Revised Proxy Soliciting Materials (definitive) (defr14a)

09 April 2022 - 6:39AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

The Securities Exchange Act of 1934 (Amendment No.

1)

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

Westamerica Bancorporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary

materials. |

| ☐ |

Fee computed on table in exhibit required

by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1108 Fifth Avenue

San Rafael, California 94901

AMENDMENT TO THE PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 28, 2022

On March 18, 2022, Westamerica

Bancorporation filed with the Securities and Exchange Commission its definitive proxy statement for the 2022 Annual Meeting of Shareholders

to be held on April 28, 2022 (the "Proxy Statement"). We are amending the Proxy Statement in order to correct the amount of

2021 Non-Stock Incentive Plan Compensation and total compensation for our Chairman, President and Chief Executive Officer and total compensation

for other executive officers for 2019 and 2020, which were incorrectly stated in the Summary Compensation Table, and to correct the calculation

of the Chief Executive Officer Pay Ratio resulting from such changes.

No other changes have been made

to the Proxy Statement, and this Amendment has not been updated to reflect events occurring subsequent to the filing of the Proxy Statement.

Capitalized terms used in this Amendment and not otherwise defined have the meaning given to such terms in the Proxy Statement.

The Proxy Statement contains important

information, and this Amendment and the information set forth below should be read in conjunction with the Proxy Statement.

CHANGES TO PROXY STATEMENT

The subsections titled “Summary

Compensation” and “Pay Ratio Disclosure” beginning on pages 26 and 27, respectively, of the Proxy Statement are

amended in their entirety as follows:

Summary Compensation

The following

table sets forth summary compensation information for the chief executive officer, chief financial officer and each of the other three

most highly compensated executive officers for the fiscal years ending December 31, 2021, 2020, and 2019. These persons are referred to

as named executive officers elsewhere in this Proxy Statement.

[The remainder of this page intentionally left blank]

| Summary Compensation Table For Fiscal Year 2021 |

| Name / Position | |

Year | |

Salary | |

Stock

Awards(1) | |

Option

Awards(2) | |

Non-Stock

Incentive Plan

Compensation(3) | |

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings(4) | |

All Other

Compensation(5) | |

TOTAL |

| David L. Payne | |

| 2021 | | |

$ | 371,000 | | |

$ | — | | |

$ | — | | |

$ | 350,000 | | |

$ | — | | |

$ | 29,563 | | |

$ | 750,563 | |

| Chairman, | |

| 2020 | | |

| 371,000 | | |

| — | | |

| — | | |

| 300,000 | | |

| — | | |

| 27,807 | | |

| 698,807 | |

| President & CEO | |

| 2019 | | |

| 371,000 | | |

| — | | |

| — | | |

| 300,000 | | |

| — | | |

| 24,274 | | |

| 695,274 | |

| Jesse Leavitt | |

| 2021 | | |

| 135,000 | | |

| 30,252 | | |

| 92,250 | | |

| 45,100 | | |

| — | | |

| 18,273 | | |

| 320,875 | |

| SVP & Chief | |

| 2020 | | |

| 135,000 | | |

| — | | |

| — | | |

| 43,500 | | |

| — | | |

| 9,252 | | |

| 187,752 | |

| Financial Officer | |

| 2019 | | |

| 106,875 | | |

| — | | |

| — | | |

| 15,000 | | |

| — | | |

| 4,224 | | |

| 126,099 | |

| John "Robert" A. Thorson | |

| 2021 | | |

| 149,000 | | |

| 123,864 | | |

| 130,500 | | |

| 136,600 | | |

| 66,657 | | |

| 32,511 | | |

| 639,132 | |

| SVP & Treasury | |

| 2020 | | |

| 149,000 | | |

| 129,500 | | |

| 171,936 | | |

| 134,000 | | |

| 79,609 | | |

| 31,469 | | |

| 695,514 | |

| Division Manager | |

| 2019 | | |

| 149,000 | | |

| 124,718 | | |

| 216,028 | | |

| 163,200 | | |

| 23,955 | | |

| 32,405 | | |

| 709,306 | |

| Russell W. Rizzardi | |

| 2021 | | |

| 120,960 | | |

| 100,461 | | |

| 105,750 | | |

| 66,000 | | |

| — | | |

| 10,939 | | |

| 404,110 | |

| SVP/Credit Administrator | |

| 2020 | | |

| 120,960 | | |

| 104,928 | | |

| 138,240 | | |

| 64,400 | | |

| — | | |

| 10,455 | | |

| 438,983 | |

| Division Manager | |

| 2019 | | |

| 120,960 | | |

| 101,529 | | |

| 175,268 | | |

| 66,800 | | |

| — | | |

| 9,050 | | |

| 473,607 | |

| Brian Donohoe | |

| 2021 | | |

| 130,008 | | |

| 108,452 | | |

| 113,250 | | |

| 87,100 | | |

| — | | |

| 37,375 | | |

| 476,185 | |

| SVP/Operations & Systems | |

| 2020 | | |

| 130,008 | | |

| 83,677 | | |

| 106,272 | | |

| 86,000 | | |

| — | | |

| 29,422 | | |

| 435,379 | |

| Division Manager | |

| 2019 | | |

| 120,000 | | |

| — | | |

| 55,026 | | |

| 49,400 | | |

| — | | |

| 2,605 | | |

| 227,031 | |

(1) Stock Awards represent RPS shares as

described in the Compensation Discussion & Analysis. The amounts shown represent the aggregate grant date fair market value computed

in accordance with FASB ASC Topic 718. For further information, see Note 1 to the Company's audited financial statements for the year

ended December 31, 2021 included in the Company's Annual Report on Form 10-K.

(2) Option awards represent Nonqualified

Stock Options as described in the Compensation Discussion & Analysis. The amounts shown represent the aggregate grant date fair market

value computed in accordance with FASB ASC Topic 718. For further information, see Note 1 to the Company's audited financial statements

for the year ended December 31, 2021 included in the Company's Annual Report on Form 10-K.

(3) The amounts shown are non-equity incentive

compensation only. No interest or other form of earnings was paid on the compensation.

(4) The amounts include interest paid on

deferred cash compensation to the extent the interest exceeds 120% of the long-term Applicable Federal Rates with compounding. The Company

has no defined benefit pension plan. Mr. Payne has a pension agreement, which is discussed under “Pension Benefits for Fiscal Year

2021.”

(5) Each of the above-named executive officers

received less than $10,000 of aggregate perquisites and personal benefits, except for Mr. Donohoe who received a car allowance of $12,000.

All other compensation includes Company contributions to defined contribution plans (ESOP and Deferred Profit Sharing), and amounts added

to taxable wages using IRS tables for the cost of providing group term life insurance coverage that is more than the cost of $50,000 of

coverage. It also includes the dollar value of the benefit to Mr. Payne for the portion of the premium payable by the Company with respect

to a split dollar life insurance policy (projected on an actuarial basis), and a bonus paid to Mr. Payne in the amount of his portion

of the split dollar life insurance premium.

Based on the

compensation disclosed in the Summary Compensation Table, approximately 35% of total compensation comes from base salaries. See Compensation

Discussion and Analysis for more details.

Pay Ratio Disclosure. In

August 2015 pursuant to a mandate of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Securities and Exchange Commission

adopted a rule requiring annual disclosure of the ratio of the median employee’s annual total compensation to the total annual compensation

of the principal executive officer (“PEO”). The Company’s PEO is Mr. Payne.

| Median Employee total annual compensation | |

| 35,351 | |

| Mr. Payne total annual compensation | |

| 750,563 | |

| Ratio of PEO to Median Employee Compensation | |

| 21.2:1.0 | |

In determining

the median employee total annual compensation, the Company prepared a census of all employees as of December 31, 2021, except the PEO,

with compensation annualized for those employees hired in 2021. For simplicity, the value of benefits provided by the Company’s

qualified retirement plans and welfare benefit plans were excluded from the determination of total annual compensation as all employees

are offered the same benefit programs.

April 8, 2022

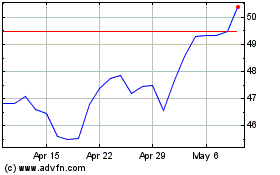

Westamerica Bancorporation (NASDAQ:WABC)

Historical Stock Chart

From Mar 2024 to Apr 2024

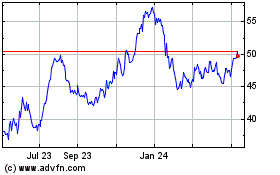

Westamerica Bancorporation (NASDAQ:WABC)

Historical Stock Chart

From Apr 2023 to Apr 2024