This prospectus is part

of a registration statement on Form F-3 that we filed with the SEC registering the securities that may be offered and sold by E-Home hereunder.

This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration

statement, the exhibits filed therewith or the documents incorporated by reference therein. For further information about us and the securities

offered hereby, reference is made to the registration statement, the exhibits filed therewith and the documents incorporated by reference

therein. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit

to the registration statement are not necessarily complete, and in each instance, we refer you to the copy of such contract or other document

filed as an exhibit to the registration statement. We are required to file reports and other information with the SEC pursuant to the

Exchange Act, including annual reports on Form 20-F and reports of foreign private issuer on Form 6-K.

The SEC maintains a website

that contains reports and other information regarding issuers, like us, that file electronically with the SEC. The address of the website

is www.sec.gov. The information on our website (www.ej111.com), other than the Company’s SEC filings, is not, and should not be,

considered part of this prospectus and is not incorporated by reference into this document.

As a foreign private

issuer, E-Home is exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements,

and E-Home’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions

contained in Section 16 of the Exchange Act. In addition, E-Home is not required under the Exchange Act to file periodic reports and financial

statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

E-Home Household Service Holdings Limited,

a Cayman Islands exempted holding company with substantially all of its operations in China, may offer, issue and sell from time to time

its ordinary shares, par value $0.0001 per share (the “Ordinary Shares”), debt securities, warrants, rights or units up to

$300,000,000 or its equivalent in any other currency, currency units, or composite currency or currencies in one or more issuances. These

securities may be sold in any combination in one or more offerings.

Throughout this prospectus, unless the context

indicates otherwise, references to “E-Home” refer to E-Home Household Service Holdings Limited, a holding company and references

to “we,” “us,” “our,” the “Company” or “our company” are to E-Home and its

consolidated subsidiaries, including E-Home Household Service Holdings Limited (Hong Kong), E-Home Household Service Technology Co.,

Ltd., E-Home (Pingtan) Home Service Co., Ltd., Fuzhou Bangchang Technology Co. Ltd., Fuzhou Yongheng Xin Electric Co., Ltd., Fujian Happiness

Yijia Family Service Co., Ltd., Yaxing Human Resource Management (Pingtan) Co., Ltd., Fuzhou Gulou Jiajiale Family Service Co., Ltd.,

Yaxing Human Resource Management (Fuzhou) Co., Ltd., Pingtan Comprehensive Experimental Area Fumao Healthcare Industry Development Co.,

Ltd., Putian YouYou Cleaning Co., Ltd. and Shenzhen Chinese Enterprises Industrial LianBao Appliance Service Co., Ltd., as a whole.

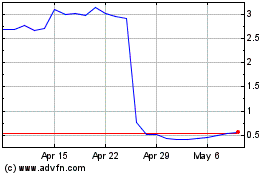

E-Home’s Ordinary Shares are listed

on the Nasdaq Capital Market under the symbol “EJH.” On June 17, 2022, the closing sale price of the Ordinary Shares, as

reported on the Nasdaq Capital Market, was $0.3209 per share. On June 17, 2022, the aggregate market value of outstanding Ordinary Shares

held by non-affiliates was approximately $19.48 million based on 42,507,745 outstanding Ordinary Shares, of which approximately 32,281,745

Ordinary Shares were held by non-affiliates, and the last sale price of Ordinary Shares as reported by the Nasdaq Capital Market of $0.6035

per share on April 22, 2022, which was the highest closing price of Ordinary Shares reported on the NASDAQ Capital Market within the

last 60 days prior to the date of this filing. E-Home Household Service Holdings Limited has not offered any Ordinary Shares pursuant

to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus.

E-Home may offer securities through underwriting

syndicates managed or co-managed by one or more underwriters, through agents, or directly to purchasers. The prospectus supplement for

each offering of securities will describe the plan of distribution for that offering. For general information about the distribution

of securities offered, please see “Plan of Distribution” in this prospectus.

The PRC government recently initiated a series

of regulatory actions and made a number of public statements on the regulation of business operations in China, including cracking down

on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest

entity (“VIE”) structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly

enforcement. We do not believe that our PRC subsidiaries are directly subject to these regulatory actions or statements, as our PRC subsidiaries

have not carried out any monopolistic behavior and the business of our PRC subsidiaries does not involve the collection of user data

or implicate cybersecurity.

We also have dissolved the VIE structure in

October 2021 as the business of our PRC subsidiaries does not involve any type of restricted industry. As advised by our PRC legal counsel,

Tian Yuan Law Firm, the risk that we may face penalties associated with our prior VIE structure if such structures are invalidated in

the PRC in the future is minimal. Currently there are no existing rules or regulations in China that may impose penalties on PRC entities

that adopted a VIE structure, which was dissolved later. On December 24, 2021, the China Securities Regulatory Commission (“CSRC”)

published the Administrative Provisions of the State Council on Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft

for Comment) and the Administrative Measures for the Filings of Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft

for Comment), which provide principles and guidelines for direct and indirect issuance of securities overseas by a Chinese domestic enterprise.

The Administrative Provisions and Measures aim to establish a unified supervision system and promote cross-border regulatory cooperation.

According to the Q&A held by CSRC officials for journalists, the CSRC will adhere to the principle of non-retroactive application

of law and first focus on issuers conducting initial public offerings and follow-on offerings by requiring them to complete the registration

procedures.

As further advised by our PRC counsel, Tian

Yuan Law Firm, as of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require E-Home or our PRC subsidiaries

to seek approval from the China Securities Regulatory Commission, or the CSRC, or any other PRC governmental authorities for the offering,

nor has E-Home, our Cayman Islands holding company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding

the offering from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC

government are newly published and detailed official guidance and related implementation rules have not been issued or taken effect,

it is uncertain how soon the regulatory bodies in China will finalize implementation measures, and the impact the modified or new laws

and regulations will have on the daily business operations of our PRC subsidiaries, our ability to accept foreign investments and list

on an U.S. or other foreign exchange. For more information on various risks related to doing business in China, see “Risk Factors—Risks

Related to Doing Business in China” beginning on page 9.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that E-Home filed with the Securities and Exchange Commission, or the SEC, using a “shelf”

registration process. Under this shelf registration process, E-Home may sell securities described in this prospectus in one or more offerings

up to a total dollar amount of $300,000,000 (or its equivalent in foreign or composite currencies).

This

prospectus provides you with a general description of the securities that may be offered. Each time E-Home offers securities, it will

provide you with a supplement to this prospectus that will describe the specific amounts, prices and terms of the securities it offers.

The prospectus supplement may also add, update or change information contained in this prospectus. This prospectus, together with applicable

prospectus supplements and the documents incorporated by reference in this prospectus and any prospectus supplements, includes all material

information relating to this offering. Please read carefully both this prospectus and any prospectus supplement together with additional

information described below under “Where You Can Find More Information.”

You

should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement.

We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may give you. The information contained in this prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not

an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted.

You

should not assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate on any date

subsequent to the date set forth on the front of the document or that any information that we have incorporated by reference is correct

on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operations

and prospects may have changed since those dates.

PROSPECTUS

SUMMARY

This

summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus.

It does not contain all of the information that may be important to you and your investment decision. Before investing in the securities

that E-Home is offering hereunder, you should carefully read this entire prospectus, including the matters set forth under the section

of this prospectus captioned “Risk Factors” and the financial statements and related notes and other information incorporated

by reference herein, including, but not limited to, our Annual Report on Form 20-F and our other periodic reports.

Company

Overview

As a holding company with no material operations

of its own, E-Home conducts its operations through subsidiaries in Hong Kong and mainland China, including E-Home Household Service Holdings

Limited (Hong Kong), E-Home Household Service Technology Co., Ltd., E-Home (Pingtan) Home Service Co., Ltd., Fuzhou Bangchang Technology

Co. Ltd., Fuzhou Yongheng Xin Electric Co., Ltd., Fujian Happiness Yijia Family Service Co., Ltd., Yaxing Human Resource Management (Pingtan)

Co., Ltd., Fuzhou Gulou Jiajiale Family Service Co., Ltd., Yaxing Human Resource Management (Fuzhou) Co., Ltd., Pingtan Comprehensive

Experimental Area Fumao Healthcare Industry Development Co., Ltd., Putian YouYou Cleaning Co., Ltd. and Shenzhen Chinese Enterprises

Industrial LianBao Appliance Service Co., Ltd..

E-Home’s operating subsidiaries provide

integrated household services through their company website and WeChat platform, “e家快服”, across 21 provinces

in China. Currently, these services primarily include home appliance services, housekeeping services and senior care services. For the

home appliance services, E-Home’s Chinese operating subsidiaries partner with individuals and service stores which provide the

technicians to deliver the on-site services. They currently have partnerships with approximately 2,387 individuals and service stores

providing these services in China. For the housekeeping services, these operating subsidiaries primarily partner with individual service

providers who serve as independent contractors. E-Home’s Chinese operating subsidiaries currently have more than 2,900 cleaners

and nannies providing the housekeeping services. Their online platform integrates these offline service providers, which helps them to

gain a larger customer base, and provides professional and reliable one-stop household services to the Company’s customers. E-Home’s

Chinese operating subsidiaries also launched and are actively promoting senior care services. We plan to further expand our business

to include smart community services, as well as sales of smart home supplementary merchandise. We currently have approximately 523 employees

to support our operations in China.

E-Home

was incorporated as an exempted company with limited liability under the laws of the Cayman Islands on September 24, 2018 to serve as

a holding company for its subsidiaries’ operations in China. On October 16, 2018, E-Home established a wholly-owned subsidiary

in Hong Kong, E-Home Household Service Holdings Limited (which name is identical to the name of the Cayman Islands parent company), which

holds all of the equity interests of E-Home Household Service Technology Co., Ltd. (“E-Home WFOE”). E-Home WFOE was established

in the PRC on December 5, 2018. In order to launch a mobile application and engage in the value-added telecommunications business, E-Home

WFOE entered into contractual arrangements with then two VIEs, Pingtan Comprehensive Experimental Area E Home Service Co., Ltd. (“E-Home

Pingtan”) and Bangchang Technology Co. Ltd. (“Fuzhou Bangchang”), which were established under the laws of the PRC

on April 1, 2014 and March 15, 2007, respectively.

In

October 2021, the board of directors of E-Home decided not to pursue the value-added telecommunications business and accordingly to dissolve

the VIE structure. On October 18, 2021, E-Home WFOE entered into an equity transfer agreement with each of E-Home Pingtan and Fuzhou

Bangchang and their respective shareholders, pursuant to which, E-Home WFOE exercised the options to acquire all of the equity interests

in each of E-Home Pingtan and Fuzhou Bangchang from their respective shareholders. The equity transfer from the shareholders of Fuzhou

Bangchang to E-Home WFOE was completed on October 18, 2021 and the equity transfer from the shareholders of E-Home Pingtan to E-Home

WFOE was completed on October 27, 2021. As a result, the VIE structure was dissolved and each of E-Home Pingtan and Fuzhou Bangchang

is now a wholly owned subsidiary of E-Home. In connection with the above equity transfers, Pingtan Comprehensive Experimental Area E

Home Service Co., Ltd. changed its name to E-Home (Pingtan) Home Service Co., Ltd.

Corporate

Structure

E-Home is not an operating company in China

but a Cayman Islands holding company. We conduct our operations in China primarily through our PRC and Hong Kong subsidiaries. Investors

in securities being offered in this prospectus are not purchasing equity interests in our operating subsidiaries in China, but instead

are purchasing equity interests in a holding company incorporated in the Cayman Islands.

The

chart below presents our current corporate structure:

This structure involves unique risks to investors, and you may never

directly hold equity interests in E-Home’s Chinese operating entities. You are specifically cautioned that there are significant

legal and operational risks associated with having substantially all of our business operations in China, including changes in the legal,

political, and economic policies of the Chinese government, the relations between China and the United States, or Chinese or United States

regulations may materially and adversely affect our business, financial condition, results of operations and the market price of E-Home

securities. Moreover, the Chinese government may exercise significant oversight and discretion over the conduct of our business and may

intervene in or influence the PRC subsidiaries’ operations in China at any time. Recent statements by the Chinese government indicate

an intent to exert more oversight and more control over offerings conducted overseas and/or foreign investment in China-based issuers.

Any such actions by the Chinese government could cause uncertainties regarding the status of the rights of the Cayman Islands holding

company and may significantly limit or completely hinder E-Home’s ability to offer or continue to offer its securities to investors

and cause the value of the securities being registered hereby to significantly decline or become worthless. Although we believe our current

operating structure is legal and permissible under the Chinese law and regulations currently in effect, Chinese regulatory authorities

could take a different position on the interpretation and enforcement of laws and regulations and disallow our holding company structure,

which would likely result in a material adverse change in our operations and/or the value of E-Home’s securities being offered,

including that it could cause the value of such securities to significantly decline or become worthless. For a detailed discussion of

risks facing us and the offering as a result of this structure, see “Risk Factors—Risks Related to Doing Business in China

—The Chinese government exerts significant oversight and discretion over the conduct of our business. The Chinese government may

intervene or influence our PRC subsidiaries’ operations at any time, which could result in a material adverse change in our PRC

subsidiaries’ operations and in the value of the securities being registered hereby” on page 9, “Risk Factors—Risks

Related to Doing Business in China —Recent statements by the Chinese government indicate an intent to exert more oversight and more

control over offerings conducted overseas and/or foreign investment in China-based issuers. Any such actions by the Chinese government

could significantly limit or completely hinder E-Home’s ability to offer or continue to offer its securities to investors and cause

the value of the securities being registered hereby to significantly decline or become worthless” on page 9 and “Risk Factors

— Risks Related to Doing Business in China — There are uncertainties regarding the interpretation and enforcement

of PRC laws, rules and regulations” on page 10.

The PRC government recently initiated a series

of regulatory actions and made a number of public statements on the regulation of business operations in China, including cracking down

on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a VIE structure,

adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We do not believe

that our PRC subsidiaries are directly subject to these regulatory actions or statements, as our PRC subsidiaries have not carried out

any monopolistic behavior and the business of our PRC subsidiaries does not involve the collection of user data or implicate cybersecurity.

We also have dissolved the VIE structure in October 2021 as the business

of our PRC subsidiaries does not involve any type of restricted industry. As advised by our PRC legal counsel, Tian Yuan Law Firm, the

risk that we may face penalties associated with our prior VIE structure if such structures are invalidated in the PRC in the future is

minimal. Currently there are no existing rules or regulations in China that may impose penalties on PRC entities that adopted a VIE structure,

which was dissolved later. On December 24, 2021, the CSRC published the Administrative Provisions of the State Council on Overseas Issuance

and Listing of Securities by Domestic Enterprises (Draft for Comment) and the Administrative Measures for the Filings of Overseas Issuance

and Listing of Securities by Domestic Enterprises (Draft for Comment), which provide principles and guidelines for direct and indirect

issuance of securities overseas by a Chinese domestic enterprise. The Administrative Provisions and Measures aim to establish a unified

supervision system and promote cross-border regulatory cooperation. According to the Q&A held by CSRC officials for journalists, the

CSRC will adhere to the principle of non-retroactive application of law and first focus on issuers conducting initial public offerings

and follow-on offerings by requiring them to complete the registration procedures.

As further advised by our PRC counsel, Tian

Yuan Law Firm, as of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require E-Home or our PRC subsidiaries

to seek approval from the CSRC, or any other PRC governmental authorities for the offering, nor has E-Home, the Cayman Islands holding

company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding the offering from the CSRC or any other

PRC governmental authorities. However, since these statements and regulatory actions by the PRC government are newly published and detailed

official guidance and related implementation rules have not been issued or taken effect, it is uncertain how soon the regulatory bodies

in China will finalize implementation measures, and the impact the modified or new laws and regulations will have on the daily business

operations of our PRC subsidiaries, our ability to accept foreign investments and list on an U.S. or other foreign exchange. For more

information on various risks related to doing business in China, see “Risk Factors—Risks Related to Doing Business in

China” beginning on page 9.

Corporate

Information

Our

principal executive offices are located at Floor 9, Building 14, HaixiBaiyue Town, No. 14 Duyuan Road, Luozhou Town, Cangshan District,

Fuzhou City 350001, People’s Republic of China. The telephone number at our executive offices is +86-591-87590668.

E-Home’s

registered office is at Harneys Fiduciary (Cayman) Limited, 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand

Cayman KY1-1002, Cayman Islands. E-Home’s agent for service of process in the United States is Cogency Global Inc., located at

122 East 42nd Street, 18th Floor, New York, NY 10168.

Our

website can be found at www.ej111.com. Information on our website is not incorporated by reference into this prospectus, any prospectus

supplement or into any information incorporated herein by reference. You should not consider information on our website to be part of

this prospectus, prospectus supplement, any free writing prospectus or any information incorporated by reference herein.

Risk

Factors Summary

There

are a number of risks that you should consider and understand before making an investment decision regarding securities that E-Home is

offering hereunder. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate

the specific factors set forth in the section titled “Risk Factors” and before deciding whether to invest in the securities.

These risks include, but are not limited to:

| ● | As

of the date of this prospectus, as advised by our PRC legal counsel, Tian Yuan Law Firm,

we believe that we are not required to obtain any approval or prior permission for E-Home

to offer its securities to foreign investors from the China Securities Regulatory Commission

(the “CSRC”) or any other Chinese regulatory authority under the Chinese laws

and regulations currently in effect. As of the date of this prospectus, neither E-Home

nor any of its subsidiaries has been informed by the CSRC, Cybersecurity Administration of

China (the “CAC”) or any other Chinese regulatory authority of any requirements,

approvals or permissions that E-Home should obtain prior to this offering. Neither E-Home

nor any of its subsidiaries has obtained the approval or clearance from either the CSRC or

any other Chinese regulatory authority for the offering that E-Home may make under this prospectus

and any applicable prospectus supplement. However, there remains significant uncertainty

inherent in relying on an opinion of our PRC counsel as to the enactment, interpretation

and implementation of regulatory requirements related to overseas securities offerings and

other capital markets activities. The PRC regulatory agencies, including the CSRC or the

CAC, may not reach the same conclusion as our PRC counsel. If we do not receive or maintain

the approvals, or we inadvertently conclude that such approvals are not required but the

CSRC or any other PRC regulatory body subsequently determines that we need to obtain the

approval for this offering or if the CSRC or any other PRC government authorities promulgates

any interpretation or implements rules subsequently that would require us to obtain CSRC

or other governmental approvals for this offering, we may not be able to proceed with this

offering, face adverse actions or sanctions by the CSRC or other PRC regulatory agencies.

In any such event, these regulatory agencies may impose fines and penalties on our Chinese

operating subsidiaries’ operations in China, limit their operating privileges in China,

delay or restrict the repatriation of the proceeds from this offering into the PRC or take

other actions that could have a material adverse effect on our business, financial condition,

the value of E-Home’s securities, as well as E-Home’s ability to offer or continue

to offer its securities to investors or cause such securities to significantly decline in

value or become worthless. The risks arising from the legal system in China include risks

and uncertainties regarding the enforcement of laws and that rules and regulations in China

can change quickly with little, if any, advance notice. As a result, there can be no assurance

that we will not be subject to such requirements, approvals, or permissions in the future.

For additional information, see “Risk Factors—Risks Related to Doing Business

in China —Our business is subject to complex and evolving laws and regulations regarding

privacy and data protection. Compliance with China’s new Data Security Law, Cybersecurity

Review Measures, Personal Information Protection Law, as well as additional laws, regulations

and guidelines that the Chinese government promulgates in the future may entail significant

expenses and could materially affect our business” on page 12 and “Risk Factors—Risks

Related to Doing Business in China — The approval of the CSRC or other Chinese regulatory

agencies may be required in connection with our overseas capital-raising activities, including

but not limited to this offering, under Chinese law” on page 14. |

| ● | There

are significant legal and operational risks associated with having substantially all business

operations in China, including those changes in the legal, political, and economic policies

of the Chinese government, the relations between China and the United States, or Chinese

or United States regulations may materially and adversely affect our business, financial

condition, results of operations and the value of the securities that E-Home is registering.

Any such changes may take place quickly and with very little notice and as a result, could

significantly limit or completely hinder E-Home’s ability to offer or continue to offer

its securities to investors, and could cause the value of E-Home’s securities to significantly

decline or become worthless. Recent statements made and regulatory actions undertaken by

China’s government, such as those related to data security or anti-monopoly concerns

and any other future laws and regulations may require us to incur significant expenses and

could materially affect our Chinese operating subsidiaries’ ability to conduct business

in China or accept foreign investments. For additional information, see “Risk Factors—Risks

Related to Doing Business in China— Changes in U.S. and Chinese regulations or in relations

between the United States and China may adversely impact our business, our operating results,

our ability to raise capital and the value of the securities being offered. Any such changes

may take place quickly and with very little notice” on page 10 and “Risk Factors—Risks

Related to Doing Business in China— Our business is subject to complex and evolving

laws and regulations regarding privacy and data protection. Compliance with China’s

new Data Security Law, Cybersecurity Review Measures, Personal Information Protection Law,

as well as additional laws, regulations, and guidelines that the Chinese government promulgates

in the future may entail significant expenses and could materially affect our business”

on page 12. |

| ● | The

increased regulatory scrutiny focusing on U.S.-listed companies with significant operations

in China could add uncertainties to our business operations, share price and reputation.

In recent years, as part of increased regulatory focus in the United States on access to

audit information, the United States enacted the HFCA Act in December 2020. Furthermore,

on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable

Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s

securities from trading on any U.S. stock exchanges if its auditor is not subject to the

PCAOB inspections for two consecutive years instead of three. Although the audit reports

incorporated by reference into this prospectus were prepared by TPS Thayer LLC, our U.S.

auditors who are subject to inspection by the PCAOB, there is no guarantee that future audit

reports will be prepared by auditors that are completely inspected by the PCAOB and, as such,

future investors may be deprived of such inspections, which could result in limitations or

restrictions to our access of the U.S. capital markets. Furthermore, trading in E-Home’s

securities may be prohibited under the HFCA Act or the Accelerating Holding Foreign Companies

Accountable Act (if enacted), if the SEC subsequently determines our audit work is performed

by auditors that the PCAOB is unable to inspect or investigate completely, and as a result,

U.S. national securities exchanges, such as Nasdaq, may determine to delist the Ordinary

Shares. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December

16, 2021, which found that the PCAOB is unable to inspect or investigate completely registered

public accounting firms headquartered in mainland China and Hong Kong, a Special Administrative

Region and dependency of the PRC, because of a position taken by one or more authorities

in such jurisdictions. In addition, the PCAOB’s report identified specific registered

public accounting firms which are subject to these determinations. Our registered public

accounting firm, TPS Thayer, LLC, is not headquartered in mainland China

or Hong Kong and was not identified in this report as a firm subject to

the PCAOB’s determination. TPS Thayer, LLC is subject to inspection by the PCAOB and

the audit workpapers of E-Home, including its Chinese subsidiaries, are retained in the United

States by TPS Thayer, LLC and available for the PCAOB inspection. However, if the PCAOB determines

that it cannot inspect or investigate completely our auditor in the future, you may be deprived

of the benefits of the inspection and such determination could result in limitation or restriction

to our access to the U.S. capital markets and trading of E-Home’s securities may be

prohibited under the HFCA Act. For additional information, see “Risk Factors—Risks

Related to Doing Business in China —The

increased regulatory scrutiny focusing on U.S.-listed companies with significant operations

in China in the U.S. could add uncertainties to our business operations, share price and

reputation. Although our auditor, TPS Thayer LLC, is subject to inspection by the PCAOB,

trading in E-Home’s securities may be prohibited under the HFCA Act if the PCAOB subsequently

determines our audit work is performed by auditors that the PCAOB is unable to inspect or

investigate completely, and as a result, U.S. national securities exchanges, such as the

Nasdaq, may determine to delist E-Home’s securities. Furthermore, on June 22, 2021,

the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which,

if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities

from trading on any U.S. stock exchanges if its auditor is not subject to the PCAOB inspections

for two consecutive years instead of three.” on page 17. |

| ● | The

Chinese government may intervene or influence our operations at any time or may exert more

control over offerings conducted overseas and/or foreign investment in China-based issuers,

which could result in a material adverse change in our operations and in the value of E-Home’s

securities that it is registering. Any actions by the Chinese government to exert more oversight

and control over offerings that are conducted overseas and/or foreign investment in China-based

issuers could significantly limit or completely hinder E-Home’s ability to offer or

continue to offer its securities to investors and cause the value of such securities to significantly

decline or become worthless. For additional information, see “Risk Factors—Risks

Related to Doing Business in China —The Chinese government exerts significant oversight

and discretion over the conduct of our business. The Chinese government may intervene or

influence our PRC subsidiaries’ operations at any time, which could result in a material

adverse change in our PRC subsidiaries’ operations and in the value of the securities

being registered hereby” on page 9 and “Risk Factors—Risks Related to

Doing Business in China —Recent statements by the Chinese government indicate an intent

to exert more oversight and more control over offerings conducted overseas and/or foreign

investment in China-based issuers. Any such actions by the Chinese government could significantly

limit or completely hinder E-Home’s ability to offer or continue to offer its securities

to investors and cause the value of the securities being registered hereby to significantly

decline or become worthless” on page 9. |

| ● | There

are uncertainties regarding the interpretation and enforcement of PRC laws, rules, and regulations.

For additional information, see “Risk Factors — Risks Related to Doing

Business in China — There are uncertainties regarding the interpretation and

enforcement of PRC laws, rules and regulations” on page 10. |

| ● | You

may face difficulties in protecting your interests and exercising your rights as a shareholder

since we conduct substantially all of our operations in China through E-Home’s PRC

subsidiaries, and most of our officers and directors reside outside of the United States. |

| ● | The

trading price of the Ordinary Shares has been and is likely to continue to be highly volatile,

which could result in significant losses to holders of the Ordinary Shares. |

| ● | Because

we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation

of your shares for return on your investment. |

| ● | You

may face difficulties in protecting your interests, and your ability to protect your rights

through U.S. courts may be limited, because E-Home is incorporated under Cayman Islands law. |

| ● | E-Home

is a foreign private issuer within the meaning of the rules under the Securities Exchange

Act of 1934, as amended, or the Exchange Act, and as such we are exempt from certain provisions

applicable to U.S. domestic public companies. |

| ● | As

a foreign private issuer, E-Home is permitted to rely on exemptions from certain Nasdaq corporate

governance standards applicable to domestic U.S. issuers. This may afford less protection

to holders of E-Home’s securities. |

Regulatory

Permissions and Developments

Permissions

to Operate Our Business

We have been advised by our PRC Counsel, Tian

Yuan Law Firm, that pursuant to the relevant laws and regulations in China, as of the date of this prospectus, none of our PRC subsidiaries’

business is stipulated on the Special Administrative Measures for the Access of Foreign Investment (Negative List) (2021 Version) (the

“2021 Negative List”) promulgated by the Ministry of Commerce of the People’s Republic of China (“MOFCOM”)

and The National Development and Reform Commission of the People’s Republic of China which took effect on January 1, 2022. Therefore,

our PRC subsidiaries are able to conduct their business without being subject to restrictions imposed by the foreign investment laws

and regulations of the PRC.

Currently,

none of our PRC subsidiaries is required to obtain additional licenses or permits beyond a regular business license for their operations.

Each of our PRC subsidiaries is required to obtain a regular business license from the local branch of the State Administration for Market

Regulation. Each of our PRC subsidiaries has obtained a valid business license for its respective business scope, and no application

for any such license has been denied.

As

of the date of this prospectus, E-Home and its PRC subsidiaries are not subject to permission requirements from the China Securities

Regulatory Commission (the “CSRC”), the Cyberspace Administration of China (the “CAC”) or any other entity that

is required to approve of its PRC subsidiaries’ operations.

Permissions

to Issue Securities to Foreign Investors

As

of the date of this prospectus, E-Home and its PRC subsidiaries are not required to obtain permissions from any PRC authorities to issue

securities to foreign investors, and nor have received or were denied such permissions by any PRC authorities.

The

General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the

“Opinions on Strictly Cracking Down on Illegal Securities Activities,” or the Opinions, which were made available to the

public on July 6, 2021. The Opinions emphasized the need to step up regulation over illegal securities activities, and the need to strengthen

oversight over overseas listings by Chinese companies. Based on existing PRC laws and regulations, as advised by our PRC counsel, Tian

Yuan Law Firm, we believe neither E-Home nor its subsidiaries are required to obtain any approval from any Chinese authority to offer

and issue securities to foreign investors, and we have not received any inquiry, notice, warning, or sanction in relation to the listing

and trading of the Ordinary Shares on Nasdaq from the CSRC, the CAC or any other Chinese authorities. However, there remains uncertainty

as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other

capital markets activities. We will continue to closely monitor regulatory developments in China regarding any necessary approvals from

the CSRC or other PRC governmental authorities required for overseas listings.

On

December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding Overseas Securities Offering and Listing

by Domestic Companies (Draft for Comments) (the “Administrative Provisions”), and the Measures Regarding Recordation of Overseas

Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Measures”). The Administrative Provisions

and Measures aim to establish a unified supervision system and promote cross-border regulatory cooperation. The Measures lay out filing

procedures for domestic companies to record their initial public offerings and follow-on offerings abroad with the CSRC. Issuers are

required to file follow-on offerings with the CSRC within 3 business days after the closing of such offerings.

While

it is uncertain when the Administrative Provisions and the Measures will take effect or if they will take effect as proposed, we are

advised by our PRC counsel, Tian Yuan Law Firm, that based on the Chinese laws and regulations currently in effect, as of the date of

this prospectus, the risk that we may face penalties associated with our prior VIE structure if such structures

are invalidated in the PRC in the future is minimal. Currently there are no existing rules or regulations in China that may impose penalties

on PRC entities that adopted a VIE structure, which was dissolved later. According to the Q&A held by CSRC officials for journalists

thereafter, the CSRC will adhere to the principle of non-retroactive application of law and first focus on issuers conducting initial

public offerings and follow-on offerings by requiring them to complete the registration procedures. Other issuers will be given a sufficient

transition period. The CSRC officials also noted that the regulation system contemplated by the draft Administrative Provisions and Measures

differentiates between IPOs and follow-on offerings to take into account overseas capital markets’ fast and efficient features

and to reduce impacts on overseas financing activities by domestic companies. If the Administrative Provisions and the Measures are enacted

in their current forms, we expect to perform necessary registration filings, through our WFOEs, with the CSRC for E-Home’s listing

on the Nasdaq within the prescribed transition period and for this offering in the event that it takes place after the Administrative

Provisions and the Measures become effective.

In

addition, as advised by our PRC counsel, Tian Yuan Law Firm, none of E-Home or any of its subsidiaries are required to obtain

permissions or approval from the CSRC, the CAC, or any other government agency in connection with E-Home’s offerings of

securities to foreign investors or trading of Ordinary Shares on Nasdaq. Neither E-Home nor any of its subsidiaries has obtained or

been denied the approval or clearance from either the CSRC or any other Chinese regulatory authority for the offering that E-Home

may make under this prospectus and any applicable prospectus supplement. However, there remains uncertainty inherent in relying on

an opinion of our PRC counsel as to the enactment, interpretation and implementation of regulatory requirements related to overseas

securities offerings and other capital markets activities. The PRC regulatory agencies, including the CSRC or the CAC, may not reach

the same conclusion as our PRC counsel.

If

we inadvertently conclude that such approvals are not required but the CSRC or other PRC regulatory body subsequently determines that

we need to obtain the approval for this offering or if the CSRC or any other PRC government authority promulgates any interpretation

or implements rules subsequently that would require us to obtain CSRC or other governmental approvals for this offering, E-Home may not

be able to proceed with this offering, and may face adverse actions or sanctions by the CSRC or other PRC regulatory agencies. In any

such event, these regulatory agencies may limit, or impose fines and penalties on our operations in China or take other actions that

could have a material adverse effect on our business, financial condition, or operating results, as well as E-Home’s ability to

offer or continue to offer its securities to investors or cause such securities to significantly decline in value or become worthless.

In addition, if the CSRC, the CAC or other regulatory agencies later promulgate new rules requiring that we obtain their approvals for

any of the offerings, we cannot assure you that we can obtain the approval, authorizations, or complete required procedures or other

requirements in a timely manner, or at all, or obtain a waiver of the requisite requirements if and when procedures are established to

obtain such a waiver. Any uncertainties and/or negative publicity regarding such an approval requirement could have a material adverse

effect on the value of the securities being offered.

Cybersecurity

Review

As advised by our

PRC counsel, Tian Yuan Law Firm, and based on their interpretation of the revised Cybersecurity Review Measures which were released for

comments in July 2021 and became effective on February 15, 2022, E-Home or any of its PRC subsidiaries are not required to apply for

a cybersecurity review with the CAC, because E-Home’s Ordinary Shares were listed on Nasdaq before the effective date of the revised

Cybersecurity Review Measures on February 15, 2022 and the requirement that “online platform operators with personal information

of more than 1 million users which intends to go public abroad must apply to the Cybersecurity Review Office of the CAC

for a cybersecurity review” set forth in Article 7 of the revised Cybersecurity Review Measures should not be applicable to E-Home

or any of its subsidiaries. Further, we do not believe that E-Home or any of its subsidiaries constitutes an online platform operator

under the draft Regulations on Network Data Security which were published for comments on November 14, 2021 by the CAC. However, there

remains uncertainty as to the interpretation and implementation of the revised Cybersecurity Review Measures and we cannot assure you

that the CAC will reach the same conclusion as our PRC counsel.

On

July 10, 2021, the Cyberspace Administration of China issued the Cybersecurity Review Measures (revised draft for public comments), which

proposed to authorize the CAC to conduct cybersecurity review on a range of activities that affect or may affect national security. The

revised Cybersecurity Review Measures expand the cybersecurity review to online platform operators in possession of personal information

of over one million users if the operators intend to list their securities in a foreign country. The revised Cybersecurity Review Measures

took effect on February 15, 2022. Under the revised Cybersecurity Review Measures, the scope of entities required to undergo cybersecurity

review to assess national security risks that arise from data processing activities would be expanded to include all critical information

infrastructure operators who purchase network products and services and all data processors carrying out data processing activities that

affect or may affect national security. Such reviews will focus on the potential risk of core data, important data, or a large amount

of personal information being stolen, leaked, destroyed, illegally used, or exported out of China, or critical information infrastructure

being affected, controlled, or maliciously used by foreign governments after a listing outside China. As advised by our PRC counsel, Tian

Yuan Law Firm, we believe that the cybersecurity review requirement under the revised Cybersecurity Review Measures for online platform

operators in possession of personal information of over one million users going public in a foreign country does not apply to E-Home

or any of its subsidiaries, because E-Home became a public company with shares listed in the US before such Measures became effective.

However, there remains uncertainty as to the interpretation and implementation of the revised Cybersecurity Review Measures and we cannot

assure you that the CAC will reach the same conclusion as our PRC counsel.

In

addition, on November 14, 2021, the CAC released the Regulations on Network Data Security (draft for public comments) and accepted public

comments until December 13, 2021. The draft Regulations on Network Data Security provide more detailed guidance on how to implement the

general legal requirements under legislations such as the Cybersecurity Law, Data Security Law, and the Personal Information Protection

Law. The draft Regulations on Network Data Security follow the principle that the state will regulate based on a data classification

and multi-level protection scheme. We believe that E-Home or any of its subsidiaries does not constitute an online platform operator

under the draft Regulations on Network Data Security as proposed, which is defined as a platform that provides information publishing,

social network, online transaction, online payment, and online audio/video services. Our PRC subsidiaries only access certain customers

through the WeChat platform but none of them is an online platform operator themselves, nor is any of them required to obtain an ICP

license for their operations. However, in anticipation of strengthened implementation of cybersecurity laws and regulations, there can

be no assurance that the Cybersecurity Review Measures will not be further amended, or other laws or regulations will not be promulgated

to subject us or any of our PRC subsidiaries to the cybersecurity review or other compliance requirements. In such case, we may face

challenges in addressing such enhanced regulatory requirements. For additional information, see “Risk Factors—Risks Related

to Doing Business in China—Our business is subject to complex and evolving laws and regulations regarding privacy and data protection.

Compliance with China’s new Data Security Law, Cybersecurity Review Measures, Personal Information Protection Law, as well as additional

laws, regulations, and guidelines that the Chinese government promulgates in the future may entail significant expenses and could materially

affect our business” on page 12.

Transfer

of Cash Through Our Organization

Holding

Company Structure

Our

equity structure is a direct holding structure, that is, E-Home, the Cayman Islands entity listed in the U.S., controls E-Home Pingtan

and Fuzhou Bangchang and other Chinese operating entities through E-Home HK. See “Prospectus Summary—Corporate Structure”

above on page 2 for more details.

Cash

and Other Assets Transfers Between the Holding Company and Its Subsidiaries

As

a result of E-Home’s IPO closed in May 2021, E-Home received net proceeds of approximately $21.66 million. On December 20, 2021,

E-Home issued the Convertible Note to an institutional investor in the principal amount of $5,275,000, before deducting original issue

discount, investor’s legal and other transaction costs, and placement agent fees. As of December 31, 2021, with respect to the net

proceeds from the IPO and the Convertible Note, E-Home had transferred approximately $11.31 million to E-Home Pingtan through E-Home

HK and separately sent approximately $4.70 million to E-Home HK; E-Home had kept the remaining approximately $10.60 million in its own

account.

Other

than the IPO and the Convertible Note, E-Home has not raised funds from investors so far, nor has it transferred any other funds to its

subsidiaries. See the section entitled “Incorporation of Certain Information by Reference” below regarding information of

our consolidated financial statements for the years ended June 30, 2021, 2020 and 2019 as well as our reports on Form 6-K that are incorporated

into this prospectus.

E-Home,

as a holding company, may rely on dividends and other distributions on equity paid by its Chinese subsidiaries for E-Home’s cash

and financing requirements, including the funds necessary to pay dividends and other cash distributions to its shareholders or to service

any expenses and other obligations it may incur. To date, there have not been any dividends or other distributions from our Chinese subsidiaries

to our subsidiary located outside of mainland China, namely E-Home HK, or the Cayman Islands holding company, E-Home.

Within

our direct holding structure, the cross-border transfer of funds from E-Home to its Chinese subsidiaries is permitted under laws and

regulations of the PRC currently in effect. Foreign investors’ funds for purchasing E-Home’s securities being offered hereby

can be remitted to our subsidiaries in China, through E-Home HK. Specifically, E-Home is permitted to provide funding to its PRC subsidiaries

in the form of shareholder loans or capital contributions, subject to satisfaction of applicable government registration, approval and

filing requirements in China. There are no quantity limits on E-Home’s ability to make capital contributions to its PRC subsidiaries

under the PRC regulations. However, the PRC subsidiaries may only procure shareholder loans from E-Home HK to the extent of the difference

between their respective registered capital and total investment amount as recorded in the Chinese Foreign Investment Comprehensive Management

Information System.

Dividends

and Other Distributions to U.S. Investors and Tax Consequences

As

of the date of this prospectus, neither E-Home nor any of its subsidiaries have paid dividends or made distributions to U.S. investors.

We intend to retain most, if not all, of our available funds and any future earnings after this offering to the development and growth

of our business in China. We do not expect to pay dividends in the foreseeable future.

Subject to

the passive foreign investment company rules, the gross amount of any distribution that we make to investors with respect to E-Home’s

securities (including any amounts withheld to reflect PRC withholding taxes) will be taxable as a dividend, to the extent paid out of

our current or accumulated earnings and profits, as determined under United States federal income tax principles.

The

PRC Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends

payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government

and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement

between mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends

by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities

determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities

may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will

apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will reduce the amount of dividends

we may receive from our PRC subsidiaries.

Restrictions on Our Ability to Transfer

Cash Out of Mainland China and Hong Kong

Our

PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our

PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, as determined in accordance

with PRC accounting standards and regulations. In addition, under PRC law, each of our PRC subsidiaries is required to set aside at least

10% of its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its registered

capital. These reserves are not distributable as cash dividends. If any of our Chinese subsidiaries incurs debt on its own behalf in

the future, the instruments governing such debt may restrict its ability to pay dividends to E-Home.

To address persistent capital outflows and

the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China, and the State Administration

of Foreign Exchange, or SAFE, implemented a series of capital control measures in the subsequent months, including stricter vetting procedures

for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The

PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other distributions may

be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies

and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures

necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. In addition, to the extent cash

is in our mainland China or Hong Kong subsidiaries, there can be no assurance that the PRC government will not intervene or impose restrictions

on the ability of E-Home or E-Home’s subsidiaries to transfer or distribute cash within our organization or to foreign investors,

which could result in an inability or prohibition on funding our operations or making transfers or distributions outside of mainland

China and Hong Kong for other use.

Currently, other than complying with the applicable

PRC laws and regulations, we do not have our own cash management policy and procedures that dictate how funds are transferred.

For additional information, see Risk Factors—Risks

Related to Doing Business in China —The Chinese government exerts significant oversight and discretion over the conduct of our

business. The Chinese government may intervene or influence our PRC subsidiaries’ operations at any time, which could result in

a material adverse change in our PRC subsidiaries’ operations and in the value of the securities being registered hereby”

on page 9 and “Risk Factors—Risks Related to Doing Business in China— PRC regulation of loans to, and direct investment

in, PRC entities by offshore holding companies and governmental control of currency conversion may restrict or prevent us from making

additional capital contributions or loans to our PRC subsidiaries” on page 16.

RISK

FACTORS

An

investment in E-Home’s securities involves a high degree of risk. We operate in a highly competitive environment in which there

are numerous factors which can influence our business, financial position, or results of operations and which can also cause the value

of the securities being offered to decline. Many of these factors are beyond our control and therefore, are difficult to predict. Prior

to making a decision about investing in E-Home’s securities, you should carefully consider the risk factors discussed in the sections

entitled “Risk Factors” contained in our most recent Annual Report on Form 20-F filed with the SEC, and in any applicable

prospectus supplement and our other filings with the SEC and incorporated by reference in this prospectus or any free writing prospectus,

together with all of the other information contained in this prospectus or any applicable prospectus supplement. If any of the risks

or uncertainties described in our SEC filings or any prospectus supplement or any additional risks and uncertainties actually occur,

our business, financial condition and results of operations could be materially and adversely affected. In that case, the trading price

of E-Home’s securities could decline, and you might lose all or part of your investment.

The

following disclosure is intended to highlight, update or supplement previously disclosed risk factors facing the Company set forth in

the Company’s public filings. These risk factors should be carefully considered along with any other risk factors identified in

the Company’s other filings with the SEC.

Risks

Related to Doing Business in China

The

Chinese government exerts significant oversight and discretion over the conduct of our business. The Chinese government may intervene

or influence our PRC subsidiaries’ operations at any time, which could result in a material adverse change in our PRC subsidiaries’

operations and in the value of the securities being offered hereby.

Substantially all of our operations are conducted

in the PRC by our PRC subsidiaries and all of our revenue is sourced from the PRC. Accordingly, our financial condition and results of

operations are affected to a significant extent by economic, political, and legal developments in the PRC. The PRC economy differs from

the economies of most developed countries in many respects, including the extent of government involvement, level of development, growth

rate, and control of foreign exchange and allocation of resources. The PRC government has implemented various measures to encourage economic

growth and to guide the allocation of resources. Some of these measures may benefit the overall PRC economy, but may also have a negative

effect on us. Our financial condition and results of operations and the value of the securities being offered hereby could be materially

and adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. In addition,

there can be no assurance that the PRC government will not intervene or impose restrictions on our ability to transfer or distribute

cash within our organization or to foreign investors, which could result in an inability or prohibition on making transfers or distributions

outside of mainland China and Hong Kong and may adversely affect our business, financial condition and results of operations.

Recent

statements by the Chinese government indicate an intent to exert more oversight and more control over offerings conducted overseas and/or

foreign investment in China-based issuers. Any such actions by the Chinese government could significantly limit or completely hinder

E-Home’s ability to offer or continue to offer its securities to investors and cause the value of the securities being registered

hereby to significantly decline or become worthless.

The

Chinese government recently has published new policies that significantly affected certain industries such as the education and internet

industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry

that could require us to seek permission from Chinese authorities to continue to operate our business, which may adversely affect our

business, financial condition and results of operations. Furthermore, recent statements made by the Chinese government have indicated

an intent to increase the government’s oversight and control over offerings of companies with significant operations in China that

are to be conducted in foreign markets, as well as foreign investment in China-based issuers like us. Any such action, once taken by

the Chinese government, could significantly limit or completely hinder E-Home’s ability to offer or continue to offer its securities

to investors, and could cause the value of such securities to significantly decline or become worthless.

In

July 2021, the Chinese government provided new guidance on China-based companies raising capital outside of China, including through

arrangements via VIEs. In light of such developments, the SEC has imposed enhanced disclosure requirements on China-based companies seeking

to register securities with the SEC. Although we have recently dissolved our VIE structure, as substantially all of our operations are

based in China, any future Chinese, U.S. or other rules and regulations that place restrictions on capital raising or other activities

by companies with extensive operations in China could adversely affect our business and results of operations. If the business environment

in China deteriorates from the perspective of domestic or international investment, or if relations between China and the United States

or other governments deteriorate, the Chinese government may intervene with our operations and our business in China, as well as the

value of the securities being offered, may also be adversely affected.

Changes

in U.S. and Chinese regulations or in relations between the United States and China may adversely impact our business, our operating

results, our ability to raise capital and the value of the securities being offered. Any such changes may take place quickly and with

very little notice.

The

U.S. government, including the SEC, has made statements and taken certain actions that led to changes to United States and international

relations, and will impact companies with connections to the United States or China. The SEC has issued statements primarily focused

on companies with significant China-based operations, such as us. For example, on July 30, 2021, Gary Gensler, Chairman of the SEC, issued

a Statement on Investor Protection Related to Recent Developments in China, pursuant to which Chairman Gensler stated that he has asked

the SEC staff to engage in targeted additional reviews of filings for companies with significant China-based operations. The statement

also addressed risks inherent in companies with VIE structures. We have dissolved our VIE structure and are not in any industry that

is subject to foreign ownership limitations by China. However, it is possible that the Company’s filings with the SEC may be subject

to enhanced review by the SEC and this additional scrutiny could affect our ability to effectively raise capital in the United States.

In

response to the SEC’s July 30, 2021 statement, the CSRC announced on August 1, 2021, that “[i]t is our belief that Chinese

and U.S. regulators shall continue to enhance communication with the principle of mutual respect and cooperation, and properly address

the issues related to the supervision of China-based companies listed in the U.S. so as to form stable policy expectations and create

benign rules framework for the market.” While the CSRC will continue to collaborate “closely with different stakeholders

including investors, companies, and relevant authorities to further promote transparency and certainty of policies and implementing measures,”

it emphasized that it “has always been open to companies’ choices to list their securities on international or domestic markets

in compliance with relevant laws and regulations.” If any new legislation, executive orders, laws and/or regulations are implemented,

if the U.S. or Chinese governments take retaliatory actions due to the recent U.S.-China tension or if the Chinese government exerts

more oversight and control over securities offerings that are conducted in the United States, such changes could have an adverse effect

on our business, financial condition and results of operations, our ability to raise capital and the value of the securities being offered.

There

are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations.

E-Home

is not a Chinese operating company but rather a holding company incorporated in the Cayman Islands. As a holding company with no material

operations of its own, E-Home conducts its business through its Chinese operating subsidiaries, in particular, E-Home Pingtan and Fuzhou

Bangchang, and their respective Chinese subsidiaries. As a result, substantially all of our operations are conducted in the PRC, and

are governed by PRC laws, rules and regulations. Our PRC subsidiaries are subject to laws, rules and regulations applicable to foreign

investment in China. The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court

decisions may be cited for reference but have limited precedential value. In 1979, the PRC government began to promulgate a comprehensive

system of laws, rules and regulations governing economic matters in general. The overall effect of legislation over the past three decades

has significantly enhanced the protections afforded to various forms of foreign investment in China. However, China has not developed

a fully integrated legal system, and recently enacted laws, rules and regulations may not sufficiently cover all aspects of economic

activities in China or may be subject to significant degrees of interpretation by PRC regulatory agencies. In particular, because these

laws, rules and regulations, especially those relating to the internet, are relatively new, and because of the limited number of published

decisions and the nonbinding nature of such decisions, and because the laws, rules and regulations often give the relevant regulator

significant discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties

and can be inconsistent and unpredictable. In addition, the PRC legal system is based in part on government policies and internal rules,

some of which are not published on a timely basis or at all, and may have a retroactive effect. As a result, we may not be aware of our

violation of these policies and rules until after the occurrence of the violation. Any administrative and court proceedings in China

may be protracted, resulting in substantial costs and diversion of resources and management attention.

The

PRC government has recently announced its plans to enhance its regulatory oversight of Chinese companies listing overseas. The Opinions

on Strictly Cracking Down on Illegal Securities Activities issued on July 6, 2021 called for:

| ● | tightening

oversight of data security, cross-border data flow and administration of classified information,

as well as amendments to relevant regulation to specify responsibilities of overseas listed

Chinese companies with respect to data security and information security; |

| ● | enhanced

oversight of overseas listed companies as well as overseas equity fundraising and listing

by Chinese companies; and |

| ● | extraterritorial

application of China’s securities laws. |

As

the Opinions on Strictly Cracking Down on Illegal Securities Activities were recently issued, there are great uncertainties as to how

soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations

and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will

have on companies like us, but among other things, E-Home’s ability to obtain external financing through the issuance of equity

securities overseas could be negatively affected.

On

December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding Overseas Securities Offering and Listing

by Domestic Companies (Draft for Comments) (the “Administrative Provisions”), and the Measures Regarding Recordation of Overseas

Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Measures”). The Administrative Provisions

and Measures aim to establish a unified supervision system and promote cross-border regulatory cooperation. The Measures lay out filing

procedures for domestic companies to record their initial public offerings and follow-on offerings abroad with the CSRC. Issuers are

required to file follow-on offerings with the CSRC within 3 business days after the closing of such offerings.

According

to the Q&A held by CSRC officials for journalists thereafter, the CSRC will adhere to the principle of non-retroactive application

of law and first focus on issuers conducting initial public offerings and follow-on offerings by requiring them to complete the registration

procedures. Other issuers will be given a sufficient transition period. The CSRC officials also noted that the regulation system contemplated

by the draft Administrative Provisions and Measures differentiates between IPOs and follow-on offerings to take into account overseas

capital markets’ fast and efficient features and to reduce impacts on overseas financing activities by domestic companies. If the

Administrative Provisions and the Measures are enacted in their current forms, we expect to perform necessary registration filings with

the CSRC for the listing of E-Home’s securities on Nasdaq within the prescribed transition period and for this offering in the

event that it takes place after the Administrative Provisions and the Measures become effective. However, it is uncertain when the Administrative

Provisions and the Measures will take effect or if they will take effect as in their current forms.

In

addition, our holding company structure involves unique risks to investors and you may never directly hold equity interests in our Chinese

operating entities. Although we believe our operating structure is legal and permissible under the Chinese law and regulations currently

in effect, Chinese regulatory authorities could take a different position on the interpretation and enforcement of laws and regulations

and disallow our operating structure, which would likely result in a material adverse change in our operations and/or the value of E-Home’s

securities being offered, including that it could cause the value of such securities to significantly decline or become worthless.

Our

business is subject to complex and evolving laws and regulations regarding privacy and data protection. Compliance with China’s

new Data Security Law, Cybersecurity Review Measures, Personal Information Protection Law, as well as additional laws, regulations and

guidelines that the Chinese government promulgates in the future may entail significant expenses and could materially affect our business.

Regulatory

authorities in China have implemented and are considering further legislative and regulatory proposals concerning data protection. China’s

new Data Security Law went into effect on September 1, 2021. The Data Security Law provides that the data processing activities must

be conducted based on “data classification and hierarchical protection system” for the purpose of data protection and prohibits

entities in China from transferring data stored in China to foreign law enforcement agencies or judicial authorities without prior approval

by the Chinese government. The Data Security Law sets forth the legal liabilities of entities and individuals found to be in violation

of their data protection obligations, including rectification order, warning, fines of up to RMB5 million, suspension of relevant business,

and revocation of business permits or licenses.

In

addition, the PRC Cybersecurity Law provides that personal information and important data collected and generated by operators of critical

information infrastructure in the course of their operations in the PRC should be stored in the PRC, and the law imposes heightened regulation

and additional security obligations on operators of critical information infrastructure. According to the Cybersecurity Review Measures

promulgated by the Cyberspace Administration of China and certain other PRC regulatory authorities in April 2020, which became effective

in June 2020, operators of critical information infrastructure must pass a cybersecurity review when purchasing network products and

services which do or may affect national security. Any failure or delay in the completion of the cybersecurity review procedures may