Honeywell Lowers Sales Guidance on Supply-Chain Constraints

22 October 2021 - 10:11PM

Dow Jones News

By Dave Sebastian

Honeywell International Inc. said it lowered its sales guidance

for the year due to supply-chain constraints and the ongoing

effects of what it described as a "macro-challenged

environment."

The industrial conglomerate Friday said it sees 2021 sales of

$34.2 billion to $34.6 billion, reflecting organic growth of 4% to

5%. It previously expected sales of $34.6 billion to $35.2 billion,

reflecting organic growth of 4% to 6%.

Organic sales growth strips out the effects from foreign

currency translation and acquisitions and divestitures for the

first 12 months following the transaction date.

Honeywell said it expects adjusted earnings of $8 a share to

$8.10 a share. It previously expected adjusted earnings of $7.95 a

share to $8.10 a share.

The company saw supply-chain constraints, increasing raw

material inflation and labor-market challenges in the third

quarter, for which it posted higher profit and sales, Chairman and

Chief Executive Darius Adamczyk said.

"We continue to focus on mitigating these challenges in the

fourth quarter," he said.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 22, 2021 06:56 ET (10:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

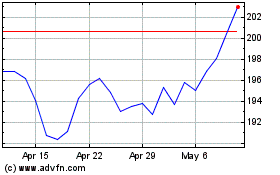

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

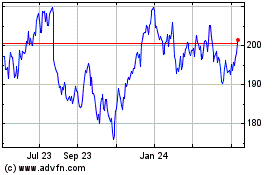

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024