The Real Good Food Company, Inc. (NASDAQ: RGF) (“Real Good Foods”

or the “Company”), a leading health and wellness frozen and

refrigerated foods company, today provided a corporate update

concurrent with the appointment of foods executive Tim Zimmer as

Chief Executive Officer, effective March 15, 2024.

Leadership Changes

The Company today announced the appointment of

Tim Zimmer as the Company’s Chief Executive Officer effective March

15, 2024. Mr. Zimmer succeeds Gerard Law, who departed the Company

as its Chief Executive Officer, effective March 15, 2024.

Tim Zimmer was most recently the Chief Marketing

Officer at Smithfield Foods and held prior roles that included

responsibilities across business management, demand planning,

R&D and operation process design. Tim has over 30 years of

experience in the packaged foods industry at Smithfield Foods, Sara

Lee Foods, Kraft Foods and Nestle.

While at Smithfield, Tim played a pivotal role

in growing the company’s packaged meats business and significantly

improving its profitability. Prior to his tenure at Smithfield, Tim

was a leader in the turnaround efforts at Sara Lee Fresh Bakery,

transforming it into a profitable business before its eventual sale

to Grupo Bimbo. Tim has served in management roles in finance,

business management, sales, and marketing over his career in

multiple channels and temperature zones. Tim holds a B.B.A. in

Marketing & Finance from the University of Texas at Arlington

and an M.B.A. in Strategy & Finance from the Wake Forest

University School of Business.

The Company also appointed Mark Dietz as Senior

Vice President of Operations, who will assist the Company with

streamlining of the Company’s supply chain and improving

efficiencies. Mark brings extensive experience in operational

leadership, having previously served as VP of Business Management

at Smithfield Foods and holding management roles within Sara Lee

Meat Brands. While at Smithfield, Mark had full P&L

responsibilities for the Curly’s and Stefano’s brands, which

represented well over $600 million in retail sales. Under Mark’s

leadership, the Curly’s brand was introduced into the retail

channel and grew to over $150 million in retail sales and turned

profitable. Mark also oversaw the plant consolidation and

turnaround of the Stefano’s brand, which was handheld business that

is similar from a manufacturing standpoint to RGF’s operations. In

his new role, Mark will spearhead initiatives to optimize supply

chain and enhance plant efficiencies. Mark holds a B.B.A. in

Finance from The University of Cincinnati, Lindner School of

Business.

Strategic Actions to Optimize Supply

Chain

In an effort to accelerate the optimizing of its

supply chain, the Company plans to cease operations at its City of

Industry (“COI”) facility by June 30, 2024. While ongoing analysis

of the closure's overall impact is underway, preliminary

assessments indicate substantial cost savings with negligible cash

outlays. With a significant portion of COI's production set to

transition to the Bolingbrook, IL facility, alongside co-packing

arrangements and rationalization measures, this decision is

expected to improve capacity utilization, reduced fixed overhead

costs, enhance margins, and streamline the supply chain.

Business Updates

- According to SPINS and IRI, for the

two months ended February 29, 2024, total consumption of the

Company’s branded products increased by 53% year over

year. This included a 23% increase in the unmeasured channel

and 96% increase in the measured channel.

- In the measured channel, according

to SPINS, consumption for the RGF brand for the two months ended

2/28/24 was $26M or up 96% y/y. For the latest four week ended

2/28/24 consumption was $12.5M or up 102% y/y.

- In the unmeasured channel,

according to IRI, consumption for the RGF brand for the two month

ended 2/28/24 was $23.7M or up 23% y/y.

- The previously disclosed refinancing in

March 2024 reduced the Company’s revolver balance to $25 million

and reduced the maximum availability under revolver to $35 million,

implying $10 million in liquidity at the time of the refinancing.

The refinancing in November 2023 and March 2024 combined have

significantly reduced the company’s cash debt service and enhanced

liquidity. Cash debt service is currently at $1.0 million a

month.

- The aforementioned organizational

changes, streamlining of supply chain and yield improvement

initiatives are expected to significantly accelerate the Company’s

path to generating free cash flow and self-funding its growth.

Management Commentary

Executive Chairman Bryan Freeman commented: “We

are pleased to announce the appointment of Tim Zimmer as Chief

Executive Officer, as his experience aligns with the slate of

strategic actions we announced today. These are aimed at

significantly accelerating the path to profitability and are a

testament to our commitment to fellow shareholders.

“Our growth remains strong, with total

consumption of our branded products increasing 53% year-over-year

in the two months ended February 29, 2024. On the liquidity front,

after taking into account our latest refinancing, the Company has

significantly reduced its cash debt service. Ultimately, we expect

these changes will enable us to generate free cash flow and

self-fund our future growth.”

Tim Zimmer concluded: “In assuming the role of

CEO, I am fully committed to leading the Company through the

transformative journey that lies ahead. The brand continues to

perform well and has a strong, rapidly growing consumer base. I see

a clear opportunity to unlock significant value by streamlining the

supply chain, improving manufacturing efficiencies and instilling a

culture of operational excellence. Together, we plan to earn back

our right to grow by proving that we can operate with excellence

and generate cash flow.”

Restatement of Prior Financial

Statements

During the preparation of the Company’s

consolidated financial statements for the year ended December 31,

2023, the Company identified certain errors related to differences

between the 2022 year-end physical inventory listing and the

inventory recorded as of December 31, 2022. The Company is

currently in the process of assessing the magnitude of the errors,

but currently estimates the reduction to the inventory balance as

between $7 million and $12 million. The Company will file an

amended Form 10-K for 2022 and amended Form 10-Qs for each of the

quarters in 2023, as soon as practicable, to restate the financial

statements for such periods. Accordingly, investors should no

longer rely upon the Company’s previously issued consolidated

financial statements and earnings releases for the aforementioned

periods. For more information, see the Company’s current report on

Form 8-K filed with the SEC on March 18, 2024.

About Real Good Food

Company

Real Good Foods, Inc. (NASDAQ: RGF) is a leading

health and wellness frozen and refrigerated foods company,

providing a better way to enjoy your favorite foods. The Company’s

mission is to provide “Real Food You Feel Good About Eating”,

making delicious, nutritious foods that are low in sugar, low in

carbohydrates and high in protein. The Real Good Foods family of

products includes breakfast, lunch, dinner, and snacks – available

in over 16,000 stores nationwide with additional direct-to-consumer

options.

To learn more, please visit our website at

realgoodfoods.com or join us on social media @realgoodfoods, where

we maintain some of the largest followings in the frozen food

industry today.

Forward-Looking Statements

This press release contains "forward-looking

statements" within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995, which

statements are subject to considerable risks and uncertainties.

Forward-looking statements include all statements other than

statements of historical fact contained in this press release,

including statements regarding its projected financial results, its

ability to increase production at its new facility, improve

profitability and meet its long-term growth objectives, the

anticipated conclusion regarding the impact of the errors

identified in the Company’s previously issued consolidated

financial statements, the scope of the anticipated restatement of

previously issued financial statements as a result of the error,

the succession of the Company’s Chief Executive Officer, and the

costs and financial and business impact associated with the closure

of COI. The Company has attempted to identify forward-looking

statements by using words such as “anticipate,” "believe,"

"estimate," "expect," "intend," "may," "plan," "predict,"

"project," "should," "will," or "would," and similar expressions or

the negative of these expressions.

Forward-looking statements represent

management's current expectations and predictions about trends

affecting the Company’s business and industry and are based on

information available as of the time such statements are made.

Although the Company does not make forward-looking statements

unless it believes it has a reasonable basis for doing so, it

cannot guarantee their accuracy or completeness. Forward-looking

statements involve numerous known and unknown risks, uncertainties

and other factors that may cause its actual results, performance or

achievements to be materially different from any future results,

performance or achievements predicted, assumed or implied by the

forward-looking statements. Some of the risks and uncertainties

that may cause its actual results to materially differ from those

expressed or implied by these forward-looking statements, including

the risk of further delays in the filing of the restated financial

statements, the discovery of additional information regarding the

error and other risk factors described in the section entitled

"Risk Factors" in its Annual Report on Form 10-K for the year ended

December 31, 2022, and other documents filed with or furnished to

the Securities and Exchange Commission by the Company from time to

time. These forward-looking statements speak only as of the date of

this press release. Except as required by law, the Company

undertakes no obligation to publicly release the result of any

revisions to these forward-looking statements to reflect the impact

of events or circumstances that may arise after the date of this

press release.

Investor Relations ContactLucas

A. ZimmermanManaging DirectorMZ Group - MZ North America(949)

259-4987RGF@mzgroup.us www.mzgroup.us

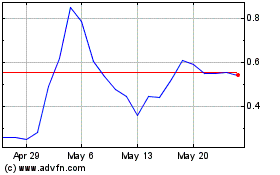

Real Good Food (NASDAQ:RGF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Real Good Food (NASDAQ:RGF)

Historical Stock Chart

From Dec 2023 to Dec 2024