false

0001522540

0001522540

2025-02-24

2025-02-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 24, 2025

MARQETA, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40465 |

|

27-4306690 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

180 Grand Avenue, 6th Floor

Oakland, California 94612

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (877) 962-7738

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share |

|

MQ |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

CEO Leadership Transition

On February 26, 2025 (the “Effective Date”),

Marqeta, Inc. (the “Company”) announced that the Board of Directors (the “Board”) has appointed Michael (Mike)

Milotich as Interim Chief Executive Officer (principal executive officer), effective immediately. Mr. Milotich will also continue to serve

in his current role of Chief Financial Officer. Mr. Milotich succeeds Simon Khalaf, who has stepped down as Chief Executive Officer and

as a director as of February 24, 2025.

Mr. Milotich, 48, has served as our Chief Financial

Officer since February 2022. Prior to joining Marqeta, Mr. Milotich was Senior Vice President, Head of Corporate Finance and Investor

Relations at Visa Inc., a publicly traded global financial platform company, from November 2018 to February 2022. He previously served

in a number of finance roles of increasing seniority at Visa since 2011, most recently as Senior Vice President, Head of Investors Relations

from April 2018 to November 2018 and Vice President, Corporate FP&A and Business Analyst Lead from December 2014 to April 2018. Mr.

Milotich holds a Master of Business Administration in Strategy and Finance from the Stern School of Business at New York University and

a Bachelor of Arts in Business Economics from the University of California, Santa Barbara.

There are no family relationships between Mr.

Milotich and any executive officer or director of the Company, there are no understandings or arrangements between Mr. Milotich and any

other person pursuant to which Mr. Milotich was appointed as Interim Chief Executive Officer and Mr. Milotich has no transactions reportable

under Item 404(a) of Regulation S-K.

In connection with his appointment as Interim

Chief Executive Officer, Mr. Milotich will receive during the period he serves as Interim Chief Executive Officer (i) an annual base salary

of $550,000; (ii) a target annual bonus at the rate of 75% of Mr. Milotich’s annual base salary, which will be prorated for the

period of his service as Interim Chief Executive Officer; and (iii) a one-time retention award of $2,000,000 (the “Retention Award”),

payable (a) 50% in cash upon the earlier of the date that is 12 months following the Effective Date or the Board’s appointment of

a new Chief Executive Officer (the date of such appointment, the “Appointment Date”), subject to Mr. Milotich remaining employed

as Interim Chief Executive Officer through that date; and (b) 50% in the form of Company restricted stock units (“RSUs”) granted

following the Effective Date, which will vest on the date that is six months following the Appointment Date, subject to Mr. Milotich’s

continued employment with the Company through such date; provided, however, that if, following the Appointment Date, Mr. Milotich’s

employment with the Company is terminated without Cause (as defined in the Marqeta Executive

Severance Plan as currently in effect (the “Severance Plan”)), 100% of Mr. Milotich’s RSUs subject to this Retention

Award immediately will vest subject to Mr. Milotich satisfying the Release Requirement (as defined in the Severance Plan). These RSUs

will be subject to the terms and conditions of the Marqeta 2021 Stock Option and Incentive

Plan and the applicable award agreement thereunder. All other terms and conditions of Mr. Milotich’s employment will remain the

same.

Mr. Khalaf is eligible to

receive the severance benefits specified in the Marqeta Executive Severance Plan, if the conditions specified therein are met.

Item 7.01.

Regulation FD Disclosures.

On February 26, 2025, the Company issued a press

release regarding the CEO leadership transition. The press release is furnished herewith as Exhibit 99.1 and is incorporated herein by

reference.

The information in this current report on Form

8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation

language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MARQETA, INC. |

| |

|

| Date: February 26, 2025 |

/s/ Michael (Mike) Milotich |

| |

Michael (Mike) Milotich |

| |

Interim Chief Executive Officer, Chief Financial Officer |

Exhibit 99.1

Marqeta Announces Leadership Transition

Mike Milotich, Marqeta’s Chief Financial

Officer, Appointed Interim CEO

Oakland, Ca., February 26, 2025 – Marqeta, Inc. (NASDAQ:

MQ), the global modern card issuing platform, today announced that its Board of Directors has appointed Mike Milotich as Interim Chief

Executive Officer, effective immediately. Mr. Milotich will also continue to serve in his current role of Chief Financial Officer. Mr.

Milotich succeeds Simon Khalaf, who has stepped down as Chief Executive Officer and as a Director.

The Company’s Board of Directors has initiated a comprehensive

search process, with the assistance of a leading executive search firm, to identify Marqeta’s next CEO.

“As we embark on a new fiscal year and look to position Marqeta

for a new chapter of growth and value creation, Simon and the Board have agreed that now is the right time to transition leadership,”

said Judson C. Linville, Independent Chair of the Marqeta Board. “The Board is confident that Mike is the right person to lead Marqeta

as Interim CEO during this important time for our business. In addition to his strong understanding of our company’s operations,

customers and strategy, Mike is a veteran of the payments industry and has been a key driver of Marqeta’s continued growth and path

to profitability. With Mike at the helm, Marqeta is well positioned to continue advancing its strategic initiatives as we work to identify

the Company’s next CEO.”

“Marqeta was the pioneer of modern card issuing to enable the

success and scale of many fintechs and commerce disruptors, and is poised to capitalize on the numerous opportunities as the market expands

with embedded finance,” said Mr. Milotich. “We are executing a clear strategy focused on innovation and profitable growth,

and I am committed to continuing to work closely with Marqeta’s Board, leadership and talented team members on the exciting path

ahead. I am confident in our ability to thrive in today’s complex operating environment and look forward to delivering long-term

sustainable value for our customers and shareholders.”

Mr. Linville continued, “On behalf of the Board and everyone

at Marqeta, I want to thank Simon for his leadership and contributions during his tenure. We wish him all the best in his future endeavors.”

“It has been a privilege to serve as Marqeta’s CEO and

to work alongside such a talented team and one that is dedicated to our customers, partners and shareholders,” said Mr. Khalaf.

“I have worked closely with Mike over the past two years and I firmly believe in his leadership of the company as it expands into

the embedded finance market.”

About Mike Milotich

Mike Milotich has served as Marqeta’s Chief Financial Officer

since February 2022, leading the Company’s financial planning and analysis, corporate development, accounting, settlement and investor

relations functions. Prior to joining Marqeta, Mike was the Senior Vice President of Corporate Finance and Investor Relations at Visa,

responsible for understanding Visa’s business and financial performance, managing the corporate outlook, evaluating M&A opportunities

and communicating with the global investor community. Prior to Visa, Mike worked at PayPal and American Express in various business analysis

roles. Mike holds a bachelor’s degree from the University of California, Santa Barbara and an MBA from New York University.

About Marqeta

Marqeta makes it possible for companies to build

and embed financial services into their branded experience—and unlock new ways to grow their business and delight users. The Marqeta

platform puts businesses in control of building financial solutions, enabling them to turn real-time data into personalized, optimized

solutions for everything from consumer loyalty to capital efficiency. With compliance and security built-in, Marqeta’s platform

has been proven at scale, processing nearly $300 billion in annual payments volume in 2024. Marqeta is certified to operate in more than

40 countries worldwide and counting. Visit www.marqeta.com to learn more.

Cautionary Note on Forward-Looking Statements

This press release contains "forward-looking

statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements expressed or implied in this press release include, but are not limited to, quotations and statements relating

to our CEO search process, growth and path to profitability, business and strategy. Actual results may differ materially from the expectations

contained in these statements due to risks and uncertainties, including, but not limited to, the following: challenges with our CEO search

process; any factors creating issues with changes in domestic and international business, market, financial, political and legal conditions;

and those risks and uncertainties included in the “Risk Factors” disclosed in Marqeta's Annual Report on Form 10-K, as may

be updated from time to time in Marqeta’s periodic filings with the SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in this press release are based on information available to Marqeta as of

the date hereof. Marqeta disclaims any obligation to update any forward-looking statements, except as required by law.

Contacts

Investors

ir@marqeta.com

Media

press@marqeta.com

v3.25.0.1

Cover

|

Feb. 24, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 24, 2025

|

| Entity File Number |

001-40465

|

| Entity Registrant Name |

MARQETA, INC.

|

| Entity Central Index Key |

0001522540

|

| Entity Tax Identification Number |

27-4306690

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

180 Grand Avenue

|

| Entity Address, Address Line Two |

6th Floor

|

| Entity Address, City or Town |

Oakland

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94612

|

| City Area Code |

877

|

| Local Phone Number |

962-7738

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

MQ

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

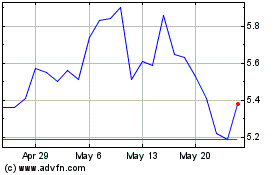

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

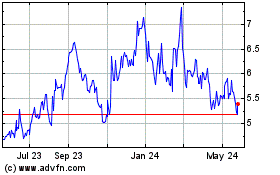

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Feb 2024 to Feb 2025