Pool Corporation (Nasdaq/GSM:POOL) today announced full year and

fourth quarter 2023 results.

“After a challenging start, we achieved our

second highest annual sales in company history of $5.5 billion

against a backdrop of unfavorable weather in the first half of the

year that delayed pool openings and a slowdown in new pool

construction as the housing market came to grips with elevated

interest rates. As the year progressed, we were able to adapt to

the demand environment and manage the business effectively. In

2023, we added fourteen greenfield and five acquired locations,

ending the year with 439 sales centers, showing our strategic

investment in organic growth to increase our customer reach and

create capacity for additional products and services, while

maintaining our industry-leading position. We also generated record

operating cash flows of $888.2 million and returned $473.8 million

to our shareholders in dividends and share repurchases. Looking

back on the year, I am proud of our team who remained focused on

delivering an outstanding customer experience, which enabled us to

outperform the industry through innovation, execution and

collaborative partnerships,” commented Peter D. Arvan, president

and CEO.

Year ended

December 31, 2023 compared to the

year ended December 31, 2022

Following a period of significant growth over

the prior three years, net sales decreased 10% to $5.5 billion in

2023 compared to $6.2 billion in 2022, resulting in a compound

annual growth rate (CAGR) of 15% from 2019 to 2023. Base business

results approximated consolidated results for the period. Our net

sales benefited approximately 3% to 4% from inflationary product

cost increases in 2023 versus a benefit of 10% in 2022. Unfavorable

weather conditions in certain markets throughout the first half of

the year resulted in a slow start to the swimming pool season and

slower maintenance activity than anticipated, limiting sales in the

first and second quarters. Our results were also impacted by lower

volumes of discretionary pool products sold due to reduced pool

construction activity and discretionary replacement activity.

Gross profit was $1.7 billion in 2023, a 14%

decrease from gross profit of $1.9 billion in 2022. Our gross

profit increased at a 16% CAGR from 2019 to 2023. Gross margin

declined 130 basis points to 30.0% in 2023 compared to 31.3% in

2022. Our 2023 gross margin is in line with our longer-term annual

gross margin outlook, while our prior year gross margin benefited

from higher levels of inflation and price increases.

Selling and administrative expenses (operating

expenses) increased 0.6%, or $5.8 million, to $913.5 million in

2023. As a percentage of net sales, operating expenses increased

180 basis points to 16.5% in 2023 compared to 14.7% in 2022. During

2023, volume-driven expenses were managed in line with lower sales,

and our largest expense growth drivers related to inflationary wage

increases, rent and facility costs and insurance and

healthcare-related costs.

Operating income for the year decreased 27% to

$746.6 million, down from $1.0 billion in 2022. Our operating

income increased at a 22% CAGR from 2019 to 2023. Operating margin

decreased 310 basis points to 13.5% in 2023 compared to 16.6% in

2022.

Interest and other non-operating expenses, net

for the year increased $17.5 million compared to 2022, as higher

average interest rates more than offset a decrease in average

debt.

We recorded a $6.7 million, or $0.17 per diluted

share, tax benefit from Accounting Standards Update (ASU) 2016-09,

Improvements to Employee Share-Based Payment Accounting, for the

year ended December 31, 2023 compared to a tax

benefit of $10.8 million, or $0.27 per diluted share, realized

in 2022.

Net income declined 30% to $523.2 million in

2023 compared to $748.5 million in 2022. Earnings per share

decreased 29% to $13.35 per diluted share compared to a record of

$18.70 per diluted share in 2022. Without the impact from ASU

2016-09 in both periods, earnings per diluted share decreased 28%

to $13.18 per diluted share compared to $18.43 per diluted share in

2022. From 2019 to 2023, our earnings per diluted share increased

by a 20% CAGR and a 23% CAGR without the impact from ASU

2016-19.

Adjusted EBITDA decreased 25% to $806.9 million

in 2023 compared to $1.1 billion in 2022 and was 14.6% of net sales

in 2023 compared to 17.5% of net sales in 2022.

Balance Sheet and Liquidity

On the balance sheet at December 31, 2023,

we ended the year with days sales outstanding ratio of 26.8, as

calculated on a trailing four quarters basis, consistent with 26.9

days at December 31, 2022. Inventory levels decreased 14% to

$1.4 billion, compared to $1.6 billion at December 31, 2022,

consistent with our inventory reduction goals and partially offset

by increases from early buy vendor deals that we took advantage of

in the last quarter of the year. Total debt outstanding decreased

$333.5 million to $1.1 billion as we have used operating cash flows

to reduce our debt.

Net cash provided by operations was a record

$888.2 million in 2023 compared to $484.9 million in 2022, an

increase of $403.4 million, primarily driven by positive

changes in working capital, particularly as we sold through our

prior year strategic inventory purchases, partially offset by lower

net income. Our 2023 operating cash flows funded our $333.5 million

debt reduction, $306.4 million in share repurchases, $167.5 million

in dividends paid to our shareholders and $71.6 million of

investments in capital expenditures and acquisitions.

Fourth quarter

ended December 31, 2023

compared to the fourth

quarter ended December 31,

2022

Net sales decreased 8% to $1.0 billion in the

fourth quarter of 2023 compared to $1.1 billion in the fourth

quarter of 2022. Base business results approximated consolidated

results for the period. Maintenance activities and demand for

non-discretionary products were stable. Lower sales during our

seasonally slowest time of year were largely attributable to softer

spending, particularly for discretionary products, as pool

construction-related activities remained tepid.

Gross profit decreased 7% to $293.8 million in

the fourth quarter of 2023 from $315.7 million in the same period

of 2022. Gross margin increased 50 basis points to 29.3% in

the fourth quarter of 2023 compared to 28.8% in the fourth quarter

of 2022. The change in gross margin between periods was consistent

with our expectation due to the impact of lower inflation from

vendor price increases compared to last year. While our gross

margin in the fourth quarter of 2022 benefited from higher levels

of inflation and price increases, it was also negatively impacted

120 basis points from $13.0 million recorded within Cost of sales

related to increased duties and tariffs for certain imported

chemicals.

Operating expenses increased 3% to $214.4

million in the fourth quarter of 2023 compared to $208.4 million in

the fourth quarter of 2022. As a percentage of net sales, operating

expenses were 21.4% in the fourth quarter of 2023 compared to 19.0%

in the same period of 2022.

Operating income in the fourth quarter of 2023

decreased 26% to $79.3 million compared to $107.3 million in the

same period of 2022. Operating margin decreased 190 basis points in

the fourth quarter.

Interest and other non-operating expenses in the

fourth quarter of 2023 decreased $3.4 million compared to the

fourth quarter of 2022, primarily due to a decrease in average debt

between periods.

We recorded an $0.8 million, or $0.02 per

diluted share, tax benefit from ASU 2016-09 in the fourth quarter

of 2023 compared to a tax benefit of $1.2 million,

or $0.03 per diluted share, realized in the fourth quarter of

2022. Net income decreased 28% in the fourth quarter of 2023 to

$51.4 million compared to $71.9 million in 2022. Earnings per

diluted share decreased 27% to $1.32 in the fourth quarter of 2023

compared to $1.82 for the same period in 2022. Without the impact

from the tax benefits discussed above in both periods, earnings per

diluted share decreased 27% to $1.30 compared to $1.79 in 2022.

2024 Outlook

“We have the privilege of serving a unique

industry that grows intrinsically; as new pools are built and added

to the installed base, including an estimated 75,000 pools built in

2023, demand for products to maintain and enhance these pools grows

too. These consistent additions to the installed base of swimming

pools and related upkeep, technological advancements and product

upgrade trends continue to be growth drivers for the outdoor living

industry. We are well-positioned and confident in our ability to

capitalize on these opportunities and continue our long-term trends

of consistent growth and exceptional shareholder returns. We expect

earnings for 2024 will be in the range of $13.10 to $14.10 per

diluted share, including an estimated $0.10 favorable impact from

ASU 2016-09,” added Arvan.

|

(Unaudited) |

|

|

2024 Earnings Guidance Range |

|

|

|

|

2023 |

|

Floor |

|

% Change |

|

|

Ceiling |

|

% Change |

|

Diluted EPS |

$ |

13.35 |

|

$ |

13.10 |

|

(2 |

)% |

|

$ |

14.10 |

|

6 |

% |

|

Less: ASU 2016-09 tax benefit |

|

0.17 |

|

|

0.10 |

|

|

|

|

|

0.10 |

|

|

|

Adjusted Diluted EPS |

$ |

13.18 |

|

$ |

13.00 |

|

(1 |

)% |

|

$ |

14.00 |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We estimate that we have approximately $3.8

million in unrealized tax benefits related to stock options that

will expire and restricted stock awards that will vest in the first

quarter of 2024, adding $0.10 in diluted earnings per share in that

period. We have included the estimated first quarter benefit in our

annual earnings guidance. We have not included any expected

benefits from additional tax benefits that could be recognized for

stock option exercises in 2024 from grants that expire in years

after 2024.

Non-GAAP Financial Measures

This press release contains certain non-GAAP

measures (adjusted EBITDA, adjusted diluted EPS and projected

adjusted diluted EPS). See the addendum to this release for

definitions of our non-GAAP measures and reconciliations of our

non-GAAP measures to GAAP measures.

About Pool Corporation

POOLCORP is the world’s largest wholesale

distributor of swimming pool and related backyard products. As of

December 31, 2023, POOLCORP operated 439 sales centers in

North America, Europe and Australia, through which it distributes

more than 200,000 products to roughly 125,000 wholesale customers.

For more information, please visit www.poolcorp.com.

Forward-Looking Statements

This news release includes “forward-looking”

statements that involve risks and uncertainties that are generally

identifiable through the use of words such as “believe,” “expect,”

“anticipate,” “intend,” “plan,” “estimate,” “project,” “should,”

“will,” “may,” and similar expressions and include projections of

earnings. The forward-looking statements in this release are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements speak

only as of the date of this release, and we undertake no obligation

to update or revise such statements to reflect new circumstances or

unanticipated events as they occur. Actual results may differ

materially due to a variety of factors, including the sensitivity

of our business to weather conditions; changes in economic

conditions, consumer discretionary spending, the housing market,

inflation or interest rates; our ability to maintain favorable

relationships with suppliers and manufacturers; the extent to which

home-centric trends will moderate or reverse; competition from

other leisure product alternatives or mass merchants; our ability

to continue to execute our growth strategies; changes in the

regulatory environment; new or additional taxes, duties or tariffs;

excess tax benefits or deficiencies recognized under ASU 2016-09

and other risks detailed in POOLCORP’s 2022 Annual Report on

Form 10-K, 2023 Quarterly Reports on Form 10-Q and other

reports and filings filed with the Securities and Exchange

Commission (SEC) as updated by POOLCORP’s subsequent filings with

the SEC.

Curtis J. Scheel

Director of Investor Relations

985.801.5341

curtis.scheel@poolcorp.com

|

POOL CORPORATIONConsolidated Statements of

Income(Unaudited) (In thousands, except per share

data) |

|

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

|

December 31, |

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

2023 |

|

2022 (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

1,003,050 |

|

|

$ |

1,095,920 |

|

$ |

5,541,595 |

|

$ |

6,179,727 |

|

|

Cost of sales |

|

709,275 |

|

|

|

780,189 |

|

|

3,881,551 |

|

|

4,246,315 |

|

|

Gross profit |

|

293,775 |

|

|

|

315,731 |

|

|

1,660,044 |

|

|

1,933,412 |

|

|

Percent |

|

29.3 |

% |

|

|

28.8 |

% |

|

30.0 |

% |

|

31.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative expenses |

|

214,431 |

|

|

|

208,436 |

|

|

913,477 |

|

|

907,629 |

|

|

Operating income |

|

79,344 |

|

|

|

107,295 |

|

|

746,567 |

|

|

1,025,783 |

|

|

Percent |

|

7.9 |

% |

|

|

9.8 |

% |

|

13.5 |

% |

|

16.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

Interest and other non-operating expenses, net |

|

12,104 |

|

|

|

15,482 |

|

|

58,431 |

|

|

40,911 |

|

|

Income before income taxes and equity in earnings |

|

67,240 |

|

|

|

91,813 |

|

|

688,136 |

|

|

984,872 |

|

|

Provision for income taxes |

|

15,745 |

|

|

|

20,076 |

|

|

165,084 |

|

|

236,763 |

|

|

Equity in earnings (loss) of unconsolidated investments, net |

|

(58 |

) |

|

|

126 |

|

|

177 |

|

|

353 |

|

| Net

income |

$ |

51,437 |

|

|

$ |

71,863 |

|

$ |

523,229 |

|

$ |

748,462 |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to common stockholders: (2) |

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.33 |

|

|

$ |

1.84 |

|

$ |

13.45 |

|

$ |

18.89 |

|

|

Diluted |

$ |

1.32 |

|

|

$ |

1.82 |

|

$ |

13.35 |

|

$ |

18.70 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

38,372 |

|

|

|

38,843 |

|

|

38,704 |

|

|

39,409 |

|

|

Diluted |

|

38,648 |

|

|

|

39,168 |

|

|

38,997 |

|

|

39,806 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per common share |

$ |

1.10 |

|

|

$ |

1.00 |

|

$ |

4.30 |

|

$ |

3.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Derived from audited financial statements.

(2) Earnings per share under the two-class method is

calculated using net income attributable to common stockholders

(net income reduced by earnings allocated to participating

securities), which was $51.2 million and $71.5 million for the

three months ended December 31, 2023 and December 31,

2022, respectively, and $520.5 million and $744.3 million for the

years ended December 31, 2023 and December 31, 2022,

respectively. Participating securities excluded from weighted

average common shares outstanding were 204,000 and 216,000 for the

three months ended December 31, 2023 and December 31,

2022, respectively, and 207,000 and 221,000 for the years ended

December 31, 2023 and December 31, 2022,

respectively.

|

|

POOL CORPORATIONCondensed Consolidated

Balance Sheets(Unaudited)(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

Change |

|

|

|

2023 |

|

2022 (1) |

|

$ |

|

% |

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

66,540 |

|

$ |

45,591 |

|

$ |

20,949 |

|

|

46 |

% |

|

|

Receivables, net (2) |

|

145,723 |

|

|

128,247 |

|

|

17,476 |

|

|

14 |

|

|

|

Receivables pledged under receivables facility |

|

197,187 |

|

|

223,201 |

|

|

(26,014 |

) |

|

(12 |

) |

|

|

Product inventories, net (3) |

|

1,365,466 |

|

|

1,591,060 |

|

|

(225,594 |

) |

|

(14 |

) |

|

|

Prepaid expenses and other current assets |

|

40,444 |

|

|

30,892 |

|

|

9,552 |

|

|

31 |

|

|

Total current assets |

|

1,815,360 |

|

|

2,018,991 |

|

|

(203,631 |

) |

|

(10 |

) |

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

223,929 |

|

|

193,709 |

|

|

30,220 |

|

|

16 |

|

|

Goodwill |

|

700,078 |

|

|

691,993 |

|

|

8,085 |

|

|

1 |

|

|

Other intangible assets, net |

|

298,282 |

|

|

305,450 |

|

|

(7,168 |

) |

|

(2 |

) |

|

Equity interest investments |

|

1,305 |

|

|

1,248 |

|

|

57 |

|

|

5 |

|

|

Operating lease assets |

|

305,688 |

|

|

269,608 |

|

|

36,080 |

|

|

13 |

|

|

Other assets |

|

83,426 |

|

|

84,438 |

|

|

(1,012 |

) |

|

(1 |

) |

|

Total assets |

$ |

3,428,068 |

|

$ |

3,565,437 |

|

$ |

(137,369 |

) |

|

(4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

508,672 |

|

$ |

406,667 |

|

$ |

102,005 |

|

|

25 |

% |

|

|

Accrued expenses and other current liabilities |

|

134,676 |

|

|

168,521 |

|

|

(33,845 |

) |

|

(20 |

) |

|

|

Short-term borrowings and current portion of long-term debt |

|

38,203 |

|

|

25,042 |

|

|

13,161 |

|

|

53 |

|

|

|

Current operating lease liabilities |

|

89,215 |

|

|

75,484 |

|

|

13,731 |

|

|

18 |

|

|

Total current liabilities |

|

770,766 |

|

|

675,714 |

|

|

95,052 |

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income taxes |

|

67,421 |

|

|

58,759 |

|

|

8,662 |

|

|

15 |

|

|

Long-term debt, net |

|

1,015,117 |

|

|

1,361,761 |

|

|

(346,644 |

) |

|

(25 |

) |

|

Other long-term liabilities |

|

40,028 |

|

|

35,471 |

|

|

4,557 |

|

|

13 |

|

|

Non-current operating lease liabilities |

|

221,949 |

|

|

198,538 |

|

|

23,411 |

|

|

12 |

|

|

Total liabilities |

|

2,115,281 |

|

|

2,330,243 |

|

|

(214,962 |

) |

|

(9 |

) |

|

Total stockholders’ equity |

|

1,312,787 |

|

|

1,235,194 |

|

|

77,593 |

|

|

6 |

|

|

Total liabilities and stockholders’ equity |

$ |

3,428,068 |

|

$ |

3,565,437 |

|

$ |

(137,369 |

) |

|

(4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Derived from audited financial statements.

(2) The allowance for doubtful accounts was $11.7 million

at December 31, 2023 and $9.5 million at December 31,

2022.

(3) The inventory reserve was $23.5 million at

December 31, 2023 and $21.2 million at December 31,

2022.

|

POOL CORPORATIONCondensed Consolidated

Statements of Cash Flows(Unaudited)(In thousands) |

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

2023 |

|

|

2022 (1) |

|

Change |

|

Operating activities |

|

|

|

|

|

| Net

income |

$ |

523,229 |

|

|

$ |

748,462 |

|

|

$ |

(225,233 |

) |

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

Depreciation |

|

31,585 |

|

|

|

30,381 |

|

|

|

1,204 |

|

|

|

Amortization |

|

8,555 |

|

|

|

8,644 |

|

|

|

(89 |

) |

|

|

Share-based compensation |

|

19,582 |

|

|

|

14,879 |

|

|

|

4,703 |

|

|

|

Equity in earnings of unconsolidated investments, net |

|

(177 |

) |

|

|

(353 |

) |

|

|

176 |

|

|

|

Net

(gain) loss on foreign currency transactions |

|

(813 |

) |

|

|

48 |

|

|

|

(861 |

) |

|

|

Goodwill impairment |

|

550 |

|

|

|

605 |

|

|

|

(55 |

) |

|

|

Other |

|

14,369 |

|

|

|

24,563 |

|

|

|

(10,194 |

) |

|

Changes in operating assets and liabilities, net of effects of

acquisitions: |

|

|

|

|

|

|

|

Receivables |

|

10,108 |

|

|

|

19,685 |

|

|

|

(9,577 |

) |

|

|

Product inventories |

|

231,240 |

|

|

|

(263,567 |

) |

|

|

494,807 |

|

|

|

Prepaid expenses and other assets |

|

57,840 |

|

|

|

(52,815 |

) |

|

|

110,655 |

|

|

|

Accounts payable |

|

96,128 |

|

|

|

7,597 |

|

|

|

88,531 |

|

|

|

Accrued expenses and other liabilities |

|

(103,967 |

) |

|

|

(53,275 |

) |

|

|

(50,692 |

) |

| Net

cash provided by operating activities |

|

888,229 |

|

|

|

484,854 |

|

|

|

403,375 |

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

Acquisition of businesses, net of cash acquired |

|

(11,533 |

) |

|

|

(9,264 |

) |

|

|

(2,269 |

) |

|

Purchase of property and equipment, net of sale proceeds |

|

(60,096 |

) |

|

|

(43,619 |

) |

|

|

(16,477 |

) |

|

Other investments, net |

|

32 |

|

|

|

2,013 |

|

|

|

(1,981 |

) |

| Net

cash used in investing activities |

|

(71,597 |

) |

|

|

(50,870 |

) |

|

|

(20,727 |

) |

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

Proceeds from revolving line of credit |

|

1,548,618 |

|

|

|

1,917,173 |

|

|

|

(368,555 |

) |

|

Payments on revolving line of credit |

|

(1,815,829 |

) |

|

|

(1,970,388 |

) |

|

|

154,559 |

|

|

Proceeds from term loan under credit facility |

|

— |

|

|

|

250,000 |

|

|

|

(250,000 |

) |

|

Payments on term loan under credit facility |

|

(12,500 |

) |

|

|

— |

|

|

|

(12,500 |

) |

|

Proceeds from asset-backed financing |

|

552,500 |

|

|

|

220,000 |

|

|

|

332,500 |

|

|

Payments on asset-backed financing |

|

(560,300 |

) |

|

|

(205,500 |

) |

|

|

(354,800 |

) |

|

Payments on term facility |

|

(47,313 |

) |

|

|

(9,250 |

) |

|

|

(38,063 |

) |

|

Proceeds from short-term borrowings and current portion of

long-term debt |

|

19,998 |

|

|

|

28,445 |

|

|

|

(8,447 |

) |

|

Payments on short-term borrowings and current portion of long-term

debt |

|

(19,338 |

) |

|

|

(27,675 |

) |

|

|

8,337 |

|

|

Payments of deferred acquisition consideration |

|

(551 |

) |

|

|

(1,374 |

) |

|

|

823 |

|

|

Payments of deferred financing costs |

|

(52 |

) |

|

|

(170 |

) |

|

|

118 |

|

|

Proceeds from stock issued under share-based compensation

plans |

|

10,455 |

|

|

|

8,934 |

|

|

|

1,521 |

|

|

Payments of cash dividends |

|

(167,461 |

) |

|

|

(150,624 |

) |

|

|

(16,837 |

) |

|

Repurchases of common stock |

|

(306,359 |

) |

|

|

(471,229 |

) |

|

|

164,870 |

|

| Net

cash used in financing activities |

|

(798,132 |

) |

|

|

(411,658 |

) |

|

|

(386,474 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

2,449 |

|

|

|

(1,056 |

) |

|

|

3,505 |

|

|

Change in cash and cash equivalents |

|

20,949 |

|

|

|

21,270 |

|

|

|

(321 |

) |

|

Cash and cash equivalents at beginning of period |

|

45,591 |

|

|

|

24,321 |

|

|

|

21,270 |

|

|

Cash and cash equivalents at end of period |

$ |

66,540 |

|

|

$ |

45,591 |

|

|

$ |

20,949 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Derived from audited financial statements.

ADDENDUM

Base Business

When calculating our base business results, we exclude sales

centers that are acquired, opened in new markets or closed for a

period of 15 months. We also exclude consolidated sales centers

when we do not expect to maintain the majority of the existing

business and existing sales centers that are consolidated with

acquired sales centers.

We generally allocate corporate overhead

expenses to excluded sales centers on the basis of their net sales

as a percentage of total net sales. After 15 months, we include

acquired, consolidated and new market sales centers in the base

business calculation including the comparative prior year

period.

We have not provided separate base business

income statements within this press release as our base business

results for the quarter and year ended December 31, 2023 closely

approximated our consolidated reported results for the same

periods, and acquisitions and sales centers excluded from base

business contributed less than 1% to the change in net sales.

The table below summarizes the changes in our sales centers

during 2023.

|

December 31, 2022 |

420 |

|

Acquired locations |

5 |

|

New locations |

14 |

|

December 31, 2023 |

439 |

|

|

|

Reconciliation of Non-GAAP Financial

Measures

The non-GAAP measures described below should be considered in

the context of all of our other disclosures in this press

release.

Adjusted EBITDA

We define Adjusted EBITDA as net income or net

loss plus interest and other non-operating expenses, income taxes,

depreciation, amortization, share-based compensation, goodwill and

other impairments and equity in earnings or loss of unconsolidated

investments. Other companies may calculate Adjusted EBITDA

differently than we do, which may limit its usefulness as a

comparative measure.

Adjusted EBITDA is not a measure of performance

as determined by generally accepted accounting principles (GAAP).

We believe Adjusted EBITDA should be considered in addition to, not

as a substitute for, operating income or loss, net income or loss,

net cash flows provided by or used in operating, investing and

financing activities or other income statement or cash flow

statement line items reported in accordance with GAAP.

We have included Adjusted EBITDA as a

supplemental disclosure because management uses it to monitor our

performance, and we believe that it is widely used by our

investors, industry analysts and others as a useful supplemental

performance measure. We believe that Adjusted EBITDA, when viewed

with our GAAP results and the accompanying reconciliations,

provides an additional measure that enables management and

investors to monitor factors and trends affecting our ability to

service debt, pay taxes and fund capital expenditures.

The table below presents a reconciliation of net

income to Adjusted EBITDA.

|

(Unaudited) |

Year Ended December 31, |

| (in

thousands) |

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

| Net

income |

$ |

523,229 |

|

|

$ |

748,462 |

|

|

|

Add: |

|

|

|

|

|

Interest and other non-operating expenses (1) |

|

59,244 |

|

|

|

40,863 |

|

|

|

Provision for income taxes |

|

165,084 |

|

|

|

236,763 |

|

|

|

Share-based compensation |

|

19,582 |

|

|

|

14,879 |

|

|

|

Equity in earnings of unconsolidated investments, net |

|

(177 |

) |

|

|

(353 |

) |

|

|

Goodwill impairment |

|

550 |

|

|

|

605 |

|

|

|

Depreciation |

|

31,585 |

|

|

|

30,381 |

|

|

|

Amortization (2) |

|

7,824 |

|

|

|

7,826 |

|

|

Adjusted EBITDA |

$ |

806,921 |

|

|

$ |

1,079,426 |

|

|

|

|

|

|

|

|

|

|

(1) Shown net of (gains) losses on foreign currency

transactions of $(813) for 2023 and $48 for 2022. (2) Excludes

amortization of deferred financing costs of $731 for 2023 and $818

for 2022, which is included in Interest and other non-operating

expenses, net on the Consolidated Statements of Income.

Adjusted Diluted EPS

We have included adjusted diluted EPS, a

non-GAAP financial measure, in this press release as a supplemental

disclosure, because we believe this measure is useful to

management, investors and others in assessing our

period-over-period operating performance.

Adjusted diluted EPS is a key measure used by

management to demonstrate the impact of tax benefits from ASU

2016-09 on our diluted EPS and to provide investors and others with

additional information about our potential future operating

performance to supplement GAAP measures.

We believe this measure should be considered in

addition to, not as a substitute for, diluted EPS presented in

accordance with GAAP, and in the context of our other disclosures

in this press release. Other companies may calculate this non-GAAP

financial measure differently than we do, which may limit its

usefulness as a comparative measure.

The table below presents a reconciliation of diluted EPS to

adjusted diluted EPS.

|

|

Three Months Ended |

|

Year Ended |

|

(Unaudited) |

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Diluted EPS |

$ |

1.32 |

|

$ |

1.82 |

|

$ |

13.35 |

|

$ |

18.70 |

|

Less: ASU 2016-09 tax benefit |

|

0.02 |

|

|

0.03 |

|

|

0.17 |

|

|

0.27 |

|

Adjusted diluted EPS |

$ |

1.30 |

|

$ |

1.79 |

|

$ |

13.18 |

|

$ |

18.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted 2024

Diluted EPS Guidance

Please see page 3 for a reconciliation of

projected 2024 diluted EPS to adjusted projected 2024 diluted EPS.

We have included adjusted projected 2024 diluted EPS, which is a

non-GAAP financial measure, in this press release as a supplemental

disclosure to demonstrate the impact of projected tax benefits from

ASU 2016-09 on our projected 2024 diluted EPS and to provide

investors and others with additional information about our

potential future operating performance. We believe adjusted

projected 2024 diluted EPS should be considered in addition to, not

as a substitute for, projected 2024 diluted EPS presented in

accordance with GAAP and in the context of our other

forward-looking and cautionary statements in this press

release.

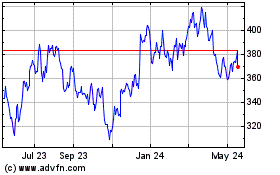

Pool (NASDAQ:POOL)

Historical Stock Chart

From Jan 2025 to Feb 2025

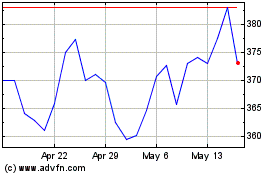

Pool (NASDAQ:POOL)

Historical Stock Chart

From Feb 2024 to Feb 2025