prospectus is part of the registration statement and does not contain all of the information included in the registration statement.

Whenever a reference is made in this prospectus to any of our contracts or other documents, the reference may not be complete and, for

a copy of the contract or document, you should refer to the exhibits that are a part of the registration statement.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information we file with it, which means that we can

disclose important information to you by referring you to those documents. Later information filed with the SEC will update and supersede

this information.

The

following documents are incorporated by reference into this document:

| · |

Our Annual Report on Form

10-K for the year ended September 30, 2021 filed on December 23, 2021; |

| |

|

| · |

Our Quarterly Report on Form 10-Q for the fiscal quarters ended December

31, 2021 (filed on February 11, 2022) and March

31, 2022 (filed on May 16, 2022); |

| |

|

| · |

Our Definitive Proxy Statement on Schedule

14A filed on January 12, 2022; |

| |

|

| · |

Our Current Reports on Form 8-K filed with the SEC on October

1, 2021; November

9, 2021; December

1, 2021; January

21, 2022 (Form 8-K/A); February

14, 2022; May

5, 2022; June

6, 2022; June

8, 2022 and June

10, 2022 in each case to the extent the information in such reports is filed and not furnished; |

| |

|

| · |

the description of our common stock, par value $0.001 per share, contained in our Registration Statement

on Form

8-A, dated and filed with the SEC on April 14, 2021, and any amendment or report filed with the SEC for the purpose of updating

the description. |

An

updated description of our capital stock is included in this prospectus under “Description of Common Stock” and “Description of Preferred Stock”.

We

also incorporate by reference into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01

of Form 8-K and exhibits filed on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of the registration statement of which this prospectus

forms a part and prior to effectiveness of the registration statement, or (ii) after the date of this prospectus but prior to the

termination of the offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

We

will provide to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no

cost to the requester, a copy of any and all of the information that is incorporated by reference in this prospectus, including exhibits

which are specifically incorporated by reference into such documents. You may request a copy of these filings, at no cost, by contacting

us at:

EBET, Inc.

Attn:

Corporate Secretary

197

E. California Ave. Ste. 302

Las

Vegas, NV 89104

Telephone:

(888) 411-2726

Any

statement contained herein or in a document incorporated or deemed to be incorporated by reference into this document will be deemed

to be modified or superseded for purposes of the document to the extent that a statement contained in this document or any other subsequently

filed document that is deemed to be incorporated by reference into this document modifies or supersedes the statement.

USE OF

PROCEEDS

We

expect to use the net proceeds from the sale of securities offered by this prospectus and the prospectus supplement for working capital

and general corporate purposes. These may include additions to working capital and acquisitions.

If

we decide to use the net proceeds of any offering of securities other than for working capital and general corporate purposes, we will

describe the use of the net proceeds in the prospectus supplement for that offering.

DESCRIPTION

OF COMMON STOCK

General

We

have authorized capital stock consisting of 100,000,000 shares of common stock, par value $0.001. As of the date of this prospectus,

we have 14,666,830 shares of common stock issued and outstanding.

Shares

of our common stock have the following rights, preferences and privileges:

Voting

Each

holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders.

Any action at a meeting at which a quorum is present will be decided by a majority of the voting power present in person or represented

by proxy, except in the case of any election of directors, which will be decided by a plurality of votes cast. There is no cumulative

voting.

Dividends

Holders

of our common stock are entitled to receive dividends when, as and if declared by our board of directors out of funds legally available

for payment, subject to the rights of holders, if any, of any class of stock having preference over the common stock. Any decision to

pay dividends on our common stock will be at the discretion of our board of directors. Our board of directors may or may not determine

to declare dividends in the future. The board’s determination to issue dividends will depend upon our profitability and financial

condition any contractual restrictions, restrictions imposed by applicable law and the SEC, and other factors that our board of directors

deems relevant.

Liquidation

Rights

In

the event of a voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of our common stock will be

entitled to share ratably on the basis of the number of shares held in any of the assets available for distribution after we have paid

in full, or provided for payment of, all of our debts and after the holders of all outstanding series of any class of stock have preference

over the common stock, if any, have received their liquidation preferences in full.

Other

Our

issued and outstanding shares of common stock are fully paid and nonassessable. Holders of shares of our common stock are not entitled

to preemptive rights. Shares of our common stock are not convertible into shares of any other class of capital stock, nor are they subject

to any redemption or sinking fund provisions.

Articles

of Incorporation and Bylaw Provisions

Our

articles of incorporation and bylaws include a number of anti-takeover provisions that may have the effect of encouraging persons considering

unsolicited tender offers or other unilateral takeover proposals to negotiate with our board of directors rather than pursue non-negotiated

takeover attempts. These provisions include:

Advance

Notice Requirements. Our bylaws establish advance notice procedures with regard to stockholder proposals relating to the nomination

of candidates for election as directors or new business to be brought before meetings of stockholders. These procedures provide that

notice of stockholder proposals must be timely and given in writing to our corporate Secretary. Generally, to be timely, notice must

be received at our principal executive offices not fewer than 120 calendar days prior to the first anniversary date on which our notice

of meeting and related proxy statement were mailed to stockholders in connection with the previous year’s annual meeting of stockholders.

The notice must contain the information required by the bylaws, including information regarding the proposal and the proponent.

Special

Meetings of Stockholders. Our bylaws provide that special meetings of stockholders may be called at any time by only the Chairman

of the Board, the Chief Executive Officer, the President or the board of directors, or in their absence or disability, by any vice president.

No

Written Consent of Stockholders. Our articles of incorporation and bylaws provide that any action required or permitted to be taken