false

0001875558

0001875558

2025-02-25

2025-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

February 25, 2025

Nuvectis Pharma, Inc.

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction

of Incorporation) |

|

001-41264

(Commission File Number) |

|

86-2405608

(IRS Employer Identification No.) |

1 Bridge Plaza Suite 275

Fort Lee, NJ 07024

(Address of Principal Executive Offices)

(201) 614-3150

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the

Exchange Act:

| Title of Class |

Trading Symbol(s) |

Exchange Name |

| Common Stock |

NVCT |

Nasdaq Capital Market |

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act. |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2b under the Exchange Act. |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02. |

Results of Operations and Financial Condition. |

On February 25, 2025, Nuvectis

Pharma, Inc. issued a press release to provide a corporate update and to announce its financial results for the fiscal year ended December

31, 2024. A copy of such press release is being furnished as Exhibit 99.1 to this report.

The information, including

Exhibit 99.1, in this Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Form 8-K shall not

be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall otherwise be expressly set

forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

The following exhibit is furnished herewith:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Nuvectis Pharma, Inc. |

| |

(Registrant) |

| |

|

|

| Date: February 25, 2025 |

|

|

| |

By: |

/s/ Ron Bentsur |

| |

|

Ron Bentsur |

| |

|

Chairman, Chief Executive Officer and President |

Exhibit 99.1

Nuvectis Pharma, Inc. Reports 2024

Financial Results and Business Highlights

| · | NXP800 Phase 1b study in patients with platinum resistant, ARID1a-mutated ovarian cancer is ongoing; Orphan Drug Designation granted

by the U.S. FDA. Updated Phase 1b results anticipated in Q2 2025 |

| · | NXP900 Phase 1a dose escalation study continues to enroll, preparation for the start of the Phase 1b program is underway. Phase 1b

program expected to begin in mid-2025 |

| · | Follow-on offering completed in February 2025 extends cash runway into 2027 |

Fort Lee, NJ, February 25, 2025 (GLOBE NEWSWIRE)

- Nuvectis Pharma, Inc. (NASDAQ: NVCT) ("Nuvectis" or the "Company"), a clinical-stage biopharmaceutical company focused

on the development of innovative precision medicines for the treatment of serious conditions of unmet medical need in oncology, today

reported its financial results for the year ended December 31, 2024 and provided an update on recent business progress.

Ron Bentsur, Chairman and Chief Executive Officer of Nuvectis, commented,

“In 2024, Nuvectis made important progress in the development of our two clinical-stage drug candidates, NXP800 and NXP900. NXP800

was granted Orphan Drug Designation by the U.S. FDA for the treatment of ARID1a-deficient ovarian, fallopian tube and primary peritoneal

cancers. Enrollment is ongoing in the Phase 1b clinical trial, in which patients with platinum resistant, ARID1a-mutated ovarian cancer

are currently being treated with a dose of 75mg/day, on an intermittent dosing schedule. We intend to provide an update from this study

in the second quarter and plan to provide the first data from the investigator-initiated study in cholangiocarcinoma later this year.”

Mr. Bentsur continued, "For NXP900, enrollment continues in the

Phase 1a dose escalation clinical trial and we are pleased with the emerging clinical profile of NXP900, based on safety, pharmacokinetics

and pharmacodynamics information to date. In parallel, preparations are underway to begin the Phase 1b program in mid-year. This program

is designed to evaluate NXP900 as monotherapy in YES1/SRC-driven solid tumors, and in combination with EGFR and ALK inhibitors, in patients

with non-small cell lung cancer. Positive results could showcase NXP900’s potential broad applicability in these large oncology

markets.

Mr. Bentsur concluded, "Our successful follow-on offering, completed

this month, provided Nuvectis with $15.5M in gross proceeds, which extend our cash runway into 2027. Based on the continued progress with

the NXP800 and NXP900 programs, the strength and drug development expertise of our team, and expanded cash resources, I believe Nuvectis

is well-positioned to generate meaningful results in our clinical portfolio in 2025 and beyond."

Full Year 2024 Financial Results

Cash and cash equivalents were $18.5 million as of December 31, 2024,

compared to $19.1 million as of December 31, 2023. The decrease of $0.6 million was a result of the Company's continued operations, offset

by access to our at-the-market offering facility.

The Company's net loss was $19.0 million for the year ended December

31, 2024, compared to $22.3 million for the year ended December 31, 2023, a decrease in net loss of $3.3 million. Net loss for the 2024

fiscal year included $4.9 million in non-cash stock-based compensation.

Research and development expenses, including non-cash stock-based

compensation were $12.9 million for the year ended December 31, 2024, compared to $15.4 million for the year ended December 31, 2023,

a decrease of $2.5 million.

General and administrative expenses, including non-cash stock-based

compensation were $6.9 million for the year ended December 31, 2024, compared to $7.5 million for the year ended December 31, 2023, a

decrease of $0.6 million.

Interest income was $0.8 million for the year ended December 31, 2024,

compared to $0.6 million for the year ended December 31, 2023, an increase of $0.2 million.

About Nuvectis Pharma, Inc.

Nuvectis Pharma, Inc. is a biopharmaceutical company focused on the

development of innovative precision medicines for the treatment of serious conditions of unmet medical need in oncology. The Company is

currently developing two clinical-stage drug candidates, NXP800 and NXP900. NXP800 is an oral small molecule GCN2 activator currently

in a Phase 1b clinical trial for the treatment for platinum resistant, ARID1a-mutated ovarian carcinoma and in an Investigator-sponsored

clinical trial for the treatment of cholangiocarcinoma. NXP900 is an oral small molecule inhibitor of the SRC Family of Kinases (SFK),

including SRC and YES1. NXP900’s unique mechanism of action enables it to inhibit both the catalytic and scaffolding functions of

the SRC kinase thereby providing complete shutdown of the signaling pathway. NXP900 is currently in a Phase 1a dose escalation study.

For more information on Nuvectis, please visit our website at https://nuvectis.com/.

Forward Looking Statements

This press release contains "forward-looking statements"

within the meaning of the U.S. federal securities laws, which statements are subject to substantial risks and uncertainties. All statements,

other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained

in this press release may be identified by the use of words such as "anticipate”, "believe”, "contemplate”,

"could”, "estimate”, "expect”, "intend”, "seek”, "may”, "might”,

"plan”, "potential”, "predict”, "project”, "target”, "aim”, "should”,

"will”, "would”, or the negative of these words or other similar expressions, although not all forward-looking statements

contain these words. Forward-looking statements are based on Nuvectis Pharma, Inc.'s current expectations, including preclinical and clinical

safety and efficacy data generated to date for NXP800 and NXP900, estimates and projections about future events and trends that we believe

may affect our business, financial condition, results of operations, prospects, business strategy, and financial needs. The outcome of

the events described in these forward-looking statements are subject to inherent uncertainties, risks, assumptions, market and other conditions,

and other factors that are difficult to predict and include statements and data regarding the preclinical studies for NXP800 and NXP900,

and the Phase 1a data for NXP800 and the NXP900 Phase 1a study data to date, as well as the clinical expectations for the ongoing NXP800

Phase 1b study in platinum-resistant, ARID1a-mutated ovarian carcinoma, including the potential ability of the 75mg/day dose intensity

in the NXP800 Phase 1b study to generate satisfactory safety and efficacy results, statements regarding NXP800's potential ability to

become a therapeutic option for the treatment of platinum-resistant, ARID1a-mutated ovarian carcinoma, cholangiocarcinoma, and potentially

other cancer indications, and the timing for completion of the clinical trials, including the ongoing NXP800 Phase 1b study in platinum-resistant

ARID1a-mutated ovarian cancer and the investigator-initiated study in cholangiocarcinoma, and statements regarding NXP900's therapeutic

potential and the expected timing for the completion of the Phase 1a dose-escalation study and start of the NXP900 Phase 1b program. Further,

certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks

and uncertainties are subject to market and other conditions and described more fully in the section titled "Risk Factors" in

our 3Q 2024 Form 10-Q and our other public filings with the U.S. Securities and Exchange Commission ("SEC"). However, these

risks are not exhaustive and new risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks

and uncertainties that could have an impact on the forward-looking statements contained in this press release or other filings with the

SEC. Any forward-looking statements contained in this press release speak only as of the date of this press release. We expressly disclaim

any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect

any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may

be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995.

Company Contact

Ron Bentsur

Chairman, Chief Executive Officer and President

201-614-3151

rbentsur@nuvectis.com

Media Relations Contact

Christopher M. Calabrese

LifeSci Advisors

Tel: 917-680-5608

ccalabrese@lifesciadvisors.com

NUVECTIS PHARMA, INC.

BALANCE SHEETS

(USD in thousands, except per share and share

amounts)

| |

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Assets |

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

18,533 |

|

|

$ |

19,126 |

|

| Other current assets |

|

|

74 |

|

|

|

59 |

|

| TOTAL CURRENT ASSETS |

|

|

18,607 |

|

|

|

19,185 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

18,607 |

|

|

$ |

19,185 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payables |

|

$ |

2,498 |

|

|

$ |

2,771 |

|

| Accrued liabilities |

|

|

840 |

|

|

|

415 |

|

| Employee compensation and benefits |

|

|

5,556 |

|

|

|

3,798 |

|

| TOTAL CURRENT LIABILITIES |

|

|

8,894 |

|

|

|

6,984 |

|

| TOTAL LIABILITIES |

|

|

8,894 |

|

|

|

6,984 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Common Shares, $0.00001 par value – 60,000,000 shares authorized as of December 31, 2024, and December 31, 2023, 19,495,683, and 17,418,886 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively |

|

|

* |

|

|

|

* |

|

| Additional paid in capital |

|

|

82,958 |

|

|

|

66,446 |

|

| Accumulated deficit |

|

|

(73,245 |

) |

|

|

(54,245 |

) |

| TOTAL STOCKHOLDERS’ EQUITY |

|

|

9,713 |

|

|

|

12,201 |

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

18,607 |

|

|

$ |

19,185 |

|

| * | Represent amount lower than $1,000 USD. |

NUVECTIS PHARMA, INC.

STATEMENT OF OPERATIONS

(USD in thousands, except per share and share

amounts)

| | |

For the year ended | | |

For the year ended | |

| | |

December 31, 2024 | | |

December 31, 2023 | |

| OPERATING EXPENSES | |

| | | |

| | |

| Research and development | |

$ | 12,918 | | |

$ | 15,380 | |

| General and administrative | |

| 6,929 | | |

| 7,517 | |

| | |

| | | |

| | |

| OPERATING LOSS | |

| (19,847 | ) | |

| (22,897 | ) |

| Finance income | |

| 847 | | |

| 637 | |

| | |

| | | |

| | |

| NET LOSS | |

$ | (19,000 | ) | |

$ | (22,260 | ) |

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS | |

$ | (19,000 | ) | |

$ | (22,260 | ) |

| BASIC AND DILUTED NET LOSS PER COMMON SHARE OUTSTANDING | |

$ | (1.11 | ) | |

$ | (1.43 | ) |

| Basic and diluted weighted average number of common shares outstanding | |

| 17,113,169 | | |

| 15,556,655 | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

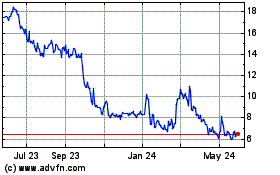

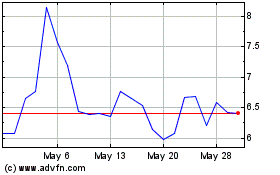

Nuvectis Pharma (NASDAQ:NVCT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nuvectis Pharma (NASDAQ:NVCT)

Historical Stock Chart

From Feb 2024 to Feb 2025