UP Fintech Holding Limited (NASDAQ: TIGR) (“UP Fintech” or the

“Company”), a leading online brokerage firm focusing on global

investors, today announced its unaudited financial results for the

third quarter ended September 30, 2024.

Mr. Wu Tianhua, Chairman and CEO of UP Fintech

stated: “Both of our financial and operating performance have

achieved significant growth in the third quarter. Total revenue

reached US$101.1 million, a historical high and representing a

sequential increase of 15.6% and a year-over-year growth of 44.1%.

Bottom line also largely increased in GAAP and non-GAAP basis. Net

income attributable to ordinary shareholders of UP Fintech reached

US$17.8 million, representing a quarter-over-quarter growth of

584.6% and a year-over-year growth of 34.0%. Non-GAAP net income

attributable to ordinary shareholders of UP Fintech amounted to

US$20.1 million, a quarter-over-quarter increase of 286.5% and a

year-over-year increase of 25.6%.

In the third quarter, we added 50,500 customers

with deposits, more than doubled from a year ago and the total

number of customers with deposits at the end of the third quarter

reached approximately 1,032,800. We took advantage of the active

market condition in October and by now we have already achieved our

annual guidance of acquiring 150,000 newly customers with deposits.

Driven by strong net asset inflow from retail clients and mark to

market gains, total account balance further increased 6.7%

quarter-over-quarter and 115.9% year-over-year to US$40.8 billion,

setting another historic high.

We continued to add new products on our platform

to enhance user experience, which we believe is key to our

long-term success. In the third quarter, we officially launched

Hong Kong stock option trading and short selling. In early

November, we have upgraded the Hong Kong stock option feature by

offering weekly option in addition to monthly option. Additionally,

in September, we introduced the Tiger Boss debit card, along with

the T+0 automatic subscription and redemption feature for our

wealth management product, Tiger Vault. This integration allows

users to manage their investment portfolios more conveniently,

seamlessly bridging daily spending, wealth management, and stock

investments.

Our corporate businesses continued to perform

well in the third quarter of 2024. During this period, we

underwrote a total of 13 U.S. and Hong Kong IPOs, including “NIP

Group” and “Voicecomm Technology” and we served as the exclusive

lead bank for the U.S. IPOs of “NIP Group” and “XCHG Limited”. In

our ESOP business, we added 18 new clients in the third quarter,

bringing the total number of ESOP clients served to 597 as of

September 30, 2024.”

Financial Highlights for Third Quarter

2024

- Total revenues increased 44.1% year-over-year

to US$101.1 million.

- Total net revenues increased 47.1%

year-over-year to US$85.4 million.

- Net income attributable to ordinary shareholders of UP

Fintech was US$17.8 million compared to a net income of

US$13.2 million in the same quarter of last year, an increase of

34.0%.

- Non-GAAP net income attributable to ordinary

shareholders of UP Fintech was US$20.1 million, compared

to a non-GAAP net income of US$16.0 million in the same quarter of

last year, an increase of 25.6%. A reconciliation of non-GAAP

financial metrics to the most comparable GAAP metrics is set forth

below.

Operating Highlights for Third Quarter

2024

- Total account balance increased 115.9%

year-over-year to US$40.8 billion.

- Total margin financing and securities lending

balance increased 101.8% year-over-year to US$4.5

billion.

- Total number of customers with deposit

increased 19.3% year-over-year to 1,032,800.

Selected Operating Data for Third Quarter

2024

|

|

|

As of and for the three months ended |

|

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

In 000’s |

|

|

|

|

|

|

|

|

|

|

Number of customer accounts |

|

|

2,147.9 |

|

|

|

2,307.9 |

|

|

|

2,368.0 |

|

|

Number of customers with deposits |

|

|

865.5 |

|

|

|

982.3 |

|

|

|

1,032.8 |

|

|

Number of options and futures contracts traded |

|

|

8,140.2 |

|

|

|

12,175.1 |

|

|

|

15,261.2 |

|

|

In USD millions |

|

|

|

|

|

|

|

|

|

|

Trading volume |

|

|

80,250.7 |

|

|

|

105,860.0 |

|

|

|

162,990.0 |

|

|

Trading volume of stocks |

|

|

22,147.8 |

|

|

|

33,504.7 |

|

|

|

41,406.3 |

|

|

Total account balance |

|

|

18,878.5 |

|

|

|

38,188.6 |

|

|

|

40,763.6 |

|

Third Quarter 2024 Financial

Results

REVENUES

Total revenues were US$101.1 million, an

increase of 44.1% from US$70.1 million in the same quarter of last

year.

Commissions were US$41.2 million, an increase of

77.7% from US$23.2 million in the same quarter of last year, due to

an increase in trading volume.

Financing service fees were US$2.8 million, a

decrease of 15.2% from US$3.3 million in the same quarter of last

year, primarily due to a decrease in margin financing and

securities lending activities of our fully disclosed account

customers.

Interest income was US$48.0 million, an increase

of 25.2% from US$38.3 million in the same quarter of last year,

primarily due to the increase in margin financing and securities

lending activities of our consolidated account customers.

Other revenues were US$9.1 million, an increase

of 69.8% from US$5.4 million in the same quarter of last year,

primarily due to the increase in IPO subscription incomes.

Interest expense was US$15.7 million, an

increase of 29.4% from US$12.1 million in the same quarter of last

year, primarily due to the increase in margin financing and

securities lending activities.

OPERATING COSTS AND

EXPENSES

Total operating costs and expenses were US$59.3

million, an increase of 21.7% from US$48.8 million in the same

quarter of last year.

Execution and clearing expenses were US$3.5

million, an increase of 48.3% from US$2.4 million in the same

quarter of last year due to an increase in our trading volume.

Employee compensation and benefits expenses were

US$28.8 million, an increase of 10.8% from US$26.0 million in the

same quarter of last year, primarily due to an increase of global

headcount to support our global expansion.

Occupancy, depreciation and amortization

expenses were US$2.2 million, a slight decrease of 3.2% from US$2.2

million in the same quarter of last year.

Communication and market data expenses were

US$9.7 million, an increase of 28.4% from US$7.6 million in the

same quarter of last year due to increased IT-related fees.

Marketing and branding expenses were US$8.2

million, an increase of 59.2% from US$5.2 million in the same

quarter of last year, primarily due to higher marketing spending

this quarter.

General and administrative expenses were US$6.9

million, an increase of 27.3% from US$5.4 million in the same

quarter of last year due to the increase in professional service

expense and general expenses resulting from business expansion and

changes.

NET INCOME attributable

to ordinary shareholders of UP Fintech

Net income attributable to ordinary shareholders

of UP Fintech was US$17.8 million, as compared to a net income of

US$13.2 million in the same quarter of last year. Net income per

ADS – diluted was US$0.110, as compared to a net income per ADS –

diluted of US$0.083 in the same quarter of last year.

Non-GAAP net income attributable to ordinary

shareholders of UP Fintech, which excludes share-based

compensation, was US$20.1 million, as compared to a US$16.0 million

non-GAAP net income attributable to ordinary shareholders of UP

Fintech in the same quarter of last year. Non-GAAP net income per

ADS – diluted was US$0.124 as compared to a non-GAAP net income per

ADS – diluted of US$0.100 in the same quarter of last year.

For the third quarter of 2024, the Company’s

weighted average number of ADSs used in calculating non-GAAP net

income per ADS – diluted was 164,482,794. As of September 30, 2024,

the Company had a total of 2,373,182,132 Class A and B ordinary

shares outstanding, or the equivalent of 158,212,142 ADSs.

CERTAIN OTHER FINANCIAL

ITEMS

As of September 30, 2024, the Company’s cash and

cash equivalents, term deposits and long-term deposits were

US$432.3 million, compared to US$327.7 million as of December 31,

2023.

As of September 30, 2024, the allowance balance

of receivables from customers was US$15.7 million compared to

US$1.0 million as of December 31, 2023, which was due to a bad

debt provision concerning the recoverability of a specific Hong

Kong stock pledge business faced with extreme market situation and

significant price drop, leading to a provision for the loan

balance.

Conference Call Information:

UP Fintech’s management will hold an earnings

conference call at 8:00 AM on November 12, 2024, U.S. Eastern Time

(9:00 PM on November 12, 2024, Singapore/Hong Kong Time).

All participants wishing to attend the call must

preregister online before they may receive the dial-in numbers.

Preregistration may require a few minutes to complete.

Preregistration Information:

Please note that all participants will need to

pre-register for the conference call, using the link:

https://register.vevent.com/register/BI98badd2259764082bdf9df7a4e175bd8

It will automatically lead to the registration

page of “UP Fintech Holding Limited Third Quarter 2024 Earnings

Conference Call”, where details for RSVP are needed.

Upon registering, all participants will be

provided in confirmation emails with participant dial-in numbers

and personal PINs to access the conference call. Please dial in 10

minutes prior to the call start time using the conference access

information.

Additionally, a live and archived webcast of the

conference call will be available at https://ir.itigerup.com

Use of Non-GAAP Financial

Measures

In evaluating our business, we consider and use

non-GAAP net loss or income attributable to ordinary shareholders

of UP Fintech and non-GAAP net loss or income per ADS - diluted as

supplemental measures to review and assess our operating

performance. The presentation of the non-GAAP financial measures is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

the United States Generally Accepted Accounting Principles (“U.S.

GAAP”). We define non-GAAP net loss or income attributable to

ordinary shareholders of UP Fintech as net loss or income

attributable to ordinary shareholders of UP Fintech excluding

share-based compensation. Non-GAAP net loss or income per ADS -

diluted is non-GAAP net loss or income attributable to ordinary

shareholders of UP Fintech divided by the weighted average number

of diluted ADSs.

We present these non-GAAP financial measures

because they are used by our management to evaluate our operating

performance and formulate business plans. Non-GAAP net loss or

income attributable to ordinary shareholders of UP Fintech enables

our management to assess our operating results without considering

the impact of share-based compensation. We also believe that the

use of these non-GAAP financial measures facilitates investors'

assessment of our operating performance.

These non-GAAP financial measures are not

defined under U.S. GAAP and are not presented in accordance with

U.S. GAAP. These non-GAAP financial measures have limitations as an

analytical tool. One of the key limitations of using these non-GAAP

financial measures is that they do not reflect all items of income

and expenses that affect our operations. Share-based compensation

has been and may continue to be incurred in our business and are

not reflected in the presentation of non-GAAP net loss or income

attributable to ordinary shareholders of UP Fintech. Further, these

non-GAAP financial measures may differ from the non-GAAP financial

information used by other companies, including peer companies, and

therefore their comparability may be limited.

These non-GAAP financial measures should not be

considered in isolation or construed as alternatives to total

operating costs and expenses, net loss or income attributable to

ordinary shareholders of UP Fintech or any other measure of

performance or as an indicator of our operating performance.

Investors are encouraged to review these historical non-GAAP

financial measures in light of the most directly comparable GAAP

measures. These non-GAAP financial measures presented here may not

be comparable to similarly titled measures presented by other

companies. Other companies may calculate similarly titled measures

differently, limiting the usefulness of such measures when

analyzing our data comparatively. We encourage investors and others

to review our financial information in its entirety and not rely on

a single financial measure.

About UP Fintech Holding

Limited

UP Fintech Holding Limited is a leading online

brokerage firm focusing on global investors. The Company’s

proprietary mobile and online trading platform enables investors to

trade in equities and other financial instruments on multiple

exchanges around the world. The Company offers innovative products

and services as well as a superior user experience to customers

through its “mobile first” strategy, which enables it to better

serve and retain current customers as well as attract new ones. The

Company offers customers comprehensive brokerage and value-added

services, including trade order placement and execution, margin

financing, IPO subscription, ESOP management, investor education,

community discussion and customer support. The Company’s

proprietary infrastructure and advanced technology are able to

support trades across multiple currencies, multiple markets,

multiple products, multiple execution venues and multiple

clearinghouses.

For more information on the Company, please

visit: https://ir.itigerup.com.

Safe Harbor Statement

This announcement contains forward−looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward−looking statements can be identified by

terminology such as “may,” “might,” “aim,” “likely to,” “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” and similar statements or expressions. Among other

statements, the business outlook and quotations from management in

this announcement, the Company’s strategic and operational plans

and expectations regarding growth and expansion of its business

lines, and the Company’s plans for future financing of its business

contain forward-looking statements. The Company may also make

written or oral forward-looking statements in its periodic reports

to the U.S. Securities and Exchange Commission (“SEC”) on Forms

20−F and 6−K, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties, including

the earnings conference call. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward−looking statements. Forward−looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: the Company’s ability to effectively

implement its growth strategies; trends and competition in global

financial markets; changes in the Company’s revenues and certain

cost or expense accounting policies; and governmental policies and

regulations affecting the Company’s industry and general economic

conditions in China, Singapore and other countries. Further

information regarding these and other risks is included in the

Company’s filings with the SEC, including the Company’s annual

report on Form 20-F filed with the SEC on April 22, 2024. All

information provided in this press release and in the attachments

is as of the date of this press release, and the Company undertakes

no obligation to update any forward-looking statement, except as

required under applicable law. Further information regarding these

and other risks is included in the Company’s filings with the

SEC.

For investor and media inquiries please

contact:

Investor Relations Contact

UP Fintech Holding Limited

Email: ir@itiger.com

|

UP FINTECH HOLDING

LIMITEDUNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS(All amounts in U.S. dollars

(“US$”)) |

|

|

|

|

As ofDecember 31, |

|

|

As ofSeptember 30, |

|

|

|

|

2023 |

|

|

2024 |

|

|

|

|

US$ |

|

|

US$ |

|

|

Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

322,599,616 |

|

|

|

429,951,960 |

|

|

Cash-segregated for regulatory purpose |

|

|

1,617,154,185 |

|

|

|

2,509,390,812 |

|

|

Term deposits |

|

|

896,683 |

|

|

|

924,530 |

|

|

Receivables from customers (net of allowance of US$991,286

andUS$15,728,761 as of December 31, 2023 and September 30,

2024) |

|

|

753,361,199 |

|

|

|

849,083,061 |

|

|

Receivables from brokers, dealers, and clearing organizations |

|

|

541,876,929 |

|

|

|

2,390,770,795 |

|

|

Financial instruments held, at fair value |

|

|

428,159,554 |

|

|

|

96,104,529 |

|

|

Prepaid expenses and other current assets |

|

|

17,936,180 |

|

|

|

20,053,858 |

|

|

Amounts due from related parties |

|

|

7,987,756 |

|

|

|

10,002,209 |

|

|

Total current assets |

|

|

3,689,972,102 |

|

|

|

6,306,281,754 |

|

|

Non-current assets: |

|

|

|

|

|

|

|

Long-term deposits |

|

|

4,225,412 |

|

|

|

1,424,989 |

|

|

Right-of-use assets |

|

|

9,067,885 |

|

|

|

12,267,414 |

|

|

Property, equipment and intangible assets, net |

|

|

16,429,543 |

|

|

|

16,090,295 |

|

|

Goodwill |

|

|

2,492,668 |

|

|

|

2,492,668 |

|

|

Long-term investments |

|

|

7,586,483 |

|

|

|

7,417,207 |

|

|

Equity method investment |

|

|

— |

|

|

|

10,094,958 |

|

|

Other non-current assets |

|

|

5,282,012 |

|

|

|

7,448,365 |

|

|

Deferred tax assets |

|

|

10,990,998 |

|

|

|

11,077,569 |

|

|

Total non-current assets |

|

|

56,075,001 |

|

|

|

68,313,465 |

|

|

Total assets |

|

|

3,746,047,103 |

|

|

|

6,374,595,219 |

|

|

Current liabilities: |

|

|

|

|

|

|

|

Payables to customers |

|

|

2,913,306,558 |

|

|

|

3,576,928,825 |

|

|

Payables to brokers, dealers and clearing organizations: |

|

|

114,771,931 |

|

|

|

1,998,452,968 |

|

|

Accrued expenses and other current liabilities |

|

|

42,381,946 |

|

|

|

52,316,609 |

|

|

Deferred income-current |

|

|

819,809 |

|

|

|

— |

|

|

Lease liabilities-current |

|

|

4,133,883 |

|

|

|

4,288,796 |

|

|

Amounts due to related parties |

|

|

10,148,142 |

|

|

|

29,860,094 |

|

|

Total current liabilities |

|

|

3,085,562,269 |

|

|

|

5,661,847,292 |

|

|

Convertible bonds |

|

|

156,887,691 |

|

|

|

158,841,594 |

|

|

Lease liabilities-non-current |

|

|

4,777,134 |

|

|

|

7,321,496 |

|

|

Deferred tax liabilities |

|

|

3,397,831 |

|

|

|

2,141,790 |

|

|

Total liabilities |

|

|

3,250,624,925 |

|

|

|

5,830,152,172 |

|

|

Mezzanine equity |

|

|

|

|

|

|

|

Redeemable non-controlling interests |

|

|

6,706,660 |

|

|

|

7,288,577 |

|

|

Total Mezzanine equity |

|

|

6,706,660 |

|

|

|

7,288,577 |

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

Class A ordinary shares |

|

|

22,528 |

|

|

|

22,755 |

|

|

Class B ordinary shares |

|

|

976 |

|

|

|

976 |

|

|

Additional paid-in capital |

|

|

505,448,080 |

|

|

|

512,363,733 |

|

|

Statutory reserve |

|

|

8,511,039 |

|

|

|

8,511,039 |

|

|

Retained earnings (Accumulated deficit) |

|

|

(19,600,434 |

) |

|

|

13,543,386 |

|

|

Treasury stock |

|

|

(2,172,819 |

) |

|

|

(2,172,819 |

) |

|

Accumulated other comprehensive (loss) income |

|

|

(3,232,993 |

) |

|

|

5,189,270 |

|

|

Total UP Fintech shareholders’ equity |

|

|

488,976,377 |

|

|

|

537,458,340 |

|

|

Non-controlling interests |

|

|

(260,859 |

) |

|

|

(303,870 |

) |

|

Total equity |

|

|

488,715,518 |

|

|

|

537,154,470 |

|

|

Total liabilities, mezzanine equity and

equity |

|

|

3,746,047,103 |

|

|

|

6,374,595,219 |

|

|

|

|

|

|

|

|

|

|

|

|

UP FINTECH HOLDING LIMITEDUNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME/(LOSS)(All amounts in U.S. dollars (“US$”),

except for number of shares (or ADSs) and per share (or ADS)

data) |

|

|

|

|

|

|

|

|

For the three months ended |

|

|

For the nine months ended |

|

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions |

|

|

23,188,375 |

|

|

|

34,086,778 |

|

|

|

41,207,882 |

|

|

|

70,638,871 |

|

|

|

103,080,878 |

|

|

Interest related income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing service fees |

|

|

3,307,720 |

|

|

|

2,905,198 |

|

|

|

2,803,878 |

|

|

|

9,003,889 |

|

|

|

8,541,141 |

|

|

Interest income |

|

|

38,298,414 |

|

|

|

44,193,949 |

|

|

|

47,957,486 |

|

|

|

109,334,691 |

|

|

|

135,992,655 |

|

|

Other revenues |

|

|

5,351,702 |

|

|

|

6,251,083 |

|

|

|

9,084,834 |

|

|

|

13,549,184 |

|

|

|

19,824,906 |

|

|

Total revenues |

|

|

70,146,211 |

|

|

|

87,437,008 |

|

|

|

101,054,080 |

|

|

|

202,526,635 |

|

|

|

267,439,580 |

|

|

Interest expense |

|

|

(12,130,614 |

) |

|

|

(13,581,981 |

) |

|

|

(15,700,359 |

) |

|

|

(30,961,919 |

) |

|

|

(44,072,175 |

) |

|

Total net revenues |

|

|

58,015,597 |

|

|

|

73,855,027 |

|

|

|

85,353,721 |

|

|

|

171,564,716 |

|

|

|

223,367,405 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Execution and clearing |

|

|

(2,372,142 |

) |

|

|

(2,807,006 |

) |

|

|

(3,518,611 |

) |

|

|

(6,839,304 |

) |

|

|

(8,556,480 |

) |

|

Employee compensation and benefits |

|

|

(25,976,638 |

) |

|

|

(28,645,229 |

) |

|

|

(28,769,980 |

) |

|

|

(74,291,713 |

) |

|

|

(85,202,427 |

) |

|

Occupancy, depreciation and amortization |

|

|

(2,235,084 |

) |

|

|

(2,109,688 |

) |

|

|

(2,162,704 |

) |

|

|

(7,196,446 |

) |

|

|

(6,416,729 |

) |

|

Communication and market data |

|

|

(7,579,357 |

) |

|

|

(8,813,405 |

) |

|

|

(9,730,680 |

) |

|

|

(22,299,360 |

) |

|

|

(27,105,567 |

) |

|

Marketing and branding |

|

|

(5,163,903 |

) |

|

|

(6,407,744 |

) |

|

|

(8,223,404 |

) |

|

|

(15,069,095 |

) |

|

|

(19,022,135 |

) |

|

General and administrative |

|

|

(5,447,961 |

) |

|

|

(20,246,128 |

) |

|

|

(6,932,672 |

) |

|

|

(14,497,733 |

) |

|

|

(32,845,937 |

) |

|

Total operating costs and expenses |

|

|

(48,775,085 |

) |

|

|

(69,029,200 |

) |

|

|

(59,338,051 |

) |

|

|

(140,193,651 |

) |

|

|

(179,149,275 |

) |

|

Other income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Others, net |

|

|

6,725,131 |

|

|

|

1,405,013 |

|

|

|

(5,189,945 |

) |

|

|

14,812,226 |

|

|

|

(169,713 |

) |

|

Income before income tax |

|

|

15,965,643 |

|

|

|

6,230,840 |

|

|

|

20,825,725 |

|

|

|

46,183,291 |

|

|

|

44,048,417 |

|

|

Income tax expenses |

|

|

(2,592,703 |

) |

|

|

(3,486,260 |

) |

|

|

(2,907,080 |

) |

|

|

(11,487,671 |

) |

|

|

(10,921,637 |

) |

|

Net income |

|

|

13,372,940 |

|

|

|

2,744,580 |

|

|

|

17,918,645 |

|

|

|

34,695,620 |

|

|

|

33,126,780 |

|

|

Less: net (loss) income attributable to non-controlling

interests |

|

|

(21,550 |

) |

|

|

(2,479 |

) |

|

|

3,353 |

|

|

|

(96,992 |

) |

|

|

(17,040 |

) |

|

Accretion of redeemable non-controlling interests to redemption

value |

|

|

(144,700 |

) |

|

|

(153,837 |

) |

|

|

(160,998 |

) |

|

|

(393,563 |

) |

|

|

(466,157 |

) |

|

Net income attributable to ordinary shareholders of UP

Fintech |

|

|

13,249,790 |

|

|

|

2,593,222 |

|

|

|

17,754,294 |

|

|

|

34,399,049 |

|

|

|

32,677,663 |

|

|

Other comprehensive (loss) income, net of

tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in cumulative foreign currency translation adjustment |

|

|

(1,670,923 |

) |

|

|

(2,909,808 |

) |

|

|

16,119,046 |

|

|

|

(7,807,129 |

) |

|

|

8,418,198 |

|

|

Total Comprehensive income (loss) |

|

|

11,702,017 |

|

|

|

(165,228 |

) |

|

|

34,037,691 |

|

|

|

26,888,491 |

|

|

|

41,544,978 |

|

|

Less: comprehensive loss attributable to non-controlling

interests |

|

|

(20,009 |

) |

|

|

(628 |

) |

|

|

(7,023 |

) |

|

|

(84,304 |

) |

|

|

(21,105 |

) |

|

Accretion of redeemable non-controlling interests to redemption

value |

|

|

(144,700 |

) |

|

|

(153,837 |

) |

|

|

(160,998 |

) |

|

|

(393,563 |

) |

|

|

(466,157 |

) |

|

Total Comprehensive income (loss) attributable to ordinary

shareholders ofUp Fintech |

|

|

11,577,326 |

|

|

|

(318,437 |

) |

|

|

33,883,716 |

|

|

|

26,579,232 |

|

|

|

41,099,926 |

|

|

Net income per ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

0.006 |

|

|

|

0.001 |

|

|

|

0.008 |

|

|

|

0.015 |

|

|

|

0.014 |

|

|

Diluted |

|

|

0.006 |

|

|

|

0.001 |

|

|

|

0.007 |

|

|

|

0.015 |

|

|

|

0.014 |

|

|

Net income per ADS (1 ADS represents 15 Class A ordinary

shares): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

0.085 |

|

|

|

0.017 |

|

|

|

0.113 |

|

|

|

0.222 |

|

|

|

0.208 |

|

|

Diluted |

|

|

0.083 |

|

|

|

0.016 |

|

|

|

0.110 |

|

|

|

0.218 |

|

|

|

0.204 |

|

|

Weighted average number of ordinary shares used in

calculating net incomeper ordinary

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,330,221,225 |

|

|

|

2,354,432,689 |

|

|

|

2,362,528,627 |

|

|

|

2,321,898,725 |

|

|

|

2,353,177,657 |

|

|

Diluted |

|

|

2,439,248,294 |

|

|

|

2,378,752,460 |

|

|

|

2,467,241,917 |

|

|

|

2,429,798,761 |

|

|

|

2,460,309,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliations of Unaudited Non-GAAP Results of

Operations Measures to the Nearest Comparable GAAP

Measures(All amounts in U.S. dollars (“US$”),

except for number of ADSs and per ADS data) |

|

|

|

|

|

|

|

For the three months ended September

30,2023 |

|

|

For the three months ended June

30,2024 |

|

|

For the three months ended September

30,2024 |

|

|

|

|

|

|

|

non-GAAP |

|

|

|

|

|

|

|

|

non-GAAP |

|

|

|

|

|

|

|

|

non-GAAP |

|

|

|

|

|

|

|

GAAP |

|

|

Adjustment |

|

|

non-GAAP |

|

|

GAAP |

|

|

Adjustment |

|

|

non-GAAP |

|

|

GAAP |

|

|

Adjustment |

|

|

non-GAAP |

|

|

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

|

|

|

|

|

|

2,744,880 |

|

(1) |

|

|

|

|

|

|

|

|

2,603,648 |

|

(1) |

|

|

|

|

|

|

|

|

2,331,274 |

|

(1) |

|

|

|

|

Net income attributable toordinary

shareholders ofUP Fintech |

|

|

13,249,790 |

|

|

|

2,744,880 |

|

|

|

15,994,670 |

|

|

|

2,593,222 |

|

|

|

2,603,648 |

|

|

|

5,196,870 |

|

|

|

17,754,294 |

|

|

|

2,331,274 |

|

|

|

20,085,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per ADS - diluted |

|

|

0.083 |

|

|

|

|

|

|

0.100 |

|

|

|

0.016 |

|

|

|

|

|

|

0.033 |

|

|

|

0.110 |

|

|

|

|

|

|

0.124 |

|

|

Weighted average number of ADSsused in calculating diluted

netincome per ADS |

|

|

162,616,553 |

|

|

|

|

|

|

162,616,553 |

|

|

|

158,583,497 |

|

|

|

|

|

|

158,583,497 |

|

|

|

164,482,794 |

|

|

|

|

|

|

164,482,794 |

|

|

|

|

|

(1) Share-based compensation. |

|

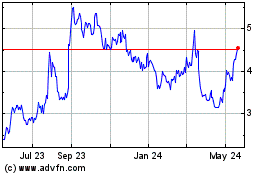

UP Fintech (NASDAQ:TIGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

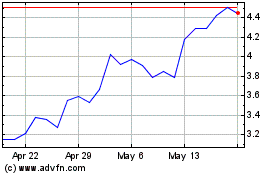

UP Fintech (NASDAQ:TIGR)

Historical Stock Chart

From Nov 2023 to Nov 2024