Akerna (Nasdaq: KERN), a leading enterprise software company and

developer of one of the most comprehensive technology

infrastructures, ecosystems, and compliance engines powering the

global cannabis industry, today reported its unaudited financial

results for the third quarter, ended September 30, 2022.

“We continue to focus our resources on building a stable and

sustainable financial model at Akerna, and we are well-positioned

for future growth,” said Jessica Billingsley, CEO of Akerna.

“This is evident in our double-digit growth in reported software

sales for the quarter, the implementation of aggressive cost

control measures we implemented throughout the year which are

tracking through the P&L, and the narrowing of our Adjusted

EBITDA losses.”

“We believe that our current business units, which are supported

by and consist of 75% recurring annual revenue, provide us the

means to reach a point of sustained profitability at our current

sales growth rate,” concluded Ms. Billingsley.

Third Quarter 2022 Financial Highlights

- Software revenue was $5.3 million, up 17% year-over-year

- Total revenue was $5.4 million, up 5% year-over-year

- Gross profit of $3.4 million, or 62% of total revenues, was

essentially flat with $3.2 million, or 62% of total revenues in the

same period of 2021

- Loss from operations was $0.8 million which included a $3.0

million benefit, attributable to an acquisition earn-out

adjustment, compared to a loss of $3.7 million in last year’s same

period

- Net loss was $2.3 million compared to a loss of $1.5 million in

last year’s third quarter

- Adjusted EBITDA* loss was $1.4 million compared with a loss of

$1.5 million for the same quarter of 2021, and compared to an

Adjusted EBITDA loss of $2.1 million in the second quarter of

2022

- Cash and restricted cash was $9.5 million as of September 30,

2022

*See “Explanation of Non-GAAP Financial Measures” below

Third Quarter 2022 Key Metrics

- CARR of $16.9 million, up 3% year-over-year

- Q3 software bookings of approximately $440K

- Transaction volume up 10% sequentially

- Average new business deal size decreased by 16%

year-over-year

- Transaction dollar amount down 10% sequentially

Other Key Developments:

- The company continues to explore strategic and financial

alternatives to strengthen its balance sheet

- Closed an equity transaction providing net proceeds of $9.2

million on July 5, 2022

- Announced that shareholders voted in favor of a 20-for-1

reverse stock split which was effectuated immediately thereafter in

order to maintain compliance with Nasdaq listing standards

The foregoing financial results are preliminary in nature. Final

financial results and other disclosures will be reported in

Akerna’s quarterly report on Form 10-Q and may differ materially

from the results and disclosures today due to, among other things,

the completion of final review procedures, the occurrence of

subsequent events or the discovery of additional information. You

are encouraged to review the Form 10-Q in detail.

Conference Call Details

Akerna will host a conference call Monday, November 14, 2022, at

11:00 a.m. Eastern Time to discuss its financial results and

business highlights. A question-and-answer session will follow

prepared remarks. Interested parties may listen to the call by

dialing:

Toll-Free: 1-877-407-3982Toll / International:

201-493-6781Conference ID#: 13733796

The conference call will also be available via a live,

listen-only webcast and can be accessed through the Investor

Relations section of Akerna’s website, https://ir.akerna.com/

To be included on the Company’s email distribution list, please

sign up at https://ir.akerna.com/news-events/email-alerts

About Akerna

Akerna (Nasdaq: KERN) is an enterprise software company focused

on compliantly serving the cannabis, hemp, and CBD industry. First

launched in 2010, Akerna has tracked more than $30 billion in

cannabis sales to date and is the first cannabis software company

listed on Nasdaq. The company’s cornerstone technology, MJ

Platform, one of the world’s leading cannabis infrastructure as a

service platform, powers retailers, manufacturers, brands,

distributors, and cultivators.

For more information, visit https://www.akerna.com/.

Forward Looking Statements

Certain statements made in this release are “forward-looking

statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the

words

“estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. Such forward-looking statements include

but are not limited to statements regarding our preliminary

financial results which may differ from our final financial

results, our preparation for a potential post-legalization

landscape, our believe enterprise capabilities, including

comprehensive compliance solutions and financial reporting

integrations, will become increasingly important to the future

leaders of the cannabis industry and the timing for management’s

conference call in relation to our quarterly results. These

forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of

significant known and unknown risks, uncertainties, assumptions,

and other important factors, many of which are outside Akerna’s

control, that could cause actual results or outcomes to differ

materially from those discussed in the forward-looking statements.

Important factors, among others that may affect actual results or

outcomes, include (i) Akerna’s ability to maintain relationships

with customers and suppliers and retain its management and key

employees, (ii) changes in applicable laws or regulations, (iii)

changes in the market place due to the coronavirus pandemic or

other market factors, (iv) and other risks and uncertainties

disclosed from time to time in Akerna’s filings with the U.S.

Securities and Exchange Commission, including those under “Risk

Factors” therein. You are cautioned not to place undue

reliance on forward-looking statements. All information herein

speaks only as of the date hereof, in the case of information about

Akerna, or the date of such information, in the case of information

from persons other than Akerna. Akerna undertakes no duty to update

or revise the information contained herein. Forecasts and estimates

regarding Akerna’s industry and end markets are based on sources

believed to be reliable; however, there can be no assurance these

forecasts and estimates will prove accurate in whole or in

part.

Explanation of Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S.

generally accepted accounting principles (“GAAP”), we believe the

following non-GAAP measures are useful in evaluating our operating

performance. We use the following non-GAAP financial information to

evaluate our ongoing operations and for internal planning and

forecasting purposes. We believe that non-GAAP financial

information, when taken collectively, may be helpful to investors

because it provides consistency and comparability with past

financial performance. However, non-GAAP financial information is

presented for supplemental informational purposes only, has

limitations as an analytical tool, and should not be considered in

isolation or as a substitute for financial information presented in

accordance with GAAP.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. Other companies, including companies in our

industry, may calculate similarly titled non-GAAP measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison. We attempt to

compensate for these limitations by providing specific information

regarding the GAAP items excluded from these non-GAAP financial

measures.

Investors are encouraged to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures

and not rely on any single financial measure to evaluate our

business.

Adjusted EBITDA

We believe that Adjusted EBITDA, when considered with the

financial statements determined in accordance with GAAP, is helpful

to investors in understanding our performance and allows for

comparison of our performance and credit strength to our peers.

Adjusted EBITDA should not be considered alternatives to net loss

as determined in accordance with GAAP as indicators of our

performance or liquidity.

We define EBITDA as net loss before interest expense, provision

for income taxes, depreciation and amortization. We calculate

Adjusted EBITDA as EBITDA further adjusted to exclude the effects

of the following items for the reasons set forth below:

- Impairment of long-lived assets, because it’s a non-cash,

non-recurring item, which effects the comparability of results of

operations and liquidity;

- Stock-based compensation expense, because this represents a

non-cash charge and our mix of cash and share-based compensation

may differ from other companies, which effects the comparability of

results of operations and liquidity;

- Cost incurred in connection with business combinations and

mergers that are required to be expensed as incurred in accordance

with GAAP, because business combination and merger related costs

are specific to the complexity and size of the underlying

transactions as well as the frequency of our acquisition activity

these costs are not reflective of our ongoing operations;

- Cost incurred in connection with non-recurring financing,

including fees incurred as a direct result of electing the fair

value option to account for our debt instruments;

- Restructuring charges, which include costs to terminate a lease

and the related write off of leasehold improvements and furniture,

as we believe these costs are not representative of operating

performance;

- Gain on forgiveness of PPP loan, as this is a one-time

forgiveness of debt that is not recurring across all periods and we

believe inclusion of the gain is not representative of operating

performance;

- Equity in losses of investees because our share of the

operations of investees is not representative of our own operating

performance and may not be monetized for a number of years;

- Changes in fair value of contingent consideration because these

adjustments are not recurring across all periods and we believe

these costs are not representative of operating performance;

and

- Other non-operating expenses which includes items such as a

one-time gain on debt extinguishment and a one-time loss on

disposal of fixed assets, which effects the comparability of

results of operations and liquidity.

Related Non-GAAP Expense Measure

We reference in our earnings call non-GAAP Operating Expenses.

We believe that this non-GAAP financial measure, when considered

with the financial statements determined in accordance with GAAP,

is helpful to management and investors in understanding our

performance quarter over quarter and to the comparable quarter in

our prior fiscal year by excluding the same items we exclude from

EBITDA to derive Adjusted EBITDA that are included in GAAP

operating expenses, as set forth above (impairment of long-lived

assets, stock-based compensation expense, costs incurred with

business combinations, changes in the fair value of contingent

consideration, costs incurred in connection with debt issuance,

restructuring costs and certain other non-operating expenses, as

described above) for the same reasons stated above-- principally,

that these expenses are not, in management’s opinion, easily

comparable across reporting periods, are not reflective of ongoing

operations and/or are not representative of our operating

performance.

We define non-GAAP Operating Expenses, as GAAP Operating

Expenses, excluding impairment of long-lived assets, stock-based

compensation expense, costs incurred with business combinations,

changes in the fair value of contingent consideration, costs

incurred in connection with debt issuance and restructuring

costs.

This non-GAAP expense measure should not be considered an

alternative to the corresponding GAAP financial measure as

determined in accordance with GAAP as an indicator of our

performance or liquidity. Please review the tables provided below,

for a reconciliation of this non-GAAP expense measure to the

corresponding GAAP financial measure.

The reconciliation of the above non-GAAP financial measures for

the quarter ended September 30, 2022 are presented in the tables

below. For comparative purposes, the reconciliation of these

non-GAAP financial measures in the prior quarter ended June 30,

2022 are contained in our press release for that quarter dated

August 10, 2022 and available in our current report on Form 8-K

filed with the Securities and Exchange Commission on August 10,

2022 and available here:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1755953/000121390022046403/ea164161-8k_akerna.htm

Key Performance Metrics

We use several key performance metrics in this

press release.

We define committed annual recurring revenue

(“CARR”) as the total amount of contracted annualized recurring

revenue for which clients have signed contracts as of the end of

the stated period, assuming any contract that expires during the

next 12 months is renewed on its existing terms. CARR includes the

annualized value of contracted subscriptions, the annualized value

of contracted software support services active and the annualized

value of contracted consulting services at the end of a reporting

period and does not include revenue reported as “Other Revenue” in

our consolidated statement of operations. We are monitoring these

metrics because they align with how our customers are increasingly

purchasing our software solutions and how we are managing our

business. The CARR metric should be viewed independently of revenue

and CARR is not an indicator of future revenue.

We define software bookings as the dollar amount

of new signed software contracts, the value of which will be

recognized over the life of the contract. We define the average new

business deal size as the average monthly recurring revenue of

bookings for new customers and expansion on existing accounts in

the period. We monitor growth in bookings and deal size as a

near-term leading indicator of our business’s performance. Software

bookings should be reviewed independently of revenue and is not an

indicator of future revenue.

We define transactions as the sale of cannabis

good recorded on our system and including sales between a retailer

and a consumer and sales throughout the supply chain throughout the

wholesale process before the consumer transaction. We define

transaction dollar amount as the total dollar value of transactions

that are tracked on our systems during the reported period. We

define transaction numbers as the total number of transactions that

are recorded on our systems during the reported period. Transaction

dollar amount and transaction value do not relate to transactions

by Akerna but to transactions undertaken by our clients tracked on

our systems. We track transaction dollar value and transaction

numbers as a long-term leading indicator of our market share. These

metrics should be viewed independently of revenue and are not an

indicator of future revenue.

Investor ContactsIR@akerna.com

| AKERNA

CORP. |

| Condensed

Consolidated Balance Sheets |

|

(unaudited) |

| |

September

30, |

|

December

31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash |

$ |

2,490,662 |

|

|

$ |

13,934,265 |

|

|

Restricted cash |

|

7,008,261 |

|

|

|

508,261 |

|

|

Accounts receivable, net |

|

1,371,133 |

|

|

|

1,403,774 |

|

|

Prepaid expenses & other current assets |

|

2,330,032 |

|

|

|

2,383,764 |

|

|

Total current assets |

|

13,200,088 |

|

|

|

18,230,064 |

|

|

|

|

Fixed assets, net |

|

124,760 |

|

|

|

153,151 |

|

|

Investment, net |

|

226,101 |

|

|

|

226,101 |

|

|

Capitalized software, net |

|

6,009,163 |

|

|

|

7,311,676 |

|

|

Intangible assets, net |

|

17,005,584 |

|

|

|

21,609,794 |

|

|

Goodwill |

|

9,025,589 |

|

|

|

46,942,681 |

|

|

Other noncurrent assets |

|

- |

|

|

|

9,700 |

|

| Total

assets |

$ |

45,591,285 |

|

|

$ |

94,483,167 |

|

|

|

|

Liabilities and equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts Payable, accrued expenses and other current

liabilities |

$ |

4,630,681 |

|

|

$ |

6,063,520 |

|

|

Contingent consideration payable |

|

3,300,000 |

|

|

|

6,300,000 |

|

|

Deferred revenue |

|

2,151,235 |

|

|

|

3,543,819 |

|

|

Current portion of long-term debt |

|

9,900,000 |

|

|

|

13,200,000 |

|

|

Derivative liability |

|

9,025 |

|

|

|

63,178 |

|

|

Total current liabilities |

|

19,990,941 |

|

|

|

29,170,517 |

|

|

|

|

Deferred revenue, noncurrent |

|

499,206 |

|

|

|

582,676 |

|

|

Long-term debt, noncurrent |

|

4,575,000 |

|

|

|

4,105,000 |

|

|

Deferred income taxes |

|

431,453 |

|

|

|

675,291 |

|

|

Total liabilities |

|

25,496,600 |

|

|

|

34,533,484 |

|

|

Equity |

|

|

|

|

Preferred stock |

|

- |

|

|

|

- |

|

|

Special voting preferred stock |

|

2,227,619 |

|

|

|

2,366,038 |

|

|

Common stock |

|

402 |

|

|

|

155 |

|

|

Additional paid-in capital |

|

159,841,800 |

|

|

|

146,030,203 |

|

|

Accumulated other comprehensive income |

|

356,028 |

|

|

|

61,523 |

|

|

Accumulated deficit |

|

(142,331,164 |

) |

|

|

(88,508,236 |

) |

|

Total equity |

|

20,094,685 |

|

|

|

59,949,683 |

|

| Total

liabilities and equity |

$ |

45,591,285 |

|

|

$ |

94,483,167 |

|

|

|

| AKERNA

CORP. |

| Condensed

Consolidated Statements of Operations |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

| |

For the

Three Months |

|

For the Nine

Months |

| |

Ended September 30, |

|

Ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Revenue |

|

|

|

|

|

|

|

|

Software |

$ |

5,326,830 |

|

|

$ |

4,557,960 |

|

|

$ |

17,756,272 |

|

|

$ |

12,809,841 |

|

|

Consulting |

|

76,500 |

|

|

|

551,402 |

|

|

|

618,809 |

|

|

|

1,135,033 |

|

|

Other revenue |

|

9,472 |

|

|

|

26,140 |

|

|

|

74,443 |

|

|

|

111,540 |

|

|

Total revenue |

|

5,412,802 |

|

|

|

5,135,502 |

|

|

|

18,449,524 |

|

|

|

14,056,414 |

|

|

Cost of revenue |

|

2,051,862 |

|

|

|

1,971,382 |

|

|

|

6,091,511 |

|

|

|

5,339,929 |

|

|

Gross profit |

|

3,360,940 |

|

|

|

3,164,120 |

|

|

|

12,358,013 |

|

|

|

8,716,485 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

Research and development |

|

1,374,133 |

|

|

|

1,566,478 |

|

|

|

5,240,922 |

|

|

|

4,517,836 |

|

|

Sales and marketing |

|

1,882,980 |

|

|

|

2,002,461 |

|

|

|

8,304,411 |

|

|

|

5,564,519 |

|

|

General and administrative |

|

1,823,076 |

|

|

|

2,077,474 |

|

|

|

6,812,617 |

|

|

|

8,306,417 |

|

|

Depreciation and amortization |

|

2,118,739 |

|

|

|

1,238,420 |

|

|

|

6,094,963 |

|

|

|

3,605,435 |

|

|

Impairment of long-lived assets |

|

- |

|

|

|

- |

|

|

|

39,600,587 |

|

|

|

- |

|

|

Changes in fair value of contingent consideration |

|

(3,000,000 |

) |

|

|

- |

|

|

|

(3,000,000 |

) |

|

|

- |

|

|

Total operating expenses |

|

4,198,928 |

|

|

|

6,884,833 |

|

|

|

63,053,500 |

|

|

|

21,994,207 |

|

| Loss from

operations |

|

(837,988 |

) |

|

|

(3,720,713 |

) |

|

|

(50,695,487 |

) |

|

|

(13,277,722 |

) |

| Other income

(expense) |

|

|

|

|

|

|

|

|

Interest income (expense) |

|

(396,022 |

) |

|

|

(238,283 |

) |

|

|

(609,746 |

) |

|

|

(1,175,789 |

) |

|

Change in fair value of convertible notes |

|

(1,113,000 |

) |

|

|

(23,227 |

) |

|

|

(2,840,000 |

) |

|

|

(2,030,904 |

) |

|

Change in fair value of warrant liability |

|

2,256 |

|

|

|

194,046 |

|

|

|

54,153 |

|

|

|

151,175 |

|

|

Gain on forgiveness of PPP Loan |

|

- |

|

|

|

2,234,730 |

|

|

|

- |

|

|

|

2,234,730 |

|

|

Other expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

243 |

|

|

Total other income (expense) |

|

(1,506,766 |

) |

|

|

2,167,266 |

|

|

|

(3,395,593 |

) |

|

|

(820,545 |

) |

| |

|

Net loss before income tax expense |

|

(2,344,754 |

) |

|

|

(1,553,447 |

) |

|

|

(54,091,080 |

) |

|

|

(14,098,267 |

) |

|

Income tax expense |

|

40,666 |

|

|

|

- |

|

|

|

268,152 |

|

|

|

(10,570 |

) |

|

Equity in losses of investee |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7,564 |

) |

| |

|

Net loss |

$ |

(2,304,088 |

) |

|

$ |

(1,553,447 |

) |

|

$ |

(53,822,928 |

) |

|

$ |

(14,116,401 |

) |

| |

| Basic and

diluted weighted average common stock outstanding |

|

3,883,847 |

|

|

|

1,322,122 |

|

|

|

2,421,262 |

|

|

|

1,215,626 |

|

| Basic and

diluted net loss per share |

$ |

(0.59 |

) |

|

$ |

(1.17 |

) |

|

$ |

(22.23 |

) |

|

$ |

(11.62 |

) |

| |

|

|

|

|

|

|

|

| AKERNA

CORP. |

| Condensed

Consolidated Statements of Cash Flows |

|

(unaudited) |

|

|

For the Nine

Months |

|

|

Ended September 30, |

|

Cash flows from operating activities |

|

|

|

|

Net loss |

$ |

(53,822,928) |

|

$ |

(14,116,401) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

Equity in losses of investment |

- |

|

7,564 |

|

Contingent consideration adjustment |

(3,000,000) |

|

- |

|

Bad debt expense |

271,474 |

|

254,029 |

|

Stock-based compensation expense, net |

697,377 |

|

1,584,751 |

|

Loss on write-off of fixed assets |

- |

|

1,045,179 |

|

Gain on forgiveness of PPP Loan |

- |

|

(2,234,730) |

|

Impairment of long-lived assets |

39,600,587 |

|

- |

|

Amortization of deferred contract cost |

275,949 |

|

356,528 |

|

Non-cash interest expense |

183,723 |

|

1,161,393 |

|

Depreciation and amortization |

6,094,963 |

|

3,605,435 |

|

Foreign currency loss (gain) |

4,718 |

|

21,496 |

|

Change in fair value of convertible notes |

2,840,000 |

|

2,030,904 |

|

Change in fair value of derivative liability |

(54,153) |

|

(151,175) |

|

Change in operating assets and liabilities: |

|

|

|

|

Accounts receivable, net |

(313,176) |

|

462,482 |

|

Prepaid expenses and other current and noncurrent assets |

(215,228) |

|

66,246 |

|

Accounts payable, accrued expenses and other accrued

liabilities |

(1,356,709) |

|

1,756,671 |

|

Deferred income tax liabilities |

(243,838) |

|

- |

|

Deferred revenue |

(1,413,665) |

|

(927,916) |

|

Net cash used in operating activities |

(10,450,906) |

|

(5,077,544) |

| Cash flows

from investing activities |

|

|

|

|

Developed software additions |

(3,324,029) |

|

(3,354,453) |

|

Fixed asset additions |

(27,383) |

|

(11,535) |

|

Cash returned from business combination working capital

settlement |

400,000 |

|

- |

|

Net cash used in investing activities |

(2,951,412) |

|

(3,365,988) |

| Cash flows

from financing activities |

|

|

|

|

Value of shares withheld related to tax withholdings |

(13,167) |

|

(437,554) |

|

Proceeds from unit and pre-funded unit offering, net |

9,178,961 |

|

- |

|

Principal payments of convertible notes |

(1,432,273) |

|

(1,164,706) |

|

Proceeds from the ATM offering program, net |

761,178 |

|

1,828,116 |

|

Net cash provided by financing activities |

8,494,699 |

|

225,856 |

|

Effect of exchange rate changes on cash and restricted cash |

(35,984) |

|

(5,915) |

| Net change

in cash and restricted cash |

(4,943,603) |

|

(8,223,591) |

| Cash and

restricted cash - beginning of period |

14,442,526 |

|

18,340,640 |

| Cash and

restricted cash - end of period |

$ |

9,498,923 |

|

$ |

10,117,049 |

| |

|

|

|

| AKERNA

CORP. |

| The

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA is as

follows: |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months

Ended September 30, 2022 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net

loss |

$ |

(2,304,088 |

) |

|

$ |

(1,553,447 |

) |

|

$ |

(53,822,928 |

) |

|

$ |

(14,116,401 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Interest expense (income) |

|

396,022 |

|

|

|

238,283 |

|

|

|

609,746 |

|

|

|

1,175,789 |

|

|

Change in fair value of convertible notes |

|

1,113,000 |

|

|

|

23,227 |

|

|

|

2,840,000 |

|

|

|

2,030,904 |

|

|

Change in fair value of derivative liability |

|

(2,256 |

) |

|

|

(194,046 |

) |

|

|

(54,153 |

) |

|

|

(151,175 |

) |

|

Income tax expense |

|

(40,666 |

) |

|

|

- |

|

|

|

(268,152 |

) |

|

|

10,570 |

|

|

Depreciation and amortization |

|

2,118,739 |

|

|

|

1,238,420 |

|

|

|

6,094,963 |

|

|

|

3,605,435 |

|

| EBITDA |

$ |

1,280,751 |

|

|

$ |

(247,563 |

) |

|

$ |

(44,600,524 |

) |

|

$ |

(7,444,878 |

) |

|

Impairment of long-lived assets |

|

- |

|

|

|

- |

|

|

|

39,600,587 |

|

|

|

- |

|

|

Stock-based compensation expense |

|

203,384 |

|

|

|

477,625 |

|

|

|

648,439 |

|

|

|

1,502,339 |

|

|

Business combination and merger related costs |

|

- |

|

|

|

182,631 |

|

|

|

5,425 |

|

|

|

290,357 |

|

|

Non-recurring financing fees |

|

71,192 |

|

|

|

280,768 |

|

|

|

424,675 |

|

|

|

410,362 |

|

|

Restructuring charges |

|

59,094 |

|

|

|

- |

|

|

|

1,127,038 |

|

|

|

2,453,776 |

|

|

Changes in fair value of contingent consideration |

|

(3,000,000 |

) |

|

|

- |

|

|

|

(3,000,000 |

) |

|

|

- |

|

|

Gain on forgiveness of PPP Loan |

|

- |

|

|

|

(2,234,730 |

) |

|

|

- |

|

|

|

(2,234,730 |

) |

|

Equity in losses of investee |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,564 |

|

|

Adjusted EBITDA |

$ |

(1,385,579 |

) |

|

$ |

(1,541,269 |

) |

|

$ |

(5,794,360 |

) |

|

$ |

(5,015,210 |

) |

| |

|

|

|

|

|

|

|

| AKERNA

CORP. |

| The

Reconciliation of Operating Expenses to non-GAAP Operating Expenses

is as follows: |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months

Ended September 30, 2022 |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

Operating Expenses |

$ |

4,198,928 |

|

|

$ |

6,884,833 |

|

$ |

63,053,500 |

|

|

$ |

21,994,207 |

|

Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

2,118,739 |

|

|

|

1,238,420 |

|

|

6,094,963 |

|

|

|

3,605,435 |

|

Stock-based compensation expense |

|

203,384 |

|

|

|

477,625 |

|

|

648,439 |

|

|

|

1,502,339 |

|

Business combination and merger related costs |

|

- |

|

|

|

182,631 |

|

|

5,425 |

|

|

|

290,357 |

|

Non-recurring financing fees |

|

71,192 |

|

|

|

280,768 |

|

|

424,675 |

|

|

|

410,362 |

|

Restructuring charges |

|

59,094 |

|

|

|

- |

|

|

1,127,038 |

|

|

|

2,453,776 |

|

Impairment of long-lived assets |

|

- |

|

|

|

- |

|

|

39,600,587 |

|

|

|

- |

|

Changes in fair value of contingent consideration |

|

(3,000,000 |

) |

|

|

- |

|

|

(3,000,000 |

) |

|

|

- |

| Non-GAAP

Operating Expenses |

$ |

4,746,519 |

|

|

$ |

4,705,389 |

|

$ |

18,152,373 |

|

|

$ |

13,731,938 |

|

|

|

|

|

|

|

|

|

| AKERNA

CORP. |

| The

Reconciliation of Product Development Expenses to non-GAAP Product

Development Expenses is as follows: |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months

Ended September 30, 2022 |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Product development expense |

$ |

1,374,133 |

|

$ |

1,566,478 |

|

$ |

5,240,922 |

|

$ |

4,517,836 |

|

Stock-based compensation expense |

|

76,432 |

|

|

166,758 |

|

|

265,063 |

|

|

574,665 |

|

Restructuring charges |

|

58,584 |

|

|

- |

|

|

226,711 |

|

|

- |

| Non-GAAP

product development expense |

$ |

1,239,117 |

|

$ |

1,399,720 |

|

$ |

4,749,148 |

|

$ |

3,943,171 |

| |

|

|

|

|

|

|

|

| AKERNA

CORP. |

| The

Reconciliation of Sales and Marketing Expenses to non-GAAP Sales

and Marketing Expenses is as follows: |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months

Ended September 30, 2022 |

| |

2022 |

|

2021 |

|

|

2022 |

|

|

2021 |

|

Sales and marketing expense |

$ |

1,882,980 |

|

$ |

2,002,461 |

|

$ |

8,304,411 |

|

|

$ |

5,564,519 |

|

Stock-based compensation expense |

|

13,502 |

|

|

123,204 |

|

|

(31,580 |

) |

|

|

366,790 |

|

Non-recurring financing fees |

|

161 |

|

|

- |

|

|

161 |

|

|

|

- |

|

Restructuring charges |

|

- |

|

|

- |

|

|

277,049 |

|

|

|

- |

| Non-GAAP

product sales and marketing |

$ |

1,869,317 |

|

$ |

1,879,257 |

|

$ |

8,058,781 |

|

|

$ |

5,197,729 |

| |

|

|

|

|

|

|

|

| AKERNA

CORP. |

| The

Reconciliation of General and Administrative Expenses to non-GAAP

General and Administrative Expenses is as follows: |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months

Ended September 30, 2022 |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

General and administrative expense |

$ |

1,823,076 |

|

$ |

2,077,474 |

|

$ |

6,812,617 |

|

$ |

8,306,417 |

|

Stock-based compensation expense |

|

104,457 |

|

|

146,989 |

|

|

393,047 |

|

|

450,466 |

|

Business combination and merger related costs |

|

- |

|

|

182,631 |

|

|

5,425 |

|

|

290,357 |

|

Non-recurring financing fees |

|

71,031 |

|

|

280,768 |

|

|

424,514 |

|

|

410,362 |

|

Restructuring charges |

|

510 |

|

|

- |

|

|

604,633 |

|

|

2,454,019 |

| Non-GAAP

general and administrative expense |

$ |

1,647,078 |

|

$ |

1,467,086 |

|

$ |

5,384,998 |

|

$ |

4,701,213 |

| |

|

|

|

|

|

|

|

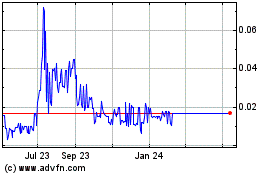

Akerna (NASDAQ:KERNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Akerna (NASDAQ:KERNW)

Historical Stock Chart

From Apr 2023 to Apr 2024