Q1false0001056285--02-0300010562852024-02-030001056285us-gaap:RestrictedStockUnitsRSUMember2023-01-292023-04-290001056285us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberkirk:CreditAgreementsMemberkirk:EffectPriorToPeriodMember2024-01-252024-01-250001056285us-gaap:CommonStockMember2024-05-0400010562852024-02-042024-05-040001056285us-gaap:RevolvingCreditFacilityMemberkirk:CreditAgreementsMembersrt:MinimumMember2024-01-250001056285us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberkirk:CreditAgreementsMember2024-01-250001056285kirk:CreditAgreementsMember2024-05-042024-05-040001056285us-gaap:RetainedEarningsMember2023-01-292023-04-290001056285us-gaap:CommonStockMember2024-02-0300010562852022-01-060001056285us-gaap:RevolvingCreditFacilityMemberkirk:CreditAgreementsMembersrt:MinimumMember2024-02-042024-05-040001056285kirk:TermLoanCreditAgreementMemberkirk:SecuredOvernightFinancingRateSofrMember2024-01-252024-01-250001056285us-gaap:RevolvingCreditFacilityMember2024-05-040001056285us-gaap:RevolvingCreditFacilityMemberkirk:CreditAgreementsMemberkirk:SecuredOvernightFinancingRateSofrMember2024-01-252024-01-250001056285us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberkirk:CreditAgreementsMember2024-02-042024-05-040001056285us-gaap:CommonStockMember2023-04-2900010562852023-01-292023-04-290001056285kirk:CustomerLoyaltyProgramMember2023-04-290001056285us-gaap:RetainedEarningsMember2024-02-042024-05-0400010562852024-05-040001056285us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2024-05-0400010562852023-04-290001056285kirk:CustomerLoyaltyProgramMember2024-05-040001056285us-gaap:RevolvingCreditFacilityMemberus-gaap:ExtendedMaturityMember2024-02-042024-05-040001056285us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMemberkirk:CreditAgreementMember2024-05-040001056285us-gaap:RestrictedStockUnitsRSUMember2024-02-042024-05-040001056285us-gaap:RetainedEarningsMember2023-04-290001056285us-gaap:RevolvingCreditFacilityMemberkirk:EffectAfterThePeriodMemberkirk:CreditAgreementsMember2024-01-252024-01-250001056285srt:MaximumMember2024-05-040001056285us-gaap:CommonStockMember2024-02-042024-05-040001056285kirk:CustomerLoyaltyProgramMember2024-02-030001056285us-gaap:CommonStockMember2023-01-292023-04-290001056285us-gaap:RetainedEarningsMember2024-05-0400010562852023-01-280001056285us-gaap:SecuredDebtMemberkirk:CreditAgreementMember2023-03-3100010562852024-05-290001056285us-gaap:RetainedEarningsMember2023-01-280001056285us-gaap:RevolvingCreditFacilityMemberkirk:CreditAgreementsMemberkirk:EffectPriorToPeriodMembersrt:MinimumMember2024-01-252024-01-250001056285kirk:TermLoanCreditAgreementMember2024-01-250001056285us-gaap:CommonStockMember2023-01-280001056285us-gaap:RetainedEarningsMember2024-02-030001056285kirk:TermLoanCreditAgreementMemberkirk:EffectAfterThePeriodMemberkirk:SecuredOvernightFinancingRateSofrMember2024-01-252024-01-25kirk:Storexbrli:purexbrli:shareskirk:Stateiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

|

☒ |

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended May 4, 2024

or

|

|

☐ |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ______to ______.

Commission file number: 000-49885

Kirkland’s, Inc.

(Exact name of registrant as specified in its charter)

|

|

Tennessee |

62-1287151 |

(State or other jurisdiction of |

(IRS Employer Identification No.) |

incorporation or organization) |

|

|

|

5310 Maryland Way |

|

Brentwood, Tennessee |

37027 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (615) 872-4800

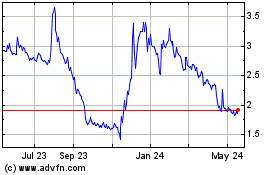

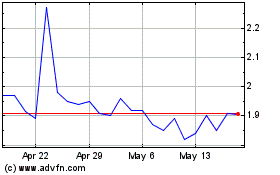

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KIRK |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

Smaller reporting company |

|

☒ |

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Stock, no par value – 13,038,978 shares outstanding as of May 29, 2024.

KIRKLAND’S, INC.

TABLE OF CONTENTS

|

|

|

|

|

Page |

|

|

|

PART I |

FINANCIAL INFORMATION |

3 |

Item 1. |

Financial Statements |

3 |

|

Condensed Consolidated Balance Sheets (Unaudited) as of May 4, 2024, February 3, 2024, and April 29, 2023 |

3 |

|

Condensed Consolidated Statements of Operations (Unaudited) for the 13-week periods ended May 4, 2024 and April 29, 2023 |

4 |

|

Condensed Consolidated Statements of Shareholders’ (Deficit) Equity (Unaudited) for the 13-week periods ended May 4, 2024 and April 29, 2023 |

5 |

|

Condensed Consolidated Statements of Cash Flows (Unaudited) for the 13-week periods ended May 4, 2024 and April 29, 2023 |

6 |

|

Notes to Condensed Consolidated Financial Statements (Unaudited) |

7 |

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

13 |

Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

19 |

Item 4. |

Controls and Procedures |

19 |

|

|

|

PART II |

OTHER INFORMATION |

20 |

Item 1. |

Legal Proceedings |

20 |

Item 1A. |

Risk Factors |

20 |

Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

20 |

Item 5. |

Other Information |

20 |

Item 6. |

Exhibits |

20 |

|

|

|

SIGNATURES |

|

21 |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

KIRKLAND’S, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May 4, |

|

|

February 3, |

|

|

April 29, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,836 |

|

|

$ |

3,805 |

|

|

$ |

7,072 |

|

Inventories, net |

|

|

75,789 |

|

|

|

74,090 |

|

|

|

83,332 |

|

Prepaid expenses and other current assets |

|

|

6,540 |

|

|

|

7,614 |

|

|

|

4,905 |

|

Total current assets |

|

|

86,165 |

|

|

|

85,509 |

|

|

|

95,309 |

|

Property and equipment: |

|

|

|

|

|

|

|

|

|

Equipment |

|

|

19,119 |

|

|

|

19,144 |

|

|

|

19,630 |

|

Furniture and fixtures |

|

|

63,516 |

|

|

|

63,823 |

|

|

|

66,115 |

|

Leasehold improvements |

|

|

100,447 |

|

|

|

100,393 |

|

|

|

102,836 |

|

Computer software and hardware |

|

|

78,561 |

|

|

|

78,580 |

|

|

|

82,130 |

|

Projects in progress |

|

|

371 |

|

|

|

647 |

|

|

|

1,027 |

|

Property and equipment, gross |

|

|

262,014 |

|

|

|

262,587 |

|

|

|

271,738 |

|

Accumulated depreciation |

|

|

(234,277 |

) |

|

|

(232,882 |

) |

|

|

(235,592 |

) |

Property and equipment, net |

|

|

27,737 |

|

|

|

29,705 |

|

|

|

36,146 |

|

Operating lease right-of-use assets |

|

|

121,410 |

|

|

|

126,725 |

|

|

|

131,289 |

|

Other assets |

|

|

7,271 |

|

|

|

8,634 |

|

|

|

7,137 |

|

Total assets |

|

$ |

242,583 |

|

|

$ |

250,573 |

|

|

$ |

269,881 |

|

LIABILITIES AND SHAREHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

39,963 |

|

|

$ |

46,010 |

|

|

$ |

38,092 |

|

Accrued expenses |

|

|

23,020 |

|

|

|

23,163 |

|

|

|

25,499 |

|

Operating lease liabilities |

|

|

38,590 |

|

|

|

40,018 |

|

|

|

41,173 |

|

Total current liabilities |

|

|

101,573 |

|

|

|

109,191 |

|

|

|

104,764 |

|

Operating lease liabilities |

|

|

94,529 |

|

|

|

99,772 |

|

|

|

110,165 |

|

Long-term debt, net |

|

|

47,541 |

|

|

|

34,000 |

|

|

|

33,000 |

|

Other liabilities |

|

|

4,405 |

|

|

|

4,486 |

|

|

|

3,872 |

|

Total liabilities |

|

|

248,048 |

|

|

|

247,449 |

|

|

|

251,801 |

|

Shareholders’ (deficit) equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, no par value, 10,000,000 shares authorized; no shares issued or outstanding at May 4, 2024, February 3, 2024, and April 29, 2023, respectively |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock, no par value; 100,000,000 shares authorized; 13,038,978; 12,926,022; and 12,812,898, shares issued and outstanding at May 4, 2024, February 3, 2024, and April 29, 2023, respectively |

|

|

176,793 |

|

|

|

176,552 |

|

|

|

175,864 |

|

Accumulated deficit |

|

|

(182,258 |

) |

|

|

(173,428 |

) |

|

|

(157,784 |

) |

Total shareholders’ (deficit) equity |

|

|

(5,465 |

) |

|

|

3,124 |

|

|

|

18,080 |

|

Total liabilities and shareholders’ (deficit) equity |

|

$ |

242,583 |

|

|

$ |

250,573 |

|

|

$ |

269,881 |

|

The accompanying notes are an integral part of these financial statements.

KIRKLAND’S, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

May 4, |

|

|

April 29, |

|

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

91,753 |

|

|

$ |

96,875 |

|

Cost of sales |

|

|

64,685 |

|

|

|

71,004 |

|

Gross profit |

|

|

27,068 |

|

|

|

25,871 |

|

Operating expenses: |

|

|

|

|

|

|

Compensation and benefits |

|

|

19,286 |

|

|

|

20,039 |

|

Other operating expenses |

|

|

14,318 |

|

|

|

14,738 |

|

Depreciation (exclusive of depreciation included in cost of sales) |

|

|

961 |

|

|

|

1,206 |

|

Asset impairment |

|

|

11 |

|

|

|

225 |

|

Total operating expenses |

|

|

34,576 |

|

|

|

36,208 |

|

Operating loss |

|

|

(7,508 |

) |

|

|

(10,337 |

) |

Interest expense |

|

|

1,127 |

|

|

|

502 |

|

Other income |

|

|

(116 |

) |

|

|

(92 |

) |

Loss before income taxes |

|

|

(8,519 |

) |

|

|

(10,747 |

) |

Income tax expense |

|

|

311 |

|

|

|

1,360 |

|

Net loss |

|

$ |

(8,830 |

) |

|

$ |

(12,107 |

) |

|

|

|

|

|

|

|

Loss per share: |

|

|

|

|

|

|

Basic |

|

$ |

(0.68 |

) |

|

$ |

(0.95 |

) |

Diluted |

|

$ |

(0.68 |

) |

|

$ |

(0.95 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

12,965 |

|

|

|

12,778 |

|

Diluted |

|

|

12,965 |

|

|

|

12,778 |

|

The accompanying notes are an integral part of these financial statements.

KIRKLAND’S, INC.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ (DEFICIT) EQUITY (UNAUDITED)

(in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated |

|

|

Total

Shareholders’ |

|

|

|

Shares |

|

|

Amount |

|

|

Deficit |

|

|

(Deficit) Equity |

|

Balance at February 3, 2024 |

|

|

12,926,022 |

|

|

$ |

176,552 |

|

|

$ |

(173,428 |

) |

|

$ |

3,124 |

|

Restricted stock issued |

|

|

134,597 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net share settlement of restricted stock units |

|

|

(21,641 |

) |

|

|

(51 |

) |

|

|

— |

|

|

|

(51 |

) |

Stock-based compensation expense |

|

|

— |

|

|

|

292 |

|

|

|

— |

|

|

|

292 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

(8,830 |

) |

|

|

(8,830 |

) |

Balance at May 4, 2024 |

|

|

13,038,978 |

|

|

$ |

176,793 |

|

|

$ |

(182,258 |

) |

|

$ |

(5,465 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated |

|

|

Total

Shareholders’ |

|

|

|

Shares |

|

|

Amount |

|

|

Deficit |

|

|

Equity |

|

Balance at January 28, 2023 |

|

|

12,754,368 |

|

|

$ |

175,450 |

|

|

$ |

(145,677 |

) |

|

$ |

29,773 |

|

Restricted stock issued |

|

|

86,824 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net share settlement of restricted stock units |

|

|

(28,294 |

) |

|

|

(76 |

) |

|

|

— |

|

|

|

(76 |

) |

Stock-based compensation expense |

|

|

— |

|

|

|

490 |

|

|

|

— |

|

|

|

490 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

(12,107 |

) |

|

|

(12,107 |

) |

Balance at April 29, 2023 |

|

|

12,812,898 |

|

|

$ |

175,864 |

|

|

$ |

(157,784 |

) |

|

$ |

18,080 |

|

The accompanying notes are an integral part of these financial statements.

KIRKLAND’S, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

May 4, |

|

|

April 29, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(8,830 |

) |

|

$ |

(12,107 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

2,624 |

|

|

|

3,257 |

|

Amortization of debt issue costs |

|

|

131 |

|

|

|

20 |

|

Asset impairment |

|

|

11 |

|

|

|

225 |

|

Gain on disposal of property and equipment |

|

|

(6 |

) |

|

|

(21 |

) |

Stock-based compensation expense |

|

|

292 |

|

|

|

490 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Inventories, net |

|

|

(1,699 |

) |

|

|

739 |

|

Prepaid expenses and other current assets |

|

|

1,063 |

|

|

|

184 |

|

Accounts payable |

|

|

(5,653 |

) |

|

|

(5,792 |

) |

Accrued expenses |

|

|

(133 |

) |

|

|

(570 |

) |

Operating lease assets and liabilities |

|

|

(1,365 |

) |

|

|

(1,555 |

) |

Other assets and liabilities |

|

|

(90 |

) |

|

|

349 |

|

Net cash used in operating activities |

|

|

(13,655 |

) |

|

|

(14,781 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

6 |

|

|

|

60 |

|

Capital expenditures |

|

|

(770 |

) |

|

|

(846 |

) |

Net cash used in investing activities |

|

|

(764 |

) |

|

|

(786 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Borrowings on revolving line of credit |

|

|

9,000 |

|

|

|

21,000 |

|

Repayments on revolving line of credit |

|

|

(4,100 |

) |

|

|

(3,000 |

) |

Borrowings on term loan |

|

|

10,000 |

|

|

|

— |

|

Debt issuance costs |

|

|

(399 |

) |

|

|

(456 |

) |

Cash used in net share settlement of stock options and restricted stock units |

|

|

(51 |

) |

|

|

(76 |

) |

Net cash provided by financing activities |

|

|

14,450 |

|

|

|

17,468 |

|

|

|

|

|

|

|

|

Cash and cash equivalents: |

|

|

|

|

|

|

Net increase |

|

|

31 |

|

|

|

1,901 |

|

Beginning of the period |

|

|

3,805 |

|

|

|

5,171 |

|

End of the period |

|

$ |

3,836 |

|

|

$ |

7,072 |

|

|

|

|

|

|

|

|

Supplemental schedule of non-cash activities: |

|

|

|

|

|

|

Non-cash accruals for purchases of property and equipment |

|

$ |

390 |

|

|

$ |

844 |

|

Non-cash accruals for debt issuance costs |

|

|

860 |

|

|

|

— |

|

The accompanying notes are an integral part of these financial statements.

KIRKLAND’S, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Note 1 – Description of Business and Basis of Presentation

Nature of business — Kirkland’s, Inc. (the “Company”, “we”, “our” or “us”) is a specialty retailer of home décor and furnishings in the United States operating 329 stores in 35 states as of May 4, 2024, as well as an e-commerce website, www.kirklands.com, under the Kirkland’s Home brand.

Principles of consolidation — The condensed consolidated financial statements of the Company include the accounts of Kirkland’s, Inc. and its wholly-owned subsidiaries, Kirkland’s Stores, Inc., Kirkland’s DC, Inc., and Kirkland’s Texas, LLC. Significant intercompany accounts and transactions have been eliminated.

Basis of presentation — The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and are presented in accordance with the requirements of Form 10-Q and pursuant to the reporting and disclosure rules and regulations of the United States Securities and Exchange Commission (“SEC”). In the opinion of management, all adjustments, including normal recurring accruals, considered necessary for a fair presentation have been included. These financial statements should be read in conjunction with the audited financial statements included in the Company’s Annual Report on Form 10-K filed with the SEC on March 29, 2024.

Seasonality — The results of the Company’s operations for the 13-week period ended May 4, 2024 are not indicative of the results to be expected for any other interim period or for the entire fiscal year due to seasonality factors.

Fiscal year — The Company’s fiscal year ends on the Saturday closest to January 31, resulting in years of either 52 or 53 weeks. Accordingly, fiscal 2024 represents the 52 weeks ending on February 1, 2025, and fiscal 2023 represents the 53 weeks ended on February 3, 2024.

Reclassifications — Certain amounts in the condensed consolidated statement of cash flows for the 13-week period ended April 29, 2023 in the operating activities section have been reclassified to conform to the current period presentation. Income taxes payable or receivable is no longer material to be presented as a separate line item and has been reclassified into prepaid and other current assets and accrued expenses.

Use of estimates — The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ from the estimates and assumptions used. It should be understood that accounting measurements at interim dates inherently involve greater reliance on estimates than those at fiscal year-end.

Changes in estimates are recognized in the period when new information becomes available to management. Areas where the nature of the estimate makes it reasonably possible that actual results could materially differ from amounts estimated include, but are not limited to, impairment assessments on long-lived assets, inventory reserves, self-insurance reserves and deferred tax asset valuation allowances.

Going concern assessment and management’s plans — The Company’s revenues, results of operations and cash flows have been materially adversely impacted by strategic and macroeconomic factors during the last several fiscal quarters. The persistently challenging home furnishings retail environment, including reduced consumer spending in the category and increased price sensitivity, has significantly impacted the Company’s performance and liquidity levels. During the 13-week period ended May 4, 2024, net sales decreased approximately $5.1 million compared to the 13-week period ended April 29, 2023. This decline drove gross margin and operating loss to be worse than the Company’s expectations. For the 13-week period ended May 4, 2024, the Company reported a net loss of $8.8 million and net cash used in operating activities of $13.7 million.

When conditions and events, in the aggregate, raise substantial doubt about an entity’s ability to continue as a going concern, management evaluates the mitigating effect of its plans to determine if it is probable that the plans will be effectively implemented within the assessment period and, when implemented, will mitigate the relevant conditions and events to alleviate substantial doubt. The Company’s plans are focused on improving its operating results and liquidity through sales growth and cost reductions. Subsequent to May 4, 2024, the Company decided to implement expense reductions to streamline its cost structure and improve its liquidity profile. The Company believes these actions are necessary as part of improving its profitability and liquidity trajectory, while minimizing any disruption to the Company’s focus on its strategic initiatives and the overall customer experience. The cost savings initiatives include a

reduction in corporate overhead, store payroll, marketing and third-party technology expenses. The Company expects to realize approximately $6 million of savings in fiscal 2024 and estimates approximately $7 million in ongoing annual pre-tax savings from these initiatives. In addition, the Company retained an investment banking firm specializing in consumer-facing companies to serve as financial advisor to the Board of Directors in the pursuit and evaluation of potential strategic opportunities to support the Company and its initiatives. The Company has not set a deadline or definitive timetable for the completion of the strategic alternatives review process, and there can be no assurance that this process will result in any particular outcome. The Company does not intend to comment further regarding the review of strategic alternatives until it determines disclosure is necessary or advisable.

The Company believes these plans will result in adequate cash flows to support its ongoing operations and to meet its covenant requirements for one year following the date these financial statements are issued. However, the Company cannot provide any assurance that its efforts will be successful, and if the Company encounters unforeseen circumstances that place further constraints on its capital resources, management will be required to take various additional measures to conserve liquidity. The accompanying unaudited condensed consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

Note 2 – Revenue Recognition

Net sales — The Company recognizes revenue at the time of sale of merchandise to customers in its stores. E-commerce revenue is recorded at the estimated time of delivery to the customer. Net sales includes the sale of merchandise, net of returns, shipping revenue, gift card breakage revenue and revenue earned from our private label credit card program and excludes sales taxes.

Sales returns reserve — The Company reduces net sales and estimates a liability for sales returns based on historical return trends, and the Company believes that its estimate for sales returns is a reasonably accurate reflection of future returns associated with past sales. However, as with any estimate, refund activity may vary from estimated amounts. The Company had a liability of approximately $1.2 million, $1.5 million and $1.3 million reserved for sales returns at May 4, 2024, February 3, 2024 and April 29, 2023, respectively, included in accrued expenses on the condensed consolidated balance sheets. The related sales return reserve products recovery asset included in prepaid expenses and other current assets on the condensed consolidated balance sheets was approximately $528,000, $710,000 and $590,000 at May 4, 2024, February 3, 2024, and April 29, 2023, respectively.

Deferred e-commerce revenue — E-commerce revenue is deferred until the customer takes possession of the merchandise and the sale is complete, as the Company receives payment before completion of its customer obligations. Deferred revenue related to e-commerce orders that have been shipped but not estimated to be received by customers included in accrued expenses on the condensed consolidated balance sheets was approximately $888,000, $750,000 and $1.2 million at May 4, 2024, February 3, 2024 and April 29, 2023, respectively. The related contract assets, reflected in inventories, net on the condensed consolidated balance sheets, totaled approximately $446,000, $387,000 and $584,000 at May 4, 2024, February 3, 2024 and April 29, 2023, respectively.

Gift cards — Gift card sales are recognized as revenue when tendered for payment. While the Company honors all gift cards presented for payment, the Company determines the likelihood of redemption to be remote for certain gift card balances due to long periods of inactivity. The Company uses the redemption recognition method to account for breakage for unused gift card amounts where breakage is recognized as gift cards are redeemed for the purchase of goods based upon a historical breakage rate. In these circumstances, to the extent the Company determines there is no requirement for remitting unredeemed card balances to government agencies under unclaimed property laws, such amounts are recognized in the condensed consolidated statements of operations as a component of net sales.

The table below sets forth selected gift card liability information (in thousands) for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May 4, 2024 |

|

|

February 3, 2024 |

|

|

April 29, 2023 |

|

Gift card liability, net of estimated breakage (included in accrued expenses) |

|

$ |

11,092 |

|

|

$ |

12,008 |

|

|

$ |

12,444 |

|

The table below sets forth selected gift card breakage and redemption information (in thousands) for the periods indicated:

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Gift card breakage revenue (included in net sales) |

$ |

328 |

|

|

$ |

1,031 |

|

Gift card redemptions recognized in the current period related to amounts included in the gift card contract liability balance as of the prior period |

|

1,458 |

|

|

|

1,701 |

|

Customer loyalty program — The Company has a loyalty program called the K-club that allows members to receive points based on qualifying purchases that are converted into certificates that may be redeemed on future purchases. This customer option is a material right and, accordingly, represents a separate performance obligation to the customer. The related loyalty program deferred revenue included in accrued expenses on the condensed consolidated balance sheets was approximately $1.4 million, $1.4 million, and $1.0 million at May 4, 2024, February 3, 2024 and April 29, 2023, respectively.

Note 3 – Income Taxes

For the 13-week periods ended May 4, 2024 and April 29, 2023, the Company recorded an income tax expense of approximately $311,000, or (3.7)% of the loss before income taxes compared to an expense of approximately $1.4 million, or (12.7)% of the loss before income taxes, respectively. The change in income taxes for the 13-week period ended May 4, 2024, compared to the prior year period, was primarily due to changes in valuation allowance adjustments and state income taxes.

The Company recognizes deferred tax assets and liabilities using estimated future tax rates for the effect of temporary differences between the book and tax basis of recorded assets and liabilities, including net operating loss carry forwards. Management assesses the realizability of deferred tax assets and records a valuation allowance if it is more likely than not that all or a portion of the deferred tax assets will not be realized. The Company considers the probability of future taxable income and our historical profitability, among other factors, in assessing the amount of the valuation allowance. Adjustments could be required in the future if the Company estimates that the amount of deferred tax assets to be realized is more than the net amount recorded. Any change in the valuation allowance could have the effect of increasing or decreasing the income tax provision in the condensed consolidated statement of operations based on the nature of the deferred tax asset deemed realizable in the period in which such determination is made. As of May 4, 2024 and April 29, 2023, the Company recorded a full valuation allowance against deferred tax assets.

Note 4 – Loss Per Share

Basic loss per share is computed by dividing net loss by the weighted average number of shares outstanding during each period presented. Diluted loss per share is computed by dividing net loss by the weighted average number of shares outstanding plus the dilutive effect of stock equivalents outstanding during the applicable periods using the treasury stock method. Diluted loss per share reflects the potential dilution that could occur if options to purchase stock were exercised into common stock and if outstanding grants of restricted stock were vested. Stock options and restricted stock units that were not included in the computation of diluted loss per share, because to do so would have been antidilutive, were approximately 887,000 shares and 601,000 shares for the 13-week periods ended May 4, 2024 and April 29, 2023, respectively.

Note 5 – Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants on the measurement date. The Company uses a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable approximate fair value because of their short maturities. The revolving line of credit approximates fair value due to the one, three or six-month interest terms and the term loan approximates fair value due to the one-month interest terms. The Company also has a non-depleting collateral trust with the Company’s workers’ compensation and general liability insurance provider named as beneficiary. The assets in this trust are invested in financial instruments that would fall within Level 1 of the fair value hierarchy, and they are included in other assets on the consolidated balance sheets.

The Company measures certain assets at fair value on a non-recurring basis, including the evaluation of long-lived assets for impairment using Company-specific assumptions, including forecasts of projected financial information that would fall within Level 3 of the fair value hierarchy. The Company uses market participant rents (Level 2 input) to calculate the fair value of right-of-use assets and discounted future cash flows of the asset or asset group using a discount rate that approximates the cost of capital of a market participant (Level 2 input) to quantify fair value for other long-lived assets. See “Note 10 — Impairment” for further discussion.

Note 6 – Commitments and Contingencies

The Company was named as a defendant in a putative class action filed in May 2018 in the Superior Court of California, Miles v. Kirkland’s Stores, Inc. The case has been removed to United States District Court for the Central District of California. The complaint alleges, on behalf of Miles and all other hourly Kirkland’s employees in California, various wage and hour violations and seeks unpaid wages, statutory and civil penalties, monetary damages and injunctive relief. Kirkland’s denies the material allegations in the complaint and believes that its employment policies are generally compliant with California law. On March 22, 2022, the District Court denied the plaintiff’s motion to certify in its entirety, and on May 26, 2022, the Ninth Circuit granted the plaintiff’s petition for permission to appeal. The appeal was argued before the Ninth Circuit on November 13, 2023, and on January 8, 2024, the Court issued its opinion affirming the District Court in part and reversing in part. The Ninth Circuit affirmed the denial of certification as to the subclasses related to the security bag check and reversed as to the rest break claim. The Ninth Circuit did not find that there is liability nor that the rest break claim is certified. The District Court has scheduled a hearing on the surviving rest break claim for June 7, 2024. The Company continues to believe the case is without merit and intends to vigorously defend itself against the allegations.

The Company was named as a defendant in a putative class action filed in August 2022 in the United States District Court for the Southern District of New York, Sicard v. Kirkland’s Stores, Inc. The complaint alleges, on behalf of Sicard and all other hourly store employees based in New York, that Kirkland’s violated New York Labor Law Section 191 by failing to pay him and the putative class members their wages within seven calendar days after the end of the week in which those wages were earned, rather paying wages on a bi-weekly basis. Plaintiff claims the putative class is entitled to recover from the Company the amount of their untimely paid wages as liquidated damages, reasonable attorneys’ fees and costs. The Company believes the case is without merit and intends to vigorously defend itself against the allegations.

The Company is also party to other pending legal proceedings and claims that arise in the normal course of business. Although the outcome of such proceedings and claims cannot be determined with certainty, the Company’s management is of the opinion that it is unlikely that such proceedings and any claims in excess of insurance coverage will have a material effect on its consolidated financial condition, operating results or cash flows.

Note 7 – Stock-Based Compensation

The Company maintains equity incentive plans under which it may grant non-qualified stock options, incentive stock options, restricted stock, restricted stock units, or stock appreciation rights to employees, non-employee directors and consultants. Compensation expense is recognized on a straight-line basis over the vesting periods of each grant. There have been no material changes in the assumptions used to compute compensation expense during the current year. The table below sets forth selected stock-based compensation information (in thousands, except share amounts) for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Stock-based compensation expense (included in compensation and benefits on the condensed consolidated statements of operations) |

|

$ |

292 |

|

|

$ |

490 |

|

Restricted stock units granted |

|

|

299,250 |

|

|

|

301,780 |

|

Stock options granted |

|

|

228,126 |

|

|

|

237,675 |

|

Note 8 – Share Repurchase Plan

On January 6, 2022, the Company announced that its Board of Directors authorized a share repurchase plan providing for the purchase in the aggregate of up to $30.0 million of the Company’s outstanding common stock. Repurchases of shares are made in accordance with applicable securities laws and may be made from time to time in the open market or by negotiated transactions. The amount and timing of repurchases are based on a variety of factors, including stock price, regulatory limitations and other market and economic factors. The share repurchase plan does not require the Company to repurchase any specific number of shares, and the Company may terminate the repurchase plan at any time. For the 13-week periods ended May 4, 2024 and April 29, 2023, the Company did not repurchase any shares of common stock under the share repurchase plan. As of May 4, 2024, the Company had approximately $26.3 million remaining under the current share repurchase plan.

Note 9 – Long-Term Debt

Long-term debt, net consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May 4, 2024 |

|

|

February 3, 2024 |

|

|

April 29, 2023 |

|

Revolving line of credit |

|

$ |

38,900 |

|

|

$ |

34,000 |

|

|

$ |

33,000 |

|

Term loan |

|

|

10,000 |

|

|

|

— |

|

|

|

— |

|

Total debt |

|

|

48,900 |

|

|

|

34,000 |

|

|

|

33,000 |

|

Less unamortized debt issuance costs |

|

|

(1,359 |

) |

|

|

— |

|

|

|

— |

|

Long-term debt, net |

|

$ |

47,541 |

|

|

$ |

34,000 |

|

|

$ |

33,000 |

|

On March 31, 2023, the Company entered into a Third Amended and Restated Credit Agreement (the “2023 Credit Agreement”) with Bank of America, N.A., as administrative agent and collateral agent, and lender. The 2023 Credit Agreement amended the previous Second Amended and Restated Credit Agreement (the “2019 Credit Agreement”) from a $75.0 million senior secured revolving credit facility to a $90.0 million senior secured revolving credit facility. The 2023 Credit Agreement contains substantially similar terms and conditions as the 2019 Credit Agreement including a swingline availability of $10.0 million, a $25.0 million incremental accordion feature and extended its maturity date to March 2028. The fee paid to the lenders on the unused portion of the 2023 Credit Agreement is 25 basis points when usage is greater than 50% of the facility amount; otherwise, the fee on the unused portion is 37.5 basis points per annum.

On January 25, 2024, the Company entered into a First Amendment to the 2023 Credit Agreement that increased the advance rate and allowed the Company to enter into a new term loan agreement. Subsequent to January 25, 2024, advances under the 2023 Credit Agreement accrue interest at an annual rate equal to the Secured Overnight Financing Rate (“SOFR”) plus a margin of 275 basis points with no SOFR floor. Upon the demonstration that the Company’s fixed charge coverage ratio is greater than 1.0 to 1.0 on a trailing twelve-month basis, the interest rate permanently decreases on the 2023 Credit Agreement to SOFR plus a margin of 225 basis points. Prior to January 25, 2024, advances under the 2023 Credit Agreement accrued interest at an annual rate equal to SOFR plus a margin ranging from 200 to 250 basis points with no SOFR floor.

The Company is subject to a Second Amended and Restated Security Agreement (“Security Agreement”) with its lenders. Pursuant to the Security Agreement, the Company pledged and granted to the administrative agent, for the benefit of itself and the secured parties specified therein, a lien on and security interest in all of the rights, title and interest in substantially all of the Company’s assets to secure the payment and performance of the obligations under the 2023 Credit Agreement.

On January 25, 2024, the Company entered into a $12.0 million “first-in, last-out” delayed-draw asset-based term loan (the “Term Loan”) with Gordon Brothers Group, via an affiliate entity, 1903P Loan Agent, LLC, as administrative agent and lender. The indebtedness under the Term Loan is subordinated in most respects to the 2023 Credit Agreement. The Term Loan will mature in March 2028, coterminous with the 2023 Credit Agreement. From closing until the first anniversary of the closing, the interest rate of the Term Loan is one-month term SOFR, plus a margin of 9.50%. Following the first anniversary of the closing, the interest rate will increase to one-month term SOFR, plus a margin of 11.50%.

Borrowings under the 2023 Credit Agreement and the Term Loan are subject to certain conditions and contain customary events of default, including, without limitation, failure to make payments, a cross-default to certain other debt, breaches of covenants, breaches of representations and warranties, a change in control, certain monetary judgments and bankruptcy and ERISA events. Upon any such event of default, the principal amount of any unpaid loans and all other obligations under the 2023 Credit Agreement and the Term Loan may be declared immediately due and payable. The maximum availability under the 2023 Credit Agreement and the Term Loan is limited by a borrowing base formula, which consists of a percentage of eligible inventory and eligible credit card receivables, less reserves and an excess required availability covenant, which limits the borrowing base formula by the greater of 10% of the combined borrowing base formula or $8.0 million.

As of May 4, 2024, the Company was in compliance with the covenants in the 2023 Credit Agreement and the Term Loan. As of May 4, 2024, there were no letters of credit outstanding under either the 2023 Credit Agreement or the Term Loan. As of May 4, 2024, the Company had approximately $0.8 million available for borrowing under the 2023 Credit Agreement and the Term Loan, after the minimum required excess availability covenant. Availability under the Credit Agreement and the Term Loan fluctuates largely based on eligible inventory levels, and as eligible inventory increases in the second and third fiscal quarters in support of the Company’s back-half sales plans, the Company’s borrowing capacity increases correspondingly. Subsequent to May 4, 2024, the Company borrowed an additional $2.0 million under the 2023 Credit Agreement.

Note 10 – Impairment

The Company evaluates the recoverability of the carrying amounts of long-lived assets when events or changes in circumstances dictate that their carrying values may not be recoverable. This review includes the evaluation of individual under-performing retail stores and the assessment of the recoverability of the carrying value of the assets related to the stores. Future cash flows are projected for the remaining lease life. If the estimated future cash flows are less than the carrying value of the assets, the Company records an impairment charge equal to the difference between the assets’ fair value and carrying value. The fair value is estimated using a discounted cash flow approach, considering such factors as future sales levels, gross margins, changes in rent and other expenses as well as the overall operating environment specific to that store. The amount of the impairment charge is allocated proportionately to all assets in the asset group with no asset written down below its individual fair value.

The table below sets forth impairment information (in thousands, except store counts) for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Impairment of leasehold improvements, fixtures and equipment at stores |

|

$ |

11 |

|

|

$ |

179 |

|

Impairment of other long-lived assets(1) |

|

|

— |

|

|

|

46 |

|

Total impairment |

|

$ |

11 |

|

|

$ |

225 |

|

|

|

|

|

|

|

|

Number of stores with leasehold improvements, fixtures and equipment impairment |

|

|

— |

|

|

|

2 |

|

(1)Other long-lived asset impairment includes the write-off of fixtures related to the closing of two-ecommerce distribution centers in fiscal 2023.

Note 11 – New Accounting Pronouncements

New Accounting Pronouncements Not Yet Adopted

In November 2023, the Financial Accounting Standard Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-07, “Segment Reporting (Topic 280) - Improvements to Reportable Segment Disclosures.” The amendment in the ASU is intended to improve reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses. The amendments in this ASU are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and should be applied on a retrospective basis to all periods presented. The Company is currently evaluating the impact of adoption on its financial disclosures.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740) - Improvements to Income Tax Disclosures.” The ASU requires that an entity disclose specific categories in the effective tax rate reconciliation as well as provide additional information for reconciling items that meet a quantitative threshold. Further, the ASU requires certain disclosures of state versus federal income tax expense and taxes paid. The amendments in this ASU are required to be adopted for fiscal years beginning after December 15, 2024. Early adoption is permitted for annual financial statements that have not yet been issued. The amendments should be applied on a prospective basis although retrospective application is permitted. The Company is currently evaluating the impact of adoption on its financial disclosures.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis is intended to provide the reader with information that will assist in understanding the significant factors affecting our consolidated operating results, financial condition, liquidity, and capital resources during the 13-week periods ended May 4, 2024 and April 29, 2023. For a comparison of our results of operations for the 53-week period ended February 3, 2024 and the 52-week period ended January 28, 2023, see “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the fiscal year ended February 3, 2024, filed with the SEC on March 29, 2024 (the “Annual Report”). The following discussion should be read with our consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q.

Forward-Looking Statements

Except for historical information contained herein, certain statements in this Quarterly Report on Form 10-Q constitute forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements deal with potential future circumstances and developments and are, accordingly, forward-looking in nature. You are cautioned that such forward-looking statements, which may be identified by words such as “anticipate,” “believe,” “expect,” “estimate,” “intend,” “plan,” “seek,” “may,” “could,” “strategy,” and similar expressions, involve known and unknown risks and uncertainties, many of which are outside of the Company’s control, which may cause our actual results to differ materially from forecasted results. Those risks and uncertainties include, among other things, risks associated with the Company's liquidity including cash flows from operations and the amount of borrowings under the secured revolving credit facility and term loan, the Company’s ability to successfully implement cost savings and other strategic initiatives intended to improve operating results and liquidity positions, the Company’s actual and anticipated progress towards its short-term and long-term objectives including its brand strategy, the risk of natural disasters, pandemic outbreaks (such as COVID-19), global political events, war and terrorism could impact the Company’s revenues, inventory and supply chain, the continuing consumer impact of inflation and countermeasures, including raising interest rates, the effectiveness of the Company’s marketing campaigns, risks related to changes in U.S. policy related to imported merchandise, particularly with regard to the impact of tariffs on goods imported from China and strategies undertaken to mitigate such impact, the Company’s ability to retain its senior management team, continued volatility in the price of the Company’s common stock, the competitive environment in the home décor industry in general and in our specific market areas, inflation, fluctuations in cost and availability of inventory, increased transportation costs and potential interruptions in supply chain, distribution systems and delivery network, including our e-commerce systems and channels, the ability to control employment and other operating costs, availability of suitable retail locations and other growth opportunities, disruptions in information technology systems including the potential for security breaches of our information or our customers’ information, seasonal fluctuations in consumer spending, and economic conditions in general. Those and other risks are more fully described in our filings with the Securities and Exchange Commission, including the Company’s Annual Report and subsequent reports. Forward-looking statements included in this Quarterly Report on Form 10-Q are made as of the date hereof. Any changes in assumptions or factors on which such statements are based could produce materially different results. Except as required by law, we disclaim any obligation to update any such factors or to publicly announce results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

Overview

We are a specialty retailer of home décor and furnishings in the United States. As of May 4, 2024, we operated a total of 329 stores in 35 states, as well as an e-commerce website, www.kirklands.com, under the Kirkland’s Home brand. We provide our customers with an engaging shopping experience characterized by a curated, affordable selection of home décor and furnishings along with inspirational design ideas. This combination of quality and stylish merchandise, value pricing and a stimulating in-store and online environment provides our customers with a unique brand experience.

Challenging Macroeconomic Conditions

The macroeconomic environment in which we operate remains uncertain as a result of numerous factors, including inflationary pressures, higher interest rates, declines in consumer spending behavior and aggressive promotional activity. These negative macroeconomic factors have impacted our business, results of operations, cash flows and liquidity levels over the last several fiscal quarters. They have also made it difficult to execute our strategic initiatives, including our financial turnaround strategy. See “Liquidity and Capital Resources” for additional information regarding our plans to mitigate these factors.

For additional information regarding risks related to macroeconomics, liquidity and strategy and strategy execution, see “Item 1A. Risk Factors” in our Annual Report.

Key Financial Measures

Net sales and gross profit are the most significant drivers of our operating performance. Net sales consists of all merchandise sales to customers, net of returns, shipping revenue associated with e-commerce sales, gift card breakage revenue, revenue earned from our private label credit card program and excludes sales taxes. Gross profit is the difference between net sales and cost of sales. Cost of sales has five distinct components: merchandise costs (including product costs, inbound freight expenses, inventory shrink and damages), store occupancy costs, outbound freight costs (including both store and e-commerce shipping expenses), central distribution costs and depreciation of store and distribution center assets. Merchandise and outbound freight costs are variable, while occupancy and central distribution costs are largely fixed. Accordingly, gross profit expressed as a percentage of net sales can be influenced by many factors including overall sales performance.

We use comparable sales to measure sales increases and decreases from stores that have been open for at least 13 full fiscal months, including our online sales. We remove closed stores from our comparable sales calculation the day after the stores close. Relocated stores remain in our comparable sales calculation. E-commerce sales, including shipping revenue, are included in comparable sales. Increases in comparable sales are an important factor in maintaining or increasing our profitability.

Operating expenses, including the costs of operating our stores and corporate headquarters, are also an important component of our operating performance. Compensation and benefits comprise the majority of our operating expenses. Operating expenses contain fixed and variable costs, and managing the operating expense ratio (operating expenses expressed as a percentage of net sales) is an important focus of management as we seek to increase our overall profitability. Operating expenses include cash costs as well as non-cash costs, such as depreciation and amortization associated with omni-channel technology, corporate property and equipment, and impairment of long-lived assets. Because many operating expenses are fixed costs, and because operating costs tend to rise over time, increases in comparable sales typically are necessary to prevent meaningful increases in the operating expense ratio. Operating expenses can also include certain costs that are of a one-time or non-recurring nature. While these costs must be considered to fully understand our operating performance, we typically identify such costs separately where significant in the consolidated statements of operations so that we can evaluate comparable expense data across different periods.

Stores

The following table summarizes store information during the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

New store openings |

|

|

1 |

|

|

|

— |

|

Permanent store closures |

|

|

2 |

|

|

|

3 |

|

Decrease in store units |

|

|

(0.3 |

)% |

|

|

(0.9 |

)% |

The following table summarizes our open stores and square footage under lease as of the dates indicated:

|

|

|

|

|

|

|

|

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Number of stores |

|

|

329 |

|

|

|

343 |

|

Square footage |

|

|

2,667,560 |

|

|

|

2,768,564 |

|

Average square footage per store |

|

|

8,108 |

|

|

|

8,072 |

|

13-Week Period Ended May 4, 2024 Compared to the 13-Week Period Ended April 29, 2023

Results of operations. The table below sets forth selected results of our operations both in dollars (in thousands) and as a percentage of net sales for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

|

|

|

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

|

Change |

|

|

|

$ |

|

|

% |

|

|

$ |

|

|

% |

|

|

$ |

|

|

% |

|

Net sales |

|

$ |

91,753 |

|

|

|

100.0 |

% |

|

$ |

96,875 |

|

|

|

100.0 |

% |

|

$ |

(5,122 |

) |

|

|

(5.3 |

)% |

Cost of sales |

|

|

64,685 |

|

|

|

70.5 |

|

|

|

71,004 |

|

|

|

73.3 |

|

|

|

(6,319 |

) |

|

|

(8.9 |

) |

Gross profit |

|

|

27,068 |

|

|

|

29.5 |

|

|

|

25,871 |

|

|

|

26.7 |

|

|

|

1,197 |

|

|

|

4.6 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

19,286 |

|

|

|

21.0 |

|

|

|

20,039 |

|

|

|

20.7 |

|

|

|

(753 |

) |

|

|

(3.8 |

) |

Other operating expenses |

|

|

14,318 |

|

|

|

15.6 |

|

|

|

14,738 |

|

|

|

15.2 |

|

|

|

(420 |

) |

|

|

(2.8 |

) |

Depreciation (exclusive of depreciation

included in cost of sales) |

|

|

961 |

|

|

|

1.1 |

|

|

|

1,206 |

|

|

|

1.3 |

|

|

|

(245 |

) |

|

|

(20.3 |

) |

Asset impairment |

|

|

11 |

|

|

|

— |

|

|

|

225 |

|

|

|

0.2 |

|

|

|

(214 |

) |

|

|

(95.1 |

) |

Total operating expenses |

|

|

34,576 |

|

|

|

37.7 |

|

|

|

36,208 |

|

|

|

37.4 |

|

|

|

(1,632 |

) |

|

|

(4.5 |

) |

Operating loss |

|

|

(7,508 |

) |

|

|

(8.2 |

) |

|

|

(10,337 |

) |

|

|

(10.7 |

) |

|

|

2,829 |

|

|

|

(27.4 |

) |

Interest expense |

|

|

1,127 |

|

|

|

1.2 |

|

|

|

502 |

|

|

|

0.5 |

|

|

|

625 |

|

|

|

124.5 |

|

Other income |

|

|

(116 |

) |

|

|

(0.1 |

) |

|

|

(92 |

) |

|

|

(0.1 |

) |

|

|

(24 |

) |

|

|

26.1 |

|

Loss before income taxes |

|

|

(8,519 |

) |

|

|

(9.3 |

) |

|

|

(10,747 |

) |

|

|

(11.1 |

) |

|

|

2,228 |

|

|

|

(20.7 |

) |

Income tax expense |

|

|

311 |

|

|

|

0.3 |

|

|

|

1,360 |

|

|

|

1.4 |

|

|

|

(1,049 |

) |

|

|

(77.1 |

) |

Net loss |

|

$ |

(8,830 |

) |

|

|

(9.6 |

)% |

|

$ |

(12,107 |

) |

|

|

(12.5 |

)% |

|

$ |

3,277 |

|

|

|

(27.1 |

)% |

Net sales. Net sales decreased 5.3% to $91.8 million for the first 13 weeks of fiscal 2024 compared to $96.9 million for the prior year period. Comparable sales decreased 3.5%, or $3.3 million, for the first 13 weeks of fiscal 2024 compared to the prior year period. For the first 13 weeks of fiscal 2024, e-commerce comparable sales decreased 19.1% compared to the prior year period, and store comparable sales increased 2.8% compared to the prior year period. The decrease in comparable sales was driven by a decrease in consolidated average ticket and a decline in online traffic, which was partially offset by higher store traffic and conversion. Merchandise categories performing below prior period levels include furniture, housewares, mirrors, outdoor and textiles, while gift, decorative accessories and floral performed above prior period levels.

Gross profit. Gross profit as a percentage of net sales increased 280 basis points from 26.7% in the first 13 weeks of fiscal 2023 to 29.5% in the first 13 weeks of fiscal 2024. The overall increase in gross profit margin was due to favorable outbound freight costs, merchandise margin, distribution center costs and depreciation, partially offset by unfavorable store occupancy costs. Outbound freight costs, including both store and e-commerce shipping expenses, decreased approximately 180 basis points to 5.9% of net sales due to the decline in shipping expense related to the decrease in e-commerce sales and fewer shipping routes to the stores. Merchandise margin increased approximately 70 basis points from 56.8% in the first 13 weeks of fiscal 2023 to 57.5% in the first 13 weeks of fiscal 2024, mainly due to a higher initial product markup and improved margin on clearance activity. Distribution center costs decreased approximately 50 basis points to 5.1% of net sales due to increased efficiency and a smooth inventory flow which led to lower compensation and benefits costs and lower fixed costs due to the closure of the two e-commerce fulfilment locations in the prior year. Depreciation of store and distribution center assets decreased approximately 30 basis points to 1.8% of net sales in the first 13 weeks of fiscal 2024, due to certain assets becoming fully depreciated. Store occupancy costs increased approximately 50 basis points to 15.2% of net sales due to the sales deleverage on these fixed costs.

Compensation and benefits. Compensation and benefits as a percentage of net sales increased approximately 30 basis points from 20.7% in the first 13 weeks of fiscal 2023 to 21.0% in the first 13 weeks of fiscal 2024, primarily due to sales deleverage of higher store payroll costs, partially offset by reductions in corporate compensation and benefits costs.

Other operating expenses. Other operating expenses as a percentage of net sales increased approximately 40 basis points from 15.2% in the first 13 weeks of fiscal 2023 to 15.6% in the first 13 weeks of fiscal 2024. The increase as a percentage of net sales was primarily related to the deleverage of operating expenses, while the decrease of approximately $420,000 was due to expense reductions, partially offset by increased consulting costs for strategic advisory services.

Income tax expense. We recorded income tax expense of approximately $311,000, or (3.7)% of the loss before income taxes, during the first 13 weeks of fiscal 2024, compared to an income tax expense of approximately $1.4 million, or (12.7)% of the loss before income taxes, during the prior year period. The change in the tax rate for the first 13 weeks of fiscal 2024 compared to the prior period was primarily due to changes in valuation allowance adjustments and state income taxes.

Net loss and loss per share. We reported net loss of $8.8 million, or a loss of $0.68 per diluted share, for the first 13 weeks of fiscal 2024 as compared to net loss of $12.1 million, or a loss of $0.95 per diluted share, for the first 13 weeks of fiscal 2023.

Non-GAAP Financial Measures

To supplement our unaudited consolidated condensed financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”), we provide certain non-GAAP financial measures, including EBITDA, adjusted EBITDA and adjusted operating loss. These measures are not in accordance with, and are not intended as alternatives to, GAAP financial measures. We use these non-GAAP financial measures internally in analyzing our financial results and believe that they provide useful information to analysts and investors, as a supplement to GAAP financial measures, in evaluating our operational performance.

We define EBITDA as net loss before interest and the provision for income tax, which is equivalent to operating loss, adjusted for depreciation and asset impairment, adjusted EBITDA as EBITDA with non-GAAP adjustments and adjusted operating loss as adjusted EBITDA including depreciation.

Non-GAAP financial measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Each non-GAAP financial measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. The Company’s non-GAAP adjustments remove stock-based compensation expense, due to the non-cash nature of this expense, and remove severance, as it fluctuates based on the needs of the business and does not represent a normal, recurring operating expense.

The following table shows a reconciliation of operating loss to EBITDA, adjusted EBITDA and adjusted operating loss (in thousands) for the 13-week periods ended May 4, 2024 and April 29, 2023:

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Operating loss |

|

$ |

(7,508 |

) |

|

$ |

(10,337 |

) |

Depreciation |

|

|

2,624 |

|

|

|

3,257 |

|

Asset impairment (1) |

|

|

11 |

|

|

|

225 |

|

EBITDA |

|

|

(4,873 |

) |

|

|

(6,855 |

) |

Non-GAAP adjustments to operating expenses: |

|

|

|

|

|

|

Stock-based compensation expense(2) |

|

|

292 |

|

|

|

490 |

|

Severance charges(3) |

|

|

73 |

|

|

|

529 |

|

Total non-GAAP adjustments |

|

|

365 |

|

|

|

1,019 |

|

Adjusted EBITDA |

|

|

(4,508 |

) |

|

|

(5,836 |

) |

Depreciation |

|

|

2,624 |

|

|

|

3,257 |

|

Adjusted operating loss |

|

$ |

(7,132 |

) |

|

$ |

(9,093 |

) |

|

|

|

|

|

|

|

(1)Asset impairment charges are related primarily to property and equipment. Asset impairment was previously shown as a non-GAAP adjustment. The current presentation includes asset impairment as a reconciling item between operating loss and EBITDA. Prior periods have been reclassified to conform to the current period presentation.

(2)Stock-based compensation expense includes amounts expensed related to equity incentive plans.

(3)Severance charges include expenses related to severance agreements and permanent store closure compensation costs.

Liquidity and Capital Resources

Our principal capital requirements are for working capital and capital expenditures. Working capital consists mainly of merchandise inventories offset by accounts payable, which typically reach their peak by the early portion of the fourth quarter of each fiscal year. Capital expenditures primarily relate to existing store maintenance, refreshes and remodels, technology and omni-channel projects, and new or relocated stores. Historically, we have funded our working capital and capital expenditure requirements with internally generated cash and borrowings under our asset-based revolving credit facility.