Ericsson 1Q Net Profit Missed Views on Delayed Contract, Russia Provision -- Update

14 April 2022 - 6:00PM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Ericsson AB's first-quarter net profit missed

expectations because of a delayed contract, expired licensing

deals, and the previously announced 900 million kronor ($95

million) provision after suspending its Russian business, the

company said Thursday.

However, the company won market share in the quarter after

having strong sales of 5G equipment in North America, Europe and

Latin America, as overall sales of network equipment grew

organically by 4%, it said.

The Swedish telecom-equipment company reported net profit

attributable to shareholders of SEK2.94 billion compared with

SEK3.17 billion a year earlier, as sales rose 11% to SEK55.06

billion.

Analysts polled by FactSet had expected net profit of SEK4.07

billion on sales of SEK54.14 billion.

The company earlier this week said it is suspending its business

in Russia indefinitely in light of recent events in Ukraine and the

subsequent sanctions imposed on Russia. Ericsson has around 600

employees in Russia spread across four locations in the country and

all personnel have been placed on paid leave.

Ericsson said the quarter was also weighed by a certain SEK1

billion annual software contract that is normally recorded in the

first quarter, but this year has been delayed into the second

quarter. Higher research-and-development costs, the expiration of

patent deals that are pending renewal, and investments in supply

chain also had an effect, the company said.

"In light of the global supply chain challenges, we decided to

create a buffer of vital components in order to secure that we meet

customer delivery commitments," Chief Executive Borje Ekholm

said.

Ericsson is facing scrutiny over previously disclosed corporate

governance issues in Iraq, where an internal investigation found

evidence of historical corruption, and the U.S. Department of

Justice has stated that the company's handling of the matter

breached a Deferred Prosecution Agreement.

"The resolution of these matters could result in a range of

actions by the DOJ, and may likely include additional monetary

payments, the magnitude of which cannot at this time be reliably

estimated," Mr. Ekholm said.

Ericsson still targets a group earnings before interest and tax

margin of 15%-18% within two to three years. The company now

forecasts the radio access network market growing by 5% this year

compared with 3% previously.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

April 14, 2022 03:45 ET (07:45 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

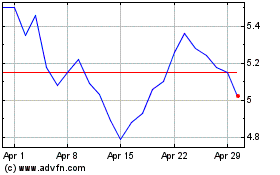

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

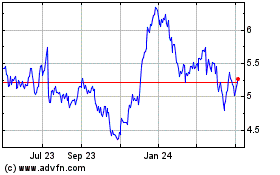

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024