Ericsson's Deal to Buy Vonage Is Focus of Cfius Probe -- Update

28 June 2022 - 9:53PM

Dow Jones News

By Stu Woo

The Committee on Foreign Investment in the U.S. is reviewing

Ericsson AB's proposed $6.2 billion acquisition of Vonage Holdings

Corp., Ericsson said, adding another regulatory challenge for the

Swedish telecom-equipment giant in Washington.

Ericsson said the deal has cleared all other U.S. and foreign

regulatory approval requirements. It said the companies were

working with the committee, known as Cfius, a Treasury

Department-led panel of federal agencies that determines how

foreign deals for U.S. assets could affect national security.

Ericsson said it hopes to close the transaction before the end

of July, a month later than it had previously forecast. A company

spokesman declined to comment further.

In November, Ericsson agreed to pay $6.2 billion in cash to buy

Vonage, a New Jersey-based company that was a pioneer in selling

subscriptions for individuals to make voice calls over the

internet. Vonage now focuses on providing businesses with

internet-based telecommunications services for customer service,

among other uses. It couldn't be learned why Cfius was reviewing

the deal. Representatives for the Treasury Department didn't

immediately return a request for comment.

Vonage shares closed at $17.58 on Monday, below Ericsson's

agreement to pay $21 a share. Vonage has traded below the offer

price for weeks, analysts say, because of uncertainty over the

outcome of the U.S. regulatory review.

Ericsson spent much of the past decade trying to revitalize its

core business of selling cellular-tower equipment and related

infrastructure to catch up with China's Huawei Technologies Co.,

the industry leader. A U.S. push to curtail Huawei business around

the world has benefited Ericsson and rival Nokia Corp.

The U.S. says the Chinese company can be compelled to spy on or

disrupt telecommunications networks by Beijing. Huawei denies

that.

The U.S. government has sought to provide financial assistance

to developing countries, on the condition that they use Ericsson or

Nokia gear, instead of Huawei or Chinese alternatives.

More recently, though, Ericsson has faced scrutiny in

Washington. In April, Ericsson said it was likely to face fines

from the Justice Department for failing to disclose allegedly

paying bribes for access to terrorist-controlled areas in Iraq.

Earlier this month, Ericsson said the Securities and Exchange

Commission is also investigating the issue.

Ericsson has said that a 2019 internal investigation didn't

identify any Ericsson employee directly involved in financing

terrorist organizations, and that its internal investigation

resulted in several disciplinary and remedial steps.

Write to Stu Woo at stu.woo@wsj.com

(END) Dow Jones Newswires

June 28, 2022 07:38 ET (11:38 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

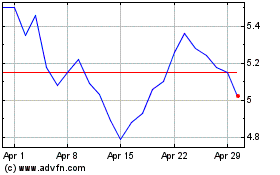

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024