AM Best Affirms Credit Ratings of Investors Title Company and Its Subsidiaries

14 October 2022 - 12:20AM

Business Wire

AM Best has affirmed the Financial Strength Rating of A

(Excellent) and the Long-Term Issuer Credit Ratings (Long-Term ICR)

of “a” (Excellent) of both subsidiaries of Investors Title

Company (ITC) [NASDAQ: ITIC]: Investors Title Insurance

Company and National Investors Title Insurance Company

(Austin, TX). These subsidiaries collectively are referred to as

Investors Title Company Group (ITC Group). Concurrently, AM

Best has affirmed the Long-Term ICR of “bbb” (Good) of ITC. The

outlook of these Credit Ratings (ratings) is stable. All companies

are domiciled in Chapel Hill, NC, unless otherwise specified.

The ratings reflect ITC Group’s balance sheet strength, which AM

Best assesses as very strong, as well as its strong operating

performance, limited business profile and appropriate enterprise

risk management (ERM).

ITC Group’s balance sheet strength assessment reflects its

strongest risk-adjusted capitalization, as measured by Best’s

Capital Adequacy Ratio (BCAR), and positive surplus growth that is

reflective of its strong operating earnings and conservative

underwriting position. ITC Group’s operating performance

consistently outperforms the industry, driven by its

lower-than-average loss and loss adjustment expense ratios. This

level of performance enables it to significantly outperform peers

in terms of return on equity and return on revenue. ITC Group’s

limited business profile is driven largely by the group’s heavy

product focus and its significant geographic concentration in North

Carolina and Texas. AM Best considers ITC Group’s ERM practices

appropriate, as it assesses and critically reviews risks annually,

and develops a comprehensive listing under which each respective

risk is assigned to the appropriate staff and managers who are

responsible for monitoring, managing and mitigation.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2022 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221013005694/en/

Edward Zonenberg Senior Financial Analyst +1 908 439 2200,

ext. 5135 edward.zonenberg@ambest.com Fred Eslami Associate

Director +1 908 439 2200, ext. 5406 fred.eslami@ambest.com

Christopher Sharkey Manager, Public Relations +1 908 439 2200,

ext. 5159 christopher.sharkey@ambest.com Al Slavin

Communications Specialist +1 908 439 2200, ext. 5098

al.slavin@ambest.com

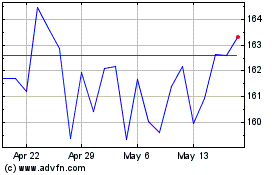

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Oct 2024 to Nov 2024

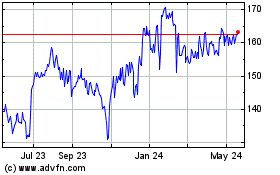

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Nov 2023 to Nov 2024