false

0001640266

0001640266

2024-06-11

2024-06-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

June 11, 2024

Voyager

Therapeutics, Inc.

(Exact name of

registrant as specified in its charter)

| Delaware |

|

001-37625 |

|

46-3003182 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

75 Hayden Avenue

Lexington,

Massachusetts |

|

02421 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (857) 259-5340

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Common

Stock, $0.001 par value |

VYGR |

Nasdaq

Global Select Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Nathan Jorgensen, Ph.D.,

M.B.A. as Chief Financial Officer

On June 11, 2024, Voyager Therapeutics, Inc.

(the “Company”) and Nathan Jorgensen entered into an employment agreement (the “Jorgensen Agreement”), pursuant

to which Dr. Jorgensen agreed to serve as the Chief Financial Officer of the Company, with his employment to commence no later than

July 8, 2024 (the “Jorgensen Commencement Date”). On June 5, 2024, the board of directors of the Company (the “Board”)

authorized and approved the appointment of Dr. Jorgensen as Chief Financial Officer, principal financial officer, and principal accounting

officer of the Company, effective upon the Jorgensen Commencement Date, and the compensation committee of the Board (the “Compensation

Committee”) authorized and approved the compensation arrangements for Dr. Jorgensen. Robin Swartz will continue to serve as

the Company’s Chief Operating Officer.

Dr. Jorgensen, age 47, previously served

as Chief Financial Officer of Vor Biopharma Inc., a biotechnology company, from May 2020 to June 2024. Prior to joining Vor

Biopharma, Dr. Jorgensen served as Healthcare Portfolio Senior Manager for the Qatar Investment Authority from August 2016 to

April 2020. Previously, Dr. Jorgensen served as Senior Research Analyst at Calamos Investments LLC, Associate Research Analyst

at Stifel, Nicolaus & Company, Incorporated, and Competitive Intelligence Senior Analyst at Prescient Healthcare Group.

Prior to entering the financial sector, Dr. Jorgensen investigated the pathobiology of Parkinson’s disease as a postdoctoral

scientist at the Columbia University Irving Medical Center. He received his Ph.D. in neuroscience from the University of Minnesota, his

M.B.A. from the Cornell SC Johnson College of Business, and his B.A. from St. John’s University.

Dr. Jorgensen has no family relationship

with any of the executive officers or directors of the Company or any person nominated or chosen by the Company to become a director or

executive officer of the Company. There are no transactions in which Dr. Jorgensen has an interest requiring disclosure under Item

404(a) of Regulation S-K.

The Jorgensen Agreement provides for Dr. Jorgensen’s

at-will employment as Chief Financial Officer. Pursuant to the Jorgensen Agreement, Dr. Jorgensen is entitled to receive an annual

base salary of $480,000. He is also eligible to receive an annual cash bonus, determined by and payable at the sole discretion of the

Board, at a target level of 40% of his annual base salary then in effect.

In accordance with the Jorgensen Agreement,

the Compensation Committee approved the grant to Dr. Jorgensen of the following equity awards: (i) effective as of the Jorgensen

Commencement Date, a stock option to purchase 200,000 shares of the Company’s common stock at an exercise price per share equal

to the closing price per share of the Company’s common stock on The Nasdaq Global Select Market on the Jorgensen Commencement Date

and (ii) effective as of the first day of the calendar quarter immediately following the Jorgensen Commencement Date (the “Jorgensen

RSU Grant Date”), a restricted stock unit award representing the right to receive 80,000 shares of the Company’s common stock.

The option award vests over a four-year period, with 25% of the shares underlying the award vesting on the first anniversary of the Jorgensen

Commencement Date and the remaining 75% of the shares underlying the award vesting monthly over the subsequent three-year period, subject

to Dr. Jorgensen’s continued employment by the Company. The restricted stock unit award vests over a three-year period, with

33.333% of the shares underlying the award vesting on the first anniversary of the Jorgensen RSU Grant Date and an additional 33.333%

of the shares underlying the award vesting annually at the end of each subsequent one-year period, subject to Dr. Jorgensen’s

continued employment by the Company. The option award and the restricted stock unit award are being granted outside of the Company’s

2015 Stock Option and Incentive Plan as an inducement material to Dr. Jorgensen’s entering into employment with the Company

in accordance with Nasdaq Stock Market Listing Rule 5635(c)(4).

Under the Jorgensen Agreement, in the event

Dr. Jorgensen terminates his employment with “good reason” or is terminated without “cause” (as such terms

are defined in the Jorgensen Agreement), Dr. Jorgensen becomes eligible to receive the continuation of his base salary then in effect

for a period of 12 months, a pro rata portion of his target annual bonus and continuation of group health insurance premium payments under

COBRA for up to 12 months. In the event Dr. Jorgensen terminates his employment with “good reason” or is terminated without

“cause” within the period ending 12 months following the consummation of a “sale event” (as defined in the Jorgensen

Agreement), Dr. Jorgensen becomes eligible to receive the continuation of his base salary for 12 months, a pro rata portion of his

target annual bonus, continuation of group health insurance premium payments under COBRA for up to 12 months and acceleration in full

of the vesting of all equity awards held by him that vest solely based on continued service. These severance benefits are subject to the

execution and effectiveness of a separation agreement and release of claims in favor of the Company and its affiliates.

The Jorgensen Agreement also obligates Dr. Jorgensen

under standard invention assignment, confidentiality, non-competition, and non-solicitation provisions.

The foregoing description of certain terms

of the Jorgensen Agreement is qualified in its entirety by reference to the Jorgensen Agreement, a copy of which is attached as Exhibit 10.1

hereto and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date: June 13, 2024 |

VOYAGER THERAPEUTICS, INC. |

| |

|

| |

By: |

/s/ Alfred Sandrock, M.D., Ph.D. |

| |

|

Alfred Sandrock, M.D., Ph.D. |

| |

|

Chief Executive Officer, President, and Director

(Principal Executive Officer) |

Exhibit 10.1

EMPLOYMENT

AGREEMENT

This Employment Agreement

(this “Agreement”) is made as of July 8, 2024 (the “Effective Date”) by and between (i) Voyager

Therapeutics, Inc., a Delaware corporation with an address at 75 Hayden Avenue, Lexington, MA 02421 (the “Company”)

and (ii) Nathan Jorgensen, Ph.D., MBA, an individual with an address at [**] (the “Executive”).

1. Employment.

The Company and the Executive desire that the Executive be employed as the Company’s Chief Financial Officer. The employment relationship

between the Company and the Executive shall be governed by this Agreement, with the Executive’s first day of employment commencing

as of a date mutually agreed upon by the Company and the Executive, but in no event later than July 8, 2024 (the “Commencement

Date”), and continuing in effect until terminated by either party in accordance with this Agreement. At all times, the Executive’s

employment with the Company will be “at-will,” meaning that the Executive’s employment may be terminated by the Company

or the Executive at any time and for any reason, subject to the terms of this Agreement.

2. Position,

Reporting and Duties. The Executive will serve as the Company’s Chief Financial Officer,

reporting to the Company’s President and Chief Executive Officer (“CEO”). The Executive agrees to abide by the

rules, regulations, instructions, personnel practices and policies of the Company and any changes therein that may be adopted from time

to time by the Company. The Executive’s normal place of work will be in the Company’s Lexington, Massachusetts offices, unless

the Executive is traveling on behalf of the Company. The Executive shall devote the Executive’s full working time and efforts to

the business and affairs of the Company and shall not engage in any other business activities without the prior written approval of the

CEO and provided that such activities do not create a conflict of interest or otherwise interfere with the Executive’s performance

of the Executive’s duties to the Company.

3. Compensation

and Related Matters.

(a) Base

Salary. The Executive will receive a base salary at the annual rate of $480,000, less all applicable taxes and withholdings

(“Base Salary”), which Base Salary is subject to review and redetermination by the Company from time to time. The Base

Salary will be payable in a manner that is consistent with the Company’s usual payroll practices for senior executives. The Executive

shall be eligible to participate in the annual salary review for the 2025 calendar year and in the annual salary review for each subsequent

year thereafter.

(b) Annual

Bonus. The Executive will be eligible to participate in the Company’s Senior Executive Cash Incentive Bonus Plan (the “Incentive

Bonus Plan”), as approved by the Company’s Board of Directors (the “Board”), its Compensation Committee,

or any other committee of the Board from time to time, commencing for calendar year 2024. The terms of the Incentive Bonus Plan shall

be established and may be altered by the Board, its Compensation Committee, or any other committee of the Board in its or their sole discretion.

For calendar year 2024, the Executive’s target bonus under the Incentive Bonus Plan shall be forty percent (40%) of the Executive’s

Base Salary, less all applicable taxes and withholdings. Any bonus paid for calendar year 2024 will be prorated based on the Commencement

Date. To earn any bonus, the Executive must be employed by the Company on the day such bonus is paid, except as provided to the contrary

in either Section 6 or 7 below, because such bonus serves as an incentive for the Executive to remain employed with the Company.

Both parties acknowledge and agree that any bonus is not intended and shall not be deemed a “wage” under any state or federal

wage-hour law.

(c) Equity.

Subject to approval by the Compensation Committee of the Board, and as a material inducement to the Executive entering into employment

with the Company, the Executive will be granted the following equity awards outside of the Company’s stock incentive plans as an

“inducement grant” within the meaning of Nasdaq Listing Rule 5635(c)(4), consisting of an Option Award and an RSU Award

(each as defined below):

| 1. | The Executive will be granted a non-qualified

option (the “Option Award”) to purchase 200,000 shares of the Company’s common stock (the “Common

Stock”). The Option Award will be granted as of the Commencement Date (the “Option Grant Date”), with the

shares underlying the Option Award (the “Option Shares”) to (a) have an exercise price per share equal to the

closing price of the Common Stock on The Nasdaq Global Select Market on the Option Grant Date and (b) vest and become exercisable,

subject to the Executive’s continued service on each applicable vesting date, as follows: 25% of the Option Shares will vest on

the first anniversary of the Option Grant Date, and an additional 2.0833% of the Option Shares will vest on a monthly basis at the end

of each one-month period following the first anniversary of the Option Grant Date until the four-year anniversary of the Option Grant

Date; and |

| 2. | The Executive will also be granted 80,000

restricted stock units, each representing the right to receive one share of Common Stock (the “RSU Award”), with the

RSU Award to (a) be granted as of the first day of the first calendar quarter immediately following the Commencement Date (the “RSU

Grant Date”), and (b) vest and become settleable, subject to the Executive’s continued service on each applicable

vesting date, over a three-year period as follows: 33.333% of the shares underlying the RSU Award will vest on the first anniversary of

the RSU Grant Date and an additional 33.333% of the shares underlying the RSU Award will vest at the end of each one-year period following

the first anniversary of the RSU Grant Date until the three-year anniversary of the RSU Grant Date. |

Each

of the Option Award and the RSU Award will be subject to and governed by the terms and conditions of the applicable equity award agreements

between the Executive and the Company (collectively, the “Equity Documents”).

(d) Employee

Benefits. The Executive shall be entitled to full participation in the Company’s flexible vacation plan each calendar year and

to such other holidays as the Company recognizes for employees having comparable responsibilities and duties. The Executive will be entitled

to participate in the Company’s employee benefit plans, subject to the terms and the conditions of such plans, and the Company’s

ability to amend and modify such plans at any time and from time to time without advance notice.

(e) Reimbursement

of Business Expenses. The Company shall reimburse the Executive for travel, entertainment, business development and other expenses

reasonably and necessarily incurred by the Executive in connection with the Company’s business. Expense reimbursement shall be subject

to such policies that the Company may adopt from time to time, including with respect to pre-approval.

4. Certain

Definitions.

(a) “Cause”

means (A) the commission by the Executive of (i) any felony; or (ii) a misdemeanor involving moral turpitude, deceit, dishonesty

or fraud; or (B) a good faith finding by the Company of: (i) conduct by the Executive constituting a material act of misconduct

in connection with the performance of the Executive’s duties, including, without limitation, misappropriation of funds or property

of the Company or any of its subsidiaries or affiliates other than the occasional, customary and de minimis use of Company property for

personal purposes; (ii) any conduct by the Executive that would reasonably be expected to result in material injury or reputational

harm to the Company or any of its subsidiaries and affiliates if the Executive were retained in the Executive’s position but, provided

that if the Company reasonably determines that such conduct is capable of being cured, only after receipt of written notice by the Company

reasonably describing such conduct and if the Executive fails to cease and cure such conduct within fifteen (15) days of receipt of said

written notice; (iii) continued non-performance by the Executive of the Executive’s responsibilities hereunder (other than

by reason of the Executive’s physical or mental illness, incapacity or disability) but, provided that if the Company reasonably

determines that such conduct is capable of being cured, only after receipt of written notice by the Company reasonably describing such

non-performance and the Executive’s failure to cure such non-performance within fifteen (15) days of receipt of said written notice;

(iv) a breach by the Executive of any confidentiality or restrictive covenant obligations to the Company, including under the Confidentiality,

Non-Solicitation, Non-Competition and Invention Assignment Agreement attached hereto as Exhibit A (the “Confidentiality

Agreement”); (v) a material violation by the Executive of any of the Company’s written employment policies communicated

to the Executive; (vi) a material misrepresentation made by the Executive in the scope of or concerning the Executive’s employment

with the Company, including, without limitation, a misrepresentation with respect to the absence of any obligation to any former employer

or any other person or entity that would or does prevent, limit, or impair in any way the performance of the Executive’s duties

to the Company; (vii) a finding or a decision by regulatory or law enforcement authorities of a material violation of any law or

regulation that would or does prevent, limit, or impair in any way the performance of the Executive’s duties to the Company or the

scope of his employment with the Company; or (viii) failure to cooperate with a bona fide internal investigation or an investigation

by regulatory or law enforcement authorities as provided under Section 13 of this Agreement, after being instructed by the Company

to cooperate, or the willful destruction or failure to preserve documents or other materials known to be relevant to such investigation

or the inducement of others to fail to cooperate or to produce documents or other materials in connection with such investigation.

(b) “Disabled”

or “Disability” means the Executive is unable to perform the essential functions of the Executive’s then existing

position or positions under this Agreement with or without reasonable accommodation for a period of one hundred and eighty (180) days

(which days need not be consecutive) in any twelve (12) month period. If any question shall arise as to whether during any period the

Executive is disabled so as to be unable to perform the essential functions of the Executive’s then existing position or positions

with or without reasonable accommodation, the Executive may, and at the request of the Company shall, submit to the Company a certification

in reasonable detail by a physician selected by the Company to whom the Executive or the Executive’s guardian has no reasonable

objection as to whether the Executive is so disabled or how long such Disability is expected to continue, and such certification shall

for the purposes of this Agreement be conclusive of the issue. The Executive shall cooperate with any reasonable request of the physician

in connection with such certification. If such question shall arise and the Executive shall fail to submit such certification, the Company’s

determination of such issue shall be binding on the Executive. Nothing in this Section 4(b) shall be construed to waive the

Executive’s rights, if any, under existing law including, without limitation, the Family and Medical Leave Act of 1993, 29 U.S.C.

§2601 et seq., and the Americans with Disabilities Act, 42 U.S.C. §12101 et seq.

(c) “Good

Reason” means that the Executive has complied with the “Good Reason Process” (hereinafter defined) following the

occurrence of any of the following events without the Executive’s consent: (A) a material diminution in the Executive’s

responsibilities, authority or duties; (B) a material diminution in the Executive’s Base Salary except for a reduction of the

Executive’s Base Salary that is part of an across-the-board salary reduction applied to substantially all senior management employees

that is caused by the Company’s financial performance and is similar to and proportionately not greater than the reductions affecting

all or substantially all senior management employees of the Company; (C) the relocation of the Executive’s principal place

of business more than fifty (50) miles other than in a direction that reduces the Executive’s daily commuting distance; or (D) the

material breach by the Company of this Agreement or any other agreements between the Executive and the Company relating to the Option

Award or the RSU Award. “Good Reason Process” means that (i) the Executive reasonably determines in good faith

that a “Good Reason” condition has occurred; (ii) the Executive notifies the Company in writing of the first occurrence

of the Good Reason condition within sixty (60) days of the first occurrence of such condition; (iii) the Executive cooperates in

good faith with the Company’s efforts for thirty (30) days following such notice (the “Cure Period”) to remedy

the condition; (iv) notwithstanding such efforts, at least one Good Reason condition continues to exist; and (v) the Executive

terminates the Executive’s employment within sixty (60) days after the end of the Cure Period. If the Company cures the Good Reason

condition during the Cure Period, Good Reason shall be deemed not to have occurred. The Company’s success at curing a Good Reason

condition shall not bar or preclude the Executive’s right to notify the Company of the occurrence of another Good Reason condition

and to proceed with the Good Reason Process.

(d) “Sale

Event” means the consummation of (i) the sale of all or substantially all of the assets of the Company on a consolidated

basis to an unrelated person or entity, (ii) a merger, reorganization or consolidation pursuant to which the holders of the Company’s

outstanding voting power immediately prior to such transaction do not own a majority of the outstanding voting power of the surviving

or resulting entity (or its ultimate parent, if applicable), (iii) the acquisition, directly or indirectly, of all or a majority

of the outstanding voting stock of the Company in a single transaction or a series of related transactions by a Person or group of Persons,

(iv) a Deemed Liquidation Event (as defined in the Company’s Certificate of Incorporation (as may be amended, restated or otherwise

modified from time to time)), or (v) any other acquisition of the business of the Company, as determined by the Board. Notwithstanding

the foregoing, a “Sale Event” shall not be deemed to have occurred as a result of (a) a merger effected solely to change

the Company’s domicile, and (b) an acquisition of shares of Company common stock by the Company which, by reducing the number

of shares outstanding, increases the proportionate number of shares beneficially owned by any person to a majority of the outstanding

shares of common stock of the Company; provided, however, that if any person referred to in this clause (b) shall thereafter become

the beneficial owner of any additional shares (other than pursuant to a stock split, stock dividend, or similar transaction or as a result

of an acquisition of shares directly from the Company) and immediately thereafter beneficially owns a majority of the then outstanding

shares, then a “Sale Event” shall be deemed to have occurred for purposes of this clause (b). Notwithstanding the foregoing,

where required to avoid extra taxation under Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”),

a Sale Event must also satisfy the requirements of Treas. Reg. Section 1.409A-3(a)(5).

(e) “Sale

Event Period” means the period ending twelve (12) months following the consummation of a Sale Event.

(f) “Terminating

Event” means termination of the Executive’s employment by the Company without Cause or by the Executive for Good Reason.

A Terminating Event does not include: (i) the termination of the Executive’s employment due to the Executive’s death

or a determination that the Executive is Disabled; (ii) the Executive’s resignation for any reason other than Good Reason,

(iii) the Company’s termination of the Executive’s employment for Cause, or (iv) any termination of this Agreement

prior to the Commencement Date by either party for any reason.

5. Compensation

in Connection with a Termination for any Reason. If the Executive’s employment with

the Company is terminated for any reason, the Company shall pay or provide to the Executive (or to the Executive’s authorized representative

or estate) any earned but unpaid Base Salary, unpaid expense reimbursements, and vested employee benefits, each as of the Date of Termination

(as defined below).

6. Severance

and Accelerated Vesting if a Terminating Event Occurs within the Sale Event Period. In the

event a Terminating Event occurs within the Sale Event Period, subject to the Executive signing and complying with a separation agreement

in a form and manner satisfactory to the Company containing, among other provisions, a general release of claims in favor of the Company

and related persons and entities, covenants to return Company property and to not disparage the Company, a reaffirmation of the Confidentiality

Agreement and a twelve (12) month post-employment non-competition restriction with a scope of prohibited competitive activity no greater

than that described in the Confidentiality Agreement (the “Separation Agreement and Release”), and the Separation Agreement

and Release becoming irrevocable (the date such Separation Agreement and Release becomes irrevocable, the “Release Effective

Date”), all within sixty (60) days after the Date of Termination or by an earlier date as determined by the Company, the following

shall occur:

(a) the

Company shall pay to the Executive an amount equal to twelve (12) months of the Executive’s Base Salary in effect immediately

prior to the Terminating Event (or the Executive’s Base Salary in effect immediately prior to the Sale Event, if higher), determined

in each case immediately before any event that constitutes Good Reason (if applicable);

(b) the

Company shall pay to the Executive a pro-rated portion of the Executive’s annual bonus at target for the year in which termination

occurs, with such proration to be based on the Date of Termination;

(c) if

the Executive timely elects and is eligible to continue receiving group health insurance pursuant to the “COBRA” law, the

Company will, until the earlier of (x) the date that is twelve (12) months following the Date of Termination, and (y) the

date on which the Executive obtains alternative coverage (as applicable, the “Sale Event COBRA Contribution Period”),

continue to pay the share of the premiums for such coverage to the same extent it was paying such premiums on the Executive’s behalf

immediately prior to the Date of Termination. The remaining balance of any premium costs during the Sale Event COBRA Contribution Period,

and all premium costs thereafter, shall be paid by the Executive monthly for as long as, and to the extent that, the Executive remains

eligible for COBRA continuation. The Executive agrees that, should the Executive obtain alternative medical and/or dental insurance coverage

prior to the date that is twelve (12) months following the Date of Termination, the Executive will so inform the Company in writing

within five (5) business days of obtaining such coverage. Notwithstanding anything to the contrary herein, in the event that the

Company’s payment of the amounts described in Section 6(c) would subject the Company to any tax or penalty under the Patient

Protection and Affordable Care Act (as amended from time to time, the “ACA”) or Section 105(h) of the Internal

Revenue Code of 1986, as amended (“Section 105(h)”), or applicable regulations or guidance issued under the ACA

or Section 105(h), the Executive and the Company agree to work together in good faith to restructure such benefit; and

(d) one

hundred percent (100%) of all equity awards held by the Executive that vest solely based on continued service shall immediately accelerate

and become fully exercisable or nonforfeitable as of the Date of Termination and the provisions of this Section 6(d) shall be

deemed to be incorporated by reference into the agreements governing all such awards.

For avoidance of doubt, the

Separation Agreement and Release for purposes of this Agreement shall not require a waiver of any rights under the indemnification agreement

between the Company and the Executive or any rights described in Section 5 above. Notwithstanding the foregoing, if the Executive’s

employment is terminated in connection with a Sale Event and the Executive immediately becomes reemployed by any direct or indirect successor

to the business or assets of the Company, the termination of the Executive’s employment upon the Sale Event shall not be considered

a termination without Cause for purposes of this Agreement.

The

amounts payable under Sections 6(a) and 6(b) shall be paid out in substantially equal installments in accordance with the

Company’s payroll practice over twelve (12) months commencing within sixty (60) days after the Date of Termination

(but no sooner than the Release Effective Date); provided, however, that if the sixty (60) day period begins in one calendar year

and ends in a second calendar year, the severance shall be paid or shall begin to be paid in the second calendar year by the last day

of such sixty (60) day period. Each payment pursuant to this Agreement is intended to constitute a separate payment for purposes of Treasury

Regulation Section 1.409A-2(b)(2).

7. Severance

if a Terminating Event Occurs Outside the Sale Event Period. In the event a Terminating Event

occurs at any time other than during the Sale Event Period, subject to the Executive signing the Separation Agreement and Release and

the Separation Agreement and Release becoming irrevocable, all within sixty (60) days after the Date of Termination or by an earlier date

as determined by the Company, the following shall occur:

(a) the

Company shall pay to the Executive an amount equal twelve (12) months of the Executive’s Base Salary in effect immediately

prior to the Terminating Event (but only after disregarding any event that constitutes Good Reason);

(b) the

Company shall pay to the Executive a pro-rated portion of the Executive’s annual bonus target for the year in which termination

occurs, with such proration to be based on the Date of Termination; and

(c) if

the Executive timely elects and is eligible to continue receiving group health insurance pursuant to the “COBRA” law, the

Company will, until the earlier of (x) the date that is twelve (12) months following the Date of Termination, and (y) the

date on which the Executive obtains alternative coverage (as applicable, the “Non-Sale Event COBRA Contribution Period”),

continue to pay the share of the premiums for such coverage to the same extent it was paying such premiums on the Executive’s behalf

immediately prior to the Date of Termination. The remaining balance of any premium costs during the Non-Sale Event COBRA Contribution

Period, and all premium costs thereafter, shall be paid by the Executive on a monthly basis for as long as, and to the extent that, the

Executive remains eligible for COBRA continuation. The Executive agrees that, should the Executive obtain alternative medical and/or dental

insurance coverage prior to the date that is twelve (12) months following the Date of Termination, the Executive will so inform

the Company in writing within five (5) business days of obtaining such coverage. Notwithstanding anything to the contrary herein,

in the event that the Company’s payment of the amounts described in Section 7(c) would subject the Company to any tax

or penalty under the ACA or Section 105(h), or applicable regulations or guidance issued under the ACA or Section 105(h), the

Executive and the Company agree to work together in good faith to restructure such benefit.

The

amounts payable under Section 7(a) and 7(b) shall be paid out in substantially equal installments in accordance with the

Company’s payroll practice over twelve (12) months commencing within sixty (60) days after the Date of Termination

(but no sooner than the Release Effective Date); provided, however, that if the sixty (60) day period begins in one calendar year and

ends in a second calendar year, the severance shall begin to be paid in the second calendar year by the last day of such sixty (60) day

period. Each payment pursuant to this Agreement is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2).

8. Confidentiality,

Non-Solicitation, Non-Competition and Invention Assignment Agreement. The Executive acknowledges

and agrees that the Executive must, as a condition of the Executive’s employment, execute, no later than the Commencement Date,

the Confidentiality Agreement attached hereto as Exhibit A indicating the Executive’s agreement to all of the Executive’s

obligations thereunder. The Executive further acknowledges that the Executive’s receipt of the grant of the Option Award and RSU

Award as set forth in Section 3(c) above is contingent on the Executive’s agreement to the post-employment non-competition

provisions set forth in the Confidentiality Agreement. The Executive further acknowledges that such consideration was mutually agreed

upon by the Executive and the Company and is fair and reasonable in exchange for the Executive’s compliance with such non-competition

obligations. The terms of the Confidentiality Agreement are incorporated by reference in this Agreement and the Executive hereby reaffirms

the terms of the Confidentiality Agreement as a material term of this Agreement. The Executive further represents that the Executive is

not under any obligation to any former employer or any other person or entity which would or does prevent, limit, or impair in any way

the performance by the Executive of the Executive’s duties pursuant to this Agreement.

9. Additional

Limitation.

(a) Anything

in this Agreement to the contrary notwithstanding, in the event that the amount of any compensation, payment or distribution by the Company

to or for the benefit of the Executive, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement

or otherwise, calculated in a manner consistent with Section 280G of the Code and the applicable regulations thereunder (the “Aggregate

Payments”), would be subject to the excise tax imposed by Section 4999 of the Code, then the Aggregate Payments shall be

reduced (but not below zero) so that the sum of all of the Aggregate Payments shall be $1.00 less than the amount at which the Executive

becomes subject to the excise tax imposed by Section 4999 of the Code; provided that such reduction shall only occur if it would

result in the Executive receiving a higher After Tax Amount (as defined below) than the Executive would receive if the Aggregate Payments

were not subject to such reduction. In such event, the Aggregate Payments shall be reduced in the following order, in each case, in reverse

chronological order beginning with the Aggregate Payments that are to be paid the furthest in time from consummation of the transaction

that is subject to Section 280G of the Code: (i) cash payments not subject to Section 409A of the Code; (ii) cash

payments subject to Section 409A of the Code; (iii) equity-based payments and acceleration; and (iv) non-cash forms of

benefits; provided that in the case of all the foregoing Aggregate Payments all amounts or payments that are not subject to calculation

under Treas. Reg. §1.280G-1, Q&A-24(b) or (c) shall be reduced before any amounts that are subject to calculation under

Treas. Reg. §1.280G-1, Q&A-24(b) or (c).

(b) For

purposes of this Section, the “After Tax Amount” means the amount of the Aggregate Payments less all federal, state,

and local income, excise and employment taxes imposed on the Executive as a result of the Executive’s receipt of the Aggregate Payments.

For purposes of determining the After Tax Amount, the Executive shall be deemed to pay federal income taxes at the highest marginal rate

of federal income taxation applicable to individuals for the calendar year in which the determination is to be made, and state and local

income taxes at the highest marginal rates of individual taxation in each applicable state and locality, net of the maximum reduction

in federal income taxes which could be obtained from deduction of such state and local taxes.

The determination as to whether

a reduction in the Aggregate Payments shall be made pursuant to this Section shall be made by a nationally recognized accounting

firm selected by the Company prior to the Sale Event (the “Accounting Firm”), which shall provide detailed supporting

calculations both to the Company and the Executive within fifteen (15) business days of the Date of Termination, if applicable, or at

such earlier time as is reasonably requested by the Company or the Executive. Any determination by the Accounting Firm shall be binding

upon the Company and the Executive.

10. Section 409A.

(a) Anything

in this Agreement to the contrary notwithstanding, if at the time of the Executive’s “separation from service” within

the meaning of Section 409A of the Code, the Company determines that the Executive is a “specified employee” within the

meaning of Section 409A(a)(2)(B)(i) of the Code, then to the extent any payment or benefit that the Executive becomes entitled

to under this Agreement on account of the Executive’s separation from service would be considered deferred compensation subject

to the twenty percent (20%) additional tax imposed pursuant to Section 409A(a) of the Code as a result of the application of

Section 409A(a)(2)(B)(i) of the Code, such payment shall not be payable and such benefit shall not be provided until the date

that is the earlier of (i) six (6) months and one (1) day after the Executive’s separation from service, or (ii) the

Executive’s death.

(b) The

parties intend that this Agreement will be administered in accordance with Section 409A of the Code. To the extent that any provision

of this Agreement is ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner so

that all payments hereunder comply with Section 409A of the Code. Each payment hereunder that is paid in instalment (whether severance

payments, reimbursements or otherwise) shall be treated as a right to receive a series of separate payments and, accordingly, each instalment

payment hereunder shall at all times be considered a separate and distinct payment. Neither the Company nor the Executive shall have the

right to accelerate or defer any payment (or installment) hereunder unless permitted or required by Code Section 409A.

(c) All

in-kind benefits provided and expenses eligible for reimbursement under this Agreement shall be provided by the Company or incurred by

the Executive during the time periods set forth in this Agreement. All reimbursements shall be paid as soon as administratively practicable,

but in no event shall any reimbursement be paid after the last day of the taxable year following the taxable year in which the expense

was incurred. The amount of in-kind benefits provided or reimbursable expenses incurred in one taxable year shall not affect the in-kind

benefits to be provided or the expenses eligible for reimbursement in any other taxable year. Such right to reimbursement or in-kind benefits

is not subject to liquidation or exchange for another benefit.

(d) To

the extent that any payment or benefit described in this Agreement constitutes “non-qualified deferred compensation” under

Section 409A of the Code, and to the extent that such payment or benefit is payable upon the Executive’s termination of employment,

then such payments or benefits shall be payable only upon the Executive’s “separation from service.” The determination

of whether and when a separation from service has occurred shall be made in accordance with the presumptions set forth in Treasury Regulation

Section 1.409A-1(h).

(e) The

Company makes no representation or warranty and shall have no liability to the Executive or any other person if any provisions of this

Agreement are determined to constitute deferred compensation subject to Section 409A of the Code but do not satisfy an exemption

from, or the conditions of, such Section.

11. Taxes.

All forms of compensation referred to in this Agreement are subject to reduction to reflect applicable withholding and payroll taxes and

other deductions required by law. The Executive hereby acknowledges that the Company does not have a duty to design its compensation policies

in a manner that minimizes tax liabilities.

12. Notice

and Date of Termination.

(a) Notice

of Termination. The Executive’s employment with the Company may be terminated by the Company or the Executive at any time and

for any reason, subject to the terms of this Agreement. Any termination of the Executive’s employment (other than by reason of death)

shall be communicated by written Notice of Termination from one party hereto to the other party hereto in accordance with this Section.

For purposes of this Agreement, a “Notice of Termination” shall mean a notice which shall indicate the specific termination

provision in this Agreement relied upon.

(b) Date

of Termination. “Date of Termination” shall mean: (i) if the Executive’s employment is terminated by

the Executive’s death, the date of the Executive’s death; (ii) if the Executive’s employment is terminated on account

of Executive’s Disability or by the Company for Cause or without Cause, the date specified in the Notice of Termination; (iii) if

the Executive’s employment is terminated by the Executive for any reason except for Good Reason, thirty (30) days after the date

specified in the Notice of Termination, and (iv) if the Executive’s employment is terminated by the Executive with Good Reason,

the date specified in the Notice of Termination given after the end of the Cure Period. Notwithstanding the foregoing, in the event that

the Executive gives a Notice of Termination to the Company, the Company may unilaterally accelerate the Date of Termination and such acceleration

shall not result in the termination being deemed a termination by the Company for purposes of this Agreement.

13. Litigation

and Regulatory Cooperation. During and after the Executive’s employment, and at all

times, so long as there is not a significant conflict with the Executive’s then employment, the Executive shall cooperate reasonably

with the Company in the defense or prosecution of any claims or actions now in existence or which may be brought in the future against

or on behalf of the Company which relate to events or occurrences that transpired while the Executive was employed by the Company. The

Executive’s reasonable cooperation in connection with such claims or actions shall include, but not be limited to, being available

to meet with counsel to prepare for discovery or trial and to act as a witness on behalf of the Company at mutually convenient times.

During and after the Executive’s employment, the Executive also shall cooperate reasonably with the Company in connection with any

investigation or review of the Company by any federal, state or local regulatory authority as any such investigation or review relates

to events or occurrences that transpired while the Executive was employed by the Company. The Company shall reasonably compensate the

Executive for the time dedicated to, and shall reimburse the Executive for any reasonable out of pocket expenses incurred in connection

with, the Executive’s performance of the obligations set forth in this Section; provided, however, that the Company will not pay

the Executive any fee or amount for time spent providing testimony in any arbitration, trial, administrative hearing or other proceeding.

14. Other

Conditions to Employment. The Executive’s employment is contingent upon reference and

background checks satisfactory to the Company. The Executive shall, prior to commencing employment, make himself available for and cooperate

with the Company in obtaining such checks on the Executive, including providing any and all consents necessary to the accomplishment of

the foregoing. The Executive shall also provide timely documentation of his identity and eligibility to work in the United States, as

required by federal law.

15. Relief.

If the Executive breaches, or proposes to breach, any portion of this Agreement, including the Confidentiality Agreement, or, if applicable,

the Separation Agreement and Release, the Company shall be entitled, in addition to all other remedies that it may have, to an injunction

or other appropriate equitable relief to restrain any such breach, and, if applicable, the Company shall have the right to suspend or

terminate the payments, benefits and/or accelerated vesting, as applicable. Such suspension or termination shall not limit the Company’s

other options with respect to relief for such breach and shall not relieve the Executive of the Executive’s duties under this Agreement,

the Confidentiality Agreement or the Separation Agreement and Release.

16. Scope

of Disclosure Restrictions. Nothing in this Agreement or the Confidentiality Agreement prohibits

the Executive from communicating with government agencies about possible violations of federal, state, or local laws or otherwise providing

information to government agencies, filing a complaint with government agencies, or participating in government agency investigations

or proceedings. The Executive is not required to notify the Company of any such communications; provided, however, that nothing

herein authorizes the disclosure of information the Executive obtained through a communication that was subject to the attorney-client

privilege. Further, notwithstanding the Executive’s confidentiality and nondisclosure obligations, the Executive is hereby

advised as follows pursuant to the Defend Trade Secrets Act: “An individual shall not be held criminally or civilly liable under

any Federal or State trade secret law for the disclosure of a trade secret that (A) is made (i) in confidence to a Federal,

State, or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting

or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding,

if such filing is made under seal. An individual who files a lawsuit for retaliation by an employer for reporting a suspected violation

of law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding, if

the individual (A) files any document containing the trade secret under seal; and (B) does not disclose the trade secret, except

pursuant to court order.”

17. Governing

Law; Consent to Jurisdiction; Forum Selection. The resolution of any disputes as to the meaning,

effect, performance or validity of this Agreement or the Confidentiality Agreement, or arising out of, related to, or in any way connected

with the Executive’s employment with the Company or any other relationship between the Executive and the Company (“Disputes”)

will be governed by the law of the Commonwealth of Massachusetts, excluding laws relating to conflicts or choice of law. The Executive

and the Company submit to the exclusive personal jurisdiction of the federal and state courts located in the Commonwealth of Massachusetts

in connection with any Dispute or any claim related to any Dispute and agree that any claims or legal action shall be commenced and maintained

solely in a state or federal court located in the Commonwealth of Massachusetts.

18. Integration.

This Agreement, together with the Confidentiality Agreement and the Equity Documents, constitutes the entire agreement between the parties

with respect to compensation, severance pay, benefits, and accelerated vesting and supersedes in all respects all prior agreements between

the parties concerning such subject matter, including without limitation any prior offer letter, draft employment agreement, or discussions

relating to the Executive’s employment relationship with the Company. For purposes of this Agreement, the Company shall include

affiliates and subsidiaries thereof.

19. Enforceability.

If any portion or provision of this Agreement (including, without limitation, any portion or provision of any Section of this Agreement)

shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this Agreement, or

the application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable,

shall not be affected thereby, and each portion and provision of this Agreement shall be valid and enforceable to the fullest extent permitted

by law.

20. Waiver.

No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of any party

to require the performance of any term or obligation of this Agreement, or the waiver by any party of any breach of this Agreement, shall

not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

21. Notices.

Any notices, requests, demands and other communications provided for by this Agreement shall be sufficient if in writing and (i) sent

by email to the email addresses used by the Chief Human Resources Officer or, if the Company does not have a Chief Human Resources Officer

at the time of the notice, the most senior officer in the human resources function of the Company (in the case of notices to the Company),

or by the Executive (in the case of notices to the Executive) in their usual course of business; (ii) delivered by hand; (iii) sent

by a nationally recognized overnight courier service or (iv) sent by registered or certified mail, postage prepaid, return receipt

requested, in each case (clauses (iii) and (iv)) to the Executive at the last address the Executive has filed in writing with the

Company, or (as applicable) to the Company at its main office, attention of the Chief Human Resources Officer or, if the Company does

not have a Chief Human Resources Officer at the time of the notice, the most senior officer in the human resources function of the Company.

22. Amendment.

This Agreement may be amended or modified only by a written instrument signed by the Executive and by a duly authorized representative

of the Company.

23. Assignment

and Transfer by the Company; Successors. The Company shall have the right to assign and/or

transfer this Agreement to any entity or person, including without limitation the Company’s parents, subsidiaries, other affiliates,

successors, and acquirers of Company stock or other assets, provided that such entity or person receives all or substantially all of the

Company’s assets. The Executive hereby expressly consents to such assignment and/or transfer. This Agreement shall inure to the

benefit of and be enforceable by the Company’s assigns, successors, acquirers and transferees.

24. Counterparts.

This Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be taken to be an original,

but all of which together shall constitute one and the same document.

[Remainder of this page is intentionally left

blank]

SIGNATURE

PAGE TO

EMPLOYMENT AGREEMENT

IN WITNESS WHEREOF, the parties

have executed this Agreement effective as of the Effective Date.

| |

VOYAGER THERAPEUTICS, INC. |

| |

|

| |

By: |

/s/ Alfred Sandrock, M.D., Ph.D. |

| |

Name: |

Alfred Sandrock, M.D., Ph.D. |

| |

Title: |

President & Chief Executive Officer |

| |

|

| |

Date: |

June 11, 2024 |

| |

|

| |

EXECUTIVE: |

| |

|

| |

/s/ Nathan Jorgensen, Ph.D.,

MBA |

| |

Nathan Jorgensen, Ph.D., MBA |

| |

|

| |

Date: |

June 11, 2024 |

Signature Page to Jorgensen Employment Agreement

EXHIBIT A

Confidentiality, Non-Solicitation, Non-Competition

and Invention Assignment Agreement

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

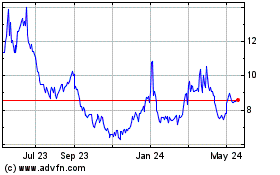

Voyager Therapeutics (NASDAQ:VYGR)

Historical Stock Chart

From Oct 2024 to Dec 2024

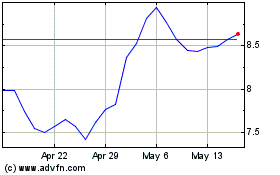

Voyager Therapeutics (NASDAQ:VYGR)

Historical Stock Chart

From Dec 2023 to Dec 2024