Current Report Filing (8-k)

27 January 2023 - 2:06AM

Edgar (US Regulatory)

0001792581false00017925812023-01-202023-01-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 20, 2023

KIROMIC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware | | 001-39619 | | 46-4762913 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

7707 Fannin, Suite 140

Houston, TX, 77054

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (832) 968-4888

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Common Stock, $0.001 par value | | KRBP | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 | Entry into a Material Definitive Agreement. |

On January 20, 2023 (the “Issuance Date”), Kiromic BioPharma, Inc. (the “Company”) entered into a note purchase agreement (the “Agreement”) with an accredited investor (the “Investor”) and pursuant to the Agreement issued a 25% Senior Secured Convertible Promissory Note (the “Note”) to the Investor. The Note has a principal amount of $2,000,000, bears interest at a rate of 25% per annum (the “Stated Rate”) and matures on January 20, 2024 (the “Maturity Date”), on which the principal balance and accrued but unpaid interest under the Note shall be due and payable. The Stated Rate will increase to 27% per annum or the highest rate then allowed under applicable law (whichever is lower) upon occurrence of an event of default, including the failure by the Company to make payment of principal or interest due under the Note on the Maturity Date, and any commencement by the Company of a case under any applicable bankruptcy or insolvency laws. Pursuant to the Agreement, the Company may sell and issue up to a maximum aggregate principal amount of $6 million for all Notes issued pursuant to the Agreement to the Investor in two subsequent closings to occur on or before February 15, 2023 and March 15, 2023.

The Note is convertible into shares (the “Conversion Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at an initial conversion price of $0.35 per share (the “Conversion Price”), subject to a beneficial ownership limitation equivalent to 9.99% (the “Beneficial Ownership Limitation”) and a share cap of 4,080,435 shares (the “Share Cap”), representing 19.9% of the total issued and outstanding shares of Common Stock as of January 20, 2023, in the event that the Conversion Price is lower than $0.2074 per share, representing the lower of the closing price immediately preceding the Issuance Date or the average closing price of the Common Stock for the five trading days immediately preceding the Issuance Date.

The unpaid principal of and interest on the Note constitute unsubordinated obligations of the Company and are senior and preferred in right of payment to all subordinated indebtedness and equity securities of the Company outstanding as of the Issuance Date; provided, however, that the Company may incur or guarantee additional indebtedness after the Issuance Date, whether such indebtedness are senior, pari passu or junior to the obligations under the Note, which are secured by all of the Company’s right, title and interest, in and to, (i) all fixtures (as defined in the Uniform Commercial Code, the “UCC”) and equipment (as defined in the UCC), and (ii) all of the Company’s intellectual property as specified in the Note, subject to certain exclusions as described in the Note.

The foregoing description of the Agreement and the Note is qualified in its entirety by reference to the full text of such Agreement and Note, a copy of which is attached hereto as exhibits 10.1 and 10.2, respectively, and incorporated herein by reference.

Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

Reference is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference.

Item 3.02 | Unregistered Sales of Equity Securities |

Reference is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference. The issuance of the Note was made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| Kiromic BioPharma, Inc. |

| | |

Date: January 26, 2023 | By: | /s/ Pietro Bersani |

| | Pietro Bersani |

| | Chief Executive Officer |

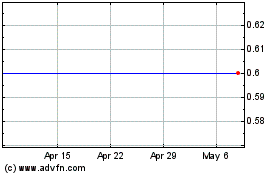

Kiromic BioPharma (NASDAQ:KRBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

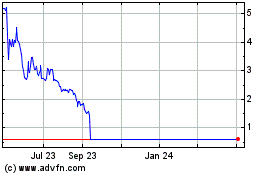

Kiromic BioPharma (NASDAQ:KRBP)

Historical Stock Chart

From Apr 2023 to Apr 2024