Securities Registration (foreign Private Issuer) (f-3/a)

29 October 2022 - 7:07AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on October 28, 2022

Registration No. 333-264807

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 4 TO

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

EpicQuest

Education Group International Limited

(Exact name of registrant as specified in its

charter)

Not Applicable

(Translation of registrant’s

name into English)

| British Virgin Islands |

|

Not Applicable |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

1209 N. University Blvd, Middletown, OH 45042

Tel: +1 513-649-8350

(Address and Telephone

Number of Registrant’s Principal Executive Offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

+1 302-738-6680

(Name, address, and telephone

number of agent for service)

Copies to:

Cavas Pavri, Esq.

ArentFox Schiff LLP

1717 K Street NW

Washington, DC 20006

Tel: (202)724-6847

Fax: (202) 778-6460

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

EpicQuest Education Group International Limited (the “Company”)

is filing this pre-effective Amendment No. 4 (the “Amendment”) to the Registration Statement on Form F-3 (File No. 333-264807)

as an exhibits-only filing to file Exhibits 5.1, 5.2 and 23.1. Accordingly, this Amendment consists solely of the facing page, this explanatory

note, Part II of the Registration Statement, the signature pages to the Registration Statement, the exhibit index and the filed exhibits.

The base prospectus contained in Part I of the Registration Statement is unchanged and has been omitted from this filing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 8. Indemnification of Directors and Officers

BVI law does limit the extent

to which a company’s Memorandum and Articles of Association may provide for indemnification of officers and directors. Our Memorandum

and Articles of Association provides for indemnification of its officers and directors for any liability incurred in their capacities

as such, except through their own fraud or willful default to the extent permitted under British Virgin Islands law. Indemnification is

only available to a person who acted in good faith and in what that person believed to be in the best interests of our Company.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling our Company pursuant to

the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act and is theretofore unenforceable.

A director, officer or agent

of a company formed under the BVI laws is obligated to act honestly and in good faith and exercise care, diligence and skill of a reasonably

prudent person acting in comparable circumstances. Our constitutional documents do not relieve directors, officers or agents from personal

liability arising from the management of the business of the company. Notwithstanding the foregoing, Section 132 of the BVI Business Companies

Act permits indemnification of directors, officers and agents against all expenses, including legal fees and judgments, fines and settlements,

in respect of actions related to their employment. There are no agreements that relieve directors, officer or agents from personal liability.

We intend to obtain director and officer insurance.

Item 9. Exhibits

(a) Exhibits

The following exhibits are

filed herewith or incorporated by reference in this prospectus:

| 10.3 |

|

Indemnification Escrow Agreement (incorporated by reference to exhibit 10.8 to the Form F-1 file number: 333-251342) |

| 10.4 |

|

2019 Equity Incentive Plan (incorporated by reference to exhibit 10.10 to the Form F-1 file number: 333-251342) |

| 10.5 |

|

Employment Agreement between Elite Education Group International Limited and Jianbo Zhang, dated November 1, 2021. (incorporated by reference to exhibit 99.1 to the Form 6-K filed November 5, 2021) |

| 10.6 |

|

Employment Agreement between Elite Education Group International Limited and Zhenyu Wu, dated November 1, 2021. (incorporated by reference to exhibit 99.2 to the Form 6-K filed November 5, 2021) |

| 10.7 |

|

Employment Agreement between Elite Education Group International Limited and Yunxia Xu, dated November 1, 2021. (incorporated by reference to exhibit 99.3 to the Form 6-K filed November 5, 2021) |

| 10.8 |

|

Employment Agreement between Elite Education Group International Limited and Jing Li, dated November 1, 2021. (incorporated by reference to exhibit 99.4 to the Form 6-K filed November 5, 2021) |

| 10.9 |

|

Employment Agreement between Elite Education Group International Limited and Bo Yu, dated November 1, 2021. (incorporated by reference to exhibit 99.5 to the Form 6-K filed November 5, 2021) |

| 10.10 |

|

Non-Employee Director Compensation Plan. (incorporated by reference to exhibit 99.6 to the Form 6-K filed November 5, 2021) |

| 10.11 |

|

Stock Purchase Agreement with Ameri-Can Education Group Corp, and the holders of shares of capital stock of Ameri-Can, dated November 24, 2021. (incorporated by reference to exhibit 99.1 to the Form 6-K filed December 1, 2021) |

| 10.12 |

|

Agreement Miami University and Renda Finance and Education Technology Company (incorporated by reference to exhibit 4.12 to the Form 20-F filed December 30, 2021) |

| 10.13 |

|

Share Purchase and Sale Agreement by and between Highrim Holding International Limited, Canada EduGlobal Holdings Inc. and Richmond Institute of Languages Inc., dated January 15, 2022. (incorporated by reference to exhibit 99.1 to the Form 6-K filed with the Commission on January 21, 2022) |

| 21.1 |

|

List of Subsidiaries of the Registrant. (incorporated by reference to exhibit 21.1 to the Form F-1 file number: 333-251342) |

| 23.1 |

|

Consent of ZH CPA, LLC |

| 23.2* |

|

Consent of Ogier (included in Exhibit 5.1) |

| 23.3* |

|

Consent of ArentFox Schiff LLP (included in Exhibit 5.2) |

| 24.1 |

|

Power of Attorney (previously included on signature page) |

| 25.1* |

|

Form T-1 Statement of Eligibility and Qualification under the Trust

Indenture Act of 1939, as amended, of the Trustee under the Indenture. |

| 107** |

|

Filing Fee Table |

| * |

To be filed, if applicable, by amendment, or as an exhibit to a Report of Foreign Private Issuer on Form 6-K and incorporated herein by reference. |

Item 10. Undertakings

| (a) |

The undersigned registrant hereby undertakes: |

| |

(1) |

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| |

(ii) |

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| |

(iii) |

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

provided, however, that paragraphs

(a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by

those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form

of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

| |

(2) |

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| |

(4) |

To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Securities Act of 1933 need not be furnished, provided, that the registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F-3, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Securities Act of 1933, or Item 8.A of Form 20-F if such financial statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Form F-3. |

| |

(5) |

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| |

(i) |

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| |

(ii) |

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date. |

| |

(6) |

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: |

The undersigned registrant undertakes

that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting

method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to

such purchaser:

| |

(i) |

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| |

(ii) |

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| |

(iii) |

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| |

(iv) |

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| |

(7) |

That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s Annual Report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s Annual Report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(8) |

To file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of section 310 of the Trust Indenture Act (“Act”) in accordance with the rules and regulations prescribed by the Commission under section 305(b)(2) of the Act. |

| |

(9) |

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form F-3/A and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in Winnipeg, Canada, on October 28, 2022.

| |

EpicQuest Education Group International Limited |

| |

|

|

| |

By: |

/s/ Zhenyu Wu |

| |

Name: |

Zhenyu Wu |

| |

Title: |

Chief Financial Officer |

Pursuant to the requirements of the Securities

Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and on the dates indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Zhang Jianbo |

|

Chairman, Chief Executive Officer |

|

October 28, 2022 |

| Zhang Jianbo |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Zhenyu Wu |

|

Chief Financial Officer and Director |

|

October 28, 2022 |

| Zhenyu Wu |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| * |

|

|

|

|

| Craig Wilson |

|

Independent Director |

|

October 28, 2022 |

| |

|

|

|

|

| * |

|

|

|

|

| G. Michael Pratt |

|

Independent Director |

|

October 28, 2022 |

| |

|

|

|

|

| * |

|

|

|

|

| M. Kelly Cowan |

|

Independent Director |

|

October 28, 2022 |

| By: |

/s/ Zhenyu Wu |

|

| |

Zhenyu Wu, |

|

| |

Attorney-in-fact |

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE

UNITED STATES

Pursuant to the Securities

Act of 1933, the undersigned, the duly authorized representative in the United States of the Company has signed this registration statement

or amendment thereto in Newark, Delaware on October 28, 2022.

| |

Authorized U.S. Representative |

| |

|

| |

Puglisi & Associates |

| |

850 Library Avenue, Suite 204 |

| |

Newark, DE 19711 |

| |

Tel: (302) 738-6680 |

| |

|

| |

By: |

/s/ Donald J. Puglisi |

| |

|

Name: |

Donald J. Puglisi |

| |

|

Title: |

Managing Director |

II-6

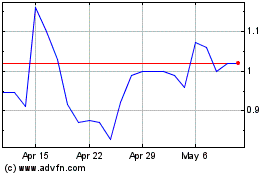

EpicQuest Education (NASDAQ:EEIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

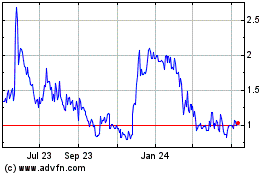

EpicQuest Education (NASDAQ:EEIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024