false

0001408443

A8

00-0000000

QC

0001408443

2024-08-28

2024-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 28, 2024

MILESTONE

PHARMACEUTICALS INC.

(Exact name of registrant as specified in its

charter)

| Québec |

|

001-38899 |

|

Not

applicable |

| (state or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1111

Dr. Frederik-Philips Boulevard, |

|

|

| Suite

420 |

|

|

| Montréal,

Québec CA |

|

H4M

2X6 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area

code: (514)

336-0444

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common

Shares |

|

MIST |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company

x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensation Arrangements of Certain Officers. |

On September 3, 2024,

the Board of Directors (the “Board”) of Milestone Pharmaceuticals Inc. (the “Company”), upon the

recommendation of the Nominating & Corporate Governance Committee of the Board, voted to elect Joeseph C. Papa as a member of

the Board and as a member of the Board’s compensation committee (the “Compensation Committee”), effective as

of September 3, 2024 (the “Effective Date”). Mr. Papa’s term as director will expire at the Company’s

2025 annual meeting of stockholders.

Mr. Papa has over 35

years of experience in the pharmaceutical, healthcare and specialty pharmaceutical industries. Since February 2024, he has served

as Chief Executive Officer of Emergent BioSolutions (NYSE: EBS). Previously, he served as Chief Executive Officer of Bausch + Lomb Corporation

from May 2022 to March 2023 and served as Chairman and CEO of Bausch Health (NYSE: BHC) from 2016 to 2022. From 2006 to 2016,

Mr. Papa served as Chairman and CEO of Perrigo (NYSE: PRGO). Prior to Perrigo, Mr. Papa served as President of PTS for Cardinal

Health (NYSE: CAH), President of Watson Pharmaceuticals, President of U.S. operations for Searle/Pharmacia, Chief Operating Officer of

DuPont Pharmaceuticals (NYSE: DD) and Vice President of Marketing for Novartis (NYSE: NVS). He currently serves as Chair of the board

of directors of SparingVision, a privately held genomic medicines company, and as a member of the board of directors of Candel Therapeutics

(Nasdaq: CADL), a clinical stage biopharmaceutical company developing immunotherapies for cancer patients, where he chairs the compensation

committee. He previously served on the boards of directors of Prometheus Biosciences, as lead independent director and chair of the compensation

committee until the company’s sale to Merck (NYSE: MRK) in 2023, and Smith & Nephew plc (NYSE: SNN) as chair of the remuneration

committee. Mr. Papa holds a B.S. in pharmacy from the University of Connecticut and an M.B.A. from Northwestern University’s

Kellogg Graduate School of Management.

There are no arrangements

or understandings between Mr. Papa and any other person pursuant to which Mr. Papa was elected as a director. Mr. Papa

does not have any family relationships with any of the Company’s directors or executive officers, and does not have a direct or

indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Pursuant to the terms of the

Company’s Non-Employee Director Compensation Policy (as amended to date, the “Compensation Policy”), Mr. Papa will

receive (i) annual cash compensation of $42,500 for his service as a director and (ii) annual cash compensation of $7,500 for

his service as a member of the Compensation Committee. Additionally, pursuant to the Compensation Policy, Mr. Papa will be granted

an option to purchase up to 80,000 common shares of the Company (the “Initial Grant”) upon the effective date of his

appointment to the Board. The Initial Grant will vest in equal monthly installments over three years from the date of grant, subject to

such director’s continued service as a director or otherwise as an employee or consultant to the Company through the applicable

vesting dates. The Initial Grant is subject to the terms of the Company’s 2019 Equity Incentive Plan and the Company’s form

of United States stock option grant notice and stock option award agreement thereunder. Furthermore, Mr. Papa is entitled to receive

additional annual equity awards in accordance with the terms and conditions of the Compensation Policy. The Company will also reimburse

reasonable out-of-pocket expenses incurred by Mr. Papa for his attendance at meetings of the Board or any committee thereof.

In connection with his appointment

to the Board, Mr. Papa has entered into the Company’s standard form of indemnity agreement, a copy of which was filed as Exhibit 10.14

to the Registration Statement on Form S-1 (File No. 333-230846) filed with the Securities and Exchange Commission on April 12,

2019.

| Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

The Company virtually held

its 2024 Annual Meeting of Shareholders (the “Annual Meeting”) on August 28, 2024. At the Annual Meeting, the

Company’s shareholders voted on two proposals, each of which is described in more detail in the Company’s definitive proxy

statement on Schedule 14A filed with the U.S. Securities and Exchange Commission on July 15, 2024. The following is a brief description

of each matter voted upon at the Annual Meeting, as well as the final tally of the number of votes cast for, withheld or against each

matter, and, if applicable, the number of abstentions and broker non-votes with respect to each matter.

| Proposal 1. | Election of Directors |

The Company’s shareholders

elected the nominees below to the Board each to hold office until the 2025 Annual Meeting of Shareholders or until their successors are

duly elected or appointed, or until such directors’ earlier resignation or removal. The votes regarding the election of directors

were as follows:

| Nominee | |

Votes For | |

Votes Withheld | |

Broker Non-Votes |

| Joseph Oliveto | |

27,367,910 | |

328,244 | |

9,337,191 |

| Lisa M. Giles | |

27,494,092 | |

202,062 | |

9,337,191 |

| Stuart M. Duty | |

27,633,939 | |

62,215 | |

9,337,191 |

| Andrew R. Saik | |

27,633,449 | |

62,705 | |

9,337,191 |

| Michael Tomsicek | |

27,495,346 | |

200,808 | |

9,337,191 |

| Robert J. Wills | |

22,522,120 | |

5,174,034 | |

9,337,191 |

| Seth H.Z. Fischer | |

27,500,738 | |

195,416 | |

9,337,191 |

Following the Annual Meeting,

Mr. Duty replaced Mr. Fischer as a member of the Board’s Nominating and Corporate Governance Committee, Mr. Saik

replaced Ms. Giles as a member of the Board’s Audit Committee and Mr. Fischer was appointed as Chair of the Board’s

Compensation Committee. The current composition of the Board committees after the Annual Meeting and the Effective Date of Mr. Papa’s

appointment the Board is as follows:

| Committee | |

Members |

| Nominating and Corporate Governance Committee | |

Robert J. Wills (Chair), Lisa M. Giles, Stuart M. Duty |

| Audit Committee | |

Michael Tomsicek (Chair), Robert J. Wills, Andrew R. Saik |

| Compensation Committee | |

Seth H.Z. Fischer (Chair), Michel Tomsicek, Joseph C. Papa |

| Proposal 2. | Appointment of the Company’s

Auditor |

Proposal 2 was a proposal

to approve the appointment of PricewaterhouseCoopers LLP as the auditor for the Company to hold office until the close of the 2025 Annual

Meeting of Shareholders and the authorization of the Board to fix the auditor’s remuneration. The votes regarding the appointment

of the Company’s auditor were as follows:

| Votes For | |

Votes Withheld |

| 36,988,292 | |

45,053 |

| Item 7.01. |

Regulation FD Disclosure. |

On September 4, 2024,

the Company issued a press release announcing the appointment of Mr. Papa to the Board, a copy of which is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

The information in this Item

7.01 and Exhibit 99.1 attached hereto is furnished solely pursuant to Item 7.01 of this Current Report on Form 8-K. Consequently,

it is not deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities

of that section.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MILESTONE PHARMACEUTICALS INC. |

| |

|

| |

By: |

/s/Amit Hasija |

| |

|

Amit Hasija |

| |

|

Chief Financial Officer |

Dated:

September 4, 2024

Exhibit 99.1

Milestone Pharmaceuticals Appoints Industry

Veteran Joseph Papa to its Board of Directors

MONTREAL

and CHARLOTTE, N.C., September 4, 2024 (GLOBE NEWSWIRE) -- Milestone® Pharmaceuticals Inc. (Nasdaq: MIST), a biopharmaceutical

company focused on the development and commercialization of innovative cardiovascular medicines, today announced the appointment of Joseph

Papa to its Board of Directors (“Board”), effective September 3, 2024.

Mr. Papa

is a renowned pharmaceutical and healthcare leader, with more than 35 years of experience navigating companies through periods of rapid

growth, transformation, and strategic M&A transactions, including as former Chairman and CEO of Bausch + Lomb, Bausch Health and Perrigo

and as a director of SparingVision and Candel Therapeutics. He brings broad commercial experience and proven capabilities of advancing

innovative products aimed at significantly enhancing patients’ lives.

“Joe is an

accomplished leader with a track record of driving growth, and we are thrilled to welcome him to our Board,” said Robert

J. Wills, PhD, Chairman of the Board of Milestone, “His tremendous experience across an extensive range of biopharmaceutical companies

and products provides a skillset that is an excellent complement to the existing board. We look forward to his strategic guidance as we

prepare for potential approval of our investigational drug CARDAMYST™ (etripamil nasal spray) for paroxysmal supraventricular tachycardia.”

Mr. Papa

commented, “I am very impressed by Milestone’s leadership team, culture of innovation, and commitment to improving the lives

of people with life-altering heart conditions. I see a great opportunity for value creation and look forward to collaborating with the

Board and the team to advance CARDAMYST and, if approved, to help bring this much needed treatment to patients.”

About Joseph

Papa

Joseph Papa has over 35 years of experience in

the pharmaceutical, healthcare and specialty pharmaceutical industries. Since February 2024, he has served as Chief Executive Officer

of Emergent BioSolutions (NYSE: EBS). He served as Chief Executive Officer of Bausch + Lomb Corporation from May 2022 to March 2023

to facilitate a smooth leadership transition. Previously, Mr. Papa served as Chairman and CEO of Bausch Health (NYSE: BHC) from 2016

to 2022, where he oversaw the company’s rapid growth and spin-off of Bausch + Lomb (NYSE: BLCO). From 2006 to 2016, Mr. Papa

served as Chairman and CEO of Perrigo (NYSE: PRGO). Prior to Perrigo, Mr. Papa served as President of PTS for Cardinal Health (NYSE:

CAH), President of Watson Pharmaceuticals, President of U.S. operations for Searle/Pharmacia, Chief Operating Officer of DuPont Pharmaceuticals

(NYSE: DD) and Vice President of Marketing for Novartis (NYSE: NVS). He currently serves as Chair of the board of directors of SparingVision,

a privately held genomic medicines company, and as a member of the board of directors of Candel Therapeutics (Nasdaq: CADL), a clinical

stage biopharmaceutical company developing immunotherapies for cancer patients, where he chairs the compensation committee. He previously

served on the boards of directors of Prometheus Biosciences, as lead independent director and chair of the compensation committee until

the company’s sale to Merck (NYSE: MRK) in 2023, and Smith & Nephew plc (NYSE: SNN) as chair of the remuneration committee.

Mr. Papa holds a B.S. in pharmacy from the University of Connecticut and an M.B.A. from Northwestern University’s Kellogg Graduate

School of Management.

About Milestone

Pharmaceuticals

Milestone Pharmaceuticals Inc. (Nasdaq: MIST)

is a biopharmaceutical company developing and commercializing innovative cardiovascular solutions to improve the lives of people living

with complex and life-altering heart conditions. The Company’s focus on understanding unmet patient needs and improving the patient

experience has led us to develop new treatment approaches that provide patients with an active role in self-managing their care. Milestone’s

lead investigational product is etripamil, a novel calcium channel blocker nasal spray that is being studied for patients to self-administer

without medical supervision to treat symptomatic episodic attacks associated with PSVT and AFib-RVR.

Forward-Looking

Statements

This

press release contains forward-looking statements and forward looking information within the meaning of the Private Securities Litigation

Reform Act of 1995 and applicable Canadian securities laws (“forward looking statements”). Words such as “believe,”

“continue,” “could,” “demonstrate,” “designed,” “develop,” “estimate,”

“expect,” “may,” “pending,” “plan,” “potential,” “progress,”

“will”, “intend” and similar expressions (as well as other words or expressions referencing future events, conditions,

or circumstances) are intended to identify forward-looking statements. These forward-looking statements are based on Milestone’s

expectations and assumptions as of the date of this press release. Each of these forward-looking statements involves risks and uncertainties.

Actual results may differ materially from these forward-looking statements. Forward-looking statements contained in this press release

include statements regarding the timing of upcoming clinical trial milestones and related data; the timing of the FDA’s review

of the NDA and the FDA’s potential approval of CARDAMYST; the potential of etripamil to help patients living with these serious

heart arrythmias; and the timing of the launch of etripamil. Important factors that could cause actual results to differ materially from

those in the forward-looking statements include, but are not limited to, whether our future interactions with the FDA will have satisfactory

outcomes; whether and when, if at all, our NDA for etripamil will be approved by the FDA; whether the FDA will require additional trials

or data which may significantly delay and put at risk our efforts to obtain approval and may not be successful, the risks inherent in

biopharmaceutical product development and clinical trials, including the lengthy and uncertain regulatory approval process; uncertainties

related to the timing of initiation, enrollment, completion, evaluation and results of our clinical trials; risks and uncertainty related

to the complexity inherent in cleaning, verifying and analyzing trial data; and whether the clinical trials will validate the safety

and efficacy of etripamil for PSVT or other indications, among others, general economic, political, and market conditions, including

deteriorating market conditions due to investor concerns regarding inflation, Russian hostilities in Ukraine and ongoing disputes in

Israel and Gaza and overall fluctuations in the financial markets in the United States and abroad, risks related to pandemics and public

health emergencies, and risks related the sufficiency of Milestone’s capital resources and its ability to raise additional capital

in the current economic climate. These and other risks are set forth in Milestone’s filings with the U.S. Securities and Exchange

Commission (SEC) and the Canadian securities regulatory authorities, including in its annual report on Form 10-K for the year ended

December 31, 2024, under the caption “Risk Factors,” as such discussion may be updated from time to time by subsequent

filings Milestone may make with the SEC and the Canadian securities regulatory authorities, which is available under Milestone’s

profile on EDGAR at www.sec.gov and on SEDAR at www.sedarplus.ca. Except as required by applicable law, Milestone

assumes no obligation to update any forward-looking statements contained herein to reflect any change in expectations, even as new information

becomes available or based on future events or otherwise.

Contact:

Kim Fox, Vice

President, Communications,

kfox@milestonepharma.com

Investor Relations

Chris Calabrese,

ccalabrese@lifesciadvisors.com

Kevin Gardner,

kgardner@lifesciadvisors.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

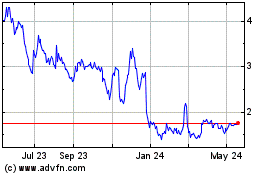

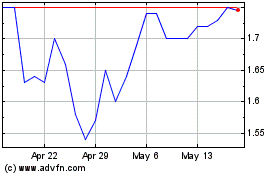

Milestone Pharmaceuticals (NASDAQ:MIST)

Historical Stock Chart

From Oct 2024 to Nov 2024

Milestone Pharmaceuticals (NASDAQ:MIST)

Historical Stock Chart

From Nov 2023 to Nov 2024