Current Report Filing (8-k)

24 December 2021 - 1:22AM

Edgar (US Regulatory)

false 0001762303 --06-30 0001762303 2021-12-22 2021-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 22, 2021

Avita Medical, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-39059

|

|

85-1021707

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

28159 Avenue Stanford, Suite 220, Valencia, CA 91355

|

|

661.367.9170

|

|

(Address of principal executive offices, including Zip Code)

|

|

(Registrant’s telephone number, including area code)

|

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.0001 per share

|

|

RCEL

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On December 22, 2021 AVITA Medical, Inc. (the “Company”) held its 2021 Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, the Stockholders of the Company approved an amendment to the Company’s Amended and Restated Bylaws that will give the Company the right to sell on behalf of a Chess Depositary Interest (“CDI”) holder the CDIs held by that CDI holder where the holding constitutes less than a marketable parcel of CDIs for the purposes of the Australian Stock Exchange (“ASX”) Listing Rules and the ASX Settlement Operating Rules.

The Company has a large number of CDI holders on its register that hold less than a “marketable parcel” of CDIs. A marketable parcel is a CDI holding worth at least $500 Australian dollars. As at October 18, 2021, 5,737 CDI holders held less than a marketable parcel of CDIs. For a CDI holder that holds less than a marketable parcel of the Company’s CDIs, it may be difficult and/or expensive for them to sell those CDIs. It is also expensive and inefficient for the Company to maintain these small holdings given there are share registry fees and other administrative costs associated with maintaining such small holdings on the Company’s CDI register.

The specific amendment to the Company’s Bylaws is as follows (inserting a new Section 7.10 after Section 7.9):

“Section 7.10. Small holdings sale facility.

|

|

(A)

|

In this Section 7.10:

|

“CDI” means a CHESS Depositary Interest, being a unit of beneficial ownership in 1/5 of a share of common stock of the Corporation or such other ratio as may be adopted by the Corporation from time to time.

“CDI holder” means a holder of the Corporation’s CDIs.

“Marketable Parcel” means a number of CDIs equal to a marketable parcel as defined in the ASX Listing Rules and the ASX Settlement Operating Rules, calculated on the day before the Corporation gives notice under Section 7.10(B).

“takeover” means a takeover bid (as that term is defined in section 9 of the Corporations Act 2001 (Cth)) or a similar bid under the laws of a foreign jurisdiction outside of Australia.

|

|

(B)

|

For so long as the Corporation is admitted to the official list of the ASX, the Corporation may sell the CDI holding of a CDI holder who holds less than a Marketable Parcel of CDIs, provided that the Corporation complies with each of the following: (i) the Corporation may do so only once in any 12-month period; (ii) the Corporation must notify the CDI holder in writing of its intention to sell such CDIs in accordance with this Section 7.10; (iii) the CDI holder must be given at least 6 weeks from the date the notice is sent in which to tell the Corporation that the CDI holder wishes to retain its CDI holding; (iv) if the CDI holder tells the Corporation in accordance with Section 7.10(B)(iii) that the CDI holder wishes to retain its CDI holding, the Corporation will not sell the holding; (v) the power to sell lapses following the announcement of a takeover but the procedure may be started again after the close of the offers made under the takeover; (vi) the Corporation or the purchaser must pay the costs of the sale; and (vii) the proceeds of the sale will not be distributed until the Corporation has received any certificate relating to the CDIs (or is satisfied that the certificate has been lost or destroyed).

|

|

|

(C)

|

The Corporation may, before a sale is effected under this Section 7.10, revoke a notice given or suspend or terminate the operation of this Section 7.10 either generally or in specific cases.

|

|

|

(D)

|

If a CDI holder is registered in respect of more than one parcel of securities (whether CDIs or shares of common stock), the Corporation may treat the CDI holder as a separate CDI holder in respect of each of those parcels so that this Section 7.10 will operate as if each parcel was held by different CDI holders.”

|

Exhibit 3.2 sets forth the Company’s Amended and Restated Bylaws, as amended by the Stockholders on December 22, 2021.

Item 5.07. Submission of Matters to a Vote of Security Holders.

At the Annual Meeting, the total number of shares of common stock eligible to vote as of the record date, October 26, 2021 (being October 27, 2021 Australian Eastern Daylight Time), was 24,925,118 and, pursuant to the Company’s Amended and Restated Bylaws, majority shares were required to be present or represented at the Annual Meeting to constitute a quorum. The total number of shares of common stock present or represented at the Annual Meeting was 12,994,665, and a quorum therefore existed.

At the Annual Meeting:

|

1.

|

Election of Directors. All seven directors named in the Company’s Proxy Statement for the Annual Meeting (“Proxy Statement”) were elected to serve on the Company’s Board of Directors with the following vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Votes For

|

|

|

Votes Withheld

|

|

|

Non-Votes

|

|

|

Louis Panaccio (Chair)

|

|

|

9,820,165

|

|

|

|

1,534,823

|

|

|

|

1,639,677

|

|

|

Michael Perry (Director and CEO)

|

|

|

10,306,193

|

|

|

|

1,048,795

|

|

|

|

1,639,677

|

|

|

Professor Suzanne Crowe (Director)

|

|

|

8,237,188

|

|

|

|

3,117,800

|

|

|

|

1,639,677

|

|

|

Louis Drapeau (Director)

|

|

|

10,063,717

|

|

|

|

1,291,271

|

|

|

|

1,639,677

|

|

|

Jeremy Curnock Cook (Director)

|

|

|

9,888,529

|

|

|

|

1,466,459

|

|

|

|

1,639,677

|

|

|

James Corbett (Director)

|

|

|

10,165,872

|

|

|

|

1,189,116

|

|

|

|

1,639,677

|

|

|

Jan Stern Reed (Director)

|

|

|

10,136,268

|

|

|

|

1,218,720

|

|

|

|

1,639,677

|

|

|

2.

|

Appointment of Independent Auditors. The appointment of Grant Thornton LLP as the Company’s independent public accountants for the fiscal year ending June 30, 2022 was ratified by a vote of (i) 12,510,997 in favor, (ii) 314,001 against, and (iii) 169,667 abstaining.

|

|

3.

|

Amendments to the Company’s Amended and Restated Bylaws: Shareholders approved amendments to the Company’s Amended and Restated Bylaws to insert provisions that will provide the Company with the right to implement a sales facility with respect to those holders of the Company’s CHESS Depositary Interests (“CDIs”) that hold at the relevant time less than a marketable parcel of the Company’s CDIs for the purposes of the ASX Listing Rules and ASX Settlement Operating Rules, on the terms and conditions set out in the Proxy Statement, by a vote of (i) 10,534,794 in favor, (ii) 610,317 against, and (iii) 209,877 abstaining.

|

|

4.

|

Issuance of Shares of Common Stock: Shareholders ratified the issue of 3,214,250 shares of common stock in the capital of the Company with an issue price of US$21.50 per share that were issued pursuant to an underwritten registered public offering that was completed in March 2021, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 7.4 and for all other purposes, by a vote of (i) 10,395,918 in favor, (ii) 828,719 against, and (iii) 130,351 abstaining.

|

|

5.

|

Maximum Aggregate Annual Cash Fee Pool for Non-Executive Directors: Shareholders approved, for the purposes of ASX Listing Rule 10.17 and the Company’s Amended and Restated Bylaws and for all other purposes, that the maximum aggregate annual cash fee pool from which the non-executive directors of the Company may be paid for their services as members of the board of directors of the Company be increased from US$600,000 per annum to US$750,000 per annum, by a vote of (i) 8,574,890 in favor, (ii) 2,675,438 against, and (iii) 104,660 abstaining.

|

|

6.

|

Issuance of Securities to Mr. Louis Panaccio: Shareholders approved the grant of restricted stock units to acquire 4,350 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 2,550 shares of common stock of the Company (which may be represented by CDIs) to Mr. Louis Panaccio, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, by a vote of (i) 8,847,609 in favor, (ii) 2,371,512 against, and (iii) 135,867 abstaining.

|

|

7.

|

Issuance of Securities to Professor Suzanne Crowe: Shareholders approved the grant of restricted stock units to acquire 4,350 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 2,550 shares of common stock of the Company (which may be represented by CDIs) to Professor Suzanne Crowe, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, by a vote of (i) 8,901,273 in favor, (ii) 2,321,245 against, and (iii) 132,470 abstaining.

|

|

8.

|

Issuance of Securities to Mr. Jeremy Curnock Cook: Shareholders approved the grant of restricted stock units to acquire 4,350 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 2,550 shares of common stock of the Company (which may be represented by CDIs) to Mr. Jeremy Curnock Cook, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, by a vote of (i) 8,853,359 in favor, (ii) 2,366,287 against, and (iii) 135,342 abstaining.

|

|

9.

|

Issuance of Securities to Mr. Louis Drapeau: Shareholders approved the grant of restricted stock units to acquire 4,350 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 2,550 shares of common stock of the Company (which may be represented by CDIs) to Mr. Louis Drapeau, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, by a vote of (i) 8,854,404 in favor, (ii) 2,363,855 against, and (iii) 136,729 abstaining.

|

|

10.

|

Issuance of Securities to Mr. James Corbett: Shareholders approved the grant of restricted stock units to acquire 4,350 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 2,550 shares of common stock of the Company (which may be represented by CDIs)

|

|

|

to Mr. James Corbett, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, by a vote of (i) 8,893,464 in favor, (ii) 2,328,760 against, and (iii) 132,764 abstaining.

|

|

11.

|

Issuance of Securities to Mr. James Corbett: Shareholders also approved the grant of restricted stock units to acquire 8,675 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 4,925 shares of common stock of the Company (which may be represented by CDIs) to Mr. James Corbett, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, in recognition of Mr. James Corbett being appointed as a new director of the Company during 2021, by a vote of (i) 8,883,367 in favor, (ii) 2,335,263 against, and (iii) 136,358 abstaining.

|

|

12.

|

Issuance of Securities to Ms. Jan Stern Reed: Shareholders approved the grant of restricted stock units to acquire 4,350 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 2,550 shares of common stock of the Company (which may be represented by CDIs) to Ms. Jan Stern Reed, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, by a vote of (i) 8,892,224 in favor, (ii) 2,322,741 against, and (iii) 140,023 abstaining.

|

|

13.

|

Issuance of Securities to Ms. Jan Stern Reed: Shareholders also approved the grant of restricted stock units to acquire 8,675 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 4,925 shares of common stock of the Company (which may be represented by CDIs) to Ms. Jan Stern Reed, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, in recognition of Ms. Jan Stern Reed being appointed as a new director of the Company during 2021, by a vote of (i) 8,889,602 in favor, (ii) 2,329,093 against, and (iii) 136,293 abstaining.

|

|

14.

|

Issuance of Securities to Dr. Michael Perry: Shareholders approved the grant of restricted stock units to acquire 95,280 shares of common stock of the Company (which may be represented by CDIs) and the grant of options to acquire 55,200 shares of common stock of the Company (which may be represented by CDIs) to the Company’s Chief Executive Officer, Dr. Michael Perry, on the terms and conditions set out in the Proxy Statement, pursuant to and for the purposes of ASX Listing Rule 10.11, by a vote of (i) 8,746,857 in favor, (ii) 2,480,955 against, and (iii) 127,176 abstaining.

|

|

15.

|

Advisory Vote to Approve Compensation of Named Executive Officers: Shareholders voted in favor of the non-binding advisory vote to approve the compensation of the Company’s named executive officers, by a vote of (i) 6,435,693 in favor, (ii) 4,729,242 against, and (iii) 190,053 abstaining.

|

On December 22, 2021, the Company issued a press release announcing the voting results with respect to each of the proposals presented to stockholders at the Annual Meeting. A copy of the Company’s press release is included as Exhibit 99.1.

Item 7.01 Reg Fd Disclosure; Item 8.01 Other Events

In the Annual Meeting, the Company presented a slide deck containing certain information attached hereto as Exhibit 99.2.

The information under this Item 7.01, 8.01 and in Item 9.01 below is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: December 23, 2021

|

|

|

|

|

|

|

|

AVITA MEDICAL, INC.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Donna Shiroma

|

|

|

|

Name:

|

|

Donna Shiroma

|

|

|

|

Title:

|

|

General Counsel

|

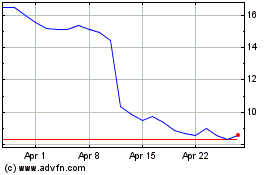

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024