Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 February 2025 - 3:07AM

Edgar (US Regulatory)

Schedule of Investments(a)

Invesco QQQ TrustSM, Series 1 (QQQ)

December 31, 2024

(Unaudited)

|

|

|

|

Common Stocks & Other Equity Interests-100.00%

|

Aerospace & Defense-0.29%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coca-Cola Europacific Partners PLC

(United Kingdom)

|

|

|

|

|

|

|

|

|

Monster Beverage Corp.(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regeneron Pharmaceuticals, Inc.(b)

|

|

|

|

Vertex Pharmaceuticals, Inc.(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MercadoLibre, Inc. (Brazil)(b)

|

|

|

|

PDD Holdings, Inc., ADR (China)(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Services & Supplies-0.82%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communications Equipment-1.50%

|

|

|

|

|

|

Consumer Staples Distribution & Retail-2.58%

|

|

|

|

|

|

|

|

American Electric Power Co., Inc.

|

|

|

|

Constellation Energy Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Equipment, Instruments & Components-0.15%

|

|

|

|

|

|

Energy Equipment & Services-0.26%

|

Baker Hughes Co., Class A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Take-Two Interactive Software, Inc.(b)

|

|

|

|

Warner Bros. Discovery, Inc.(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mondelez International, Inc., Class A

|

|

|

|

|

|

|

|

|

|

|

|

|

Ground Transportation-0.64%

|

|

|

|

|

|

Old Dominion Freight Line, Inc.

|

|

|

|

|

|

|

|

|

Health Care Equipment & Supplies-1.82%

|

|

|

|

|

|

GE HealthCare Technologies, Inc.

|

|

|

|

IDEXX Laboratories, Inc.(b)

|

|

|

|

Intuitive Surgical, Inc.(b)

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure-2.97%

|

|

|

|

|

|

|

|

|

|

|

DoorDash, Inc., Class A(b)

|

|

|

|

Marriott International, Inc., Class A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Conglomerates-0.93%

|

Honeywell International, Inc.

|

|

|

|

Interactive Media & Services-8.88%

|

|

|

|

|

|

|

|

|

|

|

Meta Platforms, Inc., Class A

|

|

|

|

|

|

|

|

|

|

|

Cognizant Technology Solutions Corp.,

Class A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charter Communications, Inc.,

Class A(b)

|

|

|

|

|

|

|

|

|

Trade Desk, Inc. (The), Class A(b)

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels-0.30%

|

|

|

|

|

|

|

|

AstraZeneca PLC, ADR (United

Kingdom)

|

|

|

|

Professional Services-1.33%

|

Automatic Data Processing, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Management & Development-0.19%

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment-22.30%

|

Advanced Micro Devices, Inc.(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASML Holding N.V., New York Shares

(Netherlands)

|

|

|

|

|

|

|

|

|

See accompanying notes which are an integral part of this schedule.

Invesco QQQ TrustSM, Series 1 (QQQ)—(continued)

December 31, 2024

(Unaudited)

|

|

|

|

Semiconductors & Semiconductor Equipment-(continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Microchip Technology, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NXP Semiconductors N.V. (China)

|

|

|

|

ON Semiconductor Corp.(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AppLovin Corp., Class A(b)

|

|

|

|

Atlassian Corp., Class A(b)

|

|

|

|

|

|

|

|

|

Cadence Design Systems, Inc.(b)

|

|

|

|

CrowdStrike Holdings, Inc., Class A(b)

|

|

|

|

Datadog, Inc., Class A(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MicroStrategy, Inc., Class A(b)

|

|

|

|

|

|

|

|

|

|

Palantir Technologies, Inc., Class A(b)

|

|

|

|

Palo Alto Networks, Inc.(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Workday, Inc., Class A(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O’Reilly Automotive, Inc.(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals-9.79%

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods-0.29%

|

lululemon athletica, inc.(b)

|

|

|

|

Trading Companies & Distributors-0.26%

|

|

|

|

|

|

Wireless Telecommunication Services-1.63%

|

|

|

|

|

|

TOTAL INVESTMENTS IN SECURITIES-100.00%

(Cost $312,090,668,202)

|

|

OTHER ASSETS LESS LIABILITIES-(0.00)%

|

|

|

|

|

Investment Abbreviations:

|

|

|

-American Depositary Receipt

|

Notes to Schedule of Investments:

|

|

|

Industry and/or sector classifications used in this report are generally according

to the Global Industry Classification Standard, which was developed by and is

the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s.

|

|

|

Non-income producing security.

|

The valuation policy and a listing of other significant accounting policies are available

in the most recent shareholder report.

See accompanying notes which are an integral part of this schedule.

Notes to Quarterly Schedule of Portfolio Holdings

December 31, 2024

(Unaudited)

NOTE 1—Additional Valuation Information

Generally Accepted Accounting Principles ("GAAP") defines fair value as the price

that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the

measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation

methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level

1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available.

Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods

may result in transfers in or out of an investment’s assigned level:

Level 1 – Prices are determined using quoted prices in an active market for identical assets.

Level 2 – Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar

securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount

rates, volatilities and others.

Level 3 – Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment

at the end of the period), unobservable inputs may be used. Unobservable inputs reflect Invesco Capital Management LLC’s assumptions about the factors market participants would use in determining fair value of the securities

or instruments and would be based on the best available information.

As of December 31, 2024, all of the securities in the Trust were valued based on Level

1 inputs (see the Schedule of Investments for security categories). The level assigned to the securities valuations

may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties

of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale

of those investments.

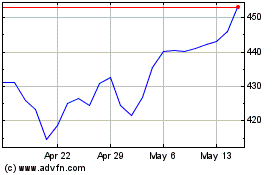

Invesco QQQ Trust Series 1 (NASDAQ:QQQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

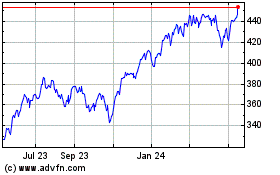

Invesco QQQ Trust Series 1 (NASDAQ:QQQ)

Historical Stock Chart

From Feb 2024 to Feb 2025