FTAI Aviation Ltd. (NASDAQ: FTAI) (the “Company” or “FTAI”) today

reported financial results for the fourth quarter and full year

2024. The Company’s consolidated comparative financial statements

and key performance measures are attached as an exhibit to this

press release.

Financial Overview

| |

| (in thousands,

except per share data) |

| Selected Financial

Results |

Q4’24 |

|

Net Income Attributable to Shareholders |

$ |

86,692 |

| Basic Earnings per Ordinary

Share |

$ |

0.85 |

| Diluted Earnings per Ordinary

Share |

$ |

0.84 |

| Adjusted EBITDA(1) |

$ |

252,015 |

| |

|

|

Fourth Quarter 2024

Dividends

On February 26, 2025, the Company’s Board of

Directors (the “Board”) declared a cash dividend on our ordinary

shares of $0.30 per share for the quarter ended December 31, 2024,

payable on March 24, 2025 to the holders of record on March 14,

2025.

Additionally, on February 26, 2025, the Board

declared cash dividends on its Fixed-Rate Reset Series C Cumulative

Perpetual Redeemable Preferred Shares (“Series C Preferred Shares”)

and Fixed-Rate Reset Series D Cumulative Perpetual Redeemable

Preferred Shares (“Series D Preferred Shares”) of $0.51563 and

$0.59375 per share, respectively, for the quarter ended December

31, 2024, payable on March 17, 2025 to the holders of record on

March 10, 2025.

Business Highlights

- Continued growth in Aerospace

Products, with net income attributable to shareholders of $346

million for fiscal year 2024, up 92% year over year, and Adjusted

EBITDA up 138% year over year(1)

- 2025 target adjusted free cash

flow(1)(2) of approximately $650 million following significant

growth investment undertaken in 2024, coupled with the Strategic

Capital Initiative (“SCI”) commencing operations in 2025

- Expanding Maintenance Capacity with

QuickTurn EuropeA subsidiary of FTAI has entered into an agreement

to acquire a 50% ownership stake in IAG Engine Center Europe S.r.l.

(“IAG Engine Center”), an Italian company operating a 200,000

square-foot CFM56 engine maintenance repair and overhaul facility

located at the Rome Fiumicino Airport, forming a joint venture

which will be rebranded as Quick Turn Engine Center Europe S.r.l.

(“QuickTurn Europe”). Completion of this transaction is expected to

add a third owned and managed CFM56 engine shop to the FTAI

network, complementing the Company’s existing facilities in

Montréal and Miami. This new joint venture is also expected to help

address the strong demand from the Company’s global customer base

in a key geography.In total, the joint venture operating at full

capacity is expected to add capacity to maintain 450 modules (150

engines) per year, bringing FTAI’s maintenance capacity to 1,800

CFM56 modules (600 engines) and over 600 engine tests annually. The

facility’s CFM56 engine test-cell is expected to be fully

operational within 24 months and its piece-part repair capabilities

are expected to be operational in the second half of 2025.The

transaction is expected to close in the first half of 2025, subject

to the satisfaction of certain closing conditions.

“In the last quarter, we delivered outstanding

financial performance across the board, and I am pleased to see the

continued strength of our Aerospace Products and Aviation Leasing

segments,” said Joe Adams, Chairman of the Board and CEO of FTAI.

“We significantly expanded our Maintenance, Repair and Exchange

capabilities and added financial firepower and flexibility with the

successful launch of our Strategic Capital Initiative. Looking

ahead to 2025, we are confident in our ability to take advantage of

the tremendous market opportunity in our Aerospace Products

business and deliver strong returns for our shareholders.”

Outlook

FTAI continues to expect 2025 Adjusted EBITDA of

approximately $1.1 to $1.15 billion from its reportable segments,

comprised of approximately $500 million from Aviation Leasing and

approximately $600 to $650 million from Aerospace Products. 2025

Adjusted EBITDA guidance reflects the following assumptions: (i) an

average of 100 modules per quarter produced at the Company’s

Montreal facility in fiscal year 2025, (ii) net Aerospace margins

in line with or better than those for fiscal year 2024, and (iii)

25 to 35 V2500 engine MRE transactions for fiscal year 2025.

Additionally, FTAI is increasing its 2026

Adjusted EBITDA from its reportable segments from its previously

projected $1.25 billion to be approximately $1.4 billion, which

reflects expected incremental upside from SCI.

|

(1) |

For definitions and reconciliations of non-GAAP measures, please

refer to the exhibit to this press release. |

| (2) |

2025 target adjusted free cash flow is based on management’s

current expectations and means target 2025 Adjusted EBITDA

excluding gains on sales, including SCI sale proceeds, less

estimated equity in SCI and replacement capital expenditures,

related interest expense, maintenance capital expenditures,

corporate expenses and working capital. |

| |

|

Additional Information

For additional information that management

believes to be useful for investors, please refer to the

presentation posted on the Investor Center section of the Company’s

website, https://www.ftaiaviation.com/, and the Company’s Annual

Report on Form 10-K, when available on the Company’s website.

Conference Call

In addition, management will host a conference

call on Thursday, February 27, 2025 at 8:00 A.M.

Eastern Time. The conference call may be accessed by registering

via the following

link https://register.vevent.com/register/BId401ec69ff8f491fb21444c5bbd87f54/.

Once registered, participants will receive a dial-in and unique pin

to access the call.

A simultaneous webcast of the conference call

will be available to the public on a listen-only basis

at https://www.ftaiaviation.com/. Please allow extra time

prior to the call to visit the site and download the necessary

software required to listen to the internet broadcast.

A replay of the conference call will be

available after 11:30 A.M. on Thursday, February 27,

2025 through 11:30 A.M. on Thursday, March 6,

2025 on https://ir.ftaiaviation.com/news-events/presentations/.

The information contained on, or accessible

through, any websites included in this press release is not

incorporated by reference into, and should not be considered a part

of, this press release.

About FTAI Aviation Ltd.

FTAI owns and maintains commercial jet engines

with a focus on CFM56 and V2500 engines. FTAI’s propriety portfolio

of products, including the Module Factory and a joint venture to

manufacture engine PMA, enables it to provide cost savings and

flexibility to our airline, lessor, and maintenance, repair, and

operations customer base. Additionally, FTAI owns and leases jet

aircraft which often facilitates the acquisition of engines at

attractive prices. FTAI invests in aviation assets and aerospace

products that generate strong and stable cash flows with the

potential for earnings growth and asset appreciation.

Cautionary Note Regarding

Forward-Looking Statements

Certain statements in this press release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including, but

not limited to, 2025 target adjusted free cash flow of

approximately $650 million, the expected timing of the closing of

the acquisition of a 50% stake in IAG Engine Center, FTAI’s

anticipated maintenance capacities, and expectations regarding when

the Rome facility’s CFM56 engine test-cell and piece-part repair

capabilities will be operational, if at all. These statements are

based on management's current expectations and beliefs and are

subject to a number of trends and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements, many of which are beyond the Company’s

control. The Company can give no assurance that its expectations

will be attained and such differences may be material. Accordingly,

you should not place undue reliance on any forward-looking

statements contained in this press release. For a discussion of

some of the risks and important factors that could affect such

forward-looking statements, see the sections entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in the Company’s most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q,

which are available on the Company’s website

(www.ftaiaviation.com). In addition, new risks and uncertainties

emerge from time to time, and it is not possible for the Company to

predict or assess the impact of every factor that may cause its

actual results to differ from those contained in any

forward-looking statements. Such forward-looking statements speak

only as of the date of this press release. The Company expressly

disclaims any obligation to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company's expectations with regard

thereto or change in events, conditions, or circumstances on which

any statement is based. This release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities.

For further information, please

contact:

Alan AndreiniInvestor RelationsFTAI Aviation

Ltd.(646) 734-9414aandreini@ftaiaviation.com

Media

Tim Lynch / Aaron Palash / Kelly SullivanJoele

Frank, Wilkinson Brimmer Katcher(212) 355-4449

Exhibit - Financial

Statements

| |

|

|

|

|

FTAI AVIATION LTD.CONSOLIDATED STATEMENTS

OF OPERATIONS (Unaudited)(Dollar amounts in thousands,

except share and per share data) |

| |

|

|

|

| |

Three Months EndedDecember 31, |

|

Year EndedDecember 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Total

revenues |

$ |

498,819 |

|

|

$ |

312,737 |

|

|

$ |

1,734,901 |

|

|

$ |

1,170,896 |

|

| |

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

| Cost of sales |

|

257,727 |

|

|

|

135,223 |

|

|

|

825,884 |

|

|

|

502,132 |

|

| Operating expenses |

|

34,587 |

|

|

|

28,945 |

|

|

|

115,861 |

|

|

|

110,163 |

|

| General and

administrative |

|

3,566 |

|

|

|

3,430 |

|

|

|

14,263 |

|

|

|

13,700 |

|

| Acquisition and transaction

expenses |

|

8,757 |

|

|

|

4,999 |

|

|

|

32,296 |

|

|

|

15,194 |

|

| Management fees and incentive

allocation to affiliate |

|

— |

|

|

|

4,900 |

|

|

|

8,449 |

|

|

|

18,037 |

|

| Internalization fee to

affiliate |

|

— |

|

|

|

— |

|

|

|

300,000 |

|

|

|

— |

|

| Depreciation and

amortization |

|

54,678 |

|

|

|

46,478 |

|

|

|

218,064 |

|

|

|

169,877 |

|

| Asset impairment |

|

— |

|

|

|

901 |

|

|

|

962 |

|

|

|

2,121 |

|

| Gain on sale of assets,

net |

|

(18,705 |

) |

|

|

— |

|

|

|

(18,705 |

) |

|

|

— |

|

| Total expenses |

|

340,610 |

|

|

|

224,876 |

|

|

|

1,497,074 |

|

|

|

831,224 |

|

| |

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

| Equity in (losses) income of

unconsolidated entities |

|

(401 |

) |

|

|

63 |

|

|

|

(2,200 |

) |

|

|

(1,606 |

) |

| Interest expense |

|

(60,881 |

) |

|

|

(43,663 |

) |

|

|

(221,721 |

) |

|

|

(161,639 |

) |

| Loss on extinguishment of

debt |

|

(3,181 |

) |

|

|

— |

|

|

|

(17,101 |

) |

|

|

— |

|

| Other income |

|

14,319 |

|

|

|

6,713 |

|

|

|

17,364 |

|

|

|

7,590 |

|

| Total other expense |

|

(50,144 |

) |

|

|

(36,887 |

) |

|

|

(223,658 |

) |

|

|

(155,655 |

) |

| Income before income

taxes |

|

108,065 |

|

|

|

50,974 |

|

|

|

14,169 |

|

|

|

184,017 |

|

| Provision for (benefit from)

income taxes |

|

5,617 |

|

|

|

(67,386 |

) |

|

|

5,487 |

|

|

|

(59,800 |

) |

| Net

income |

|

102,448 |

|

|

|

118,360 |

|

|

|

8,682 |

|

|

|

243,817 |

|

| Less: Dividends on preferred

shares |

|

7,758 |

|

|

|

8,335 |

|

|

|

32,763 |

|

|

|

31,795 |

|

| Less: Loss on redemption of

preferred shares |

|

7,998 |

|

|

|

— |

|

|

|

7,998 |

|

|

|

— |

|

| Net income (loss)

attributable to shareholders |

$ |

86,692 |

|

|

$ |

110,025 |

|

|

$ |

(32,079 |

) |

|

$ |

212,022 |

|

| |

|

|

|

|

|

|

|

| Earnings (loss) per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.85 |

|

|

$ |

1.10 |

|

|

$ |

(0.32 |

) |

|

$ |

2.12 |

|

|

Diluted |

$ |

0.84 |

|

|

$ |

1.09 |

|

|

$ |

(0.32 |

) |

|

$ |

2.11 |

|

| |

|

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

| Basic |

|

102,549,890 |

|

|

|

100,239,011 |

|

|

|

101,538,835 |

|

|

|

99,908,214 |

|

| Diluted |

|

103,603,350 |

|

|

|

100,853,151 |

|

|

|

101,538,835 |

|

|

|

100,425,777 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

FTAI AVIATION LTD.CONSOLIDATED BALANCE

SHEETS (Dollar amounts in thousands, except share and per

share data) |

| |

|

| |

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Assets |

|

|

|

|

Current Assets |

|

|

|

|

Cash and cash equivalents |

$ |

115,116 |

|

|

$ |

90,756 |

|

|

Accounts receivable, net |

|

150,823 |

|

|

|

115,156 |

|

|

Inventory, net |

|

551,156 |

|

|

|

316,637 |

|

|

Other current assets |

|

408,923 |

|

|

|

148,885 |

|

|

Total current assets |

|

1,226,018 |

|

|

|

671,434 |

|

|

Leasing equipment, net |

|

2,373,730 |

|

|

|

2,032,413 |

|

|

Property, plant, and equipment, net |

|

107,451 |

|

|

|

45,175 |

|

|

Investments |

|

19,048 |

|

|

|

22,722 |

|

|

Intangible assets, net |

|

42,205 |

|

|

|

50,590 |

|

|

Goodwill |

|

61,070 |

|

|

|

4,630 |

|

|

Other non-current assets |

|

208,430 |

|

|

|

137,721 |

|

| Total

assets |

$ |

4,037,952 |

|

|

$ |

2,964,685 |

|

| |

|

|

|

|

Liabilities |

|

|

|

|

Current Liabilities |

|

|

|

|

Accounts payable |

$ |

69,119 |

|

|

$ |

41,590 |

|

|

Accrued liabilities |

|

96,910 |

|

|

|

71,317 |

|

|

Current maintenance deposits |

|

62,552 |

|

|

|

39,455 |

|

|

Current security deposits |

|

18,100 |

|

|

|

17,735 |

|

|

Other current liabilities |

|

100,565 |

|

|

|

11,746 |

|

|

Total current liabilities |

|

347,246 |

|

|

|

181,843 |

|

|

Long-term debt, net |

|

3,440,478 |

|

|

|

2,517,343 |

|

|

Non-current maintenance deposits |

|

44,179 |

|

|

|

25,932 |

|

|

Non-current security deposits |

|

26,830 |

|

|

|

23,330 |

|

|

Other non-current liabilities |

|

97,851 |

|

|

|

40,354 |

|

| Total

liabilities |

$ |

3,956,584 |

|

|

$ |

2,788,802 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| |

|

|

|

| Equity |

|

|

|

| Ordinary shares ($0.01 par

value per share; 2,000,000,000 shares authorized; 102,550,975 and

100,245,905 shares issued and outstanding as of December 31, 2024

and 2023, respectively) |

$ |

1,026 |

|

|

$ |

1,002 |

|

| Preferred shares ($0.01 par

value per share; 200,000,000 shares authorized; 11,740,000 and

15,920,000 shares issued and outstanding as of December 31, 2024

and 2023, respectively) |

|

117 |

|

|

|

159 |

|

| Additional paid in

capital |

|

153,328 |

|

|

|

255,973 |

|

| Accumulated deficit |

|

(73,103 |

) |

|

|

(81,785 |

) |

| Shareholders' equity |

|

81,368 |

|

|

|

175,349 |

|

| Non-controlling interest in

equity of consolidated subsidiaries |

|

— |

|

|

|

534 |

|

| Total equity |

$ |

81,368 |

|

|

$ |

175,883 |

|

| Total liabilities and

equity |

$ |

4,037,952 |

|

|

$ |

2,964,685 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Key Performance Measures

In addition to net income (loss), the Chief

Operating Decision Maker (“CODM”) utilizes Adjusted EBITDA as a key

performance measure.

Adjusted EBITDA provides the CODM with the

information necessary to assess operational performance, as well as

make resource and allocation decisions. Adjusted EBITDA is defined

as net income (loss) attributable to shareholders, adjusted (a) to

exclude the impact of provision for (benefit from) income taxes,

equity-based compensation expense, acquisition and transaction

expenses, losses on the modification or extinguishment of debt and

preferred shares and capital lease obligations, changes in fair

value of non-hedge derivative instruments, asset impairment

charges, incentive allocations, depreciation and amortization

expense, dividends on preferred shares and interest expense,

internalization fee to affiliate, (b) to include the impact of our

pro-rata share of Adjusted EBITDA from unconsolidated entities and

(c) to exclude the impact of equity in earnings (losses) of

unconsolidated entities and the non-controlling share of Adjusted

EBITDA, if any.

Reconciliations of forward-looking non-GAAP

financial measures to their most directly comparable GAAP financial

measures are not included in this press release because the most

directly comparable GAAP financial measures are not available on a

forward-looking basis without unreasonable effort.

The following table sets forth a reconciliation

of net income (loss) attributable to shareholders to Adjusted

EBITDA for the three and twelve months ended December 31, 2024 and

2023:

| |

|

|

|

| |

Three Months EndedDecember 31, |

|

Year EndedDecember 31, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income (loss)

attributable to shareholders |

$ |

86,692 |

|

|

$ |

110,025 |

|

|

$ |

(32,079 |

) |

|

$ |

212,022 |

|

| Add: Provision for (benefit

from) income taxes |

|

5,617 |

|

|

|

(67,386 |

) |

|

|

5,487 |

|

|

|

(59,800 |

) |

| Add: Equity-based compensation

expense |

|

3,428 |

|

|

|

510 |

|

|

|

6,006 |

|

|

|

1,638 |

|

| Add: Acquisition and

transaction expenses |

|

8,757 |

|

|

|

4,999 |

|

|

|

32,296 |

|

|

|

15,194 |

|

| Add: Losses on the

modification or extinguishment of debt and preferred shares and

capital lease obligations |

|

11,179 |

|

|

|

— |

|

|

|

25,099 |

|

|

|

— |

|

| Add: Changes in fair value of

non-hedge derivative instruments |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Add: Asset impairment

charges |

|

— |

|

|

|

901 |

|

|

|

962 |

|

|

|

2,121 |

|

| Add: Incentive

allocations |

|

— |

|

|

|

4,576 |

|

|

|

7,456 |

|

|

|

17,116 |

|

| Add: Depreciation &

amortization expense (1) |

|

67,647 |

|

|

|

56,557 |

|

|

|

262,031 |

|

|

|

213,641 |

|

| Add: Interest expense and

dividends on preferred shares |

|

68,639 |

|

|

|

51,998 |

|

|

|

254,484 |

|

|

|

193,434 |

|

| Add: Internalization fee to

affiliate |

|

— |

|

|

|

— |

|

|

|

300,000 |

|

|

|

— |

|

| Add: Pro-rata share of

Adjusted EBITDA from unconsolidated entities (2) |

|

(345 |

) |

|

|

214 |

|

|

|

(1,892 |

) |

|

|

310 |

|

| Less: Equity in losses

(earnings) of unconsolidated entities |

|

401 |

|

|

|

(63 |

) |

|

|

2,200 |

|

|

|

1,606 |

|

| Less: Non-controlling share of

Adjusted EBITDA |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Adjusted EBITDA

(non-GAAP) |

$ |

252,015 |

|

|

$ |

162,331 |

|

|

$ |

862,050 |

|

|

$ |

597,282 |

|

____________________

|

(1) |

Includes the following items for the three months ended December

31, 2024 and 2023: (i) depreciation and amortization expense of

$54,678 and $46,478, (ii) lease intangible amortization of $4,117

and $3,801 and (iii) amortization for lease incentives of $8,852

and $6,278, respectively.Includes the following items for the years

ended December 31, 2024 and 2023: (i) depreciation and amortization

expense of $218,064 and $169,877, (ii) lease intangible

amortization of $15,597 and $15,126 and (iii) amortization for

lease incentives of $28,370 and $28,638, respectively. |

|

|

|

| (2) |

Includes the following items for the three months ended December

31, 2024 and 2023: (i) net (loss) income of $(401) and $63,

(ii) depreciation and amortization expense of $56 and $286 and

(iii) acquisition and transaction expense of $0 and $(135),

respectively.Includes the following items for the years ended

December 31, 2024 and 2023: (i) net loss of $2,200 and $1,606,

(ii) depreciation and amortization expense of $308 and $1,488

and (iii) acquisition and transaction expense of $0 and $428,

respectively. |

| |

|

The following table sets forth a reconciliation

of net income attributable to shareholders to Adjusted EBITDA for

Aerospace Products for the twelve months ended December 31, 2024

and 2023:

| |

|

| |

Year EndedDecember 31, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

| Net income

attributable to shareholders |

$ |

346,346 |

|

|

$ |

180,177 |

|

| Add: Provision for (benefit

from) income taxes |

|

22,221 |

|

|

|

(24,440 |

) |

| Add: Equity-based compensation

expense |

|

309 |

|

|

|

225 |

|

| Add: Acquisition and

transaction expenses |

|

4,906 |

|

|

|

1,722 |

|

| Add: Losses on the

modification or extinguishment of debt and preferred shares and

capital lease obligations |

|

— |

|

|

|

— |

|

| Add: Changes in fair value of

non-hedge derivative instruments |

|

— |

|

|

|

— |

|

| Add: Asset impairment

charges |

|

— |

|

|

|

— |

|

| Add: Incentive

allocations |

|

— |

|

|

|

— |

|

| Add: Depreciation and

amortization expense |

|

6,630 |

|

|

|

661 |

|

| Add: Interest expense and

dividends on preferred shares |

|

— |

|

|

|

— |

|

| Add: Pro-rata share of

Adjusted EBITDA from unconsolidated entities (1) |

|

(1,769 |

) |

|

|

206 |

|

| Less: Equity in losses of

unconsolidated entities |

|

1,993 |

|

|

|

1,458 |

|

| Less: Non-controlling share of

Adjusted EBITDA |

|

— |

|

|

|

— |

|

| Adjusted EBITDA

(non-GAAP) |

$ |

380,636 |

|

|

$ |

160,009 |

|

________________________

|

(1) |

Includes the following items for the years ended December 31, 2024

and 2023: (i) net loss of $1,993 and $1,458 (ii) depreciation and

amortization of $224 and $1,236 and (iii) acquisition and

transaction expense of $0 and $428, respectively. |

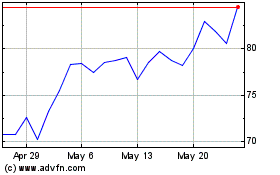

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Jan 2025 to Feb 2025

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Feb 2024 to Feb 2025