Intel Sells $6 Billion in Notes, Including Green Bonds

06 August 2022 - 8:51AM

Dow Jones News

By Mary de Wet

Intel Corp. issued $6 billion in senior notes Friday, including

$1.25 billion in green bonds due 2032.

The proceeds of the green bonds will be used to fund eligible

projects, such as investing in green buildings or energy

efficiency. The 4.150% notes are due 2032, the tech company said in

a filing with the U.S. Securities and Exchange Commission.

Intel aims to use the proceeds of the other notes for general

corporate purposes, including refinancing debt and to fund working

capital and capital expenditures.

The company issued $1.25 billion of 3.75% notes due 2027, $850

million of 4% notes due 2029, $1.75 billion of 4.9% notes due 2052,

and $900 million of 5.05% notes due 2062.

J.P. Morgan Securities LLC, BNP Paribas Securities Corp., BofA

Securities Inc. and Goldman Sachs & Co. LLC are underwriters,

Intel said.

S&P Global Ratings and Fitch have rated the notes as A+.

Write to Mary de Wet at mary.dewet@dowjones.com

(END) Dow Jones Newswires

August 05, 2022 18:36 ET (22:36 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

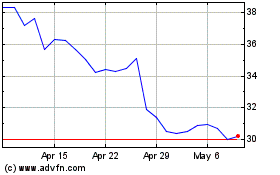

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

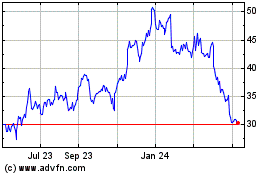

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024