Current Report Filing (8-k)

14 May 2022 - 6:40AM

Edgar (US Regulatory)

0001324424false00013244242022-05-132022-05-130001324424exch:XNGS2022-05-132022-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): May 13, 2022

EXPEDIA GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37429 | | 20-2705720 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

1111 Expedia Group Way W.

Seattle, Washington 98119

(Address of principal executive offices) (Zip code)

(206) 481-7200

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address if changed since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value | EXPE | The Nasdaq Global Select Market |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 8.01. Other Events.

On May 13, 2022, Expedia Group, Inc. (the “Company”) provided notice to (x) U.S. Bank National Association (in such capacity, the “2023 Notes Trustee”) under that certain Indenture, dated as of July 14, 2020 (as amended, supplemented or otherwise modified from time to time, the “2023 Notes Indenture”), by and among the Company, the subsidiary guarantors from time to time party thereto and the 2023 Notes Trustee, that on May 30, 2022 (the “2023 Notes Redemption Date”), the Company intends to redeem all of the $500 million of the aggregate principal amount of its outstanding 3.600% Senior Notes due 2023 (the “2023 Notes”) at a redemption price equal to the greater of (i) 100% of the aggregate principal amount of the 2023 Notes to be redeemed and (ii) the sum of the present values of the Remaining Scheduled Payments (as defined in the 2023 Notes Indenture) thereon (exclusive of interest accrued to the 2023 Notes Redemption Date) discounted to the 2023 Notes Redemption Date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate (as defined in the 2023 Notes Indenture) plus 50 basis points, in each case, plus accrued and unpaid interest thereon to but excluding the 2023 Notes Redemption Date, in accordance with the terms of the 2023 Notes Indenture and (y) The Bank of New York Mellon Trust Company, N.A. (in such capacity, the “2024 Notes Trustee”) under that certain Indenture, dated as of August 18, 2014 (as amended, supplemented or otherwise modified from time to time, including by that First Supplemental Indenture, dated as of August 18, 2014, the “2024 Notes Indenture”), by and among the Company, the subsidiary guarantors from time to time party thereto and the 2024 Notes Trustee, that on June 13, 2022 (the “2024 Notes Redemption Date”), the Company intends to redeem all of the $500 million of the aggregate principal amount of its outstanding 4.500% Senior Notes due 2024 (the “2024 Notes”) at a redemption price equal to the greater of (i) 100% of the principal amount of such 2024 Notes and (ii) the sum of the present values of the Remaining Scheduled Payments (as defined in the 2024 Notes Indenture) thereon (exclusive of interest accrued to the 2024 Notes Redemption Date) discounted to the 2024 Notes Redemption Date on a semiannual basis (assuming a 360-day year comprised of twelve 30-day months) at the Treasury Rate (as defined in the 2024 Notes Indenture) plus 35 basis points, in each case plus accrued and unpaid interest thereon to but excluding the 2024 Notes Redemption Date, in accordance with the terms of the 2024 Notes Indenture.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EXPEDIA GROUP, INC. |

| | |

| By: | /s/ Robert J. Dzielak |

| | Robert J. Dzielak |

| | Chief Legal Officer and Secretary |

Dated: May 13, 2022

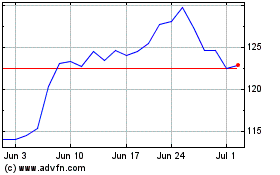

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

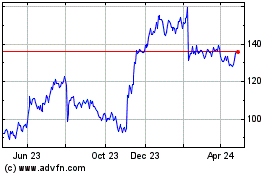

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024