Filed by Uniti Group Inc.

(Commission File No.: 001-36708)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Uniti Group Inc.

(Commission File No.: 001-36708)

On September 26, Uniti Group inc.

("Uniti") discussed information regarding Uniti's contemplated merger (the "Merger") with Windstream Holdings II, LLC ("Windstream")

in a press release. The press release in available below.

|

Press Release

Release Date: September 26, 2024 |

| |

|

Uniti Group Inc. Announces Pricing of Windstream

Refinancing Transactions

Windstream Will Amend Credit Agreement to

Allow Collapse of Dual Debt Silos Upon Closing of Planned Merger

LITTLE ROCK, Ark.

– Uniti Group Inc. (“Uniti”) (Nasdaq: UNIT) today announced the pricing of $800 million aggregate principal amount

of new 8.250% Senior First Lien Notes due 2031 (the “New Windstream Notes”) by Windstream Services, LLC and Windstream Escrow

Finance Corp. (collectively, the “Windstream Co-Issuers”), each a subsidiary of Windstream Holdings II, LLC (“Windstream”).

The indenture governing the New Windstream Notes will contain provisions that allow for the collapse of Uniti’s and Windstream’s

debt silos (the “Post-Closing Reorganization”) upon the closing of the planned merger between Uniti and Windstream. The offering

of the New Windstream Notes is expected to close on October 4, 2024, subject to customary closing conditions.

Concurrently

with the pricing of the New Windstream Notes, the Windstream Co-Issuers agreed to a $500 million incremental first lien term loan facility

(the “First Lien Incremental Term Facility”) under Windstream’s existing credit agreement (the “Windstream Credit

Agreement”). Loans under the First Lien Incremental Term Facility will bear interest based on a floating rate (which, at Windstream’s

election, may be the Base Rate plus 3.75% or the Adjusted Term SOFR Rate plus 4.75% (each as defined in the Windstream Credit provided

that the Adjusted Term SOFR Rate “floor” shall be 0%)) and will mature on October 1, 2031. In addition, Windstream agreed

to amend the terms of the Windstream Credit Agreement to permit the Post-Closing Reorganization. The incremental term loan borrowings

and amendments to the Windstream Credit Agreement are expected to close on October 4, 2024, subject to customary closing conditions.

Upon the amendments becoming effective at closing, all outstanding Windstream indebtedness will permit the Post-Closing Reorganization.

Windstream intends

to use the net proceeds from the offering of the New Windstream Notes and borrowings under the First Lien Incremental Term Facility to

repay, refinance and reduce certain loans outstanding under the Windstream Credit Agreement and pay any related premiums, fees and expenses,

including accrued and unpaid interest, if any. Any remaining proceeds will be used for general corporate purposes, which may include

investments in Windstream’s network and other capital expenditures, such as expansion and acceleration of its Kinetic fiber-to-the-home

buildout.

“The successful

Windstream refinancing transactions, combined with the amendments to Windstream’s credit agreement, will provide a clear path to

collapsing the dual debt silos upon closing of the merger between Uniti and Windstream. In addition, Windstream plans to use a portion

of the proceeds from these financing activities to expand and accelerate their Kinetic fiber-to-the-home buildout, further strengthening

their position within the residential fiber market,” commented Paul Bullington, Senior Vice President, Chief Financial Officer

& Treasurer.

The

Windstream Notes were offered and sold only to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A

and in offshore transactions to non-U.S. persons pursuant to Regulation S, each under the Securities Act.

This

press release shall not constitute an offer to sell, or the solicitation of an offer to buy, the New Windstream Notes issued pursuant

to the offering of New Windstream Notes described above.

ABOUT UNITI

Uniti, an internally

managed real estate investment trust, is engaged in the acquisition and construction of mission critical communications infrastructure,

and is a leading provider of fiber and other wireless solutions for the communications industry. As of June 30, 2024, Uniti owns approximately

142,000 fiber route miles, 8.6 million fiber strand miles, and other communications real estate throughout the United States. Additional

information about Uniti can be found on its website at www.uniti.com.

NO

OFFER OR SOLICITATION

This communication

and the information contained in it are provided for information purposes only and are not intended to be and shall not constitute a

solicitation of any vote or approval, or an offer to sell or solicitation of an offer to buy, or an invitation or recommendation to subscribe

for, acquire or buy securities of Uniti, Windstream or Windstream Parent, Inc., the proposed combined company following the closing

of the Merger (as defined below) (“New Uniti”) or any other financial products or securities, in any place or jurisdiction,

nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made in the United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities

Act”), or pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

ADDITIONAL

INFORMATION AND WHERE TO FIND IT

In connection with

the contemplated Merger, New Uniti has filed a registration statement on Form S-4 with the SEC that contains a proxy statement/prospectus

and other documents, which has not yet become effective. Once effective, Uniti will mail the proxy statement/prospectus contained in

the Form S-4 to its stockholders. This communication is not a substitute for any registration statement, proxy statement/prospectus or

other documents that may be filed with the SEC in connection with the Merger.

THE

PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE MERGER CONTAINS IMPORTANT INFORMATION ABOUT

UNITI, WINDSTREAM, NEW UNITI, THE MERGER AND RELATED MATTERS. INVESTORS SHOULD READ THE PROXY STATEMENT/PROSPECTUS AND SUCH OTHER

DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE PROXY STATEMENT/PROSPECTUS

AND SUCH DOCUMENTS, BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE MERGER.

The proxy statement/prospectus,

any amendments or supplements thereto and all other documents filed with the SEC in connection with the Merger will be available

free of charge on the SEC’s website (at www.sec.gov). Copies of documents filed with

the SEC by Uniti will be made available free of charge on Uniti's investor relations website (at https://investor.uniti.com/financial-information/sec-filings).

PARTICIPANTS

IN THE SOLICITATION

Uniti, Windstream and

their respective directors and certain of their executive officers and other employees may be deemed to be participants in the solicitation

of proxies from Uniti’s stockholders in connection with the Merger. Information about Uniti’s directors and executive officers

is set forth in the sections titled “Proposal No. 1 Election of Directors” and “Security Ownership of Certain Beneficial

Owners and Management” included in Uniti’s proxy statement for its 2024 annual meeting of stockholders, which was filed with

the SEC on April 11, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/1620280/000110465924046100/0001104659-24-046100-index.htm),

the section titled “Directors, Executive Officers and Corporate Governance” included in its Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, which was filed with the SEC on February 29, 2024 (and which is available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/1620280/000162828024008054/unit-20231231.htm),

and subsequent statements of beneficial ownership on file with the SEC and other filings made from time to time with the SEC.

Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of

Uniti stockholders in connection with the Merger, including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth in the proxy statement/prospectus and other relevant materials filed by New Uniti with the SEC. These

documents can be obtained free of charge from the sources indicated above.

FORWARD-LOOKING

STATEMENTS

This communication

contains forward-looking statements, including within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements can often be identified by terms such as “may,” “will,” “appears,” “should,”

“expects,” “plans,” “anticipates,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,”

or “continue,” or the negative of these words or other similar terms or expressions that concern expectations, strategy,

plans, or intentions. However, the absence of these words or similar terms does not mean that a statement is not forward-looking. All

forward-looking statements are based on information and estimates available to Uniti and Windstream at the time of this communication

and are not guarantees of future performance.

Examples of forward-looking

statements in this communication (made at the date of this communication unless otherwise indicated) include, among others, statements

regarding the Merger and the future performance of Uniti, Windstream and New Uniti (the “Merged Group”), whether

Windstream amends the terms of its existing credit agreement, the implementation and expected effects of the Post-Closing Reorganization,

the perceived and potential synergies and other benefits of the Merger, and expectations around the financial impact of the Merger on

the Merged Group’s financials. In addition, this communication contains statements concerning the intentions, beliefs and expectations,

plans, strategies and objectives of the directors and management of Uniti and Windstream for Uniti and Windstream, respectively,

and the Merged Group, the anticipated timing for and outcome and effects of the Merger (including expected benefits to shareholders

of Uniti), expectations for the ongoing development and growth potential of the Merged Group and the future operation of Uniti, Windstream and

the Merged Group.

These statements

involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results,

levels of activity, performance or achievements expressed or implied by any forward-looking statement and may include statements regarding

the expected timing and structure of the Merger; the ability of the parties to complete the Merger considering the various closing conditions;

the expected benefits of the Merger, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market

profile, business plans, expanded portfolio and financial strength; the competitive ability and position of New Uniti following completion

of the Merger; and anticipated growth strategies and anticipated trends in Uniti’s, Windstream’s and, following the expected

completion of the Merger, New Uniti’s business.

In addition,

other factors related to the Merger that contribute to the uncertain nature of the forward-looking statements and that could cause actual

results and financial condition to differ materially from those expressed or implied include, but are not limited to: the satisfaction

of the conditions precedent to the consummation of the Merger, including, without limitation, the receipt of shareholder and regulatory

approvals on the terms desired or anticipated; unanticipated difficulties or expenditures relating to the Merger, including, without

limitation, difficulties that result in the failure to realize expected synergies, efficiencies and cost savings from the Merger within

the expected time period (if at all); potential difficulties in Uniti’s and Windstream’s ability to retain employees as a

result of the announcement and pendency of the Merger; risks relating to the value of New Uniti’s securities to be issued in the

Merger; disruptions of Uniti’s and Windstream’s current plans, operations and relationships with customers caused by the

announcement and pendency of the Merger; legal proceedings that may be instituted against Uniti or Windstream following announcement

of the Merger; funding requirements; regulatory restrictions (including changes in regulatory restrictions or regulatory policy) and

risks associated with general economic conditions.

Additional factors

that could cause actual results, level of activity, performance or achievements to differ materially from the results, level of activity,

performance or achievements expressed or implied by the forward-looking statements are detailed in the filings with the SEC, including

Uniti’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents

filed with the SEC.

There can be

no assurance that the Merger will be implemented or that plans of the respective directors and management of Uniti and Windstream for

the Merged Group, including the Post-Closing Reorganization, will proceed as currently expected or will ultimately be successful.

Investors are strongly cautioned not to place undue reliance on forward-looking statements, including in respect of the financial or

operating outlook for Uniti, Windstream or the Merged Group (including the realization of any expected synergies).

Except as required

by applicable law, Uniti does not assume any obligation to, and expressly disclaims any duty to, provide any additional or updated information

or to update any forward-looking statements, whether as a result of new information, future events or results, or otherwise. Nothing

in this communication will, under any circumstances (including by reason of this communication remaining available and not being superseded

or replaced by any other presentation or publication with respect to Uniti, Windstream or the Merged Group, or the subject

matter of this communication), create an implication that there has been no change in the affairs of Uniti or Windstream since

the date of this communication.

INVESTOR

AND MEDIA CONTACTS:

Paul

Bullington, 251-662-1512

Senior

Vice President, Chief Financial Officer & Treasurer

| paul.bullington@uniti.com | |

Bill

DiTullio, 501-850-0872

Vice

President, Investor Relations & Treasury

No Offer or Solicitation

This communication and the information contained

in it are provided for information purposes only and are not intended to be and shall not constitute a solicitation of any vote or approval,

or an offer to sell or solicitation of an offer to buy, or an invitation or recommendation to subscribe for, acquire or buy securities

of Uniti, Windstream or Windstream Parent, Inc., the proposed combined company following the closing of

the Merger (as defined below) (“New Uniti”) or any other financial products or securities, in any place or jurisdiction, nor

shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made in the

United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”). or pursuant to

an exemption from, or in a transaction not subject to, such registration requirements.

Additional Information and Where to Find It

In connection with the Merger, New Uniti has filed a registration statement on Form S-4 with the SEC that contains a proxy statement/prospectus

and other documents, which has not yet become effective. Once effective, Uniti will mail the proxy statement/prospectus contained in the

Form S-4 to its stockholders. This communication is not a substitute for any registration statement, proxy statement/prospectus or other

documents that may be filed with the SEC in connection with the Merger.

THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS

FILED WITH THE SEC IN CONNECTION WITH THE MERGER CONTAINS IMPORTANT INFORMATION ABOUT UNITI, WINDSTREAM, NEW UNITI, THE MERGER AND RELATED

MATTERS. INVESTORS SHOULD READ THE PROXY STATEMENT/PROSPECTUS AND SUCH OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE PROXY STATEMENT/PROSPECTUS AND SUCH DOCUMENTS, BEFORE THEY MAKE ANY DECISION WITH RESPECT

TO THE MERGER. The proxy statement/prospectus, any amendments or supplements thereto and all other documents filed with the SEC in connection

with the Merger will be available free of charge on the SEC’s website (at www.sec.gov). Copies of documents filed with the SEC by

Uniti will be made available free of charge on Uniti's investor relations website (at https://investor.uniti.com/financial-information/sec-filings).

Participants in the Solicitation

Uniti, Windstream and their respective directors

and certain of their executive officers and other employees may be deemed to be participants in the solicitation of proxies from Uniti’s

stockholders in connection with the Merger. Information about Uniti’s directors and executive officers is set forth in the sections

titled “Proposal No. 1 Election of Directors” and “Security Ownership of Certain Beneficial Owners and Management”

included in Uniti’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 11, 2024

(and which is available at https://www.sec.gov/Archives/edgar/data/1620280/000110465924046100/0001104659-24-046100-index.htm), the section

titled “Directors, Executive Officers and Corporate Governance” included in its Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, which was filed with the SEC on February 29, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1620280/000162828024008054/unit-20231231.htm),

and subsequent statements of beneficial ownership on file with the SEC and other filings made from time to time with the SEC. Additional

information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Uniti stockholders

in connection with the Merger, including a description of their direct or indirect interests, by security holdings or otherwise, is set

forth in the proxy statement/prospectus and other relevant materials filed by New Uniti with the SEC. These documents can be obtained

free of charge from the sources indicated above.

Forward-Looking Statements

This communication contains forward-looking statements,

including within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can often be identified

by terms such as “may,” “will,” “appears,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative

of these words or other similar terms or expressions that concern expectations, strategy, plans, or intentions. However, the absence of

these words or similar terms does not mean that a statement is not forward-looking. All forward-looking statements are based on information

and estimates available to Uniti and Windstream at the time of this communication and are not guarantees of future performance.

Examples of forward-looking statements in this

communication (made at the date of this communication unless otherwise indicated) include, among others, statements regarding the Merger

and the future performance of Uniti, Windstream and New Uniti (the “Merged Group”), the perceived and potential synergies

and other benefits of the Merger, and expectations around the financial impact of the Merger on the Merged Group’s financials. In

addition, this communication contains statements concerning the intentions, beliefs and expectations, plans, strategies and objectives

of the directors and management of Uniti and Windstream for Uniti and Windstream, respectively, and the Merged Group, the anticipated

timing for and outcome and effects of the Merger (including expected benefits to shareholders of Uniti), expectations for the ongoing

development and growth potential of the Merged Group and the future operation of Uniti, Windstream and the Merged Group.

These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance

or achievements expressed or implied by any forward-looking statement and may include statements regarding the expected timing and structure

of the Merger; the ability of the parties to complete the Merger considering the various closing conditions; the expected benefits of

the Merger, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business plans,

expanded portfolio and financial strength; the competitive ability and position of New Uniti following completion of the Merger; and anticipated

growth strategies and anticipated trends in Uniti’s, Windstream’s and, following the expected completion of the Merger, New

Uniti’s business.

In addition, other factors related to the Merger

that contribute to the uncertain nature of the forward-looking statements and that could cause actual results and financial condition

to differ materially from those expressed or implied include, but are not limited to: the satisfaction of the conditions precedent to

the consummation of the Merger, including, without limitation, the receipt of shareholder and regulatory approvals on the terms desired

or anticipated; unanticipated difficulties or expenditures relating to the Merger, including, without limitation, difficulties that result

in the failure to realize expected synergies, efficiencies and cost savings from the Merger within the expected time period (if at all);

potential difficulties in Uniti’s and Windstream’s ability to retain employees as a result of the announcement and pendency

of the Merger; risks relating to the value of New Uniti’s securities to be issued in the Merger; disruptions of Uniti’s and

Windstream’s current plans, operations and relationships with customers caused by the announcement and pendency of the Merger; legal

proceedings that may be instituted against Uniti or Windstream following announcement of the Merger; funding requirements; regulatory

restrictions (including changes in regulatory restrictions or regulatory policy) and risks associated with general economic conditions.

Additional factors that could cause actual results,

level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed

or implied by the forward-looking statements are detailed in the filings with the SEC, including Uniti’s annual report on Form 10-K,

periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC.

There can be no assurance that the Merger will

be implemented or that plans of the respective directors and management of Uniti and Windstream for the Merged Group will proceed as currently

expected or will ultimately be successful. Investors are strongly cautioned not to place undue reliance on forward-looking statements,

including in respect of the financial or operating outlook for Uniti, Windstream or the Merged Group (including the realization of any

expected synergies).

Except as required by

applicable law, Uniti does not assume any obligation to, and expressly disclaims any duty to, provide any additional or updated information

or to update any forward-looking statements, whether as a result of new information, future events or results, or otherwise. Nothing in

this communication will, under any circumstances (including by reason of this communication remaining available and not being superseded

or replaced by any other presentation or publication with respect to Uniti, Windstream or the Merged Group, or the subject matter of this

communication), create an implication that there has been no change in the affairs of Uniti or Windstream since the date of this communication.

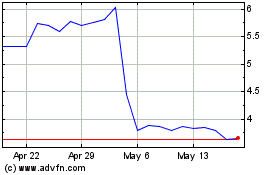

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Oct 2024 to Nov 2024

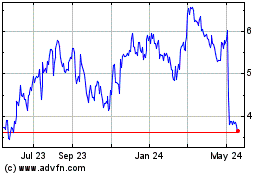

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Nov 2023 to Nov 2024