false0000035527Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock00000355272024-10-182024-10-180000035527us-gaap:CommonStockMember2024-10-182024-10-180000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf6.625FixedToFloatingRateNotCumulativePerpetualPreferredStockSeriesI2Member2024-10-182024-10-180000035527fitb:DepositarySharesRepresentingA140thOwnershipInterestInAShareOf6.00NotCumulativePerpetualClassBPreferredStockSeriesAMember2024-10-182024-10-180000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf4.95NotCumulativePerpetualPreferredStockSeriesKMember2024-10-182024-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 18, 2024

Fifth Third Bancorp

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | | 001-33653 | | 31-0854434 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| Fifth Third Center | | |

| 38 Fountain Square Plaza | , | Cincinnati | , | Ohio | | 45263 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(800) 972-3030

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | | | |

| | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

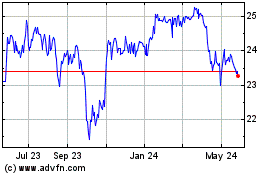

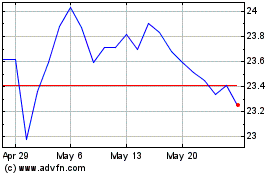

| Common Stock, Without Par Value | | FITB | | The | NASDAQ | Stock Market LLC |

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I | | FITBI | | The | NASDAQ | Stock Market LLC |

| Depositary Shares Representing a 1/40th Ownership Interest in a Share of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A | | FITBP | | The | NASDAQ | Stock Market LLC |

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 4.95% Non-Cumulative Perpetual Preferred Stock, Series K | | FITBO | | The | NASDAQ | Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 18, 2024, Fifth Third Bancorp issued a press release announcing its earnings release for the third quarter of 2024. A copy of this press release is attached as Exhibit 99.1. This information is furnished under both Item 2.02 Results of Operations and Financial Condition and Item 7.01 Regulation FD Disclosure.

The information in this Item 2.02 of Form 8-K and Exhibits attached hereto shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Exchange Act of 1934 or the Securities Act of 1933, except as shall be expressly set forth by specific reference.

Item 7.01 Regulation FD Disclosure.

On October 18, 2024, Fifth Third Bancorp issued a press release announcing its earnings release for the third quarter of 2024. A copy of this press release is attached as Exhibit 99.1. This information is furnished under both Item 2.02 Results of Operations and Financial Condition and Item 7.01 Regulation FD Disclosure.

For the benefit of its investors, Fifth Third Bancorp is also furnishing a presentation regarding its earnings conference call. A copy of this item is attached as Exhibit 99.2.

The information in this Item 7.01 of Form 8-K and Exhibits attached hereto shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Exchange Act of 1934 or the Securities Act of 1933, except as shall be expressly set forth by specific reference.

Item 9.01 Financial Statements and Exhibits

Exhibit 104 – Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | FIFTH THIRD BANCORP |

| | (Registrant) |

| | | |

Date: October 18, 2024 | | /s/ Bryan D. Preston |

| | | |

| | Bryan D. Preston |

| | Executive Vice President and

Chief Financial Officer |

Fifth Third Bancorp Reports Third Quarter 2024 Diluted Earnings Per Share of $0.78

Fee income growth and resilient balance sheet leads to another quarter of strong returns

Reported results included a negative $0.07 impact from certain items on page 2

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Key Financial Data | | | | | | | Key Highlights |

| | | | | | | | | | |

| $ in millions for all balance sheet and income statement items | | | | | | | |

| | 3Q24 | 2Q24 | 3Q23 | Stability: •Sequential growth in net interest income and net interest margin driven by the repricing benefit on fixed rate loan portfolio and moderating deposit costs •Strong profitability resulted in CET1 increasing to 10.75% while executing a $200 million share repurchase and raising common stock dividend by 6% •Loan-to-core deposit ratio of 71% Profitability: •Disciplined expense management; efficiency ratio(a) of 58.2%; adjusted efficiency ratio(a) of 56.1% improved 70 bps sequentially •Interest-bearing liabilities costs down 1 bp from 2Q24 Growth: •Strong fee performance driven by strategic investments. Compared to 3Q23: •Wealth & asset management revenue up 12% •Commercial payments revenue up 10% •Capital markets fees up 9% •Generated consumer household growth of 3% compared to 3Q23 |

| | | | | | | |

| Income Statement Data | | | | | | |

| Net income available to common shareholders | $532 | | $561 | | $623 | |

| Net interest income (U.S. GAAP) | 1,421 | | 1,387 | | 1,438 | |

| Net interest income (FTE)(a) | 1,427 | | 1,393 | | 1,445 | |

| Noninterest income | 711 | | 695 | | 715 | |

| Noninterest expense | 1,244 | | 1,221 | | 1,188 | |

| | | | | | | |

| Per Share Data | | | | | | |

| Earnings per share, basic | $0.78 | | $0.82 | | $0.91 | |

| Earnings per share, diluted | 0.78 | | 0.81 | | 0.91 | |

| Book value per share | 27.60 | | 25.13 | | 21.19 | |

| Tangible book value per share(a) | 20.20 | | 17.75 | | 13.76 | |

| | | | | | | |

| Balance Sheet & Credit Quality | | | | | | |

| Average portfolio loans and leases | $116,826 | | $116,891 | | $121,630 | |

| Average deposits | 167,196 | | 167,194 | | 165,644 | |

| Accumulated other comprehensive loss | (3,446) | | (4,901) | | (6,839) | |

| Net charge-off ratio(b) | 0.48 | % | 0.49 | % | 0.41 | % |

| Nonperforming asset ratio(c) | 0.62 | | 0.55 | | 0.51 | |

| | | | | | | |

| Financial Ratios | | | | | | |

| Return on average assets | 1.06 | % | 1.14 | % | 1.26 | % |

| Return on average common equity | 11.7 | | 13.6 | | 16.3 | |

| Return on average tangible common equity(a) | 16.3 | | 19.8 | | 24.7 | |

| CET1 capital(d)(e) | 10.75 | | 10.62 | | 9.80 | |

| Net interest margin(a) | 2.90 | | 2.88 | | 2.98 | |

| Efficiency(a) | 58.2 | | 58.5 | | 55.0 | |

| Other than the Quarterly Financial Review tables beginning on page 14, commentary is on a fully taxable-equivalent (FTE) basis unless otherwise noted. Consistent with SEC guidance in Regulation S-K that contemplates the calculation of tax-exempt income on a taxable-equivalent basis, net interest income, net interest margin, net interest rate spread, total revenue and the efficiency ratio are provided on an FTE basis. |

|

|

| | | | | | | | | | | | | | |

| From Tim Spence, Fifth Third Chairman, CEO and President: | | |

Fifth Third achieved another quarter of strong and consistent performance driven by our resilient balance sheet, diversified and growing revenue streams, and disciplined expense management. With our strong core deposit franchise and liquidity, we are well positioned for the declining interest rate environment and volatility driven by the economic and regulatory uncertainty.

Our strategic growth priorities continue to deliver strong results. In the Southeast, where we are expanding into high-growth markets, deposits grew by 16% over the last twelve months. We generated record revenue in our Wealth & Asset Management business and assets under management grew 21% year-over-year to $69 billion. Our Commercial Payments revenue grew 10% compared to the year-ago quarter, with Newline adding industry leaders to its customer base.

Our strong and stable returns on capital allowed us to raise our common stock dividend by 6%, execute a $200 million share repurchase, and grow our tangible book value per share, ex. AOCI by 6% in the past year.

We remain well-positioned to generate long-term, sustainable value to our shareholders as we adhere to our guiding principles of stability, profitability, and growth – in that order.

Investor contact: Matt Curoe (513) 534-2345 | Media contact: Jennifer Hendricks Sullivan (614) 744-7693 October 18, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income Statement Highlights | | | | | | | | | | | | | |

| ($ in millions, except per share data) | For the Three Months Ended | | | % Change | |

| | September | | June | | September | | | | | |

| | 2024 | | 2024 | | 2023 | | Seq | | Yr/Yr | |

| Condensed Statements of Income | | | | | | | | | | | | | |

| Net interest income (NII)(a) | $1,427 | | $1,393 | | $1,445 | | 2% | | (1)% | |

| Provision for credit losses | 160 | | 97 | | 119 | | 65% | | 34% | |

| Noninterest income | 711 | | 695 | | 715 | | 2% | | (1)% | |

| Noninterest expense | 1,244 | | 1,221 | | 1,188 | | 2% | | 5% | |

| Income before income taxes(a) | $734 | | $770 | | $853 | | (5)% | | (14)% | |

| | | | | | | | | | | | | | |

| Taxable equivalent adjustment | $6 | | $6 | | $7 | | — | | (14)% | |

| Applicable income tax expense | 155 | | 163 | | 186 | | (5)% | | (17)% | |

| Net income | $573 | | $601 | | $660 | | (5)% | | (13)% | |

| Dividends on preferred stock | 41 | | 40 | | 37 | | 3% | | 11% | |

| Net income available to common shareholders | $532 | | $561 | | $623 | | (5)% | | (15)% | |

| Earnings per share, diluted | $0.78 | | $0.81 | | $0.91 | | (4)% | | (14)% | |

| | | | | | | | | | | | | | |

Fifth Third Bancorp (NASDAQ®: FITB) today reported third quarter 2024 net income of $573 million compared to net income of $601 million in the prior quarter and $660 million in the year-ago quarter. Net income available to common shareholders in the current quarter was $532 million, or $0.78 per diluted share, compared to $561 million, or $0.81 per diluted share, in the prior quarter and $623 million, or $0.91 per diluted share, in the year-ago quarter.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Diluted earnings per share impact of certain item(s) - 3Q24 | | |

| | | | | |

| | (after-tax impact(f); $ in millions, except per share data) | | |

| | | | | |

| | Restructuring severance expense | $(7) | | |

| | Interchange litigation matters | | | |

| | Valuation of Visa total return swap (noninterest income) | $(36) | | |

| | Mastercard litigation (noninterest expense) | (8) | | |

| | | | | |

| | | | | |

| | | | | |

| | subtotal | (44) | | |

| | | | | |

| | After-tax impact(f) of certain items | $(51) | | |

| | | | | |

| | Diluted earnings per share impact of certain item(s)1 | $(0.07) | | |

| | | | | |

| | Totals may not foot due to rounding; 1Diluted earnings per share impact reflects 686.109 million average diluted shares outstanding | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income | | | | | | | | | | | | | |

| (FTE; $ in millions)(a) | For the Three Months Ended | | | % Change | |

| | September | | June | | September | | | | | |

| | 2024 | | 2024 | | 2023 | | Seq | | Yr/Yr | |

| Interest Income | | | | | | | | | | | | | |

| Interest income | $2,675 | | | $2,626 | | | $2,536 | | | 2% | | 5% | |

| Interest expense | 1,248 | | | 1,233 | | | 1,091 | | | 1% | | 14% | |

| Net interest income (NII) | $1,427 | | | $1,393 | | | $1,445 | | | 2% | | (1)% | |

| NII excluding certain items(a) | $1,427 | | | $1,398 | | | $1,445 | | | 2% | | (1)% | |

| | | | | | | | | | | | | | |

| Average Yield/Rate Analysis | | | | | | | | | | bps Change | |

| Yield on interest-earning assets | 5.43 | % | | | 5.43 | % | | | 5.23 | % | | | — | | 20 | |

| Rate paid on interest-bearing liabilities | 3.38 | % | | | 3.39 | % | | | 3.10 | % | | | (1) | | 28 | |

| | | | | | | | | | | | | | |

| Ratios | | | | | | | | | | | | | |

| Net interest rate spread | 2.05 | % | | | 2.04 | % | | | 2.13 | % | | | 1 | | (8) | |

| Net interest margin (NIM) | 2.90 | % | | | 2.88 | % | | | 2.98 | % | | | 2 | | (8) | |

| NIM excluding certain items(a) | 2.90 | % | | | 2.89 | % | | | 2.98 | % | | | 1 | | (8) | |

| | | | | | | | | | | | | | |

Compared to the prior quarter, NII increased $34 million. Excluding the $5 million reduction related to the customer remediations in the prior quarter, NII was up $29 million, or 2%, primarily reflecting higher loan yields, the benefit of higher day count, and lower wholesale funding costs, partially offset by lower average commercial loan balances. Compared to the prior quarter, NIM increased 2 bps. Excluding the aforementioned customer remediations in the prior quarter, NIM increased 1 bp, primarily reflecting higher loan yields from the repricing benefit on the fixed rate loan portfolio, partially offset by the impact of higher cash balances. NIM results continue to be impacted by the decision to carry elevated liquidity given the environment, with the combination of cash and other short-term investments of approximately $25 billion at quarter-end.

Compared to the year-ago quarter, NII decreased $18 million, or 1%, reflecting the impact of the RWA diet lowering average loans by 4% and the deposit mix shift from demand to interest-bearing accounts at higher funding costs, partially offset by higher loan yields. Compared to the year-ago quarter, NIM decreased 8 bps, reflecting the net impact of higher market rates and their effects on deposit pricing and the decision to carry additional cash, partially offset by higher loan yields.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Income | | | | | | | | | | | | | |

| ($ in millions) | For the Three Months Ended | | % Change | | | | |

| | September | | June | | September | | | | | | | | |

| | 2024 | | 2024 | | 2023 | | Seq | | Yr/Yr | | | | |

| Noninterest Income | | | | | | | | | | | | | |

| Service charges on deposits | $161 | | $156 | | $149 | | 3% | | 8% | | | | |

| Commercial banking revenue | 163 | | 144 | | 154 | | 13% | | 6% | | | | |

| Mortgage banking net revenue | 50 | | 50 | | 57 | | — | | (12)% | | | | |

| Wealth and asset management revenue | 163 | | 159 | | 145 | | 3% | | 12% | | | | |

| Card and processing revenue | 106 | | 108 | | 104 | | (2)% | | 2% | | | | |

| Leasing business revenue | 43 | | 38 | | 58 | | 13% | | (26)% | | | | |

| Other noninterest income | 15 | | 37 | | 55 | | (59)% | | (73)% | | | | |

| Securities gains (losses), net | 10 | | 3 | | (7) | | 233% | | NM | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Total noninterest income | $711 | | $695 | | $715 | | 2% | | (1)% | | | | |

| | | | | | | | | | | | | | |

Reported noninterest income increased $16 million, or 2%, from the prior quarter, and decreased $4 million, or 1%, from the year-ago quarter. The reported results reflect the impact of certain items in the table below, including the mark-to-market on the valuation of Visa total return swap and securities gains/losses which incorporate mark-to-market impacts from securities associated with non-qualified deferred compensation plans that are more than offset in noninterest expense.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Income excluding certain items |

| ($ in millions) | For the Three Months Ended | | | | | | |

| | September | | June | | | September | | | % Change | |

| | 2024 | | 2024 | | | 2023 | | | Seq | | Yr/Yr | |

| Noninterest Income excluding certain items | | | | | | | | | | | | | |

| Noninterest income (U.S. GAAP) | $711 | | | $695 | | | $715 | | | | | | |

| Valuation of Visa total return swap | 47 | | | 23 | | | 10 | | | | | | |

| Legal settlements and remediations | — | | | 2 | | | — | | | | | | |

| Securities (gains) losses, net | (10) | | | (3) | | | 7 | | | | | | |

| Noninterest income excluding certain items(a) | $748 | | | $717 | | | $732 | | | 4% | | 2% | |

| | | | | | | | | | | | | | |

Noninterest income excluding certain items increased $31 million, or 4%, compared to the prior quarter, and increased $16 million, or 2%, from the year-ago quarter.

Compared to the prior quarter, service charges on deposits increased $5 million, or 3%, reflecting an increase in both consumer deposit fees and commercial payments revenue. Commercial banking revenue increased $19 million, or 13%, primarily reflecting increases in corporate bond fees and institutional brokerage revenue, partially offset by a decrease in client financial risk management revenue. Wealth and asset management revenue increased $4 million, or 3%, primarily driven by increases in personal asset management revenue and brokerage fees. Card and processing revenue decreased $2 million, or 2%, driven by a decrease in interchange revenue. Leasing business revenue increased $5 million, or 13%, primarily driven by an increase in lease remarketing revenue.

Compared to the year-ago quarter, service charges on deposits increased $12 million, or 8%, primarily reflecting an increase in commercial payments revenue. Commercial banking revenue increased $9 million, or 6%, primarily reflecting an increase in corporate bond fees, partially offset by a decrease in client financial risk management revenue. Mortgage banking net revenue decreased $7 million, or 12%, primarily reflecting decreases in MSR net valuation adjustments and mortgage servicing revenue. Wealth and asset management revenue increased $18 million, or 12%, primarily reflecting increases in personal asset management revenue and brokerage fees. Leasing business revenue decreased $15 million, or 26%, primarily reflecting a decrease in operating lease revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Expense | | | | | | | | | | | | | |

| ($ in millions) | For the Three Months Ended | | | % Change | |

| | September | | June | | September | | | | | |

| | 2024 | | 2024 | | 2023 | | Seq | | Yr/Yr | |

| Noninterest Expense | | | | | | | | | | | | | |

| Compensation and benefits | $690 | | | $656 | | | $629 | | | 5% | | 10% | |

| Net occupancy expense | 81 | | | 83 | | | 84 | | | (2)% | | (4)% | |

| Technology and communications | 121 | | | 114 | | | 115 | | | 6% | | 5% | |

| Equipment expense | 38 | | | 38 | | | 37 | | | — | | 3% | |

| Card and processing expense | 22 | | | 21 | | | 21 | | | 5% | | 5% | |

| Leasing business expense | 21 | | | 22 | | | 29 | | | (5)% | | (28)% | |

| Marketing expense | 26 | | | 34 | | | 35 | | | (24)% | | (26)% | |

| Other noninterest expense | 245 | | | 253 | | | 238 | | | (3)% | | 3% | |

| Total noninterest expense | $1,244 | | | $1,221 | | | $1,188 | | | 2% | | 5% | |

| | | | | | | | | | | | | | |

Reported noninterest expense increased $23 million, or 2%, from the prior quarter, and increased $56 million, or 5%, from the year-ago quarter. The reported results reflect the impact of certain items in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Expense excluding certain item(s) | | | | | | | |

| ($ in millions) | For the Three Months Ended | | | % Change | | | |

| | September | | June | | | September | | | | | | | |

| | 2024 | | 2024 | | | 2023 | | | Seq | | Yr/Yr | | | |

| Noninterest Expense excluding certain item(s) | | | | | | | | | | | | | | | |

| Noninterest expense (U.S. GAAP) | $1,244 | | | $1,221 | | | $1,188 | | | | | | | | |

| Mastercard litigation | (10) | | | — | | | — | | | | | | | | |

| Restructuring severance expense | (9) | | | — | | | — | | | | | | | | |

| Legal settlements and remediations | — | | | (11) | | | — | | | | | | | | |

| FDIC special assessment | — | | | (6) | | | — | | | | | | | | |

| Noninterest expense excluding certain item(s)(a) | $1,225 | | | $1,204 | | | $1,188 | | | 2% | | 3% | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Compared to the prior quarter, noninterest expense excluding certain items increased $21 million, or 2%, primarily reflecting an increase in compensation and benefits expense due to higher performance-based compensation resulting from strong fee revenue, partially offset by a decrease in marketing expense. Noninterest expense in the current quarter included a $12 million expense related to the impact of non-qualified deferred compensation mark-to-market compared to a $4 million expense in the prior quarter, both of which were largely offset in net securities gains through noninterest income.

Compared to the year-ago quarter, noninterest expense excluding certain items increased $37 million, or 3%, primarily reflecting increases in compensation and benefits expense as well as technology and communications expense, partially offset by decreases in marketing expense and leasing business expense. The year-ago quarter included a $5 million benefit related to the impact of non-qualified deferred compensation mark-to-market, which was largely offset in net securities losses through noninterest income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Interest-Earning Assets | | | | | | | | | | | | | |

| ($ in millions) | For the Three Months Ended | | | % Change | |

| | September | | June | | September | | | | | |

| | 2024 | | 2024 | | 2023 | | Seq | | Yr/Yr | |

| Average Portfolio Loans and Leases | | | | | | | | | | | | | |

| Commercial loans and leases: | | | | | | | | | | | | | |

| Commercial and industrial loans | $51,615 | | | $52,357 | | | $57,001 | | | (1)% | | (9)% | |

| Commercial mortgage loans | 11,488 | | | 11,352 | | | 11,216 | | | 1% | | 2% | |

| Commercial construction loans | 5,981 | | | 5,917 | | | 5,539 | | | 1% | | 8% | |

| Commercial leases | 2,685 | | | 2,575 | | | 2,616 | | | 4% | | 3% | |

| Total commercial loans and leases | $71,769 | | | $72,201 | | | $76,372 | | | (1)% | | (6)% | |

| Consumer loans: | | | | | | | | | | | | | |

| Residential mortgage loans | $17,031 | | | $17,004 | | | $17,400 | | | — | | (2)% | |

| Home equity | 4,018 | | | 3,929 | | | 3,897 | | | 2% | | 3% | |

| Indirect secured consumer loans | 15,680 | | | 15,373 | | | 15,787 | | | 2% | | (1)% | |

| Credit card | 1,708 | | | 1,728 | | | 1,808 | | | (1)% | | (6)% | |

| Solar energy installation loans | 3,990 | | | 3,916 | | | 3,245 | | | 2% | | 23% | |

| Other consumer loans | 2,630 | | | 2,740 | | | 3,121 | | | (4)% | | (16)% | |

| Total consumer loans | $45,057 | | | $44,690 | | | $45,258 | | | 1% | | — | |

| Total average portfolio loans and leases | $116,826 | | | $116,891 | | | $121,630 | | | — | | (4)% | |

| | | | | | | | | | | | | | |

| Average Loans and Leases Held for Sale | | | | | | | | | | | | | |

| Commercial loans and leases held for sale | $16 | | | $33 | | | $17 | | | (52)% | | (6)% | |

| Consumer loans held for sale | 573 | | | 359 | | | 619 | | | 60% | | (7)% | |

| Total average loans and leases held for sale | $589 | | | $392 | | | $636 | | | 50% | | (7)% | |

| | | | | | | | | | | | | | |

| Total average loans and leases | $117,415 | | | $117,283 | | | $122,266 | | | — | | (4)% | |

| | | | | | | | | | | | | | |

| Securities (taxable and tax-exempt) | $56,707 | | | $56,607 | | | $56,994 | | | — | | (1)% | |

| Other short-term investments | 21,714 | | | 20,609 | | | 12,956 | | | 5% | | 68% | |

| Total average interest-earning assets | $195,836 | | | $194,499 | | | $192,216 | | | 1% | | 2% | |

| | | | | | | | | | | | | | |

Compared to the prior quarter, total average portfolio loans and leases were stable. Average commercial portfolio loans and leases decreased 1%, primarily reflecting a decrease in C&I loans, partially offset by an increase in commercial mortgage loans. Average consumer portfolio loans increased 1%, primarily reflecting increases in indirect secured consumer loans, home equity balances, and solar energy installation loans, partially offset by a decrease in other consumer loans.

Compared to the year-ago quarter, total average portfolio loans and leases decreased 4%. Average commercial portfolio loans and leases decreased 6%, primarily reflecting a decrease in C&I loans. Average consumer portfolio loans were stable primarily reflecting decreases in other consumer loans and residential mortgage loans, offset by increases in solar energy installation loans and home equity balances.

Average securities (taxable and tax-exempt; amortized cost) of $57 billion in the current quarter were stable compared to the prior quarter and decreased 1% compared to the year-ago quarter. Average other short-term investments (including interest-bearing cash) of $22 billion in the current quarter increased 5% compared to the prior quarter and increased 68% compared to the year-ago quarter.

Period-end commercial portfolio loans and leases of $71 billion decreased 1% compared to the prior quarter, primarily reflecting a decrease in C&I loans, partially offset by an increase in commercial leases. Compared to the year-ago quarter, period-end commercial portfolio loans and leases decreased 5%, primarily reflecting a decrease in C&I loans.

Period-end consumer portfolio loans of $46 billion increased 2% compared to the prior quarter, primarily reflecting an increase in indirect secured consumer loans. Compared to the year-ago quarter, period-end consumer portfolio loans increased 1%, reflecting increases in solar energy installation loans and indirect secured consumer loans.

Total period-end securities (taxable and tax-exempt; amortized cost) of $57 billion in the current quarter were stable compared to the prior quarter and decreased 1% compared to the year-ago quarter. Period-end other short-term investments of approximately $22 billion increased 3% compared to the prior quarter, and increased 15% compared to the year-ago quarter.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Deposits | | | | | | | | | | | | | |

| ($ in millions) | For the Three Months Ended | | | % Change | |

| | September | | June | | September | | | | | |

| | 2024 | | 2024 | | 2023 | | Seq | | Yr/Yr | |

| Average Deposits | | | | | | | | | | | | | |

| Demand | $40,020 | | | $40,266 | | | $44,228 | | | (1)% | | (10)% | |

| Interest checking | 58,441 | | | 57,999 | | | 53,109 | | | 1% | | 10% | |

| Savings | 17,272 | | | 17,747 | | | 20,511 | | | (3)% | | (16)% | |

| Money market | 37,257 | | | 35,511 | | | 32,072 | | | 5% | | 16% | |

| Foreign office(g) | 164 | | | 157 | | | 168 | | | 4% | | (2)% | |

| Total transaction deposits | $153,154 | | | $151,680 | | | $150,088 | | | 1% | | 2% | |

| CDs $250,000 or less | 10,543 | | | 10,767 | | | 9,630 | | | (2)% | | 9% | |

| Total core deposits | $163,697 | | | $162,447 | | | $159,718 | | | 1% | | 2% | |

| CDs over $250,000 | 3,499 | | | 4,747 | | | 5,926 | | | (26)% | | (41)% | |

| | | | | | | | | | | | | | |

| Total average deposits | $167,196 | | | $167,194 | | | $165,644 | | | — | | 1% | |

| CDs over $250,000 includes $2.6BN, $3.8BN, and $5.2BN of retail brokered certificates of deposit which are fully covered by FDIC insurance for the three months ended 9/30/24, 6/30/24, and 9/30/23, respectively. | |

| |

Compared to the prior quarter, total average deposits were stable, primarily reflecting an increase in money market balances, offset by a decline in CDs over $250,000. Average demand deposits represented 24% of total core deposits in the current quarter. Compared to the prior quarter, average commercial segment deposits increased 3%, while average consumer and small business banking segment deposits and average wealth & asset management segment deposits were stable. Period-end total deposits increased 1% compared to the prior quarter.

Compared to the year-ago quarter, total average deposits increased 1%, primarily reflecting increases in interest checking and money market balances, partially offset by decreases in demand account balances and savings balances. Period-end total deposits were stable compared to the year-ago quarter.

The period-end portfolio loan-to-core deposit ratio was 71% in the current quarter, compared to 72% in the prior quarter and 74% in the year-ago quarter.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Wholesale Funding | | | | | | | | | | | | | |

| ($ in millions) | For the Three Months Ended | | | % Change | |

| | September | | June | | September | | | | | |

| | 2024 | | 2024 | | 2023 | | Seq | | Yr/Yr | |

| Average Wholesale Funding | | | | | | | | | | | | | |

| CDs over $250,000 | $3,499 | | | $4,747 | | | $5,926 | | | (26)% | | (41)% | |

| | | | | | | | | | | | | | |

| Federal funds purchased | 176 | | | 230 | | | 181 | | | (23)% | | (3)% | |

| Securities sold under repurchase agreements | 396 | | | 373 | | | 352 | | | 6% | | 13% | |

| FHLB advances | 2,576 | | | 3,165 | | | 3,726 | | | (19)% | | (31)% | |

| Derivative collateral and other secured borrowings | 52 | | | 54 | | | 48 | | | (4)% | | 8% | |

| Long-term debt | 16,716 | | | 15,611 | | | 14,056 | | | 7% | | 19% | |

| Total average wholesale funding | $23,415 | | | $24,180 | | | $24,289 | | | (3)% | | (4)% | |

| CDs over $250,000 includes $2.6BN, $3.8BN, and $5.2BN of retail brokered certificates of deposit which are fully covered by FDIC insurance for the three months ended 9/30/24, 6/30/24, and 9/30/23, respectively. | |

| | | | | | | | | | | | | | |

Compared to the prior quarter, average wholesale funding decreased 3%, primarily reflecting a decrease in CDs over $250,000, partially offset by an increase in long-term debt. Compared to the year-ago quarter, average wholesale funding decreased 4%, primarily reflecting a decrease in CDs over $250,000 and FHLB advances, partially offset by an increase in long-term debt.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit Quality Summary | | | | | | | | | | | | | | |

| ($ in millions) | As of and For the Three Months Ended |

| September | | June | | March | | December | | September |

| 2024 | | 2024 | | 2024 | | 2023 | | 2023 |

| | | | | | | | | | | | | | |

| Total nonaccrual portfolio loans and leases (NPLs) | $686 | | | $606 | | | $708 | | | $649 | | | $570 | |

| Repossessed property | 11 | | | 9 | | | 8 | | | 10 | | | 11 | |

| OREO | 28 | | | 28 | | | 27 | | | 29 | | | 31 | |

| Total nonperforming portfolio loans and leases and OREO (NPAs) | $725 | | | $643 | | | $743 | | | $688 | | | $612 | |

| | | | | | | | | | | | | | |

NPL ratio(h) | 0.59 | % | | | 0.52 | % | | | 0.61 | % | | | 0.55 | % | | | 0.47 | % | |

NPA ratio(c) | 0.62 | % | | | 0.55 | % | | | 0.64 | % | | | 0.59 | % | | | 0.51 | % | |

| | | | | | | | | | | | | | |

| Portfolio loans and leases 30-89 days past due (accrual) | $283 | | | $302 | | | $342 | | | $359 | | | $316 | |

| Portfolio loans and leases 90 days past due (accrual) | 40 | | | 33 | | | 35 | | | 36 | | | 29 | |

| | | | | | | | | | | | | | |

| 30-89 days past due as a % of portfolio loans and leases | 0.24 | % | | | 0.26 | % | | | 0.29 | % | | | 0.31 | % | | | 0.26 | % | |

| 90 days past due as a % of portfolio loans and leases | 0.03 | % | | | 0.03 | % | | | 0.03 | % | | | 0.03 | % | | | 0.02 | % | |

| | | | | | | | | | | | | | |

| Allowance for loan and lease losses (ALLL), beginning | $2,288 | | | $2,318 | | | $2,322 | | | $2,340 | | | $2,327 | |

| Total net losses charged-off | (142) | | | (144) | | | (110) | | | (96) | | | (124) | |

| Provision for loan and lease losses | 159 | | | 114 | | | 106 | | | 78 | | | 137 | |

| ALLL, ending | $2,305 | | | $2,288 | | | $2,318 | | | $2,322 | | | $2,340 | |

| | | | | | | | | | | | | | |

| Reserve for unfunded commitments, beginning | $137 | | | $154 | | | $166 | | | $189 | | | $207 | |

| Provision for (benefit from) the reserve for unfunded commitments | 1 | | | (17) | | | (12) | | | (23) | | | (18) | |

| Reserve for unfunded commitments, ending | $138 | | | $137 | | | $154 | | | $166 | | | $189 | |

| | | | | | | | | | | | | | |

| Total allowance for credit losses (ACL) | $2,443 | | | $2,425 | | | $2,472 | | | $2,488 | | | $2,529 | |

| | | | | | | | | | | | | | |

| ACL ratios: | | | | | | | | | | | | | | |

| As a % of portfolio loans and leases | 2.09 | % | | | 2.08 | % | | | 2.12 | % | | | 2.12 | % | | | 2.11 | % | |

| As a % of nonperforming portfolio loans and leases | 356 | % | | | 400 | % | | | 349 | % | | | 383 | % | | | 443 | % | |

| As a % of nonperforming portfolio assets | 337 | % | | | 377 | % | | | 333 | % | | | 362 | % | | | 413 | % | |

| | | | | | | | | | | | | | |

| ALLL as a % of portfolio loans and leases | 1.98 | % | | | 1.96 | % | | | 1.99 | % | | | 1.98 | % | | | 1.95 | % | |

| | | | | | | | | | | | | | |

| Total losses charged-off | $(183) | | | $(182) | | | $(146) | | | $(133) | | | $(158) | |

| Total recoveries of losses previously charged-off | 41 | | | 38 | | | 36 | | | 37 | | | 34 | |

| Total net losses charged-off | $(142) | | | $(144) | | | $(110) | | | $(96) | | | $(124) | |

| | | | | | | | | | | | | | |

Net charge-off ratio (NCO ratio)(b) | 0.48 | % | | | 0.49 | % | | | 0.38 | % | | | 0.32 | % | | | 0.41 | % | |

| Commercial NCO ratio | 0.40 | % | | | 0.45 | % | | | 0.19 | % | | | 0.13 | % | | | 0.34 | % | |

| Consumer NCO ratio | 0.62 | % | | | 0.57 | % | | | 0.67 | % | | | 0.64 | % | | | 0.53 | % | |

| | | | | | | | | | | | | | |

The provision for credit losses totaled $160 million in the current quarter. The ACL ratio was 2.09% of total portfolio loans and leases at quarter end, compared with 2.08% for the prior quarter end and 2.11% for the year-ago quarter end. In the current quarter, the ACL was 356% of nonperforming portfolio loans and leases and 337% of nonperforming portfolio assets.

Net charge-offs were $142 million in the current quarter, resulting in an NCO ratio of 0.48%. Compared to the prior quarter, net charge-offs decreased $2 million and the NCO ratio decreased 1 bp. Commercial net charge-offs were $72 million, resulting in a commercial NCO ratio of 0.40%, which decreased 5 bps compared to the prior quarter. Consumer net charge-offs were $70 million, resulting in a consumer NCO ratio of 0.62%, which increased 5 bps compared to the prior quarter.

Compared to the year-ago quarter, net charge-offs increased $18 million and the NCO ratio increased 7 bps. The commercial NCO ratio increased 6 bps compared to the prior year, and the consumer NCO ratio increased 9 bps compared to the prior year.

Nonperforming portfolio loans and leases were $686 million in the current quarter, with the resulting NPL ratio of 0.59%. Compared to the prior quarter, NPLs increased $80 million with the NPL ratio increasing 7 bps. Compared to the year-ago quarter, NPLs increased $116 million with the NPL ratio increasing 12 bps.

Nonperforming portfolio assets were $725 million in the current quarter, with the resulting NPA ratio of 0.62%. Compared to the prior quarter, NPAs increased $82 million with the NPA ratio increasing 7 bps. Compared to the year-ago quarter, NPAs increased $113 million with the NPA ratio increasing 11 bps.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Position | | | | | | | | | | | | | | |

| | | | As of and For the Three Months Ended |

| | | | September | | June | | March | | December | September |

| | | | 2024 | | 2024 | | 2024 | | 2023 | | 2023 | |

| Capital Position | | | | | | | | | | | | | | |

| Average total Bancorp shareholders' equity as a % of average assets | | 9.47 | % | | | 8.80 | % | | 8.78 | % | | 8.04 | % | | 8.30 | % | |

| Tangible equity(a) | | 8.99 | % | | | 8.91 | % | | 8.75 | % | | 8.65 | % | | 8.46 | % | |

| Tangible common equity (excluding AOCI)(a) | | 8.00 | % | | | 7.92 | % | | 7.77 | % | | 7.67 | % | | 7.49 | % | |

| Tangible common equity (including AOCI)(a) | | 6.52 | % | | | 5.80 | % | | 5.67 | % | | 5.73 | % | | 4.51 | % | |

| | | | | | | | | | | | | | | | |

| Regulatory Capital Ratios(d)(e) | | | |

| CET1 capital | | 10.75 | % | | | 10.62 | % | | 10.47 | % | | 10.29 | % | | 9.80 | % | |

| Tier 1 risk-based capital | | 12.07 | % | | | 11.93 | % | | 11.77 | % | | 11.59 | % | | 11.06 | % | |

| Total risk-based capital | | 14.12 | % | | | 13.95 | % | | 13.81 | % | | 13.72 | % | | 13.13 | % | |

| Leverage | | 9.11 | % | | | 9.07 | % | | 8.94 | % | | 8.73 | % | | 8.85 | % | |

| | | | | | | | | | | | | | | | |

CET1 capital ratio of 10.75% increased 13 bps sequentially driven by strong profitability. During the third quarter of 2024, Fifth Third repurchased $200 million of its common stock, which reduced shares outstanding by approximately 4.9 million at quarter end. Fifth Third increased its quarterly cash dividend on its common shares by $0.02, or 6%, to $0.37 per share for the third quarter of 2024.

Tax Rate

The effective tax rate for the quarter was 21.3% consistent with the prior quarter and slightly lower than 22.0% in the year-ago quarter.

Conference Call

Fifth Third will host a conference call to discuss these financial results at 9:00 a.m. (Eastern Time) today. This conference call will be webcast live and may be accessed through the Fifth Third Investor Relations website at www.53.com (click on “About Us” then “Investor Relations”). Those unable to listen to the live webcast may access a webcast replay through the Fifth Third Investor Relations website at the same web address, which will be available for 30 days.

Corporate Profile

Fifth Third is a bank that’s as long on innovation as it is on history. Since 1858, we’ve been helping individuals, families, businesses and communities grow through smart financial services that improve lives. Our list of firsts is extensive, and it’s one that continues to expand as we explore the intersection of tech-driven innovation, dedicated people, and focused community impact. Fifth Third is one of the few U.S.-based banks to have been named among Ethisphere's World’s Most Ethical Companies® for several years. With a commitment to taking care of our customers, employees, communities and shareholders, our goal is not only to be the nation’s highest performing regional bank, but to be the bank people most value and trust.

Fifth Third Bank, National Association is a federally chartered institution. Fifth Third Bancorp is the indirect parent company of Fifth Third Bank and its common stock is traded on the NASDAQ® Global Select Market under the symbol “FITB.” Investor information and press releases can be viewed at www.53.com.

Earnings Release End Notes

(a)Non-GAAP measure; see discussion of non-GAAP reconciliation beginning on page 27.

(b)Net losses charged-off as a percent of average portfolio loans and leases presented on an annualized basis.

(c)Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO.

(d)Regulatory capital ratios are calculated pursuant to the five-year transition provision option to phase in the effects of CECL on regulatory capital after its adoption on January 1, 2020.

(e)Current period regulatory capital ratios are estimated.

(f)Assumes a 23% tax rate.

(g)Includes commercial customer Eurodollar sweep balances for which the Bank pays rates comparable to other commercial deposit accounts.

(h)Nonperforming portfolio loans and leases as a percent of portfolio loans and leases.

FORWARD-LOOKING STATEMENTS

This release contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. All statements other than statements of historical fact are forward-looking statements. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”).

There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) deteriorating credit quality; (2) loan concentration by location or industry of borrowers or collateral; (3) problems encountered by other financial institutions; (4) inadequate sources of funding or liquidity; (5) unfavorable actions of rating agencies; (6) inability to maintain or grow deposits; (7) limitations on the ability to receive dividends from subsidiaries; (8) cyber-security risks; (9) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (10) failures by third-party service providers; (11) inability to manage strategic initiatives and/or organizational changes; (12) inability to implement technology system enhancements; (13) failure of internal controls and other risk management programs; (14) losses related to fraud, theft, misappropriation or violence; (15) inability to attract and retain skilled personnel; (16) adverse impacts of government regulation; (17) governmental or regulatory changes or other actions; (18) failures to meet applicable capital requirements; (19) regulatory objections to Fifth Third’s capital plan; (20) regulation of Fifth Third’s derivatives activities; (21) deposit insurance premiums; (22) assessments for the orderly liquidation fund; (23) weakness in the national or local economies; (24) global political and economic uncertainty or negative actions; (25) changes in interest rates and the effects of inflation; (26) changes and trends in capital markets; (27) fluctuation of Fifth Third’s stock price; (28) volatility in mortgage banking revenue; (29) litigation, investigations, and enforcement proceedings by governmental authorities; (30) breaches of contractual covenants, representations and warranties; (31) competition and changes in the financial services industry; (32) potential impacts of the adoption of real-time payment networks; (33) changing retail distribution strategies, customer preferences and behavior; (34) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (35) potential dilution from future acquisitions; (36) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (37) results of investments or acquired entities; (38) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (39) inaccuracies or other failures from the use of models; (40) effects of critical accounting policies and judgments or the use of inaccurate estimates; (41) weather-related events, other natural disasters, or health emergencies (including pandemics); (42) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; (43) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases; and (44) Fifth Third's ability to meet its environmental and/or social targets, goals and commitments.

You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The information contained herein is intended to be reviewed in its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this press release should be read as applying mutatis mutandis to every other instance of such information appearing herein.

# # #

Quarterly Financial Review for September 30, 2024

Table of Contents

| | | | | | | | | | | |

| | | |

| | | |

| Financial Highlights | 14-15 | |

| Consolidated Statements of Income | 16-17 | |

| Consolidated Balance Sheets | 18-19 | |

| Consolidated Statements of Changes in Equity | 20 | |

| Average Balance Sheets and Yield/Rate Analysis | 21-22 | |

| Summary of Loans and Leases | 23 | |

| Regulatory Capital | 24 | |

| Summary of Credit Loss Experience | 25 | |

| Asset Quality | 26 | |

| Non-GAAP Reconciliation | 27-29 | |

| Segment Presentation | 30 | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp and Subsidiaries | | | | | | | | |

| Financial Highlights | As of and For the Three Months Ended | % / bps | | | % / bps |

| $ in millions, except per share data | Change | Year to Date | Change |

| (unaudited) | September | June | September | | | September | September | |

| | 2024 | 2024 | 2023 | Seq | Yr/Yr | 2024 | 2023 | Yr/Yr |

| Income Statement Data | | | | | | | | |

| Net interest income | $1,421 | $1,387 | $1,438 | 2% | (1%) | $4,192 | $4,411 | (5%) |

Net interest income (FTE)(a) | 1,427 | 1,393 | 1,445 | 2% | (1%) | 4,210 | 4,429 | (5%) |

| Noninterest income | 711 | 695 | 715 | 2% | (1%) | 2,117 | 2,137 | (1%) |

| Total revenue (FTE)(a) | 2,138 | 2,088 | 2,160 | 2% | (1%) | 6,327 | 6,566 | (4%) |

| Provision for credit losses | 160 | 97 | 119 | 65% | 34% | 351 | 460 | (24%) |

| Noninterest expense | 1,244 | 1,221 | 1,188 | 2% | 5% | 3,807 | 3,750 | 2% |

| Net income | 573 | 601 | 660 | (5%) | (13%) | 1,694 | 1,819 | (7%) |

| Net income available to common shareholders | 532 | 561 | 623 | (5%) | (15%) | 1,573 | 1,719 | (8%) |

| | | | | | | | | |

| Earnings Per Share Data | | | | | | | | |

| Net income allocated to common shareholders | $532 | $561 | $623 | (5%) | (15%) | $1,573 | $1,719 | (8%) |

| Average common shares outstanding (in thousands): | | | | | | | | |

| Basic | 680,895 | 686,781 | 684,224 | (1%) | — | 684,462 | 684,091 | — |

| Diluted | 686,109 | 691,083 | 687,059 | (1%) | — | 689,263 | 687,661 | — |

| Earnings per share, basic | $0.78 | $0.82 | $0.91 | (5%) | (14%) | $2.30 | $2.51 | (8%) |

| Earnings per share, diluted | 0.78 | 0.81 | 0.91 | (4%) | (14%) | 2.28 | 2.50 | (9%) |

| | | | | | | | | |

| Common Share Data | | | | | | | | |

| Cash dividends per common share | $0.37 | $0.35 | $0.35 | 6% | 6% | $1.07 | $1.01 | 6% |

| Book value per share | 27.60 | 25.13 | 21.19 | 10% | 30% | 27.60 | 21.19 | 30% |

| Market value per share | 42.84 | 36.49 | 25.33 | 17% | 69% | 42.84 | 25.33 | 69% |

| Common shares outstanding (in thousands) | 676,269 | 680,789 | 680,990 | (1%) | (1%) | 676,269 | 680,990 | (1%) |

| Market capitalization | $28,971 | $24,842 | $17,249 | 17% | 68% | $28,971 | $17,249 | 68% |

| | | | | | | | | |

| Financial Ratios | | | | | | | | |

| Return on average assets | 1.06 | % | 1.14 | % | 1.26 | % | (8) | (20) | 1.06 | % | 1.18 | % | (12) |

| Return on average common equity | 11.7 | % | 13.6 | % | 16.3 | % | (190) | (460) | 12.3 | % | 14.6 | % | (230) |

Return on average tangible common equity(a) | 16.3 | % | 19.8 | % | 24.7 | % | (350) | (840) | 17.6 | % | 21.8 | % | (420) |

Noninterest income as a percent of total revenue(a) | 33 | % | 33 | % | 33 | % | — | — | 33 | % | 33 | % | — |

| Dividend payout | 47.4 | % | 42.7 | % | 38.5 | % | 470 | 890 | 46.5 | % | 40.2 | % | 630 |

Average total Bancorp shareholders’ equity as a percent of average assets | 9.47 | % | 8.80 | % | 8.30 | % | 67 | 117 | 9.02 | % | 8.65 | % | 37 |

Tangible common equity(a) | 8.00 | % | 7.92 | % | 7.49 | % | 8 | 51 | 8.00 | % | 7.49 | % | 51 |

Net interest margin (FTE)(a) | 2.90 | % | 2.88 | % | 2.98 | % | 2 | (8) | 2.88 | % | 3.12 | % | (24) |

Efficiency (FTE)(a) | 58.2 | % | 58.5 | % | 55.0 | % | (30) | 320 | 60.2 | % | 57.1 | % | 310 |

| Effective tax rate | 21.3 | % | 21.3 | % | 22.0 | % | — | (70) | 21.3 | % | 22.2 | % | (90) |

| | | | | | | | | |

| Credit Quality | | | | | | | | |

| Net losses charged-off | $142 | $144 | $124 | (1 | %) | 15 | % | $396 | $292 | 36 | % |

| Net losses charged-off as a percent of average portfolio loans and leases (annualized) | 0.48 | % | 0.49 | % | 0.41 | % | (1) | 7 | 0.45 | % | 0.32 | % | 13 |

| ALLL as a percent of portfolio loans and leases | 1.98 | % | 1.96 | % | 1.95 | % | 2 | 3 | 1.98 | % | 1.95 | % | 3 |

ACL as a percent of portfolio loans and leases(g) | 2.09 | % | 2.08 | % | 2.11 | % | 1 | (2) | 2.09 | % | 2.11 | % | (2) |

| Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO | 0.62 | % | 0.55 | % | 0.51 | % | 7 | 11 | 0.62 | % | 0.51 | % | 11 |

| | | | | | | | | |

| Average Balances | | | | | | | | |

| Loans and leases, including held for sale | $117,415 | $117,283 | $122,266 | — | (4%) | $117,466 | $123,284 | (5%) |

| Securities and other short-term investments | 78,421 | 77,216 | 69,950 | 2% | 12% | 77,765 | 66,294 | 17% |

| Assets | 213,838 | 212,475 | 208,385 | 1% | 3% | 213,174 | 206,528 | 3% |

Transaction deposits(b) | 153,154 | 151,680 | 150,088 | 1% | 2% | 152,400 | 149,641 | 2% |

Core deposits(c) | 163,697 | 162,447 | 159,718 | 1% | 2% | 162,918 | 157,178 | 4% |

Wholesale funding(d) | 23,415 | 24,180 | 24,289 | (3%) | (4%) | 24,120 | 24,548 | (2%) |

Bancorp shareholders' equity | 20,251 | 18,707 | 17,305 | 8% | 17% | 19,232 | 17,873 | 8% |

| | | | | | | | | |

Regulatory Capital Ratios(e)(f) | | | | | | | | |

CET1 capital | 10.75 | % | 10.62 | % | 9.80 | % | 13 | 95 | 10.75 | % | 9.80 | % | 95 |

Tier 1 risk-based capital | 12.07 | % | 11.93 | % | 11.06 | % | 14 | 101 | 12.07 | % | 11.06 | % | 101 |

Total risk-based capital | 14.12 | % | 13.95 | % | 13.13 | % | 17 | 99 | 14.12 | % | 13.13 | % | 99 |

| Leverage | 9.11 | % | 9.07 | % | 8.85 | % | 4 | 26 | 9.11 | % | 8.85 | % | 26 |

| | | | | | | | | |

| Additional Metrics | | | | | | | | |

| Banking centers | 1,072 | 1,070 | 1,073 | — | — | 1,072 | 1,073 | — |

| ATMs | 2,060 | 2,067 | 2,101 | — | (2%) | 2,060 | 2,101 | (2%) |

| Full-time equivalent employees | 18,579 | 18,607 | 18,804 | — | (1%) | 18,579 | 18,804 | (1%) |

Assets under care ($ in billions)(h) | $635 | $631 | $547 | 1% | 16% | $635 | $547 | 16% |

Assets under management ($ in billions)(h) | 69 | 65 | 57 | 6% | 21% | 69 | 57 | 21% |

(a)Non-GAAP measure; see discussion and reconciliation of non-GAAP measures beginning on page 27.

(b)Includes demand, interest checking, savings, money market and foreign office deposits of commercial customers.

(c)Includes transaction deposits plus CDs $250,000 or less.

(d)Includes CDs over $250,000, other deposits, federal funds purchased, other short-term borrowings and long-term debt.

(e)Current period regulatory capital ratios are estimates.

(f)Regulatory capital ratios are calculated pursuant to the five-year transition provision option to phase in the effects of CECL on regulatory capital after its adoption on January 1, 2020.

(g)The allowance for credit losses is the sum of the ALLL and the reserve for unfunded commitments.

(h)Assets under management and assets under care include trust and brokerage assets.

| | | | | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp and Subsidiaries | | | | | |

| Financial Highlights | | | | | |

| $ in millions, except per share data | As of and For the Three Months Ended |

| (unaudited) | September | June | March | December | September |

| | 2024 | 2024 | 2024 | 2023 | 2023 |

| Income Statement Data | | | | | |

| Net interest income | $1,421 | $1,387 | $1,384 | $1,416 | $1,438 |

Net interest income (FTE)(a) | 1,427 | 1,393 | 1,390 | 1,423 | 1,445 |

| Noninterest income | 711 | 695 | 710 | 744 | 715 |

| Total revenue (FTE)(a) | 2,138 | 2,088 | 2,100 | 2,167 | 2,160 |

| Provision for credit losses | 160 | 97 | 94 | 55 | 119 |

| Noninterest expense | 1,244 | 1,221 | 1,342 | 1,455 | 1,188 |

| Net income | 573 | 601 | 520 | 530 | 660 |

| Net income available to common shareholders | 532 | 561 | 480 | 492 | 623 |

| | | | | | |

| Earnings Per Share Data | | | | | |

| Net income allocated to common shareholders | $532 | $561 | $480 | $492 | $623 |

| Average common shares outstanding (in thousands): | | | | | |

| Basic | 680,895 | 686,781 | 685,750 | 684,413 | 684,224 |

| Diluted | 686,109 | 691,083 | 690,634 | 687,729 | 687,059 |

| Earnings per share, basic | $0.78 | $0.82 | $0.70 | $0.72 | $0.91 |

| Earnings per share, diluted | 0.78 | 0.81 | 0.70 | 0.72 | 0.91 |

| | | | | | |

| Common Share Data | | | | | |

| Cash dividends per common share | $0.37 | $0.35 | $0.35 | $0.35 | $0.35 |

| Book value per share | 27.60 | 25.13 | 24.72 | 25.04 | 21.19 |

| Market value per share | 42.84 | 36.49 | 37.21 | 34.49 | 25.33 |

| Common shares outstanding (in thousands) | 676,269 | 680,789 | 683,812 | 681,125 | 680,990 |

| Market capitalization | $28,971 | $24,842 | $25,445 | $23,492 | $17,249 |

| | | | | | |

| Financial Ratios | | | | | |

| Return on average assets | 1.06 | % | 1.14 | % | 0.98 | % | 0.98 | % | 1.26 | % |

| Return on average common equity | 11.7 | % | 13.6 | % | 11.6 | % | 12.9 | % | 16.3 | % |

Return on average tangible common equity(a) | 16.3 | % | 19.8 | % | 17.0 | % | 19.8 | % | 24.7 | % |

Noninterest income as a percent of total revenue(a) | 33 | % | 33 | % | 34 | % | 34 | % | 33 | % |

| Dividend payout | 47.4 | % | 42.7 | % | 50.0 | % | 48.6 | % | 38.5 | % |

Average total Bancorp shareholders’ equity as a percent of average assets | 9.47 | % | 8.80 | % | 8.78 | % | 8.04 | % | 8.30 | % |

Tangible common equity(a) | 8.00 | % | 7.92 | % | 7.77 | % | 7.67 | % | 7.49 | % |

Net interest margin (FTE)(a) | 2.90 | % | 2.88 | % | 2.86 | % | 2.85 | % | 2.98 | % |

Efficiency (FTE)(a) | 58.2 | % | 58.5 | % | 63.9 | % | 67.2 | % | 55.0 | % |

| Effective tax rate | 21.3 | % | 21.3 | % | 21.1 | % | 18.4 | % | 22.0 | % |

| | | | | | |

| Credit Quality | | | | | |

| Net losses charged-off | $142 | $144 | $110 | $96 | $124 |

| Net losses charged-off as a percent of average portfolio loans and leases (annualized) | 0.48 | % | 0.49 | % | 0.38 | % | 0.32 | % | 0.41 | % |

| ALLL as a percent of portfolio loans and leases | 1.98 | % | 1.96 | % | 1.99 | % | 1.98 | % | 1.95 | % |

ACL as a percent of portfolio loans and leases(g) | 2.09 | % | 2.08 | % | 2.12 | % | 2.12 | % | 2.11 | % |

| Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO | 0.62 | % | 0.55 | % | 0.64 | % | 0.59 | % | 0.51 | % |

| | | | | | |

| Average Balances | | | | | |

| Loans and leases, including held for sale | $117,415 | $117,283 | $117,699 | $119,309 | $122,266 |

| Securities and other short-term investments | 78,421 | 77,216 | 77,650 | 78,857 | 69,950 |

| Assets | 213,838 | 212,475 | 213,203 | 214,057 | 208,385 |

Transaction deposits(b) | 153,154 | 151,680 | 152,357 | 153,232 | 150,088 |

Core deposits(c) | 163,697 | 162,447 | 162,601 | 163,788 | 159,718 |

Wholesale funding(d) | 23,415 | 24,180 | 24,771 | 26,115 | 24,289 |

Bancorp shareholders’ equity | 20,251 | 18,707 | 18,727 | 17,201 | 17,305 |

| | | | | | |

Regulatory Capital Ratios(e)(f) | | | | | |

CET1 capital | 10.75 | % | 10.62 | % | 10.47 | % | 10.29 | % | 9.80 | % |

| Tier 1 risk-based capital | 12.07 | % | 11.93 | % | 11.77 | % | 11.59 | % | 11.06 | % |

Total risk-based capital | 14.12 | % | 13.95 | % | 13.81 | % | 13.72 | % | 13.13 | % |

| Leverage | 9.11 | % | 9.07 | % | 8.94 | % | 8.73 | % | 8.85 | % |

| | | | | | |

| Additional Metrics | | | | | |

| Banking centers | 1,072 | 1,070 | 1,070 | 1,088 | 1,073 |

| ATMs | 2,060 | 2,067 | 2,082 | 2,104 | 2,101 |

| Full-time equivalent employees | 18,579 | 18,607 | 18,657 | 18,724 | 18,804 |

Assets under care ($ in billions)(h) | $635 | $631 | $634 | $574 | $547 |

Assets under management ($ in billions)(h) | 69 | 65 | 62 | 59 | 57 |

(a)Non-GAAP measure; see discussion and reconciliation of non-GAAP measures beginning on page 27.

(b)Includes demand, interest checking, savings, money market and foreign office deposits of commercial customers.

(c)Includes transaction deposits plus CDs $250,000 or less.

(d)Includes CDs over $250,000, other deposits, federal funds purchased, other short-term borrowings and long-term debt.

(e)Current period regulatory capital ratios are estimates.

(f)Regulatory capital ratios are calculated pursuant to the five-year transition provision option to phase in the effects of CECL on regulatory capital after its adoption on January 1, 2020.

(g)The allowance for credit losses is the sum of the ALLL and the reserve for unfunded commitments.

(h)Assets under management and assets under care include trust and brokerage assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp and Subsidiaries | | | | | | | | |

| Consolidated Statements of Income | | | | | | | | |

| $ in millions | For the Three Months Ended | % Change | Year to Date | % Change |

| (unaudited) | September | June | September | | | September | September | |

| 2024 | 2024 | 2023 | Seq | Yr/Yr | 2024 | 2023 | Yr/Yr |

| Interest Income | | | | | | | | |

| Interest and fees on loans and leases | $1,910 | $1,871 | $1,899 | 2% | 1% | $5,640 | $5,445 | 4% |

| Interest on securities | 461 | 458 | 444 | 1% | 4% | 1,374 | 1,320 | 4% |

| Interest on other short-term investments | 298 | 291 | 186 | 2% | 60% | 883 | 348 | 154% |

| Total interest income | 2,669 | 2,620 | 2,529 | 2% | 6% | 7,897 | 7,113 | 11% |

| | | | | | | | |

| Interest Expense | | | | | | | | |

| Interest on deposits | 968 | 958 | 844 | 1% | 15% | 2,880 | 1,977 | 46% |

| Interest on federal funds purchased | 2 | 3 | 2 | (33%) | — | 8 | 13 | (38%) |

| Interest on other short-term borrowings | 40 | 48 | 52 | (17%) | (23%) | 135 | 198 | (32%) |

| Interest on long-term debt | 238 | 224 | 193 | 6% | 23% | 682 | 514 | 33% |

| Total interest expense | 1,248 | 1,233 | 1,091 | 1% | 14% | 3,705 | 2,702 | 37% |

| | | | | | | | |

| Net Interest Income | 1,421 | 1,387 | 1,438 | 2% | (1%) | 4,192 | 4,411 | (5%) |

| | | | | | | | |

| Provision for credit losses | 160 | 97 | 119 | 65% | 34% | 351 | 460 | (24%) |

| Net Interest Income After Provision for Credit Losses | 1,261 | 1,290 | 1,319 | (2%) | (4%) | 3,841 | 3,951 | (3%) |

| | | | | | | | |

| Noninterest Income | | | | | | | | |

| Service charges on deposits | 161 | 156 | 149 | 3% | 8% | 467 | 431 | 8% |

| Commercial banking revenue | 163 | 144 | 154 | 13% | 6% | 451 | 461 | (2%) |

| Mortgage banking net revenue | 50 | 50 | 57 | — | (12%) | 154 | 184 | (16%) |

| Wealth and asset management revenue | 163 | 159 | 145 | 3% | 12% | 483 | 434 | 11% |

| Card and processing revenue | 106 | 108 | 104 | (2%) | 2% | 316 | 310 | 2% |

| Leasing business revenue | 43 | 38 | 58 | 13% | (26%) | 120 | 162 | (26%) |

| Other noninterest income | 15 | 37 | 55 | (59%) | (73%) | 103 | 152 | (32%) |

| Securities gains (losses), net | 10 | 3 | (7) | 233% | NM | 23 | 3 | 667% |

| | | | | | | | |

| Total noninterest income | 711 | 695 | 715 | 2% | (1%) | 2,117 | 2,137 | (1%) |

| | | | | | | | |

| Noninterest Expense | | | | | | | | |

| Compensation and benefits | 690 | 656 | 629 | 5% | 10% | 2,099 | 2,036 | 3% |

| Net occupancy expense | 81 | 83 | 84 | (2%) | (4%) | 251 | 248 | 1% |

| Technology and communications | 121 | 114 | 115 | 6% | 5% | 351 | 347 | 1% |

| Equipment expense | 38 | 38 | 37 | — | 3% | 114 | 110 | 4% |

| Card and processing expense | 22 | 21 | 21 | 5% | 5% | 63 | 63 | — |

| Leasing business expense | 21 | 22 | 29 | (5%) | (28%) | 69 | 94 | (27%) |

| Marketing expense | 26 | 34 | 35 | (24%) | (26%) | 92 | 96 | (4%) |

| Other noninterest expense | 245 | 253 | 238 | (3%) | 3% | 768 | 756 | 2% |

| Total noninterest expense | 1,244 | 1,221 | 1,188 | 2% | 5% | 3,807 | 3,750 | 2% |

| Income Before Income Taxes | 728 | 764 | 846 | (5%) | (14%) | 2,151 | 2,338 | (8%) |

| Applicable income tax expense | 155 | 163 | 186 | (5%) | (17%) | 457 | 519 | (12%) |

| Net Income | 573 | 601 | 660 | (5%) | (13%) | 1,694 | 1,819 | (7%) |

| Dividends on preferred stock | 41 | 40 | 37 | 3% | 11% | 121 | 100 | 21% |

| Net Income Available to Common Shareholders | $532 | $561 | $623 | (5%) | (15%) | $1,573 | $1,719 | (8%) |

| | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp and Subsidiaries | | | | | |

| Consolidated Statements of Income | | | | | |

| $ in millions | For the Three Months Ended |

| (unaudited) | September | June | March | December | September |

| 2024 | 2024 | 2024 | 2023 | 2023 |

| Interest Income | | | | | |

| Interest and fees on loans and leases | $1,910 | $1,871 | $1,859 | $1,889 | $1,899 |

| Interest on securities | 461 | 458 | 455 | 451 | 444 |

| Interest on other short-term investments | 298 | 291 | 294 | 308 | 186 |

| Total interest income | 2,669 | 2,620 | 2,608 | 2,648 | 2,529 |

| | | | | |

| Interest Expense | | | | | |

| Interest on deposits | 968 | 958 | 954 | 952 | 844 |

| Interest on federal funds purchased | 2 | 3 | 3 | 3 | 2 |

| Interest on other short-term borrowings | 40 | 48 | 47 | 49 | 52 |

| Interest on long-term debt | 238 | 224 | 220 | 228 | 193 |

| Total interest expense | 1,248 | 1,233 | 1,224 | 1,232 | 1,091 |

| | | | | |

| Net Interest Income | 1,421 | 1,387 | 1,384 | 1,416 | 1,438 |

| | | | | |

| Provision for credit losses | 160 | 97 | 94 | 55 | 119 |

| Net Interest Income After Provision for Credit Losses | 1,261 | 1,290 | 1,290 | 1,361 | 1,319 |

| | | | | |

| Noninterest Income | | | | | |

| Service charges on deposits | 161 | 156 | 151 | 146 | 149 |

| Commercial banking revenue | 163 | 144 | 143 | 163 | 154 |

| Mortgage banking net revenue | 50 | 50 | 54 | 66 | 57 |

| Wealth and asset management revenue | 163 | 159 | 161 | 147 | 145 |

| Card and processing revenue | 106 | 108 | 102 | 106 | 104 |

| Leasing business revenue | 43 | 38 | 39 | 46 | 58 |

| Other noninterest income | 15 | 37 | 50 | 54 | 55 |

| Securities gains (losses), net | 10 | 3 | 10 | 16 | (7) |

| | | | | |

| Total noninterest income | 711 | 695 | 710 | 744 | 715 |

| | | | | |

| Noninterest Expense | | | | | |

| Compensation and benefits | 690 | 656 | 753 | 659 | 629 |

| Net occupancy expense | 81 | 83 | 87 | 83 | 84 |

| Technology and communications | 121 | 114 | 117 | 117 | 115 |

| Equipment expense | 38 | 38 | 37 | 37 | 37 |

| Card and processing expense | 22 | 21 | 20 | 21 | 21 |

| Leasing business expense | 21 | 22 | 25 | 27 | 29 |

| Marketing expense | 26 | 34 | 32 | 30 | 35 |

| Other noninterest expense | 245 | 253 | 271 | 481 | 238 |

| Total noninterest expense | 1,244 | 1,221 | 1,342 | 1,455 | 1,188 |

| Income Before Income Taxes | 728 | 764 | 658 | 650 | 846 |

| Applicable income tax expense | 155 | 163 | 138 | 120 | 186 |

| Net Income | 573 | 601 | 520 | 530 | 660 |

| Dividends on preferred stock | 41 | 40 | 40 | 38 | 37 |

| Net Income Available to Common Shareholders | $532 | $561 | $480 | $492 | $623 |

| | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp and Subsidiaries | | | | | |

| Consolidated Balance Sheets | | | | | |

| $ in millions, except per share data | As of | % Change |

| (unaudited) | September | June | September | | |

| 2024 | 2024 | 2023 | Seq | Yr/Yr |

| Assets | | | | | |

| Cash and due from banks | $3,215 | $2,837 | $2,837 | 13% | 13% |

| Other short-term investments | 21,729 | 21,085 | 18,923 | 3% | 15% |

Available-for-sale debt and other securities(a) | 40,396 | 38,986 | 47,893 | 4% | (16%) |

Held-to-maturity securities(b) | 11,358 | 11,443 | 2 | (1%) | NM |

| Trading debt securities | 1,176 | 1,132 | 1,222 | 4% | (4%) |

| Equity securities | 428 | 476 | 250 | (10%) | 71% |

| Loans and leases held for sale | 612 | 537 | 614 | 14% | — |

| Portfolio loans and leases: | | | | | |

| Commercial and industrial loans | 50,916 | 51,840 | 55,790 | (2%) | (9%) |

| Commercial mortgage loans | 11,394 | 11,429 | 11,122 | — | 2% |

| Commercial construction loans | 5,947 | 5,806 | 5,582 | 2% | 7% |

| Commercial leases | 2,873 | 2,708 | 2,624 | 6% | 9% |

| Total commercial loans and leases | 71,130 | 71,783 | 75,118 | (1%) | (5%) |

| Residential mortgage loans | 17,166 | 17,040 | 17,293 | 1% | (1%) |

| Home equity | 4,074 | 3,969 | 3,898 | 3% | 5% |

| Indirect secured consumer loans | 15,942 | 15,442 | 15,434 | 3% | 3% |

| Credit card | 1,703 | 1,733 | 1,817 | (2%) | (6%) |

| Solar energy installation loans | 4,078 | 3,951 | 3,383 | 3% | 21% |

| Other consumer loans | 2,575 | 2,661 | 3,145 | (3%) | (18%) |

| Total consumer loans | 45,538 | 44,796 | 44,970 | 2% | 1% |

| Portfolio loans and leases | 116,668 | 116,579 | 120,088 | — | (3%) |

| Allowance for loan and lease losses | (2,305) | (2,288) | (2,340) | 1% | (1%) |

| Portfolio loans and leases, net | 114,363 | 114,291 | 117,748 | — | (3%) |

| Bank premises and equipment | 2,425 | 2,389 | 2,303 | 2% | 5% |

| Operating lease equipment | 357 | 392 | 480 | (9%) | (26%) |

| Goodwill | 4,918 | 4,918 | 4,919 | — | — |

| Intangible assets | 98 | 107 | 136 | (8%) | (28%) |

| Servicing rights | 1,656 | 1,731 | 1,822 | (4%) | (9%) |

| Other assets | 11,587 | 12,938 | 13,818 | (10%) | (16%) |

| Total Assets | $214,318 | $213,262 | $212,967 | — | 1% |

| | | | | |

| Liabilities | | | | | |

| Deposits: | | | | | |

| Demand | $41,393 | $40,617 | $43,844 | 2% | (6%) |

| Interest checking | 58,572 | 57,390 | 53,421 | 2% | 10% |

| Savings | 16,990 | 17,419 | 20,195 | (2%) | (16%) |

| Money market | 37,482 | 36,259 | 33,492 | 3% | 12% |

| Foreign office | 155 | 119 | 168 | 30% | (8%) |

| CDs $250,000 or less | 10,480 | 10,882 | 10,306 | (4%) | 2% |

| CDs over $250,000 | 3,268 | 4,082 | 6,246 | (20%) | (48%) |

| Total deposits | 168,340 | 166,768 | 167,672 | 1% | — |

| Federal funds purchased | 169 | 194 | 205 | (13%) | (18%) |

| Other short-term borrowings | 1,424 | 3,370 | 4,594 | (58%) | (69%) |

| Accrued taxes, interest and expenses | 2,034 | 2,040 | 1,834 | — | 11% |

| Other liabilities | 4,471 | 5,371 | 5,808 | (17%) | (23%) |

| Long-term debt | 17,096 | 16,293 | 16,310 | 5% | 5% |

| Total Liabilities | 193,534 | 194,036 | 196,423 | — | (1%) |

| Equity | | | | | |

Common stock(c) | 2,051 | 2,051 | 2,051 | — | — |

| Preferred stock | 2,116 | 2,116 | 2,116 | — | — |

| Capital surplus | 3,784 | 3,764 | 3,733 | 1% | 1% |

| Retained earnings | 23,820 | 23,542 | 22,747 | 1% | 5% |

| Accumulated other comprehensive loss | (3,446) | (4,901) | (6,839) | (30%) | (50%) |

| Treasury stock | (7,541) | (7,346) | (7,264) | 3% | 4% |

| Total Equity | 20,784 | 19,226 | 16,544 | 8% | 26% |

| Total Liabilities and Equity | $214,318 | $213,262 | $212,967 | — | 1% |

| (a) Amortized cost | $43,754 | $43,596 | $55,557 | — | (21%) |

| (b) Market values | 11,554 | | 11,187 | | 2 | | 3 | % | NM |

| (c) Common shares, stated value $2.22 per share (in thousands): | | | | | |

| Authorized | 2,000,000 | 2,000,000 | 2,000,000 | — | — |

| Outstanding, excluding treasury | 676,269 | 680,789 | 680,990 | — | — |

| Treasury | 247,624 | 243,103 | 242,903 | 2 | % | — |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp and Subsidiaries | | | | | |

| Consolidated Balance Sheets | | | | | |

| $ in millions, except per share data | As of |

| (unaudited) | September | June | March | December | September |

| 2024 | 2024 | 2024 | 2023 | 2023 |

| Assets | | | | | |

| Cash and due from banks | $3,215 | $2,837 | $2,796 | $3,142 | $2,837 |

| Other short-term investments | 21,729 | 21,085 | 22,840 | 22,082 | 18,923 |

Available-for-sale debt and other securities(a) | 40,396 | 38,986 | 38,791 | 50,419 | 47,893 |

Held-to-maturity securities(b) | 11,358 | 11,443 | 11,520 | 2 | 2 |

| Trading debt securities | 1,176 | 1,132 | 1,151 | 899 | 1,222 |

| Equity securities | 428 | 476 | 380 | 613 | 250 |

| Loans and leases held for sale | 612 | 537 | 339 | 378 | 614 |

| Portfolio loans and leases: | | | | | |

| Commercial and industrial loans | 50,916 | 51,840 | 52,209 | 53,270 | 55,790 |

| Commercial mortgage loans | 11,394 | 11,429 | 11,346 | 11,276 | 11,122 |

| Commercial construction loans | 5,947 | 5,806 | 5,789 | 5,621 | 5,582 |

| Commercial leases | 2,873 | 2,708 | 2,572 | 2,579 | 2,624 |

| Total commercial loans and leases | 71,130 | 71,783 | 71,916 | 72,746 | 75,118 |

| Residential mortgage loans | 17,166 | 17,040 | 16,995 | 17,026 | 17,293 |

| Home equity | 4,074 | 3,969 | 3,883 | 3,916 | 3,898 |

| Indirect secured consumer loans | 15,942 | 15,442 | 15,306 | 14,965 | 15,434 |

| Credit card | 1,703 | 1,733 | 1,737 | 1,865 | 1,817 |

| Solar energy installation loans | 4,078 | 3,951 | 3,871 | 3,728 | 3,383 |

| Other consumer loans | 2,575 | 2,661 | 2,777 | 2,988 | 3,145 |

| Total consumer loans | 45,538 | 44,796 | 44,569 | 44,488 | 44,970 |

| Portfolio loans and leases | 116,668 | 116,579 | 116,485 | 117,234 | 120,088 |

| Allowance for loan and lease losses | (2,305) | (2,288) | (2,318) | (2,322) | (2,340) |

| Portfolio loans and leases, net | 114,363 | 114,291 | 114,167 | 114,912 | 117,748 |

| Bank premises and equipment | 2,425 | 2,389 | 2,376 | 2,349 | 2,303 |

| Operating lease equipment | 357 | 392 | 427 | 459 | 480 |

| Goodwill | 4,918 | 4,918 | 4,918 | 4,919 | 4,919 |

| Intangible assets | 98 | 107 | 115 | 125 | 136 |

| Servicing rights | 1,656 | 1,731 | 1,756 | 1,737 | 1,822 |

| Other assets | 11,587 | 12,938 | 12,930 | 12,538 | 13,818 |

| Total Assets | $214,318 | $213,262 | $214,506 | $214,574 | $212,967 |

| | | | | |

| Liabilities | | | | | |

| Deposits: | | | | | |

| Demand | $41,393 | $40,617 | $41,849 | $43,146 | $43,844 |

| Interest checking | 58,572 | 57,390 | 58,809 | 57,257 | 53,421 |

| Savings | 16,990 | 17,419 | 18,229 | 18,215 | 20,195 |

| Money market | 37,482 | 36,259 | 35,025 | 34,374 | 33,492 |

| Foreign office | 155 | 119 | 129 | 162 | 168 |

| CDs $250,000 or less | 10,480 | 10,882 | 10,337 | 10,552 | 10,306 |

| CDs over $250,000 | 3,268 | 4,082 | 5,209 | 5,206 | 6,246 |

| Total deposits | 168,340 | 166,768 | 169,587 | 168,912 | 167,672 |

| Federal funds purchased | 169 | 194 | 247 | 193 | 205 |

| Other short-term borrowings | 1,424 | 3,370 | 2,866 | 2,861 | 4,594 |

| Accrued taxes, interest and expenses | 2,034 | 2,040 | 1,965 | 2,195 | 1,834 |

| Other liabilities | 4,471 | 5,371 | 5,379 | 4,861 | 5,808 |

| Long-term debt | 17,096 | 16,293 | 15,444 | 16,380 | 16,310 |

| Total Liabilities | 193,534 | 194,036 | 195,488 | 195,402 | 196,423 |

| Equity | | | | | |

Common stock(c) | 2,051 | 2,051 | 2,051 | 2,051 | 2,051 |

| Preferred stock | 2,116 | 2,116 | 2,116 | 2,116 | 2,116 |

| Capital surplus | 3,784 | 3,764 | 3,742 | 3,757 | 3,733 |

| Retained earnings | 23,820 | 23,542 | 23,224 | 22,997 | 22,747 |

| Accumulated other comprehensive loss | (3,446) | (4,901) | (4,888) | (4,487) | (6,839) |

| Treasury stock | (7,541) | (7,346) | (7,227) | (7,262) | (7,264) |

| Total Equity | 20,784 | 19,226 | 19,018 | 19,172 | 16,544 |

| Total Liabilities and Equity | $214,318 | $213,262 | $214,506 | $214,574 | $212,967 |

| (a) Amortized cost | $43,754 | $43,596 | $43,400 | $55,789 | $55,557 |

| (b) Market values | 11,554 | 11,187 | 11,341 | 2 | 2 |

| (c) Common shares, stated value $2.22 per share (in thousands): | | | | | |

| Authorized | 2,000,000 | 2,000,000 | 2,000,000 | 2,000,000 | 2,000,000 |

| Outstanding, excluding treasury | 676,269 | 680,789 | 683,812 | 681,125 | 680,990 |

| Treasury | 247,624 | 243,103 | 240,080 | 242,768 | 242,903 |

| | | | | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp and Subsidiaries | | | | |

| Consolidated Statements of Changes in Equity | | | | |

| $ in millions | | | | |

| (unaudited) | | | | |

| | | For the Three Months Ended | Year to Date |

| | | September | September | September | September |

| | | 2024 | 2023 | 2024 | 2023 |

| Total Equity, Beginning | $19,226 | $17,809 | $19,172 | $17,327 |

| Impact of cumulative effect of change in accounting principle | — | — | (10) | 37 |

| Net income | 573 | 660 | 1,694 | 1,819 |

| Other comprehensive income (loss), net of tax: | | | | |