AMMO, Inc. (Nasdaq: POWW, POWWP) (“AMMO” or the “Company”), the

owner of GunBroker.com, the largest online marketplace serving the

firearms and shooting sports industries, and a leading vertically

integrated producer of high-performance ammunition and components,

today reported results for its second quarter of fiscal 2023, ended

September 30, 2022.

Second Quarter Fiscal 2023 vs. First Quarter Fiscal

2022

| |

● |

Net Revenues decreased 21% to

$48.3 million. |

| |

● |

Gross profit margin of

approximately 26.6%. |

| |

● |

Adjusted EBITDA of $8.2 million

compared to $24.0 million. |

| |

● |

Net loss of ($0.8) million,

compared to net income of $14.1 million. |

| |

● |

Diluted EPS of ($0.01), compared

to $0.11. |

| |

● |

Adjusted EPS of $0.05, compared

to $0.17. |

GunBroker.com “Marketplace” Metrics – Second Quarter

2023

| |

● |

Marketplace revenue of

approximately $14.6 million. |

| |

● |

New user growth averaged 36,000

per month. |

| |

● |

Average take rate increased to

5.3% compared to 5.0% in fiscal 2022. |

“This past quarter witnessed AMMO’s on-time and

within budget grand opening of its new 185,000 square foot

Wisconsin manufacturing facility. Our new plant is running

smoothly, and we are diligently working to bring it to its full

operational production capacity, to meet commercial demand and

satisfy the understandably stringent technical and timeline

requirements set out by our US military partners. Additionally, we

continue on our charted path to strategically and continually

optimize the GunBroker.com Marketplace to ensure it fully addresses

our customers’ needs while leveraging that amazing platform to

drive more revenue and increase earnings quarter over quarter. We

are also pleased to have resolved the proxy contest issues and

double the teams’ focus on the operational and financial tasks at

hand. Namely, to provide optimal shareholder value as we endeavor

to continue to position ourselves as leaders in the ammunition and

firearms business, both as a manufacturer and operator of the

premier outdoor and shooting sports Marketplace”, commented Fred

Wagenhals, AMMO’s Chairman and CEO.

Second Quarter 2023 Results

We ended our second fiscal quarter increasing

our ending cash by nearly 25% to $29 million. Current assets

increased to approximately to $133M, while decreasing current

liabilities to $32M. In total for the quarter, we had $424M in

total assets, $47M in Liabilities and $377M in shareholders equity.

This compares to our most recent year-end with $414M in total

assets, $40M in Liabilities and $374M in shareholders equity.

Total revenues for the second fiscal quarter

were approximately $48.3M in comparison to approximately $61M in

the prior year quarter - this was a decrease of 21% from the prior

year quarter.

This decrease is in line with the industry

decline of our peers of 23% quarter over quarter. The performance

of our manufacturing operations has softened with the market and

the move into our new facility brought production offline for a

longer period than originally anticipated, notwithstanding

extensive planning undertaken months in advance of the plant move.

GunBroker.com also saw a softening in the marketplace revenue as

well of approximately 13%.

Our COGS was approximately $35.5M for the

quarter compared to $34.8M in the comparable prior year quarter. In

this quarter, the manufacturing operations were forced to absorb a

significant increase in commodity pricing across the board, coupled

with a dramatic increase in shipping costs. We have seen commodity

pricing beginning to fall to a more “new” normalized level which we

believe should have a significant impact on margin in our fourth

fiscal quarter. Accordingly, this resulted in a gross margin of

$12.8M compared to $26.2M.

Coupled with the reduction in sales, the Company

also faced impactful one-time like legal expenses related to the

proxy contest as well as increased expenses related to the

following:

| ● |

Higher commodity costs |

| ● |

Substantially increased freight

costs |

| ● |

Stock compensation |

| ● |

Corporate insurance, and |

| ● |

Payroll |

We will also unfortunately see increased legal

expenses, advisory service billings and other expenses impact us

next quarter directly related to the proxy contest.

For the quarter, we recorded Adjusted EBITDA of

approximately $8.2M, compared to prior year quarter Adjusted EBITDA

of $20.1M. This resulted in a loss per share of $0.01 or adjusted

net Income per share of $0.05 in comparison to earnings per share

of $0.11 and adjusted net income per share of $0.17.

To address these increased costs, we have

already implemented expense reductions of approximately $5M in

savings on an annualized basis for payroll related expenses. We are

continuing to make cost cutting measures that we believe will not

impact future growth of our Company. At the same time, AMMO and the

market expect to see the stabilization of commodity pricing while

our new plant continues to measurably increase production capacity

from approximately 400M rounds at the end of our most recent fiscal

year to rounds to approximately 1 Billion rounds and better absorb

manufacturing related expenses which drive down cost of goods and

thus increase gross profit. These reductions are designed to

benefit both our profit margin and net income.

Also, as you have seen in recent our recent

public announcements, we are implementing several marketplace

enhancements at GunBroker.com which are designed to drive revenue

and gross profit while significantly improving the users’ overall

experience such as in-house ACH/Credit card processing, loyalty

programs, data analytics offerings, as well as carting ability on

the site. Management has been working on these leveraging

opportunities and a suite of others since the acquisition of

GunBroker.com

Outlook

We are reducing our guidance for our 2023 Fiscal

Year to revenues in the range of $220 million to $240 million,

EBITDA in the range of $30 million to $40 million and Adjusted

EBITDA in the range of $50 million to $60 million.

Conference Call

Management will host a conference call to

discuss the Company’s Fiscal second quarter 2023 results at 5:00

p.m. ET today, November 14th, 2022.

Investors interested in participating in the

live conference call or audio-only webcast, may join by dialing

1-866-777-2509 (domestic), 1-412-317-5413 (international), or via

webcast https://dpregister.com/sreg/10172810/f4f769018a. Please

join at least 5-10 minutes prior to the scheduled start and follow

the operator’s instructions. When requested, please ask for “AMMO,

Inc. Second Quarter 2023 Conference Call.”

About AMMO, Inc.

With its corporate offices headquartered in

Scottsdale, Arizona, AMMO designs and manufactures products for a

variety of aptitudes, including law enforcement, military, sport

shooting and self-defense. The Company was founded in 2016 with a

vision to change, innovate and invigorate the complacent munitions

industry. AMMO promotes branded munitions as well as its patented

STREAK™ Visual Ammunition, /stelTH/™ subsonic munitions, and

specialty rounds for military use via government programs. For more

information, please visit: www.ammo-inc.com.

About GunBroker.com

GunBroker.com is the largest online marketplace

dedicated to firearms, hunting, shooting and related products.

Aside from merchandise bearing its logo, GunBroker.com currently

sells none of the items listed on its website. Third-party sellers

list items on the site and Federal and state laws govern the sale

of firearms and other restricted items. Ownership policies and

regulations are followed using licensed firearms dealers as

transfer agents. Launched in 1999, GunBroker.com is an informative,

secure and safe way to buy and sell firearms, ammunition, air guns,

archery equipment, knives and swords, firearms accessories and

hunting/shooting gear online. GunBroker.com promotes responsible

ownership of guns and firearms. For more information, please visit:

www.gunbroker.com.

Forward Looking Statements

This document contains certain “forward-looking

statements”. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and

state securities laws, including, but not limited to, any

projections of earnings, revenue or other financial items; any

statements of the plans, strategies, goals and objectives of

management for future operations; any statements concerning

proposed new products and services or developments thereof; any

statements regarding future economic conditions or performance; any

statements or belief; and any statements of assumptions underlying

any of the foregoing.

Forward looking statements may include the words

“may,” “could,” “estimate,” “intend,” “continue,” “believe,”

“expect” or “anticipate” or other similar words, or the negative

thereof. These forward-looking statements present our estimates and

assumptions only as of the date of this report. Accordingly,

readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the dates on

which they are made. We do not undertake to update forward-looking

statements to reflect the impact of circumstances or events that

arise after the dates they are made. You should, however, consult

further disclosures and risk factors we include in Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, and Reports filed on

Form 8-K.

Investor Contact:CoreIRPhone: (212)

655-0924IR@ammo-inc.com

AMMO, Inc.CONDENSED

CONSOLIDATED BALANCE SHEETS

|

|

|

September 30, 2022 |

|

|

March 31, 2022 |

|

|

|

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

29,004,539 |

|

|

$ |

23,281,475 |

|

|

Accounts receivable, net |

|

|

30,430,044 |

|

|

|

43,955,084 |

|

|

Due from related parties |

|

|

6,000 |

|

|

|

15,000 |

|

|

Inventories |

|

|

68,607,008 |

|

|

|

59,016,152 |

|

|

Prepaid expenses |

|

|

4,328,855 |

|

|

|

3,423,925 |

|

|

Current portion of restricted cash |

|

|

500,000 |

|

|

|

- |

|

|

Total Current Assets |

|

|

132,876,446 |

|

|

|

129,691,636 |

|

| |

|

|

|

|

|

|

|

|

| Property and

Equipment, net |

|

|

53,786,118 |

|

|

|

37,637,806 |

|

| |

|

|

|

|

|

|

|

|

| Other

Assets: |

|

|

|

|

|

|

|

|

|

Deposits |

|

|

8,701,667 |

|

|

|

11,360,322 |

|

|

Restricted cash, net of current portion |

|

|

500,000 |

|

|

|

- |

|

|

Patents, net |

|

|

5,279,486 |

|

|

|

5,526,218 |

|

|

Other intangible assets, net |

|

|

130,013,599 |

|

|

|

136,300,387 |

|

|

Goodwill |

|

|

90,870,094 |

|

|

|

90,870,094 |

|

|

Right of use assets – operating leases |

|

|

2,393,817 |

|

|

|

2,791,850 |

|

| TOTAL

ASSETS |

|

$ |

424,421,227 |

|

|

$ |

414,178,313 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

23,799,668 |

|

|

$ |

26,817,083 |

|

|

Factoring liability |

|

|

794,389 |

|

|

|

485,671 |

|

|

Accrued liabilities |

|

|

5,019,029 |

|

|

|

6,178,814 |

|

|

Inventory credit facility |

|

|

- |

|

|

|

825,675 |

|

|

Current portion of operating lease liability |

|

|

836,544 |

|

|

|

831,429 |

|

|

Current portion of note payable related party |

|

|

531,397 |

|

|

|

684,639 |

|

|

Current portion of construction note payable |

|

|

243,372 |

|

|

|

- |

|

|

Insurance premium note payable |

|

|

701,336 |

|

|

|

- |

|

|

Total Current Liabilities |

|

|

31,925,735 |

|

|

|

35,823,311 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

Liabilities: |

|

|

|

|

|

|

|

|

|

Contingent consideration payable |

|

|

178,896 |

|

|

|

204,142 |

|

|

Notes payable related party, net of current portion |

|

|

- |

|

|

|

181,132 |

|

|

Construction note payable, net of unamortized issuance costs |

|

|

10,616,164 |

|

|

|

38,330 |

|

|

Operating lease liability, net of current portion |

|

|

1,683,052 |

|

|

|

2,091,351 |

|

|

Deferred income tax liability |

|

|

2,353,791 |

|

|

|

1,536,481 |

|

|

Total Liabilities |

|

|

46,757,638 |

|

|

|

39,874,747 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

Equity: |

|

|

|

|

|

|

|

|

|

Series A cumulative perpetual preferred Stock 8.75%, ($25.00 per

share, $0.001 par value) 1,400,000 shares issued and outstanding as

of September 30, 2022 and March 31, 2022, respectively |

|

|

1,400 |

|

|

|

1,400 |

|

|

Common stock, $0.001 par value, 200,000,000 shares authorized

117,274,755 and 116,485,747 shares issued and outstanding at

September 30, 2022 and March 31, 2022, respectively |

|

|

117,275 |

|

|

|

116,487 |

|

|

Additional paid-in capital |

|

|

387,892,917 |

|

|

|

385,426,431 |

|

|

Accumulated deficit |

|

|

(10,348,003 |

) |

|

|

(11,240,752 |

) |

|

Total Shareholders’ Equity |

|

|

377,663,589 |

|

|

|

374,303,566 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

$ |

424,421,227 |

|

|

$ |

414,178,313 |

|

AMMO, Inc.CONDENSED

CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

|

|

|

For the Three Months EndedSeptember

30, |

|

|

For the Six Months EndedSeptember

30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ammunition sales |

|

$ |

29,386,969 |

|

|

$ |

40,208,402 |

|

|

$ |

70,356,852 |

|

|

$ |

68,560,182 |

|

|

Marketplace revenue |

|

|

14,562,694 |

|

|

|

16,777,216 |

|

|

|

31,067,640 |

|

|

|

29,049,282 |

|

|

Casing sales |

|

|

4,338,896 |

|

|

|

4,016,467 |

|

|

|

7,620,093 |

|

|

|

7,868,953 |

|

| |

|

|

48,288,559 |

|

|

|

61,002,085 |

|

|

|

109,044,585 |

|

|

|

105,478,417 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Revenues |

|

|

35,452,850 |

|

|

|

34,786,017 |

|

|

|

78,073,214 |

|

|

|

60,291,455 |

|

| Gross Profit |

|

|

12,835,709 |

|

|

|

26,216,068 |

|

|

|

30,971,371 |

|

|

|

45,186,962 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing |

|

|

1,068,501 |

|

|

|

1,550,394 |

|

|

|

2,976,671 |

|

|

|

2,716,243 |

|

|

Corporate general and administrative |

|

|

5,055,699 |

|

|

|

4,082,236 |

|

|

|

10,084,996 |

|

|

|

7,238,833 |

|

|

Employee salaries and related expenses |

|

|

3,923,700 |

|

|

|

2,647,108 |

|

|

|

6,708,798 |

|

|

|

5,003,981 |

|

|

Depreciation and amortization expense |

|

|

3,291,322 |

|

|

|

3,708,012 |

|

|

|

6,641,678 |

|

|

|

6,319,073 |

|

|

Total operating expenses |

|

|

13,339,222 |

|

|

|

11,987,750 |

|

|

|

26,412,143 |

|

|

|

21,278,130 |

|

| Income/(Loss) from

Operations |

|

|

(503,513 |

) |

|

|

14,228,318 |

|

|

|

4,559,228 |

|

|

|

23,908,832 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

5,098 |

|

|

|

- |

|

|

|

198,596 |

|

|

|

21,425 |

|

|

Interest expense |

|

|

(97,265 |

) |

|

|

(112,806 |

) |

|

|

(217,752 |

) |

|

|

(278,085 |

) |

|

Total other income/(expense) |

|

|

(92,167 |

) |

|

|

(112,806 |

) |

|

|

(19,156 |

) |

|

|

(256,660 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income/(Loss) before Income

Taxes |

|

|

(595,680 |

) |

|

|

14,115,512 |

|

|

|

4,540,072 |

|

|

|

23,652,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for Income

Taxes |

|

|

207,827 |

|

|

|

- |

|

|

|

2,090,552 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) |

|

|

(803,507 |

) |

|

|

14,115,512 |

|

|

|

2,449,520 |

|

|

|

23,652,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred Stock Dividend |

|

|

(782,639 |

) |

|

|

(782,639 |

) |

|

|

(1,556,771 |

) |

|

|

(1,120,384 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) Attributable

to Common Stock Shareholders |

|

$ |

(1,586,146 |

) |

|

$ |

13,332,873 |

|

|

$ |

892,749 |

|

|

$ |

22,531,788 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.01 |

) |

|

$ |

0.12 |

|

|

$ |

0.01 |

|

|

$ |

0.21 |

|

|

Diluted |

|

$ |

(0.01 |

) |

|

$ |

0.11 |

|

|

$ |

0.01 |

|

|

$ |

0.20 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

116,927,607 |

|

|

|

113,174,363 |

|

|

|

116,744,972 |

|

|

|

109,545,553 |

|

|

Diluted |

|

|

116,927,607 |

|

|

|

116,721,949 |

|

|

|

118,063,619 |

|

|

|

112,848,821 |

|

Non-GAAP Financial Measures

We analyze operational and financial data to

evaluate our business, allocate our resources, and assess our

performance. In addition to total net sales, net income, and other

results under accounting principles generally accepted in the

United States (“GAAP”), the following information includes key

operating metrics and non-GAAP financial measures we use to

evaluate our business. We believe these measures are useful for

period-to-period comparisons of the Company. We have included these

non-GAAP financial measures in this Quarterly Report on Form 10-Q

because they are key measures we use to evaluate our operational

performance, produce future strategies for our operations, and make

strategic decisions, including those relating to operating expenses

and the allocation of our resources. Accordingly, we believe these

measures provide useful information to investors and others in

understanding and evaluating our operating results in the same

manner as our management and board of directors.

| |

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

|

|

30-Sep-22 |

|

|

30-Sep-21 |

|

|

30-Sep-22 |

|

|

30-Sep-21 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of GAAP

net income to Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) |

|

$ |

(803,507 |

) |

|

$ |

14,115,512 |

|

|

$ |

2,449,520 |

|

|

$ |

23,652,172 |

|

| Provision for Income

Taxes |

|

|

207,827 |

|

|

|

- |

|

|

|

2,090,552 |

|

|

|

- |

|

| Depreciation and

amortization |

|

|

4,294,845 |

|

|

|

4,667,957 |

|

|

|

8,594,968 |

|

|

|

8,154,748 |

|

| Excise Taxes |

|

|

2,435,051 |

|

|

|

3,937,118 |

|

|

|

6,147,392 |

|

|

|

6,334,889 |

|

| Interest expense, net |

|

|

97,265 |

|

|

|

112,806 |

|

|

|

217,752 |

|

|

|

278,085 |

|

| Employee stock awards |

|

|

1,176,375 |

|

|

|

1,153,625 |

|

|

|

2,351,438 |

|

|

|

1,853,125 |

|

| Stock grants |

|

|

43,750 |

|

|

|

65,098 |

|

|

|

91,594 |

|

|

|

132,012 |

|

| Other income, net |

|

|

(5,098 |

) |

|

|

- |

|

|

|

(198,596 |

) |

|

|

(21,425 |

) |

| Contingent consideration fair

value |

|

|

(23,944 |

) |

|

|

(3,444 |

) |

|

|

(25,246 |

) |

|

|

(60,082 |

) |

| Proxy contention fees |

|

|

741,131 |

|

|

|

- |

|

|

|

741,131 |

|

|

|

- |

|

| Adjusted EBITDA |

|

$ |

8,163,695 |

|

|

$ |

24,048,672 |

|

|

$ |

22,460,505 |

|

|

$ |

40,323,524 |

|

| |

|

For the Three Months Ended |

|

|

|

|

30-Sept-22 |

|

|

30-Sept-21 |

|

| Reconciliation of GAAP

net income to Fully Diluted EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) |

|

$ |

(803,507 |

) |

|

$ |

(0.01 |

) |

|

$ |

14,115,512 |

|

|

$ |

0.12 |

|

| Provision for income

taxes |

|

|

207,827 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Depreciation and

amortization |

|

|

4,294,845 |

|

|

|

0.04 |

|

|

|

4,667,957 |

|

|

|

0.04 |

|

| Interest expense, net |

|

|

97,265 |

|

|

|

- |

|

|

|

112,806 |

|

|

|

- |

|

| Employee stock awards |

|

|

1,176,375 |

|

|

|

0.01 |

|

|

|

1,153,625 |

|

|

|

0.01 |

|

| Stock grants |

|

|

43,750 |

|

|

|

- |

|

|

|

65,098 |

|

|

|

- |

|

| Other income, net |

|

|

(5,098 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Contingent consideration fair

value |

|

|

(23,944 |

) |

|

|

- |

|

|

|

(3,444 |

) |

|

|

- |

|

| Proxy contention fees |

|

|

741,131 |

|

|

|

0.01 |

|

|

|

- |

|

|

|

- |

|

| Adjusted Net Income |

|

$ |

5,728,644 |

|

|

$ |

0.05 |

|

|

$ |

20,111,554 |

|

|

$ |

0.17 |

|

| |

|

For the Six Months Ended |

|

|

|

|

30-Sept-22 |

|

|

30-Sept-21 |

|

| Reconciliation of GAAP

net income to Fully Diluted EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

2,449,520 |

|

|

$ |

0.02 |

|

|

$ |

23,652,172 |

|

|

$ |

0.21 |

|

| Depreciation and

amortization |

|

|

2,090,552 |

|

|

|

0.02 |

|

|

|

- |

|

|

|

- |

|

| Provision for income

taxes |

|

|

8,594,968 |

|

|

|

0.07 |

|

|

|

8,154,748 |

|

|

|

0.07 |

|

| Interest expense, net |

|

|

217,752 |

|

|

|

- |

|

|

|

278,085 |

|

|

|

- |

|

| Employee stock awards |

|

|

2,351,438 |

|

|

|

0.02 |

|

|

|

1,853,125 |

|

|

|

0.02 |

|

| Stock grants |

|

|

91,594 |

|

|

|

- |

|

|

|

132,012 |

|

|

|

- |

|

| Other income, net |

|

|

(198,596 |

) |

|

|

- |

|

|

|

(21,425 |

) |

|

|

- |

|

| Contingent consideration fair

value |

|

|

(25,246 |

) |

|

|

- |

|

|

|

(60,082 |

) |

|

|

- |

|

| Proxy contention fees |

|

|

741,131 |

|

|

|

0.01 |

|

|

|

- |

|

|

|

- |

|

| Adjusted Net Income |

|

$ |

16,313,113 |

|

|

$ |

0.14 |

|

|

$ |

33,988,635 |

|

|

$ |

0.30 |

|

| |

|

For the Three Months EndedSeptember

30, |

|

|

For the Six Months EndedSeptember

30, |

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Weighted average number of

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

116,927,607 |

|

|

|

113,174,363 |

|

|

|

116,744,972 |

|

|

|

109,545,553 |

|

|

Diluted |

|

|

118,265,167 |

|

|

|

116,721,949 |

|

|

|

118,063,619 |

|

|

|

112,848,821 |

|

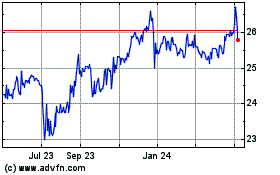

AMMO (NASDAQ:POWWP)

Historical Stock Chart

From Mar 2024 to Apr 2024

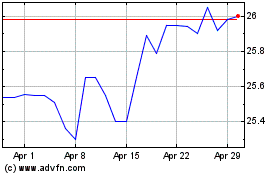

AMMO (NASDAQ:POWWP)

Historical Stock Chart

From Apr 2023 to Apr 2024