Current Report Filing (8-k)

18 February 2023 - 12:48AM

Edgar (US Regulatory)

0001451448

false

MT

0001451448

2023-02-14

2023-02-14

0001451448

us-gaap:CommonStockMember

2023-02-14

2023-02-14

0001451448

GMBL:CommonStockPurchaseWarrants1Member

2023-02-14

2023-02-14

0001451448

GMBL:Sec10.0SeriesCumulativeRedeemableConvertiblePreferredStockMember

2023-02-14

2023-02-14

0001451448

GMBL:CommonStockPurchaseWarrantsMember

2023-02-14

2023-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 14, 2023

ESPORTS

ENTERTAINMENT GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39262 |

|

26-3062752 |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation

or organization) |

|

File

Number) |

|

Identification

No.) |

BLOCK

6,

TRIQ

PACEVILLE,

ST.

JULIANS STJ 3109

MALTA

(Address

of principal executive offices)

356

2713 1276

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

GMBL |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

GMBLW |

|

The

Nasdaq Stock Market LLC |

| 10.0%

Series A Cumulative Redeemable Convertible Preferred Stock |

|

GMBLP |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

GMBLZ |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

On

February 14, 2023, Esports Entertainment Group, Inc. (“Company”) and Gameday Group PLC (“Purchaser”) entered

into a share purchase agreement (“Purchase Agreement”) for the sale of the Company’s Bethard business, an online operator

of casino and sportsbook brands that is licensed in Malta and Sweden. Under the terms of the Purchase Agreement, the Purchaser will acquire

the shares of Prozone Limited, a company registered in Malta for total purchase consideration determined between the parties of approximately

€9.5 million (approximately $10.2 million using exchange rates in effect on the date of the Purchase Agreement) comprised of €1.65

million (approximately $1.77 million using exchange rates in effect on the date of the Purchase Agreement) of cash proceeds payable to

the Company at closing, with an additional €6.5 million (approximately $7.0 million using exchange rates in effect on the date of

the Purchase Agreement) of purchase consideration attributed to the Company’s release from payment of its contingent consideration

liability from the Bethard acquisition. The purchaser of the Bethard business will also assume liabilities of approximately €1.2

million (approximately $1.3 million using exchange rates in effect on the date of the Purchase Agreement). The terms of sale allow for

a cash holdback of €0.15 million (approximately $0.16 million using exchange rates in effect on the date of the Purchase Agreement)

which may be retained by the purchaser should liabilities exceed agreed upon amounts in the Purchase Agreement.

The

closing date (“Closing Date”) of the sale of the Bethard Business is subject to closing terms and conditions as outlined

in the Purchase Agreement. The Purchase Agreement sets forth a two-week period for the Company to satisfy certain conditions for completion

of sale following the signing of the Purchase Agreement.

The

Company entered into an Amendment and Waiver Agreement (“Amendment”) on February 16, 2023 as a condition to the closing of

the sale of the Bethard business. The Amendment requires the Company to deposit 50% of the proceeds from the sale of the Bethard business

in a bank account in favor of the holder (the “Debt Holder”) of its Senior Convertible Note, dated February 22, 2022 (the

“Senior Convertible Note”). The Amendment also requires the Company to deposit 50% of the proceeds of any permitted future

sale of assets or any subsequent debt or equity offer or sale (a “Securities Transaction”) and 100% of the proceeds of any

additional indebtedness incurred in the future, into such bank account in favor of the Debt Holder, or, at the option of the Debt Holder,

redeem amounts under the Senior Convertible Note using such proceeds.

The

Amendment also modifies the Senior Convertible Note to increase the principal balance by $2.95 million for additional interest and other

amounts previously recorded by the Company as liabilities to the Debt Holder, as well as for fees for the Amendment. The Amendment further

provides for a voluntary reduction in the Conversion Price (as defined in the Senior Convertible Note) when the Company issues or is

deemed to issue common stock in a future registered offering at a price below the Conversion Price then in effect, to the lower issuance

price in such offering, subject to certain exceptions. The Amendment also provides rights to the Debt Holder to participate in future

Securities Transactions for a period of two years from the later of the date of the Amendment and the date that no payment amounts due

to the Debt Holder remain outstanding.

This

summary of the Purchase Agreement and Amendment does not purport to be complete and is qualified in its entirety by reference to the

provisions of the Purchase Agreement and Amendment, copies of which are filed as Exhibit 10.1 and Exhibit 10.2 to this Current Report

on Form 8-K and incorporated herein by reference.

Item

8.01 Other Events.

The

full text of the press release announcing the sale of the Bethard business is attached as Exhibit 99.1 hereto and is incorporated herein

by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

Forward-Looking

Statements

The

information contained herein includes forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “plans,” “predicts,” “projects,” “will be,”

“will continue,” “will likely result,” and similar expressions. These statements relate to future events or to

our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results,

levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements, including, the amount of debt for equity exchanges we will

be able to effect, the conversion price, and for what period of time such exchanges will continue to occur, if at all. You should not

place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which

are, in some cases, beyond our control and which could, and likely will, materially affect actual results, levels of activity, performance

or achievements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our most

recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, and those discussed in other documents we file with

the SEC, including, our significant indebtedness, and our obligations under our Senior Convertible Note, our ability to continue as a

going concern, and our ability to regain compliance with Nasdaq Listing Rules. Any forward-looking statement reflects our current views

with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results

of operations, growth strategy and liquidity. We assume no obligation to publicly update or revise these forward-looking statements for

any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements,

even if new information becomes available in the future, unless required by law. The safe harbor for forward-looking statements contained

in the Private Securities Litigation Reform Act of 1995 protects companies from liability for their forward-looking statements if they

comply with the requirements of such Act.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

Date:

February 17, 2023

| |

ESPORTS

ENTERTAINMENT GROUP, INC. |

| |

|

| |

By: |

/s/

Michael Villani |

| |

Name:

|

Michael

Villani |

| |

Title: |

Interim

Chief Financial Officer and Controller |

Esports Entertainment (NASDAQ:GMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

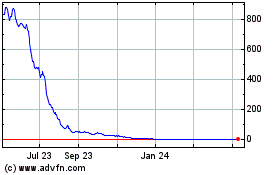

Esports Entertainment (NASDAQ:GMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024