false

0001817004

0001817004

2024-11-18

2024-11-18

0001817004

dei:FormerAddressMember

2024-11-18

2024-11-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 18, 2024

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

67

NW 183rd Street, Miami, Florida 33169

(Address

of principal executive offices, including Zip Code)

305

-791-1169

(Registrant’s

telephone number, including area code)

2999

NE 191st Street, Ste 500, Aventura Florida 33180

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

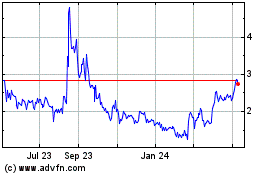

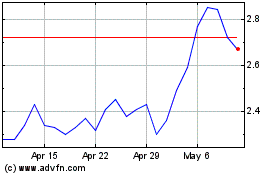

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Asset

Purchase Agreement dated November 18, 2024:

On

November 18, 2024, EzFill Holdings, Inc. (the “Company”) entered into an Asset Purchase Agreement (the “APA”)

with Yoshi, Inc., a Delaware limited liability company involved in the business of mobile fueling and operations, related parts and tools

and the provision of services related thereto (the “Seller”). Pursuant to the APA, subject to the terms and conditions thereof,

the Company agreed to acquire certain assets of the Seller including certain equipment, contracts and other tangible personal property

owned by the seller and used (or allocated for use) in its business, free and clear of any lien, pledge, security interest, mortgage,

right of way, easement, encroachment, or right of first offer or first refusal (collectively, the “Assets”), other than certain

excluded assets and certain liabilities as contained in the APA.

The

total consideration to be paid by the Company is $2,000,000 subject to certain adjustments as laid out in the APA (the “Purchase

Price”). The Purchase Price will be paid as follows: (i) $1,250,000 will be paid by the Company to the Seller on or before December

2, 2024; (ii) $500,000 through issuance by the Company to the Seller of shares of the Company’s Common Stock, to be issued based

on the closing price of the Company’s Common Stock on the Nasdaq Capital Market on the last trading date prior to December 2, 2024

(the “Closing Date”); and (iii) the remaining $250,000 in the form of a promissory note to be provided by the Buyer, which

promissory note shall be paid after six (6) months but within nine (9) months of the Closing Date.

The

APA contains customary representations, warranties and covenants. The APA also contains customary indemnification provisions by each

of Seller and the Company in favor of one another.

The

information set forth above is qualified in its entirety by reference to the APA, which is incorporated herein by reference and attached

hereto as Exhibit 10.1.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

*Certain

schedules were omitted pursuant to Item 601 of Regulation S-K promulgated by the SEC. The Company agrees to supplementally furnish a

copy of any omitted schedule to the SEC upon request.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 22, 2024

| EZFILL

HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name: |

Yehuda

Levy |

|

| Title: |

Interim

Chief Executive Officer |

|

Exhibit

10.1

ASSET

PURCHASE AGREEMENT

THIS

ASSET PURCHASE AGREEMENT is made and effective as of November 18th, 2024, by and among EZFill Holdings, Inc., a Delaware Corporation

(“Buyer”), and Yoshi, Inc., a Delaware Corporation (“Seller”).

RECITALS

WHEREAS,

the Parties desire for Seller to sell, and Buyer to purchase, the Acquired Assets on the terms and subject to the conditions set forth

below.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, and other good and valuable consideration,

the receipt of which is hereby acknowledged, the Parties hereby agree, intending to be legally bound, as follows:

Article

I DEFINITIONS

Definitions.

The following terms have the meanings specified in this Section 1.1:

“Affiliate”

means, with respect to a specified Person, a Person that directly, or indirectly through one or more intermediaries, controls, is controlled

by or is under common control with, the specified Person. In addition to the foregoing, if the specified Person is an individual, the

term “Affiliate” also includes (i) the individual’s spouse, (ii) the members of the immediate family (including parents,

siblings and children) of the individual or of the individual’s spouse and (iii) any corporation, limited liability company, general

or limited partnership, trust, association or other business or investment entity that directly or indirectly, through one or more intermediaries

controls, is controlled by or is under common control with any of the foregoing individuals.

“Agreement”

means this Asset Purchase Agreement, including all Exhibits and Schedules hereto, as it may be amended, modified or supplemented from

time to time in accordance with its terms.

“Asset

List” means the list of the Assets dated as of November 12, 2024, and attached hereto as Schedule 1.

“Assumed

Payables” means the trade accounts payable of Seller for the purchase of parts, supplies and other materials ordered in the

ordinary course of the Business prior to the Closing Date that remain outstanding as of the Closing Date, and which parts, supplies and

other materials are not received until after the Closing Date.

“Books

and Records” means the books and records relating to the Acquired Assets and the Business, including any and all past and pending

documents of sales and service information, customer lists, supplier lists, inventory cost records, machinery and equipment records,

mailing lists, sales and purchasing materials, employee policy manuals, quality control records and procedures, books of account, customer

records, employment and personnel records and records quotations, purchase orders, correspondence, sales, brochures, advertising materials,

samples and display materials.

“Business”

means Seller’s mobile fueling business and operations, related parts and tools and the provision of services related thereto conducted

by Seller.

“Business

Day” means any weekday other than a state holiday in Florida or Tennessee or a federal holiday in the United States.

“Buyer

Ancillary Agreements” means all agreements, instruments, certificates and other documents being or to be executed and delivered

by Buyer under this Agreement.

“Closing”

means the consummation of the Transactions in accordance with Article IV.

“Closing

Date” means the date of this Agreement, December 2, 2024.

“Code”

means the Internal Revenue Code of 1986, as amended, and the rules and regulations promulgated thereunder.

“Common

Stock” means the stock value of EzFill Holdings, Inc. common stock as of the close of the previous trading day.

“Consent”

means a consent, waiver, authorization or approval of, or a declaration, filing or registration with, a Person.

“Contracts”

means all contracts, agreements, leases, licenses, commitments, arrangements and undertakings, written or oral.

“Employee

Plan” means any plan, program, agreement, policy or arrangement, whether or not reduced to writing, and whether covering a

single individual or a group of individuals, that is (a) an employee welfare benefit plan within the meaning of Section 3(1) of ERISA,

(b) an employee pension benefit plan within the meaning of Section 3(2) of ERISA, (c) a stock bonus, stock purchase, stock option, restricted

stock, stock appreciation right, profit sharing or similar equity-based plan or agreement, or (d) any other deferred-compensation, retirement,

severance, retention, change-in-control, leave, vacation, welfare-benefit, bonus, incentive or fringe-benefit plan, program, agreement

or arrangement maintained for the benefit of any officers, directors, employees or consultants of Seller or any ERISA Affiliate.

“Encumbrance”

means any lien, pledge, security interest, mortgage, right of way, easement, encroachment, or right of first offer or first refusal.

“Equipment”

means the itemized equipment, vehicles of Seller used or held for use in connection with the Business.

“ERISA”

means the federal Employee Retirement Income Security Act of 1974, as amended, and the rules and regulations promulgated thereunder.

“ERISA

Affiliate” means any other Person that, together with Seller, would be treated as a single employer under Section 414 of the

Code.

“GAAP”

means generally accepted accounting principles for financial reporting in the United States, as in effect as of the date of this Agreement.

“Governmental

Authority” means any federal, state or local government, or political subdivision thereof, any governmental authority, agency

or commission, or any arbitrator or arbitral body.

“Governmental

Authorization” means any Consent, license, certification, permit or other authorization issued, granted, given or otherwise

made available by or under the authority of any Governmental Authority or pursuant to any Law.

“Governmental

Order” means any order, writ, judgment, injunction, decree, stipulation, ruling, determination or award entered by or with

any Governmental Authority.

“Indebtedness”

means, with respect to any Person at any date, all indebtedness of such Person and its Subsidiaries, including all obligations for borrowed

money, the capitalized amount of all capital lease obligations, operating leases with respect to the Acquired Assets, all Liabilities

secured by an Encumbrance other than a Permitted Encumbrance, and all guarantees of such Person and its Subsidiaries in connection with

any of the foregoing; provided, however, the term “Indebtedness” will not include ordinary course trade account

payables.

“Intellectual

Property Rights” means all of the rights arising from or in respect of the following, whether protected, created or arising

under the Laws of the United States or any foreign jurisdiction: (a) patents and patent applications; (b) registered or unregistered

trademarks, service marks, trade dress rights, trade names, Internet domain names, identifying symbols, logos, emblems, signs or insignia,

and including all goodwill associated with the foregoing; (c) copyrights, mask work rights, works of authorship and moral rights; (d)

confidential and proprietary information, or non-public processes, designs, specifications, technology, know-how, techniques, formulas,

invention disclosures, inventions, concepts, trade secrets, discoveries, ideas, research and development, compositions, manufacturing

and production processes, technical data and information, customer lists, supplier lists, pricing and cost information, and business

and marketing plans and proposals.

“IRS”

means the Internal Revenue Service.

“Knowledge”

means (a) with respect to Seller, the actual knowledge, information and belief, after due inquiry, and (b) with respect to Buyer, the

actual knowledge, information and belief, after due inquiry.

“Labor

Matter” means any organized labor strike, dispute, slowdown or stoppage, or collective bargaining or unfair labor practice

claim.

“Law”

means any foreign, federal, state or local law, statute, ordinance, rule, regulation, policy or common law ruling.

“Liability”

means any liability or obligation of a Person whether known or unknown, whether asserted or unasserted, whether determined, determinable

or otherwise, whether absolute or contingent, whether accrued or unaccrued, whether liquidated or unliquidated and whether due or to

become due.

“Losses”

means any and all losses, Liabilities, claims, damages, expenses (including reasonable attorneys’ or other professional fees and

expenses and court costs), fines, Taxes or other costs or expenses, whether or not involving the claim of another Person.

“Material

Adverse Effect” means any event, circumstance, change, occurrence or development, whether or not such event, circumstance,

change, occurrence or development would be inconsistent with the representations and warranties of Seller under this Agreement, that

is materially adverse to, or has resulted in or could reasonably be expected to result in a material adverse effect on or a material

adverse change in, the Business or the Acquired Assets; provided that changes or effects, alone or in combination, that arise

out of or result from the following, individually or in the aggregate, shall not be considered when determining whether a Material Adverse

Effect has occurred: (a) changes to the industry or markets in which the Business operates that are not unique to the Business; (b) changes

in economic or financial or capital markets conditions generally; (c) a change or proposed change in any accounting standard, principle

or interpretation; (d) a change or proposed change in any Law; (e) the announcement or the execution of this Agreement, the pendency

or consummation of the Transactions; (f) the compliance with the terms of this Agreement or the taking of any action required or contemplated

by this Agreement; (g) any natural disaster; (h) any acts of terrorism or war or the outbreak or escalation of hostilities or change

in geopolitical conditions; provided that with respect to clauses (a), (b), (c), (d), (g) and (h), such matter does not disproportionately

affect the Business as compared to a similarly situated business operating in the principal business in which the Business operates.

“Organizational

Documents” means, with respect to any Person (other than an individual), the certificate or articles of incorporation or organization,

certificate of limited partnership and any joint venture, limited liability company, operating, voting or partnership agreement, by-laws,

or similar documents, instruments or agreements relating to the organization or governance of such Person, in each case, as amended or

supplemented.

“Parties”

means all of the parties hereto.

“Person”

means any individual, firm, proprietorship, partnership, corporation, limited liability company, limited partnership, association, joint

stock company, trust, joint venture, unincorporated organization, Governmental Authority or any other type of entity.

“Pre-Closing

Payables” means the trade accounts payable of Seller for the purchase of parts, supplies and other materials ordered in the

ordinary course of the Business prior to the Closing Date, and which parts, supplies and other materials are received prior to the Closing

Date.

“Pre-Closing

Receivables” means the trade accounts receivable of Seller for Business services rendered in the ordinary course of Business

prior to the Closing Date.

“Proceeding”

means any action, arbitration, audit, examination, investigation, hearing, litigation or suit (whether civil, criminal, administrative,

judicial or investigative, whether formal or informal, and whether public or private) commenced, brought, conducted or heard by or before,

or otherwise involving, any Governmental Authority.

“Real

Property” means real property at which Business is conducted or the Acquired Assets have been stored.

“Recently

Purchased Equipment” means all Equipment which is not included on the Equipment List and which (a) has been purchased by Seller

after November 12,

2024 but prior to the Closing Date, and (b) is accounted for in the list of Acquired Assets.

“Recently

Sold Equipment” means all Equipment included on the Asset List which has been sold by Seller after the date of the Equipment

List, but prior to the Closing Date.

“Seller

Ancillary Agreements” means all agreements, instruments, certificates and documents being or to be executed and delivered by

Seller under this Agreement.

“Seller

Disclosure Schedule” means the disclosure schedule delivered by Seller to Buyer in connection with the execution of this Agreement.

The Sections of the Seller Disclosure Schedule will be numbered to correspond to the applicable Section of this Agreement and, together

with all matters under such heading, will be deemed to qualify only that section; provided, however, any information disclosed in the

Seller Disclosure Schedule under any Section number will be deemed to be disclosed and incorporated into any other Section of the Seller

Disclosure Schedule where it is reasonably apparent on the face of such disclosure that such disclosures apply.

“Seller

Intellectual Property” means all Intellectual Property Rights owned or held for use by Seller in the conduct of the Business.

“Straddle

Period” means any Tax period which begins before the Closing Date and ends on or after the Closing Date.

“Subsidiary”

means, with respect to a specified Person, any other Person of which securities or other interests having the power to elect a majority

of that other Person’s board of directors or similar governing body, or otherwise having the power to direct or cause the direction

of the management and policies of that other Person (other than securities or other interests having such power only upon the happening

of a contingency that has not occurred) are held by the specified Person or one or more of its Subsidiaries.

“Tax”

or “Taxes” means (a) any and all federal, state, local, or foreign income, gross receipts, license, payroll, employment,

excise, severance, stamp, occupation, premium, windfall profits, environmental, customs duties, capital stock, franchise, profits, withholding,

social security (or similar, including FICA), unemployment, disability, real property, personal property, sales, use, transfer, registration,

value added, alternative or add-on minimum, estimated, or other tax of any kind, whether direct or indirect and whether imposed by way

of a withholding or a deduction for or on an account of tax, or any charge of any kind in the nature of (or similar to) taxes whatsoever,

including any interest, penalty, or addition thereto, whether disputed or not and (b) any Liability for the payment of any amounts of

the type described in clause (a) of this definition as a result of being a member of an affiliated, consolidated, combined or unitary

group for any period, as a result of any tax sharing or tax allocation agreement, arrangement or understanding, or as a result of being

liable for another Person’s taxes as a transferee or successor, by contract or otherwise.

“Tax

Return” means any report, return or other information required to be supplied to a Governmental Authority in connection with

any Taxes.

“Transactions”

refers collectively to the transactions contemplated by this Agreement.

“Treasury

Regulations” means the final and temporary Income Tax Regulations promulgated under the Code, as such regulations may be amended

from time to time (including corresponding provisions of succeeding regulations).

Terms

Defined Elsewhere in this Agreement. In addition to the defined terms in Section 1.1, the following is a list of defined terms used

in this Agreement and a reference to the Section hereof in which such term is defined:

| |

Accounting

Firm |

Section

3.3 |

| |

Acquired Assets |

Section

2.1 |

| |

Allocation Schedule |

Section

3.4 |

| |

Assignment and Assumption Agreement |

Section

4.2(b) |

| |

Assumed Contracts |

Section

2.1(d) |

| |

Bill of Sale |

Section

4.2(a) |

| |

Business Employees |

Section

5.12(b) |

| |

Buyer |

Opening

Paragraph |

| |

Buyer Core Representations |

Section

8.5 |

| |

Buyer Indemnified Parties |

Section

8.1 |

| |

Claim Amount |

Section

8.8(b) |

| |

Claim Notice |

Section

8.3(a) |

| |

Closing Statement |

Section

3.3(a) |

| |

COBRA |

Section

2.4(h) |

| |

Excluded Assets |

Section

2.2 |

| |

Excluded Liabilities |

Section

2.4 |

| |

Financial Statements |

Section

5.4 |

| |

Indemnification Period |

Section

8.5 |

| |

Indemnified Party |

Section

8.3(a) |

| |

Indemnifying Party |

Section

8.3(a) |

| |

Interim Balance Sheet |

Section

5.4(a) |

| |

Objection Notice |

Section

8.3(b) |

| |

Penalty Date |

Section

7.5(b) |

| |

Purchase Price |

Section

3.1(a) |

| |

Seller |

Opening

Paragraph |

| |

Seller Benefit Plan |

Section

5.9 |

| |

Seller Core Representations |

Section

8.5 |

| |

Seller Closing Statement |

Section

4.2 |

| |

Seller Indemnified Parties |

Section

8.2 |

| |

Third Party Claim |

Section

8.3(a) |

| |

Threshold Amount |

Section

8.6(a) |

Interpretation.

The use of the masculine, feminine or neuter gender or the singular or plural form of words used herein (including defined terms) will

not limit any provision of this Agreement. The terms “include,” “includes” and “including” are not

intended to be limiting and will be deemed to be followed by the words “without limitation” (whether or not they are in fact

followed by such words) or words of like import. Reference to a particular Person includes such Person’s successors and assigns

to the extent such successors and assigns are permitted by the terms of any applicable agreement. The Exhibits and Schedules identified

in this Agreement are incorporated into this Agreement by reference and made a part hereof. The Article, Section, paragraph, Exhibit

and Schedule headings contained in this Agreement are for reference purposes only and will not affect in any way the meaning or interpretation

of this Agreement.

Article

II PURCHASE AND SALE

1.

Purchase and Sale of Acquired Assets. Upon the terms and subject to the conditions of this Agreement, at the Closing, Seller will

sell, convey, transfer, assign and deliver to Buyer, and Buyer will purchase and acquire from Seller, free and clear of all Encumbrances,

all of the properties, assets and rights of Seller constituting the Business, other than the Excluded Assets, including all right, title

and interest of Seller in and to the following properties, assets and rights (such properties, assets and rights, the “Acquired

Assets”):

(a)

all Equipment and all the non-itemized or non-serialized equipment, parts, consumable and retail supplies and merchandise, office, shop

and other equipment, machinery, fixtures, tools, attachments, hoses, cables, supplies, leasehold improvements and other tangible personal

property owned by Seller and used (or allocated for use) in the Business;

(b)

all the rights of Seller under the Contracts listed on Schedule 2 (the “Assumed Contracts”);

(c)

all warranties (express and implied) that continue in effect with respect to any Acquired Asset.

2.

Excluded Assets. Notwithstanding the provisions of Section 2.1, Seller will not sell, convey, transfer or assign to Buyer, and

Buyer will not purchase, acquire or take assignment of, any right, title or interest of Seller in any of the following (collectively,

the “Excluded Assets”):

(a)

all cash, cash equivalents, certificates of deposit, money market instruments, bank balances and rights in and to bank accounts, Treasury

bills, marketable securities and other securities;

(b)

Aggregated Accounts Receivable prior to the closing date;

(c)

the taxpayer and other identification numbers, seal, account books of original entry, all original accounts, checks, payment records,

Tax records and other documents, records and information relating to the organization, maintenance and existence of Seller as a corporation;

and

(d)

all rights of Seller under this Agreement and the Seller Ancillary Agreements.

(e)

any of Seller’s Intellectual Property Rights, except for those pertaining to the Contracts of the Seller’s Business as detailed

in Section 2.1.

3.

Excluded Liabilities. Buyer will not assume, nor will it agree to pay, perform or discharge, any Liability of Seller or any Affiliate

of Seller, whether or not arising from or relating to the conduct of the Business or the Acquired Assets (such Liabilities which are

not being assumed, the “Excluded Liabilities”). Without limiting the generality of the prior sentence, the Excluded

Liabilities will include the following:

| |

(a) |

any

Liability to pay any Taxes of Seller or any of its Affiliates; |

| |

|

|

| |

(b) |

any

Liability of Seller or its Affiliates for performance under this Agreement or the Seller Ancillary Agreements; |

| |

|

|

| |

(c) |

any

Liability under any Assumed Contract arising prior to the Closing Date or relating to any breach, violation, default or failure to

perform by Seller or its Affiliates that occurred prior to the Closing Date; |

| |

|

|

| |

(d) |

any

Liability relating to any Indebtedness of Seller or its Affiliates; |

| |

|

|

| |

(e) |

any

Liability for any accounts payable or other accruals related to the Business arising prior to the Closing Date, including the Pre-Closing

Payables but excluding the Assumed Payables; |

| |

|

|

| |

(f)

|

any

Liability with respect to any Proceeding arising from the operation of the Business prior to the Closing Date; |

| |

|

|

| |

(g)

|

any

Liability relating to the Excluded Assets; |

| |

|

|

| |

(h)

|

any

Liability under any Seller Benefit Plan, including all Liabilities for or arising from any health care continuation coverage required

to be provided under Section 4980B of the Code and Sections 601-608 of ERISA (“COBRA”) to employees, former employees

and any other COBRA qualified beneficiaries with respect to Seller or any ERISA Affiliate, including those who incur a COBRA qualifying

event in connection with the Transactions; |

| |

|

|

| |

(i)

|

all

employment related Liabilities of Seller. |

4.

Certain Provisions Regarding Assignments. Notwithstanding anything in this Agreement or any Seller Ancillary Agreement to the

contrary, neither this Agreement nor any Seller Ancillary Agreement will constitute an agreement to assign or transfer any interest in

any Assumed Contract or any claim or right arising thereunder if such assignment or transfer without the Consent of a third party would

constitute a breach thereof or affect adversely the rights of Buyer thereunder, and any such transfer or assignment will be made subject

to such Consent being obtained. In the event any such Consent is not obtained prior to Closing, Seller will continue to use commercially

reasonable efforts to obtain any such Consent after Closing, and Seller will cooperate with Buyer in any lawful and economically feasible

arrangement to provide that Buyer will receive the interest of Seller in the benefits under any such Assumed Contract, including performance

by Seller as agent, provided that Buyer will undertake to pay or satisfy the corresponding Liabilities for the enjoyment of such benefit

to the extent Buyer would have been responsible therefor if such Consent had been obtained. Nothing in this Section 2.4 will be deemed

a waiver by Buyer of its right to receive prior to or at Closing an effective assignment of all of the Acquired Assets, nor will this

Section 2.4 be deemed to constitute an agreement to exclude from the Acquired Assets any assets described under Section 2.1.

Article

III PURCHASE PRICE

1.

Purchase Price. The purchase price for the Acquired Assets (the “Purchase Price”) will be an amount equal to

$2,000,000.00.

2.

Payment of Purchase Price. On or before December 2, 2024, Buyer will pay to Seller, by wire

transfer of immediately available funds to an account designated by Seller, an amount equal to $1,250,000. Additionally, on the Closing

Date Buyer will issue to Seller $500,000 in the form of Buyer’s Common Stock. The Common Stock will be issued based on the Nasdaq

Official Closing Price for Seller’s Common Stock on the last trading day prior to the Closing Date. At the Closing, Buyer will

provide $250,000 in the form of a promissory note paid after six (6) months but within nine (9) months of the Closing Date.

3.

Closing Statement. Within thirty (30) days after the Closing, Buyer will prepare (or cause to be prepared), issue and deliver

to Seller a statement, the “Closing Statement”. Within the fifteen (15) day period after delivery by Buyer of the

Closing Statement, Seller will, in a written notice to Buyer, either accept the Closing Statement, or, in the event that Seller believes

that the Closing Statement is inaccurate, describe in reasonable detail any proposed adjustments to the Closing Statement which Seller

believes should be made and the basis therefor. If Buyer has not received such notice of proposed adjustments within such fifteen (15)

day period, the Closing Statement will be deemed to have been accepted and agreed to by Seller in the form in which such Closing Statement

is delivered by Buyer and will be final and binding on the Parties. Buyer and Seller will negotiate in good faith to resolve any dispute

over Buyer’s proposed Closing Statement, provided that if any such dispute is not resolved within fifteen (15) days following receipt

by Seller of the proposed adjustments, Buyer and Seller jointly will select (or, if Buyer and Seller are unable to agree, the American

Arbitration Association will select) an independent accounting firm which has not had a material relationship with Buyer, Seller or any

of their respective Affiliates within two (2) years preceding such selection (such firm, the “Accounting Firm”) to

resolve by arbitration any remaining dispute over Seller’s Closing Statement. The Accounting Firm will resolve the items in dispute

and render a written report on the resolved disputed items (and only on those disputed items) within thirty (30) days after the date

on which they are engaged or as soon thereafter as possible. In resolving any disputed item, the Accounting Firm may not assign a value

to any item greater than the greatest value for such item claimed by Buyer or Seller or less than the smallest value for such item claimed

by Buyer or Seller. The resolution of the dispute by the Accounting Firm will be final and binding upon the Parties except in the case

of fraud or manifest clerical error, and judgment may be entered on the award. The cost of the services of the Accounting Firm will be

allocated by the Accounting Firm between Buyer and Seller in the same proportion that the aggregate amount of such resolved disputed

items so submitted to the Accounting Firm that is unsuccessfully disputed by each such Party (as finally determined by the Accounting

Firm) bears to the total amount of such resolved disputed items so submitted.

4.

Allocation of Purchase Price. Within ninety (90) days of the Closing Date, Buyer will provide Seller with a schedule (the “Allocation

Schedule”) allocating the Purchase Price among the Acquired Assets in accordance with Section 1060 of the Code. If Seller fails

to object to the Allocation Schedule within fifteen (15) days of Seller’s receipt of the Allocation Schedule, then Buyer and Seller

agree to allocate the Purchase Price among the Acquired Assets as set forth on the Allocation Schedule. If Seller objects in writing

to the Allocation Schedule within fifteen (15) days of Seller’s receipt of the Allocation Schedule, then the Parties will attempt

to agree on the allocation of the Purchase Price among the Acquired Assets. If Buyer and Seller fail to agree on the allocation of the

Purchase Price, either Party may file an IRS Form 8594 reflecting an allocation of the Purchase Price as determined by such Party in

its discretion. Any adjustments to the Purchase Price pursuant to this Agreement will be allocated in a manner consistent with the final

allocation of the Purchase Price.

Article

IV CLOSING

1.

Closing Date. The Closing will be via the electronic exchange of documents and signature pages and will be effective for economic

and accounting purposes as of 12:01 a.m. eastern time on the Closing Date.

2.

Seller’s Deliveries. At Closing, Seller will deliver, or cause to be delivered, to Buyer the following: a bill of sale for

each of the titled Acquired Assets (the “Bill of Sale”), duly executed by Seller; an assignment and assumption agreement

(the “Assignment and Assumption Agreement”), duly executed by Seller; any certificates of title to motor vehicles

then in the Seller’s possession included in the Acquired Assets, duly endorsed for transfer to Buyer; and a written statement (the

“Seller Closing Statement”).

(a)

evidence that all Encumbrances on the Acquired Assets have been released and that termination statements with respect to all UCC financing

statements relating to such Encumbrances have been, or will be promptly following the Closing, filed at the expense of Seller;

(b)

such other bills of sale, assignments and other instruments of transfer or conveyance, duly executed by Seller, as may be reasonably

requested by Buyer to effect the sale, conveyance and delivery of the Acquired Assets to Buyer.

3.

Buyer’s Deliveries. At Closing, Buyer will deliver, or cause to be delivered, to Seller the following:

(a)

the portion of the Purchase Price due and payable pursuant to Section 3;

(b)

A Promissory Note as detailed in Section 3;

(c)

the Assignment and Assumption Agreement and any Lease Assignments, each duly executed by Buyer; and

(d)

such other instruments of transfer or conveyance as may be reasonably requested by Seller to effect the sale, conveyance and delivery

of the Acquired Assets as described in this Agreement.

Article

V REPRESENTATIONS AND WARRANTIES REGARDING SELLER

In

order to induce Buyer to enter into and perform this Agreement and to consummate the Transactions, Seller hereby make the following representations

and warranties to Buyer as of the date of this Agreement:

1.

Organization.

(a)

Seller is duly organized, validly existing and in good standing under the Laws of Delaware. Seller is registered and in good standing

under the laws of Tennessee, Texas, California, and Michigan. Seller has all requisite corporate power and authority to own assets and

to conduct its business as presently conducted.

(b)

Seller has no Subsidiaries and Seller does not own any equity, partnership, membership or similar interest in, or any interest convertible

into, exercisable for the purchase of or exchangeable for any such equity, partnership, membership or similar interest, or is under any

current or prospective obligation to form or participate in, provide funds to, make any loan, capital contribution or other investment

in, or assume any Liability of, any Person.

2.

Authorization. Seller has the requisite corporate power and authority to execute and deliver this Agreement and the Seller Ancillary

Agreements to which it is a party, to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution,

delivery and performance by Seller of this Agreement and any Seller Ancillary Agreement to which it is a party and the consummation by

Seller of the Transactions have been duly authorized by all necessary corporate action and no other action on the part of Seller is necessary

to authorize the execution, delivery and performance by Seller of this Agreement and any Seller Ancillary Agreement to which it is a

party and the consummation by Seller of the Transactions. The Seller has the full capacity, power, and authority to execute and deliver

this Agreement and the Seller Ancillary Agreements to which such Seller is a party, to perform his obligations hereunder and thereunder

and to consummate the Transactions. Seller has duly and validly executed and delivered this Agreement and each Seller Ancillary Agreement

to which it or he is a party. Assuming the due authorization, execution and delivery by Buyer of this Agreement and the Buyer Ancillary

Agreements, this Agreement and the Seller Ancillary Agreements constitute the legal, valid and binding obligation of Seller, as the case

may be, enforceable against Seller, as the case may be, in accordance with their respective terms.

3.

Governmental Authorizations and Consents; Non-Contravention. Except as set forth in Section

5.3 of the Seller Disclosure Schedule, the execution and delivery by Seller of this Agreement and the Seller Ancillary Agreements,

the performance by Seller of its respective obligations hereunder and thereunder and the consummation by Seller of the Transactions do

not and will not (a) require Seller to make any declaration, filing or registration with, or provide any notice to, any Governmental

Authority, or obtain any Governmental Authorization, (b) require any Consent from or to any Person, including any Consent required in

connection with the assignment of the Assumed Contracts, (c) violate or contravene any provision of the Organizational Documents of Seller,

(d) violate or conflict with, or result (with or without notice, lapse of time or both) in a violation of or constitute a default (or

give rise to any right of termination, cancellation or acceleration) under, constitute a change in control under, result in any payment

becoming due under, result in the imposition of any Encumbrance on any of the Acquired Assets under, or otherwise give rise to any right

on the part of any Person to exercise any remedy or obtain any relief under any Governmental Authorization or Contract to which Seller

is a party or by which Seller is bound or by which the Business or any of the Acquired Assets is subject, or (e) violate any Law or Governmental

Order applicable to Seller, the Acquired Assets, the Business or the Assumed Liabilities.

4.

Absence of Certain Changes or Events. Seller has not suffered any event which has had a Material Adverse Effect, Seller has conducted

the Business in the ordinary course and in substantially the same manner as conducted during the periods covered by Financial Statements

and Seller has not: (i) sold or transferred any asset, tangible or intangible other than the Recently

Sold Equipment; (ii) made any individual capital expenditure or commitment therefore without the pre-purchase approval of Buyer;

(iii) suffered damages, destruction or casualty loss, whether or not covered by insurance, materially affecting any of the Acquired Assets;

(iv) made any material change in the nature or operations of the Business; (v) made any material change in any method of accounting or

accounting principles of Seller; or (vi) made any material change in Seller’s cash management practices and its policies, practices

and procedures with respect to issuance of customer invoices, collection of accounts receivable, establishment of reserves for uncollectible

accounts, accrual of accounts receivable, inventory control, prepayment of expenses, payment of trade accounts payable, accrual of other

expenses, deferral of revenue and acceptance of customer deposits.

5.

Taxes. Seller has filed all federal, state, county and local Tax Returns which are required to be filed prior to the date of this

Agreement and has paid all Taxes which have become due and payable. No event has occurred which could impose on Buyer any successor or

transferee Liability for any Taxes in respect of Seller. All such Tax Returns are complete and accurate and disclose all Taxes required

to be paid. Seller has not waived or been requested to waive any statute of limitations in respect of Taxes. All Taxes that Seller is

required by Law to withhold or collect, including any sales and use Taxes and amounts required to be withheld or collected in connection

with any amount paid or owing to any employee, independent contractor, creditor, member, or other Person, have been duly withheld or

collected, and either paid to the respective taxing authorities, set aside in accounts for such purpose, or accrued, reserved against

and entered upon the books of Seller. No examination or audit of any Tax Return is currently in progress and no Governmental Authority

is asserting or, to the Knowledge of Seller, threatening to assert or expected to assert against Seller any deficiency, proposed deficiency

or claim for additional Taxes or any adjustment thereof with respect to any period for which a Tax Return has been filed, for which Tax

Returns have not yet been filed or for which Taxes are not yet due and payable. No claim has ever been made by a Governmental Authority

in a jurisdiction where Seller does not file a Tax Return that it is or may be subject to taxation by that jurisdiction. Seller has not

been a party to any “reportable transaction,” as defined in Section 6707A(c)(2) of the Code and Section 1.6011-4(b) of the

Treasury Regulations.

6.

Omitted.

7.

Title to Assets and Sufficiency of Assets. Seller has good and valid title to the Acquired Assets, free and clear of all Encumbrances

other than Permitted Encumbrances. All Encumbrances will be terminated or released at or prior to Closing at the expense of Seller. Upon

delivery to Buyer on or after the Closing Date of the instruments of transfer contemplated by Section 4.2, Seller will thereby transfer

to Buyer good and marketable title to the Acquired Assets, free and clear of all Encumbrances.

(a)

Except for the Excluded Assets, the Acquired Assets comprise in all material respects all of the assets used by Seller to conduct the

Business as presently conducted.

8.

Proceedings. There is no Proceeding pending or, to the Knowledge of Seller, threatened (a) against Seller or either Member or

relating to or affecting the Acquired Assets, the Real Property, or the Business or (b) which seeks to prohibit, restrict or delay consummation

of the Transactions or any of the conditions to consummation of the Transactions. There is no Governmental Order outstanding (i) against

Seller or either Member or relating to or affecting any of the Acquired Assets, the Real Property, or the Business or (ii) which seeks

to prohibit, restrict or delay consummation of the Transactions or any of the conditions to consummation of the Transactions.

9.

Employee Benefit Plans and Employee Compensation. Seller does not maintain, participate in or contribute to, and has never maintained,

participated in or contributed to (i) an employee benefit plan subject to Title IV of ERISA; (ii) a multiemployer plan within the meaning

of Section 3(37) of ERISA; or (iii) an employee benefit plan subject to the minimum funding standards of Section 412 of the Code or Section

302 of ERISA. No Employee Plans to which Seller sponsors, maintains, contributes or is obligated to contribute, or under which Seller

has or may have any Liability (each, a “Seller Benefit Plan”) is a multiple employer plan within the meaning of Section

413(c) of the Code or a “multiple employer welfare arrangement” as defined in Section 3(40) of ERISA. Each Seller Benefit

Plan conforms to and has been operated and administered in compliance with the requirements of ERISA, the Code and applicable Laws.

Section

5.9 of the Seller Disclosure Schedule contains: (i) a list of all employees employed for the operation of the Business of Seller as of

the date of this Agreement (the “Business Employees”); (ii) the current annual or hourly compensation and/or commission

rate of such Business Employees; and (iii) a list of all present or former employees of Seller who have terminated or given notice of

their intention to terminate their relationship with Seller since November 12, 2024. Except

as otherwise provided in this Agreement, the execution of and consummation of the Transactions, either alone or in connection with a

termination of employment or other event, do not constitute a triggering event under any Seller Benefit Plan or other arrangement or

agreement which will or may result in any payment, acceleration, vesting or increase of or in benefits to any employee or former employee

of Seller.

10.

Employment and Labor Matters. There are not, and during the past three (3) years there have not been, any Labor Matters pending

between Seller and any of the Business Employees. Seller is not subject to any collective bargaining agreements. To the Knowledge of

Seller, there is no current organization campaign for any union election likely to affect Seller.

11.

Contracts. Each of the Assumed Contracts is in full force and effect and constitutes a valid, legal, binding and enforceable obligation

of Seller and, to the Knowledge of Seller, the other Persons party thereto, subject to (a) Laws of general application relating to bankruptcy,

insolvency and the relief of debtors, and (b) rules of Law governing specific performance, injunctive relief and other equitable remedies.

Seller is not in breach or default under, and, to the Knowledge of Seller, no other Person party to any of the Assumed Contracts has

breached or defaulted thereunder.

12.

Compliance with Laws. Seller is not in breach or violation of, or default under, and has not been in breach or violation of, or

default under any Law. None of Seller, either Member, nor, to the Knowledge of Seller, any officers, employees, or agents of Seller have

directly or indirectly, overtly or covertly, in violation of any Law in connection with the Business made, or agreed to make, any contribution,

gift, bribe, rebate, payoff, influence payment, kickback or other payment to any Person (including, in the case of an individual, any

family members of such Person, and in the case of an entity, any Affiliates of such entity), regardless of form, whether in money, property

or services, including (a) to obtain favorable treatment in securing business, (b) to pay for favorable treatment for business secured,

or (c) to obtain special concessions or pay for special concessions already obtained for or in respect of Seller, which, in the case

of clause (a), (b) or (c) above: (i) would reasonably be likely to subject Seller to any damage or penalty in any Proceeding, including

under The Foreign Corrupt Practice Act of 1977 or any rules or regulations promulgated thereunder, (ii) if not given in the past, would

have had a Material Adverse Effect, or (iii) if not continued in the future, would have a Material Adverse Effect.

13.

Relationships with Affiliates. Except for standard confidentiality, assignment of invention and non-competition agreements or

employment agreements, none of any present officer, either Member, or any other Person that, to the Knowledge of Seller, is an Affiliate

of any of the foregoing, is currently a party to any transaction or Contract with Seller, including any loan, extension of credit or

arrangement for the extension of credit, any Contract providing for the furnishing of services by, rental or sale of assets from or to,

or otherwise requiring payments to or from, any such officer, director, Member or Affiliate.

14.

Brokers’ Fees. No agent, broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or

commission in connection with the Transactions based upon arrangements made by or on behalf of Seller or any of its Affiliates.

Article

VI REPRESENTATIONS AND WARRANTIES REGARDING BUYER

In

order to induce Seller to enter into and perform this Agreement and to consummate the Transactions, Buyer hereby makes the following

representations and warranties to Seller as of the date of this Agreement:

1.

Organization. Buyer is duly incorporated, validly existing and in good standing under the laws of the State of Delaware and has

the requisite corporate power and authority to own, lease and operate its properties and assets and to conduct its business as presently

conducted.

2.

Authorization. Buyer has full corporate power and authority to execute and deliver this Agreement and the Buyer Ancillary Agreements,

to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution, delivery and performance by Buyer

of this Agreement and the Buyer Ancillary Agreements and the consummation by Buyer of the Transactions have been duly authorized by all

necessary corporate action. Buyer has duly and validly executed and delivered this Agreement and the Buyer Ancillary Agreements. Assuming

the due authorization, execution and delivery by Seller of this Agreement and the Seller Ancillary Agreements, as applicable, this Agreement

and the Buyer Ancillary Agreements constitute the legal, valid and binding obligation of Buyer, enforceable against Buyer in accordance

with their respective terms.

3.

Governmental Authorizations and Consents; Non-Contravention. The execution and delivery by Buyer of this Agreement and the Buyer

Ancillary Agreements, the performance by Buyer of its obligations hereunder and thereunder and the consummation by Buyer of the Transactions

do not and will not (a) require Buyer to make any declaration, filing or registration with, or provide any notice to, any Governmental

Authority or obtain any Governmental Authorization, (b) require any Consent from or to any Person, (c) violate or contravene any provision

of the Organizational Documents of Buyer, or any resolution adopted by the shareholder or board of directors of Buyer, in each case as

amended to date, or (d) violate any Law or Governmental Order applicable to Buyer or its properties or assets.

4.

Proceedings. There are no Proceedings pending or, to the Knowledge of Buyer, threatened by or against Buyer with respect to this

Agreement or the Buyer Ancillary Agreements or in connection with the Transactions.

5.

Brokers’ Fees. No agent, broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or

commission in connection with the Transactions based upon arrangements made by or on behalf of Buyer or any of its Affiliates.

6.

Due Diligence Investigation. Buyer has conducted its own independent investigation of the Business and the Acquired Assets. In

making its decision to execute and deliver this Agreement and to consummate the Transactions, Buyer has relied solely upon the representations

and warranties of Seller set forth in Article V (and acknowledges that such representations and warranties are the only representations

and warranties made by Seller) and has not relied upon any other information provided by, for or on behalf of Seller, or its respective

agents or representatives, to Buyer in connection with the Transactions. Buyer has entered into the Transactions with the understanding,

acknowledgement and agreement that no representations or warranties, express or implied, are made with respect to any projection or forecast

regarding future results or activities or the probable success or profitability of the Business.

Article

VII COVENANTS

1.

Taxes. Seller will be liable for and will pay all personal property Taxes (whether assessed or unassessed) applicable to the Business

and the Acquired Assets, in each case to the extent attributable to taxable years or periods ending prior to the Closing Date and, with

respect to any Straddle Period, the portion of the Straddle Period ending on the date immediately

prior to the Closing Date. Buyer will be liable for and will pay all personal property Taxes (whether assessed or unassessed) applicable

to the Business and the Acquired Assets, in each case to the extent attributable to taxable years or periods beginning on or after the

Closing Date and, with respect to any Straddle Period, the portion of the Straddle Period including and beginning on the Closing Date.

All Taxes will be allocated on a daily basis. After the Closing, the Parties will cooperate in preparing and filing all personal property

Tax Returns applicable to the Business and the Acquired Assets to the extent reasonably requested, including by providing each other

with access to information, records, documents, properties and personnel relating to the Business, the Acquired Assets or the Assumed

Liabilities. Seller will pay the cost of all sales, use or transfer Taxes arising out of the Transactions. The sales, use and transfer

Tax Returns required by reason of the Transactions will be timely prepared by the Party required by applicable Law. The Parties will

cooperate with each other in connection with the preparation and filing of such Tax Returns, in obtaining all available exemptions from

such sales, use and transfer Taxes and in timely providing each other with resale certificates and any other documents necessary to satisfy

any such exemptions.

2.

Further Assurances. After the Closing, upon the reasonable request of another Party and at the expense of the requesting Party,

each Party will execute and deliver, or cause to be executed and delivered, to the requesting Party such bills of sale, assignments and

other instruments as may be reasonably requested and as are required to effectuate completely the transfer and assignment to Buyer of

Seller’s right, title and interest in and to the Acquired Assets and the assumption by Buyer of the Assumed Liabilities.

3.

Employees and Employee Benefit Plans. At the time of the Closing, Seller will terminate all of the Business Employees and, at

or following the Closing, Seller will pay to such Business Employees all amounts to which such Business Employees are entitled which

have been earned or accrued for wages, commissions, salaries, bonuses, holiday and vacation pay, and past service claims as of the date

immediately prior to the Closing Date, and will make and remit, for all periods through and including the date immediately prior to the

Closing Date, all proper deductions, remittances and contributions for employees’ wages, commissions and salaries required under

all Contracts and Laws (including for any health, hospital and medical insurance, group life insurance, pension plans, workers’

compensation, unemployment insurance, income Tax, FICA taxes and the like) and, wherever required by such Contracts and/or Laws, all

proper deductions and contributions from its own funds for such purposes. Seller will be responsible for all Liabilities arising out

of or based upon such termination of the Business Employees, including any severance pay obligations of Seller or its Affiliates.

4.

Expenses. Except as set forth in Section 3.3(b), all expenses incurred in connection with this Agreement and the Transactions

will be paid and borne by the Party incurring such expenses.

5.

Pre-Closing Payables; Pre-Closing Receivables.

After

the Closing Date, Buyer will promptly forward to Seller any invoices, bills, notices or requests for payments relating to Pre-Closing

Payables. Promptly upon receipt, and in any event no later than the expiration of the period of time during which such Pre-Closing Payables

may be paid by Seller without the incurrence of any interest penalty, late fee or other charge thereon (the “Penalty Date”),

Seller will pay all such bona fide Pre-Closing Payables (it being understood that where any such Pre-Closing Payable is the subject of

a bona fide good faith dispute between Seller and the third party claiming such amount, Seller may delay payment of such Pre-Closing

Payable until such dispute is resolved). In the event Seller fails to pay any bona fide Pre-Closing Payable (including any interest penalties,

late fees or other charges thereon) within sixty (60) days after the Penalty Date (other than in the event of a bona fide good faith

dispute as described above), upon sixty (60) days prior written notice to Seller, if Buyer reasonably believes that the ongoing failure

to pay such bona fide Pre-Closing Payables is reasonably likely to result in damages to the operation of the Business, then Buyer will

have the right to pay such bona fide Pre-Closing Payable on behalf of Seller (including any interest penalties, late fees or other charges

thereon) and Buyer will be entitled to repayment by Seller.

After

the Closing Date, Buyer will promptly forward to Seller any payments relating to Pre-Closing Receivables. Promptly upon receipt, Buyer

will pay all such bona fide Pre-Closing Receivables to Seller (it being understood that where any such Pre-Closing Receivables is the

subject of a bona fide good faith dispute between Seller and Buyer, Buyer may delay payment of such Pre-Closing Receivable until such

dispute is resolved).

6.

Use of Name. After the Closing, Seller will maintain all rights and use of the name “Yoshi” or “Yoshi Mobility”.

Buyer agrees that they will not commercially use the name “Yoshi” or Yoshi Mobility” or any derivatives thereof or

any trademarks or service marks associated therewith. Buyer acknowledges and agrees that Seller would suffer irreparable injury, which

could not be fairly remedied by money damages, in the event of a breach by Buyer of the provisions of this Section and that Seller will

be entitled to an injunction restraining Buyer from any breach thereof.

Article

VIII INDEMNIFICATION

1.

Indemnification of Buyer. Subject to the limitations and other provisions of this Article VIII, Seller, jointly and severally,

will indemnify and hold harmless Buyer and its Affiliates (collectively, the “Buyer Indemnified Parties”) from and

against any and all Losses incurred or suffered by the Buyer Indemnified Parties arising out of, relating to or resulting from any of

the following:

(a)

any inaccuracy in or breach of any representation or warranty set forth in Article V;

(b)

the nonfulfillment, nonperformance or other breach of any covenant or agreement of Seller contained in this Agreement;

and

(c)

any arrangements or agreements made or alleged to have been made by Seller with any broker, finder or other agent in connection with

the Transactions.

2.

Indemnification of Seller. Subject to the limitations and other provisions of this Article VIII, Buyer will indemnify and hold

harmless Seller and the Seller’s respective Affiliates (collectively, the “Seller Indemnified Parties”) from

and against any and all Losses incurred or suffered by the Seller Indemnified Parties arising out of, relating to or resulting from any

of the following:

(a)

any inaccuracy in or breach of any representation or warranty set forth in Article VI;

(b)

the nonfulfillment, nonperformance or other breach of any covenant or agreement of Buyer contained in this Agreement;

(c)

any arrangements or agreements made or alleged to have been made by Buyer with any broker, finder or other agent in connection with the

Transactions; and

(d)

the ownership and operation of the Acquired Assets by Buyer after the Closing Date but excluding Liabilities to the extent arising out

of or relating to circumstances forming the basis of a claim for indemnification against Seller

pursuant to Section 8.1.

3.

Claim Procedure. A Party entitled to indemnification hereunder (the “Indemnified

Party”) will promptly give written notice (the “Claim Notice”) to the Party obligated to provide indemnification

hereunder (the “Indemnifying Party”) after (i) becoming aware of a Loss for which the Indemnified Party intends to

seek indemnification, or (ii) receipt by the Indemnified Party of notice of any claim or the commencement of any Proceeding against it

by a Person other than an Indemnified Party (a “Third Party Claim”) which may result in a Loss for which the Indemnified

Party is entitled to indemnification hereunder. The Claim Notice will describe the Loss and/or the asserted Liability in reasonable detail,

and will indicate the amount (estimated, if necessary) of the Loss and/or asserted Liability that has been or may be suffered by the

Indemnified Party. Except as provided in Section 8.4 below, the failure to provide a Claim Notice will not relieve the Indemnifying Party

of any Liability that it may have to any Indemnified Party, except to the extent that the Indemnifying Party demonstrates that the defense

of such Third Party Claim is prejudiced by the Indemnified Party’s failure to give such Claim Notice.

(a)

Within fifteen (15) days after receipt of a Claim Notice relating to a claim other than a Third Party Claim, the Indemnifying Party will

deliver to the Indemnified Party a written response in which the Indemnifying Party will either: (i) agree that the Indemnified Party

is entitled to receive all of the Losses at issue in the Claim Notice; or (ii) dispute the Indemnified Party’s entitlement to indemnification

by delivering to the Indemnified Party a written notice (an “Objection Notice”) setting forth in reasonable detail

each disputed item, the basis for each such disputed item and certifying that all such disputed items are being disputed in good faith.

If the Indemnifying Party fails to take either of the foregoing actions within fifteen (15) days after delivery of the Claim Notice,

then the Indemnifying Party will be deemed to have irrevocably accepted the Claim Notice and the Indemnifying Party will be deemed to

have irrevocably agreed to pay the Losses at issue in the Claim Notice.

(b)

If the Indemnifying Party delivers an Objection Notice to the Indemnified Party within fifteen

(15) days after delivery of the Claim Notice, then the dispute may be resolved by any legally available means consistent with the provisions

of Section 9.10. Third Party Claims. Any Indemnifying Party will have the right to contest, and defend the Indemnified Party against,

any Third Party Claim with counsel of the Indemnifying Party’s choice reasonably satisfactory to the Indemnified Party so long

as the Indemnifying Party notifies the Indemnified Party in writing within fifteen (15) days after the Indemnified Party has given a

Claim Notice that, subject to the limits set forth in this Article VIII, the Indemnifying Party will indemnify the Indemnified Party

from and against the Losses the Indemnified Party may suffer with respect to the Third Party Claim.

(c)

So long as the Indemnifying Party is conducting the defense of the Third Party Claim in accordance with Section 8.4(a): (i) the Indemnified

Party may retain separate co-counsel at its sole cost and expense and participate in the defense of the Third Party Claim, (ii) the Indemnified

Party will not consent to the entry of any Governmental Order or enter into any settlement with respect to the Third Party Claim without

the prior written consent of the Indemnifying Party (not to be withheld, delayed or conditioned unreasonably), and (iii) the Indemnifying

Party will not consent to the entry of any Governmental Order or enter into any settlement with respect to the Third Party Claim without

the prior written consent of the Indemnified Party (not to be withheld, delayed or conditioned unreasonably).

(d)

In the event the Indemnifying Party does not conduct the defense in accordance with Section 8.4(a), the Indemnified Party may defend

against the Third Party Claim in any manner it reasonably may deem appropriate; provided, however, that (i) the Indemnifying Party may

participate in such defense at its own expense, and (ii) the Indemnified Party will not consent to the entry of any Governmental Order

or enter into any settlement with respect to the Third Party Claim without the prior written consent of the Indemnifying Party (not to

be withheld, delayed or conditioned unreasonably).

4.

Survival. All representations and warranties contained in this Agreement will survive the consummation of the Transactions for

a period of two (2) years from the Closing Date, except that (a) the representations and warranties set forth in Sections 5.1(a),

5.1(b), 5.2(a), 5.2(b), 5.10(a), 6.1 and 6.2 will survive the consummation of the Transactions

indefinitely and (b) the representations and warranties contained in Section 5.6 will expire sixty (60) days after the end of the relevant

statute of limitations (taking into account any tolling periods and other extensions). The survival period of each representation and

warranty as provided in this Section 8.5 is hereinafter referred to as the “Indemnification Period.” No Party will

have any Liability with respect to claims first asserted in connection with any representation or warranty after expiration of the Indemnification

Period. Covenants contemplating or involving actions to be taken, or obligations in effect, after the Closing, will survive the Closing

and will continue in full force and effect after the Closing in accordance with their terms. If an Indemnified Party delivers to an Indemnifying

Party, before expiration of the Indemnification Period, a Claim Notice based upon a breach of any such representation or warranty, then

the applicable representation or warranty will survive until, but only for purposes of, the resolution of the matter covered by such

notice.

5.

Limitations on Liability. The indemnification contemplated by Sections 8.1 and 8.2 will be subject to the following limitations

and conditions: Seller will not be subject to any Liability for indemnification under Section 8.1(a) unless and until the aggregate Losses

with respect to claims for indemnification under Section 8.1(a) exceed an amount equal to $10,000 (the “Threshold Amount”),

at which point Seller will be subject to Liability for indemnification under Section 8.1(a) for all such Losses; provided, however,

the Threshold Amount will not be applicable with respect to claims for indemnification for any inaccuracy in or breach of the representations

and warranties contained in Section 5.1(a), 5.1(b), 5.2(a), 5.2(b), 5.6 and 5.10(a) (the “Seller Core Representations”);

Buyer will not be subject to any Liability for indemnification under Section 8.2(a) unless and until the aggregate Losses with respect

to claims for indemnification under Section 8.2(a) exceed an amount equal to the Threshold Amount, at which point Buyer will be subject

to Liability for indemnification under Section 8.2(a) for all such Losses; provided, however, the Threshold Amount will

not be applicable with respect to claims for indemnification for any inaccuracy in or breach of the representations and warranties contained

in Section 6.1 and 6.2 (the “Buyer Core Representations”) ;no Party will be obligated to pay for any claims for indemnification

made under this Agreement in an aggregate amount in excess of ten percent (10%) of the Base Purchase Price; provided, however,

the limitation set forth in this Section 8.6(c) will not apply to Losses arising out of or based on (i) fraud or intentional misrepresentation,

(ii) indemnification claims based on any inaccuracy in or breach of the Seller Core Representations or the Buyer Core Representations,

as the case may be, or (iii) indemnification claims based on Sections 8.1(b), 8.1(c), 8.1(d), 8.2(b) or 8.2(c);

(a)

each Party’s sole and exclusive remedy for any breach of this Agreement by any other Party will be as provided in this Article

VIII; provided, however, nothing in this Agreement will be deemed to prohibit or limit (i) any Party’s right at any

time, on or after the Closing, to seek or obtain recovery for Losses, or to limit any Party’s remedies, resulting from fraud or

an intentional misrepresentation or (ii) Buyer’s right to specific performance or injunctive relief in the event of a breach or

threatened breach of Section 7.6;

(b)

in no event will any Party be entitled to recover or make a claim for (i) consequential, special or indirect damages that are remote

or speculative damages and not the natural, probable and reasonably foreseeable consequence of the event that gave rise thereto or the

matter for which indemnification is sought hereunder, or (ii) punitive damages, other than, in either case (i) or (ii), a claim for indemnification

for such damages that arise from a Third Party Claim; and

(c)

in the event any Losses related to a claim by a Party is covered by third party insurance, such Party agrees to use commercially reasonable

efforts to seek recovery from such third party insurance and no Party will be entitled to recover from another Party (and will refund

amounts received up to the amount of indemnification actually received) with respect to the Losses to the extent that such Party received

any insurance payment under such third party insurance with respect to such Losses (net of any deductible or reasonable out-of-pocket

expenses incurred in obtained such insurance proceeds).

6.

Knowledge. The right to indemnification based upon the representations and warranties of either Party in this Agreement will not

be affected by any Knowledge acquired (or capable of being acquired) by the other Party before the execution and delivery of this Agreement

with respect to the accuracy or inaccuracy of any such representation or warranty.

Article

IX GENERAL PROVISIONS

1.

Governing Law. The Laws of Delaware (without giving effect to its conflicts of law principles) govern this Agreement and all matters

arising out of or relating to this Agreement and the Transactions, including its negotiation, execution, validity, interpretation, construction,

performance and enforcement.

2.

Public Announcements. No Party shall make any public announcements in respect of this Agreement or the Transactions without the

prior written consent of the other Party. Following the Closing and without the prior approval of Seller, (a) Buyer may disclose the

Transactions and the Purchase Price in the notes to its consolidated financial statements contained in Buyer’s quarterly and annual

reports, and (b) Buyer may publicly discuss the Transactions in conference calls and discussions with investors and analysts from time-to-time.

Notwithstanding the foregoing, (i) each Party may disclose this Agreement or the Transactions (A) as required by Law or (B) to (x) current

and future representatives of such Party and its Affiliates, and (y) current and potential lenders to, investors in and purchasers of

such Party and its Affiliates, and (ii) nothing in this Section 9.2 will prevent any Party from enforcing its rights hereunder.

3.

Notices. All notices and other communications under this Agreement must be in writing and are deemed duly delivered when (a) delivered

if delivered personally or by nationally recognized overnight courier service (costs prepaid), (b) sent by electronic email with confirmation

of transmission by the transmitting equipment (or, the first Business Day following such transmission if the date of transmission is

not a Business Day) or (c) received or rejected by the addressee, if sent by certified mail, return receipt requested; in each case to

the following addresses or emails and marked to the attention of the individual (by name or title) designated below (or to such other

address, email or individual as a Party may designate by notice to the other Parties):

| |

If to Buyer: |

EzFill

Holdings, Inc. |

| |

|

67

NW 183rd St. |

| |

|

Miami,

FL 33169 |

| |

|

Attention:

Yehuda Levy |

| |

|

Email:

yehuda@ezfl.com |

| |

|

|

| |

|

|

| |

If to Seller: |

Yoshi,

Inc. |

| |

|

10

Burton Hills Blvd. Ste. 400 |

| |

|

Nashville,

TN 37215 |

| |

|

Attention:

Bryan Frist |

| |

|

Email:

legal@yoshimobility.com |

4.

Waivers. Except as otherwise provided in Article VIII, the failure of a Party at any time or times to require performance of any

provision hereof or claim damages with respect thereto will in no manner affect its right at a later time to enforce the same. No waiver

by a Party of any condition or of any breach of any term, covenant, representation or warranty contained in this Agreement will be effective

unless in writing, and no waiver in any one or more instances will be deemed to be a further or continuing waiver of any such condition

or breach in other instances or a waiver of any other condition or breach of any other term, covenant, representation or warranty.

5.

Severability. If any term or other provision of this Agreement is determined by a court of competent jurisdiction to be invalid,

illegal or incapable of being enforced by any rule of Law or public policy, all other terms, provisions and conditions of this Agreement

will nevertheless remain in full force and effect. Upon such determination that any term or other provision is invalid, illegal or incapable

of being enforced, the Parties hereto will negotiate in good faith to modify this Agreement so as to effect the original intent of the