Filed

by Kairous Acquisition Corp. Limited

Pursuant

to Rule 425 under the Securities Act of 1933

and

deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Commission

File No. 001-41155

Subject

Company: Kairous Acquisition Corp. Limited

Post-merger

goals: Wellous gears up for global market expansion, NPD and MarTech capability boost

By

Hui Ling Dang

March

20, 2023 (NUTRAINGREDIENTS-ASIA)

Malaysia-based

nutrition company Wellous says multi-pronged expansion plans are in motion, after sealing a US$270 million merger deal with Nasdaq-listed

Kairous Acquisition Corporation Limited.

This

partnership comes after Kairous’ evaluation of more than 1,000 fast-growing companies in Asia over the past decade.

“Becoming

a public company has always been a part of our business strategy, and the merger with Kairous will provide us access to the US markets

and potential capacity in accelerating the growth.

“Wellous

is well established in Malaysia, and have a rising presence in Singapore and Hong Kong. We are looking to reach new consumers in countries

with growth opportunities through local marketing strategies, as well as increasing penetration into our main markets. Partnering with

Kairous gives us the potential to go further than we could on our own, “Andy Tan, co-founder and CEO of Wellous, told NutraIngredients-Asia.

Going

forward, the firm will focus on several key areas, namely market expansion, product innovation, and upgrading of IT infrastructure.

All-round

development

Wellous’

best-selling products include Liveon’s anti-ageing beverage, Zenso’s weight management supplement, and TIGROX’s Tiger

Milk King supplement that supports the lungs and respiratory system.

The

firm is working to bolster its product development capabilities by adopting a customer-centric approach, utilising its in-house R&D

team consisting of healthcare professionals, and extending collaborations with external research institutions and universities.

“We

will continue to ensure product relevancy, novelty and differentiation in our portfolio, while expanding to adjacent categories, such

as halal-certified products, which we believe possess significant growth opportunities. At the same time, we will focus on sourcing natural

ingredients from diverse origins globally and developing formulations based on market needs,” Tan shared.

Currently,

Wellous’ products can be purchased from online retailers and a pool of “techpreneurs” who sell direct to consumers.

As

such, the firm intends to optimise its IT infrastructure to better manage data and streamline processes. It will be investing in marketing

technology innovations to train the techpreneurs in elevating the shopping experience and enhancing their relationship with customers.

Meeting

evolving needs

Wellous

has observed notable shifts in consumer behaviour in recent times, particularly after the COVID-19 pandemic.

Citing

the rising demand for functional foods and supplements, Tan said: “The growth of the nutraceutical market is mostly being driven

by consumers who are becoming more health-conscious and living healthier lifestyles. More people are consuming nutritional supplements

on a regular basis as a preventive measure, rather than a treatment method. Consumers today also seek to ensure that the products are

made responsibly and sustainably.

“We

not only want to improve the health of consumers, but also raise their awareness on nutrition and wellness. Our strong presence in South

East Asia (SEA) is underpinned by the increasing prioritisation of healthy diets, ageing populations, and the rising consumption power

in the Asia-Pacific (APAC) region,” he added.

In

the long term, Wellous is committed to supporting the global sustainability agenda, and is taking steps to embed the principles and practices

of sustainability into its business.

For

instance, the firm has recently embarked on a collaboration with DHL Express Malaysia.

“This

partnership makes Wellous the first in APAC to use DHL’s GoGreen Plus service, supporting our goal to reduce carbon emissions of

our international shipments, “Tan said.

About

Wellous

Wellous

Group Limited (“Wellous”) is a health food and nutrition company that develops, manufactures, markets and distributes trusted

and beneficial health and wellness products. The Company offers only the best of nature, the most precious ingredients from a wide sourcing

network. Based in Malaysia, Wellous’ products and services are distributed through its tech-enabled distribution channels. The

Company has a strong footprint in the Asia-Pacific markets and growing presence in other markets across the world.

About

Kairous Acquisition Corp. Limited

Kairous

Acquisition Corp. Limited is a blank check company, also commonly referred to as a special purpose acquisition company, or SPAC, formed

for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination

with one or more businesses or entities.

Additional

Information and Where to Find It

In

connection with the proposed business combination, Kairous and/or its subsidiary will file with the SEC a Registration Statement on Form

F-4 (as amended, the Registration Statement”), which will include a proxy statement/prospectus. After the Registration Statement

is declared effective, Kairous will send the proxy statement/prospectus and other relevant documents to its shareholders. This press

release is not a substitute for the proxy statement/prospectus. INVESTORS AND SECURITY HOLDERS AND OTHER INTERESTED PARTIES ARE URGED

TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN FILED OR WILL BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT WELLOUS, KAIROUS, THE PROPOSED TRANSACTION AND RELATED MATTERS. The Registration Statement and any other

relevant filed documents (when they are available) can be obtained free of charge from the SEC’s website at www.sec.gov. These

documents (when they are available) can also be obtained free of charge from Kairous at https://www.kairous.com/insights or upon written

request at Kairous Acquisition Corp. Limited, Unit 9-3, Oval Tower @ Damansara, No. 685, Jalan Damansara, 60000 Taman Tun Dr. Ismail,

Kuala Lumpur, Malaysia.

Forward-Looking

Statements

This

press release contains certain “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, both as amended. Statements that are not historical facts, including statements about the pending transactions

described herein, and the parties’ perspectives and expectations, are forward-looking statements. Such statements include, but

are not limited to, statements regarding the proposed transaction, including the anticipated initial enterprise value and post-closing

equity value, the benefits of the proposed transaction, integration plans, expected synergies and revenue opportunities, anticipated

future financial and operating performance and results, including estimates for growth, the expected management and governance of the

combined company, and the expected timing of the transactions. The words “expect,” “believe,” “estimate,”

“intend,” “plan” and similar expressions indicate forward-looking statements. These forward-looking statements

are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about

general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially

from those indicated or anticipated.

Such

risks and uncertainties include, but are not limited to: (i) risks related to the expected timing and likelihood of completion of the

pending business combination, including the risk that the transaction may not close due to one or more closing conditions to the transaction

not being satisfied or waived, such as regulatory approvals not being obtained, on a timely basis or otherwise, or that a governmental

entity prohibited, delayed or refused to grant approval for the consummation of the transaction or required certain conditions, limitations

or restrictions in connection with such approvals; (ii) risks related to the ability of Kairous and the Company to successfully integrate

the businesses; (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the applicable

transaction agreements; (iv) the risk that there may be a material adverse change with respect to the financial position, performance,

operations or prospects of the Company or Kairous; (v) risks related to disruption of management time from ongoing business operations

due to the proposed transaction; (vi) the risk that any announcements relating to the proposed transaction could have adverse effects

on the market price of Kairous’s securities; (vii) the risk that the proposed transaction and its announcement could have an adverse

effect on the ability of the Company to retain customers and retain and hire key personnel and maintain relationships with their suppliers

and customers and on their operating results and businesses generally; (viii): risks relating to the wellness and nutritional supplements

sectors, including consumer preference and purchasing habit changes, raw material supply fluctuation, governmental regulatory and enforcement

changes, market competitions, competitive product and pricing activity; and (ix) risks relating to the combined company’s ability

to enhance its services and products, execute its business strategy, expand its customer base and maintain stable relationship with its

business partners.

A

further list and description of risks and uncertainties can be found in the Prospectus filed on December 14, 2021 relating Kairous’s

initial public offering and in the Registration Statement and proxy statement that will be filed with the SEC by Kairous and/or its subsidiary

in connection with the proposed transactions, and other documents that the parties may file or furnish with the SEC, which you are encouraged

to read. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place

undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and Kairous, the

Company and their subsidiaries undertake no obligation to update forward-looking statements to reflect events or circumstances after

the date they were made except as required by law or applicable regulation.

No

Offer or Solicitation

This

press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the transactions described above and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of

Kairous or the Company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offering

of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as

amended, or an exemption therefrom.

Participants

in the Solicitation

Kairous

and the Company, and certain shareholders of Kairous, and their respective directors, executive officers and employees and other persons

may be deemed to be participants in the solicitation of proxies from the holders of Kairous ordinary shares in respect of the proposed

transaction. Information about Kairous’s directors and executive officers and their ownership of Kairous ordinary shares is set

forth in the Prospectus filed on December 14, 2021 and filed with the SEC as modified or supplemented by any Form 3 or Form 4 filed with

the SEC since the date of that filing. Other information regarding the interests of the participants in the proxy solicitation will be

included in the Registration Statement/proxy statement pertaining to the proposed transaction when it becomes available. These documents

can be obtained free of charge from the sources indicated above.

Wellous

and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of

Kairous in connection with the proposed business combination. A list of the names of such directors and executive officers and information

regarding their interests in the proposed business combination will be included in the Registration Statement/proxy statement pertaining

to the proposed transaction when it becomes available for the proposed business combination.

Contacts

Investors:

Michael

Bowen

wellousIR@icrinc.com

Media:

Brad

Burgess

wellousPR@icrinc.com

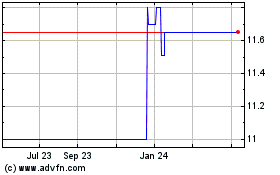

Kairous Acquisition (NASDAQ:KACLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

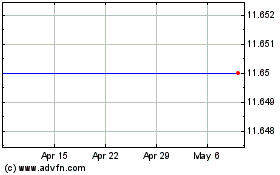

Kairous Acquisition (NASDAQ:KACLU)

Historical Stock Chart

From Apr 2023 to Apr 2024