UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

___________________

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No.__)

|

|

|

Filed by the Registrant ☒ |

|

|

Filed by a Party other than the Registrant ☐ |

|

|

Check the appropriate box:

|

|

|

☐ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material under §240.14a-12 |

KINTARA THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

☒ |

|

No fee required. |

☐ |

|

Fee paid previously with preliminary materials. |

☐ |

|

Fee computer on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

KINTARA THERAPEUTICS, Inc.

9920 Pacific Heights Blvd, Suite 150

San Diego, California 92121

March 31, 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders of Kintara Therapeutics, Inc., or the Annual Meeting, which will be held on Monday, May 8, 2023, at 12:00 p.m., Eastern time. This year’s Annual Meeting will be held via the Internet. Stockholders will be able to listen to the meeting live, submit questions and vote online regardless of location via the Internet at http://www.viewproxy.com/kintara/2023/vm. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/kintara/2023. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. You will not be able to attend the Annual Meeting in person.

The Annual Meeting is being held for the following purposes:

•to elect four directors to the Board of Directors to hold office for the following year until their successors are elected;

•to approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the number of shares of common stock authorized for issuance thereunder from 5,500,000 to 75,000,000 (“Proposal 2”);

•to approve the adjournment of the Annual Meeting in the event that the number of shares of common stock and Series C Preferred Stock present or represented by proxy at the Annual Meeting and voting “FOR” the adoption of Proposal 2 are insufficient;

•to ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for our fiscal year ending June 30, 2023; and

•to transact any other business that may properly come before the meeting or any adjournment thereof.

Please complete, sign and return the proxy card whether or not you plan to attend the Annual Meeting. Alternatively, you may vote online at http://www.viewproxy.com/kintara/2023. Your vote is important regardless of the number of shares you own. Voting by proxy will not prevent you from voting at the virtual Annual Meeting (provided you follow the revocation procedures described in the accompanying proxy statement) but will assure that your vote is counted if you cannot attend.

On behalf of the Board of Directors and the employees of Kintara Therapeutics, Inc., we thank you for your continued support and look forward to speaking with you at the Annual Meeting.

|

|

By: |

/s/ Robert E. Hoffman |

|

Robert E. Hoffman |

|

President, Chief Executive Officer, and Chairman of the Board |

|

|

If you have any questions or require any assistance in voting your shares, please call:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

855-600-2576

1

Notice of Annual Meeting of Stockholders

|

|

|

Date: |

|

May 8, 2023 |

Time: |

|

12:00 p.m., Eastern Time |

Place: |

|

This year’s Annual Meeting will be held via the Internet. Stockholders will be able to listen, vote and submit questions regardless of location via the Internet at http://www.viewproxy.com/kintara/2023/vm. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/kintara/2023. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. |

At our 2023 Annual Meeting, we will ask you:

1.to elect four directors to the Board of Directors to hold office for the following year until their successors are elected;

2.to approve an amendment to our Articles of Incorporation, as amended, to increase the number of shares of common stock authorized for issuance thereunder from 5,500,000 to 75,000,000;

3.to approve the adjournment of the Annual Meeting in the event that the number of shares of common stock and Series C Preferred Stock present or represented by proxy at the Annual Meeting and voting “FOR” the adoption of Proposal 2 are insufficient;

4.to ratify the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2023; and

5.to transact any other business that may properly come before the meeting or any adjournment thereof.

You may vote at the Annual Meeting (or any adjournment or postponement of the Annual Meeting) if you were a stockholder of Kintara Therapeutics, Inc. at the close of business on March 28, 2023, or the Record Date. Only stockholders of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting.

|

|

|

By Order of the Board of Directors, |

|

|

|

/s/ Scott Praill |

|

Scott Praill |

|

Secretary |

San Diego, California

March 31, 2023

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 8, 2023: The Company’s Proxy Statement for the 2023 Annual Meeting of Stockholders and the Annual Report to Stockholders on Form 10-K for the fiscal year ended June 30, 2022 are available at http://www.viewproxy.com/kintara/2023. You are cordially invited to attend the Annual Meeting via live webcast by visiting http://www.viewproxy.com/kintara/2023/vm. To be sure your vote is counted and assure a quorum is present, it is important that you vote your shares regardless of the number of shares you own. The Board of Directors urges you to vote over the Internet by going to http://www.viewproxy.com/kintara/2023 or by telephone by calling (855) 600-2576 or to sign, date and mark the proxy card promptly and return it to Kintara. Voting over the Internet or by telephone or by returning the proxy card will not prevent you from voting at the virtual Annual Meeting. Under Securities and Exchange Commission rules, we are providing access to our proxy materials both by sending you this full set of proxy materials, and by notifying you of the availability of our proxy materials on the Internet. |

2

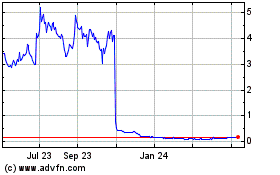

SPECIAL NOTE

On November 11, 2022, Kintara Therapeutics, Inc. completed a 1:50 reverse stock split (the "Reverse Stock Split") of our issued and outstanding common stock as well as our authorized shares of common stock. As a result of the Reverse Stock Split, every 50 shares of issued and outstanding common stock were converted into one share of common stock with a proportionate reduction in our authorized shares of common stock. Any fractional shares of common stock resulting from the Reverse Stock Split were rounded up to the nearest whole post-Reverse Stock Split share. The Reverse Stock Split did not change the par value of our common stock. All outstanding securities entitling their holders to purchase shares of common stock or acquire shares of common stock, including preferred stock, stock options, restricted stock units, and warrants, were adjusted as a result of the Reverse Stock Split, as required by the terms of those securities. Unless otherwise indicated, all historical share and per share amounts in this proxy statement have been adjusted to reflect the Reverse Stock Split.

THE MEETING

General

Kintara Therapeutics, Inc., or Kintara, is a Nevada corporation. As used in this proxy statement, “we,” “us,” “our” and the “Company” refer to Kintara. The term “Annual Meeting” as used in this proxy statement refers to the 2023 Annual Meeting of Stockholders and includes any adjournment or postponement of the Annual Meeting.

Pursuant to Securities and Exchange Commission (“SEC”) rules, we are providing access to our proxy materials both by sending you this full set of proxy materials, and by notifying you of the availability of our proxy materials online at http://www.viewproxy.com/kintara/2023, where you can access this proxy statement for the 2023 Annual Meeting, our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 (the “Annual Report”), and our proxy card. In addition, our proxy materials provide instructions on how you may request to receive, at no charge, all future proxy materials in printed form by mail or electronically by email. Your election to receive proxy materials by mail or email will remain in effect until you revoke it. Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to stockholders and will reduce the impact of our annual meetings on the environment.

The Board of Directors (the “Board”) is soliciting your proxy to vote at the Annual Meeting. This proxy statement summarizes the information you will need to know to cast an informed vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. You may simply complete, sign and return the proxy card and your votes will be cast for you at the Annual Meeting or you may vote online at http://www.viewproxy.com/kintara/2023. This process is described below in the section entitled “Voting Rights.”

This proxy statement and the Notice of Annual Meeting are dated March 31, 2023. If you owned shares of common stock or Series C Preferred Stock of Kintara at the close of business on March 28, 2023 (the “Record Date”), you are entitled to vote at the Annual Meeting, as set out below. On the Record Date, there were 1,692,175 shares of common stock and 14,208 shares of Series C Preferred Stock of Kintara outstanding.

Each share of common stock is entitled to one vote per share. Each share of Series C Preferred Stock is convertible into shares of common stock based on the respective conversion prices and is entitled to vote with the common stock on an as-converted basis. The conversion prices for the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock are $58.00, $60.70, and $57.50, respectively. As of the Record Date, we had outstanding shares of Series C Preferred Stock that were convertible into an aggregate of 244,631 shares of common stock.

This year’s Annual Meeting will be held in a virtual meeting format only. The Annual Meeting will convene on May 8, 2023, at 12:00 p.m. Eastern time. In order to participate in the Annual Meeting live via the Internet, you must register at http://www.viewproxy.com/kintara/2023/vm by 11:59 p.m. Eastern Time by May 7, 2023. If you are a registered holder, you must register using the virtual control number included on your Notice of Internet Availability of proxy materials or your proxy card (if you received a printed copy of the proxy materials). If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the Annual Meeting. If you are

3

unable to obtain a legal proxy to vote your shares, you will still be able to attend the 2023 Annual Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://www.viewproxy.com/kintara/2023.

On the day of the Annual Meeting, if you have properly registered, you may enter the Annual Meeting by logging in using the event password you received via email in your registration confirmation at http://www.viewproxy.com/kintara/2023/vm.

The Annual Meeting can be accessed by visiting http://www.viewproxy.com/kintara/2023/vm, where you will be able to listen to the meeting live, submit questions and vote online. You will need the virtual control number. As part of the Annual Meeting, we will hold a live question and answer session, during which we intend to answer questions submitted in writing during the meeting in accordance with the Annual Meeting procedures which are pertinent to the Company and the meeting matters, as time permits. Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered once.

If you encounter any difficulties accessing the Annual Meeting live audio webcast during the meeting time, please email VirtualMeeting@viewproxy.com or call (866) 612-8937.

Even if you plan to attend the live webcast of the Annual Meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you later decide not to attend the virtual Annual Meeting.

Purpose Of Annual Meeting

At the Annual Meeting, you will be asked to vote:

•to elect four directors to the Board of Directors to hold office for the following year until their successors are elected;

•to approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the number of shares of common stock authorized for issuance thereunder from 5,500,000 to 75,000,000;

•to approve the adjournment of the Annual Meeting in the event that the number of shares of common stock and Series C Preferred Stock present or represented by proxy at the Annual Meeting and voting “FOR” the adoption of Proposal 2 are insufficient;

•to ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for our fiscal year ending June 30, 2023; and

•to transact any other business that may properly come before the meeting or any adjournment thereof.

Quorum

A quorum of stockholders is necessary to hold a valid meeting. The holders of at least 33.3% of the voting power of the capital stock issued and outstanding and entitled to vote at the Annual Meeting as of the Record Date, represented in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Kintara will include proxies marked as abstentions, withheld votes, and broker non-votes to determine the number of shares present at the Annual Meeting.

Voting Rights

Holders of Kintara’s common stock are entitled to one vote at the Annual Meeting for each share of the common stock that he or she owned as of the Record Date.

4

Holders of Kintara’s Series C Preferred Stock are entitled to vote on an as-converted basis with the common stock. The conversion prices for the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock are $58.00, $60.70, and $57.50, respectively. Each share of the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock was convertible into 196,864 shares, 14,801 shares, and 32,966 shares, respectively, of common stock as of the Record Date, based on the $1,000 per share stated value and is entitled to the same number of votes per share.

You may vote your shares at the Annual Meeting via live webcast, over the Internet or by proxy. If you wish to vote your shares electronically at the Annual Meeting, there will be a live link provided during the Annual Meeting (you will need the virtual control number assigned to you).

To vote over the Internet, you must go to http://www.viewproxy.com/kintara/2023. To vote by proxy, complete, sign and return the proxy card in the enclosed postage-paid envelope. If you properly complete your proxy card and send it to us in time to vote, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. If you are a stockholder of record and you return a properly executed proxy card or vote by proxy over the Internet but do not mark the boxes showing how you wish to vote, your proxy will vote your shares FOR the Board’s nominees for director; FOR the amendment to the Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”), to increase the number of shares authorized for issuance thereunder; FOR the adjournment of the Annual Meeting if the number of shares of common stock and Series C Preferred Stock present or represented by proxy at the Annual Meeting and voting “FOR” the adoption of Proposal 2 are insufficient; and FOR the ratification of the appointment of our independent registered public accounting firm and, in the discretion of the proxy holders, on any other matters that properly come before the meeting. If any other matter is presented, your proxy will vote your shares as a majority of the Board determines. As of the date of this proxy statement, we know of no other matters that may be presented at the Annual Meeting, other than those listed in the Notice of the Annual Meeting.

If you hold your shares through a bank, brokerage firm or other nominee, you should vote your shares in accordance with the steps required by such bank, brokerage firm or other nominee.

Vote Required

Assuming that a quorum is present, the following votes will be required to approve each proposal:

•With respect to the first proposal (election of directors), directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote on the election of directors. The director nominees who receive the greatest number of votes at the Annual Meeting (up to the total number of directors to be elected) will be elected. As a result, withheld votes and “broker non-votes” (see below), if any, will not affect the outcome of the vote on Proposal 1. Consequently, only shares that are voted in favor of a particular nominee will be counted toward such nominee’s achievement of a plurality. You may not vote your shares cumulatively for the election of directors.

•With respect to the second proposal to approve an amendment to our Articles of Incorporation to increase the number of shares of common stock authorized for issuance thereunder from 5,500,000 to 75,000,000, the affirmative vote of holders of a majority of the voting power of the issued and outstanding shares of common stock and Series C Preferred Stock that are entitled to vote, voting together as a single class, is required to approve Proposal 2. As a result, abstentions and “broker non-votes” (see below), if any, will have the effect of a vote “AGAINST” Proposal 2. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares.

•With respect to the third proposal to approve the adjournment of the Annual Meeting to the extent there are insufficient proxies at the Annual Meeting to approve Proposal 2, and the fourth proposal to ratify the appointment of Marcum LLP, as well as the approval of any other matter that may properly come before the Annual Meeting, the affirmative vote of a majority of the total votes cast is required to approve these proposals. As a result, abstentions, broker non-votes, if any, and any other failure to submit a proxy or vote in person at the meeting, will not affect the outcome of the vote of Proposals 3 and 4.

5

You will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the meeting.

The Board has determined that a vote in favor of the foregoing proposals is in the best interests of Kintara and our stockholders and unanimously recommends a vote “FOR” the Board’s nominees for director; “FOR” the amendment to the Company’s Articles of Incorporation to increase the number of shares authorized for issuance thereunder; “FOR” the adjournment of the Annual Meeting in the event of insufficient proxies at the Annual Meeting to approve Proposal 2; and “FOR” the ratification of the appointment of our independent registered public accounting firm and, in the discretion of the proxy holders, on any other matters that properly come before the meeting.

The Board of Directors is not aware of any other matters to be presented for action at the meeting, but if other matters are properly brought before the meeting, shares represented by properly completed proxies received by mail, telephone or the Internet will be voted in accordance with the judgment of the persons named as proxies.

Broker Non-Votes

Banks and brokers acting as nominees are permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine” by the New York Stock Exchange (the exchange that makes such determinations) but are not permitted to use discretionary voting authority to vote proxies for proposals that are deemed “non-routine” by the New York Stock Exchange. A broker “non-vote” occurs when a proposal is deemed “non-routine” and a nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to the matter being considered and has not received instructions from the beneficial owner. The determination of which proposals are deemed “routine” versus “non-routine” may not be made by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As such, it is important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your shares.

Under the applicable rules governing such brokers, we believe Proposal 2 to approve an amendment to our Articles of Incorporation to increase the number of shares of common stock authorized for issuance thereunder from 5,500,000 to 75,000,000, Proposal 3 to approve the adjournment of the Annual Meeting to the extent there are insufficient proxies at the Annual Meeting to approve Proposal 2, and Proposal 4 to ratify the appointment of Marcum LLP as our independent registered public accounting firm are likely to be considered “routine” items. This means that brokers may vote using their discretion on such proposals on behalf of beneficial owners who have not furnished voting instructions. In contrast, certain items are considered “non-routine”, and a “broker non-vote” occurs when brokers do not receive voting instructions from beneficial owners with respect to such items because the brokers are not entitled to vote such uninstructed shares. We believe Proposal 1 to elect directors is likely to be considered “non-routine”, which means that brokers cannot vote your uninstructed shares when they do not receive voting instructions from you. Furthermore, if approvals of Proposals 2, 3 or 4 are deemed by the New York Stock Exchange to be “non-routine” matters, brokers will not be permitted to vote on Proposals 2, 3 or 4 if the broker has not received instructions from the beneficial owner. In addition, if the New York Stock Exchange determines Proposal 2 to be “non-routine,” failure to vote on Proposal 2, which requires the affirmative vote of at least a majority in voting power of our issued and outstanding voting securities, or to instruct your broker how to vote any shares held for you in your broker’s names, will have the same effect as a vote against such proposal. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares for these proposals.

If your shares are held of record by a bank, broker, or other nominee, we urge you to give instructions to your bank, broker, or other nominee as to how you wish your shares to be voted so you may participate in the stockholder voting on these important matters.

Changing Your Vote after Voting over the Internet or Revoking Your Proxy

You may change your vote by attending the Annual Meeting and voting online even if you previously voted over the Internet. Alternatively, you may change your vote by contacting Alliance Advisors LLC by phone at (855) 600-2576, or re-voting over the Internet following the instructions provided.

6

You may revoke your proxy at any time before it is exercised by:

•filing a letter with our Secretary revoking the proxy;

•submitting another signed proxy with a later date; or

•attending the Annual Meeting and voting online, provided you file a written revocation with the Secretary of the Annual Meeting prior to the voting of such proxy.

If your shares are not registered in your own name, you will need appropriate documentation from your stockholder of record to vote at the Annual Meeting. Examples of such documentation include a broker’s statement, letter or other document that will confirm your ownership of shares of Kintara.

Solicitation of Proxies

Kintara will pay the costs of soliciting proxies from our stockholders, directors, officers or employees of Kintara may solicit proxies by mail, telephone or other forms of communication. We will also reimburse banks, brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to you.

Kintara has also retained Alliance Advisors LLC to assist it in the solicitation of proxies. Alliance Advisors LLC will solicit proxies on behalf of Kintara from individuals, brokers, bank nominees and other institutional holders in the same manner described above. The fees that will be paid to Alliance Advisors LLC are anticipated to be approximately $14,000, and we will reimburse their out-of-pocket expenses. Kintara has also agreed to indemnify Alliance Advisors LLC against certain claims.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of March 28, 2023, with respect to the beneficial ownership of the outstanding common stock by (i) any holder of more than five (5%) percent; (ii) each of the Company’s named executive officers and directors; and (iii) the Company’s directors and executive officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment power over the shares beneficially owned.

|

|

|

|

|

|

Name of Beneficial Owner (1) |

|

Common

Stock

Beneficially

Owned |

|

Percentage of Common Stock (2) |

Directors and Named Executive Officers: |

|

|

|

|

|

Robert E. Hoffman |

|

33,545 |

(3) |

|

1.95% |

Saiid Zarrabian |

|

1,122 |

|

|

* |

John Liatos |

|

3,935 |

|

|

* |

Scott Praill |

|

14,142 |

(4) |

|

* |

Dennis Brown |

|

11,002 |

(5) |

|

* |

Robert J. Toth, Jr. |

|

7,810 |

(6) |

|

* |

Laura Johnson |

|

6,127 |

(7) |

|

* |

Tamara A. Favorito |

|

3,367 |

(8) |

|

* |

All executive officers and directors as a group (6 persons) |

|

75,993 |

|

|

4.3% |

* Less than 1%

(1)Except as otherwise indicated, the address of each beneficial owner is c/o Kintara Therapeutics, Inc., 9920 Pacific Heights Blvd, Suite 150, San Diego, CA 92121.

(2)Applicable percentage ownership is based on 1,692,175 shares of common stock outstanding as of March 28, 2023, together with securities exercisable or convertible into shares of common stock within 60 days of March 28, 2023, for each stockholder. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock that are currently exercisable or exercisable within 60 days of March 28, 2023, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

(3)Includes 32,445 shares issuable upon exercise of vested stock options and outstanding stock options exercisable within 60 days of March 28, 2023. Excludes 8,002 Restricted Stock Units which vest in four equal instalments beginning August 1, 2023.

(4)Includes 13,398 shares issuable upon exercise of vested stock options and outstanding stock options exercisable within 60 days of March 28, 2023. Excludes 4,801 Restricted Stock Units which vest in four equal instalments beginning August 1, 2023.

(5)Includes 1,075 shares held by Valent Technologies, LLC, and 9,426 shares issuable upon exercise of vested stock options and outstanding stock options exercisable within 60 days of March 28, 2023. Excludes 4,801 Restricted Stock Units which vest in four equal instalments beginning August 1, 2023.

(6)Includes 7,778 shares issuable upon exercise of vested stock options and outstanding stock options exercisable within 60 days of March 28, 2023.

(7)Includes 6,067 shares issuable upon exercise of vested stock options and outstanding stock options exercisable within 60 days of March 28, 2023.

(8)Includes 3,367 shares issuable upon exercise of vested stock options and outstanding stock options exercisable within 60 days of March 28, 2023.

8

_____________________

PROPOSAL 1

ELECTION OF DIRECTORS

_____________________

Our Board is currently composed of four directors, all of whom are being nominated for reelection at this Annual Meeting. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors or by the sole remaining director. A director elected by the Board to fill a vacancy, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that director for which the vacancy was created and until the director’s successor is duly elected and qualified.

Each of the four nominees listed below are incumbent directors. If elected at the Annual Meeting, each of these nominees would serve until the next annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. Because the number of nominees properly nominated for the Annual Meeting is the same as the number of directors to be elected, the election of directors at this Annual Meeting is uncontested.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. In accordance with our Amended and Restated Bylaws (the “Bylaws”) and Nevada law, a stockholder entitled to vote for the election of directors may withhold authority to vote for certain nominees for directors or may withhold authority to vote for all nominees for directors. Withheld votes and broker non-votes will not be treated as a vote for or against any particular director nominee and will not affect the outcome of the election. Stockholders may not vote, or submit a proxy, for a greater number of nominees than the four nominees named below. The director nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the four director nominees named below. If any director nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our Board. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Nominees for Election Until the Next Annual Meeting

The following table sets forth the name, age, position and tenure of each of the nominees at the 2023 Annual Meeting:

|

|

|

|

|

|

|

Name |

|

Age |

|

Position(s) Held With

Kintara |

|

Director

Since |

Robert E. Hoffman |

|

57 |

|

Chief Executive Officer, President, and Chairman of the Board |

|

2018 |

Robert J. Toth, Jr. |

|

59 |

|

Director |

|

2013 |

Laura Johnson |

|

58 |

|

Director |

|

2020 |

Tamara A. (Seymour) Favorito |

|

64 |

|

Director |

|

2021 |

The following includes a brief biography of each of the nominees standing for election to the Board of Directors at the Annual Meeting, based on information furnished to us by each director nominee, with each biography including information regarding the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the applicable nominee should serve as a member of our Board.

Robert E. Hoffman has served as our director since April 2018, as our Chairman since June 2018, and as our Chief Executive Officer and President since November 2021. He has served as a member of board of directors of ASLAN Pharmaceuticals, Inc., a publicly-held, clinical-stage immunology focused biopharmaceutical company, since October 2018, and as a member of the board of directors of FibroGenesis, a clinical-stage regenerative medicine company, since April 2021. He has also served as a member of board of directors, on the Audit Committee, and on

9

the Human Resources and Compensation Committee of Antibe Therapeutics Inc. (“Antibe”), a publicly-held clinical-stage biotechnology company, since November 2020, and as Chairman of Antibe’s board of directors since May 2022. Mr. Hoffman served as Senior Vice President and Chief Financial Officer of Heron Therapeutics, Inc., a publicly-held pharmaceutical company, from April 2017 to October 2020. From July 2015 to September 2016, Mr. Hoffman served as Chief Financial Officer of AnaptysBio, Inc., a publicly-held biotechnology company. From June 2012 to July 2015, Mr. Hoffman served as the Senior Vice President, Finance and Chief Financial Officer of Arena Pharmaceuticals, Inc. (“Arena”), a biopharmaceutical company, prior to its acquisition by Pfizer Inc. in March 2022. From August 2011 to June 2012 and previously from December 2005 to March 2011, he served as Arena’s Vice President, Finance and Chief Financial Officer and in a number of various roles of increasing responsibility from 1997 to December 2005. Mr. Hoffman formerly served as a member of the board of directors of Saniona AB, a biopharmaceutical company, from September 2021 to May 2022, and as a member of the board of directors of Kura Oncology, Inc., a cancer research company, from March 2015 to August 2021. He also previously served as a member of the board of directors of CombiMatrix Corporation, a molecular diagnostics company, MabVax Therapeutics Holdings, Inc., a biopharmaceutical company, and Aravive, Inc., a clinical stage biotechnology company. Mr. Hoffman serves as a member of the steering committee of the Association of Bioscience Financial Officers. Mr. Hoffman formerly served as a director and President of the San Diego Chapter of Financial Executives International and was an advisor to the Financial Accounting Standard Board (FASB) for 10 years (2010 to 2020) advising the United States accounting rulemaking organization on emerging issues and new financial guidance. Mr. Hoffman holds a B.B.A. from St. Bonaventure University. Mr. Hoffman’s financial and executive business experience qualifies him to serve on our Board of Directors.

Robert J. Toth, Jr. has served as our director since August 2013 and serves as Chair of our Compensation Committee. Since 2005, Mr. Toth has primarily been managing his personal investment portfolio. From 2004-2005, Mr. Toth served as a consulting analyst to Narragansett Asset Management, a New York-based healthcare-focused hedge fund, where he advised the firm on biotechnology investments. From 2001-2003, he was the Senior Portfolio Manager for San Francisco-based EGM Capital’s Medical Technology hedge fund, where he was responsible for managing and maintaining a dedicated medical technology portfolio. Mr. Toth began his Wall Street career in 1996 as an Equity Research Associate for Vector Securities International, a healthcare-focused brokerage firm. From 1997-1999 he served as Senior Biotechnology Analyst. He joined Prudential Securities as Senior Vice President and Biotechnology Analyst where he served from 1999-2001 following Prudential’s acquisition of Vector. His responsibilities included the analysis of commercial, clinical and scientific fundamentals of oncology and genomics-based biotechnology companies on behalf of institutional investors. Mr. Toth was named to the Wall Street Journal’s Allstar List for stock picking in 1999. Mr. Toth received an MBA from the University of Washington and Bachelor of Science degrees in Biological Sciences and Biochemistry from California Polytechnic State University, San Luis Obispo. Mr. Toth’s financial and biotechnology industry knowledge and experience qualify him to serve on our Board of Directors.

Laura Johnson has served as our director since June 2020 and serves as Chair of our Nominating and Corporate Governance Committee. Ms. Johnson currently serves as the President and Chief Executive Officer of Next Generation Clinical Research, a contract research organization that Ms. Johnson founded in 1999. Additionally, Ms. Johnson is the President and Chief Executive Officer of Eufaeria Biosciences, Inc., a development biotechnology company that she founded in 2016. Ms. Johnson is also a founder and former member of the board of directors of SB Bancorp, Inc., a financial holding company, and Settlers Bank, Inc., a Wisconsin chartered business bank. In addition, Ms. Johnson has served as a member of the board of directors of Harmony Hill Farm Sanctuary, a 501(c)(3) nonprofit organization, since 2019. Ms. Johnson previously served as a member of the board of directors of La Jolla Pharmaceutical Company, a biopharmaceutical company, from 2013 to 2022, Odonate Therapeutics, a biopharmaceutical company, from 2018 to 2022, and Agrace HospiceCare from 2013 to 2016. In 2008 and 2010, she was honored as a biotechnology entrepreneur by the national organization, Women in Bio, and in 2008 received the Rising Star Award by the Wisconsin Biotech and Medical Device Association. Most recently, she was the recipient of the Wisconsin Biohealth Business Award at the BioForward Annual Biohealth Summit in October 2019. Ms. Johnson holds a nursing degree from The University of the State of New York-Albany. Ms. Johnson’s biotechnology industry and executive knowledge and experience qualify her to serve on our Board of Directors.

Tamara A. (Seymour) Favorito has served as our director since April 2021 and serves as Chair of our Audit Committee. Ms. Favorito has more than 30 years of life sciences industry experience including 20 years as a chief financial officer. She currently serves as a board member and audit committee chair of Artelo Biosciences, Inc. and

10

as a board member, compensation committee chair, and audit committee chair of Zevra Therapeutics (f/k/a KemPharm, Inc.), both publicly-traded clinical-development stage companies. Ms. Favorito served on the board of directors of Beacon Discovery, Inc. from 2018 until its acquisition in 2021. Ms. Favorito was Interim Chief Financial Officer of Immunic, Inc., a publicly-traded clinical-stage drug development company in 2019. She served as Chief Financial Officer of Signal Genetics, Inc., a publicly-traded molecular diagnostics company, from 2014 to 2017, HemaQuest Pharmaceuticals, Inc., a venture-backed clinical-stage drug development company, from 2010 to 2014 and Favrille, Inc., a previously publicly-traded clinical-stage drug development company, from 2001 to 2009. While at these companies, she led multiple private and public financings, including Favrille’s IPO. In addition, she was instrumental in M&A transactions and led the finance, investor relations, human resources, administration and managed care and payor reimbursement functions. Ms. Favorito is a Certified Public Accountant (inactive). She received an MBA, with an emphasis in Finance, from Georgia State University, and a bachelor's degree in Business Administration, with an emphasis in Accounting from Valdosta State University. Ms. Favorito also participated in an executive management program at Kellogg Graduate School of Management at Northwestern University. Ms. Favorito’s professional experience and financial expertise qualify her to serve on our Board of Directors.

Board Membership Diversity

In accordance with the Board Diversity Rules (Rule 5605(f) and Rule 5606) promulgated by The Nasdaq Stock Market LLC (“Nasdaq”), the following Board Diversity Matrix presents our Board diversity statistics. The minimum diversity objective for smaller reporting companies listed on The Nasdaq Capital Market prior to August 6, 2021 with a board of five or fewer directors is one diverse director by December 31, 2023 who self-identifies as either female, an underrepresented minority or LGBTQ+. “Underrepresented Minority” means an individual who self-identifies as one or more of the following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or Two or More Races or Ethnicities. “Two or More Races or Ethnicities” means a person who identifies with more than one of the following categories: White (not of Hispanic or Latinx origin), Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander.

11

Board Diversity Matrix (As of March 31, 2023)

|

|

|

|

|

Total Number of Directors |

4 |

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

Part I: Gender Identity |

|

|

|

|

Directors |

2 |

2 |

0 |

0 |

Part 2: Demographic Background |

|

|

|

|

African American or Black |

0 |

0 |

0 |

0 |

Alaskan Native or Native American |

0 |

0 |

0 |

0 |

Asian |

0 |

0 |

0 |

0 |

Hispanic or Latinx |

0 |

0 |

0 |

0 |

Native Hawaiian or Pacific Islander |

0 |

0 |

0 |

0 |

White |

2 |

2 |

0 |

0 |

Two or More Races or Ethnicities |

0 |

0 |

0 |

0 |

LGBTQ+ |

0 |

Did Not Disclose Demographic Background |

0 |

The Board of Directors recommends a vote “FOR” all of the nominees for election as directors.

12

CORPORATE GOVERNANCE

Board of Directors Operations and Meetings

Our Board currently consists of four members. Our directors are appointed for a one-year term to hold office until their successors have been elected and qualified or until the earlier of their resignation or removal.

We have no formal policy regarding board diversity. Our priority in selection of board members is identification of members who will further the interests of our stockholders through their established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, knowledge of our business and understanding of the competitive landscape.

Our Board met ten (10) times in fiscal 2022. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of our Board (held during the period for which such directors served on the Board), and (ii) the total number of meetings of all committees of our Board on which the director served (during the periods for which the director served on such committee or committees).

The Board oversees our business and monitors the performance of our management. In accordance with our corporate governance procedures, the Board does not involve itself in the day-to-day operations of Kintara. Our executive officers and management oversee our day-to-day operations. Our directors fulfill their duties and responsibilities by attending meetings of the Board, which are usually held on at least a quarterly basis. Our directors also discuss business and other matters with other key executives and our principal external advisers (legal counsel, auditors, financial advisors and other consultants).

Independent Directors

Our Board has determined that Robert J. Toth, Jr., Laura Johnson, and Tamara A. Favorito are qualified to serve as independent directors. The standards relied on by the Board in affirmatively determining whether a director is “independent,” in compliance with Nasdaq’s rules, are comprised of those objective standards set forth in the rules promulgated by Nasdaq. The Board is responsible for ensuring that independent directors do not have a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Nasdaq’s rules, as well as SEC rules, impose additional independence requirements for all members of the Audit Committee. Specifically, in addition to the “independence” requirements discussed above, “independent” audit committee members must: (1) not accept, directly or indirectly, any consulting, advisory, or other compensatory fees from Kintara or any subsidiary of Kintara other than in the member’s capacity as a member of the Board and any Board committee; (2) not be an affiliated person of Kintara or any subsidiary of Kintara; and (3) not have participated in the preparation of the financial statements of Kintara or any current subsidiary of Kintara at any time during the past three years. In addition, Nasdaq’s rules require that all audit committee members be able to read and understand fundamental financial statements, including Kintara’s balance sheet, income statement, and cash flow statement. The Board believes that the current members of the Audit Committee meet these additional standards.

Audit Committee

The Board has formed an Audit Committee, which currently consists of Tamara A. Favorito, Chair, Robert J. Toth, Jr., and Laura Johnson. Each member of the Audit Committee is “independent” as that term is defined under the applicable rules of the SEC and Nasdaq. The Board has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Audit Committee. In addition, our Board has determined that Ms. Favorito qualifies as an audit committee financial expert within the meaning of SEC regulations and the Nasdaq Marketplace Rules. The Audit Committee met three (3) times in fiscal 2022.

The Audit Committee oversees and monitors our financial reporting process and internal control system, reviews and evaluates the audit performed by our registered independent public accountants and reports to our Board any substantive issues found during the audit. The Audit Committee will be directly responsible for the appointment,

13

compensation and oversight of the work of our registered independent public accountants. The Audit Committee reviews and approves all transactions with affiliated parties. The Board has adopted a written charter for the Audit Committee.

A copy of the Audit Committee Charter is posted under the “Investors” tab on our website, which is located at www.kintara.com.

Compensation Committee

The Board has formed a Compensation Committee which consists of Robert J. Toth, Jr., Chair, Laura Johnson, and Tamara A. Favorito, all of whom are independent (as that term is defined under the Nasdaq Marketplace Rules). The Compensation Committee assists the Board in fulfilling its oversight responsibilities relating to (i) corporate governance practices and policies and (ii) compensation matters, including compensation of the directors and senior management of the Company and the administration of compensation plans of the Company. The Compensation Committee met three (3) times in fiscal 2022.

The Board has adopted a written charter for the Compensation Committee. A copy of the Compensation Committee Charter is posted under the “Investors” tab on our website, which is located at www.kintara.com.

The Compensation Committee has engaged Anderson Pay Advisors LLC as our independent compensation consultant. In 2022, Anderson Pay Advisors LLC reviewed both executive and director compensation and did not provide us any other services. Anderson Pay Advisors LLC reported directly to the Compensation Committee and provided guidance on trends in executive and non-employee director compensation, the development of specific executive compensation programs, the composition of our compensation peer group and other matters as directed by the Compensation Committee.

Nominating and Corporate Governance Committee

The Board has formed a Nominating and Corporate Governance Committee, which currently consists of Laura Johnson, Chair, Robert J. Toth, Jr., and Tamara A. Favorito. The Nominating and Corporate Governance Committee assesses potential candidates to fill perceived needs on the Board for required, skills, expertise, independence and other factors. The Nominating and Corporate Governance Committee met one (1) time in fiscal 2022.

The Board has adopted a written charter for the Nominating and Corporate Governance Committee. A copy of the Nominating and Corporate Governance Committee Charter is posted under the “Investors” tab on our website, which is located at www.kintara.com.

Nomination of Directors

The Nominating and Corporate Governance Committee of the Board assesses potential candidates to fill perceived needs on the Board of Directors for required skills, expertise, independence and other factors. A director candidate recommended by our stockholders will be considered in the same manner as a nominee recommended by a Board member, management or other sources. Stockholders wishing to recommend a candidate for nomination should contact our Secretary in writing at the Secretary of Kintara at 9920 Pacific Heights Blvd Suite 150 San Diego, CA 92121. Our Nominating and Corporate Governance Committee has discretion to decide which individuals to recommend for nomination as directors.

Board Leadership Structure and Role in Risk Oversight

Periodically, our Board will assess the roles of Chairman and Chief Executive Officer, and the Board leadership structure to ensure the interests of Kintara and our stockholders are best served. Our Board believes the current combination of the two roles is satisfactory at present. Mr. Hoffman, as our President, Chief Executive Officer and Chairman, has extensive knowledge of all aspects of Kintara and our business. We have no policy requiring the combination or separation of leadership roles and our governing documents do not mandate a particular structure. This

14

has allowed, and will continue to allow, our Board the flexibility to establish the most appropriate structure for the Company at any given time.

Our Board is primarily responsible for overseeing our risk management processes. The Board receives and reviews periodic reports from management, auditors, legal counsel, and others, as considered appropriate regarding the Company’s assessment of risks. The Board focuses on the most significant risks facing the Company and the Company’s general risk management strategy, and also ensures that risks undertaken by the Company are consistent with the Board’s risk strategy. While the Board oversees the Company’s risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

Related Party Transactions

Other than compensation arrangements for our Named Executive Officers and directors, which are described in the section entitled “Executive Compensation,” since July 1, 2021, there have been no transactions or series of similar transactions to which we were a party or will be a party, in which:

•the amounts involved exceeded or will exceed $120,000; and

•any of our directors, executive officers or holders of more than 5% of our capital stock, or any member of the immediate family of the foregoing persons, had or will have a direct or indirect material interest.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our executive officers, financial and accounting officers, our directors, our financial managers and all of our employees. The Board is committed to a high standard of corporate governance practices and, through its oversight role, encourages and promotes a culture of ethical business conduct. A copy of our Code of Business Conduct and Ethics is posted under the “Investors” tab on our website, which is located at www.kintara.com.

Stockholder Communication with the Board of Directors and Attendance at Annual Meetings

The Board maintains a process for stockholders to communicate with the Board and its committees. Stockholders of Kintara and other interested persons may communicate with the Board or the chair of the Audit Committee, Compensation Committee, and the Nominating and Corporate Governance Committee by writing to the Secretary of Kintara at 9920 Pacific Heights Blvd Suite 150 San Diego, CA 92121. All communications that relate to matters that are within the scope of the responsibilities of the Board will be presented to the Board no later than the next regularly scheduled meeting. Communications that relate to matters that are within the responsibility of one of the Board committees will be forwarded to the chair of the appropriate committee. Communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities will be forwarded to the appropriate officer. Solicitations, junk mail and obviously frivolous or inappropriate communications will not be forwarded, but will be made available to any director who wishes to review them.

Executive Officers

The following table sets forth certain information regarding our current executive officers:

|

|

|

|

|

Name of Individual |

|

Age |

|

Position(s) Held With

Kintara |

Robert E. Hoffman |

|

57 |

|

Chief Executive Officer, President, and Chairman of the Board |

Dennis Brown, PhD |

|

73 |

|

Chief Scientific Officer |

Scott Praill, CPA |

|

57 |

|

Chief Financial Officer |

15

Robert E. Hoffman, see Mr. Hoffman’s biography under “Proposal 1”.

Dennis Brown, PhD, has been our Chief Scientific Officer since January 2013. He also served as our director from February 11, 2013 to April 11, 2018. Dr. Brown is one of our founders and has served as Chief Scientific Officer and director of Del Mar Pharmaceuticals (BC) Ltd. (“Del Mar (BC)”), a wholly-owned subsidiary of Kintara, since inception. Dr. Brown has more than thirty years of drug discovery and development experience. He has served as Chairman of Mountain View Pharmaceutical’s Board of Directors since 2000 and is the President of Valent Technologies, LLC. In 1999 he founded ChemGenex Therapeutics, which merged with a publicly traded Australian company in 2004 to become ChemGenex Pharmaceuticals, of which he served as President and a Director until 2009. He was previously a co-founder of Matrix Pharmaceutical, Inc., where he served as Vice President (VP) of Scientific Affairs from 1985-1995 and as VP, Discovery Research, from 1995-1999. He also previously served as an Assistant Professor of Radiology at Harvard University Medical School and as a Research Associate in Radiology at Stanford University Medical School. He received his B.A. in Biology and Chemistry (1971), M.S. in Cell Biology (1975) and Ph.D. in Radiation and Cancer Biology (1979), all from New York University. Dr. Brown is an inventor of many issued U.S. patents and applications, many with foreign counterparts.

Scott Praill, CPA, BSc. has been our Chief Financial Officer since January 2013, and previously served as a consultant to Del Mar (BC). From 2004 to 2012 Mr. Praill was an independent consultant providing accounting and administrative services to companies in the resource industry. Mr. Praill served as Chief Financial Officer of Strata Oil & Gas, Inc. from June 2007 to September 2008. From November 1999 to October 2003 Mr. Praill was Director of Finance at Inflazyme Pharmaceuticals Inc. Mr. Praill completed his articling at Price Waterhouse (now PricewaterhouseCoopers LLP) and obtained his Chartered Professional Accountant designation in 1996. Mr. Praill obtained his Certified Public Accountant (Illinois) designation in 2001. Mr. Praill received a Financial Management Diploma (Honors), from British Columbia Institute of Technology in 1993, and a Bachelor of Science from Simon Fraser University in 1989.

EXECUTIVE COMPENSATION

The Board has formed a Compensation Committee. The Compensation Committee is responsible for reviewing and approving management compensation, including salaries, bonuses, and equity compensation. We seek to provide competitive compensation arrangements that attract and retain key talent necessary to achieve our business objectives. At our 2021 annual meeting of stockholders, stockholders voted, on an advisory, non-binding basis, to approve the compensation paid to the Company’s named executive officers, as disclosed in the proxy statement for the 2021 annual meeting. Our stockholders also voted at our 2018 annual meeting of stockholders, on an advisory, non-binding basis, that such votes on named executive officer compensation should be held every three years. The next advisory, non-binding vote to approve named executive officer compensation is expected to occur in connection with the 2024 annual meeting of stockholders.

Summary Compensation Table

The following table presents information regarding the total compensation awarded to, earned by, or paid to each person serving as our Chief Executive Officer during the fiscal year ended June 30, 2022, the two most highly-compensated executive officers (other than the Chief Executive Officer) who were serving as executive officers during the fiscal year ended June 30, 2022, and up to two additional individuals for whom disclosure would have been provided but for the fact that such individuals were not serving as an executive officer as of June 30, 2022 for services rendered in all capacities to us for the fiscal years ended June 30, 2022 and June 30, 2021. These individuals are our named executive officers for fiscal 2022.

16

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position |

|

Period |

|

Salary (US$) |

|

Bonus Awards (US$) |

|

Equity Awards (US$) |

|

Total (US$) |

Robert E. Hoffman, President and CEO (1) |

|

Year Ended June 30, 2022 |

|

356,619 |

|

181,811 |

|

2,622,597 |

|

3,161,028 |

|

|

Year Ended

June 30, 2021 |

|

– |

|

– |

|

– |

|

– |

Saiid Zarrabian, Former President and CEO and Former Head of Strategic Partnerships (2) |

|

Year Ended June 30, 2022 |

|

563,297 |

|

119,530 |

|

– |

|

682,827 |

|

|

Year Ended

June 30, 2021 |

|

520,000 |

|

180,830 |

|

4,270,860 |

|

4,971,690 |

Scott Praill, Chief Financial Officer (3) |

|

Year Ended June 30, 2022 |

|

312,000 |

|

127,920 |

|

– |

|

439,920 |

|

|

Year Ended

June 30, 2021 |

|

290,000 |

|

79,808 |

|

954,150 |

|

1,323,958 |

Dennis Brown, Chief Scientific Officer (4) |

|

Year Ended June 30, 2022 |

|

206,000 |

|

41,277 |

|

– |

|

247,277 |

|

|

Year Ended

June 30, 2021 |

|

200,000 |

|

33,544 |

|

532,149 |

|

765,693 |

John Liatos, Former Senior V.P., Business Development (5) |

|

Year Ended June 30, 2022 |

|

334,769 |

|

– |

|

– |

|

334,769 |

|

|

Year Ended

June 30, 2021 |

|

340,000 |

|

105,725 |

|

796,986 |

|

1,242,711 |

(1)On November 8, 2021, Mr. Hoffman, the Chairman of the Board, was appointed President and Chief Executive Officer. Also on November 8, 2021, we entered into an employment agreement with Mr. Hoffman pursuant to which Mr. Hoffman will receive an annual base salary of $551,000 (which may be adjusted on an annual basis in the discretion of the Board) and will be eligible to receive a fiscal year target bonus of up to 50% of base salary (which may be adjusted by the Board to up to 75% of base salary based on overachievement of bonus targets or other performance criteria). The employment agreement may be terminated by us with or without cause (as defined therein). In the event we terminate the employment agreement without cause, we will be required to pay Mr. Hoffman continued payment of his base salary for 12 months, a prorated bonus for the year of termination based on performance through the date of termination, an additional six months of vesting credit for any outstanding options, and continued health coverage during the severance period. In the event that an involuntary termination occurs during a period beginning sixty days before a definitive corporate transaction agreement is entered into that would result in a change in control (as defined therein), or within twelve months following a change in control, the severance period will increase to eighteen months’ severance, Mr. Hoffman will receive 100% of his target bonus, and his equity grants will be fully vested.

17

On November 8, 2021, Mr. Hoffman was granted 70,384 stock options that are exercisable at $48.00 per share until November 8, 2031. On September 22, 2021, while still an independent director, Mr. Hoffman was granted 2,000 stock options that are exercisable at $62.00 per share until September 22, 2031. Mr. Hoffman's bonus for the fiscal year ended June 30, 2022 was $181,811.

(2)On July 7, 2017, Mr. Zarrabian was elected to the Board. On November 3, 2017, he was appointed interim Chief Executive Officer and on January 1, 2018, he was also appointed interim President. On May 21, 2018, we entered into an employment agreement with Mr. Zarrabian pursuant to which Mr. Zarrabian was appointed as our permanent President and Chief Executive Officer. Under the agreement, as amended, Mr. Zarrabian was entitled to receive an annual base salary of $470,000 (which was subject to adjustment on an annual basis in the discretion of the Board) and was eligible to receive a fiscal year target bonus of up to 50% of base salary (which was subject to adjustment by the Board to up to 75% of base salary based on overachievement of bonus targets or other performance criteria). The employment agreement was terminable by us with or without cause (as defined therein). In the event we terminated the employment agreement without cause, we would have been required to pay Mr. Zarrabian continued payment of his base salary for 12 months, a prorated bonus for the year of termination based on performance through the date of termination, an additional six months of vesting credit for any outstanding options, and continued health coverage during the severance period. In the event that an involuntary termination occurred during a period beginning sixty days before a definitive corporate transaction agreement was entered into that would result in a change in control (as defined therein), or within twelve months following a change in control, the severance period would have increased to eighteen months’ severance, Mr. Zarrabian would have been entitled to receive 100% of his target bonus, and his options would have been fully vested.

On November 8, 2021, in connection with the appointment of Mr. Hoffman, the Board and Mr. Zarrabian agreed to enter into a Second Amended Employment Agreement pursuant to which Mr. Zarrabian was appointed Head of Strategic Partnerships. Pursuant to the terms of the agreement, Mr. Zarrabian was entitled to receive an annual base salary of $285,000 and was eligible to receive a fiscal year target bonus of up to 40% of base salary, subject to the achievement of performance targets or criteria established by the Board for such year. The employment agreement was terminable by us with or without cause (as defined therein). In the event we terminated Mr. Zarrabian’s employment without cause, or if Mr. Zarrabian resigned for good reason (as defined in the employment agreement), we would have been required to pay Mr. Zarrabian continued payment of his base salary for nine months, any earned, but unpaid bonus for the preceding year, and a prorated bonus for the year of termination based on performance through the date of termination. In addition, in that event Mr. Zarrabian would have been provided an additional six months of vesting credit for any outstanding stock options, and continued health coverage during the severance period. In the event that a termination of Mr. Zarrabian’s employment under such circumstances occurred during a period beginning 60 days before a definitive corporate transaction agreement was entered into that would result in a change in control (as defined in the employment agreement), or within 12 months following a change in control, the foregoing separation pay and benefits would have applied except that his base salary would continue for 12 months (instead of nine months), he would have received 100% of his target bonus (rather than a prorated bonus), and his stock options would have been fully vested. In connection with Mr. Zarrabian’s appointment as Head of Strategic Partnerships, the vesting terms of certain of Mr. Zarrabian’s outstanding unvested stock option were amended, such that an aggregate of 754,175 shares subject to such stock option that were unvested and subject to continued service requirements were then subject to vesting based on both Mr. Zarrabian’s continued service and achievement of certain milestones established by the Board.

On November 11, 2020, 5,594 stock options previously granted to Mr. Zarrabian at $30.50 per share had their vesting accelerated such that the 5,594 stock options all vested on November 11, 2020. Mr. Zarrabian’s bonus for the fiscal year ended June 30, 2021 was $180,830.

On May 20, 2022, we mutually agreed with Mr. Zarrabian that he would step down from his role as Head of Strategic Partnerships and as a member of the Board, effective as of May 23, 2022. In connection with Mr. Zarrabian’s separation on May 20, 2022, we entered into a separation and general release agreement with Mr. Zarrabian which provides, among other things, for Mr. Zarrabian to receive continued payments of nine months of his annual base salary, equal to the sum of $213,750, commencing on the first regular payroll date that is after the separation date and paid in installments in accordance with our regular payroll practices, a one-time bonus payment of $24,826.67 in connection with his service as our Head of Strategic Partnerships, reimbursement of healthcare coverage payments for a period of up to nine months following the separation date, continued payments of life insurance premiums for a period of up to nine months following the separation date, and an additional six months of service vesting credit for each of his stock options outstanding as of the separation date, and all of his vested stock options, including any options so accelerated, remaining exercisable for up to a nine-month period measured from the separation date (or earlier expiration of the option’s term). The separation agreement further provides for general release and non-disparagement provisions in our favor. In addition, Mr. Zarrabian will be subject to non-solicitation provisions, which will apply for a period of twelve months following the separation date.

(3)On February 9, 2017, we entered into an employment agreement with Scott Praill, our Chief Financial Officer. Pursuant to the employment agreement, Mr. Praill will continue to serve as our Chief Financial Officer for an indefinite period until termination of the employment agreement in accordance with its terms. We will pay Mr. Praill an annual base salary of

18

$200,000 (which may be adjusted on an annual basis in the discretion of the Board) and Mr. Praill will also be eligible to participate in any bonus plan and long-term incentive plan established for our senior executives. The employment agreement may be terminated by us with or without cause (as defined therein). In the event we terminate the employment agreement without cause, we will be required to pay Mr. Praill, any accrued and unpaid base salary, plus an amount equal to 12 months of Mr. Praill’s base salary plus one additional month’s base salary for each completed year of service, up to 18 months’ base salary. On September 15, 2020, he was granted 12,132 stock options that are exercisable at $85.00 per share until September 15, 2030.

(4)On January 1, 2015, we entered into a consulting agreement with Dr. Dennis Brown, our Chief Scientific Officer. Subsequent to this agreement, it has been amended and is now renewed on an annual basis. Under the most recent renewal, Dr. Brown will continue to serve as our Chief Scientific Officer until June 30, 2023, which period may be extended in accordance with the terms of the agreement. For fiscal year 2022, we paid Dr. Brown an annual consulting fee of $206,000. We may also pay to Dr. Brown a bonus and incentive compensation as determined at the discretion of our Board. The consulting agreement with Dr. Brown does not specify the amount of time Dr. Brown is required to devote to us but does require that Dr. Brown provide us with the full benefit of his knowledge, expertise and ingenuity, and prohibits Dr. Brown from engaging in any business, enterprise or activity contrary to or that would detract from our business.

On September 15, 2020, Dr. Brown was granted 1,789 stock options that are exercisable at $85.00 per share until September 15, 2030, and on September 22, 2020, he was granted 1,200 stock options that are exercisable at $68.00 per share until September 22, 2030.

(5)On March 1, 2018, Adgero Biopharmaceuticals Holdings, Inc. (“Adgero”), a Delaware corporation that we merged with in 2020, entered into an amended and restated employment agreement with John Liatos which was for an indefinite term. Under the terms of Mr. Liatos’s amended and restated employment agreement, Mr. Liatos received an annual base salary of $320,000 (which may be adjusted on an annual basis in the discretion of the Board). In addition, Mr. Liatos was eligible to receive an annual bonus, which was targeted at up to 35% of his base salary. Mr. Liatos was also eligible to receive, from time to time, equity awards. The employment agreement provided for accelerated vesting of all unvested equity awards granted to Mr. Liatos upon certain terminations of employment following a change in control (as defined therein). If the employment agreement was terminated without cause (as defined in therein) or Mr. Liatos terminated his employment for good reason (as defined in therein), severance is payable including: (i) continued payments of eight months of his annual base salary, paid in installments in accordance with the Company’s regular payroll practices; (ii) reimbursement of healthcare continuation payments under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”) for a period of eight months; and (iii) an additional six months of service vesting credit for each of his stock options outstanding at the time of his termination, and all of his vested options will remain exercisable for up to a twelve-month period measured from his termination date (or earlier expiration of the options term). Notwithstanding the foregoing, Mr. Liatos’s post-employment healthcare coverage payments as described herein will cease at such time as Mr. Liatos becomes otherwise eligible to obtain alternative healthcare coverage from a new employer if such event occurs prior to the expiration of his receipt of such benefit. Mr. Liatos’s severance benefits will be subject to reduction to the extent doing so would put him in a better after-tax position after taking into account any excise tax he may incur under Section 4999 of the Code in connection with any change in control of us or his subsequent termination of employment. Mr. Liatos is also subject to non-compete and non-solicitation provisions, which will apply during the term of his employment and for a period of twelve months following termination of his employment. Upon the closing of the Merger with Adgero, Mr. Liatos’ employment contract was continued by the Company.

On September 15, 2020 Mr. Liatos was granted 10,133 stock options that are exercisable at $85.00 per share until September 15, 2030. Mr. Liatos’ performance bonus for the fiscal year ended June 30, 2021 was $49,725 and he also received a retention bonus of $56,000.

On October 25, 2021, we mutually agreed with Mr. Liatos that Mr. Liatos would step down from his role as the Company’s Senior Vice President, Business Development. In connection with the termination of Mr. Liatos’s services, on October 29, 2021, we entered into a separation and general release agreement with Mr. Liatos. In substantial part, the terms of the severance payable under the separation agreement will be governed by the terms of Mr. Liatos’s amended and restated employment agreement, dated March 1, 2018. As contemplated in that agreement, among other things, Mr. Liatos received continued payments of eight months of his annual base salary, equal to the sum of $226,667, commencing on the first regular payroll date that is at least 60 days after the termination date and paid in installments in accordance with our regular payroll practices, reimbursement of healthcare continuation payments under COBRA for a period of up to eight months following the termination date, and an additional six months of service vesting credit for each of his stock options outstanding as of the termination date, and all of his vested options, including any options so accelerated, remaining exercisable for up to a twelve-month period measured from the termination date (or earlier expiration of the option’s term). In addition, Mr. Liatos was subject to non-compete and non-solicitation provisions, which applied for a period of twelve months following the termination date.

19

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth outstanding equity awards to our named executive officers as of June 30, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards |

|

Stock Awards |

|

Name |

|

Number of

securities

underlying

unexercised

options (#)

Exercisable |

|

|

Number of

securities

underlying

unexercised

options (#)

un-exercisable |

|

|

Equity

incentive

plan awards:

number of

securities

underlying

unexercised

unearned

options

(#) |

|

|

Option

exercise

price

(US$) |

|

|

Option

expiration

date |

|

Equity

incentive

plan awards:

Number of

unearned

shares, units

or other rights

that have

not vested

(#) |

|

|

Equity

incentive

plan awards:

Market or

payout value

of unearned

shares, units

or other rights

that have

not vested

($) |

|

Robert E. Hoffman |

|

|

72 |

|

|

|

— |

|

|

|

— |

|

|

|

530.00 |

|

|

April 13, 2028 |

|

|

— |

|

|

|

— |

|

|

|

|

80 |

|

|

|

— |

|

|

|

— |

|

|

|

304.95 |

|

|

November 8, 2028 |

|

|

— |

|

|

|

— |

|

|

|

|

1,499 |

|

|

|

— |

|

|

|

— |

|

|

|

30.50 |

|

|

September 5, 2029 |

|

|

— |

|

|

|

— |

|

|

|

|

2,400 |

|

|

|

— |

|

|

|

— |

|

|

|

85.00 |

|

|

September 15, 2030 |

|

|

— |

|

|

|

— |

|

|

|

|

1,500 |

|

(1) |

|

500 |

|

|

|

— |

|

|

|

62.00 |

|

|

September 22, 2031 |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

(2) |

|

70,383 |

|

|

|

— |

|

|

|

48.00 |

|

|

November 8, 2031 |

|

|