UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment

No. 1)

AMMO, INC.

(Name

of Issuer)

Common Stock, par value $0.001 per share

(Title

of Class of Securities)

00175J107

(CUSIP

Number)

Steven

F. Urvan

c/o

Ammo, Inc.

7681 E.

Gray Rd.

Scottsdale, AZ

85260

(480)

947-0001

Copies

to:

Brian

A. Teras, Esq

Arnall

Golden Gregory LLP

171

17th

Street, Suite 2100

Atlanta, GA

30363

(Name,

Address and Telephone Number of Person Authorized to

Receive

Notices and Communications)

November 9, 2021

(Date

of Event which Requires Filing of this Statement)

If the

filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box

[ ]

The

information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or

otherwise subject to the liabilities of that section of the Act but

shall be subject to all other provisions of the Act

(however, see the

Notes).

|

1

|

NAME OF

REPORTING PERSON

|

|

|

|

|

|

Steven

F. Urvan

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

|

|

|

(a)

[ ]

|

|

|

(b)

[ ]

|

|

3

|

SEC USE

ONLY

|

|

|

|

|

4

|

SOURCE

OF FUNDS*

|

|

|

|

|

|

OO

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

|

|

|

|

|

[ ]

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

|

|

|

|

|

|

United

States

|

|

|

7

|

SOLE

VOTING POWER

|

|

|

|

|

|

NUMBER

OF

|

|

20,010,000

|

|

SHARES

|

8

|

SHARED

VOTING POWER

|

|

BENEFICIALLY

|

|

|

|

OWNED

BY

|

|

0

|

|

EACH

|

9

|

SOLE

DISPOSITIVE POWER

|

|

REPORTING

|

|

|

|

PERSON

|

|

20,010,000

|

|

WITH

|

10

|

SHARED

DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

|

|

|

|

|

|

20,010,000

(1)

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

|

|

|

|

|

|

[ ]

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

17.38%(2)

|

|

14

|

TYPE OF

REPORTING PERSON (See Instructions)

|

|

|

|

|

|

IN

|

1.

Consists

of 20,010,000 shares of common stock of the Issuer held directly by

Mr. Urvan.

2.

Percentage

of class based on 115,113,016 total outstanding shares of common

stock of the Issuer as reported in the Issuer’s Form 10-Q

filed on November 15, 2021.

This

Amendment No. 1 amends and supplements the Schedule 13D filed by

Steven F. Urvan (“Mr. Urvan”) on May 10, 2021 (the

“Schedule 13D”). Each Item below amends and supplements

the information disclosed under the corresponding Item of the

Schedule 13D. Unless otherwise indicated herein, capitalized terms

used but not defined in this Amendment No. 1 shall have the same

meaning herein as are ascribed to such terms in the Schedule 13D.

Item 1 Security and Issuer.

The

statement (“Statement”) relates to shares of common

stock, par value $0.001 per share (the “Common Stock”),

of Ammo, Inc., a Delaware corporation (the “Issuer”).

The principal executive office of the Issuer is located at 7681 E.

Gray Rd., Scottsdale, AZ 85260.

Item 2 Identity and Background.

Mr.

Urvan’s present principal occupation or employment is serving

as Chief Strategy Officer of the Issuer. Mr. Urvan is a United

States citizen. The business address of Mr. Urvan is c/o Ammo,

Inc., 7681 E. Gray Rd., Scottsdale, AZ 85260.

During

the last five years Mr. Urvan has not (i) been convicted in a

criminal proceeding (excluding traffic violations or similar

misdemeanors); or (ii) been a party to a civil proceeding of a

judicial or administrative body of competent jurisdiction as a

result of which proceeding he was or is subject to a judgment,

decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such

laws.

Item 3 Source and Amount of Funds or Other

Consideration.

Mr.

Urvan acquired 20,000,000 shares of Common Stock pursuant to an

Agreement and Plan of Merger, dated as of April 30, 2021 (the

“Merger Agreement”), by and among Mr. Urvan, Gemini

Direct Investments, LLC (“Gemini”), the Issuer and

SpeedLight Group I, LLC (“Merger Sub”), whereby Merger

Sub merged (the “Merger”) with and into Gemini, with

Merger Sub surviving the merger as a wholly owned subsidiary of the

Issuer. Pursuant to the Merger Agreement, the Issuer acquired from

Mr. Urvan 100% of the equity of Gemini which owns 100% of the

Gunrboker.com business (the

“Acquisition”).

As

consideration for the Acquisition, on April 30, 2021, (i) the

Issuer assumed an aggregate amount of indebtedness of Gemini and

its subsidiaries equal to $50,000,000; and, (ii) the issued and

outstanding membership interests in Gemini, held by Mr. Urvan,

automatically converted into the right to receive (A) $50,000,000,

and (B) 20,000,000 shares of Common Stock of the Issuer, $0.001 par

value per share (the “Stock Consideration”). The Stock

Consideration consisted of: (a) 14,500,000 shares issued without

being held in escrow or requiring prior stockholder approval (the

“Initial Shares”); (b) 4,000,000 shares issued subject

to a Pledge and Escrow Agreement as described below (the

“Pledged Securities”); and (c) 1,500,000 shares whose

issuance was contingent upon stockholder approval for the issuance

(the “Additional Securities”). The issuance of the

Additional Securities was approved at the Issuer’s 2021

Annual Meeting of Shareholders and were issued on November 9, 2021

in accordance with the terms of the Merger Agreement.

Further,

on October 5, 2021, the Issuer granted Mr. Urvan 10,000 shares of

restricted Common Stock of the Issuer. The restricted shares were

issued as compensation for Mr. Urvan’s service as a member of

the Board of Directors of the Issuer.

Item 4 Purpose of Transaction.

Mr.

Urvan intends to participate in and influence the affairs of the

Issuer through the exercise of voting rights with respect to shares

of the Issuer’s common stock. In additional, Mr. Urvan will

influence the affairs of the Issuer in his capacity as Chief

Strategy Officer and as a member of the Board of Directors. Mr.

Urvan intends to review the performance of his investments and

consider or explore a variety of alternatives, including with

limitation, the acquisition of additional securities of the Issuer,

or the disposition of securities of the Issuer.

Mr.

Urvan does not have any current plans or proposals which relate to

or would result in: (a) an extraordinary corporate transaction,

such as a merger, reorganization or liquidation, involving the

Issuer or any of its subsidiaries; (b) a sale or transfer of a

material amount of assets of the Issuer or any of its subsidiaries;

(c) any change in the present board of directors or management of

the Issuer, including any plans or proposals to change the number

or term of directors or to fill any existing vacancies on the

board; (d) any material change in the present capitalization or

dividend policy of the Issuer; (e) any other material change in the

Issuer’s business or corporate structure; (f) any change in

the Issuer’s charter, bylaws or instruments corresponding

thereto or other actions which may impede the acquisition of

control of the Issuer by any person; (g) causing a class of

securities of the Issuer to be delisted from a national securities

exchange or to cease to be authorized to be quoted in an

inter-dealer quotation system of a registered national securities

association; (h) a class of equity securities of the Issuer

becoming eligible for termination of registration pursuant to

section 12(g)(4) of the Exchange Act; or (i) any action similar to

any of those enumerated above.

Item 5 Interest in Securities of the Issuer.

(a) As

of the date hereof, Mr. Urvan beneficially owns 20,010,000 shares

(the “Shares”) of the issued and outstanding

Common Stock of the Issuer. Such amount represents approximately

17.38% of the total of the issued and outstanding shares of the

Issuer’s Common Stock as of the date hereof.

(b) Mr.

Urvan holds sole voting and dispositive power over the Initial

Shares and the Additional Securities. Pursuant to the Pledge and

Escrow Agreement and the Company Lock-Up Agreement (as described

below), Mr. Urvan has sole voting rights with respect to the

Pledged Securities but may not sell or transfer the Pledged

Securities without the consent of the Issuer, until such

restrictions are removed pursuant to the terms of the Pledge and

Escrow Agreement and the Lock-Up Agreement.

(c)

Other than disclosed above, there were no transactions by Mr. Urvan

in the Issuer’s Common Stock during the last 60

days.

(d) No

other person is known to have the right to receive, or the power to

direct the receipt of, dividends from, or the proceeds from the

sale of, the securities of the Issuer owned by Mr.

Urvan.

(e) Not

applicable.

Item 6 Contracts, Agreements, Understandings or Relationships With

Respect to Securities of the Issuer.

Pledge

and Escrow Agreement

On

April 30, 2021, in connection with the Merger Agreement, the Issuer

and Mr. Urvan entered into a Pledge and Escrow Agreement (the

“Pledge and Escrow Agreement”). In order to secure the

fulfilment of Mr. Urvan’s indemnification obligations set

forth in the Merger Agreement, Mr. Urvan agreed to irrevocably

pledge and grant to the Issuer a continuing lien and security

interest in and to the Pledged Securities. Mr. Urvan retained his

voting rights with regard to the Pledged Securities.

Company

Lock-Up Agreement

On

April 30, 2021, in connection with the Merger Agreement, the Issuer

and Mr. Urvan entered into a Lock-Up Agreement (the “Company

Lock-Up Agreement”), pursuant to which, until the Pledged

Securities are released in accordance with the terms of the Company

Lock-Up, the Pledged Securities shall not be sold or transferred by

Mr. Urvan without the prior written consent of the

Issuer.

Voting

Agreement

On

April 30, 2021, in connection with the Merger Agreement, the Issuer

and Mr. Urvan entered into a Voting Agreement (the “Voting

Agreement”) containing the terms previously disclosed on the

Schedule 13D. The Voting Agreement terminated on October 30, 2021

in accordance with its terms.

Standstill

Agreement

On

April 30, 2021, in connection with the Merger Agreement, the Issuer

and Mr. Urvan entered into a Standstill Agreement (the

“Standstill Agreement”), whereby for a one-year period

(the “Standstill Period”), Mr. Urvan agreed not to,

among other things, make, effect, initiate, cause or participate in

(i) any acquisition of any securities of the Issuer or any

securities of any subsidiary or other affiliate or associate of the

Issuer if such acquisition would result in Mr. Uvan and his

affiliates and associates collectively beneficially owning

twenty-five percent (25%) or more of the then issued and

outstanding shares of common stock of the Issuer, (ii) any Company

Acquisition Transaction (as this term is defined in the Standstill

Agreement), or (iii) any “solicitation” of

“proxies” (as those terms are defined in Rule 14a-1 of

the General Rules and Regulations under the Exchange Act) or

consents with respect to any securities of the Issuer.

Investor

Rights Agreement

On

April 30, 2021, in connection with the Merger Agreement, the Issuer

and Mr. Urvan entered into an Investor Rights Agreement (the

“Investor Rights Agreement”). The Investor Rights

Agreement required the Issuer to use its commercially reasonable

efforts to register 10 million shares of the Stock Consideration

(the “Registration Shares”) for resale on a

registration statement to be filed with the Securities and Exchange

Commission (the “SEC”), under the Securities Act of

1933, as amended (the “Securities Act”), within ninety

(90) days following April 30, 2021. On July 29, 2021, the Issuer

filed a registration statement on Form S-3 with the SEC registering

the Registration Shares as required by the terms of the Investor

Rights Agreement.

The

Issuer also agreed in the Investor Rights Agreement to provide Mr.

Urvan with demand registration rights in connection with the other

shares received by Mr. Urvan as part of the Stock Consideration,

including the Pledged Securities (to the extent released and

delivered to Mr. Urvan in accordance with the terms of the Merger

Agreement) and the Additional Securities.

Item 7 Material to be Filed as Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true,

complete and correct.

|

Date:

November 30, 2021

|

|

|

|

|

|

/s/

Steven F. Urvan

|

|

|

Steven

F. Urvan

|

|

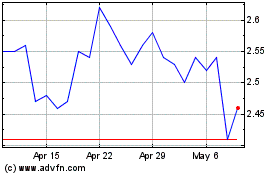

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

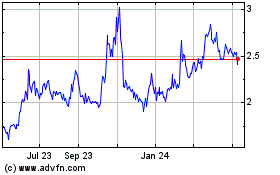

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Apr 2023 to Apr 2024