FALSE000093541900009354192024-09-092024-09-09

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2024

RCI HOSPITALITY HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Texas | 001-13992 | 76-0458229 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

10737 Cutten Road

Houston, Texas 77066

(Address of Principal Executive Offices, Including Zip Code)

(281) 397-6730

(Issuer’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | RICK | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On September 9-11, 2024, we will be meeting with investors via the H.C. Wainwright Conference. On September 9, 2024, we issued a press release announcing this. A copy of the press release is furnished as Exhibit 99.1 to this current report on Form 8-K. A copy of the presentation slides that may be used in whole or in part at those meetings is also furnished with this current report as Exhibit 99.2.

ITEM 7.01 REGULATION FD DISCLOSURE.

The disclosure in Item 2.02 above is incorporated herein by reference.

The furnishing of the attached presentation slides is not an admission as to the materiality of any information therein. The information contained in the slides is summary information that is intended to be considered in the context of more complete information included in our filings with the U.S. Securities and Exchange Commission (the “SEC”) and other public announcements that we have made and may make from time to time by press release or otherwise. We undertake no duty or obligation to update or revise the information contained in this report, although we may do so from time to time as management believes is appropriate. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosures. For important information about forward-looking statements, see the slide titled “Forward-Looking Statements” in Exhibit 99.2 included herewith.

The information in this current report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is being furnished and will not be treated as “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| | |

| Date: September 9, 2024 | By: | /s/ Eric Langan |

| | Eric Langan |

| | President and Chief Executive Officer |

RCI to Participate at H.C. Wainwright 26th Annual Investment Conference

HOUSTON – September 9, 2024 – RCI Hospitality Holdings, Inc. (Nasdaq: RICK) announced it will be featured as a presenting company at the H.C. Wainwright 26th Annual Global Investment Conference Monday-Wednesday this week in New York City.

The conference is being held at the Lotte New York Palace Hotel at 455 Madison Avenue. Virtual participation will be staged simultaneously with more than 550 company presentations scheduled as live feed or available on-demand.

RCI CEO Eric Langan will meet with investors in one-on-one meetings as well as review the company’s Back to Basics focus on its adult nightclubs business and capital allocation strategy. RCI is scheduled to present Wednesday, September 11, 2024, at 12 PM ET.

If you are an institutional investor, and would like to attend in person or virtually, visit www.hcwevents.com/annualconference to register.

About RCI Hospitality Holdings, Inc. (Nasdaq: RICK) (X: @RCIHHinc)

With more than 60 locations, RCI Hospitality Holdings, Inc., through its subsidiaries, is the country’s leading company in adult nightclubs and sports bars/restaurants. See all our brands at www.rcihospitality.com.

About H.C. Wainwright & Co.

H.C. Wainwright is a full-service investment bank dedicated to providing corporate finance, strategic advisory and related services to public and private companies across multiple sectors and regions. H.C. Wainwright & Co. also provides research and sales and trading services to institutional investors. According to EPFR, H.C. Wainwright’s team is ranked as the #1 Placement Agent in terms of aggregate CMPO (confidentially marketed public offering), RD (registered direct offering), and PIPE (private investment in public equity) executed cumulatively since 1998. For more information visit H.C. Wainwright & Co. on the web at www.hcwco.com.

Forward-Looking Statements

This press release may contain forward-looking statements that involve a number of risks and uncertainties that could cause the company's actual results to differ materially from those indicated, including, but not limited to, the risks and uncertainties associated with (i) operating and managing an adult entertainment or restaurant business, (ii) the business climates in cities where it operates, (iii) the success or lack thereof in launching and building the company's businesses, (iv) cyber security, (v) conditions relevant to real estate transactions, (vi) the impact of the COVID-19 pandemic, and (vii) numerous other factors such as laws governing the operation of adult entertainment or restaurant businesses, competition and dependence on key personnel. For more detailed discussion of such factors and certain risks and uncertainties, see RCI's annual report on Form 10-K for the year ended September 30, 2023, as well as its other filings with the U.S. Securities and Exchange Commission. The company has no obligation to update or revise the forward-looking statements to reflect the occurrence of future events or circumstances.

Media & Investor Contacts

Gary Fishman and Steven Anreder at 212-532-3232 or gary.fishman@anreder.com and steven.anreder@anreder.com

Building a portfolio of well-managed, high cash-flowing nightclubs & sports-bar restaurants NASDAQ: RICK | H. C. Wainwright Conference | September 9-11, 2024 | www.rcihospitality.com | @RCIHHinc

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, statements regarding plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements, which are other than statements of historical facts. Forward- looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this presentation and those discussed in other documents we file with the U.S. Securities and Exchange Commission (“SEC”). This presentation may contain forward-looking statements that involve a number of risks and uncertainties that could cause the company’s actual results to differ materially from those indicated in this presentation, including, but not limited to, the risks and uncertainties associated with (i) operating and managing an adult entertainment or restaurant business, (ii) the business climates in cities where we operate, (iii) the success or lack thereof in launching and building our businesses, (iv) cyber security, (v) conditions relevant to real estate transactions, (vi) the impact of the COVID-19 pandemic, and (vii) numerous other factors such as laws governing the operation of adult entertainment or restaurant businesses, competition and dependence on key personnel. For more detailed discussion of such factors and certain risks and uncertainties, see RCI’s annual report on Form 10-K for the year ended September 30, 2023, as well as its other filings with the U.S. Securities and Exchange Commission. The company has no obligation to update or revise the forward-looking statements to reflect the occurrence of future events or circumstances. The novel coronavirus (COVID-19) pandemic has disrupted and may continue to disrupt our business, which has and could continue to materially affect our operations, financial condition, and results of operations for an extended period of time. As used herein, the “Company,” “we,” “our,” and similar terms include RCI Hospitality Holdings, Inc. (RCIHH) and its subsidiaries, unless the context indicates otherwise. 2 Trademarks Except as otherwise indicated, all trademarks, service marks, logos, and trade names in this presentation are property of RCI Hospitality Holdings, Inc., its subsidiaries or affiliates.

Non-GAAP Financial Measures In addition to our financial information presented in accordance with GAAP, management uses certain non-GAAP financial measures, within the meaning of the SEC Regulation G, to clarify and enhance understanding of past performance and prospects for the future. Generally, a non-GAAP financial measure is a numerical measure of a company’s operating performance, financial position or cash flows that excludes or includes amounts that are included in or excluded from the most directly comparable measure calculated and presented in accordance with GAAP. We monitor non-GAAP financial measures because it describes the operating performance of the Company and helps management and investors gauge our ability to generate cash flow, excluding (or including) some items that management believes are not representative of the ongoing business operations of the Company, but are included in (or excluded from) the most directly comparable measures calculated and presented in accordance with GAAP. Relative to each of the non-GAAP financial measures, we further set forth our rationale as follows: • Non-GAAP Operating Income and Non-GAAP Operating Margin. We calculate non-GAAP operating income and non-GAAP operating margin by excluding the following items from income from operations and operating margin: (a) amortization of intangibles, (b) impairment of assets, (c) settlement of lawsuits, (d) gains or losses on sale of businesses and assets, (e) gains or losses on insurance, and (f) stock-based compensation. We believe that excluding these items assists investors in evaluating period-over-period changes in our operating income and operating margin without the impact of items that are not a result of our day-to-day business and operations. • Non-GAAP Net Income and Non-GAAP Net Income per Diluted Share. We calculate non-GAAP net income and non-GAAP net income per diluted share by excluding or including certain items to net income or loss attributable to RCIHH common stockholders and diluted earnings per share. Adjustment items are: (a) amortization of intangibles, (b) impairment of assets, (c) settlement of lawsuits, (d) gains or losses on sale of businesses and assets, (e) gains or losses on insurance, (f) stock-based compensation, and (g) the income tax effect of the above-described adjustments. Included in the income tax effect of the above adjustments is the net effect of the non-GAAP provision for income taxes, calculated at 11.7% and 21.6% effective tax rate of the pre-tax non-GAAP income before taxes for the nine months ended June 30, 2024 and 2023, respectively, and the GAAP income tax expense (benefit). We believe that excluding and including such items help management and investors better understand our operating activities. • Adjusted EBITDA. We calculate adjusted EBITDA by excluding the following items from net income or loss attributable to RCIHH common stockholders: (a) depreciation and amortization, (b) impairment of assets, (c) income tax expense (benefit), (d) net interest expense, (e) settlement of lawsuits, (f) gains or losses on sale of businesses and assets, (g) gains or losses on insurance, and (h) stock-based compensation. We believe that adjusting for such items helps management and investors better understand our operating activities. Adjusted EBITDA provides a core operational performance measurement that compares results without the need to adjust for federal, state and local taxes which have considerable variation between domestic jurisdictions. The results are, therefore, without consideration of financing alternatives of capital employed. We use adjusted EBITDA as one guideline to assess our unleveraged performance return on our investments. Adjusted EBITDA is also the target benchmark for our acquisitions of nightclubs. • We also use certain non-GAAP cash flow measures such as free cash flow. Free cash flow is derived from net cash provided by operating activities less maintenance capital expenditures. We use free cash flow as the baseline for the implementation of our capital allocation strategy. Our 3Q24 10-Q and our August 8, 2024 earnings news release and financial tables contain additional details and reconciliation of non-GAAP financial measures for the quarter ended June 30, 2024, and are posted on our website at www.rcihospitality.com and filed with the US Securities and Exchange Commission. 3

Adult Nightclubs Compelling Investment Opportunity Only public company that owns & acquires adult nightclubs Classic, timeless & legal segment of adult entertainment Consistent & predictable cash flows High barriers to entry & limited competition Fragmented market with significant acquisition opportunities 4 Strong Business Model

Times Have Changed 5 Perception Reality Tootsie’s Cabaret Miami

Our Club Portfolio 6 Great Locations • 56 clubs • 13 states Major Brands • More than 20 • Some of the best in the business Wide Appeal • Gen Z, Millennials, Gen X, Baby Boomers • Blue & white collar • White, Black, Hispanic Strong Moat • Few municipalities issue new adult club licenses Excellent Economics • Large % of high margin alcohol & service sales • Fast inventory turns • Low maintenance capex • Own most of our real estate TX 34% FL 27% NY 10% IL 7% CO 7% Other 15% By State 9M24 Sales Alcohol 44% Food & Other Service 40% By Type

Some of Our Top Brands 7 Elegant clubs with fine dining restaurants High-energy “party" style adult nightclubs High-energy adult nightclubs playing top hip hop music World’s largest adult nightclub with 74,000 square feet All-American Rock/Country themed adult clubs Lively BYOB clubs for blue collar patrons & the college crowd High-end, high-energy “party" style adult nightclubs Elegant gentlemen clubs with restaurant & cigar lounge Vibrant Latin Fusion themed adult clubs

Bombshells 8 Plan Improve sales & margins Finish new builds Continue to explore strategic options Capitalize further on our investment Bombshells 290 in Houston Overview • 12 locations in Texas • Big sports bar/restaurant • Generated 100% ROIC • Over-performed during Covid • More recently SSS has declined Bombshells 290 in Houston

Capital Allocation Strategy* 9 Overview • Initiated in 2015 • Governs use of FCF, creates financial discipline, focuses us on shareholder value • Inspired by The Outsiders by William N. Thorndike Jr. Approaches • Club acquisitions that can generate at least 25-33% cash on cash return • Share buybacks if FCF/PS yield is 10% or greater • Debt repayment if the after-tax yield is 10% or greater • Dividend Target • Increase FCF/PS by average of 10-15% CAGR * We may deviate from this strategy if other strategic rationale warrants Drive Value with 10-15% Average Compound Annual FCF/Share Growth

Track Record of Success $135 $298 FY15 TTM 6/30/24 43 70 9/30/2015 6/30/2024 $16 $52 FY15 TTM 6/30/24 $15 $46 FY15 TTM 6/30/24 10.285 8.997 9/30/2015 8/5/2024 $10.42 $46.50 9/30/2015 8/9/2024 1,920 5,344 9/30/2015 8/9/2024 Total Revenues ($M) +120% Locations +63% Net Cash Provided by Operating Activities ($M) +219% Free Cash Flow ($M) +211% Share Count (M) -13% RICK Stock +346% S&P 500 +178% 10

Our Unique Advantage 11 Exit Strategy of Choice for the Industry • 3-5x adjusted EBITDA for clubs • Market price for real estate • Upfront cash downpayment • Trusted seller financing for the balance Multiple Cash Sources • Free cash flow • Bank real estate financings / refinancings • Private lender group RCI Management, Inc. • Team leadership has been in place for +20 years • Methods proven to increase club EBITDA • Our scale enables us to provide infrastructure most club owners can't afford (purchasing, legal, security, IT) Scarlett’s Cabaret Miami Light Show

The Road Ahead 12 FY20-23 • Survived Covid • Big benefit from post- Covid bounce • Made our two biggest acquisitions FY23-24 • Working through uncertain economy • 3Q24: First club SSS increase since 2Q23 FY25-29 • Developing 5-year plan • Focus: How to best increase FCF/PS & return value to shareholders • Two key pillars

Pillar 1: Back to Basics 13 Project Location Status Bombshells Stafford, TX • Opened November 2023 PT’s Centerfold Lubbock, TX • Opened March 2024 (BYOB) Scarlett’s Cabaret Denver Glendale, CO • 4 AM liquor license approved late March 2024 Baby Dolls (rebranded) Tye, TX • Opened April 2024 (liquor) Dallas Showclub (rebranded) Dallas, TX • Opened June 2024 (liquor) Chicas Locas (rebranded) Harlingen, TX • Opened June 2024 (liquor) Chicas Locas Dallas, TX • Opened June 2024 in unused space (BYOB) Chicas Locas (rebranded) El Paso, TX • Opening September 12 Baby Dolls West Fort Worth, TX • Awaiting construction permits Baby Dolls Fort Worth, TX • Plan to rebuild following fire July 2024 Rick’s Cabaret & Steakhouse Central City, CO • 24-hour liquor licenses approved • Construction in process Bombshells Denver, CO • Interior remodel well underway • Target opening October 2024 Bombshells Lubbock, TX • All MEP (mechanical, electrical & plumbing) & stucco underway Bombshells Rowlett, TX • Starting MEP Plan Return to pure play on adult nightclubs Open/Reopen/Reformat remaining 7 projects fast & efficiently Grow SSS & margins Rebrand/Reformat/Sell underperformers

Acquisitions (~50%) Dividends (Less than ~10%) Share Buybacks (~40%) FCF Use Targets After Debt Service FY25-29 FCF Assuming No Growth ~$200-250M Pillar 2: Capital Allocation 14

Summary Mission • Follow our Capital Allocation Strategy • Acquire the right adult nightclubs • Make sure our guests have a great time Success Leads to… • Regular guests returning • Prosperity for entertainers, our teams, & the company • Continued expansion & growth through: ❑ Increasing FCF/PS ❑ Acquiring more clubs ❑ Share buybacks ❑ Growing our dividend ❑ Enhancing shareholder value Baby Dolls Dallas on a Recent Monday Night 15 Thank you to our teams! You make RCI strong!

Corporate Office 10737 Cutten Road Houston, TX 77066 Phone: (281) 397-6730 Investor Relations Gary Fishman Steven Anreder Phone: (212) 532-3232 IR Website www.rcihospitality.com Nasdaq: RICK Contact Information 16

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

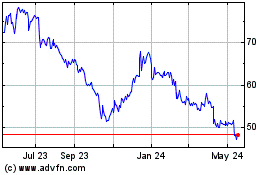

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Oct 2024 to Nov 2024

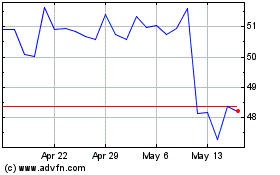

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Nov 2023 to Nov 2024