Strategic Education, Inc. (Strategic Education) (NASDAQ: STRA)

today announced financial results for the period ended December 31,

2024.

“During 2024, we delivered strong performance consistent with

our notional operating model including enrollment, revenue, and

earnings growth,” said Karl McDonnell, Chief Executive Officer of

Strategic Education. “We started 2025 positioned well to continue

to deliver growth from the investments we've made across our

diversified portfolio of education offerings.”

STRATEGIC EDUCATION CONSOLIDATED

RESULTS

Year Ended December 31

- Revenue increased 7.7% to $1,219.9 million compared to $1,132.9

million in 2023. Revenue on a constant currency basis, which is a

non-GAAP financial measure, increased 7.8% to $1,220.9 million in

2024 compared to $1,132.9 million in 2023. For more details on

non-GAAP financial measures used in this press release, refer to

the information in the Non-GAAP Financial Measures section of this

press release.

- Income from operations was $155.6 million or 12.8% of revenue,

compared to $95.3 million or 8.4% of revenue in 2023. Adjusted

income from operations, which is a non-GAAP financial measure, was

$157.3 million in 2024 compared to $124.6 million in 2023. The

adjusted operating income margin, which is a non-GAAP financial

measure, was 12.9% compared to 11.0% in 2023.

- Net income was $112.7 million in 2024 compared to $69.8 million

in 2023. Adjusted net income, which is a non-GAAP financial

measure, was $117.7 million compared to $89.1 million in 2023.

- Adjusted EBITDA, which is a non-GAAP financial measure, was

$233.8 million compared to $196.5 million in 2023.

- Diluted earnings per share was $4.67 compared to $2.91 in 2023.

Adjusted diluted earnings per share, which is a non-GAAP financial

measure, increased to $4.87 from $3.72 in 2023. Adjusted diluted

earnings per share on a constant currency basis, which is a

non-GAAP financial measure, was $4.87. Diluted weighted average

shares outstanding increased to 24,140,000 from 23,956,000 in

2023.

Three Months Ended December 31

- Revenue increased 2.9% to $311.5 million compared to $302.7

million for the same period in 2023. Revenue on a constant currency

basis, which is a non-GAAP financial measure, increased 2.7% to

$310.8 million in the fourth quarter of 2024 compared to $302.7

million for the same period in 2023. For more details on non-GAAP

financial measures used in this press release, refer to the

information in the Non-GAAP Financial Measures section of this

press release.

- Income from operations was $36.0 million or 11.6% of revenue,

compared to $54.2 million or 17.9% of revenue for the same period

in 2023. Adjusted income from operations, which is a non-GAAP

financial measure, was $40.4 million compared to $56.6 million for

the same period in 2023. The adjusted operating income margin,

which is a non-GAAP financial measure, was 13.0% compared to 18.7%

for the same period in 2023.

- Net income was $25.3 million compared to $39.1 million for the

same period in 2023. Adjusted net income, which is a non-GAAP

financial measure, was $30.8 million compared to $40.4 million for

the same period in 2023.

- Adjusted EBITDA, which is a non-GAAP financial measure, was

$60.1 million compared to $74.4 million for the same period in

2023.

- Diluted earnings per share was $1.05 compared to $1.63 for the

same period in 2023. Adjusted diluted earnings per share, which is

a non-GAAP financial measure, decreased to $1.27 from $1.68 for the

same period in 2023. Adjusted diluted earnings per share on a

constant currency basis, which is a non-GAAP financial measure, was

$1.26. Diluted weighted average shares outstanding increased to

24,149,000 from 23,968,000 for the same period in 2023.

U.S. Higher Education Segment Highlights

- The U.S. Higher Education segment (USHE) is comprised of

Capella University and Strayer University.

- For the fourth quarter, student enrollment within USHE

increased 3.0% to 88,860 compared to 86,233 for the same period in

2023. Full-year 2024 student enrollment within USHE increased 6.4%

compared to 2023.

- For the fourth quarter, FlexPath enrollment was 24% of USHE

enrollment compared to 21% for the same period in 2023.

- Revenue decreased 1.5% to $214.3 million in the fourth quarter

of 2024 compared to $217.6 million for the same period in 2023,

driven by lower revenue per student.

- Income from operations was $17.9 million in the fourth quarter

of 2024 compared to $32.9 million for the same period in 2023. The

operating income margin was 8.3% compared to 15.1% for the same

period in 2023.

Education Technology Services Segment Highlights

- The Education Technology Services segment (ETS) is comprised

primarily of Enterprise Partnerships, Sophia Learning, and

Workforce Edge.

- For the fourth quarter, employer affiliated enrollment was

30.2% of USHE enrollment compared to 27.7% for the same period in

2023. Full-year 2024 employer affiliated enrollment was 29.6% of

USHE enrollment compared to 27.2% in 2023.

- For the fourth quarter, average total subscribers at Sophia

Learning increased approximately 29% from the same period in

2023.

- As of December 31, 2024, Workforce Edge had a total of 76

corporate agreements, collectively employing approximately

3,820,000 employees.

- Revenue increased 39.3% to $30.5 million in the fourth quarter

of 2024 compared to $21.9 million for the same period in 2023,

driven by growth in Sophia Learning subscriptions, employer

affiliated enrollment, and revenue from a new Workforce Edge

employer partnership.

- Income from operations was $11.8 million in the fourth quarter

of 2024 compared to $8.8 million for the same period in 2023. The

operating income margin was 38.8% compared to 40.3% for the same

period in 2023.

Australia/New Zealand Segment Highlights

- The Australia/New Zealand segment (ANZ) is comprised of Torrens

University, Think Education, and Media Design School.

- For the fourth quarter, student enrollment within ANZ increased

3.0% to 19,825 compared to 19,252 for the same period in 2023.

Full-year 2024 student enrollment within ANZ increased 4.8%

compared to 2023.

- Revenue increased 5.4% to $66.7 million in the fourth quarter

of 2024 compared to $63.3 million for the same period in 2023,

driven by higher fourth quarter enrollment and revenue per student.

Revenue on a constant currency basis, which is a non-GAAP financial

measure, increased 4.3% to $66.0 million in the fourth quarter of

2024 compared to $63.3 million for the same period in 2023, driven

by higher fourth quarter enrollment and revenue per student.

- Income from operations was $10.7 million in the fourth quarter

of 2024 compared to $14.9 million for the same period in 2023. The

operating income margin was 16.1% compared to 23.5% for the same

period in 2023. Income from operations on a constant currency

basis, which is a non-GAAP financial measure, was $10.3 million in

the fourth quarter of 2024 compared to $14.9 million for the same

period in 2023. The operating income margin on a constant currency

basis, which is a non-GAAP financial measure, was 15.6% compared to

23.5% for the same period in 2023.

BALANCE SHEET AND CASH

FLOW

At December 31, 2024, Strategic Education had cash, cash

equivalents, and marketable securities of $199.0 million and no

debt outstanding under its revolving credit facility. Cash provided

by operations in 2024 was $169.3 million compared to $117.1 million

in 2023. Capital expenditures for 2024 were $40.6 million compared

to $36.9 million in 2023.

For the fourth quarter of 2024, consolidated bad debt expense as

a percentage of revenue was 4.5% compared to 3.7% of revenue for

the same period in 2023.

COMMON STOCK CASH

DIVIDEND

Strategic Education announced today that it declared a regular,

quarterly cash dividend of $0.60 per share of common stock. This

dividend will be paid on March 17, 2025 to shareholders of record

as of March 10, 2025.

CONFERENCE CALL WITH

MANAGEMENT

Strategic Education will host a conference call to discuss its

fourth quarter 2024 results at 10:00 a.m. (ET) today. This call

will be available via webcast. To access the live webcast of the

conference call, please go to www.strategiceducation.com in the

Investor Relations section 15 minutes prior to the start time of

the call to register. An earnings release presentation will also be

posted to www.strategiceducation.com in the Investor Relations

section. Following the call, the webcast will be archived and

available at www.strategiceducation.com in the Investor Relations

section. To participate in the live call, investors should register

here prior to the call to receive dial-in information and a

PIN.

About Strategic Education, Inc.

Strategic Education, Inc. (NASDAQ: STRA)

(www.strategiceducation.com) is dedicated to helping advance

economic mobility through higher education. We primarily serve

working adult students globally through our core focus areas: 1)

U.S. Higher Education, including Capella University and Strayer

University, each institutionally accredited, and collectively offer

flexible and affordable associate, bachelor’s, master’s, and

doctoral programs including the Jack Welch Management Institute at

Strayer University, and non-degree web and mobile application

development courses through Strayer University’s Hackbright Academy

and Devmountain; 2) Education Technology Services, developing and

maintaining relationships with employers to build education

benefits programs providing employees access to affordable and

industry-relevant training, certificate, and degree programs,

including through Workforce Edge, a full-service education benefits

administration solution for employers, and Sophia Learning, which

offers low-cost online general education-level courses that are

ACE-recommended for college credit; and 3) Australia/New Zealand,

comprised of Torrens University, Think Education, and Media Design

School that collectively offer certificate and degree programs in

Australia and New Zealand. This portfolio of high quality,

innovative, relevant, and affordable programs and institutions

helps our students prepare for success in today’s workforce and

find a path to bettering their lives.

Forward-Looking Statements

This communication contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such statements may be identified by the use of words such

as “expect,” “estimate,” “assume,” “believe,” “anticipate,” “may,”

“will,” “forecast,” “outlook,” “plan,” “project,” “potential” and

other similar words, and include all statements that are not

historical facts, including with respect to, among other things,

the future financial performance and growth opportunities of

Strategic Education; Strategic Education’s plans, strategies and

prospects; and future events and expectations. The statements are

based on Strategic Education’s current expectations and are subject

to a number of assumptions, uncertainties and risks, including but

not limited to:

- the pace of student enrollment;

- Strategic Education’s continued compliance with Title IV of the

Higher Education Act, and the regulations thereunder, as well as

other federal laws and regulations, institutional accreditation

standards and state regulatory requirements;

- legislation and other actions by the U.S. Congress, actions by

the current administration, rulemaking and other action by the

Department of Education or other governmental entities, including

without limitation action related to borrower defense to repayment

applications, gainful employment, 90/10, increased focus by

governmental entities on for-profit education institutions, and

including actions by governmental entities in Australia and New

Zealand;

- competitive factors;

- risks associated with the opening of new campuses;

- risks associated with the offering of new educational programs

and adapting to other changes;

- risks associated with the acquisition of existing educational

institutions, including Strategic Education’s acquisition of

Torrens University and associated assets in Australia and New

Zealand;

- the risk that the benefits of the acquisition of Torrens

University and associated assets in Australia and New Zealand may

not be fully realized or may take longer to realize than

expected;

- the risk that the acquisition of Torrens University and

associated assets in Australia and New Zealand may not advance

Strategic Education’s business strategy and growth strategy;

- risks relating to the timing of regulatory approvals;

- Strategic Education’s ability to implement its growth

strategy;

- the risk that the combined company may experience difficulty

integrating employees or operations;

- risks associated with the ability of Strategic Education’s

students to finance their education in a timely manner;

- general economic and market conditions; and

- additional factors described in Strategic Education’s most

recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K.

Many of these risks, uncertainties and assumptions are beyond

Strategic Education’s ability to control or predict. Because of

these risks, uncertainties and assumptions, you should not place

undue reliance on these forward-looking statements. Furthermore,

these forward-looking statements speak only as of the information

currently available to Strategic Education on the date they are

made, and Strategic Education undertakes no obligation to update or

revise forward-looking statements, except as required by law.

Actual results may differ materially from those projected in the

forward-looking statements.

STRATEGIC EDUCATION,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per

share data)

For the three months ended

December 31,

For the twelve months ended

December 31,

2023

2024

2023

2024

Revenues

$

302,702

$

311,456

$

1,132,924

$

1,219,930

Costs and expenses:

Instructional and support costs

153,751

166,884

623,903

650,496

General and administration

92,377

104,145

384,443

412,158

Amortization of intangible assets

1,093

—

11,457

—

Merger and integration costs

209

—

1,544

—

Restructuring costs

1,048

4,405

16,256

1,648

Total costs and expenses

248,478

275,434

1,037,603

1,064,302

Income from operations

54,224

36,022

95,321

155,628

Other income

994

1,869

5,405

5,804

Income before income taxes

55,218

37,891

100,726

161,432

Provision for income taxes

16,089

12,555

30,935

48,748

Net income

$

39,129

$

25,336

$

69,791

$

112,684

Earnings per share:

Basic

$

1.67

$

1.08

$

2.98

$

4.81

Diluted

$

1.63

$

1.05

$

2.91

$

4.67

Weighted average shares outstanding:

Basic

23,367

23,370

23,403

23,406

Diluted

23,968

24,149

23,956

24,140

STRATEGIC EDUCATION,

INC.

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

(in thousands, except share

and per share data)

December 31, 2023

December 31,

2024

ASSETS

Current assets:

Cash and cash equivalents

$

168,481

$

137,074

Marketable securities

39,728

46,949

Tuition receivable, net

76,102

76,127

Other current assets

44,758

44,793

Total current assets

329,069

304,943

Property and equipment, net

118,529

111,247

Right-of-use lease assets

119,202

103,673

Marketable securities, non-current

483

14,981

Intangible assets, net

251,623

245,098

Goodwill

1,251,888

1,206,883

Other assets

54,419

62,910

Total assets

$

2,125,213

$

2,049,735

LIABILITIES &

STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable and accrued expenses

$

90,888

$

101,749

Income taxes payable

2,200

2,926

Contract liabilities

92,341

89,563

Lease liabilities

24,190

22,222

Total current liabilities

209,619

216,460

Long-term debt

61,400

—

Deferred income tax liabilities

28,338

27,586

Lease liabilities, non-current

127,735

103,004

Other long-term liabilities

45,603

40,186

Total liabilities

472,695

387,236

Commitments and contingencies

Stockholders’ equity:

Common stock, par value $0.01; 32,000,000

shares authorized; 24,406,816 and 24,502,385 shares issued and

outstanding at December 31, 2023 and December 31, 2024,

respectively

244

245

Additional paid-in capital

1,517,650

1,532,414

Accumulated other comprehensive loss

(34,247

)

(88,565

)

Retained earnings

168,871

218,405

Total stockholders’ equity

1,652,518

1,662,499

Total liabilities and stockholders’

equity

$

2,125,213

$

2,049,735

STRATEGIC EDUCATION,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the year ended December

31,

2023

2024

Cash flows from operating activities:

Net income

$

69,791

$

112,684

Adjustments to reconcile net income to net

cash provided by operating activities:

Gain on sale of property and equipment

(2,136

)

—

Gain on early termination of operating

leases, net

(141

)

(6,166

)

Amortization of deferred financing

costs

557

674

Amortization of investment

discount/premium

(65

)

(290

)

Depreciation and amortization

57,313

44,378

Deferred income taxes

(6,322

)

(150

)

Stock-based compensation

19,772

25,571

Impairment of right-of-use lease

assets

5,135

677

Changes in assets and liabilities:

Tuition receivable, net

(12,874

)

221

Other assets

(7,631

)

(11,622

)

Accounts payable and accrued expenses

552

11,577

Income taxes payable and income taxes

receivable

(4,688

)

1,067

Contract liabilities

4,495

(2,948

)

Other liabilities

(6,639

)

(6,342

)

Net cash provided by operating

activities

117,119

169,331

Cash flows from investing activities:

Purchases of property and equipment

(36,943

)

(40,580

)

Purchases of marketable securities

(26,905

)

(54,117

)

Proceeds from marketable securities

9,800

31,025

Proceeds from sale of property and

equipment

5,890

—

Proceeds from other investments

457

20

Other investments

(314

)

(531

)

Cash paid for acquisition, net of cash

acquired

(530

)

(177

)

Net cash used in investing activities

(48,545

)

(64,360

)

Cash flows from financing activities:

Common dividends paid

(58,780

)

(58,971

)

Payments on long-term debt

(40,000

)

(61,275

)

Net payments for stock awards

(4,828

)

(3,318

)

Payments of deferred financing costs

—

(1,698

)

Repurchase of common stock

(9,999

)

(11,510

)

Net cash used in financing activities

(113,607

)

(136,772

)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(496

)

(3,468

)

Net decrease in cash, cash equivalents,

and restricted cash

(45,529

)

(35,269

)

Cash, cash equivalents, and restricted

cash — beginning of period

227,454

181,925

Cash, cash equivalents, and restricted

cash — end of period

$

181,925

$

146,656

STRATEGIC EDUCATION,

INC.

UNAUDITED SEGMENT

REPORTING

(in thousands)

For the three months ended

December 31,

For the twelve months ended

December 31,

2023

2024

2023

2024

Revenues:

U.S. Higher Education

$

217,551

$

214,332

$

818,953

$

857,890

Australia/New Zealand

63,279

66,666

233,518

257,119

Education Technology Services

21,872

30,458

80,453

104,921

Consolidated revenues

$

302,702

$

311,456

$

1,132,924

$

1,219,930

Income from operations:

U.S. Higher Education

$

32,886

$

17,881

$

59,628

$

77,165

Australia/New Zealand

14,878

10,743

35,862

37,394

Education Technology Services

8,810

11,803

29,088

42,717

Amortization of intangible assets

(1,093

)

—

(11,457

)

—

Merger and integration costs

(209

)

—

(1,544

)

—

Restructuring costs

(1,048

)

(4,405

)

(16,256

)

(1,648

)

Consolidated income from operations

$

54,224

$

36,022

$

95,321

$

155,628

Non-GAAP Financial Measures

In our press release and schedules, we report certain financial

measures that are not required by, or presented in accordance with,

accounting principles generally accepted in the United States of

America (“GAAP”). We discuss management’s reasons for reporting

these non-GAAP measures below, and the press release schedules that

follow reconcile the most directly comparable GAAP measure to each

non-GAAP measure that we reference. Although management evaluates

and presents these non-GAAP measures for the reasons described

below, please be aware that these non-GAAP measures have

limitations and should not be considered in isolation or as a

substitute for revenue, total costs and expenses, income from

operations, operating margin, income before income taxes, net

income, earnings per share or any other comparable financial

measure prescribed by GAAP. In addition, we may calculate and/or

present these non-GAAP financial measures differently than measures

with the same or similar names that other companies report, and as

a result, the non-GAAP measures we report may not be comparable to

those reported by others.

Management uses certain non-GAAP measures to evaluate financial

performance because those non-GAAP measures allow for

period-over-period comparisons of the Company’s ongoing operations

before the impact of certain items described below. Management

believes this information is useful to investors to compare the

Company’s results of operations period-over-period. These measures

are Adjusted Revenue, Adjusted Total Costs and Expenses, Adjusted

Income from Operations, Adjusted Operating Margin, Adjusted Income

Before Income Taxes, Adjusted Net Income, Earnings Before Interest,

Taxes, Depreciation and Amortization (EBITDA), Adjusted EBITDA and

Adjusted Diluted Earnings Per Share (EPS). We define Adjusted

Revenue, Adjusted Total Costs and Expenses, Adjusted Income from

Operations, Adjusted Operating Margin, Adjusted Income Before

Income Taxes, Adjusted Net Income, and Adjusted Diluted EPS to

exclude (1) amortization and depreciation expense related to

intangible assets and software assets associated with the Company’s

acquisition of Torrens University and associated assets in

Australia and New Zealand, (2) integration expenses associated with

the Company’s merger with Capella Education Company and the

Company’s acquisition of Torrens University and associated assets

in Australia and New Zealand, (3) severance costs, asset impairment

charges, gains on sale of real estate and early termination of

leased facilities, and other costs associated with the Company’s

restructuring activities, (4) income/loss recognized from the

Company’s investments in partnership interests and other

investments, and (5) discrete tax adjustments utilizing adjusted

effective income tax rates of 30.0% and 27.5% for the three months

ended December 31, 2023 and 2024, respectively, and adjusted

effective income tax rates of 30.0% and 29.0% for the twelve months

ended December 31, 2023 and 2024, respectively. To illustrate

currency impacts to operating results, Adjusted Revenue, Adjusted

Total Costs and Expenses, Adjusted Income from Operations, Adjusted

Operating Margin, Adjusted Income Before Income Taxes, Adjusted Net

Income, and Adjusted Diluted EPS for the three and twelve months

ended December 31, 2024 are also presented on a constant currency

basis utilizing an exchange rate of 0.65 and 0.66 Australian

Dollars to U.S. Dollars, respectively, which were the average

exchange rates for the same periods in 2023. We define EBITDA as

net income before other income, the provision for income taxes,

gains on sale of property and equipment, depreciation and

amortization, and from this amount in arriving at Adjusted EBITDA

we also exclude stock-based compensation expense, amortization

expense associated with deferred implementation costs incurred in

cloud computing arrangements, and the amounts in (2) and (3) above.

These non-GAAP measures are reconciled to the most directly

comparable GAAP measures in the sections that follow. Non-GAAP

measures should not be viewed as substitutes for GAAP measures.

STRATEGIC EDUCATION,

INC.

UNAUDITED RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES

ADJUSTED REVENUE, ADJUSTED

TOTAL COSTS AND EXPENSES, ADJUSTED INCOME FROM OPERATIONS, ADJUSTED

OPERATING MARGIN, ADJUSTED INCOME BEFORE INCOME TAXES, ADJUSTED NET

INCOME, AND ADJUSTED EPS

(in thousands, except per

share data)

For the three months ended

December 31, 2023

Non-GAAP Adjustments

As Reported (GAAP)

Amortization of intangible

assets(1)

Merger and integration

costs(2)

Restructuring costs(3)

Loss from other

investments(4)

Tax adjustments(5)

As Adjusted (Non-GAAP)

Revenues

$

302,702

$

—

$

—

$

—

$

—

$

—

$

302,702

Total costs and expenses

$

248,478

$

(1,093

)

$

(209

)

$

(1,048

)

$

—

$

—

$

246,128

Income from operations

$

54,224

$

1,093

$

209

$

1,048

$

—

$

—

$

56,574

Operating margin

17.9

%

18.7

%

Income before income taxes

$

55,218

$

1,093

$

209

$

1,048

$

108

$

—

$

57,676

Net income

$

39,129

$

1,093

$

209

$

1,048

$

108

$

(1,214

)

$

40,373

Earnings per share:

Diluted

$

1.63

$

1.68

Weighted average shares

outstanding:

Diluted

23,968

23,968

For the three months ended

December 31, 2024

Non-GAAP Adjustments

As Reported (GAAP)

Amortization of intangible

assets(1)

Merger and integration

costs(2)

Restructuring costs(3)

Loss from other

investments(4)

Tax adjustments(5)

As Adjusted (Non-GAAP)

Revenues

$

311,456

$

—

$

—

$

—

$

—

$

—

$

311,456

Total costs and expenses

$

275,434

$

—

$

—

$

(4,405

)

$

—

$

—

$

271,029

Income from operations

$

36,022

$

—

$

—

$

4,405

$

—

$

—

$

40,427

Operating margin

11.6

%

13.0

%

Income before income taxes

$

37,891

$

—

$

—

$

4,405

$

193

$

—

$

42,489

Net income

$

25,336

$

—

$

—

$

4,405

$

193

$

850

$

30,784

Earnings per share:

Diluted

$

1.05

$

1.27

Weighted average shares

outstanding:

Diluted

24,149

24,149

For the twelve months ended

December 31, 2023

Non-GAAP Adjustments

As Reported (GAAP)

Amortization of intangible

assets(1)

Merger and integration

costs(2)

Restructuring costs(3)

Income from other

investments(4)

Tax adjustments(5)

As Adjusted (Non-GAAP)

Revenues

$

1,132,924

$

—

$

—

$

—

$

—

$

—

$

1,132,924

Total costs and expenses

$

1,037,603

$

(11,457

)

$

(1,544

)

$

(16,256

)

$

—

$

—

$

1,008,346

Income from operations

$

95,321

$

11,457

$

1,544

$

16,256

$

—

$

—

$

124,578

Operating margin

8.4

%

11.0

%

Income before income taxes

$

100,726

$

11,457

$

1,544

$

16,256

$

(2,718

)

$

—

$

127,265

Net income

$

69,791

$

11,457

$

1,544

$

16,256

$

(2,718

)

$

(7,245

)

$

89,085

Earnings per share:

Diluted

$

2.91

$

3.72

Weighted average shares

outstanding:

Diluted

23,956

23,956

For the twelve months ended

December 31, 2024

Non-GAAP Adjustments

As Reported (GAAP)

Amortization of intangible

assets(1)

Merger and integration

costs(2)

Restructuring costs(3)

Loss from other

investments(4)

Tax adjustments(5)

As Adjusted (Non-GAAP)

Revenues

$

1,219,930

$

—

$

—

$

—

$

—

$

—

$

1,219,930

Total costs and expenses

$

1,064,302

$

—

$

—

$

(1,648

)

$

—

$

—

$

1,062,654

Income from operations

$

155,628

$

—

$

—

$

1,648

$

—

$

—

$

157,276

Operating margin

12.8

%

12.9

%

Income before income taxes

$

161,432

$

—

$

—

$

1,648

$

2,660

$

—

$

165,740

Net income

$

112,684

$

—

$

—

$

1,648

$

2,660

$

684

$

117,676

Earnings per share:

Diluted

$

4.67

$

4.87

Weighted average shares

outstanding:

Diluted

24,140

24,140

(1)

Reflects amortization and depreciation

expense of intangible assets and software assets acquired through

the Company’s acquisition of Torrens University and associated

assets in Australia and New Zealand.

(2)

Reflects integration expenses associated

with the Company’s merger with Capella Education Company and the

Company’s acquisition of Torrens University and associated assets

in Australia and New Zealand.

(3)

Reflects severance costs, asset impairment

charges, gains on sale of real estate and early termination of

leased facilities, and other costs associated with the Company’s

restructuring activities.

(4)

Reflects income/loss recognized from the

Company’s investments in partnership interests and other

investments.

(5)

Reflects tax impacts of the adjustments

described above and discrete tax adjustments related to stock-based

compensation and other adjustments, utilizing adjusted effective

income tax rates of 30.0% and 27.5% for the three months ended

December 31, 2023 and 2024, respectively, and adjusted effective

income tax rates of 30.0% and 29.0% for the twelve months ended

December 31, 2023 and 2024, respectively.

STRATEGIC EDUCATION,

INC.

UNAUDITED RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES

2024 AS ADJUSTED WITH CONSTANT

CURRENCY

(in thousands, except per

share data)

For the three months ended

December 31, 2024

For the twelve months ended

December 31, 2024

As Adjusted

(Non-GAAP)

Constant currency

adjustment(1)

As Adjusted with Constant

Currency (Non-GAAP)

As Adjusted

(Non-GAAP)

Constant currency

adjustment(1)

As Adjusted with Constant

Currency (Non-GAAP)

Revenues

$

311,456

$

(672

)

$

310,784

$

1,219,930

$

977

$

1,220,907

Total costs and expenses

$

271,029

$

(246

)

$

270,783

$

1,062,654

$

1,292

$

1,063,946

Income from operations

$

40,427

$

(426

)

$

40,001

$

157,276

$

(315

)

$

156,961

Operating margin

13.0

%

12.9

%

12.9

%

12.9

%

Income before income taxes

$

42,489

$

(423

)

$

42,066

$

165,740

$

(297

)

$

165,443

Net income

$

30,784

$

(300

)

$

30,484

$

117,676

$

(212

)

$

117,464

Earnings per share:

Diluted

$

1.27

$

1.26

$

4.87

$

4.87

Weighted average shares

outstanding:

Diluted

24,149

24,149

24,140

24,140

(1)

Reflects an adjustment to

translate foreign currency results for the three and twelve months

ended December 31, 2024 at a constant exchange rate of 0.65 and

0.66 Australian Dollars to U.S. Dollars, respectively, which were

the average exchange rates for the same periods in 2023.

STRATEGIC EDUCATION,

INC.

UNAUDITED NON-GAAP SEGMENT

REPORTING

(in thousands)

For the three months ended

December 31,

For the twelve months ended

December 31,

2023

2024

2023

2024

Revenues:

U.S. Higher Education

$

217,551

$

214,332

$

818,953

$

857,890

Australia/New Zealand

63,279

66,666

233,518

257,119

Education Technology Services

21,872

30,458

80,453

104,921

Consolidated revenues

302,702

311,456

1,132,924

1,219,930

Income from operations:

U.S. Higher Education

$

32,886

$

17,881

$

59,628

$

77,165

Australia/New Zealand

14,878

10,743

35,862

37,394

Education Technology Services

8,810

11,803

29,088

42,717

Amortization of intangible assets

(1,093

)

—

(11,457

)

—

Merger and integration costs

(209

)

—

(1,544

)

—

Restructuring costs

(1,048

)

(4,405

)

(16,256

)

(1,648

)

Consolidated income from operations

54,224

36,022

95,321

155,628

Adjustments to consolidated income from

operations:

Amortization of intangible assets

1,093

—

11,457

—

Merger and integration costs

209

—

1,544

—

Restructuring costs

1,048

4,405

16,256

1,648

Total adjustments to consolidated income

from operations

2,350

4,405

29,257

1,648

Adjusted income from operations by

segment:

U.S. Higher Education

32,886

17,881

59,628

77,165

Australia/New Zealand

14,878

10,743

35,862

37,394

Education Technology Services

8,810

11,803

29,088

42,717

Total adjusted income from operations

$

56,574

$

40,427

$

124,578

$

157,276

STRATEGIC EDUCATION,

INC.

UNAUDITED RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES

ADJUSTED EBITDA

(in thousands)

For the three months ended

December 31,

For the twelve months ended

December 31,

2023

2024

2023

2024

Net income

$

39,129

$

25,336

$

69,791

$

112,684

Provision for income taxes

16,089

12,555

30,935

48,748

Other income

(994

)

(1,869

)

(5,405

)

(5,804

)

Gain on sale of property and equipment

—

—

(2,136

)

—

Depreciation and amortization

12,432

11,345

57,313

44,378

EBITDA (1)

66,656

47,367

150,498

200,006

Stock-based compensation

4,570

6,782

19,772

25,571

Merger and integration costs (2)

209

—

1,208

—

Restructuring costs (3)

907

4,154

17,500

1,123

Cloud computing amortization (4)

2,024

1,762

7,547

7,143

Adjusted EBITDA (1)

$

74,366

$

60,065

$

196,525

$

233,843

(1)

Denotes non-GAAP financial measures.

Please see the information in the Non-GAAP Financial Measures

section of this press release for more detail regarding these

adjustments and management’s reasons for providing this

information.

(2)

Reflects integration charges associated

with the Company’s merger with Capella Education Company and the

Company’s acquisition of Torrens University and associated assets

in Australia and New Zealand. Excludes $0.3 million of depreciation

and amortization for the twelve months ended December 31, 2023.

(3)

Reflects severance costs, asset impairment

charges, gains on sale of real estate and early termination of

leased facilities, and other costs associated with the Company’s

restructuring activities. Excludes $2.1 million of gain on the sale

of property and equipment for the twelve months ended December 31,

2023. Excludes $0.4 million of depreciation and amortization

expense for the twelve months ended December 31, 2023, and $0.2

million of depreciation and amortization expense for the three and

twelve months ended December 31, 2024. Excludes $0.1 million and

$0.5 million of stock-based compensation expense for the three and

twelve months ended December 31, 2023, respectively, and $0.1

million and $0.3 million of stock-based compensation expense for

the three and twelve months ended December 31, 2024,

respectively.

(4)

Reflects amortization expense associated

with deferred implementation costs incurred in cloud computing

arrangements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227616272/en/

Terese Wilke Senior Director of Investor Relations Strategic

Education, Inc. (612) 977-6331 terese.wilke@strategiced.com

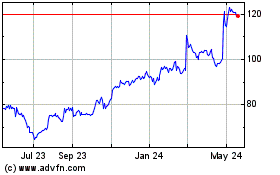

Strategic Education (NASDAQ:STRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

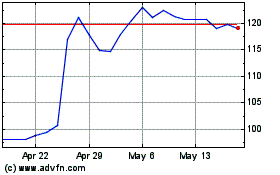

Strategic Education (NASDAQ:STRA)

Historical Stock Chart

From Feb 2024 to Feb 2025